Regarding the legitimacy of WZG forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is WZG safe?

Software Index

Risk Control

Is WZG markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

萬洲金業集團有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.wzg.comExpiration Time:

--Address of Licensed Institution:

新界荃灣楊屋道8號如心廣場2座26樓2601-02室Phone Number of Licensed Institution:

23889560Licensed Institution Certified Documents:

Is WZG A Scam?

Introduction

WZG, a forex broker based in Hong Kong, has been gaining attention in the trading community. It claims to offer a range of trading services, primarily focused on precious metals. As the forex market continues to attract both seasoned traders and newcomers, it becomes increasingly essential for individuals to evaluate brokers thoroughly before investing their hard-earned money. The rise of online trading has also led to a proliferation of unregulated brokers, making it crucial for traders to exercise caution. This article aims to provide an objective analysis of WZG, exploring its regulatory status, company background, trading conditions, customer experiences, and overall safety.

To assess WZG's credibility, this investigation relies on a comprehensive review of multiple sources, including user feedback, regulatory information, and expert evaluations. By employing a structured framework, the analysis will highlight both the strengths and weaknesses of WZG as a forex broker, ultimately guiding potential investors in making informed decisions.

Regulation and Legitimacy

The regulatory status of a forex broker is a vital factor in determining its legitimacy and trustworthiness. WZG operates without a solid regulatory framework, which raises significant concerns regarding investor protection and the safety of funds. The lack of regulation often indicates a higher risk of fraud, as unregulated brokers are not held to the same standards as their regulated counterparts.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CGSE | 141 | Hong Kong | Suspicious Clone |

The Chinese Gold & Silver Exchange Society (CGSE) has issued a license to WZG, but there are suspicions that this could be a clone license, which further complicates the broker's regulatory standing. The CGSE is known for its limited oversight, and its licensing does not provide the same level of protection as regulators like the FCA or ASIC. This raises questions about WZG's compliance history and the transparency of its operations.

In the context of regulatory quality, WZG's lack of robust oversight mechanisms means that traders may find it challenging to seek recourse in case of disputes. The absence of a reliable regulatory framework can lead to potential exploitation, making it imperative for traders to approach WZG with caution.

Company Background Investigation

WZG, officially known as Wanzhou Gold Group Limited, was established in 2017 and is headquartered in Tsuen Wan, Hong Kong. The company claims to specialize in providing online trading services for precious metals, including London gold and silver. However, the lack of detailed information about its ownership structure and management team raises concerns about its transparency.

The management team of WZG is not well-documented, and there is limited information available regarding their professional backgrounds and experience in the financial sector. This lack of transparency can be a red flag for potential investors, as a knowledgeable and experienced management team is often indicative of a broker's reliability.

Furthermore, WZG's website provides minimal information about its operational practices and policies, which adds to the uncertainty surrounding the broker. In an industry that thrives on trust and transparency, WZG's opaque structure may deter potential traders from engaging with its services.

Trading Conditions Analysis

Understanding the trading conditions offered by WZG is crucial for evaluating its competitiveness in the market. The broker claims to provide a range of trading instruments, including forex pairs and precious metals, but details regarding spreads, commissions, and other fees remain vague.

| Fee Type | WZG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not specified | 1-2 pips |

| Commission Model | Not specified | Varies |

| Overnight Interest Range | Not specified | Varies |

The absence of clear information regarding spreads and commissions makes it difficult for traders to assess the overall cost of trading with WZG. Moreover, the lack of competitive pricing could indicate that WZG may not be the best choice for cost-conscious traders.

Additionally, complaints regarding hidden fees or unexpected charges have surfaced in customer reviews, which can further complicate the trading experience. Traders are advised to be vigilant and thoroughly review the terms and conditions before committing to any trades.

Customer Funds Safety

The safety of customer funds is paramount when choosing a forex broker. WZG claims to implement various measures to safeguard client funds, including segregating client accounts. However, the effectiveness of these measures is called into question due to the broker's unregulated status.

The absence of investor protection schemes, such as those provided by regulated brokers, means that traders' funds may not be adequately protected in the event of insolvency or fraud. This raises serious concerns about the overall safety of funds held with WZG.

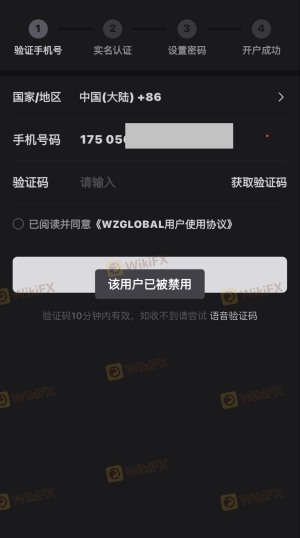

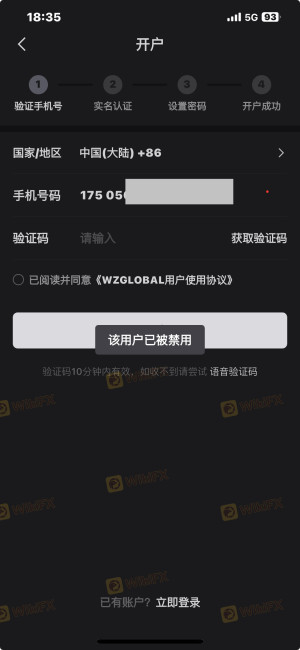

Moreover, there have been reports of difficulties in withdrawing funds, with clients alleging that the broker delays or denies withdrawal requests. Such practices can be indicative of potential fraud, leading to a lack of confidence in WZG's ability to manage client funds responsibly.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall experience of traders with WZG. Numerous reviews highlight a pattern of negative experiences, with many users reporting issues related to withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Account Closure Complaints | High | Poor |

Common complaints include difficulties in withdrawing funds, lack of communication from customer service, and account closures without clear explanations. These issues not only reflect poorly on WZG's operational practices but also raise concerns about the broker's commitment to customer satisfaction.

For instance, one user reported being unable to withdraw funds after making significant profits, only to be met with vague explanations from customer service. Such experiences can be detrimental to the broker's reputation and can dissuade potential clients from engaging with its services.

Platform and Trade Execution

The trading platform's performance is a critical aspect of the trading experience. WZG offers the MetaTrader 4 (MT4) platform, which is widely regarded for its user-friendly interface and comprehensive trading tools. However, user feedback indicates that the platform may experience stability issues, particularly during high volatility periods.

Additionally, reports of slippage and order rejections have surfaced, which can significantly impact trading outcomes. Traders expect reliable execution and minimal slippage, and any signs of manipulation or technical glitches can undermine trust in the broker.

Risk Assessment

Using WZG as a trading platform involves inherent risks that potential investors should carefully consider. The lack of regulatory oversight, coupled with negative customer experiences, indicates a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud risk. |

| Withdrawal Risk | High | Reports of fund withdrawal issues. |

| Transparency Risk | Medium | Lack of clear information about fees. |

To mitigate these risks, traders should conduct thorough research before investing. Engaging with regulated brokers that offer transparent fee structures and robust customer support can significantly reduce the potential for negative experiences.

Conclusion and Recommendations

In conclusion, WZG presents several red flags that suggest it may not be a safe option for traders. The lack of robust regulation, negative customer feedback, and concerns regarding fund security raise significant doubts about the broker's credibility.

Potential investors are advised to exercise extreme caution when considering WZG for trading. It is recommended to explore regulated alternatives that offer greater transparency, competitive trading conditions, and a proven track record of customer satisfaction. By prioritizing safety and reliability, traders can better safeguard their investments and enhance their trading experience.

Is WZG a scam, or is it legit?

The latest exposure and evaluation content of WZG brokers.

WZG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WZG latest industry rating score is 6.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.