Winfxmarkets 2025 Review: Everything You Need to Know

Summary: Winfxmarkets has garnered significant negative attention in recent reviews, primarily due to its lack of regulation and numerous user complaints regarding withdrawal issues. The broker presents itself as a viable option for traders, but the overwhelming consensus suggests it poses considerable risks to investors.

Note: It is crucial to recognize that Winfxmarkets operates under different entities across regions, which may complicate regulatory oversight. This review aims to provide a fair and accurate assessment based on available information.

Rating Overview

We evaluate brokers based on comprehensive research and user feedback to deliver an informed rating.

Broker Overview

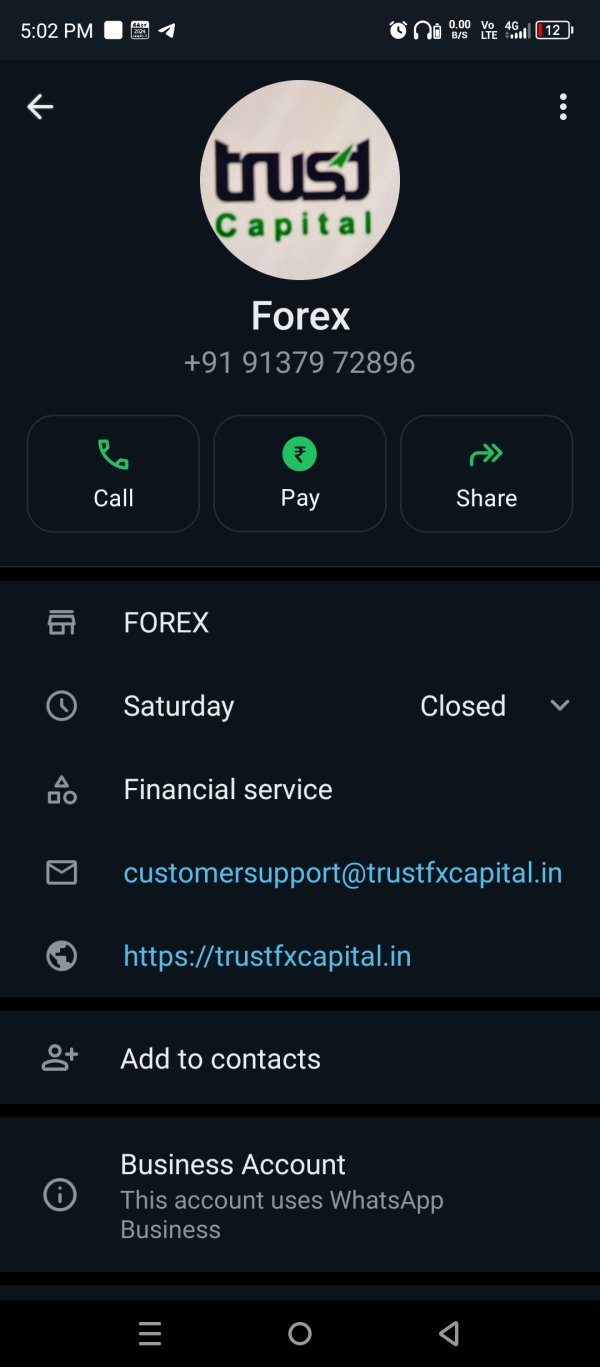

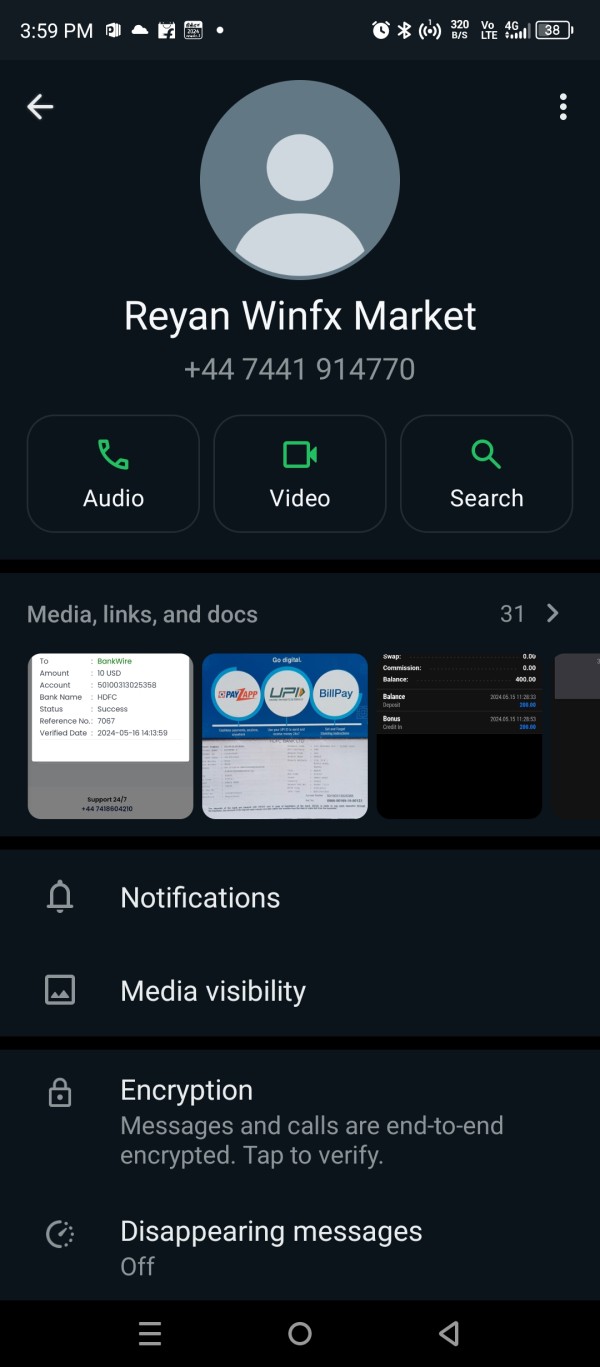

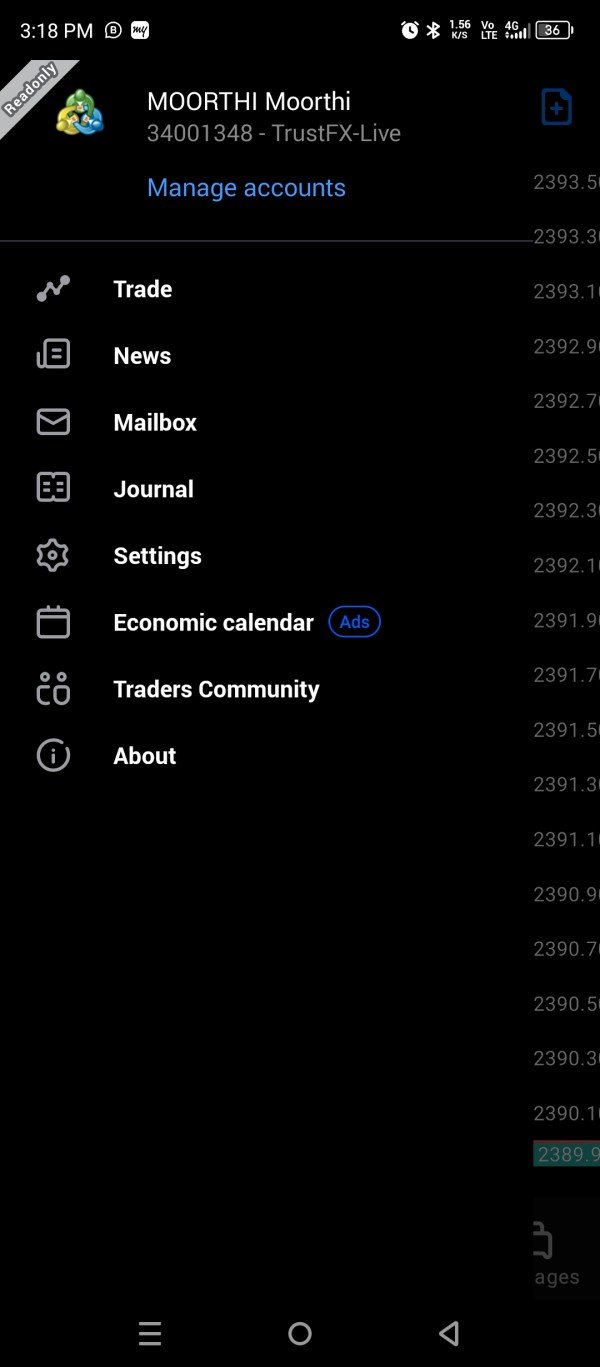

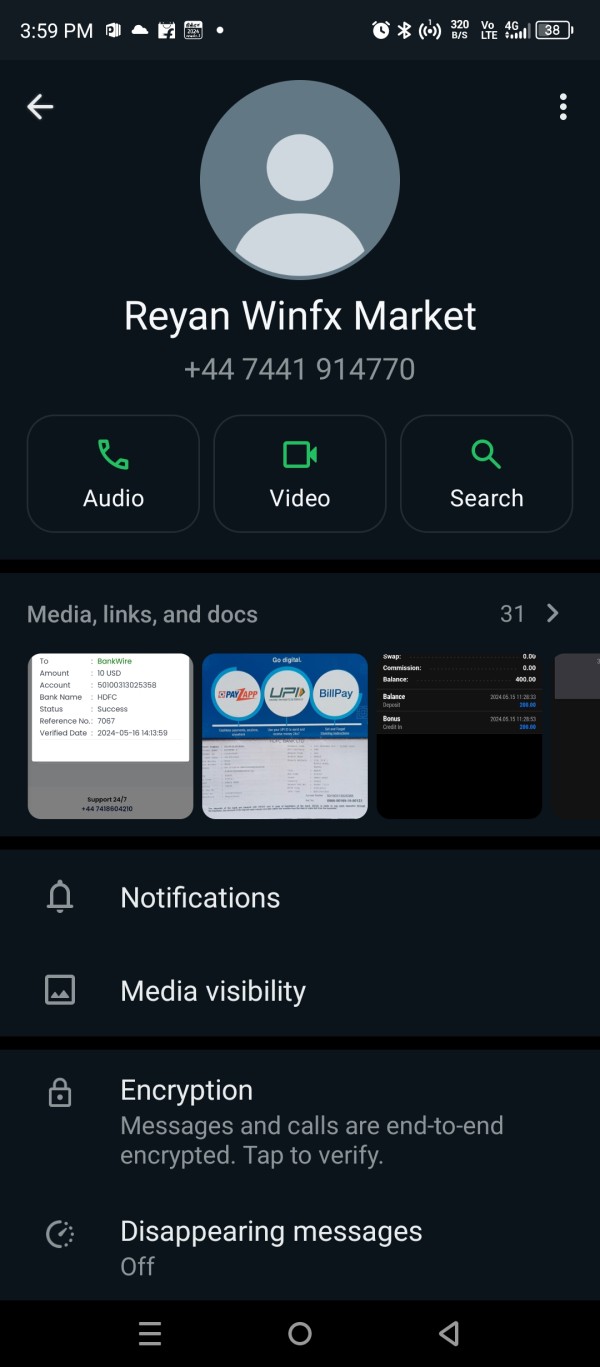

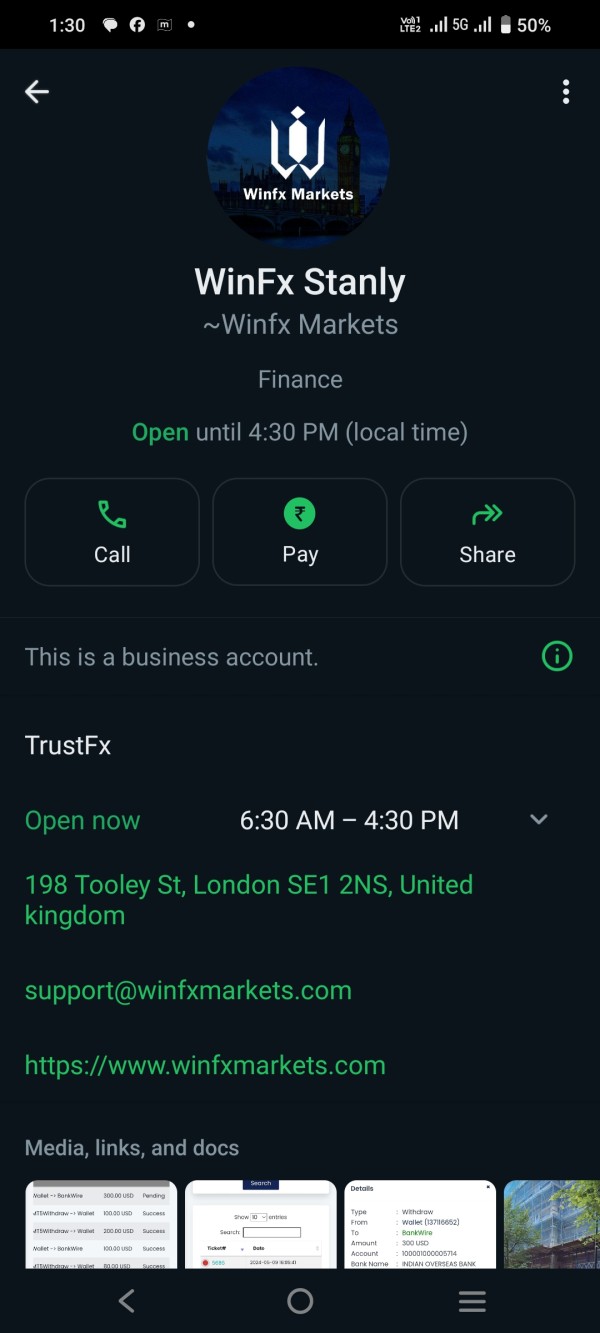

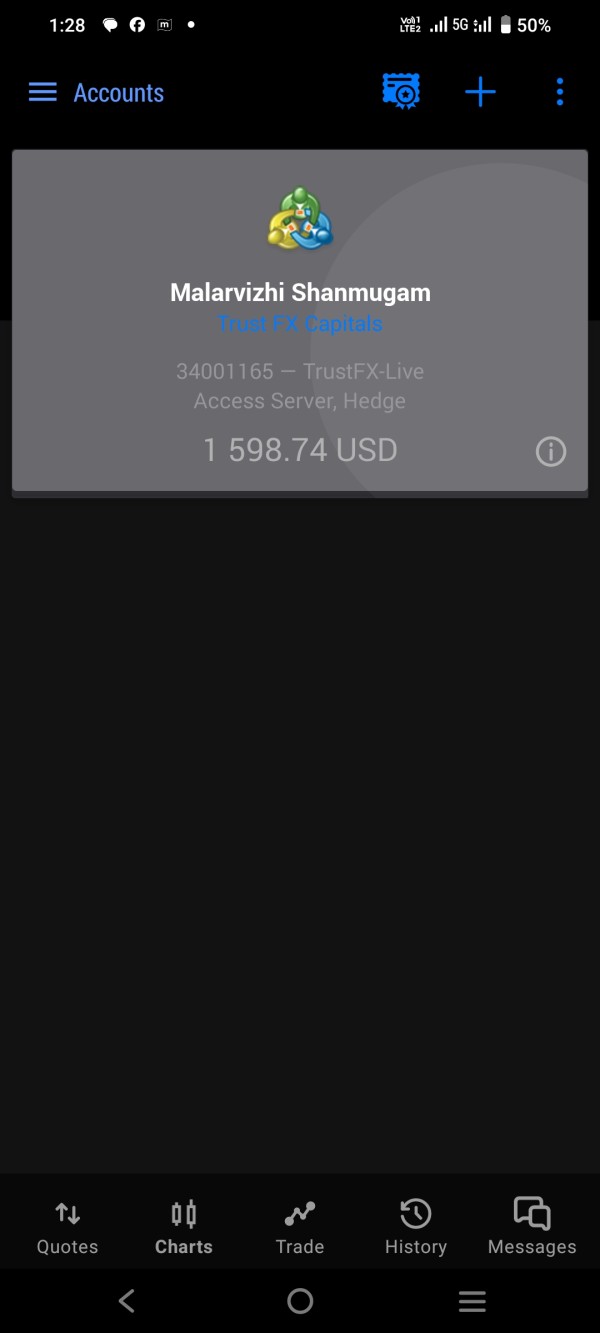

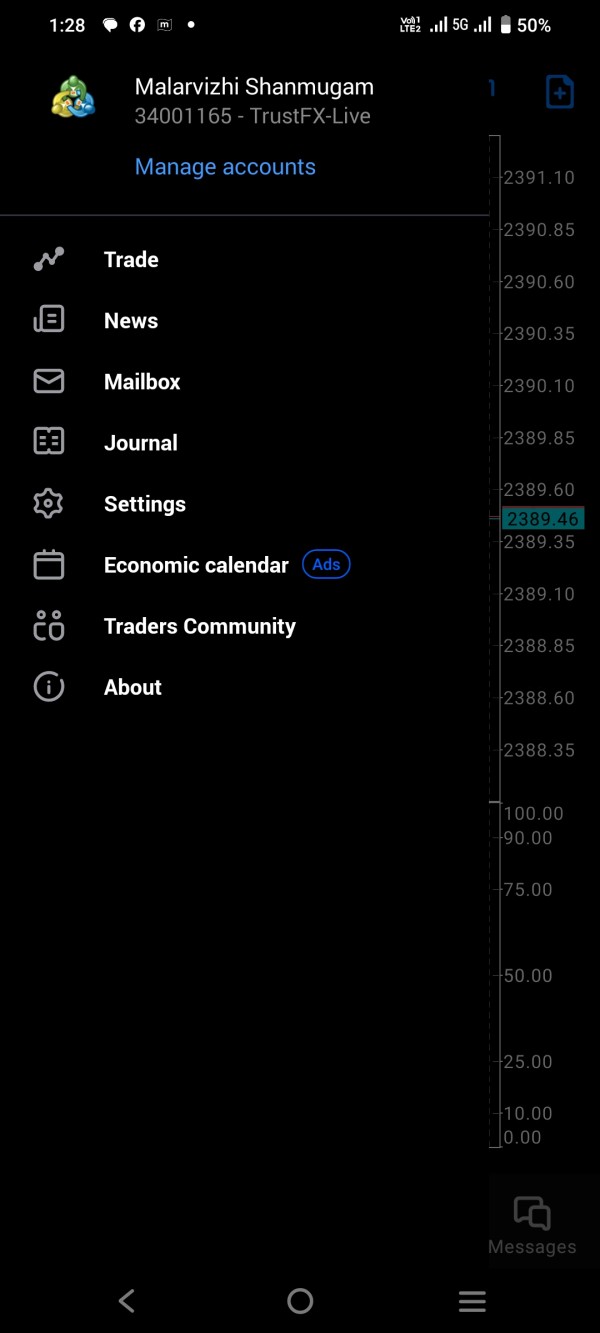

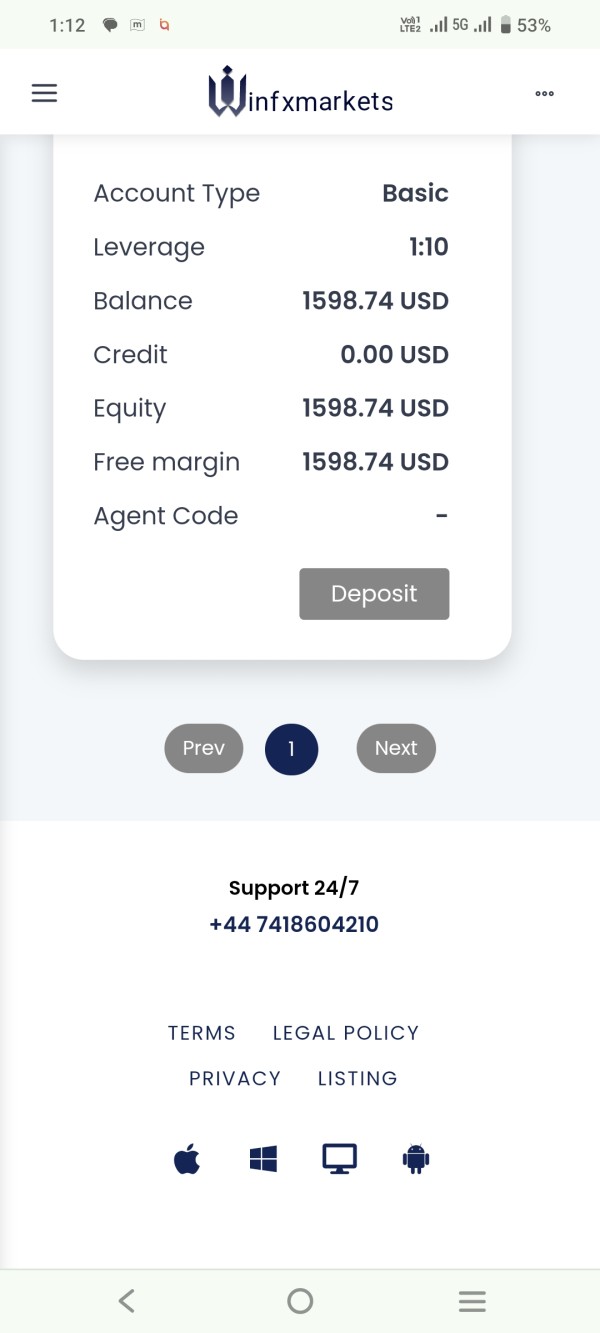

Winfxmarkets, established in 2022, markets itself as an online trading platform offering various financial instruments. The broker claims to provide access to popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), although there are concerns regarding the authenticity of these platforms. The broker offers a range of asset classes, including forex, cryptocurrencies, commodities, and indices. However, it operates without oversight from major regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK, which has issued warnings against Winfxmarkets.

Detailed Breakdown

Regulatory Status

Winfxmarkets is unregulated, with significant concerns raised about its legitimacy. The FCA has explicitly warned that the broker is unauthorized to provide financial services in the UK, marking it as a high-risk entity for potential investors. This lack of regulation leaves clients vulnerable to financial losses without any recourse to regulatory bodies.

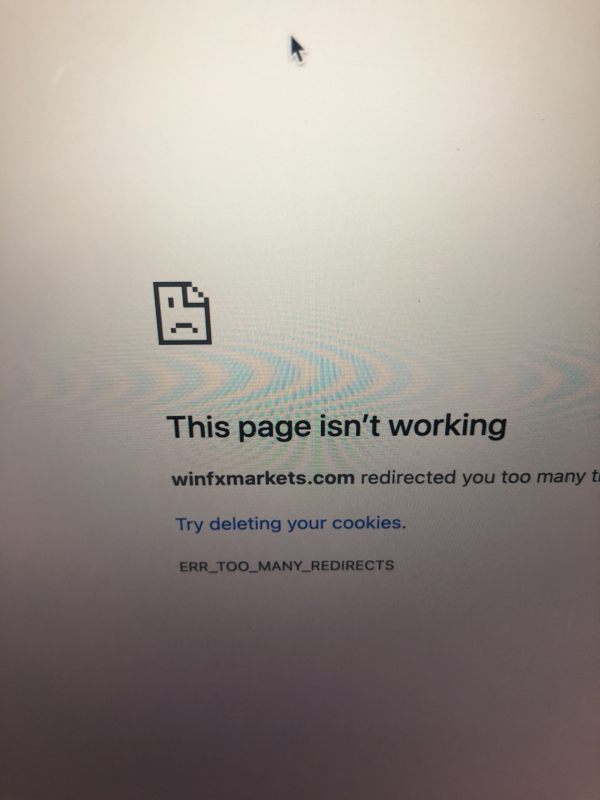

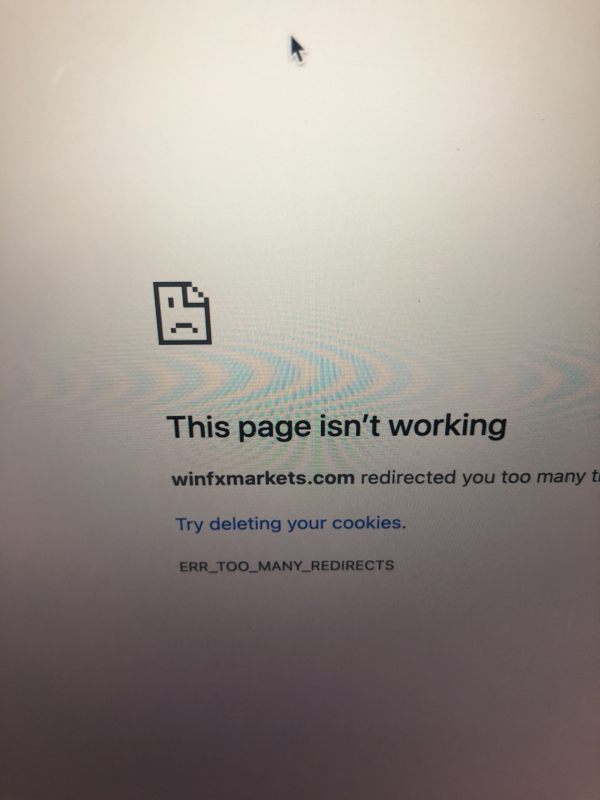

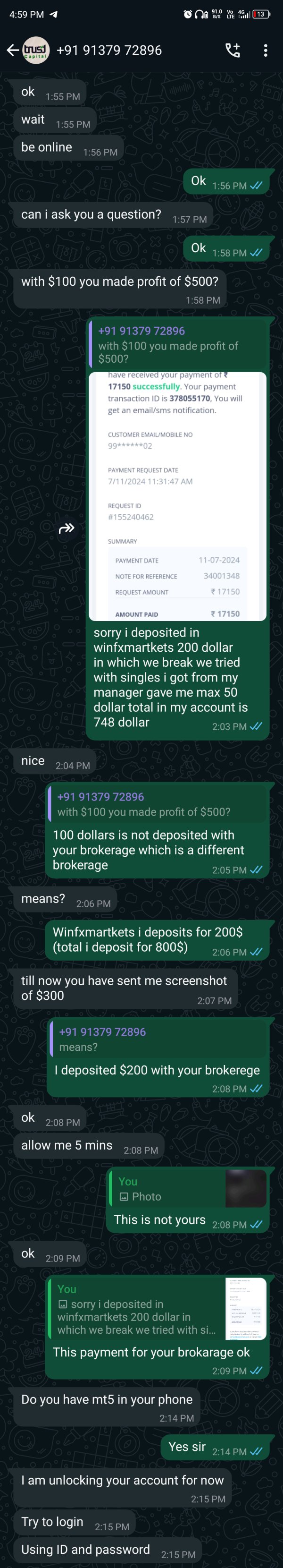

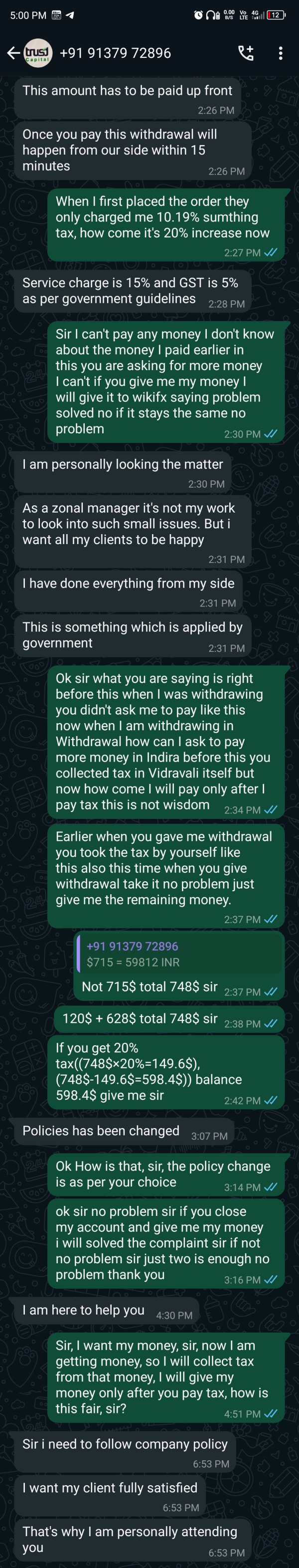

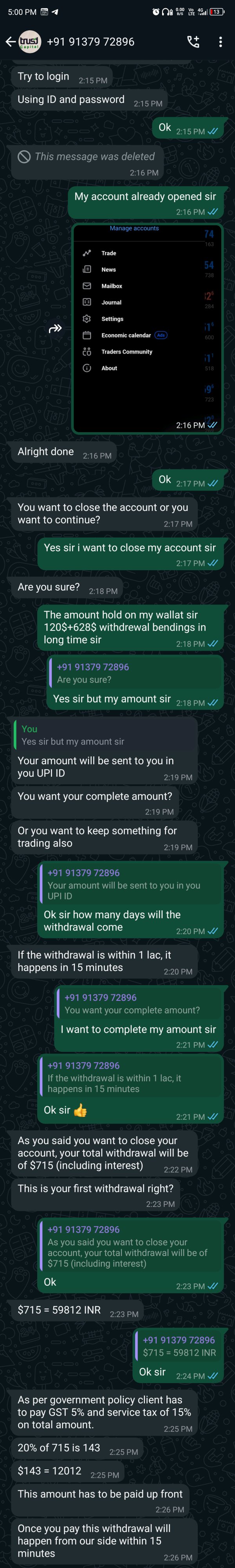

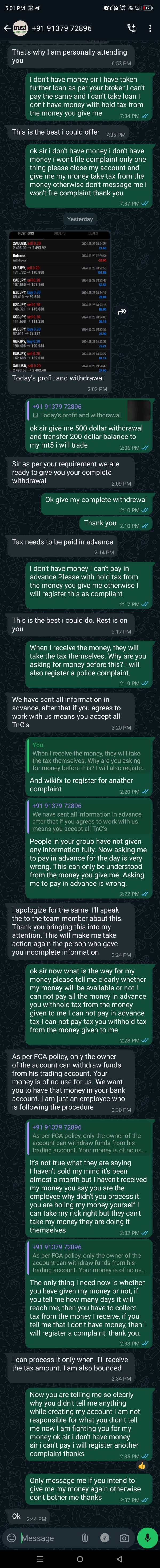

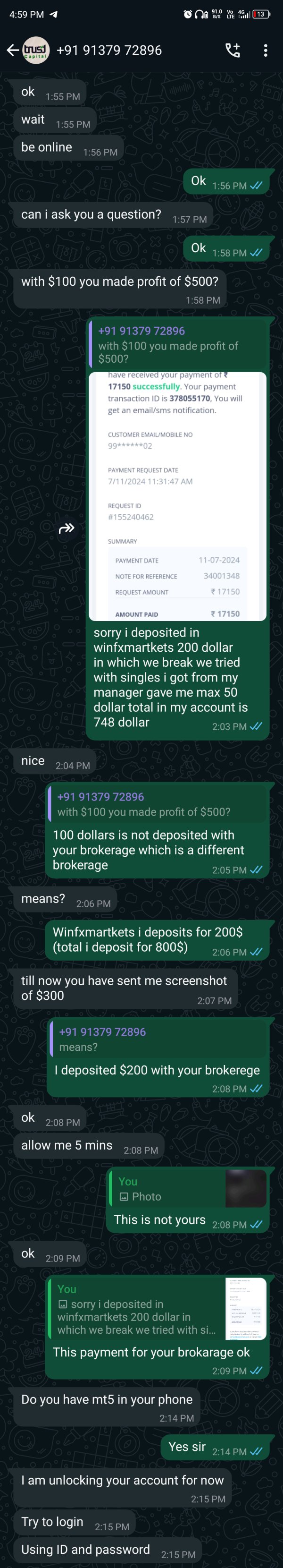

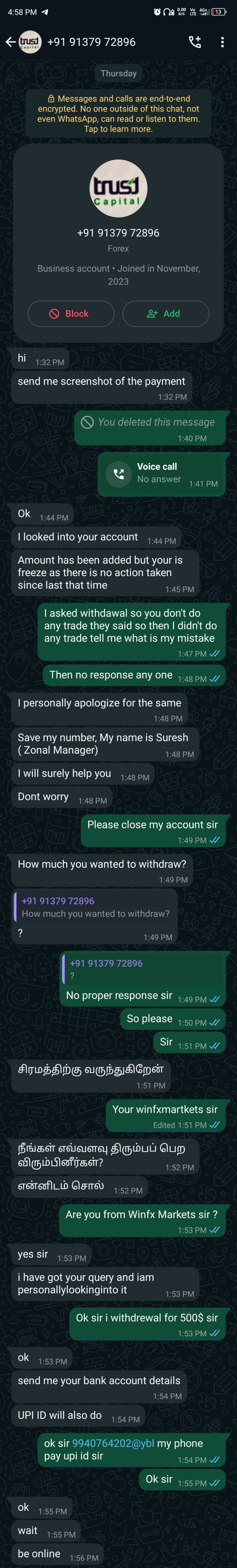

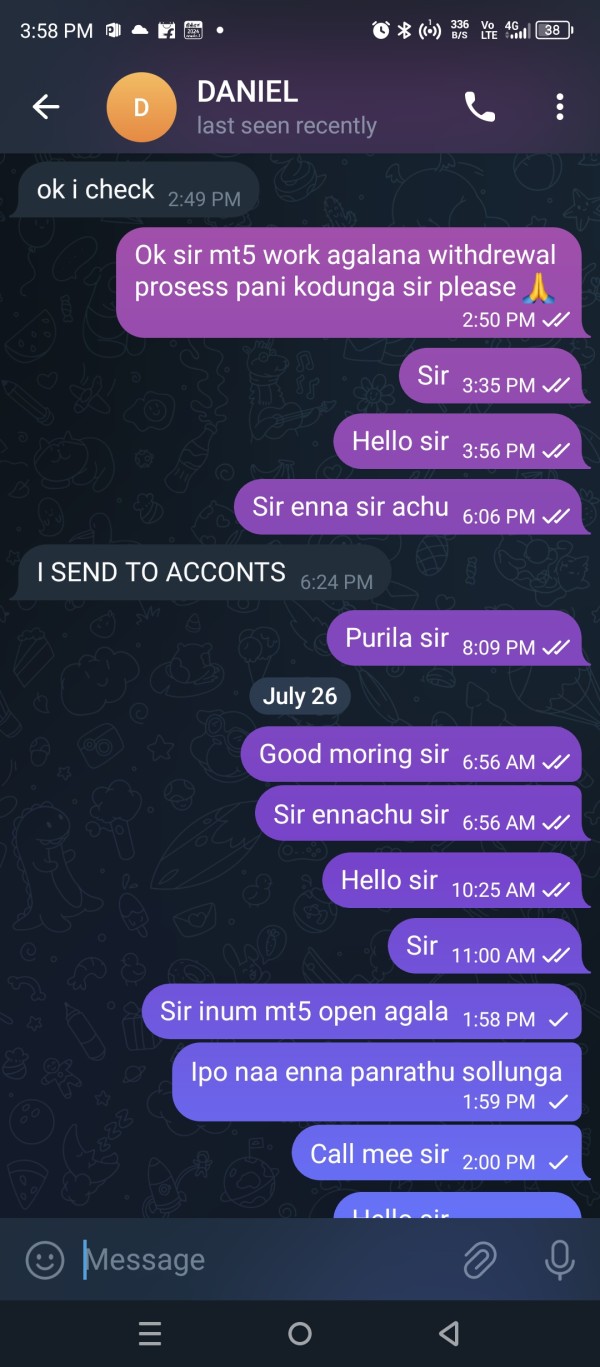

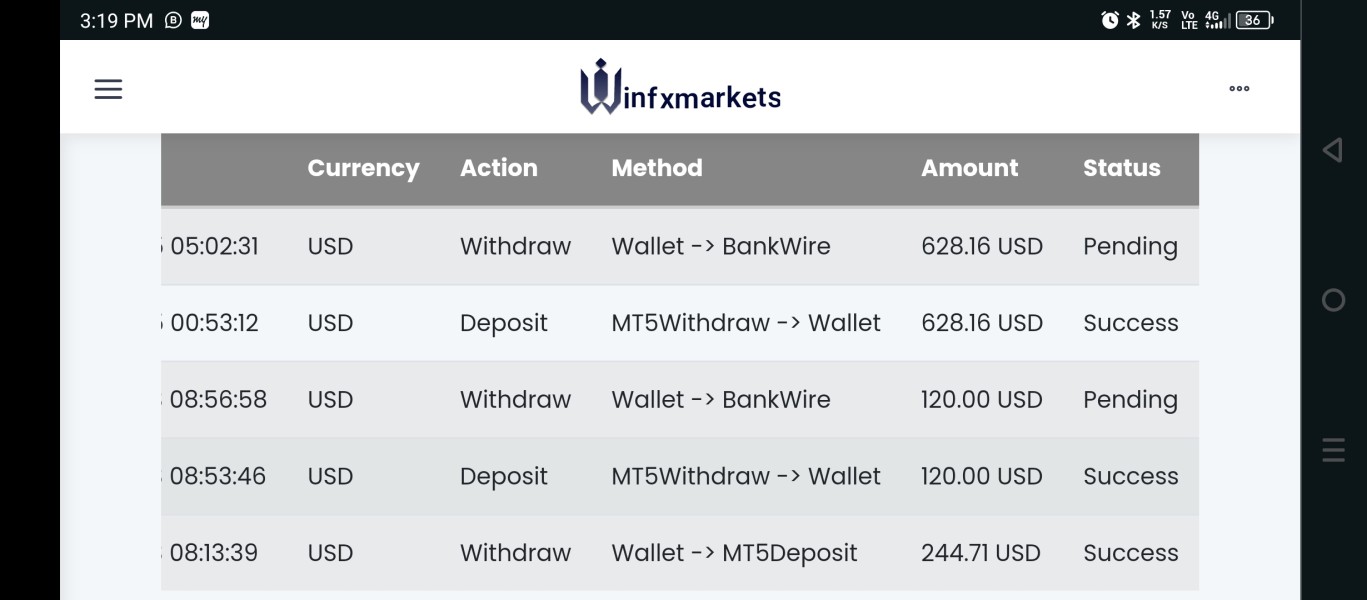

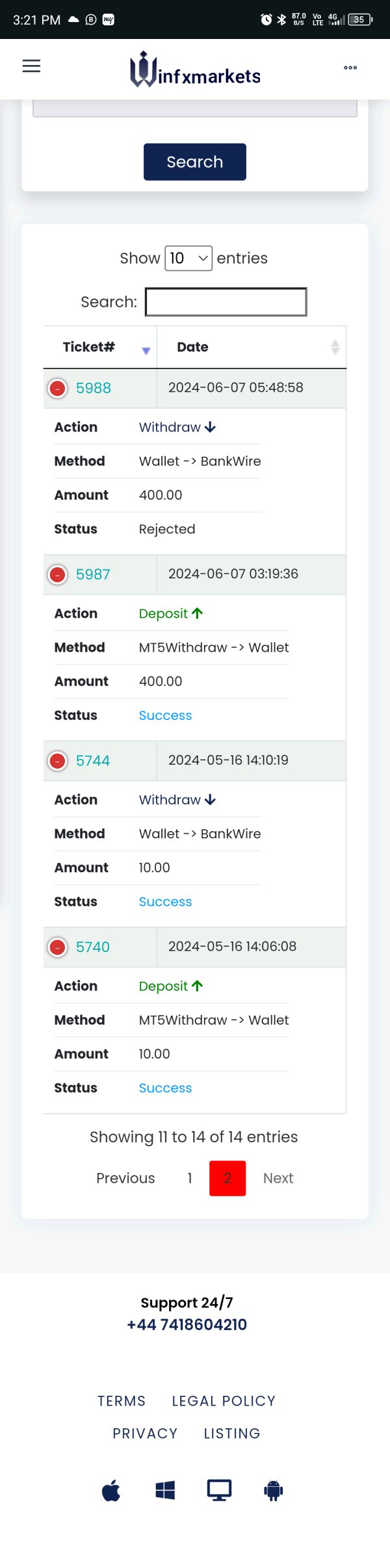

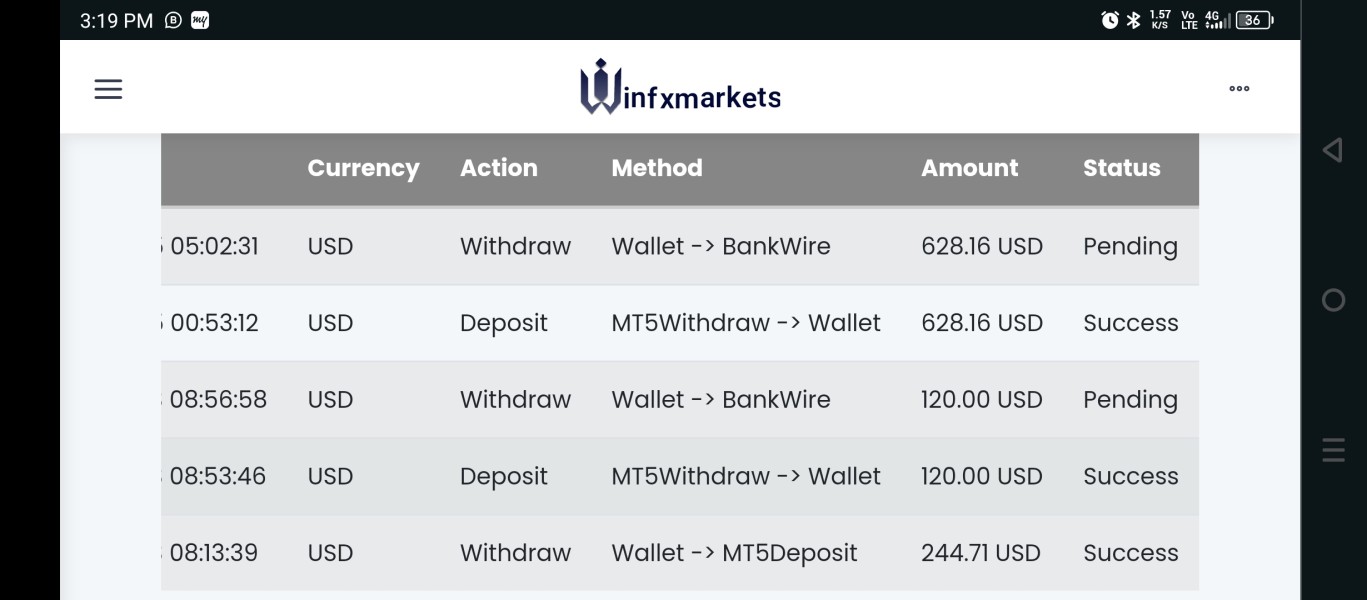

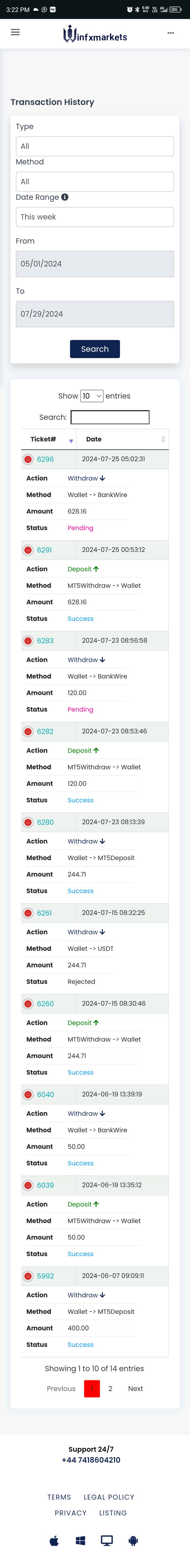

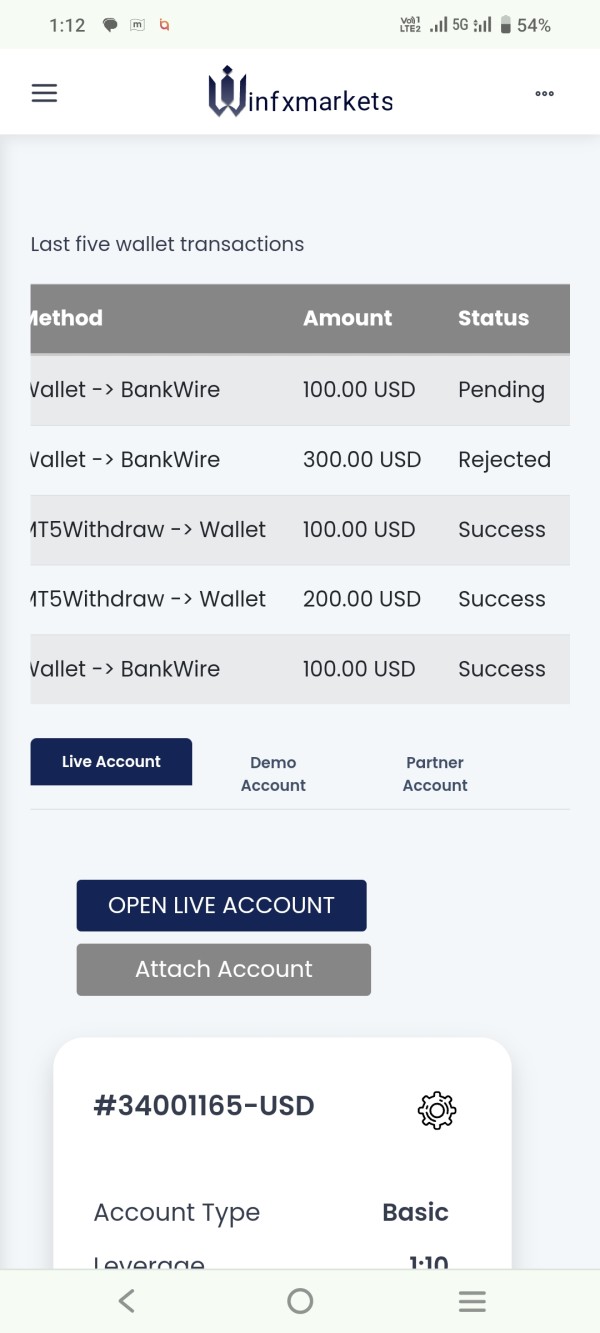

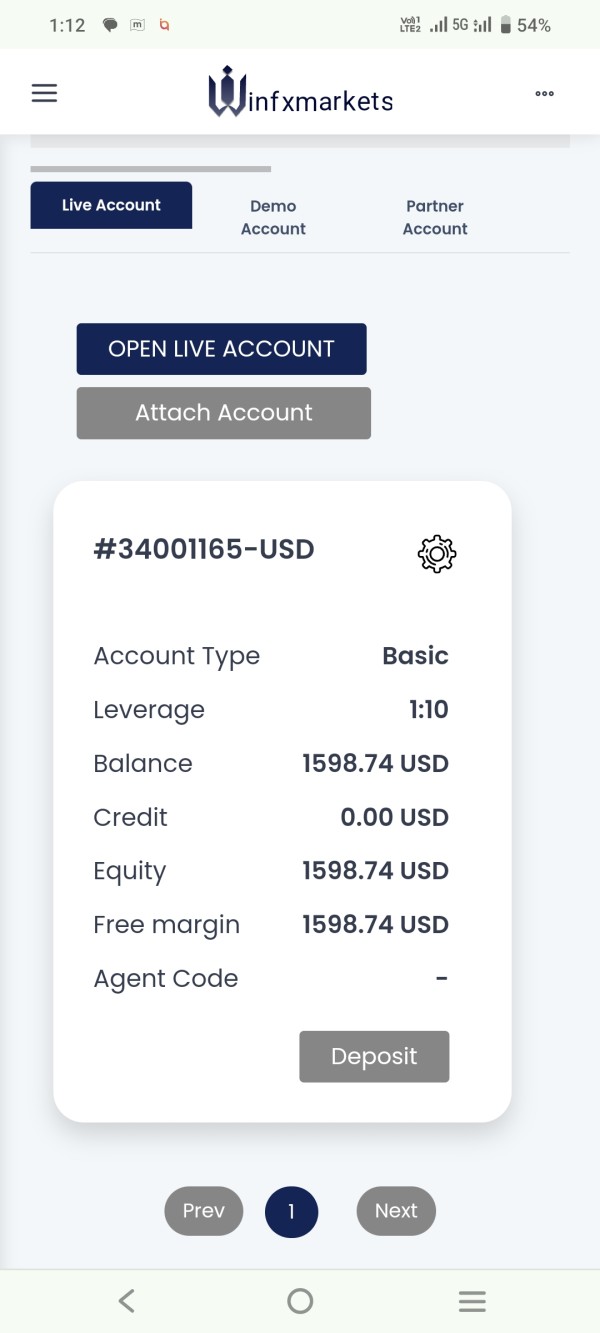

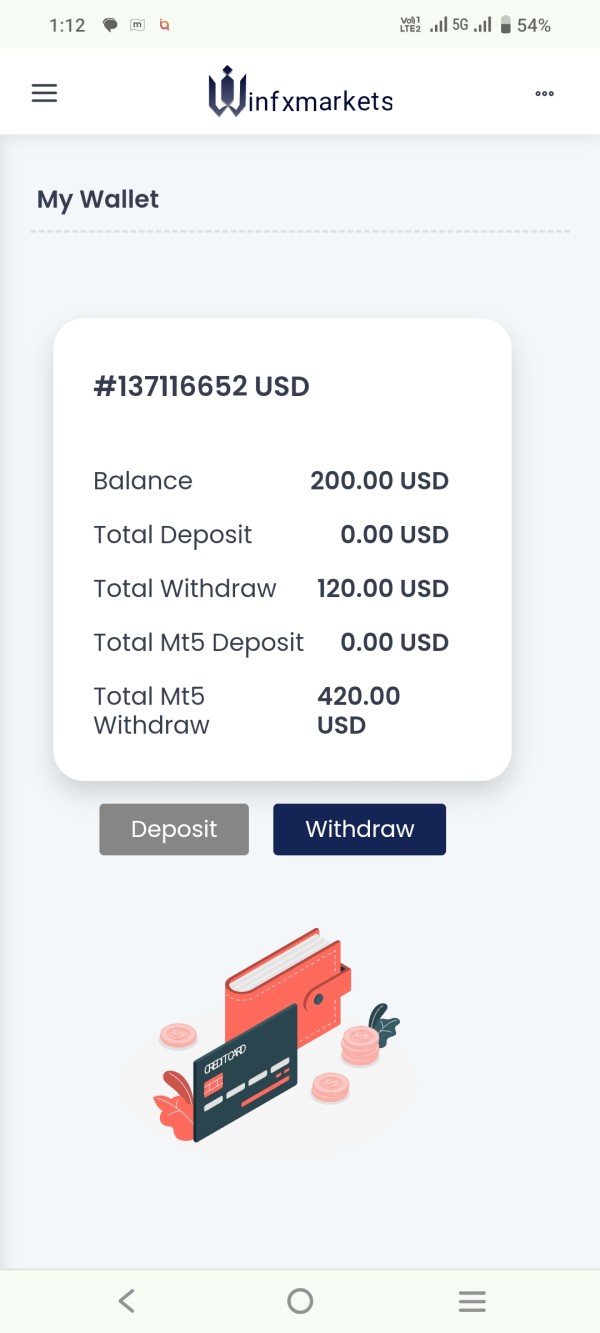

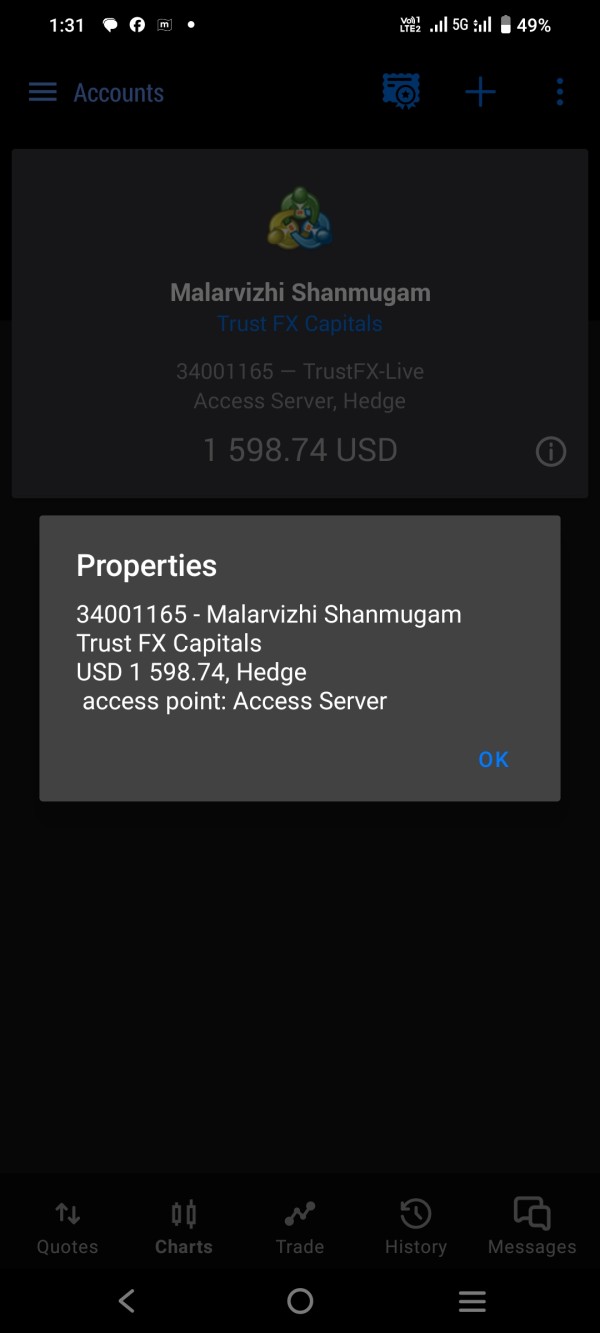

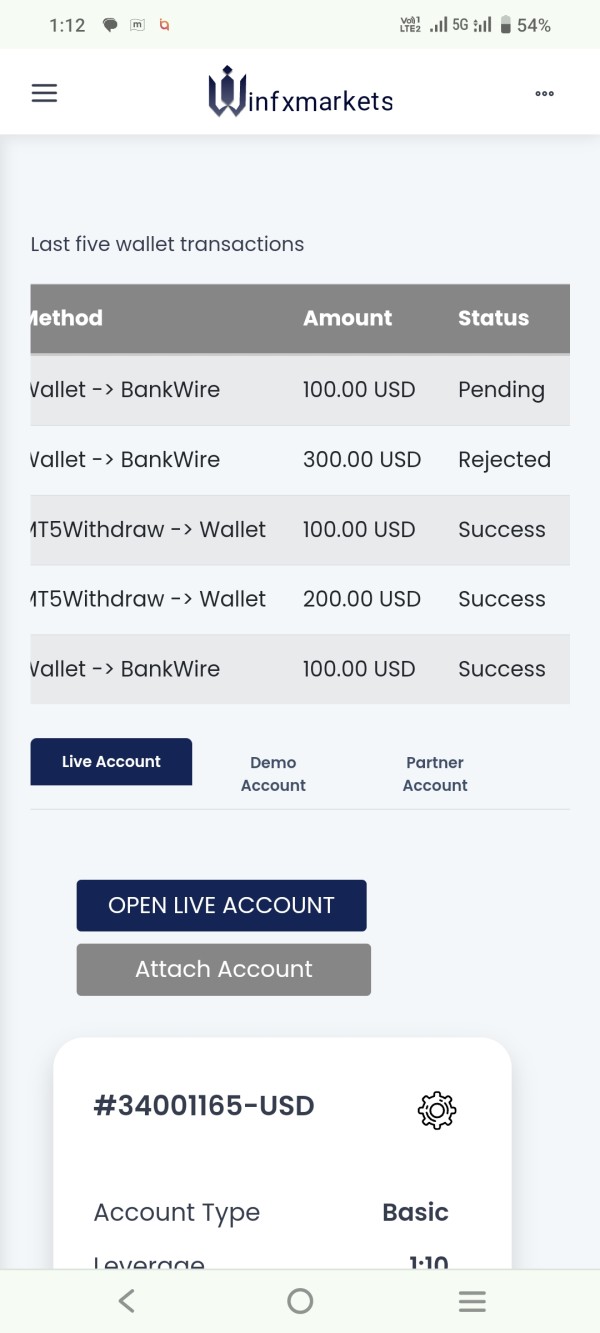

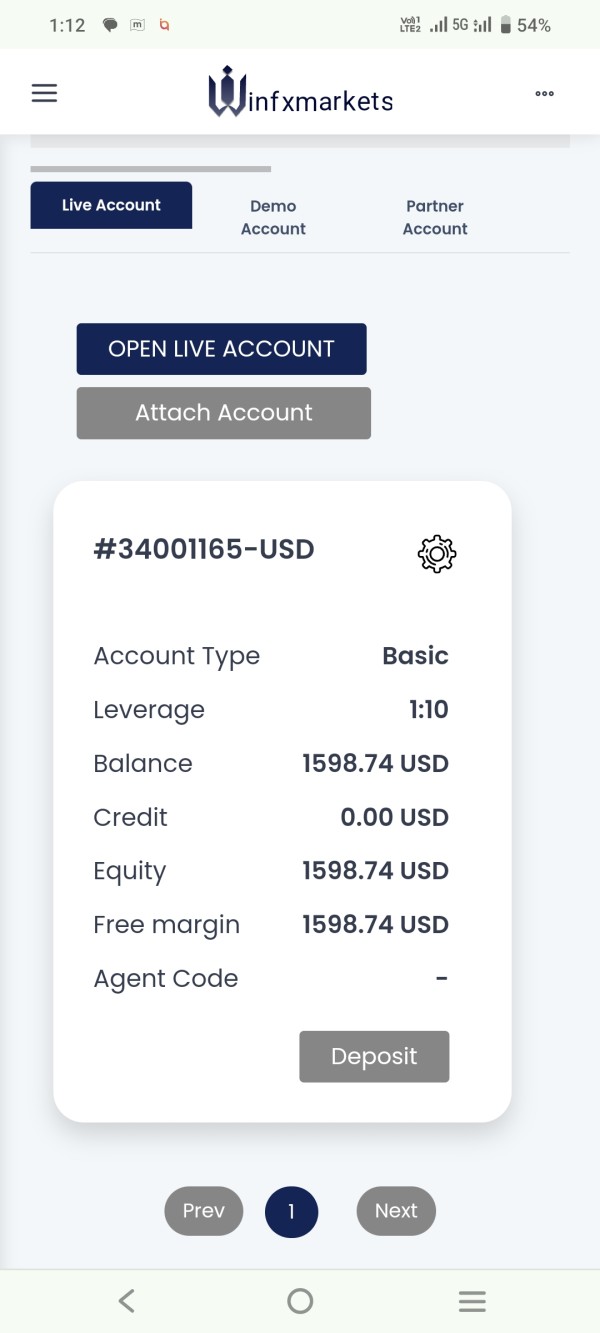

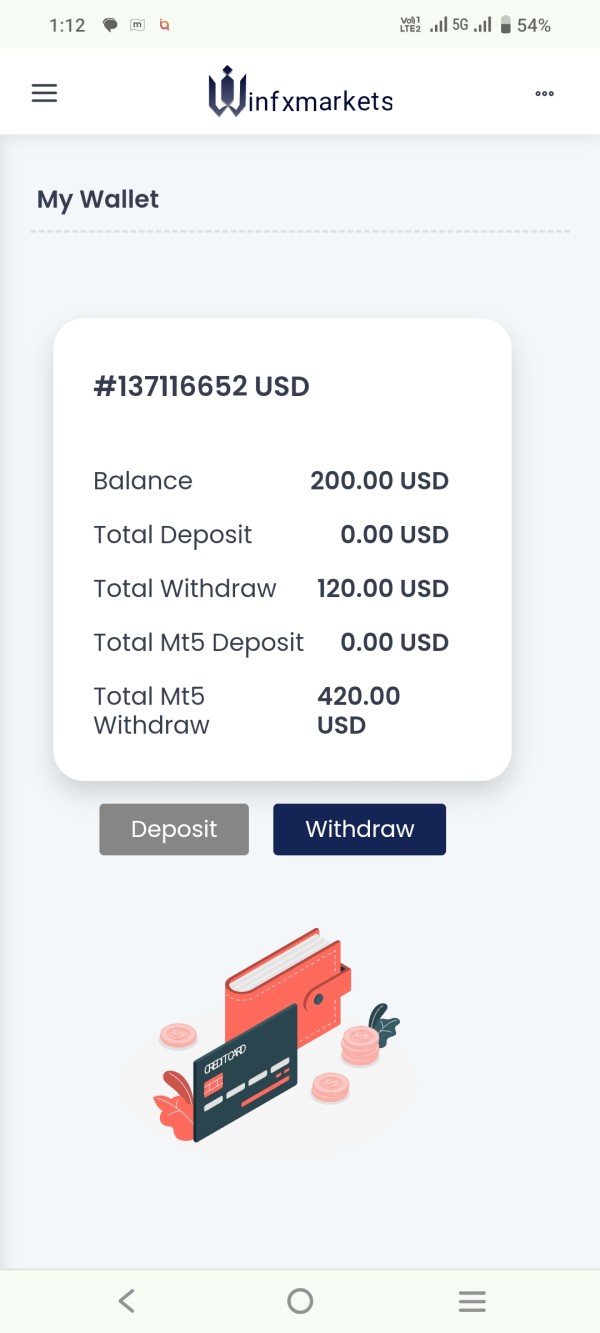

Deposit and Withdrawal

Winfxmarkets requires a minimum deposit of $200 to open a basic account, which many consider high for novice traders. The broker supports various deposit methods, including credit/debit cards and cryptocurrencies. However, numerous user complaints indicate that withdrawal requests are often delayed or denied altogether, raising red flags about the broker's reliability. One user reported, “I tried to withdraw my funds this morning and noticed their website was down,” highlighting the operational issues faced by clients.

Trading Costs

The broker offers spreads starting from 1.6 pips, which vary based on account types. However, there is a lack of transparency regarding additional fees or commissions associated with trading. This ambiguity can lead to unexpected costs for traders, further complicating their experience with the platform.

Available Assets

Winfxmarkets claims to provide access to a diverse range of trading instruments, including forex currency pairs, metals, cryptocurrencies, shares, energies, and indices. Yet, the absence of a demo account option limits new traders' ability to practice and familiarize themselves with the trading environment before risking real capital.

Customer Support

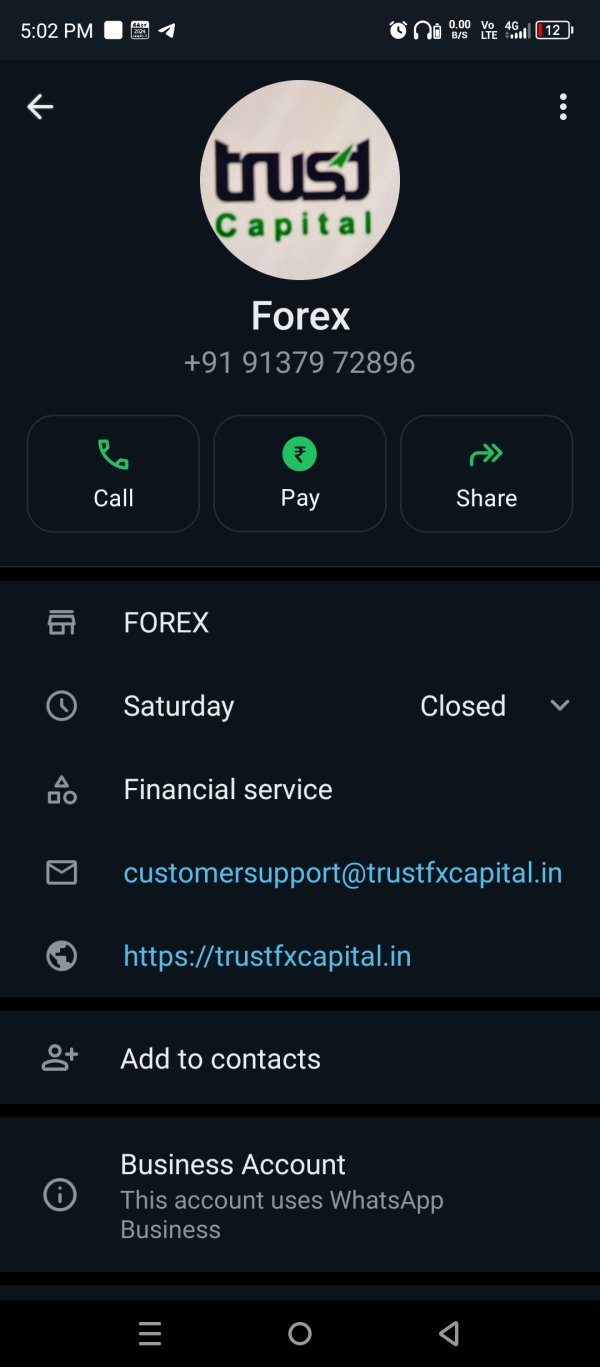

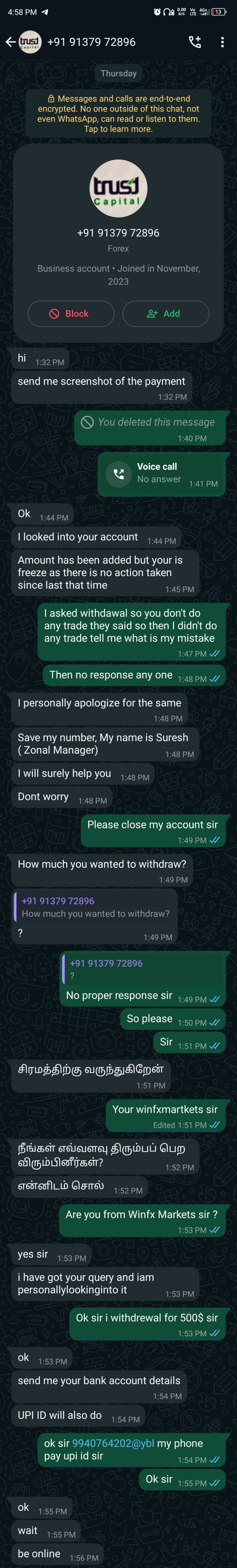

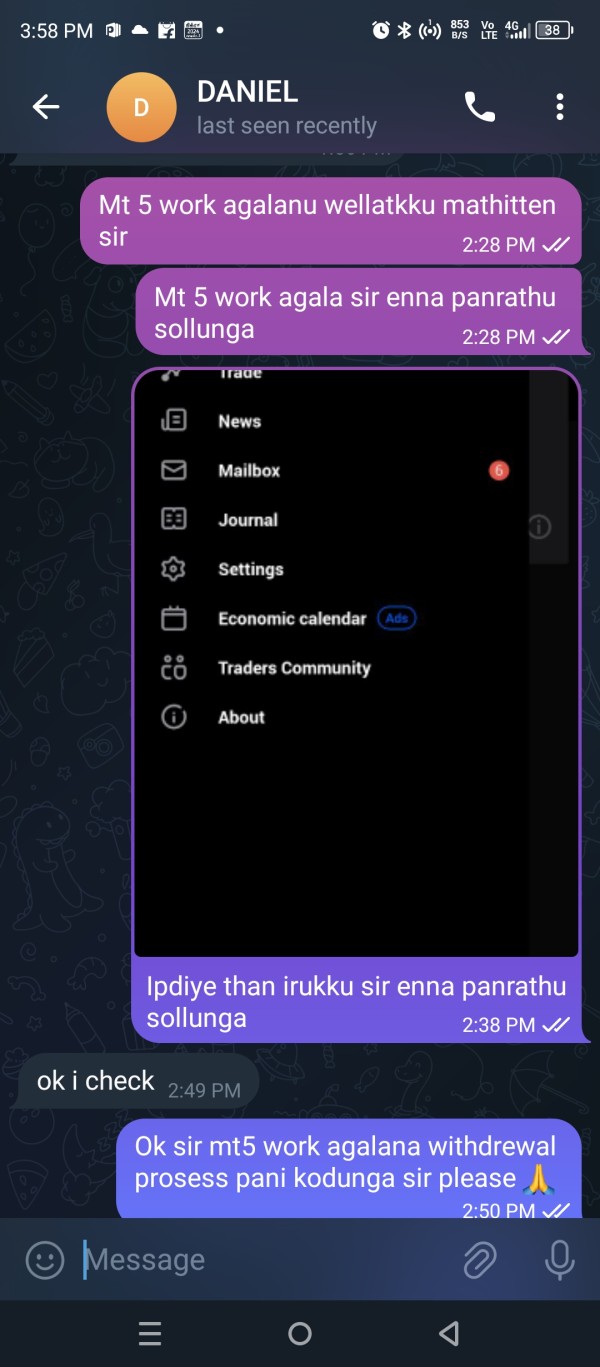

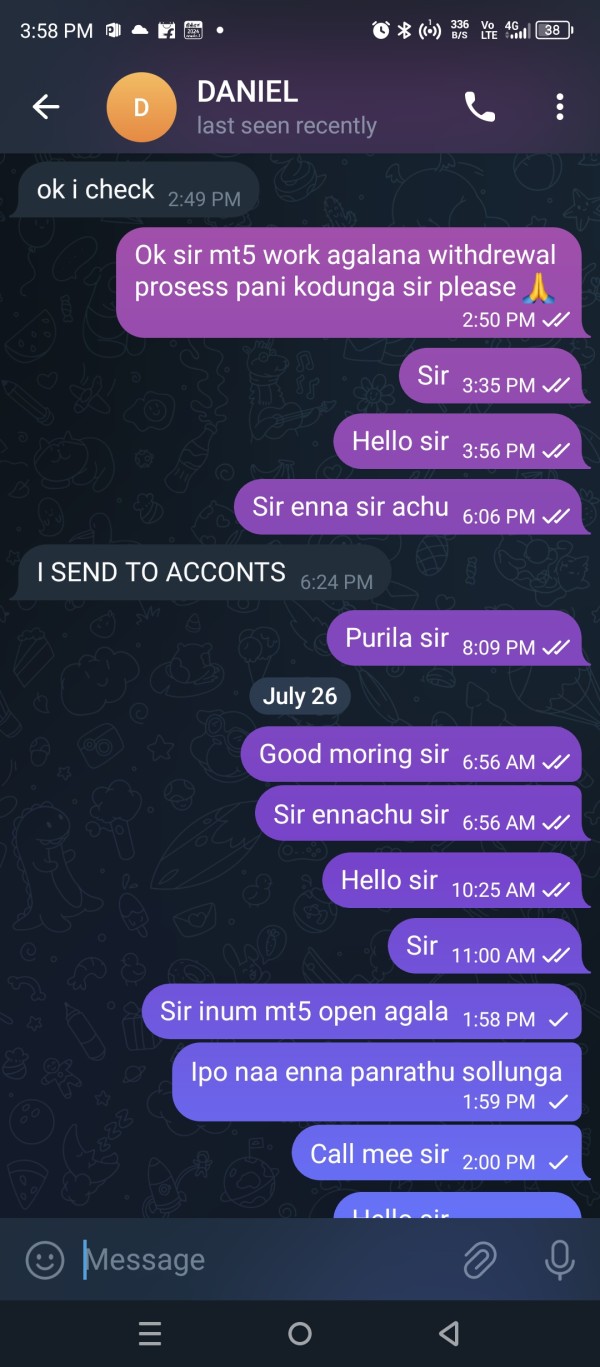

Customer service for Winfxmarkets appears to be lacking. Users have reported difficulties in reaching support when issues arise, particularly during withdrawal attempts. One trader noted, “They ceased answering my calls, emails, and WhatsApp messages,” indicating a concerning pattern of unresponsiveness.

User Experience

Overall user experiences with Winfxmarkets have been predominantly negative. Many users have shared their frustrations regarding withdrawal issues, with some stating that their accounts were suspended without justification. The lack of clear communication and support has led to a growing distrust of the broker.

Final Rating Overview

Detailed Evaluation

-

Account Conditions: Winfxmarkets offers tiered account structures, but the minimum deposit is considered high for beginners, which is a significant drawback.

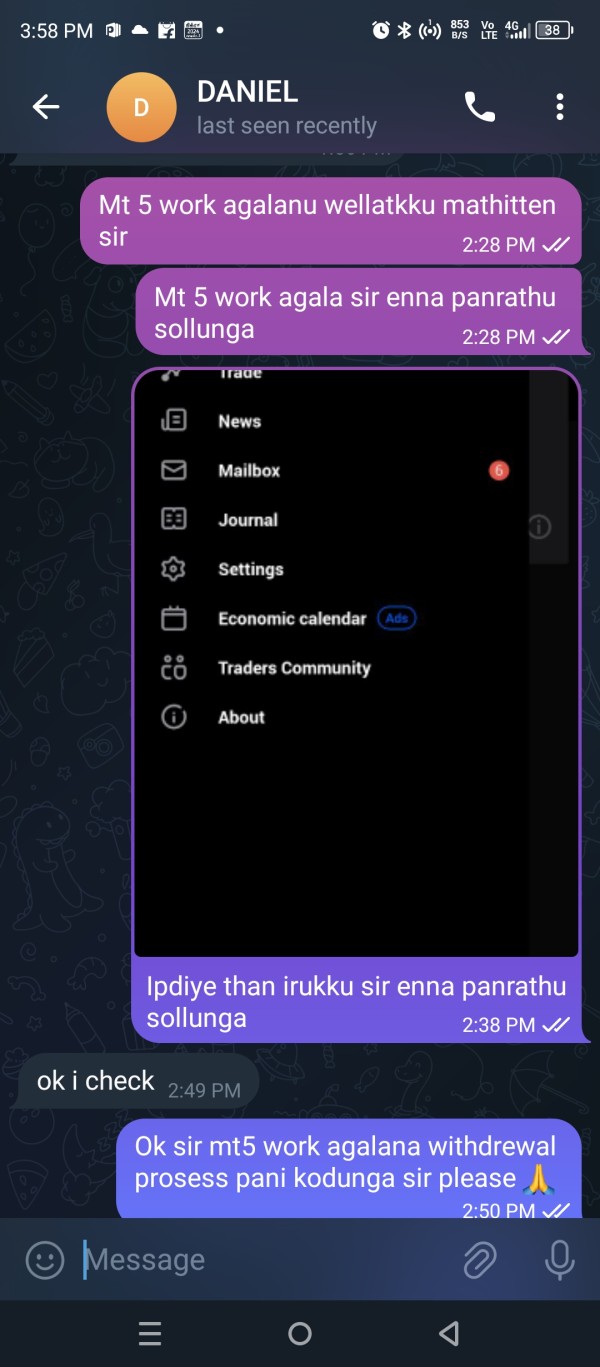

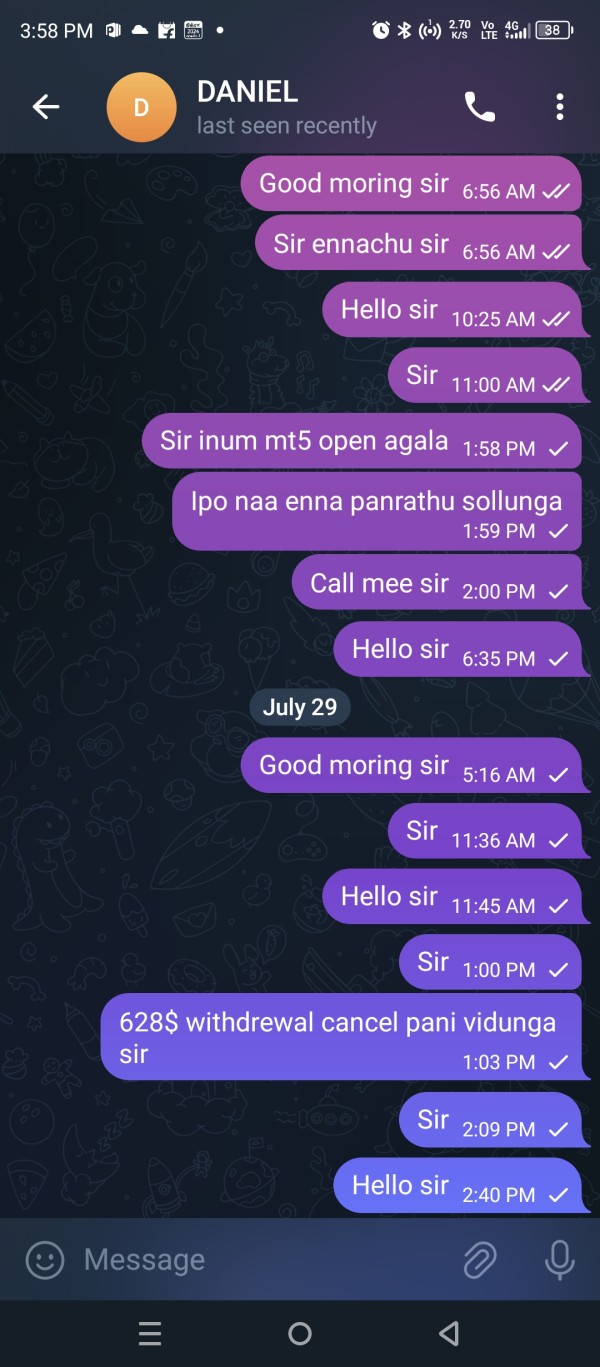

Tools and Resources: While the broker claims to provide access to MT4 and MT5, users have raised concerns about the authenticity of these platforms, questioning the reliability of the trading tools offered.

Customer Service and Support: The lack of responsive customer support is a major concern, with numerous reports of unreturned calls and emails, particularly when clients attempt to withdraw funds.

Trading Setup (Experience): The trading experience is marred by withdrawal issues and a lack of transparency regarding trading costs. Users have expressed frustration over delayed withdrawals and unclear fee structures.

Trustworthiness: Winfxmarkets has been flagged as a potentially fraudulent broker by the FCA, leading to a low trust rating. This lack of regulation is a significant risk factor for investors.

User Experience: User feedback highlights a pattern of negative experiences, particularly regarding withdrawal difficulties and poor customer service. Many users have warned others to avoid this broker.

In conclusion, based on the extensive analysis of user experiences and expert opinions, Winfxmarkets appears to be a risky choice for traders. The combination of unregulated status, withdrawal issues, and poor customer service makes it advisable for potential investors to seek more reliable and regulated trading platforms. Always conduct thorough research before committing to any broker, especially those like Winfxmarkets that have raised significant concerns in the trading community.