esfx 2025 In-Depth Review: Opportunity or Trap?

1. Executive Summary

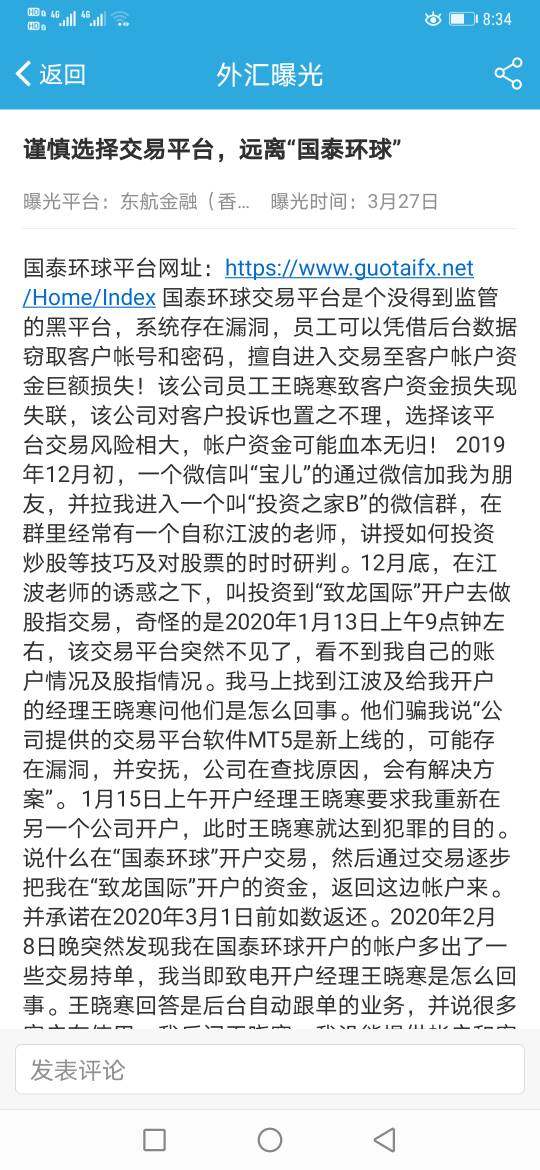

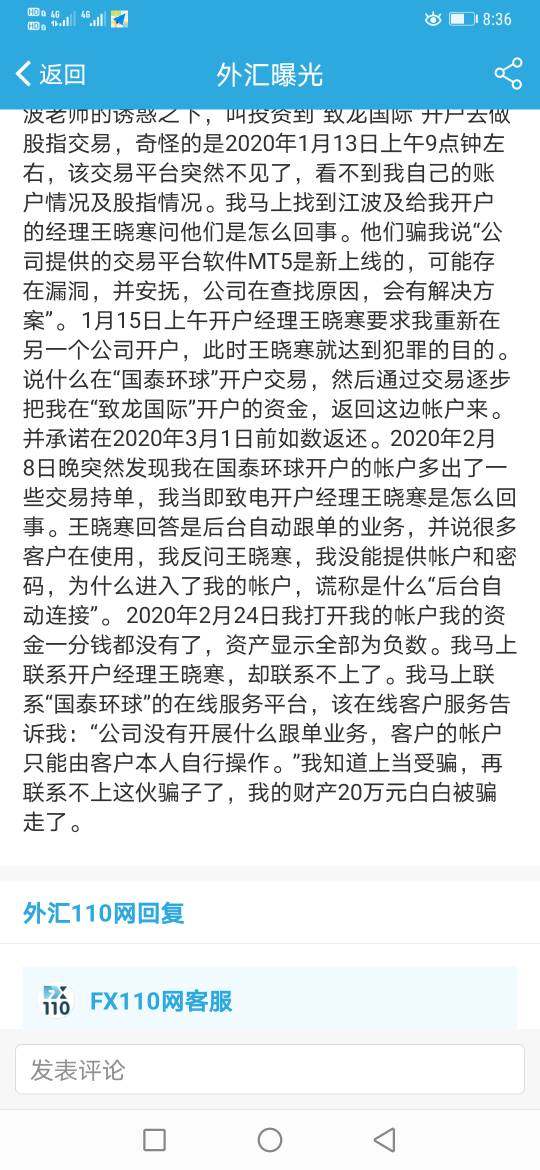

In a rapidly evolving landscape of online trading, the esfx broker emerges as a controversial player, offering tantalizing trading opportunities marked by high leverage and low fees. Tailored to attract traders with a high-risk tolerance and a penchant for speculative investments, esfx seems to provide a diverse range of trading instruments, from forex to cryptocurrencies. However, this appealing facade is obscured by serious allegations ranging from scams to misleading practices and disappointing customer service, which collectively position it as a potentially perilous choice for investors. It is crucial for prospective clients to meticulously weigh the enticing offers against the backdrop of numerous complaints and regulatory concerns.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement: Engaging with the esfx broker involves considerable risks, including potential scams, restricted access to funds, and unfulfilled promises of financial gains.

Potential Harms:

- Loss of funds due to scams or misleading practices.

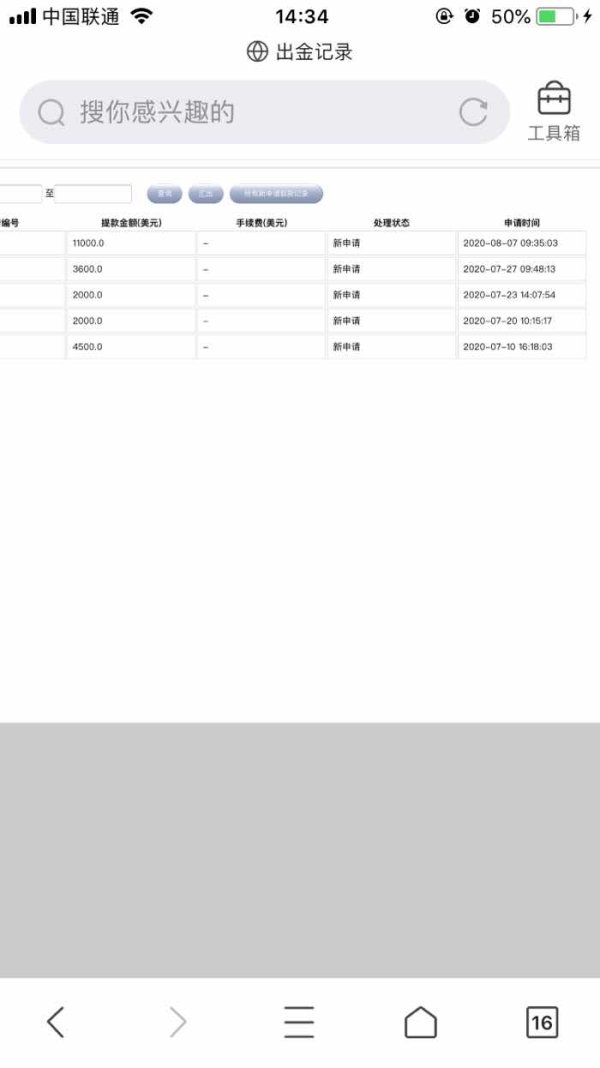

- Difficulty in withdrawing deposited funds.

- Negative impacts on personal finance and investment strategies.

How to Self-Verify:

- Research Broker Status:

- Check for regulatory compliance through reliable sources.

- Investigate online reviews and feedback from other users.

- Evaluate Regulatory Bodies:

- Identify if esfx is registered with a top-tier financial authority.

- Review the regulatory status on official websites or databases.

- Scrutinize Marketing Claims:

- Look for excessive guarantees of profit or atypical returns.

- Assess the realism of promotional materials and pricing structures.

- Engage Customer Support:

- Test the responsiveness and effectiveness of customer service.

- Use live chat or direct communication methods to clarify doubts.

- Review Customer Testimonials:

- Investigate detailed user experiences regarding withdrawals and customer service.

- Focus on common themes in complaints to gauge overall trustworthiness.

2. Rating Framework

3. Broker Overview

3.1 Company Background and Positioning

Founded relatively recently amid the surge of online trading platforms, esfx has positioned itself in the competitive forex brokerage market, with headquarters purportedly located in Singapore. The broker's emergence coincides with an increase in demand for high-leverage trading options, making it attractive to traders looking for quick profits. However, the lack of substantial regulation and the storm of negative sentiment surrounding its practices raise serious questions about its long-term viability and legitimacy.

3.2 Core Business Overview

esfx claims to specialize in various trading services, including forex pairs, commodities, and cryptocurrencies. Promising low spreads, high leverage up to 1:500, and a swift execution environment, it appeals particularly to experienced traders who understand the significant risks involved in trading on platforms lacking solid regulatory oversight. The broker's website vaguely references affiliations with regulatory bodies without providing transparent verification, leading to skepticism over its operational credibility.

4. Quick-Look Details Table

5. In-depth Analysis of Each Dimension

5.1 Trustworthiness Analysis

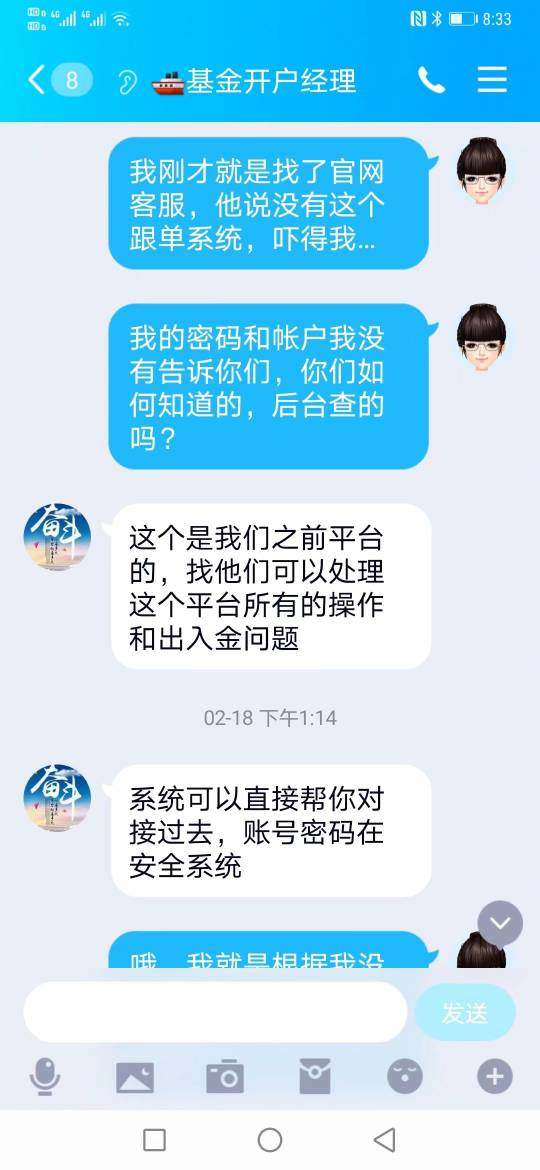

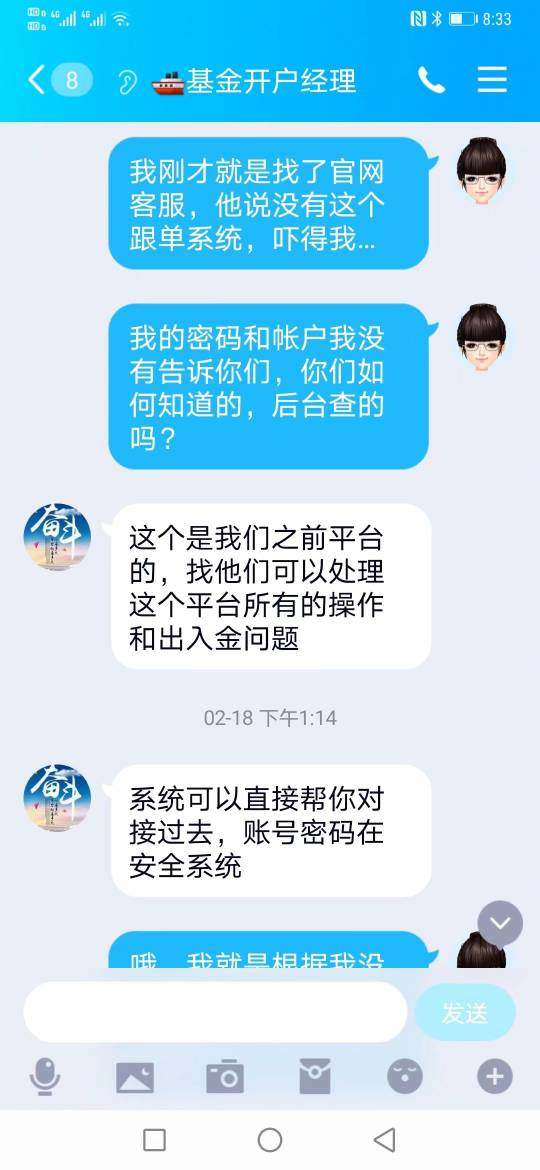

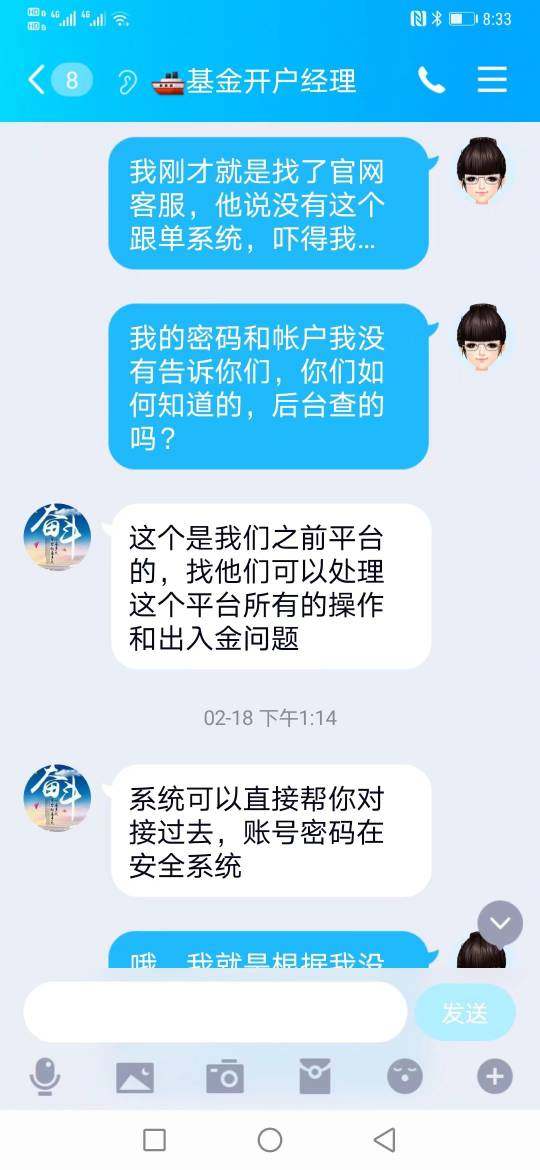

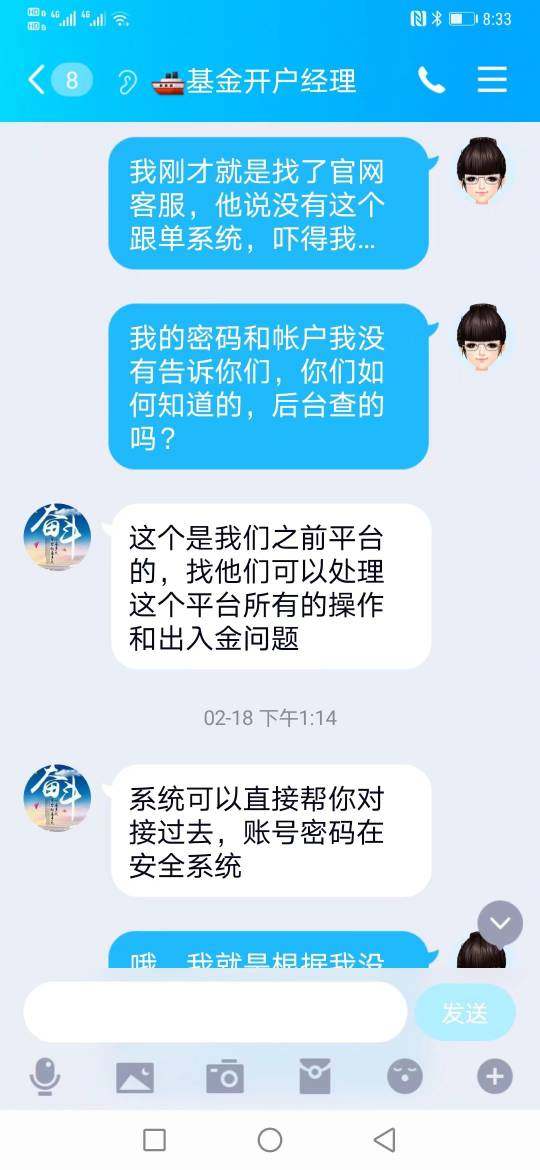

The most alarming aspect of esfx is its apparent lack of regulation, which stands out starkly against the industry's push for transparency and security. While many brokers operate under strict oversight from reputable regulatory bodies, esfx remains unregulated or loosely regulated, leaving clients vulnerable. Research indicates that having no regulatory backing raises significant red flags about the broker's legitimacy and operational motives—potentially allowing for manipulative trading practices.

User Self-Verification Guide

- Visit Regulatory Websites:

- Go to authorities like FCA, ASIC, or NFA's official websites.

- Search for Licensing Information:

- Type "esfx" in the search bar for any relevant registration details.

- Cross-check Broker Reputation:

- Look for any official warnings or sanctions against esfx.

- Review Feedback:

- Explore user reviews on platforms like Trustpilot, noting both praises and complaints.

- Examine the Overview:

- Use a simple Google search to note any recent articles or news reports about esfx's practices.

Industry Reputation and Summary

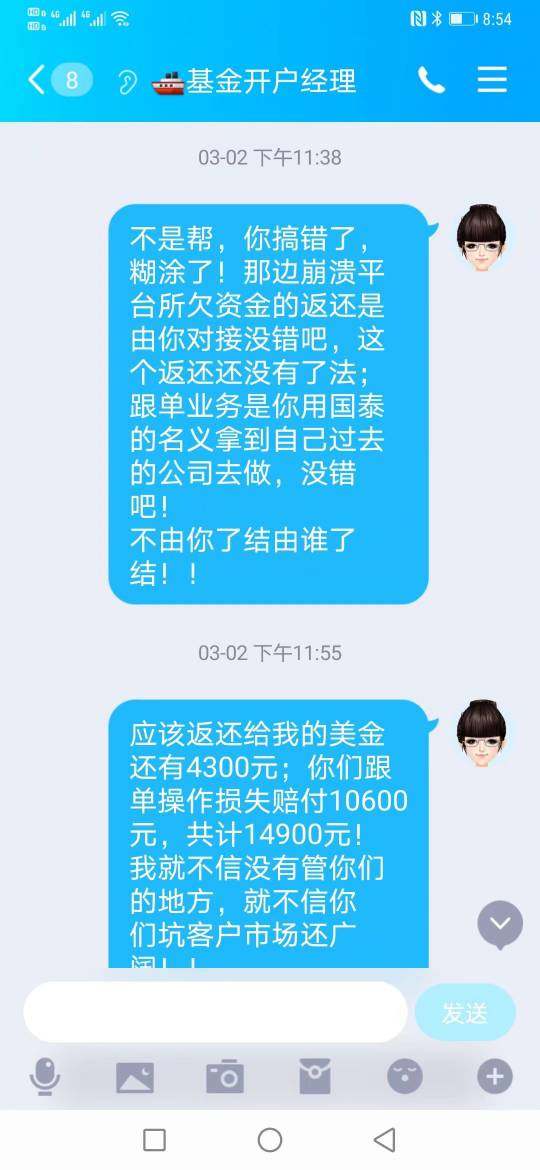

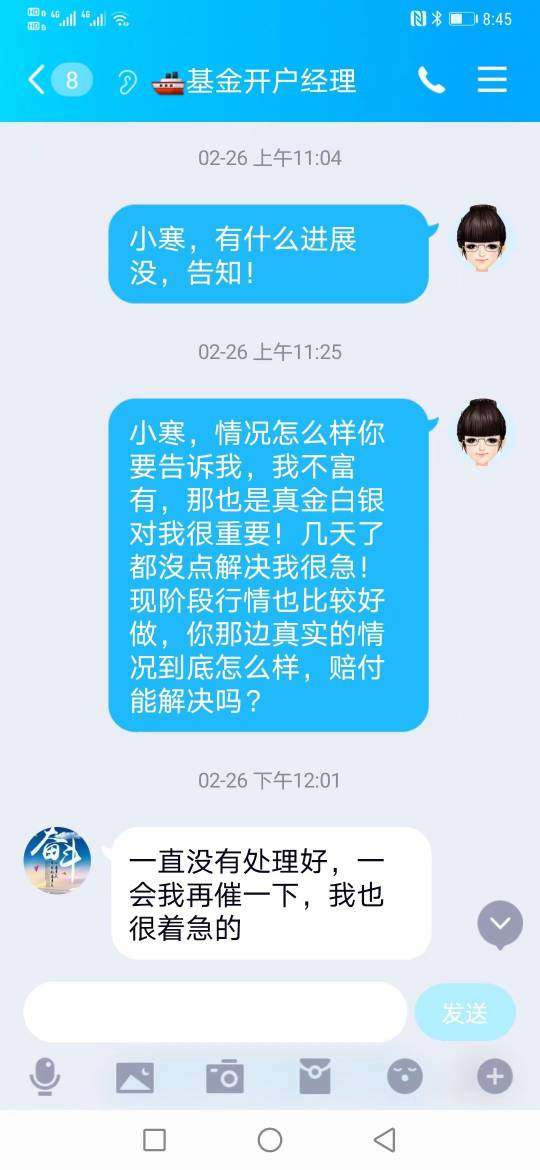

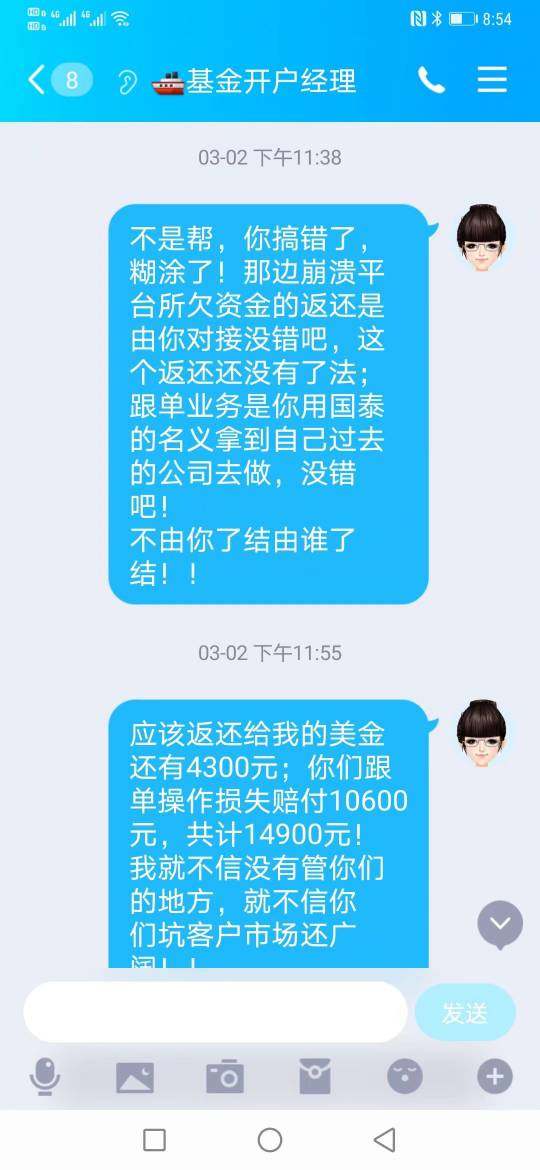

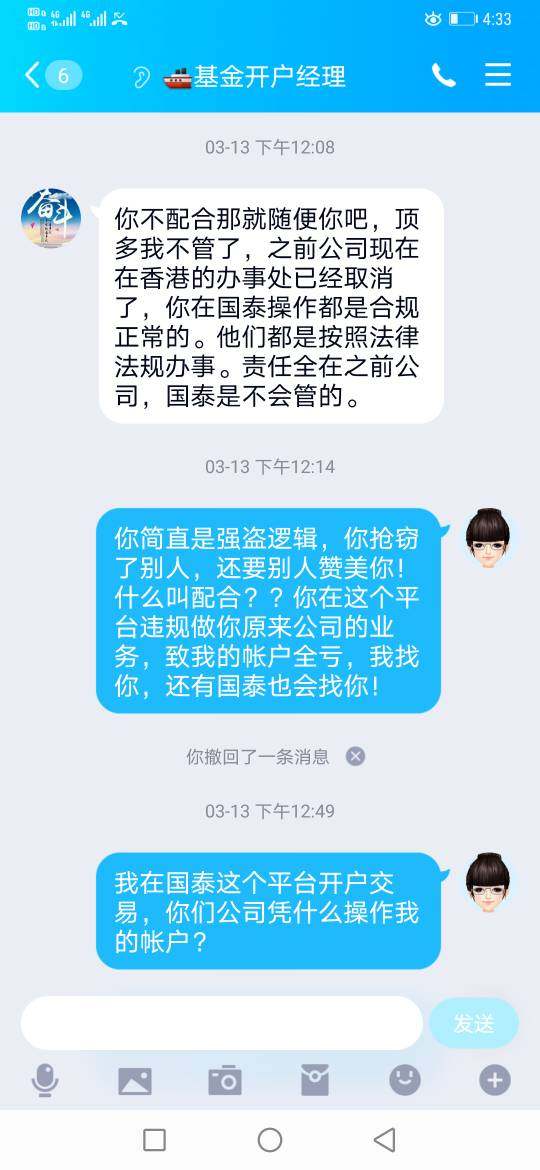

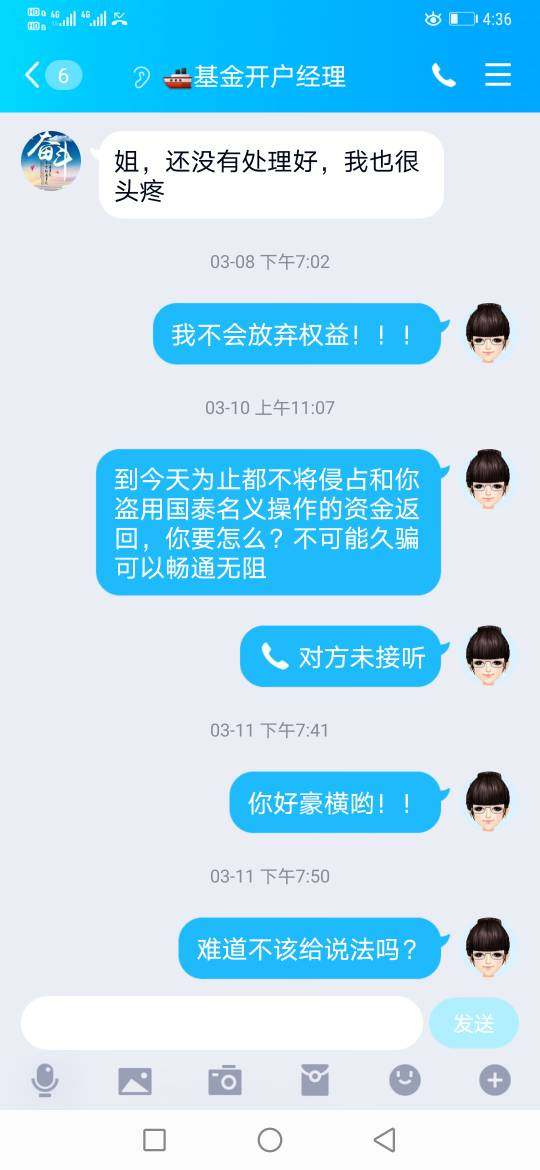

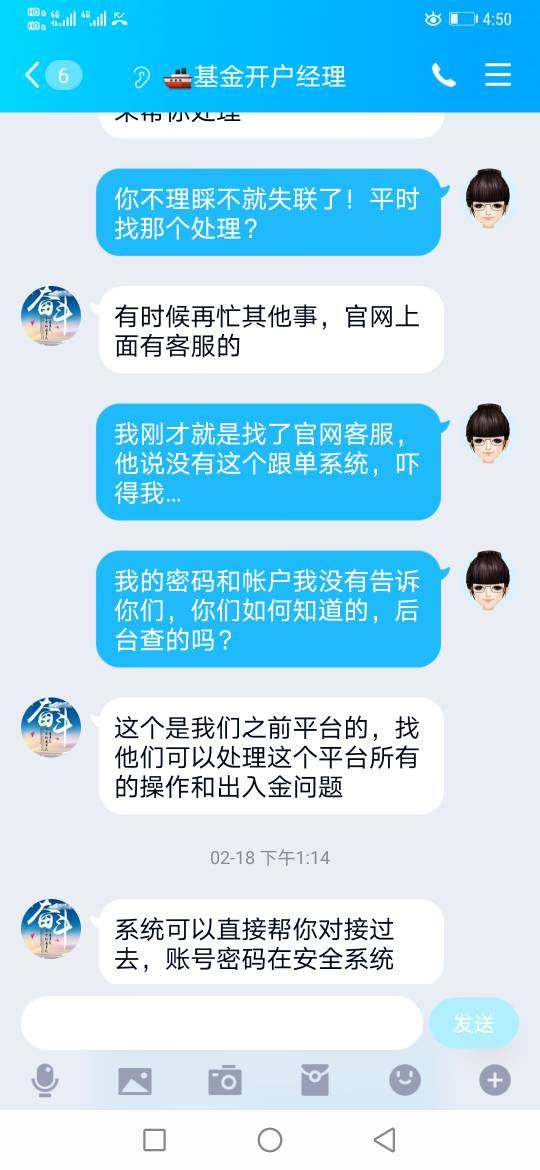

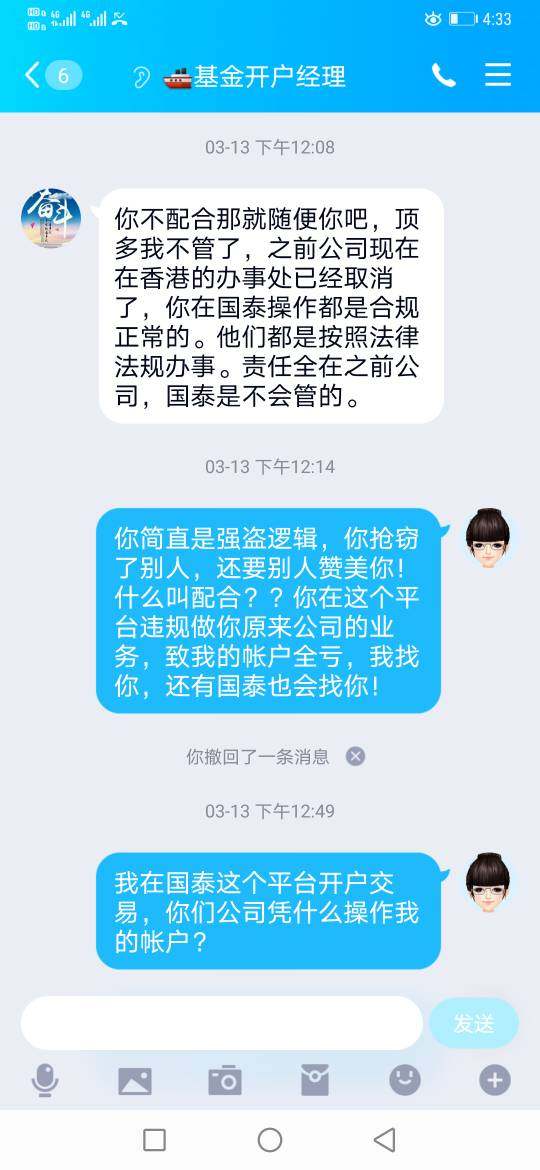

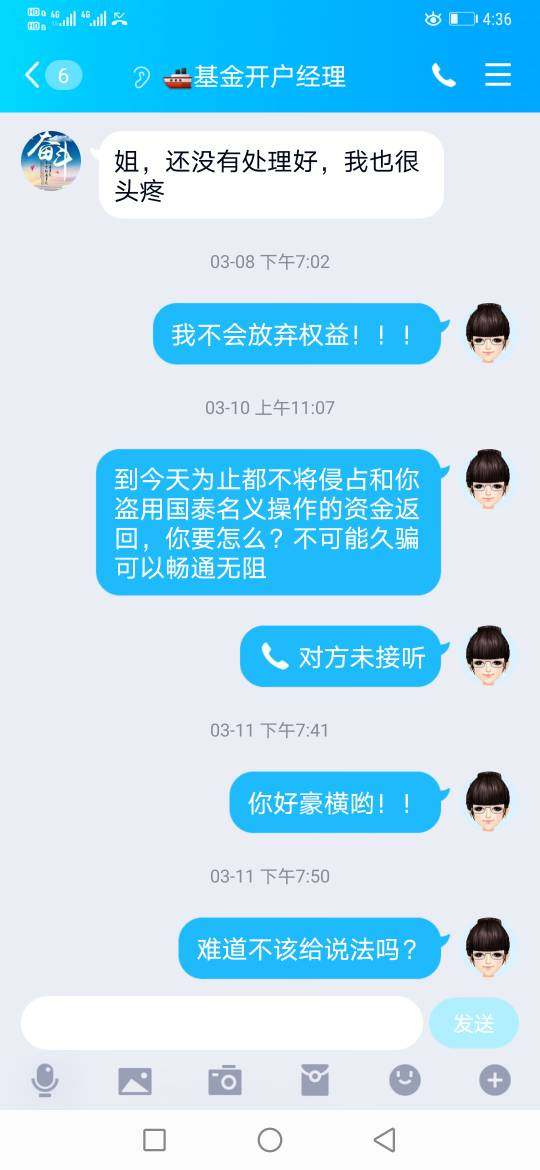

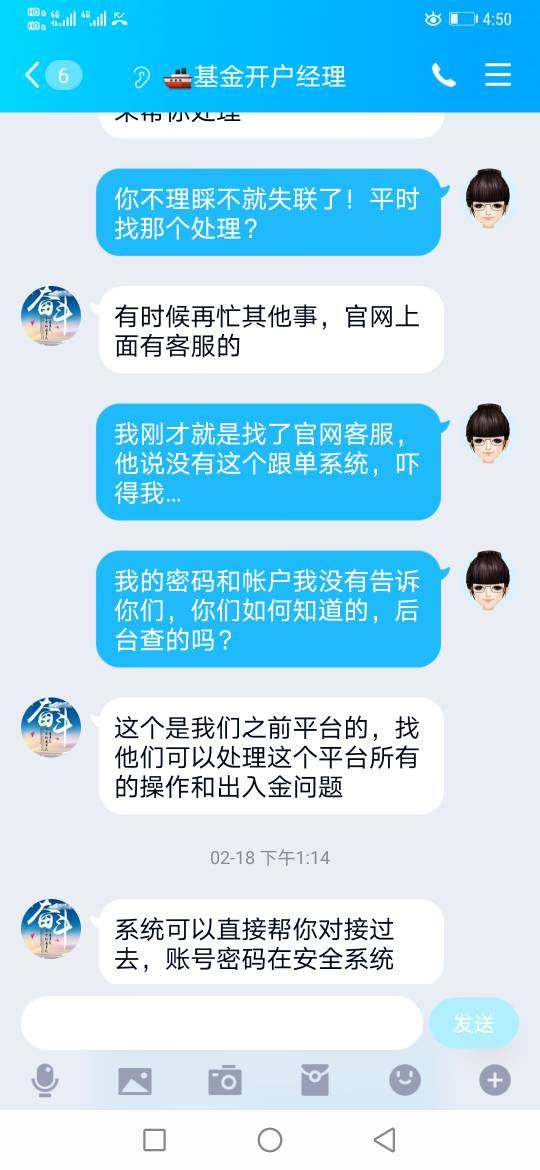

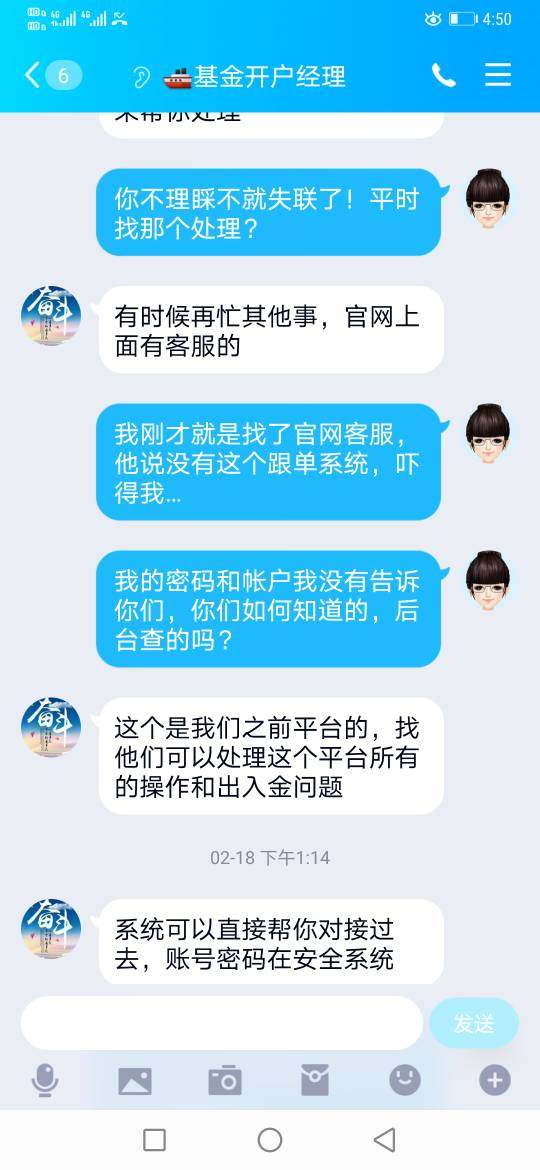

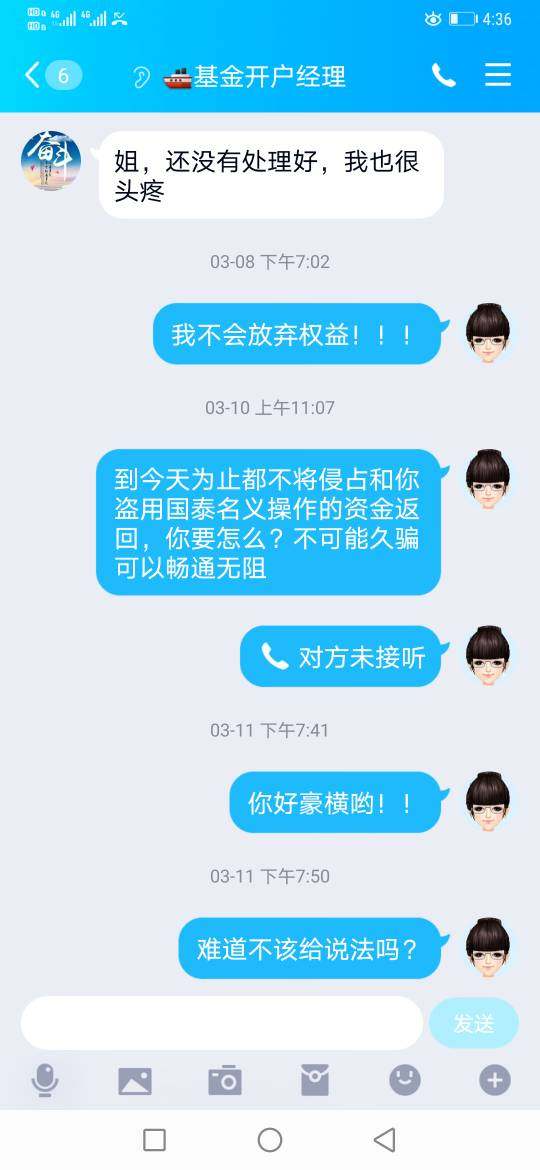

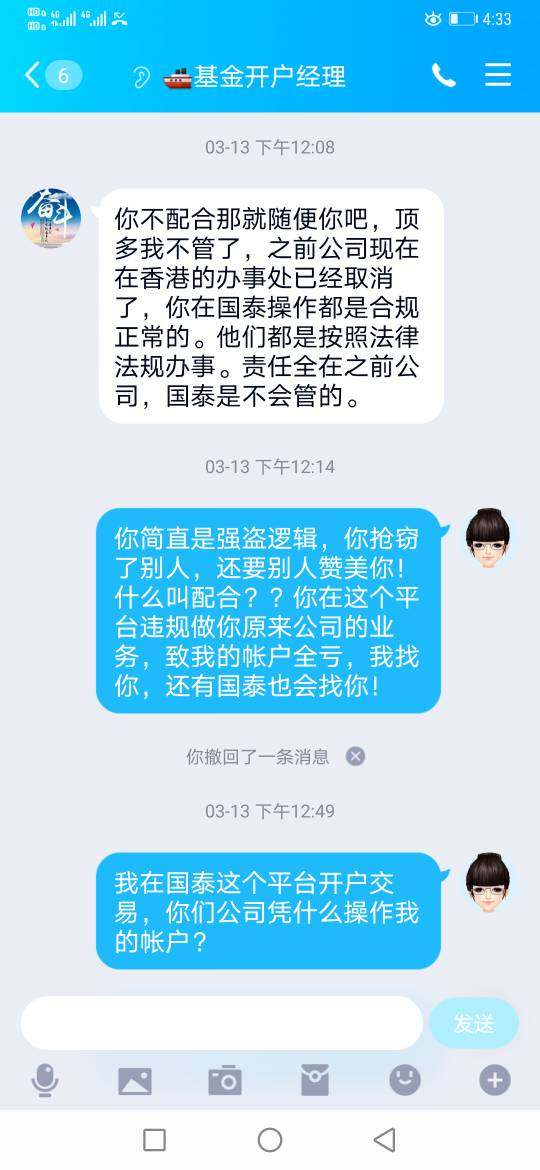

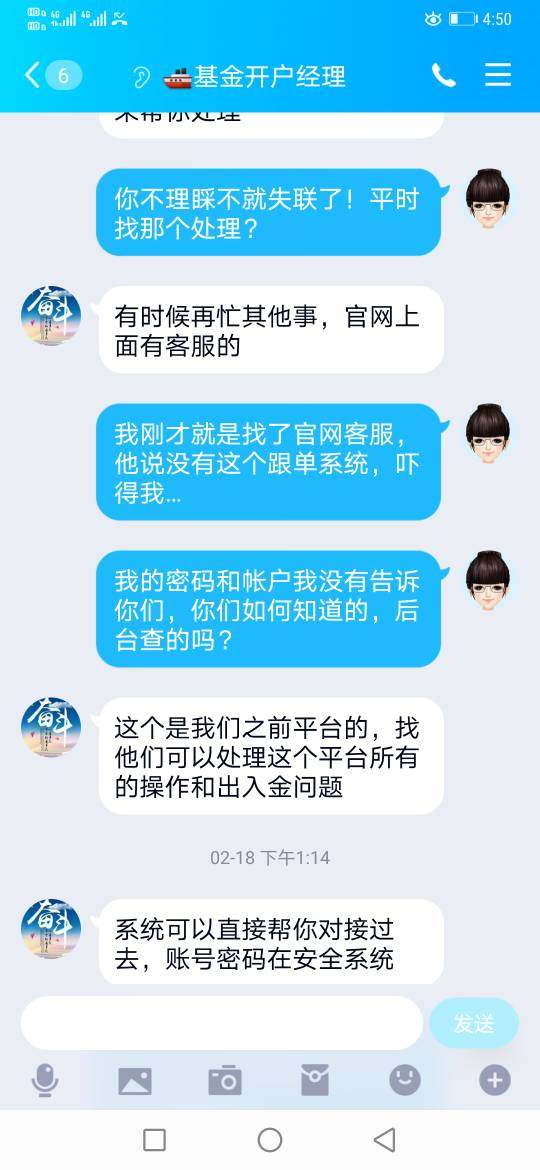

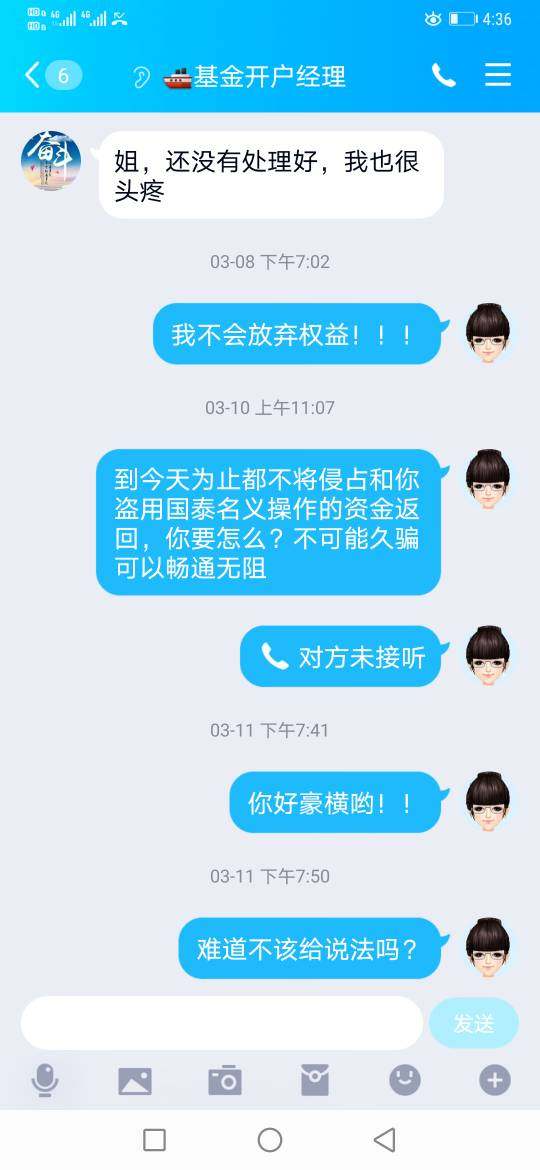

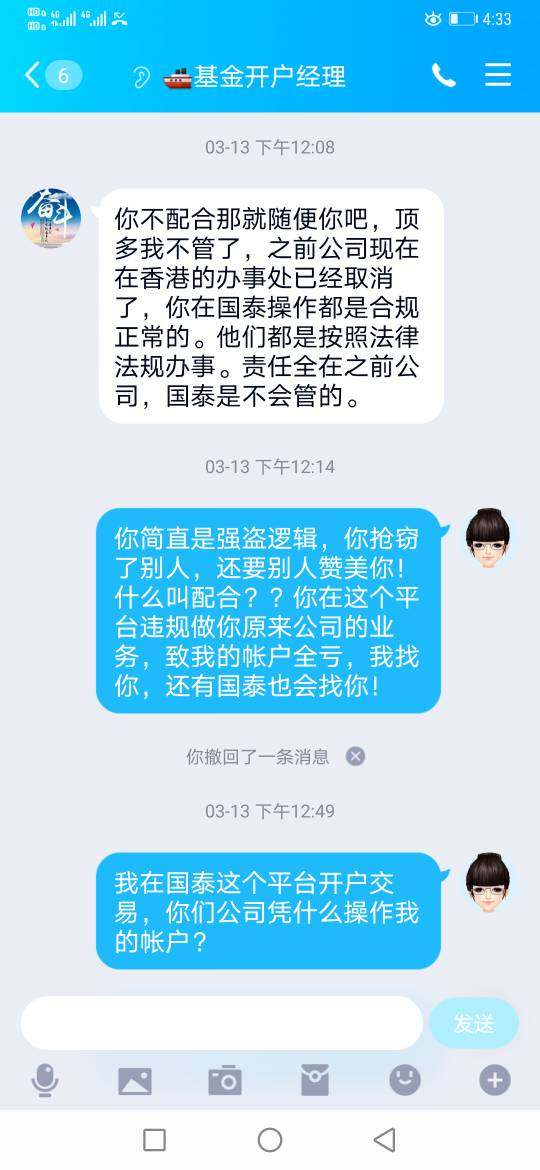

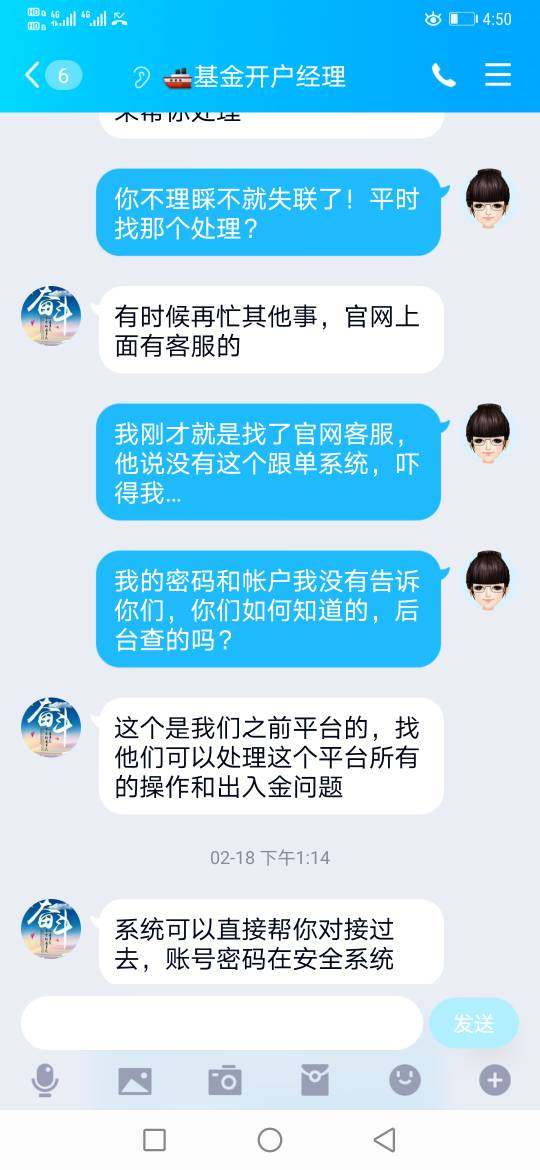

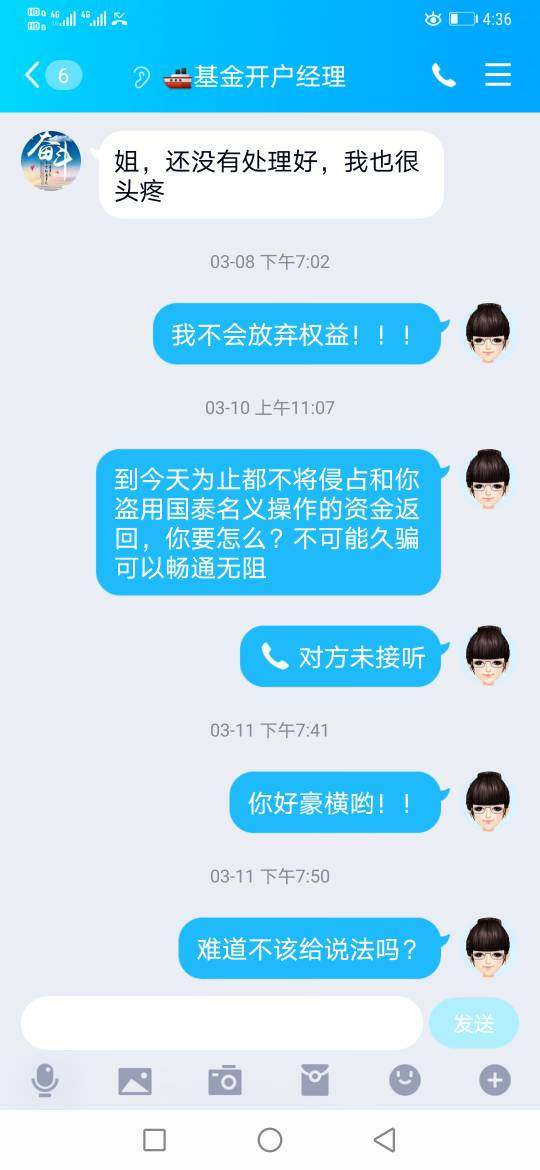

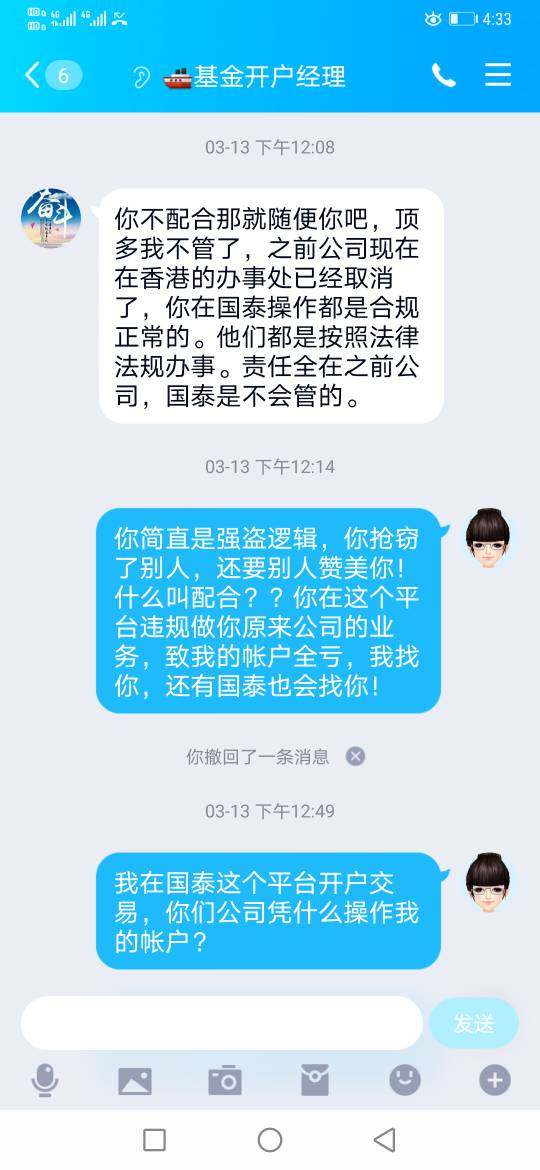

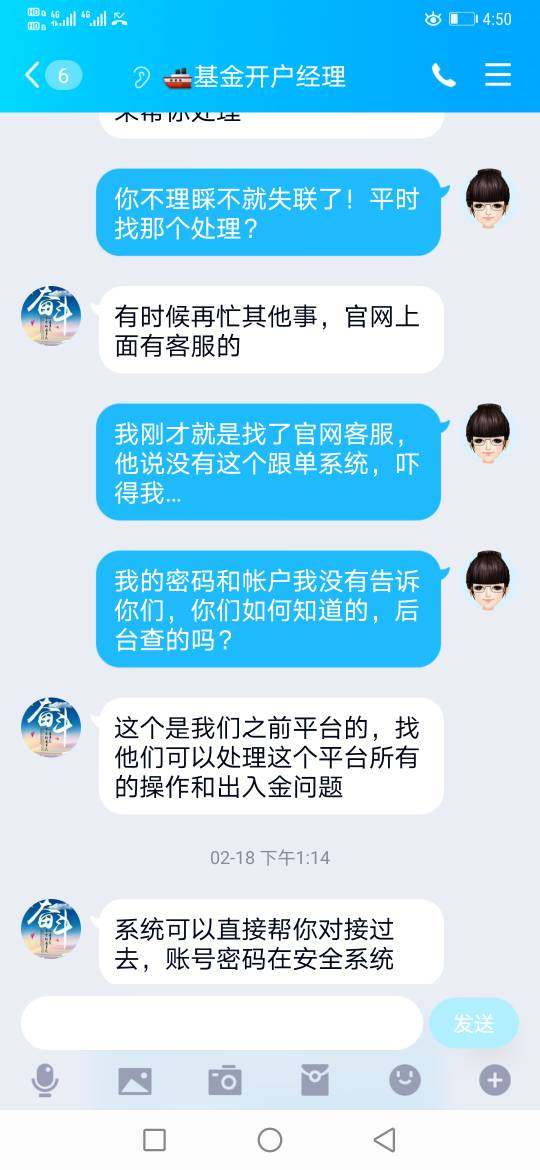

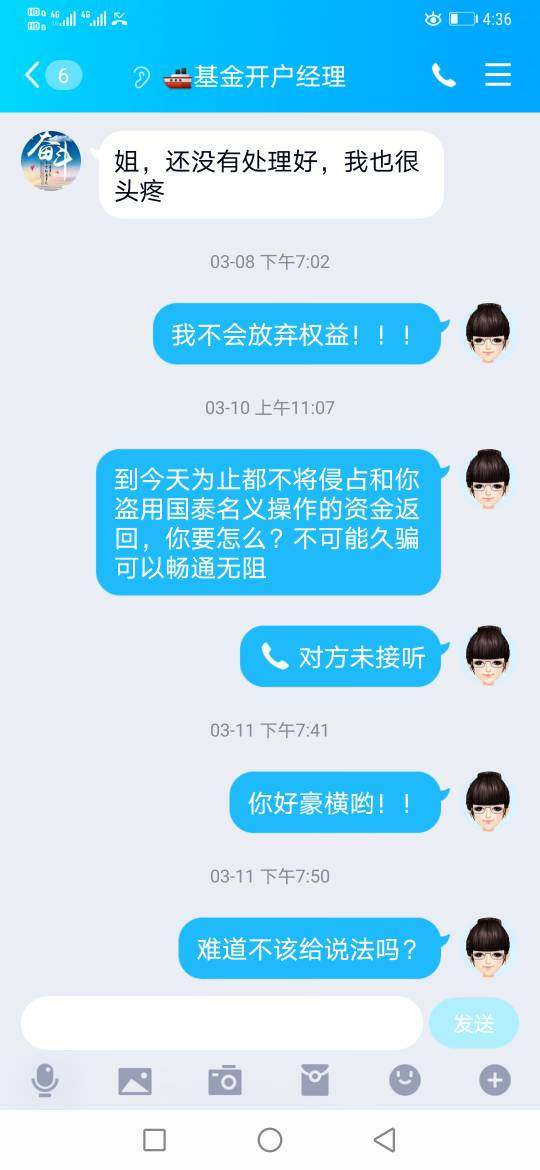

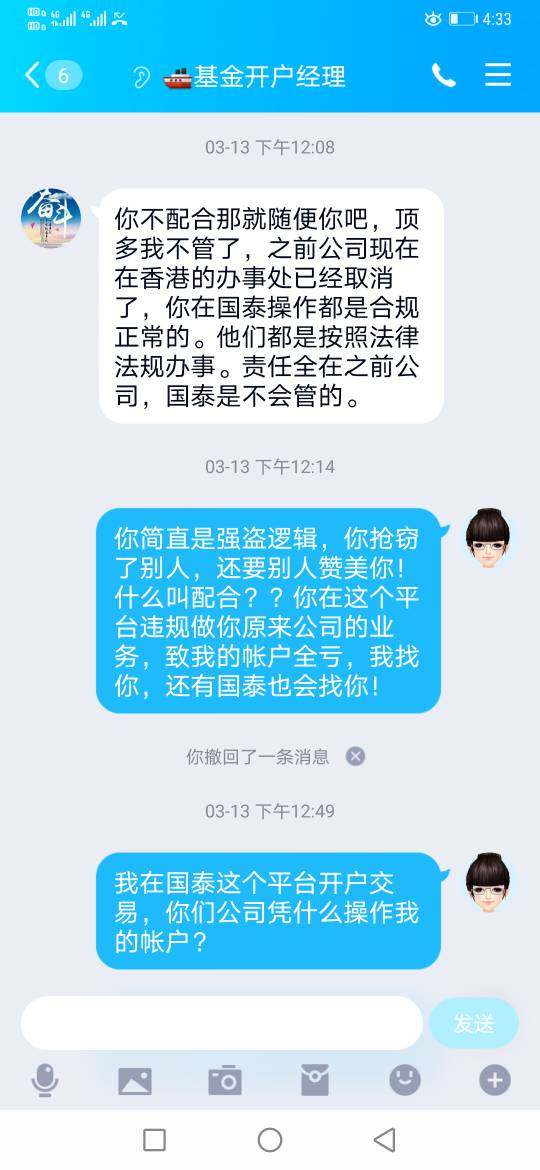

Amid the concerning feedback, users have reported feelings of mistrust due to unverified regulatory claims and low-quality customer interaction. Users mentioned issues including aggressive marketing methods and scandals involving fund withdrawals. As one user noted:

"I lost a lot of money and could not get my funds back. It's a hostile environment."

5.2 Trading Costs Analysis

Advantages in Commissions

One of the main draws of esfx is its competitive trading cost structure. Traders are enticed by the promise of low spreads and attractive commission rates, making it appealing for those who engage in high-volume trading. The general trading costs are reportedly lower than many competitors.

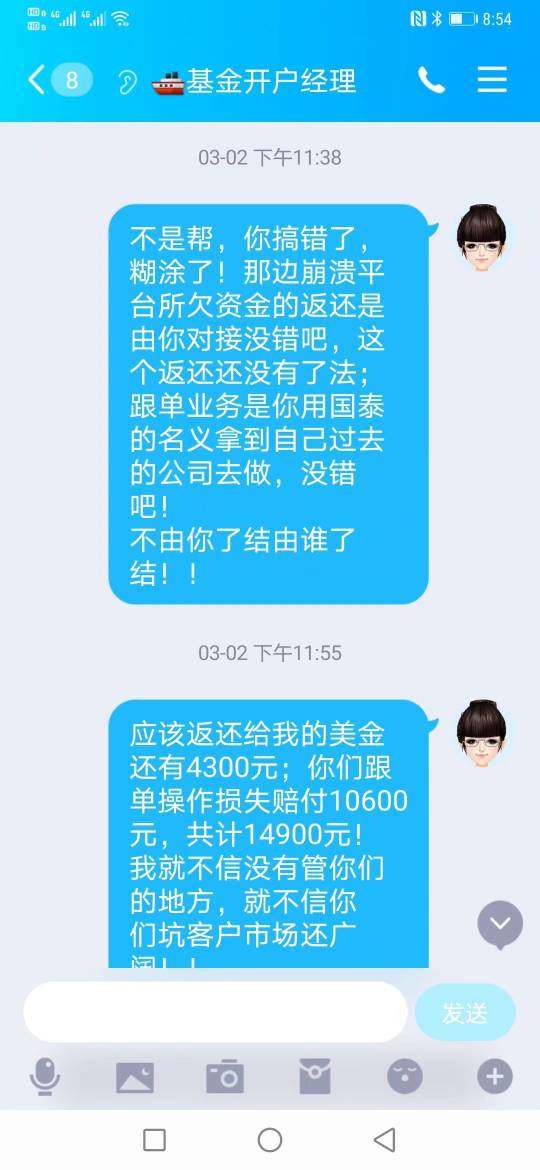

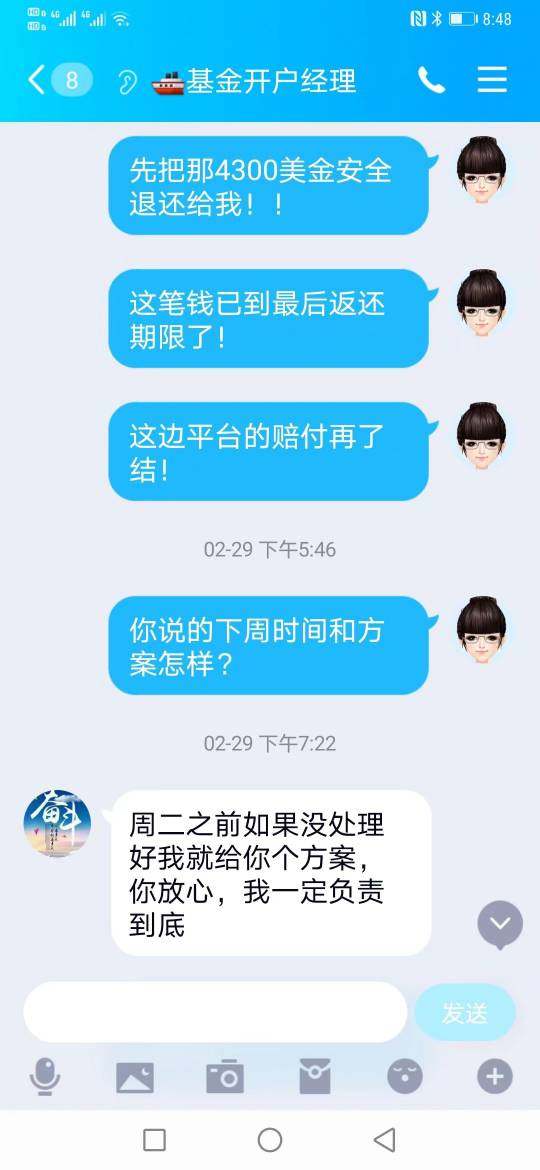

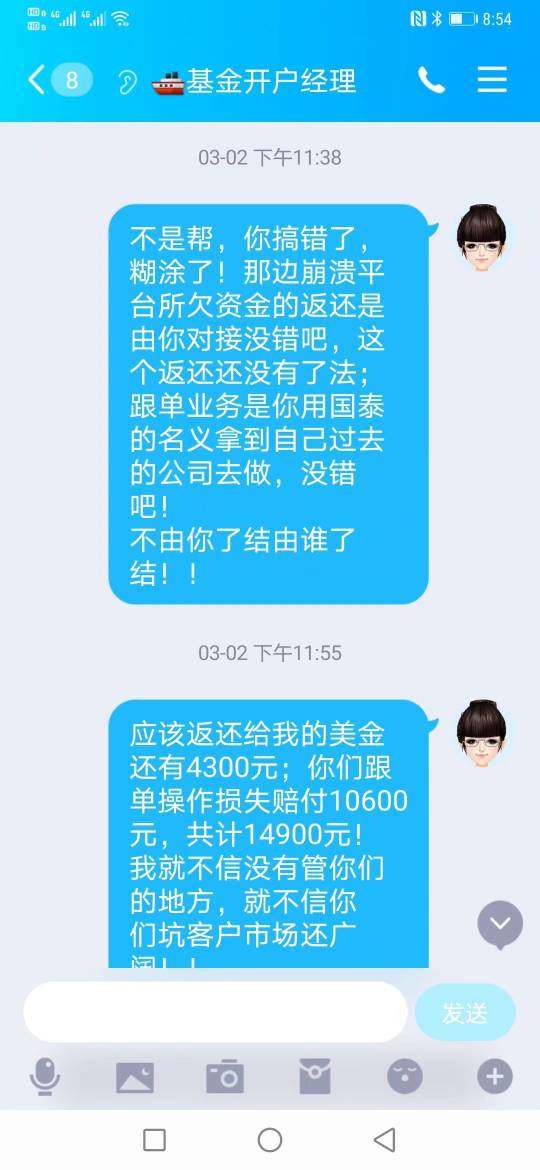

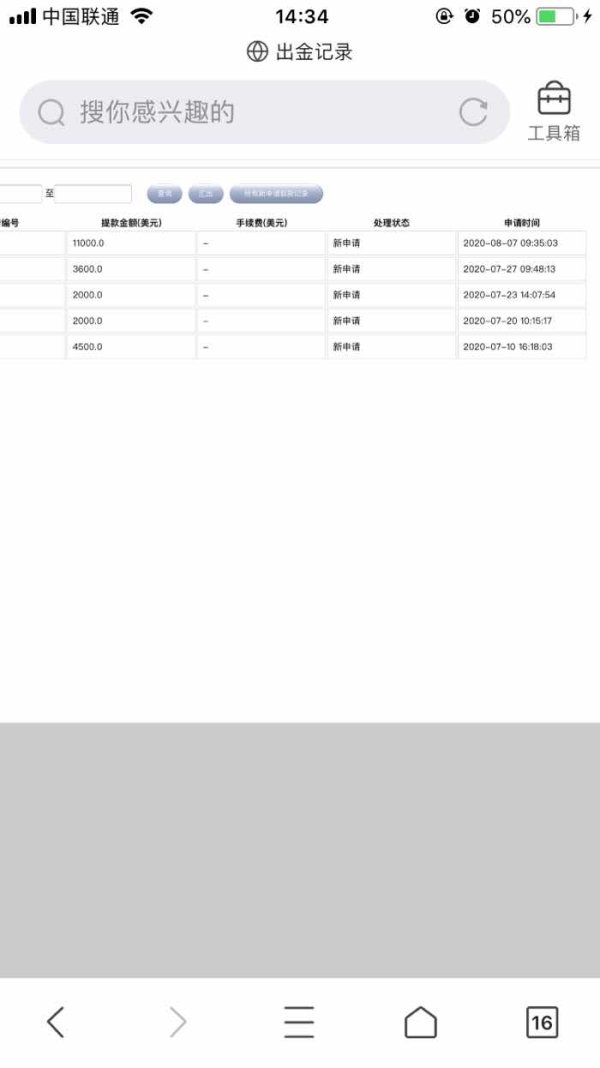

The "Traps" of Non-Trading Fees

However, users have reported that while trading costs are low, non-trading fees—including high withdrawal fees—can make for an unpleasant surprise. As one user highlighted, "Every time I tried to withdraw my earnings, I was charged $150 without explanation, a true trap for gullible traders." This discrepancy in transparency could lead to unexpected financial losses.

Cost Structure Summary

While esfx's trading costs may attract high-frequency traders, the potential for hidden fees raises important considerations. Experienced traders should assess their individual trading strategies, weighing the savings on commissions against the possible losses incurred from excessive withdrawal fees.

esfx offers a selection of trading platforms, primarily focusing on popular solutions like MetaTrader 4 (MT4). The platform features various tools aimed at enhancing the user experience through real-time market data, technical analysis features, and intuitive interface design.

Despite boasting a range of tools, user feedback indicates a significant gap between the broker's promises and actual offerings. The educational resources appear limited, leaving new traders at a disadvantage. Users have commented:

"While the platform is stable, it lacked comprehensive tutorials and support materials."

Overall sentiment about the platform experience tends towards moderate satisfaction, although advanced features found in competing platforms are noticeably absent. Multiple users have reported difficulties in accessing responsive help regarding platform features.

5.4 User Experience Analysis

User Interface

User feedback showcases a generally favorable interface but highlights significant flaws within customer support. Users report experiencing delays and a lack of meaningful assistance when faced with challenges.

Experience Summary

The general consensus is that while the trading interface shows promise, the lack of effective customer support diminishes the overall user experience. Features such as instant live chat and thorough FAQs are notably scarce, discouraging traders from effectively managing their accounts.

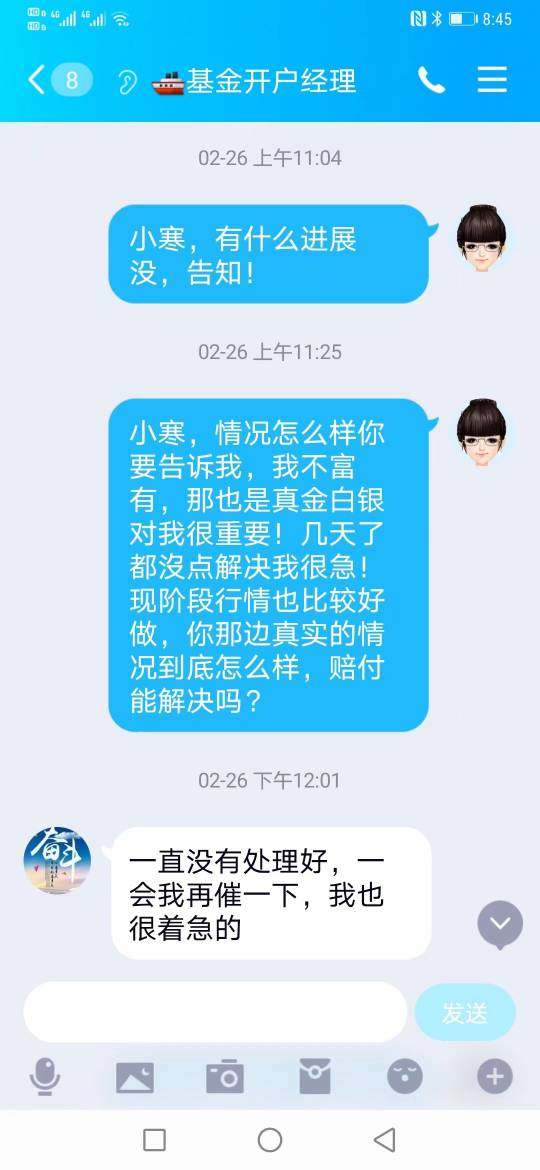

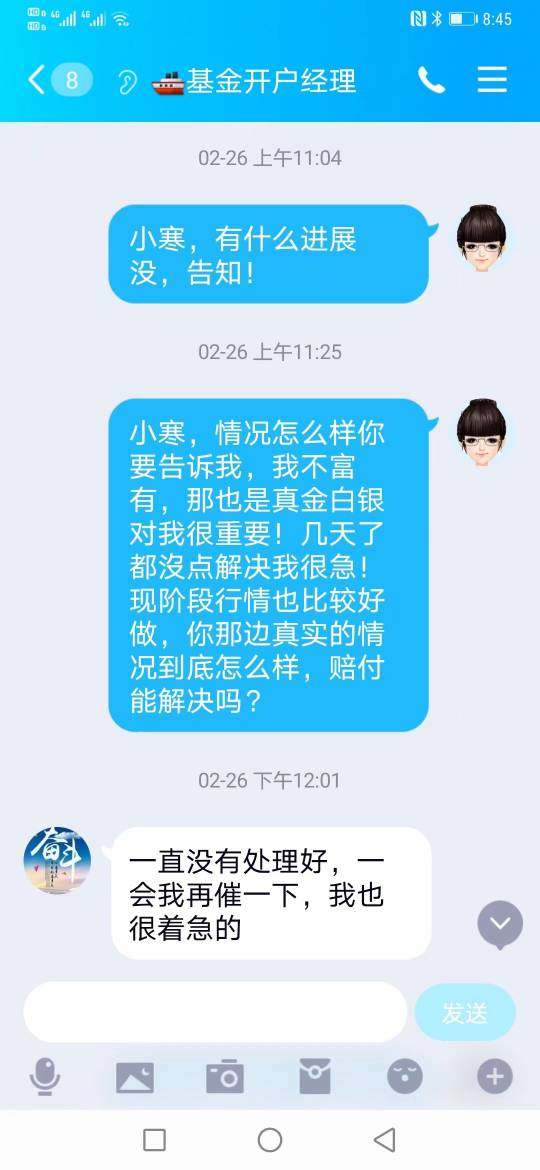

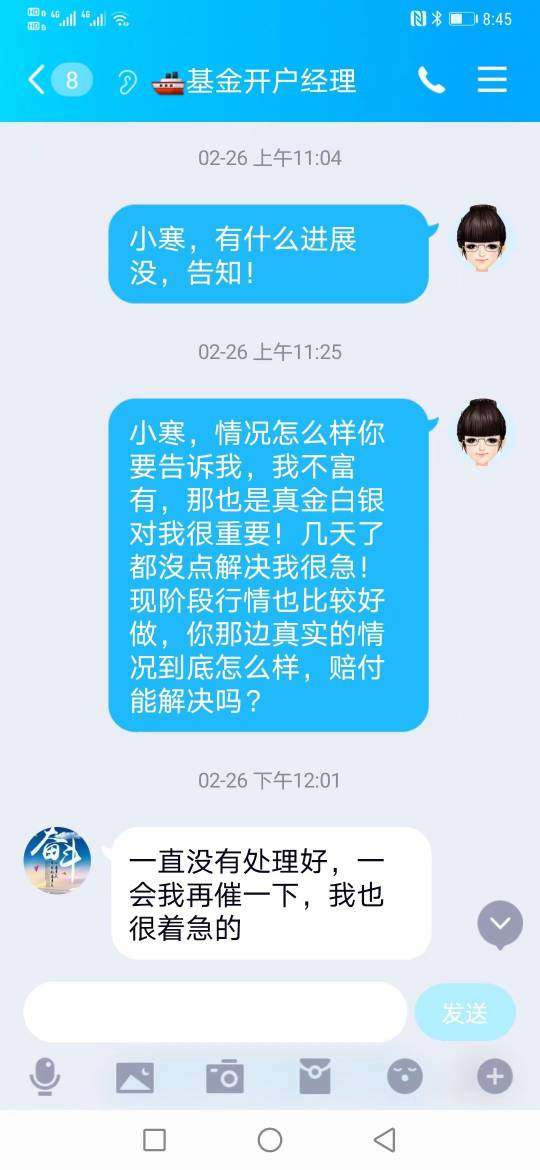

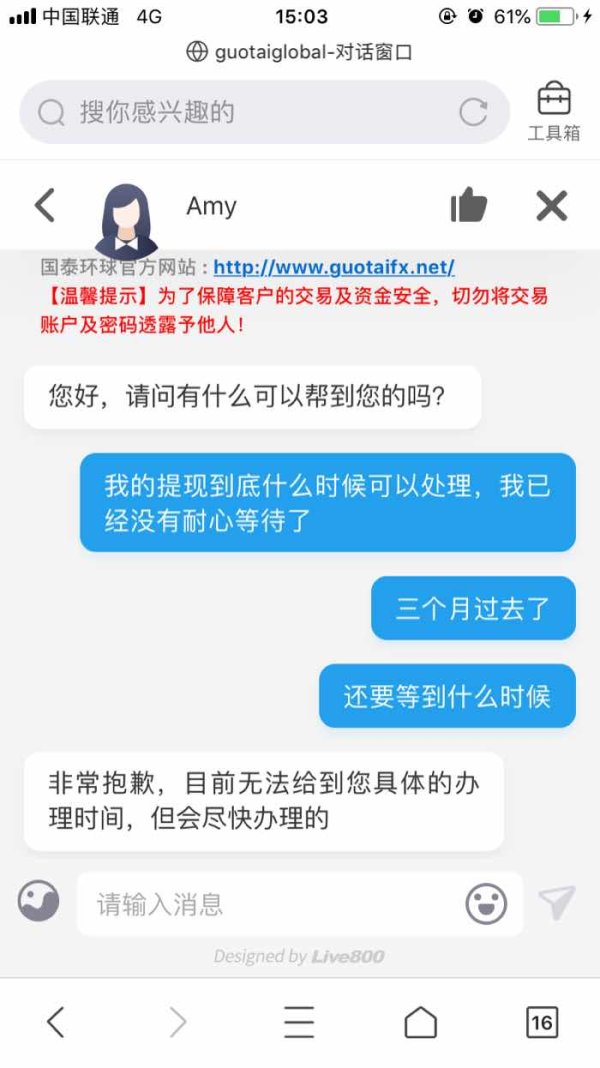

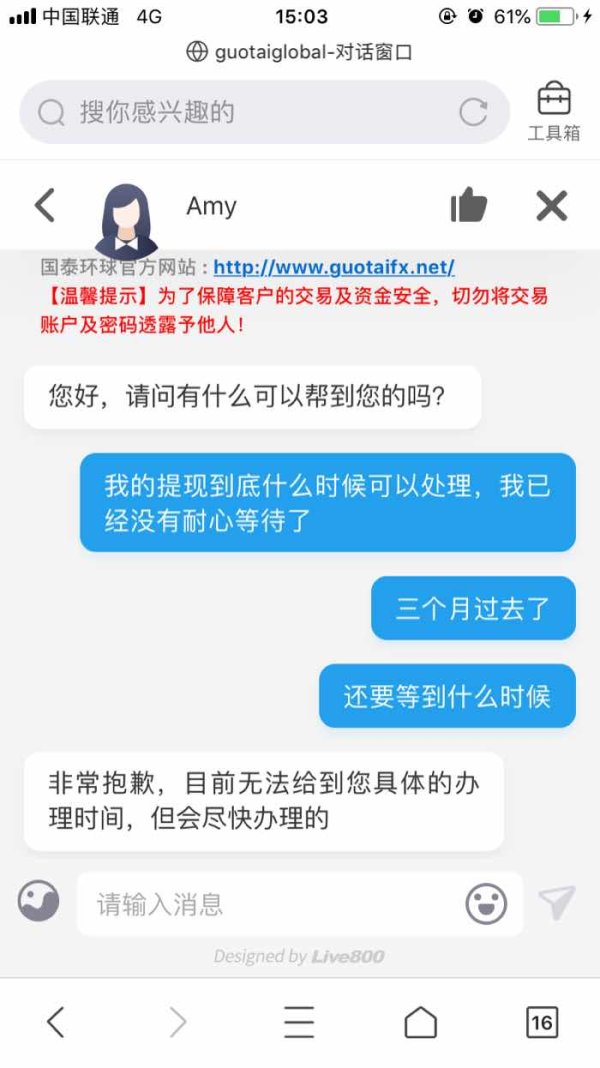

5.5 Customer Support Analysis

Quality & Response Time

Customer service interactions often lead to dissatisfaction among users. Reports indicate long wait times and unhelpful responses, further fueling concerns about the broker's reliability. Users encountered rude agents who did not address basic inquiries effectively.

Customer Sentiment

Many users have expressed frustration with poor customer service, with one stating,

"When I needed help, I received nothing but vague responses. It felt like they didnt care about client issues."

5.6 Account Conditions Analysis

Account Variety

esfx offers a range of account types devised to cater to various trading needs, appealing primarily to experienced traders. Each account purportedly targets specific strategies, yet details on actual execution and fund access remain unclear.

Client Fund Safety

Given the numerous complaints surrounding customer funds, emerging concerns over safety become evident. A definitive stance on whether client funds are adequately protected is a critical gap in esfxs offerings.

Conclusion

In summary, while esfx market strategies appear enticing, potential investors should exercise extreme caution. The considerable risks—I.e., unregulated status, negative user experiences, and aggressive marketing practices—outweigh the benefits presented. Thorough research and a cautious approach are paramount for those considering opening an account with esfx, as regulatory legitimacy and customer support remain crucial anchors in successful trading.

By grasping the outlined details and employing the self-verification guidelines, traders can make educated decisions that align with their trading goals while prioritizing the safety of their investments.