Trade245 2025 Review: Everything You Need to Know

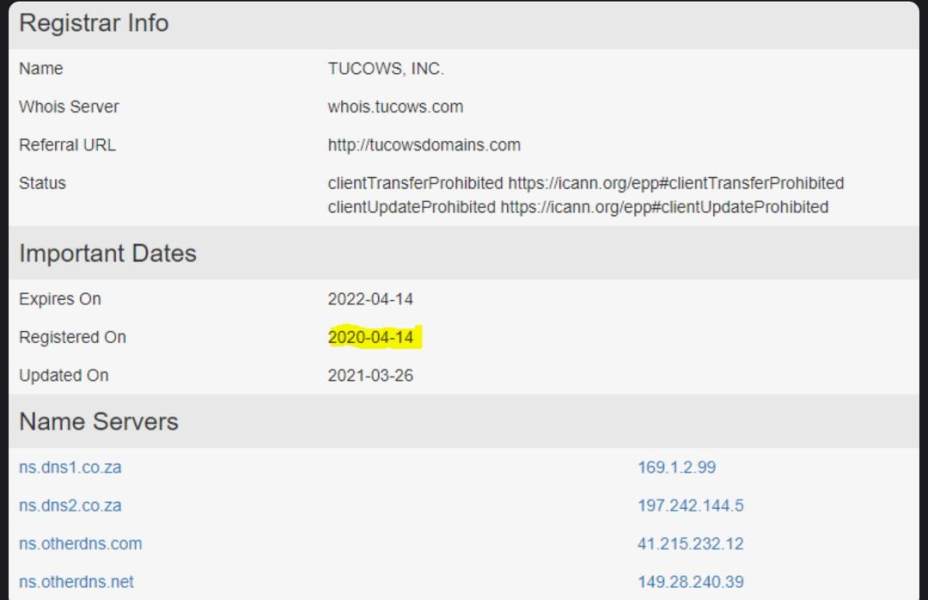

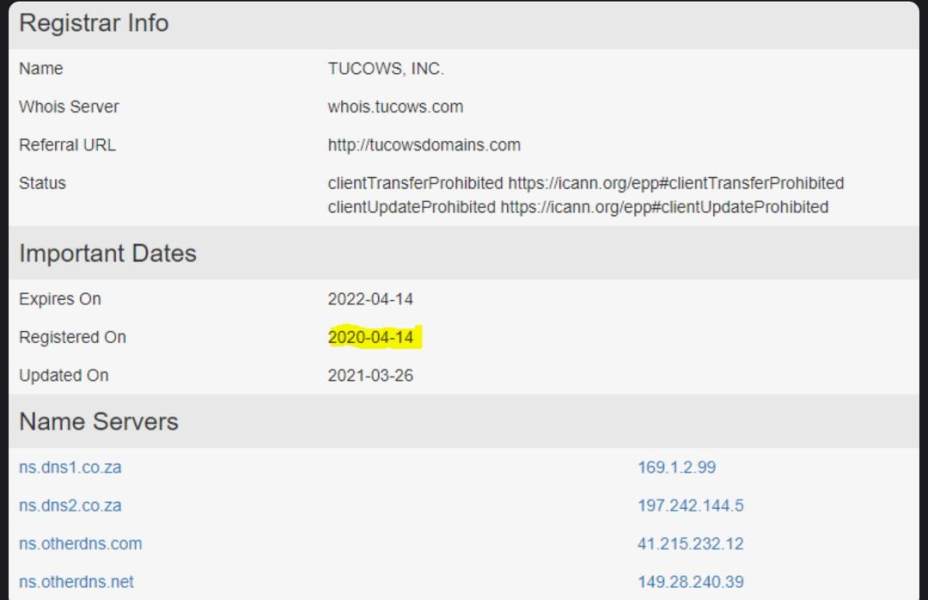

Trade245, a relatively new player in the online trading space, has garnered mixed reviews from traders and analysts alike. Established in 2020 and regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, Trade245 offers a variety of trading options, including forex and CFDs on various asset classes. However, the broker's reputation is marred by concerns regarding its regulatory status and customer service. This review synthesizes user experiences, expert opinions, and critical features of Trade245 to provide a comprehensive overview.

Note: It is essential to recognize that Trade245 operates under different entities in various regions, which may lead to discrepancies in user experience and regulatory protections.

Rating Overview

We rate brokers based on a combination of user feedback, expert analysis, and performance metrics.

Broker Overview

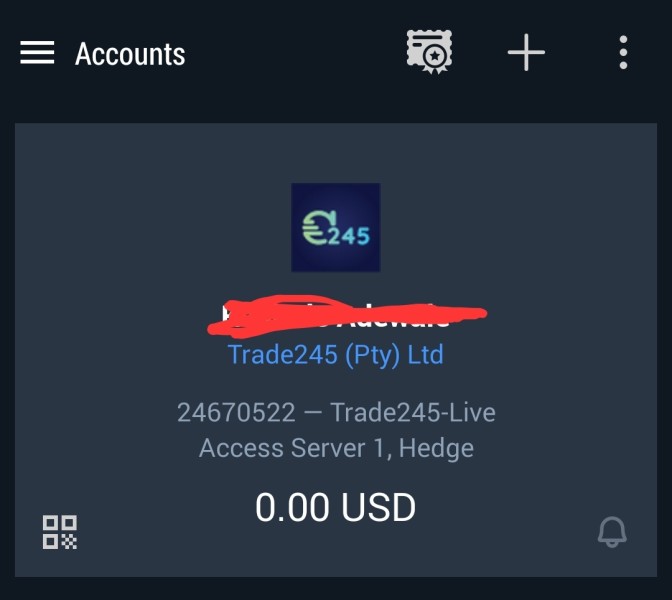

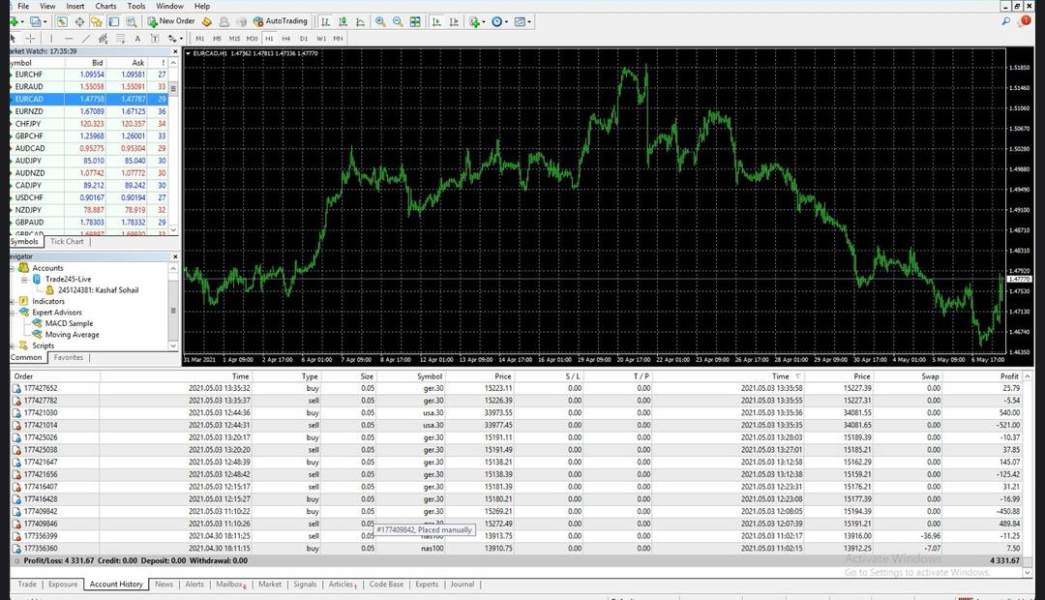

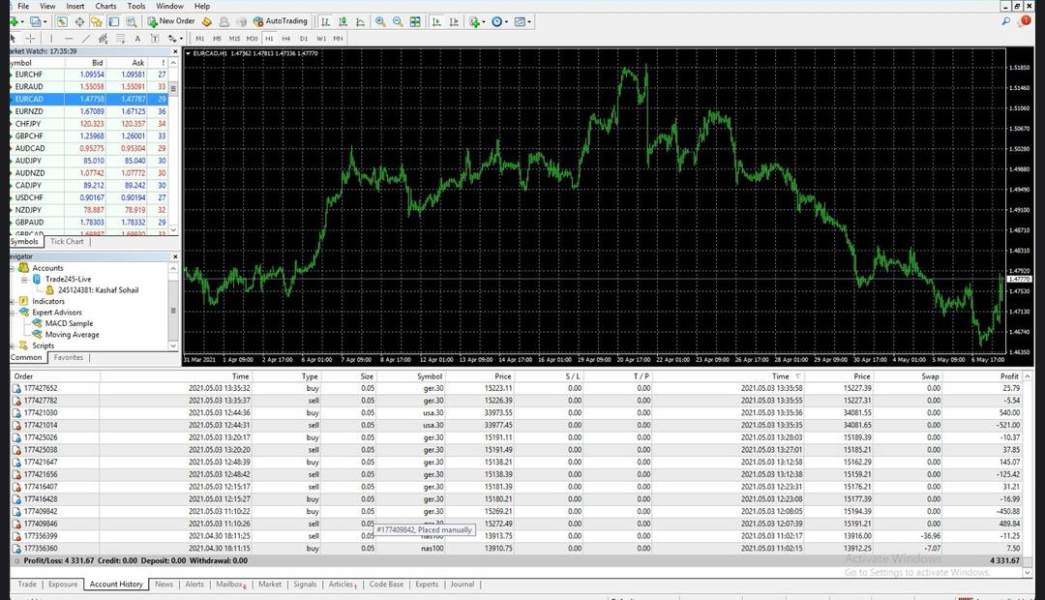

Founded in 2020, Trade245 is headquartered in Johannesburg, South Africa, and operates under the license of Red Pine Capital (Pty) Ltd, regulated by the FSCA (FSP No. 46044). The broker provides access to the popular MetaTrader 4 and MetaTrader 5 platforms, allowing traders to engage in forex, indices, stocks, commodities, and cryptocurrencies. With a maximum leverage of up to 1:500, Trade245 aims to cater to both novice and experienced traders.

Detailed Breakdown

Regulatory Geographical Regions

Trade245 is primarily regulated by the FSCA in South Africa, which ensures a level of oversight and protection for traders. However, the broker also operates through an offshore entity, Market Financials Ltd, regulated by the Seychelles Financial Services Authority (FSA). This dual structure raises concerns about the regulatory robustness and investor protection for clients outside South Africa.

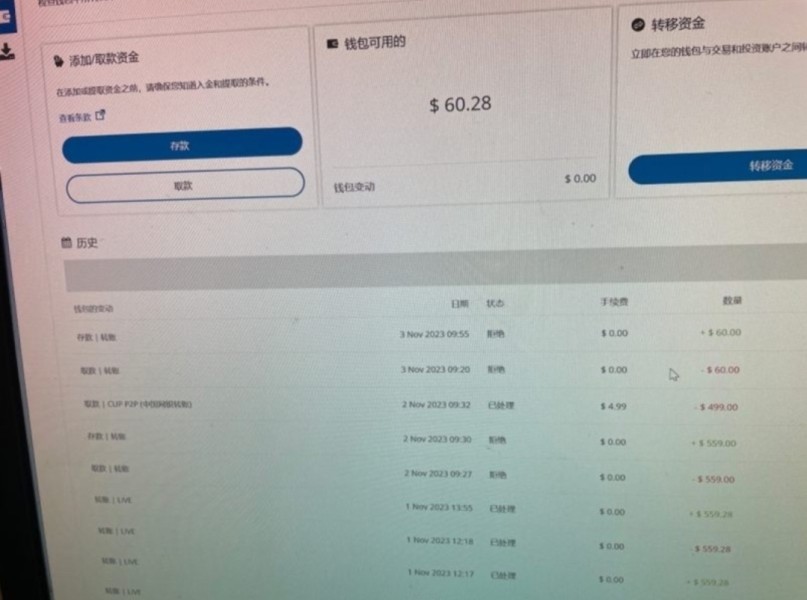

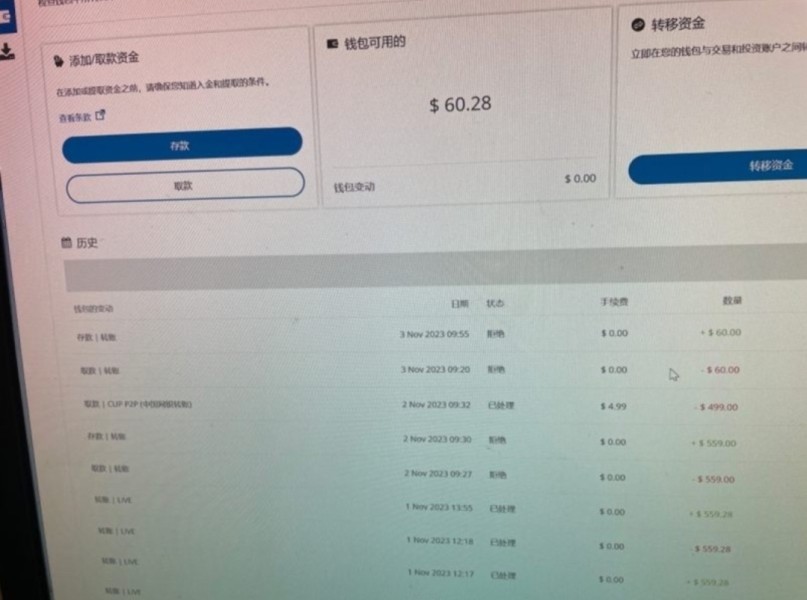

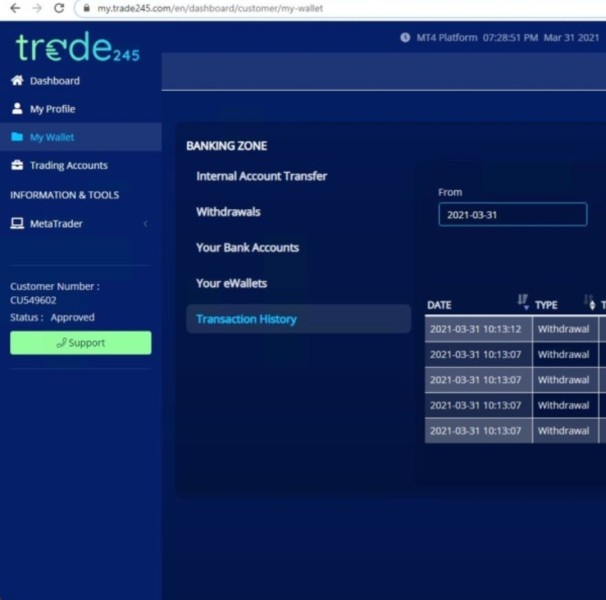

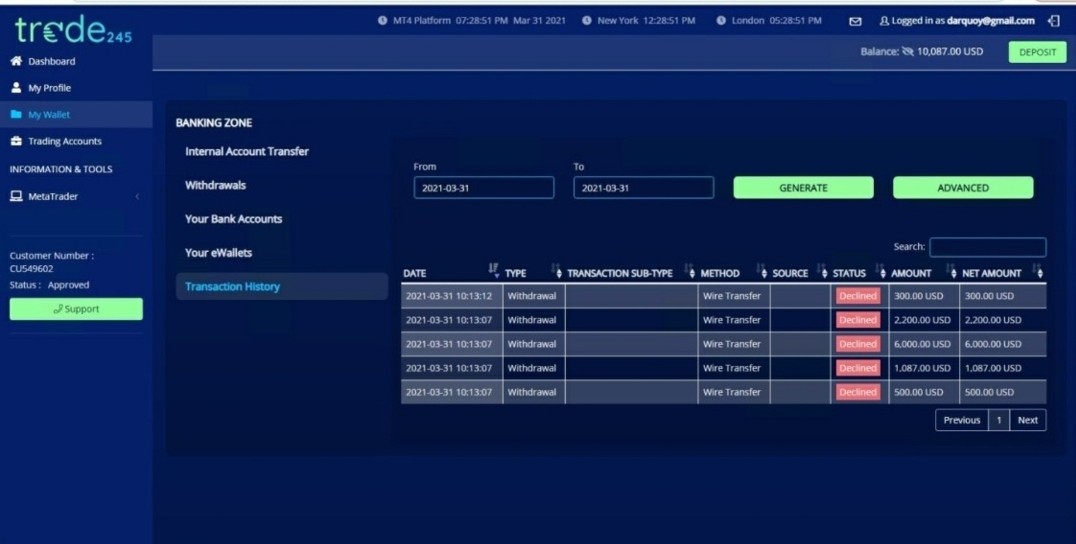

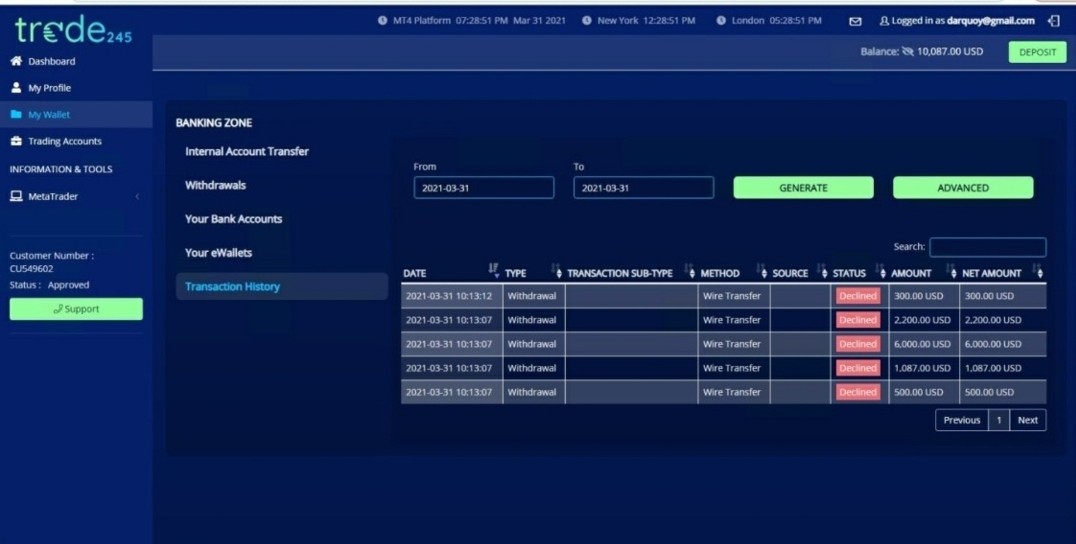

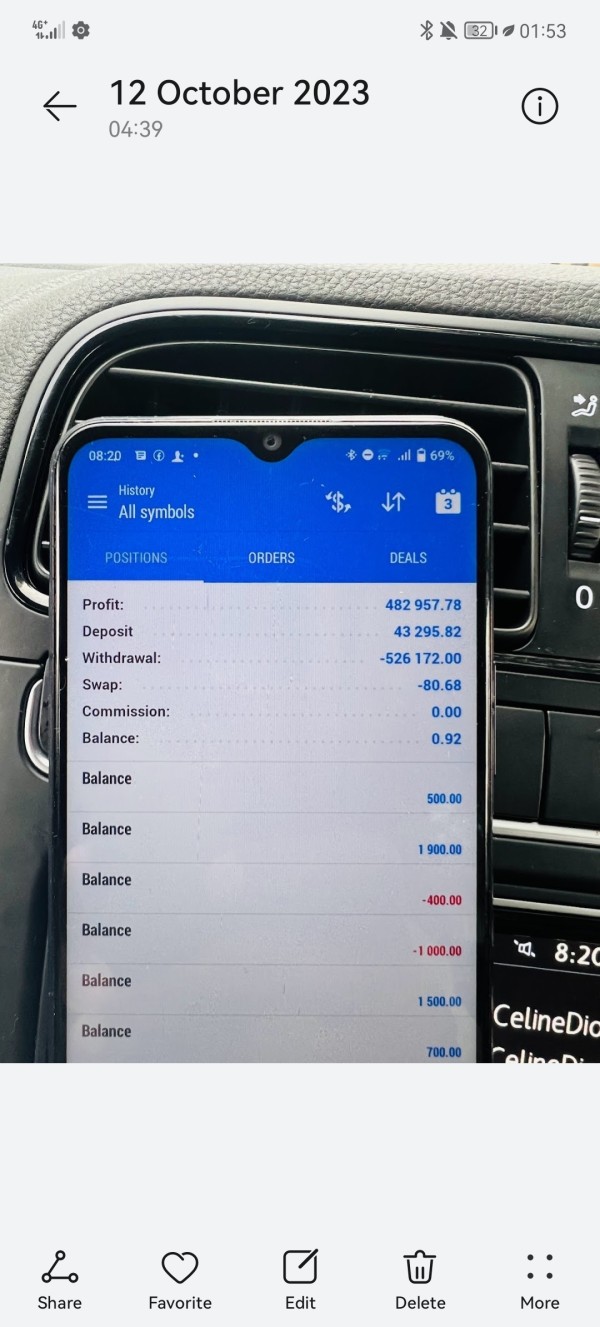

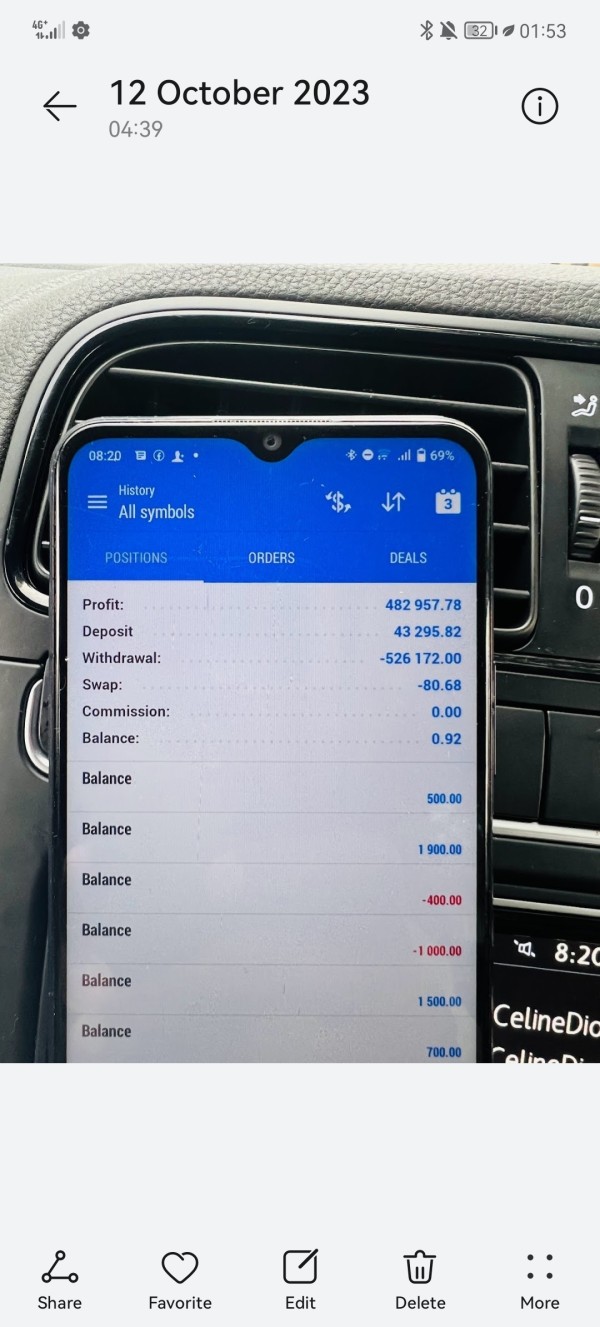

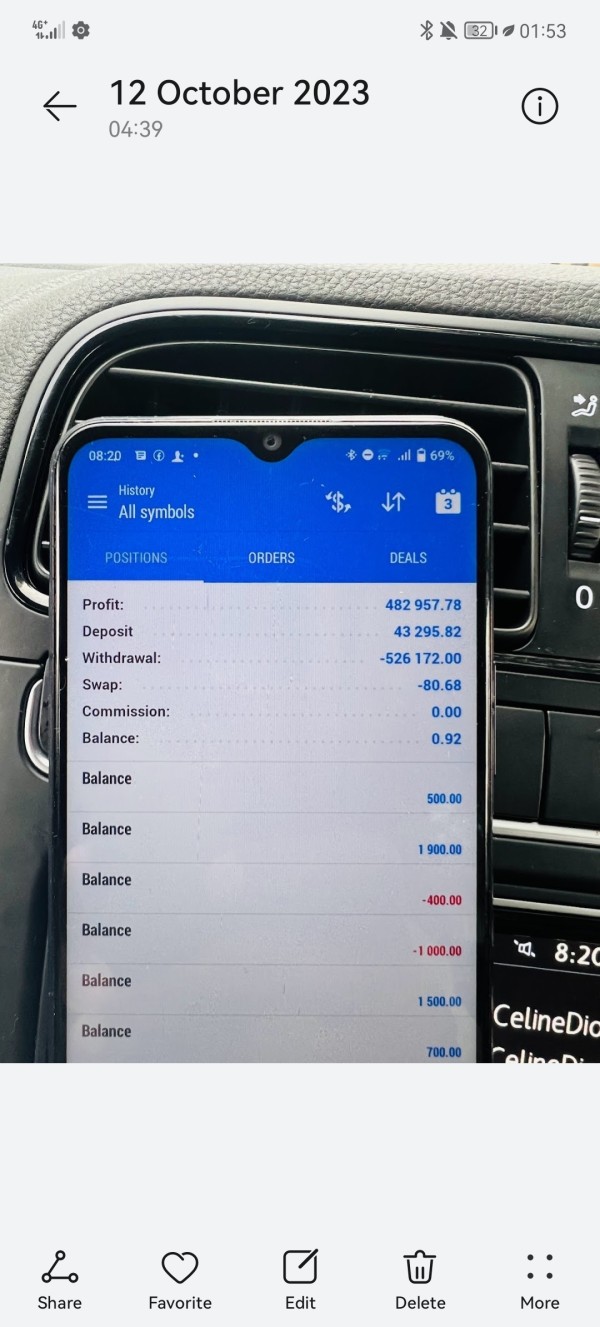

Deposit/Withdrawal Currencies/Cryptocurrencies

Trade245 supports multiple currencies for deposits and withdrawals, including USD, GBP, and ZAR. Additionally, the broker allows deposits in cryptocurrencies, enhancing its appeal to a broader audience. Notably, the broker does not impose fees for deposits or withdrawals, which is a significant advantage for traders.

Minimum Deposit

The minimum deposit required to open an account with Trade245 is $100. This amount is consistent across various account types, including cent accounts aimed at beginners. While this is a reasonable entry point for many traders, some reviews suggest that the minimum deposit requirement may deter less experienced traders looking to start with smaller amounts.

Trade245 offers various bonuses, including a welcome bonus for new traders. However, these bonuses are limited to specific account types, such as the Bonus 100 account, which provides a 100% deposit bonus. This promotional strategy can be appealing but may come with stringent conditions that could affect withdrawal capabilities.

Tradable Asset Categories

The broker offers a diverse range of trading instruments, including forex pairs, CFDs on stocks, commodities, indices, and cryptocurrencies. However, some reviews indicate that the variety of available assets may be limited compared to other brokers, which could restrict trading opportunities for more experienced traders.

Costs (Spreads, Fees, Commissions)

Trade245's spreads start from as low as 0 pips for certain account types, with an average spread of 1 pip for major currency pairs like EUR/USD. The broker charges a commission of $10 per lot for specific accounts, which is competitive in the industry. Additionally, there are no inactivity fees, making it a cost-effective option for traders who may not trade frequently.

Leverage

The maximum leverage offered by Trade245 is up to 1:500, which is attractive for traders seeking to maximize their capital efficiency. However, this high leverage can also pose significant risks, particularly for inexperienced traders who may not fully understand the implications of leveraged trading.

Trade245 provides access to the widely used MetaTrader 4 and 5 platforms, both of which are known for their user-friendly interfaces and comprehensive trading tools. While the availability of these platforms is a strong point for the broker, the absence of proprietary or web-based trading platforms may limit options for some traders.

Restricted Regions

Trade245 does not accept clients from certain regions, including the United States, Canada, and a few others. This restriction may limit its appeal to a global audience, particularly for traders in regions where regulatory protections are crucial.

Available Customer Support Languages

Trade245 primarily offers customer support in English, which may be a barrier for non-English speaking traders. The broker provides support via email and phone, but the lack of 24/7 support and live chat options may hinder immediate assistance for traders in different time zones.

Repeated Rating Overview

Detailed Breakdown of Ratings

-

Account Conditions (6.5/10): Trade245 offers a reasonable minimum deposit and a variety of account types. However, the minimum deposit requirement may deter some beginner traders.

Tools and Resources (5.0/10): While the broker provides access to popular trading platforms and some educational resources, the overall offering lacks depth, particularly for novice traders.

Customer Service and Support (4.0/10): The absence of 24/7 support and live chat options limits the effectiveness of customer service, which is a significant drawback for a broker operating in multiple time zones.

Trading Setup (6.0/10): The trading experience on MetaTrader platforms is generally positive, but some users report issues with spreads and execution, particularly during high volatility.

Trustworthiness (4.5/10): The dual regulatory structure raises concerns about investor protection, particularly for clients trading through the offshore entity.

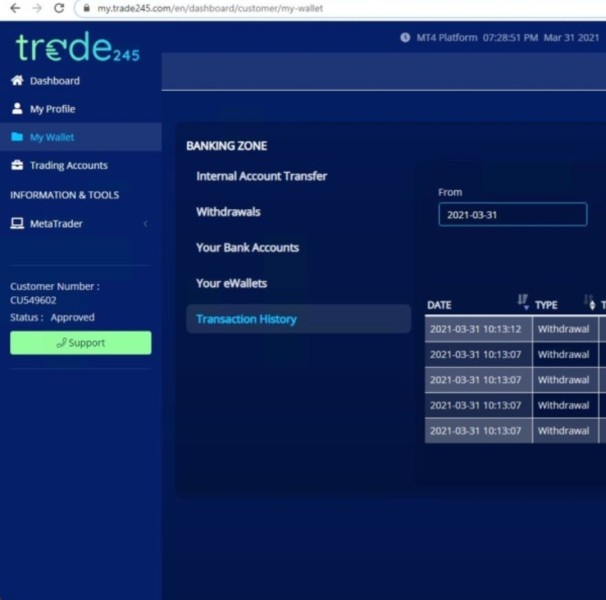

User Experience (5.5/10): Overall user reviews are mixed, with some praising the broker's efficiency and others raising concerns about withdrawal issues and customer service.

In summary, while Trade245 offers a range of trading options and competitive conditions, potential clients should be cautious and conduct thorough research before engaging with the broker. The mixed reviews, regulatory concerns, and limited customer support highlight the importance of understanding the risks involved in trading with Trade245.