KFD 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive kfd review reveals concerning findings about KFD as a forex broker platform. Despite achieving a moderate trust score of 72 on Scam Detector, KFD has been flagged with serious fraud allegations that warrant significant caution from potential users. The platform presents itself as a forex trading solution with some technical capabilities, including reported average trading speeds of 0ms, suggesting potential advantages in trade execution efficiency. KFD primarily targets forex traders seeking trading opportunities, but the mounting evidence of fraudulent activities raises substantial red flags.

The broker appears to operate under multiple entities, including connections to ELAN FINANCIAL, which has also faced similar fraud accusations. According to available information, the platform is managed by an individual surnamed Wang and focuses exclusively on forex trading services. While the platform may offer certain technical features that could appeal to active traders, the overall assessment of KFD trends heavily negative due to trust and regulatory concerns. Potential users should exercise extreme caution and thoroughly investigate alternatives before considering this platform for their trading activities.

Important Disclaimers

Cross-Regional Entity Variations: KFD operates in connection with ELAN FINANCIAL, and both entities have been subject to fraud allegations. Users should be aware that regulatory oversight and operational standards may vary significantly across different jurisdictions where these related entities operate. Review Methodology: This evaluation is based on publicly available information, user feedback from various review platforms, and ratings from third-party assessment websites including Scam Detector.

Given the limited transparency of information available about KFD, this review incorporates all accessible data while noting significant information gaps.

Rating Framework

Broker Overview

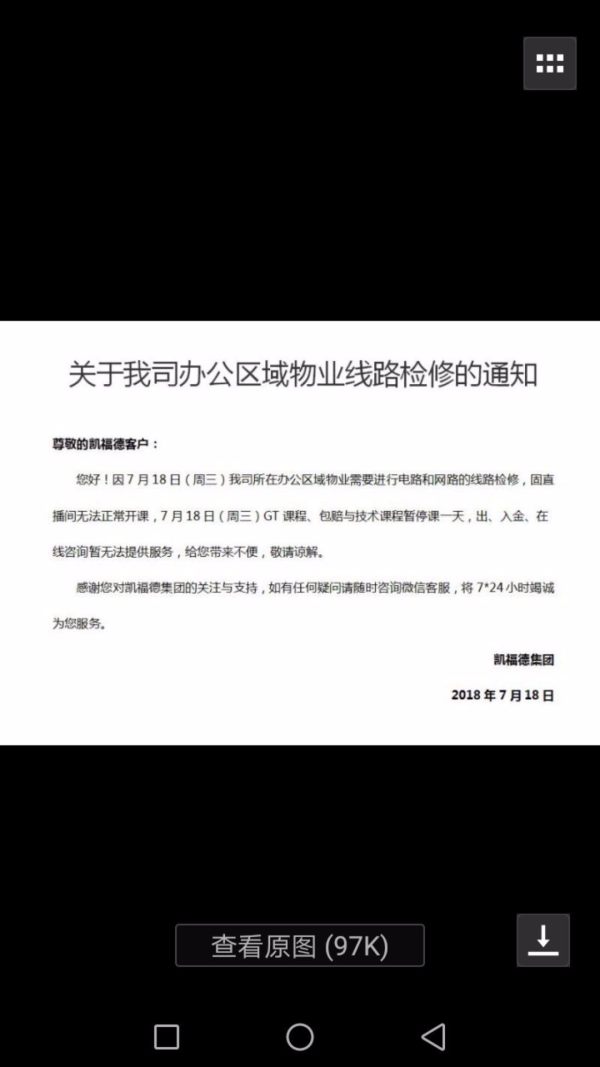

KFD operates as a forex broker in an increasingly competitive trading landscape, though specific details about its establishment date and corporate history remain unclear from available sources. The platform is reportedly managed by an individual identified only by the surname Wang, which raises questions about corporate transparency and accountability standards typically expected from reputable financial service providers. The company's primary business model centers exclusively around forex trading services, positioning itself to serve traders interested in currency market opportunities.

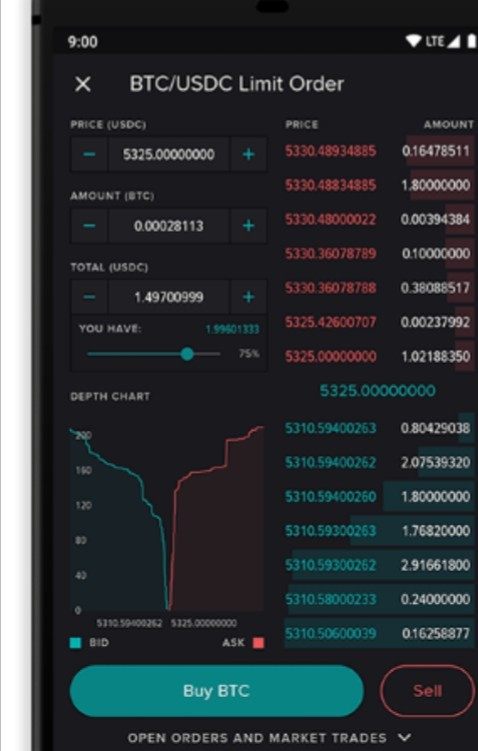

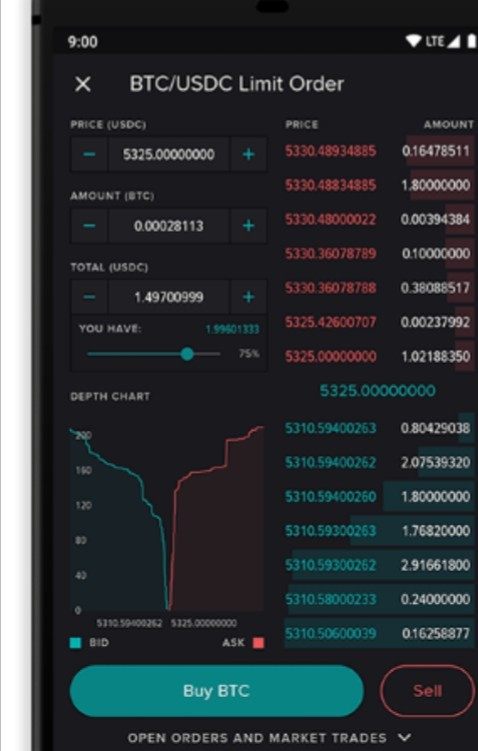

However, the lack of detailed corporate background information and the emergence of fraud allegations significantly impact the platform's credibility in the competitive broker marketplace. From an operational perspective, this kfd review finds that the platform claims to offer various trading strategies and forex-focused services. The technical infrastructure appears to support rapid trade execution, with reported average trading speeds of 0ms, which could theoretically provide advantages in fast-moving market conditions.

However, these technical capabilities must be weighed against the serious trust and regulatory concerns that have emerged. The broker's association with ELAN FINANCIAL adds another layer of complexity to its operational structure. Both entities have faced similar fraud accusations, suggesting potential systemic issues that extend beyond individual platform problems and point to broader organizational concerns that prospective users should carefully consider.

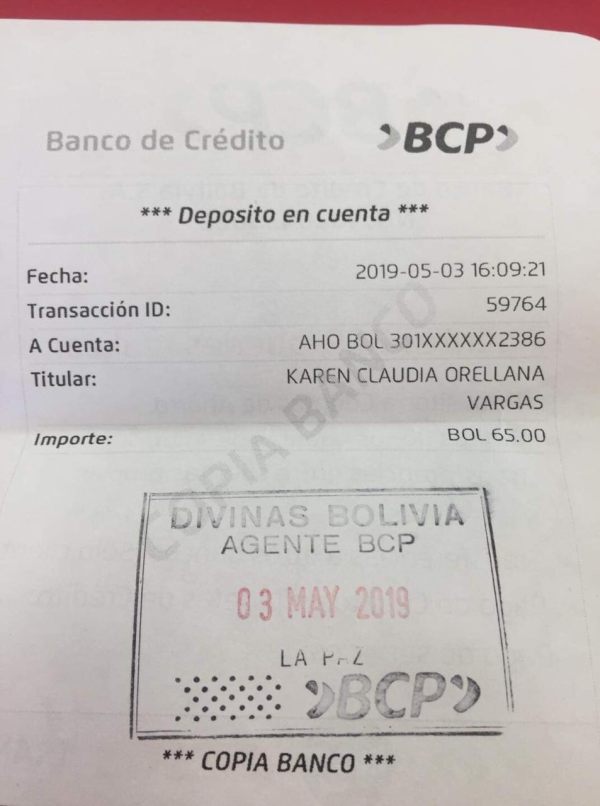

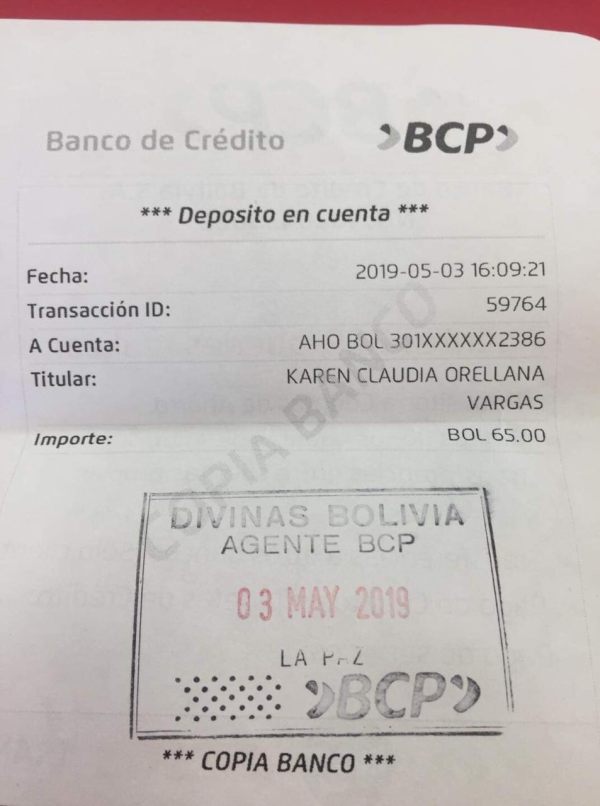

Regulatory Status: Available information does not specify concrete regulatory oversight or licensing details for KFD, which represents a significant concern for potential users seeking regulated trading environments. Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in available sources.

Minimum Deposit Requirements: The platform's minimum deposit requirements are not specified in accessible documentation, making it difficult for potential users to plan their initial investment. Bonuses and Promotions: Details about promotional offers, welcome bonuses, or ongoing incentive programs are not mentioned in available materials.

Tradeable Assets: KFD focuses primarily on forex trading, though specific currency pairs, exotic options, and market depth information are not comprehensively detailed. Cost Structure: Critical information about spreads, commission structures, overnight fees, and other trading costs remains unspecified in available sources, making cost comparison difficult.

Leverage Options: Leverage ratios and margin requirements are not detailed in accessible platform information. Platform Choices: Specific trading platform software, compatibility options, and technical features are not comprehensively outlined in available documentation.

Geographic Restrictions: Information about regional limitations or restricted territories is not specified in accessible sources. Customer Support Languages: This kfd review finds no specific details about multilingual support capabilities or available communication languages.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions evaluation for KFD reveals significant information gaps that substantially impact the user experience assessment. Without clear details about account types, tier structures, or specific features offered to different user categories, potential traders cannot make informed decisions about whether the platform meets their trading requirements and financial capabilities. The absence of transparent minimum deposit information creates uncertainty for users attempting to budget for their trading activities.

Reputable brokers typically provide clear, upfront information about account funding requirements, fee structures, and any associated conditions that might affect account access or trading capabilities. Account opening procedures and verification requirements remain unspecified in available sources, raising questions about onboarding efficiency and compliance standards. The lack of information about special account features, such as Islamic accounts for Muslim traders or demo accounts for practice trading, further limits the platform's appeal to diverse user needs.

This kfd review notes that the overall account conditions framework appears underdeveloped compared to industry standards, with insufficient transparency about user rights, account limitations, and service level agreements that typically govern broker-client relationships.

The evaluation of trading tools and resources available through KFD reveals concerning gaps in platform capabilities that are typically considered essential for effective forex trading. Without detailed information about chart analysis tools, technical indicators, or market research resources, traders cannot assess whether the platform provides adequate support for informed trading decisions. Educational resources, which are increasingly important for trader development and platform differentiation, appear to be absent or inadequately documented.

Reputable brokers typically offer comprehensive educational materials, webinars, market analysis, and trading guides to support user success and platform engagement. The absence of information about automated trading support, expert advisors, or algorithmic trading capabilities suggests limited platform sophistication. Modern forex traders often require these advanced features for strategy implementation and portfolio management, making their absence a significant competitive disadvantage.

Research and analysis resources that help traders understand market conditions, economic events, and trading opportunities are not detailed in available information. This lack of analytical support can significantly impact trader success and overall platform value proposition.

Customer Service and Support Analysis

Customer service evaluation for KFD is hampered by the lack of specific information about support channels, availability, and service quality standards. Without clear details about contact methods, response times, or support team capabilities, potential users cannot assess whether the platform provides adequate assistance when needed. The absence of information about multilingual support capabilities raises concerns for international users who may require assistance in their native languages.

Global forex brokers typically provide comprehensive language support to serve diverse user bases effectively. Support availability hours and timezone coverage are not specified, which is particularly important for forex trading that occurs across global markets with different operating hours. Traders need confidence that assistance will be available when market conditions require immediate attention or technical issues arise.

Problem resolution procedures and escalation processes remain unclear, making it difficult for users to understand how disputes or technical difficulties will be addressed. The lack of documented customer service standards or satisfaction metrics further complicates the assessment of support quality.

Trading Experience Analysis

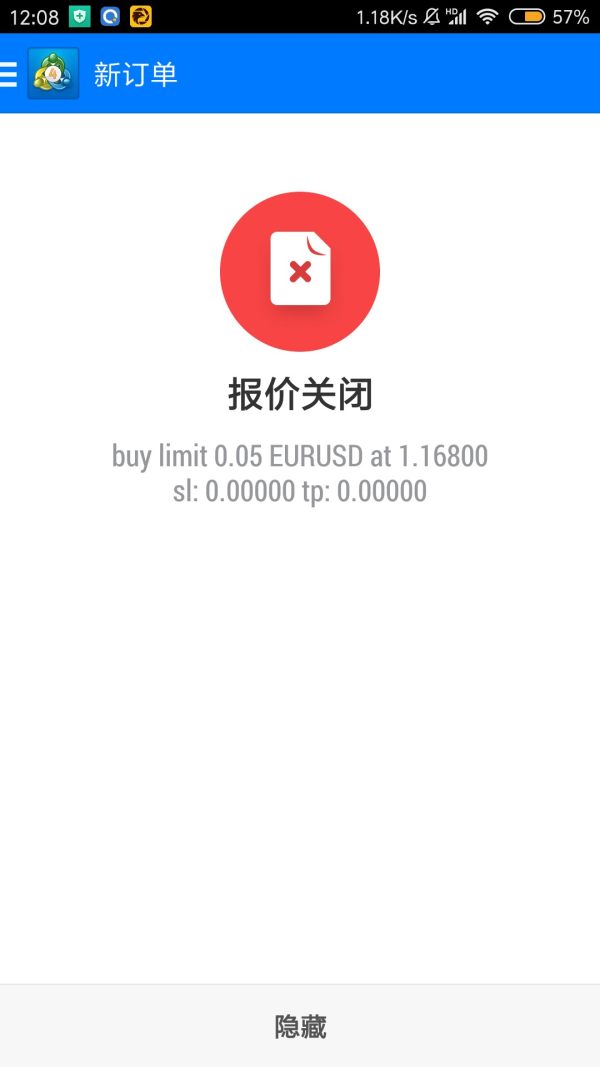

The trading experience assessment reveals mixed findings, with some technical capabilities offset by significant information gaps. The reported average trading speed of 0ms suggests potentially strong technical infrastructure that could provide advantages in rapid market conditions, though this claim requires independent verification and context about measurement methodology. However, critical performance metrics such as slippage rates, requote frequency, and order execution quality are not documented in available sources.

These factors significantly impact actual trading costs and success rates, making their absence a substantial limitation for trader evaluation. Platform stability information, including uptime statistics, system reliability during high-volume periods, and technical support for platform issues, is not detailed. Forex markets operate continuously, making platform reliability essential for trader success and risk management.

This kfd review finds that mobile trading capabilities, chart functionality, and technical analysis tools are not comprehensively described, limiting assessment of the complete trading environment. Modern traders expect seamless integration across devices and comprehensive analytical capabilities that support sophisticated trading strategies.

Trust and Security Analysis

The trust and security evaluation reveals the most concerning aspects of KFD's operations. The platform, along with associated entity ELAN FINANCIAL, has been specifically flagged for fraud allegations, representing a fundamental threat to user security and financial protection. Despite achieving a trust score of 72 on Scam Detector, the fraud allegations significantly outweigh this moderate rating.

The scoring methodology and criteria used by Scam Detector may not fully capture the severity of fraud risks, making the numerical score potentially misleading for user decision-making. Regulatory oversight information is notably absent, with no clear licensing details or supervisory authority identification. Reputable forex brokers typically operate under strict regulatory frameworks that provide user protection, dispute resolution mechanisms, and financial safeguards that appear to be missing from KFD's operational structure.

The lack of transparency about fund segregation, insurance coverage, or client protection measures raises substantial concerns about financial security. The collaboration with high-tech fraud prevention companies, while potentially positive, appears insufficient to address the fundamental trust issues that have emerged around the platform's operations.

User Experience Analysis

User experience evaluation is significantly limited by the absence of comprehensive user feedback and satisfaction data in available sources. Without detailed user reviews, satisfaction surveys, or experience testimonials, it becomes challenging to assess real-world platform performance and user satisfaction levels. Interface design, navigation efficiency, and platform usability information are not detailed in accessible sources.

Modern trading platforms require intuitive design and efficient workflow management to support effective trading activities, making these omissions significant for user assessment. Registration and verification processes, which significantly impact initial user experience, are not described in available documentation. Streamlined onboarding procedures are essential for user acquisition and satisfaction, particularly in competitive broker markets.

The overall user journey, from account opening through active trading and fund management, lacks documentation that would help potential users understand what to expect from platform engagement. This information gap, combined with trust concerns, creates substantial barriers to user confidence and platform adoption.

Conclusion

This comprehensive evaluation of KFD reveals a forex broker with significant red flags that substantially outweigh any potential technical advantages. While the platform may offer some trading capabilities, including reported fast execution speeds, the fraud allegations and lack of regulatory transparency create unacceptable risks for potential users. KFD appears most suited for traders specifically seeking forex trading opportunities, but the trust and security concerns make it difficult to recommend the platform to any user category.

The absence of clear regulatory oversight, combined with documented fraud allegations, suggests that users should prioritize alternative brokers with stronger reputational standings and transparent operational frameworks. The primary advantages of potentially fast trading execution are substantially overshadowed by the disadvantages of fraud allegations, regulatory uncertainty, and limited transparency about platform operations, costs, and user protections. Prospective traders should exercise extreme caution and thoroughly investigate regulated alternatives before considering KFD for their trading activities.