CEZ Review 2

The asset chart fluctuated and I lost 80000 pesos. Could you please help me?

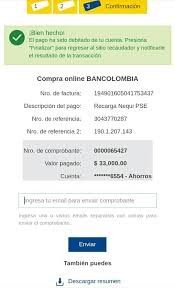

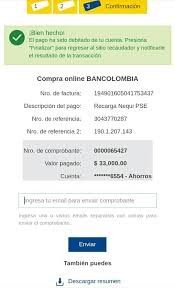

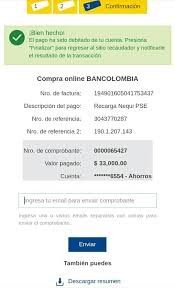

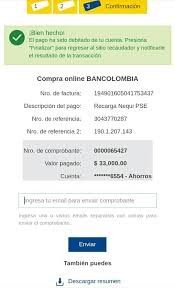

I was unable to withdraw more than $5,000 and they asked me to pay 50% of it, which was a scam. I deposited 32,000 pesos.

CEZ Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

The asset chart fluctuated and I lost 80000 pesos. Could you please help me?

I was unable to withdraw more than $5,000 and they asked me to pay 50% of it, which was a scam. I deposited 32,000 pesos.

This Cez review reveals a concerning picture of an energy trading entity that has been misrepresented in some online broker listings. CEZ is primarily a Czech Republic-based energy company. It operates in the European electricity markets, particularly through the Polish Power Exchange and EEX transparency platforms. The company provides commodity trading services for CEZ Group subsidiaries. It also maintains transparency reporting under EU REMIT regulations for wholesale energy market integrity.

However, when evaluated as a traditional forex or financial services broker, CEZ falls significantly short of industry standards. The available information suggests limited retail trading capabilities. It has minimal customer support infrastructure and unclear regulatory status for individual traders. The company's primary focus remains on institutional energy trading rather than retail financial services. This makes it unsuitable for most individual forex traders seeking comprehensive trading solutions.

For traders considering CEZ, it's important to understand that this entity operates primarily in the energy sector with institutional clients. It offers limited resources for retail trading activities.

This Cez review is based on available public information and regulatory filings related to CEZ's energy trading operations. Readers should note that CEZ's primary business model focuses on energy commodity trading rather than traditional forex or CFD services. The evaluation criteria applied in this review may not fully align with CEZ's intended business scope.

Regional differences may apply, and potential users should verify regulatory compliance in their jurisdiction before engaging with any trading services. This assessment reflects the entity's suitability for retail forex trading rather than its performance in energy markets.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 2/10 | Limited information available about retail account options |

| Tools and Resources | 2/10 | Primarily institutional energy trading tools |

| Customer Service | 2/10 | Basic contact information available, limited retail support |

| Trading Experience | 1/10 | No evidence of retail trading platform |

| Trust and Regulation | 3/10 | Regulated in energy markets but unclear retail authorization |

| User Experience | 1/10 | Not designed for retail trader experience |

CEZ operates as an energy trading entity within the broader CEZ Group. It is one of Central Europe's largest energy companies. The organization maintains its primary operations in the Czech Republic and participates actively in European energy markets. According to available regulatory filings, CEZ Trading provides commodity purchasing services for CEZ Group subsidiaries that serve end customers across multiple European markets.

The company's trading activities focus on electricity, gas, and other energy commodities through established exchanges. These include the Polish Power Exchange and EEX platforms. CEZ maintains compliance with European Union REMIT regulations. This ensures transparency in wholesale energy market operations. Their business model centers on institutional trading relationships and energy supply chain management rather than retail financial services.

This Cez review must emphasize that the entity's core competencies lie in energy market operations rather than traditional forex or CFD trading services typically sought by retail investors.

Regulatory Status: CEZ operates under EU energy market regulations, particularly REMIT compliance for wholesale energy trading. However, specific authorization for retail forex or CFD services remains unclear from available documentation.

Deposit and Withdrawal Methods: Information regarding retail trading account funding methods is not detailed in available public sources.

Minimum Deposit: No specific minimum deposit requirements for retail trading accounts are documented in accessible materials.

Promotions and Bonuses: No retail trading promotions or bonus structures are evident in the company's public communications.

Tradeable Assets: Primary focus on energy commodities including electricity, gas, and related derivatives through institutional channels.

Cost Structure: Specific details about spreads, commissions, or fees for retail trading services are not available in public documentation.

Leverage Options: Information about leverage offerings for retail clients is not specified in available materials.

Platform Options: No dedicated retail trading platforms are prominently featured in the company's service descriptions.

Regional Restrictions: Services appear focused on European energy markets with potential limitations outside this geographic scope.

Customer Support Languages: Contact information suggests Czech and English language capabilities. However, this Cez review cannot confirm comprehensive multilingual support for retail clients.

The account conditions at CEZ present significant limitations for retail forex traders. Unlike traditional forex brokers that offer multiple account tiers with varying features and benefits, CEZ's structure appears designed primarily for institutional energy trading relationships. Available documentation does not detail specific account types, minimum balance requirements, or the typical features retail traders expect such as micro-lots, multiple currency base options, or tiered service levels.

The absence of clear retail account structures suggests that CEZ may not actively pursue individual trader relationships. This represents a significant disadvantage compared to established forex brokers that provide comprehensive account options including standard, premium, and VIP tiers. The lack of transparent account opening procedures and requirements further complicates the evaluation process for potential retail clients.

This Cez review finds that the account conditions fail to meet standard industry expectations for retail forex trading. This is primarily due to the company's focus on institutional energy market operations rather than individual trader services.

CEZ's trading tools and resources appear primarily oriented toward energy market professionals rather than retail forex traders. The company's integration with EEX transparency platforms and Polish Power Exchange systems demonstrates sophisticated institutional trading capabilities. However, these tools are specifically designed for energy commodity trading rather than currency pairs or traditional CFDs.

Educational resources, market analysis, and research materials commonly provided by retail forex brokers are not prominently featured in CEZ's available documentation. The absence of fundamental and technical analysis tools, economic calendars, or trading signals represents a significant gap for retail traders accustomed to comprehensive trading support.

Automated trading support, expert advisors, and API access for retail clients remain undocumented in available sources. This limitation significantly impacts the platform's appeal to modern retail traders who increasingly rely on algorithmic trading strategies and automated execution systems.

Customer service infrastructure at CEZ appears limited from a retail trading perspective. While the company maintains contact points including ceztradingbo@cez.cz for back office operations, the availability and scope of retail trader support remains unclear. Traditional forex brokers typically offer 24/5 customer support through multiple channels including live chat, phone support, and comprehensive FAQ sections.

Response times, service quality metrics, and customer satisfaction data are not readily available in public documentation. The absence of dedicated retail support channels suggests that CEZ may not prioritize individual trader assistance. Instead, it focuses on institutional client relationships within the energy sector.

Multilingual support capabilities, while potentially available given the company's European operations, are not specifically detailed for retail trading contexts. This uncertainty creates additional barriers for international traders seeking reliable customer service.

The trading experience at CEZ cannot be properly evaluated using traditional forex broker criteria due to the absence of a dedicated retail trading platform. Standard considerations such as platform stability, execution speed, order types, and mobile trading capabilities are not applicable to CEZ's current service structure.

Unlike established forex brokers that provide MetaTrader platforms, proprietary trading software, or web-based trading interfaces, CEZ's trading activities appear conducted through energy market-specific systems and exchanges. This fundamental difference makes direct comparison with retail forex brokers inappropriate and highlights the entity's unsuitability for typical forex trading needs.

The lack of retail-focused trading infrastructure, including real-time price feeds for currency pairs, advanced charting tools, and order management systems, represents a complete absence of expected trading experience elements. This Cez review concludes that the trading experience fails to meet retail forex market standards entirely.

From a regulatory perspective, CEZ demonstrates compliance within its core energy trading operations, particularly regarding EU REMIT requirements for wholesale energy market transparency. However, this regulatory framework differs significantly from the financial services regulations that govern traditional forex brokers such as CySEC, FCA, or ASIC oversight.

The absence of specific retail forex trading authorization raises questions about the entity's legal capacity to offer traditional currency trading services to individual clients. Established forex brokers typically maintain multiple regulatory licenses and provide detailed information about client fund segregation, investor compensation schemes, and dispute resolution procedures.

Fund security measures, while potentially robust within the energy trading context, are not specifically detailed for retail trading accounts. The lack of transparency regarding client fund protection, segregated accounts, and insurance coverage represents a significant trust deficit compared to regulated forex brokers.

The overall user experience at CEZ reflects its institutional energy trading focus rather than retail client needs. The absence of user-friendly interfaces, streamlined account opening processes, and intuitive trading platforms creates substantial barriers for individual traders seeking accessible forex trading solutions.

Registration and verification procedures, if available for retail clients, are not clearly documented or promoted through accessible channels. This contrasts sharply with modern forex brokers that emphasize quick account opening, digital verification processes, and immediate trading access.

The lack of mobile trading applications, social trading features, and community resources further diminishes the user experience from a retail perspective. These limitations reflect the fundamental mismatch between CEZ's energy market focus and retail forex trading expectations.

This Cez review reveals that CEZ operates primarily as an energy trading entity rather than a retail forex broker. While the company demonstrates competence in European energy markets and maintains regulatory compliance within that sector, it lacks the essential infrastructure, services, and regulatory authorization typically required for retail forex trading.

The entity is unsuitable for individual traders seeking traditional forex trading services, educational resources, or comprehensive customer support. Retail traders would be better served by established forex brokers that specialize in currency trading and maintain appropriate regulatory oversight for individual client protection.

CEZ's focus on institutional energy trading represents its core strength. However, this specialization makes it inappropriate for retail forex trading activities and individual investor needs.

FX Broker Capital Trading Markets Review