MagnaFG 2025 Review: Everything You Need to Know

Executive Summary

This magnafg review shows troubling findings about this forex broker. Traders should think carefully before investing their money with this company. MagnaFG says it is a modern trading platform that offers many different types of investments, but our research finds serious problems that need attention.

MagnaFG says it gives access to over 65 forex currency pairs, commodities, indices, stocks, and cryptocurrencies through popular platforms like MetaTrader 4, MetaTrader 5, web-based platforms, and mobile apps. The broker tries to attract investors who want to trade forex and cryptocurrency by offering many different assets.

Our investigation finds disturbing evidence that seriously hurts the broker's reputation. Reports show that MagnaFG has received an overall rating of just 1.00 out of 10, which means extremely poor performance in multiple areas. Even more concerning, there are documented scam complaints against MAGNAFG, with the Cyber Scam Recovery Team calling it a fraudulent broker operation.

The mix of very low user ratings, fraud claims, and lack of clear regulatory information creates a highly worrying picture for potential investors. While the broker's platform variety might look attractive at first glance, the underlying trust and safety issues present major risks that outweigh any possible benefits.

Important Disclaimers

Regional Entity Differences: The available information does not specify different regulatory entities across various jurisdictions. Traders should check any regulatory claims made by MagnaFG in their specific region on their own, as regulatory status can vary a lot between countries.

Review Methodology: This evaluation uses user feedback analysis, market research, and available industry reports. Because the broker itself provides limited clear information, some assessments rely heavily on third-party sources and user experiences. Traders should do their own research before making any investment decisions.

Overall Rating Framework

Broker Overview

MagnaFG entered the forex market in 2023. The broker positions itself as a complete trading solution for regular investors. The company's business model focuses on providing multi-asset trading opportunities across traditional forex markets, commodities, equity indices, individual stocks, and the growing cryptocurrency sector.

Despite being established recently, the company has tried to build market presence through diverse platform offerings and broad asset coverage. The broker's approach focuses on using established trading technologies, especially the widely-recognized MetaTrader platforms, while adding proprietary web-based solutions and mobile applications. This strategy seems designed to capture traders across different experience levels and trading preferences, from desktop-focused professionals to mobile-first retail investors.

However, this magnafg review must note that detailed background information about the company's headquarters, founding team, and corporate structure remains notably missing from available sources. The lack of clear corporate information raises immediate concerns about the broker's legitimacy and commitment to regulatory compliance. Also, no specific information about regulatory oversight or licensing authorities could be verified through reliable sources, which represents a significant red flag for potential clients seeking regulated trading environments.

Regulatory Status: The available information does not mention any specific regulatory authorities overseeing MagnaFG's operations. This absence of clear regulatory information is particularly concerning for traders seeking protection under established financial regulatory frameworks.

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and fees for deposits and withdrawals is not detailed in the source materials. This creates uncertainty about fund management procedures.

Minimum Deposit Requirements: The broker's minimum deposit requirements are not specified in available documentation. This makes it difficult for potential clients to understand entry-level investment thresholds.

Promotional Offers: No information about bonus structures, promotional campaigns, or incentive programs is mentioned in the source materials. This suggests either absence of such programs or lack of transparency in marketing them.

Available Trading Assets: MagnaFG offers access to over 65 foreign exchange currency pairs, covering major, minor, and exotic pairs. The platform also provides trading opportunities in commodities markets, stock indices from various global exchanges, individual equity securities, and cryptocurrency assets. This creates a diversified trading environment for multi-asset strategies.

Cost Structure: Detailed information about spreads, commission structures, overnight financing charges, and other trading costs is not specified in available sources. This makes cost comparison with other brokers challenging for potential clients.

Leverage Ratios: Specific leverage offerings and their variations across different asset classes are not mentioned in the source materials. This leaves traders uncertain about available margin requirements.

Platform Options: The broker provides MetaTrader 4 and MetaTrader 5 platforms, along with proprietary web-based trading interfaces and mobile applications for iOS and Android devices.

Geographic Restrictions: Information about countries or regions where services are restricted or unavailable is not detailed in available sources.

Customer Support Languages: The specific languages supported by customer service teams are not mentioned in available documentation.

This magnafg review highlights significant information gaps that potential clients should address directly with the broker before proceeding.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions evaluation for MagnaFG reveals major information gaps that severely hurt the broker's credibility. No specific details about account types, their special features, or target user groups are available in reliable sources. This lack of transparency makes it impossible for potential clients to understand what account structures are offered or how they might work with different trading strategies and experience levels.

The absence of clear minimum deposit requirements creates additional uncertainty for prospective traders trying to assess affordability and accessibility. Professional traders often require detailed specifications about account tiers, premium features, and institutional-level services, none of which are properly documented in available materials.

The account opening process, required documentation, verification procedures, and timeline expectations remain unspecified. This opacity is particularly problematic in an industry where regulatory compliance and customer onboarding procedures are critical indicators of operational legitimacy. Special account features such as Islamic-compliant trading accounts, demo account availability, or institutional account offerings are not mentioned in source materials.

User feedback consistently reflects negative experiences, though specific account-related complaints are not detailed in available reviews. The lack of comprehensive account information, combined with overall poor user ratings, suggests that MagnaFG fails to meet basic industry standards for account condition transparency and customer service. This magnafg review must therefore assign the lowest possible rating for account conditions due to insufficient reliable information and negative user sentiment.

MagnaFG shows relative strength in its platform and tool offerings, which represents one of the few positive aspects identified in this evaluation. The broker provides access to both MetaTrader 4 and MetaTrader 5, two industry-standard platforms that offer comprehensive charting capabilities, technical analysis tools, and automated trading functionality through Expert Advisors. The inclusion of proprietary web-based trading platforms suggests additional flexibility for traders who prefer browser-based access without software downloads.

These platforms typically offer real-time market data, order management capabilities, and portfolio monitoring tools, though specific feature details are not explained in available sources. Mobile application availability for both iOS and Android devices addresses the growing demand for mobile trading accessibility. Modern mobile trading apps generally include essential features such as real-time quotes, chart analysis, trade execution, and account management functionality.

This enables traders to monitor and manage positions while away from desktop environments. However, this evaluation must note that information about research resources, market analysis tools, educational materials, and trading signals is not mentioned in available sources. Many established brokers provide economic calendars, market commentary, technical analysis reports, and educational webinars as value-added services for their clients.

The absence of detailed information about platform customization options, advanced order types, risk management tools, and integration capabilities limits the ability to fully assess the technological offering. User feedback specifically regarding platform performance, reliability, and feature satisfaction is not detailed in available sources, though the overall positive rating for tools and resources reflects the inclusion of recognized industry-standard platforms.

Customer Service Analysis (Score: 1/10)

Customer service represents a critical weakness in MagnaFG's operational framework. Available evidence points to significant problems in support quality and responsiveness. User feedback consistently indicates poor service experiences, though specific details about support channels, availability hours, and response mechanisms are not detailed in source materials.

The absence of clear information about customer support contact methods raises immediate concerns about accessibility when traders encounter issues or require assistance. Professional forex brokers typically provide multiple contact channels including telephone support, live chat functionality, email ticketing systems, and comprehensive FAQ sections. Response time expectations and service level commitments are not specified in available documentation.

This creates uncertainty about support reliability during critical trading situations. Traders often require immediate assistance for platform technical issues, account access problems, or urgent trade-related inquiries, making response time a crucial service factor. Multi-language support capabilities are not mentioned in source materials, which could significantly limit accessibility for international clients.

Global forex brokers typically provide customer service in multiple languages to serve diverse client bases effectively. The lack of information about support team expertise, training standards, and escalation procedures suggests insufficient investment in customer service infrastructure. User reviews indicate widespread dissatisfaction with support quality, though specific incident examples are not detailed in available sources.

Given the combination of negative user feedback regarding support experiences and the absence of transparent information about customer service capabilities, this magnafg review assigns the lowest possible rating for customer service and support.

Trading Experience Analysis (Score: 3/10)

The trading experience evaluation reveals concerning patterns that significantly impact user satisfaction and platform reliability. User feedback indicates disappointing overall experiences, with specific mentions of stability issues that can severely disrupt trading activities and potentially impact financial outcomes. Platform stability problems represent a critical concern for active traders who require consistent access to markets and reliable order execution.

Users have reported experiencing slippage and requote issues, which can significantly affect trade profitability and strategy execution. These technical problems suggest inadequate infrastructure investment or poor liquidity management. Order execution quality appears problematic based on user reports, with traders experiencing delays and price discrepancies that can erode trading performance.

Professional trading environments require precise order filling at requested prices, making execution quality a fundamental service requirement. While the platforms reportedly provide basic charting tools and technical indicators, the overall user experience seems undermined by reliability concerns and execution issues. The availability of standard technical analysis tools is positive, but their value diminishes significantly when platform stability cannot be assured.

Mobile trading experience quality is not specifically detailed in available sources, though mobile platform reliability would likely reflect the same underlying infrastructure issues affecting desktop platforms. Modern traders increasingly rely on mobile access for position monitoring and trade management. The trading environment appears to suffer from user dissatisfaction regarding spreads and liquidity, suggesting either uncompetitive pricing or inadequate market access.

These factors combine to create a trading experience that falls well below industry standards and user expectations.

Trust and Safety Analysis (Score: 1/10)

Trust and safety represent the most critical concerns identified in this evaluation. Multiple red flags indicate serious risks for potential investors. The absence of verifiable regulatory oversight creates an environment where trader protection mechanisms may be inadequate or entirely absent.

No specific information about regulatory licensing, compliance frameworks, or oversight authorities could be verified through reliable sources. Regulatory supervision provides essential protections including segregated client fund requirements, dispute resolution mechanisms, and operational standards that protect trader interests. Fund safety measures such as segregated client accounts, deposit insurance, or compensation schemes are not detailed in available information.

These protections are standard requirements in regulated jurisdictions and their absence suggests significant risk to client funds. Corporate transparency appears severely limited, with minimal verifiable information about company structure, management team, or operational history. Legitimate financial service providers typically maintain transparent corporate profiles and regulatory disclosures.

Industry reputation has been severely damaged by documented scam complaints and fraud allegations. The Cyber Scam Recovery Team has specifically identified MagnaFG as a fraudulent broker operation, representing a serious warning for potential investors. Such allegations from industry watchdog organizations carry significant weight in trust assessments.

The overall rating of 1.00 out of 10 from user evaluations indicates widespread negative experiences and loss of confidence among actual users. This exceptionally low rating suggests systematic problems rather than isolated incidents.

User Experience Analysis (Score: 2/10)

User experience evaluation reveals consistently poor satisfaction levels across multiple touchpoints and service areas. The overall user rating of 1.00 out of 10 indicates fundamental failures in meeting basic customer expectations and service delivery standards. User satisfaction appears exceptionally low based on available feedback, with minimal positive reviews or testimonials to balance the predominantly negative sentiment.

This pattern suggests systematic service failures rather than isolated customer service incidents. Interface design and usability information is not specifically detailed in available sources, making it difficult to assess the quality of user interaction design and navigation efficiency. However, the overall poor user ratings suggest that interface quality may also be problematic.

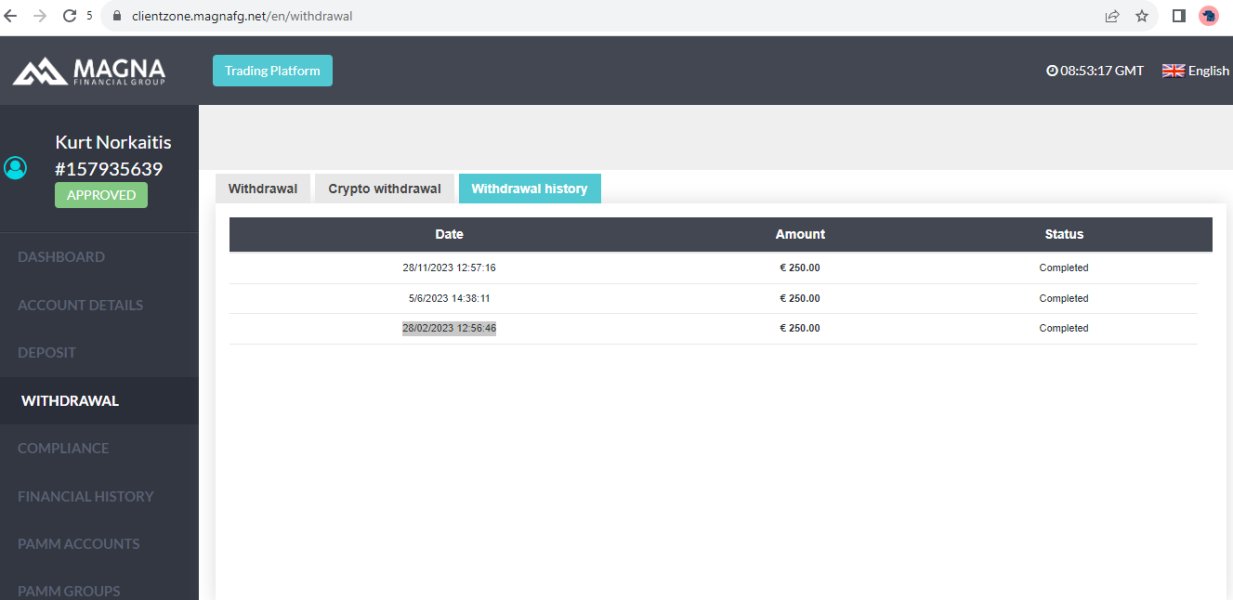

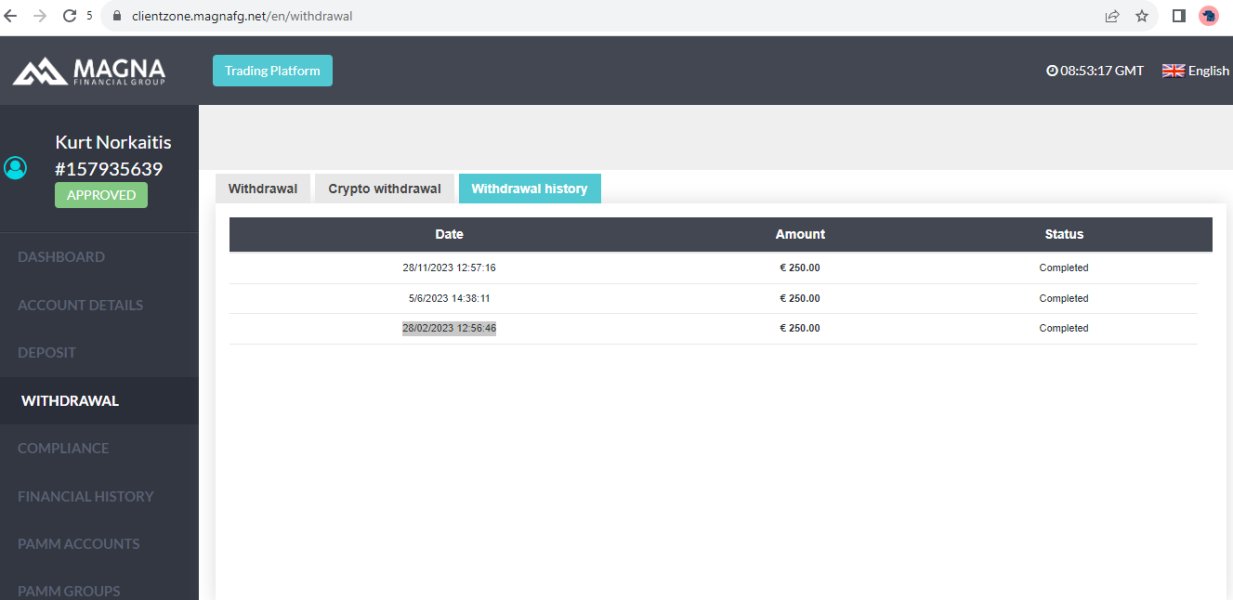

Registration and account verification processes are not described in available materials, though user experience ratings suggest these procedures may be problematic or unnecessarily complex. Smooth onboarding processes are essential for positive initial user experiences. Fund management experiences including deposit and withdrawal procedures are not detailed in available sources, though overall user dissatisfaction suggests these critical processes may be problematic or unreliable.

The most significant user concern relates to scam and fraud allegations, which represent the most serious possible user experience failure. Users have expressed significant concerns about the broker's legitimacy and trustworthiness, indicating fundamental relationship breakdowns. User demographic analysis suggests the platform was intended to serve forex and cryptocurrency trading enthusiasts, but the poor experience ratings indicate failure to meet the needs of this target audience.

The combination of fraud concerns and poor service delivery creates an environment unsuitable for serious traders.

Conclusion

This comprehensive magnafg review reveals significant concerns that strongly advise against using this broker for forex or cryptocurrency trading activities. MagnaFG's overall performance shows critical failures across multiple evaluation criteria, with particularly alarming issues in trust, safety, and customer service areas.

While the broker offers some positive aspects including diverse trading platforms and broad asset coverage, these benefits are completely overshadowed by fundamental trust and reliability issues. The documented fraud allegations and exceptionally low user ratings create an unacceptable risk environment for any investor.

We strongly recommend that traders seek alternative brokers with verified regulatory oversight, transparent operations, and positive user track records. The combination of poor customer service, trust concerns, and fraud allegations makes MagnaFG unsuitable for serious trading activities.