Is Nature Forex safe?

Business

License

Is Nature Forex Safe or Scam?

Introduction

Nature Forex, established in 2011, positions itself as a global player in the forex trading market, offering a range of trading instruments including forex, CFDs, commodities, and cryptocurrencies. As the forex market continues to grow, the number of brokers has surged, making it increasingly crucial for traders to carefully assess each broker's credibility. The potential for scams and fraudulent practices is a significant concern in this industry, leading traders to seek reliable, transparent, and regulated options.

In this article, we will conduct a thorough investigation into Nature Forex to determine whether it is a safe trading platform or a potential scam. Our evaluation will be based on various criteria, including regulatory compliance, company background, trading conditions, customer safety measures, user experiences, and overall risk assessment. By synthesizing information from multiple credible sources, we aim to provide a balanced and comprehensive overview of Nature Forex.

Regulation and Legitimacy

Regulation is a vital aspect of any forex broker's credibility, as it serves as a safeguard for traders' funds and ensures that the broker adheres to industry standards. Nature Forex claims to be regulated by the International Financial Services Commission (IFSC) of Belize. However, it is essential to evaluate the quality of this regulation and its implications for traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | 60/214/TS/12 | Belize | Active |

While being regulated by the IFSC provides some level of oversight, it is important to note that the regulatory framework in Belize is often considered lenient compared to more stringent jurisdictions like the UK or Australia. The IFSC primarily focuses on the promulgation of regulations rather than rigorous enforcement, which raises concerns about the effectiveness of its regulatory oversight. The lack of a compensation scheme for clients in the event of broker insolvency further exacerbates these concerns. Therefore, while Nature Forex is technically regulated, the quality of that regulation may not provide sufficient protection for traders, leading to questions about whether Nature Forex is safe.

Company Background Investigation

Nature Forex is operated by a company named Nature Forex Ltd., which is registered in Belize. The broker has been in operation for over a decade, and its ownership structure appears to be primarily Japanese, with all key executives and managers being of Japanese nationality. This international presence may contribute to a diverse understanding of the forex market, but it also necessitates scrutiny regarding transparency and accountability.

The company's history shows that it has been active in the forex trading space since 2011. However, details about its operational practices, financial health, and any past regulatory issues are less transparent. A lack of comprehensive disclosure about the management team and their backgrounds can raise red flags for potential traders. Transparency is crucial in the financial industry, and any gaps in information can lead to mistrust. Therefore, while Nature Forex has been operational for several years, the opacity surrounding its management and ownership may raise concerns about whether Nature Forex is safe for traders.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is essential. Nature Forex has positioned itself as a broker with competitive trading conditions, including low minimum deposits and high leverage. The broker allows traders to open accounts with a minimum deposit of just $20 and offers leverage up to 1:1000, which can be attractive for traders looking to maximize their potential returns.

However, it is crucial to assess the overall cost structure associated with trading on this platform. The absence of a clear commission model and the presence of variable spreads can complicate the cost analysis for traders. Below is a comparison of core trading costs:

| Cost Type | Nature Forex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.3 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range (Swap) | High | Moderate |

While the spreads offered by Nature Forex appear competitive, the potential high swap rates could significantly impact traders who hold positions overnight. The lack of a clear commission structure raises questions about hidden fees or costs that may not be immediately apparent to users. Therefore, while Nature Forex markets itself as a cost-effective option, traders should scrutinize the fee structure carefully to determine if it aligns with their trading strategies. This leads to further contemplation on whether Nature Forex is safe.

Customer Funds Security

The security of client funds is paramount in the forex trading industry. Nature Forex claims to prioritize the safety of its clients' funds by maintaining them in segregated accounts at reputable financial institutions. This practice is essential for protecting traders' capital in the event of the broker's financial difficulties.

However, the effectiveness of these measures can vary significantly based on the regulatory framework in which the broker operates. As previously mentioned, the IFSC's regulatory oversight is considered less stringent than that of other jurisdictions, which may limit the effectiveness of these safety measures. Furthermore, there are no investor compensation schemes in place, which means that traders may have little recourse in the event of fraud or bankruptcy.

Additionally, historical data on Nature Forex's handling of client funds is limited, with no significant incidents reported. However, the lack of comprehensive information on their security protocols and any past controversies raises questions about the overall safety of client funds. Thus, while Nature Forex asserts that it takes measures to ensure client fund security, the overall effectiveness of these measures remains uncertain, leading to further doubts about whether Nature Forex is safe.

Customer Experience and Complaints

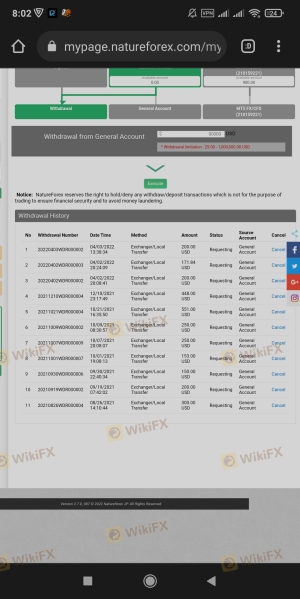

Understanding customer experiences is crucial when assessing the reliability of a forex broker. Reviews and feedback from actual users can provide valuable insights into the broker's operational practices and customer service quality. Nature Forex has received mixed reviews, with some users praising its trading conditions and customer support, while others have raised concerns about withdrawal processes and responsiveness.

Common complaints include delays in fund withdrawals, issues with order execution during volatile market conditions, and a perceived lack of transparency regarding fees and charges. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Order Execution Issues | Medium | Mixed response |

| Fee Transparency | High | Lacks clarity |

For instance, one user reported a significant delay in withdrawing funds after a profitable trading period, leading to frustration and uncertainty about the broker's reliability. Another trader highlighted issues with order execution during high volatility, raising concerns about potential slippage or rejected orders. These complaints indicate that while some traders have had positive experiences, there are notable areas of concern regarding customer service and operational reliability, prompting further scrutiny into whether Nature Forex is safe.

Platform and Trade Execution

The performance and reliability of the trading platform are critical factors for any forex trader. Nature Forex offers two platforms: MetaTrader 4 (MT4) and its proprietary JTrade platform. MT4 is widely regarded as a reliable and user-friendly platform, providing traders with a range of analytical tools and features. However, the performance of JTrade, which is developed in-house, needs to be assessed for stability and execution quality.

User feedback on platform performance has been mixed, with some traders reporting smooth execution and minimal downtime, while others have experienced issues such as lag during peak trading hours. The quality of order execution, including slippage and rejection rates, is another area of concern. If traders consistently face issues with order execution, it can significantly impact their trading performance and overall satisfaction.

In summary, while Nature Forex provides access to reputable trading platforms, the overall performance and reliability of these platforms remain a critical consideration for traders. Any signs of manipulation or poor execution quality could further erode trust in the broker, leading to questions about whether Nature Forex is safe for traders.

Risk Assessment

Engaging with any forex broker carries inherent risks, and Nature Forex is no exception. The combination of high leverage, potential withdrawal issues, and regulatory concerns creates a complex risk landscape for traders. Below is a summary of the key risk categories associated with trading with Nature Forex:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lenient oversight from the IFSC |

| Fund Security Risk | Medium | Lack of investor compensation schemes |

| Operational Risk | Medium | Mixed reviews on customer service and execution |

| Market Risk | High | High leverage increases potential losses |

To mitigate these risks, traders should consider implementing strict risk management strategies, such as setting appropriate stop-loss levels, avoiding over-leveraging, and conducting thorough due diligence before depositing funds. Additionally, it may be prudent to start with a demo account to familiarize oneself with the platform before committing real capital. These precautions can help traders navigate the complexities of trading with Nature Forex and assess whether Nature Forex is safe for their trading activities.

Conclusion and Recommendations

In conclusion, while Nature Forex has established itself as a player in the forex trading market, several factors warrant caution. The regulatory framework under which it operates is relatively lenient, and the lack of a compensation scheme for investors raises concerns about fund safety. Furthermore, mixed customer feedback regarding withdrawal processes and order execution adds to the uncertainty surrounding the broker's reliability.

Based on the evidence presented, it is advisable for traders to approach Nature Forex with caution. While some traders may find value in its low minimum deposit and high leverage, the potential risks associated with regulatory oversight and customer service issues suggest that it may not be the safest option available.

For traders seeking more reliable alternatives, brokers with robust regulatory frameworks, transparent fee structures, and positive customer reviews should be prioritized. Brokers like XM, eToro, and IG are worth considering, as they offer comprehensive regulatory oversight and a strong reputation within the trading community.

Ultimately, the decision to engage with Nature Forex should be made after careful consideration of the associated risks and a thorough evaluation of personal trading needs and risk tolerance.

Is Nature Forex a scam, or is it legit?

The latest exposure and evaluation content of Nature Forex brokers.

Nature Forex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Nature Forex latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.