Is Tradingweb safe?

Business

License

Is Tradingweb Safe or a Scam?

Introduction

Tradingweb is a relatively new player in the forex market, aiming to provide trading services to a diverse clientele. However, as with any broker, potential investors must exercise caution when considering where to allocate their funds. The forex market is rife with both legitimate and fraudulent brokers, making it essential for traders to conduct thorough evaluations before engaging with any trading platform. This article aims to investigate the safety and legitimacy of Tradingweb, examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our assessment is based on a comprehensive review of available data, including user reviews, regulatory information, and expert analyses.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety of any trading platform. A regulated broker is typically subject to strict oversight, ensuring compliance with industry standards and protecting investors' funds. Unfortunately, Tradingweb does not hold any valid regulatory licenses from recognized authorities, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Tradingweb operates without the safeguards that licensed brokers provide. This lack of oversight can lead to various risks, including the potential for fraudulent activities. Moreover, several reviews indicate that Tradingweb has been flagged as a potential scam, further emphasizing the need for caution. Traders should be particularly wary of engaging with unregulated brokers like Tradingweb, as they lack the legal protections that come with regulatory oversight.

Company Background Investigation

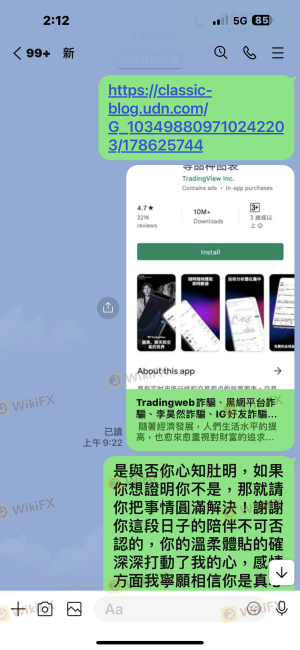

Understanding a broker's history and ownership structure is crucial for assessing its credibility. Tradingweb claims to be based in China, but detailed information about its ownership and management team is conspicuously absent. The lack of transparency regarding the company's origins and operational history is a significant red flag.

Furthermore, the website does not disclose any information about its leadership or the professional backgrounds of its executives. This opacity can lead to skepticism about the broker's intentions and practices. A reputable broker typically provides clear information about its founders and key management personnel, including their qualifications and experience in the financial industry. The absence of such details in Tradingweb's case raises concerns about its legitimacy and commitment to transparency.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer can significantly impact a trader's experience. In the case of Tradingweb, information regarding its fee structure, spreads, and trading conditions is notably scarce. This lack of clarity can lead to confusion and potential financial losses for traders.

| Fee Type | Tradingweb | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

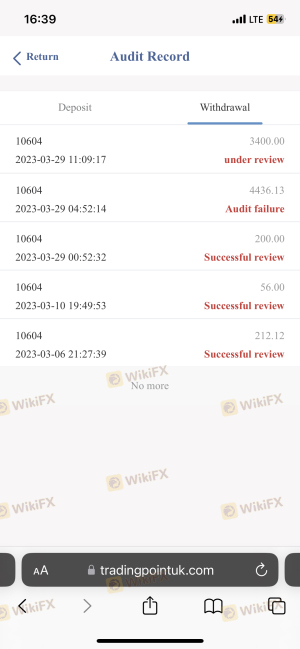

The absence of information about spreads and commissions is concerning, as traders rely on this data to make informed decisions. Additionally, any unusual or hidden fees can significantly affect profitability. Reports from users suggest that Tradingweb may impose unexpected withdrawal conditions, which could further complicate the trading experience and lead to potential financial losses.

Client Fund Safety

The safety of client funds is paramount when selecting a broker. A trustworthy broker should implement measures such as segregated accounts and investor protection policies. However, Tradingweb's lack of regulatory oversight raises serious questions about its ability to safeguard client funds effectively.

There is no publicly available information on whether Tradingweb employs client fund segregation or offers negative balance protection. The absence of these critical safety features can expose traders to significant risks, particularly in volatile market conditions. Furthermore, user complaints about withdrawal issues indicate that clients may struggle to access their funds, which is a common tactic employed by fraudulent brokers.

Customer Experience and Complaints

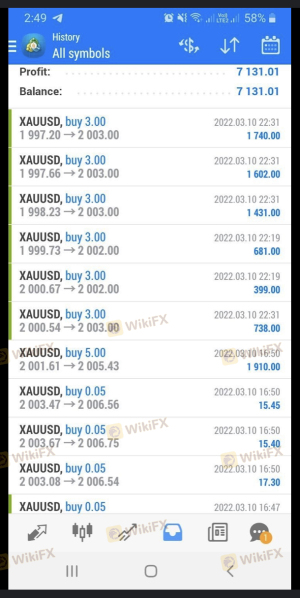

User feedback provides valuable insights into a broker's reliability and service quality. Unfortunately, Tradingweb has garnered numerous negative reviews from clients, indicating widespread dissatisfaction with its services. Common complaints include difficulties in withdrawing funds, poor customer support, and lack of transparency regarding trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | Medium | Poor |

| Transparency Concerns | High | Poor |

For instance, several users have reported being unable to withdraw their deposits, with some alleging that their accounts were deactivated without warning. These issues highlight significant operational shortcomings and raise alarms about the broker's trustworthiness. When a broker fails to address customer complaints effectively, it indicates a lack of accountability and professionalism.

Platform and Execution

The performance and reliability of a trading platform are crucial for a successful trading experience. Tradingweb claims to offer a proprietary trading platform, but user reviews suggest that it may not be as reliable as advertised. Issues such as slippage, order rejections, and platform downtime have been reported, which can severely impact traders' ability to execute trades effectively.

Additionally, the absence of a demo account further complicates matters, as potential clients are unable to test the platform before committing funds. This lack of transparency and user experience raises further questions about the legitimacy of Tradingweb and whether it is indeed safe for traders.

Risk Assessment

Engaging with Tradingweb poses several risks, primarily due to its unregulated status and negative user feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Safety Risk | High | Lack of investor protections |

| Operational Risk | Medium | Poor customer service and withdrawal issues |

To mitigate these risks, potential clients should conduct thorough research and consider alternative, regulated brokers with a proven track record. Engaging with an unregulated broker like Tradingweb can expose traders to significant financial risks, including the potential loss of their entire investment.

Conclusion and Recommendations

In summary, Tradingweb exhibits several red flags that suggest it may not be a safe broker for traders. The absence of regulation, lack of transparency, and numerous negative user experiences indicate that potential clients should exercise extreme caution.

If you are considering trading with Tradingweb, it is advisable to look for alternative brokers that are regulated and have a history of positive customer experiences. Reliable options include established firms with strong regulatory oversight, transparent trading conditions, and responsive customer support. Ultimately, the evidence points to Tradingweb being a broker that traders should approach with skepticism, as it does not appear to meet the necessary criteria for safety and legitimacy.

Is Tradingweb a scam, or is it legit?

The latest exposure and evaluation content of Tradingweb brokers.

Tradingweb Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tradingweb latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.