Oinvest 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Oinvest review looks at a new online trading platform that started in 2018. Oinvest is based in South Africa and calls itself a smart online trading platform that focuses on secure trading of financial assets. The platform promises financial freedom and chances to build capital for traders.

Our analysis shows big concerns about this broker's current status and openness. Oinvest first launched with goals to serve the trading community, but the available information suggests it may have operational problems. The platform's website appears to be for sale, which makes us question if it's still running.

There are also regulatory warnings and scam claims about the broker that potential users should think about carefully. Given the limited openness and concerning reports from various sources, this Oinvest review gives a neutral to cautious view of the platform's current position in the forex and trading industry.

Important Notice

Regional Entity Differences: Oinvest's regulatory status changes a lot across different areas. The broker's South African base may put it under different regulatory rules compared to other major financial centers.

Traders should check the specific regulatory protections available in their region before using this platform. Review Methodology: This evaluation uses publicly available information, user feedback from various trading forums, and reports from financial regulatory bodies.

Due to limited operational openness from Oinvest itself, some assessments rely on third-party sources and should be considered accordingly.

Rating Framework

Broker Overview

Company Background and Establishment

Oinvest joined the online trading market in 2018. The company set itself up as a modern solution for traders who want secure financial asset trading.

The company put its headquarters in South Africa, targeting both local and international markets. The platform's first marketing focused on smart trading abilities and financial freedom for its users.

The broker's business model focused on giving access to various financial tools through what it called a user-friendly platform. Oinvest marketed itself with slogans like "Celebrate your financial freedom" and "Start building your capital with a platform that's made for you," showing its target group of retail traders looking for easy trading solutions.

Current Operational Status and Platform Details

Recent investigations show concerning developments about Oinvest's operational status. The platform's main website appears to be for sale, with reports showing only 66 visitors in the last 30 days.

This suggests either big operational challenges or potential stopping of services. The trading platform type and specific technical setup remain unclear from available sources.

While the company first promoted features like tight spreads and no commission trading, the current availability and reliability of these services cannot be checked. The lack of detailed information about trading platforms, asset coverage, and regulatory compliance presents big transparency issues for potential users.

Regulatory Status and Compliance

The regulatory information for Oinvest remains largely unclear. This presents a big concern for potential traders.

While the company is based in South Africa, specific regulatory approval from the Financial Sector Conduct Authority or other relevant bodies has not been clearly documented in available sources. This lack of regulatory clarity is particularly concerning given the importance of proper oversight in the financial services industry.

Account Types and Requirements

Specific information about account types, minimum deposit requirements, and account features is not detailed in available sources. This lack of openness makes it difficult for potential traders to understand what services they might expect or what financial commitments would be required.

Trading Conditions and Costs

While Oinvest first promoted "no commission" trading and tight spreads, current pricing structures, swap rates, and other trading costs are not clearly documented. The absence of detailed cost information makes it impossible to accurately assess the platform's competitiveness in the current market.

Available Assets and Instruments

The range of tradable instruments offered by Oinvest is not fully detailed in available sources. Without clear information about forex pairs, commodities, indices, or other financial instruments, traders cannot properly assess whether the platform meets their trading needs.

Platform Technology and Features

Details about the trading platform technology, mobile applications, and advanced trading features remain largely undocumented. This information gap makes it difficult to evaluate the platform's technical abilities or user experience quality.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions evaluation for Oinvest shows big information gaps that impact our assessment. This Oinvest review finds that basic account information such as minimum deposit requirements, available account types, and specific terms and conditions are not easily available through official channels.

The lack of clear account information presents several concerns for potential traders. Without clear documentation of account opening procedures, verification requirements, or minimum balance obligations, users cannot make informed decisions about whether the platform suits their needs.

Also, the absence of information about special account features, such as Islamic accounts for Muslim traders or different tier structures for various trading volumes, suggests either limited service offerings or poor communication of available options. The platform's marketing materials mention account funding options, but specific details about deposit methods, processing times, and any associated fees are not clearly outlined.

This lack of openness in account conditions greatly impacts the overall user experience and raises questions about the platform's commitment to clear communication with its clients.

The analysis of trading tools and resources available through Oinvest shows big deficiencies in this area. Available sources provide minimal evidence of comprehensive trading tools, analytical resources, or educational materials that modern traders typically expect from a professional trading platform.

Research and analysis abilities appear to be limited or poorly documented. Professional traders rely heavily on market analysis, economic calendars, technical indicators, and research reports to make informed trading decisions.

The absence of clear information about these essential tools suggests that Oinvest may not provide the analytical depth required for serious trading activities. Educational resources, which are crucial for new traders, also appear to be lacking or poorly promoted.

Most reputable brokers offer extensive educational materials including webinars, tutorials, market guides, and trading strategies. The limited evidence of such resources indicates that Oinvest may not properly support trader development and education.

Automated trading support and advanced charting abilities are also unclear from available information, which further limits the platform's appeal to sophisticated traders who rely on these technologies for their trading strategies.

Customer Service and Support Analysis (2/10)

Customer service evaluation shows concerning gaps in support infrastructure and availability. The assessment of Oinvest's customer support abilities is hampered by limited information about service channels, response times, and support quality.

Available sources do not clearly document the customer service channels offered by Oinvest, such as live chat, phone support, or email assistance. This lack of clarity about how users can reach support staff is particularly concerning given the time-sensitive nature of trading activities where quick resolution of issues is crucial.

Response time information is not available, making it impossible to assess whether the broker can provide timely assistance when traders encounter problems. In the fast-paced trading environment, delays in customer support can result in big financial losses for traders.

The availability of multilingual support, which is important for an international trading platform, is also not clearly documented. Also, support hours and availability across different time zones remain unclear, which could impact traders in various geographic locations.

These customer service limitations contribute to overall concerns about the platform's operational abilities and commitment to client satisfaction.

Trading Experience Analysis (3/10)

The trading experience evaluation for this Oinvest review shows big uncertainties about platform performance and reliability. Platform stability and execution quality cannot be properly assessed due to limited operational openness and user feedback.

Order execution quality, which is fundamental to successful trading, remains unclear from available sources. Factors such as slippage rates, execution speeds, and order fill quality are not documented, making it impossible to determine whether the platform can deliver the execution standards that serious traders require.

Platform functionality and user interface quality are also poorly documented. Modern traders expect sophisticated charting abilities, real-time data feeds, and intuitive navigation.

The absence of detailed information about these features suggests either limited platform abilities or poor communication of available features. Mobile trading experience, which is increasingly important for active traders, is not clearly described in available sources.

With many traders requiring the ability to monitor and execute trades from mobile devices, the lack of information about mobile platform abilities represents a big gap in service openness. The overall trading environment, including server stability, data feed reliability, and platform uptime, cannot be properly evaluated based on available information, contributing to concerns about the platform's operational readiness.

Trust and Safety Analysis (2/10)

Trust and safety evaluation shows the most big concerns in this Oinvest review. The regulatory status of Oinvest remains unclear, with no clear documentation of approval from major financial regulatory bodies.

This regulatory uncertainty presents big risks for potential traders who rely on regulatory protection for their funds and trading activities. Fund safety measures, including segregated client accounts, deposit protection schemes, and insurance coverage, are not clearly documented.

These protections are essential for trader confidence and are typically prominently featured by legitimate brokers. The absence of clear information about fund safety protocols raises big concerns about client protection.

Company openness is notably lacking, with limited information available about company management, financial statements, or operational procedures. Legitimate brokers typically provide comprehensive information about their corporate structure and regulatory compliance to build client confidence.

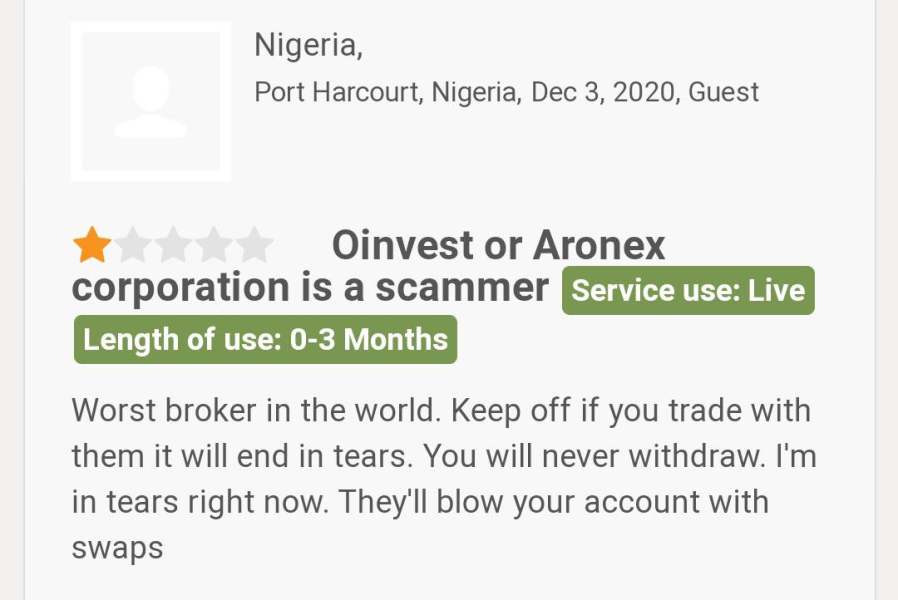

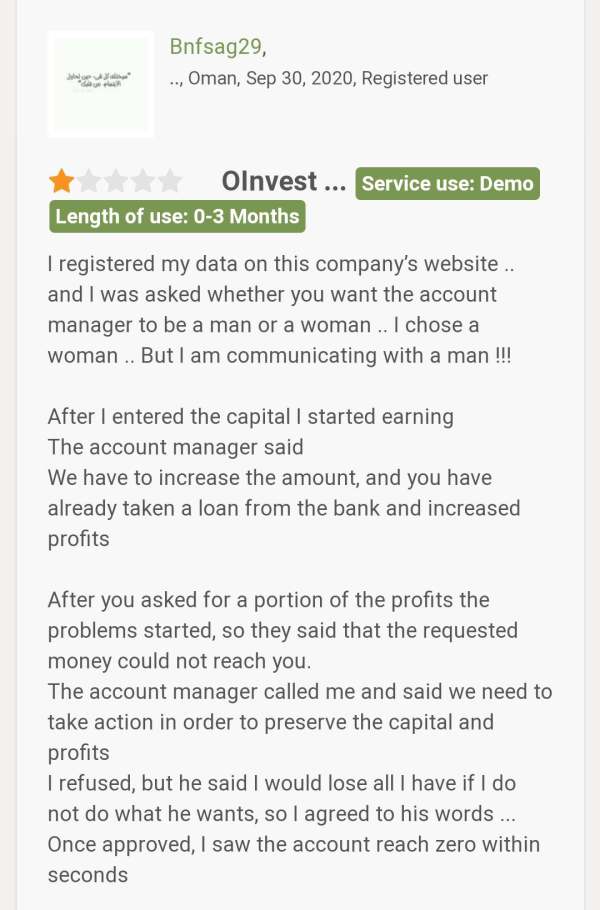

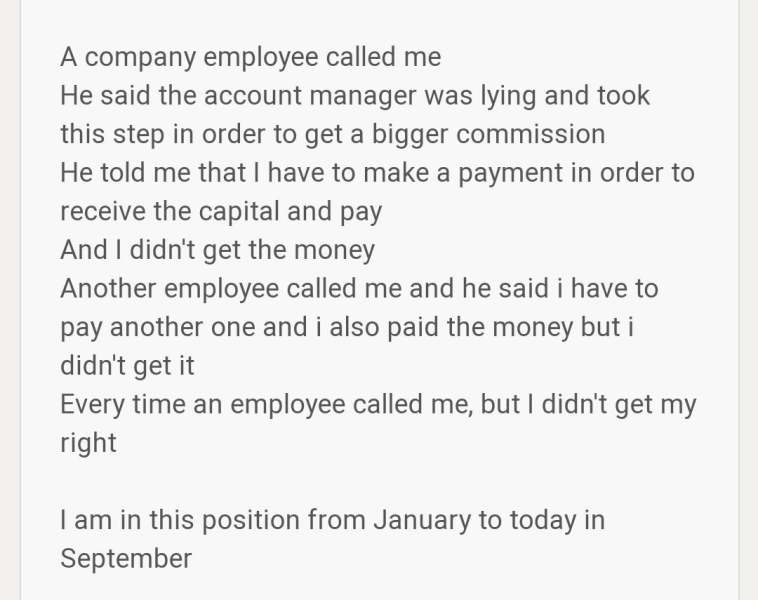

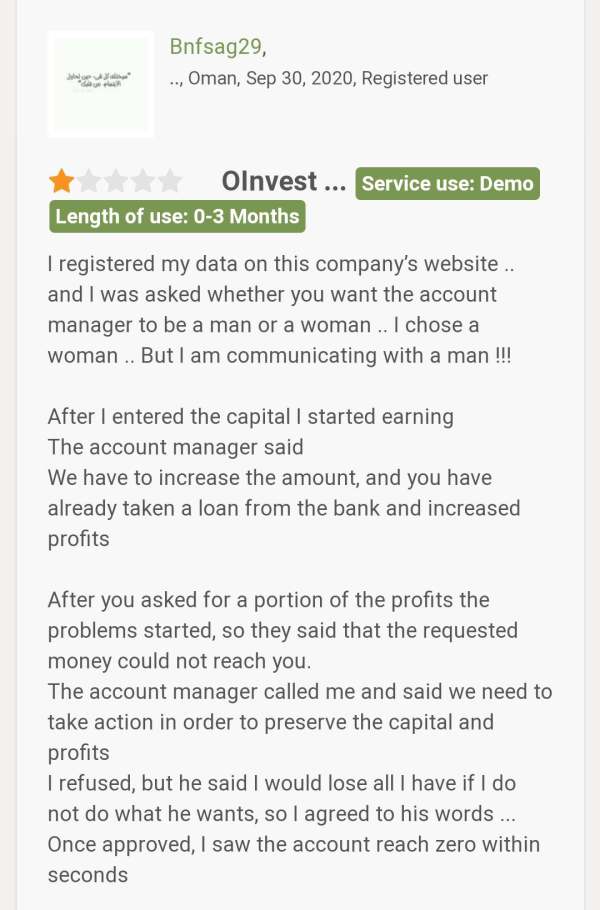

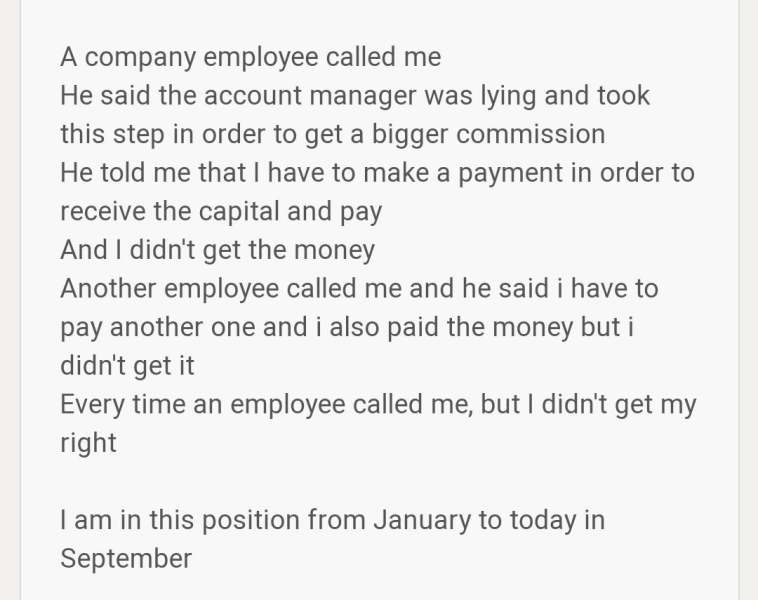

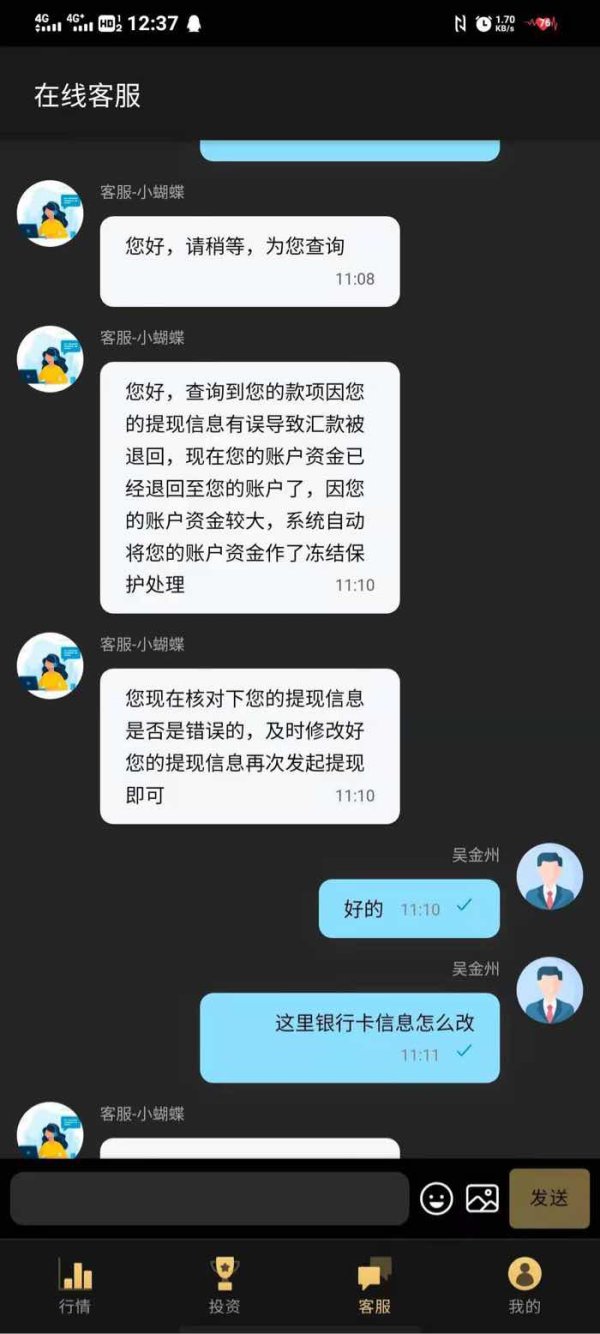

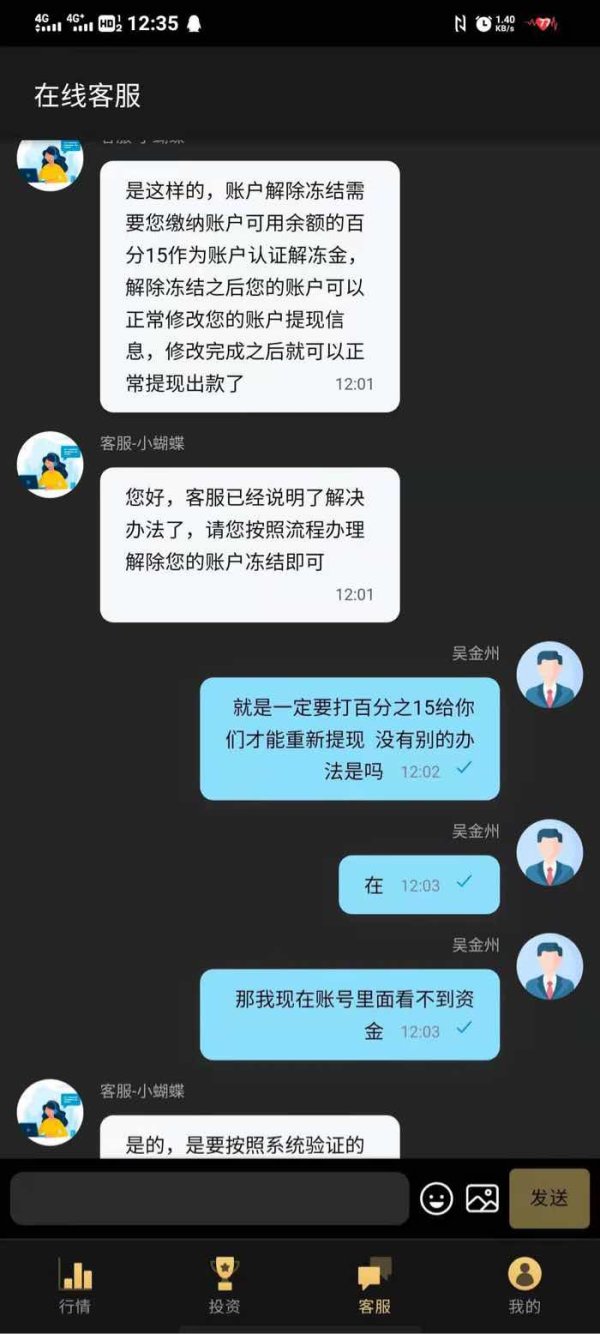

Industry reputation assessment shows concerning reports and regulatory warnings associated with the Oinvest name. These negative reports, combined with the apparent domain sale situation, greatly impact the trust assessment for this broker.

The handling of negative events and client complaints is also unclear, with no documented procedures for dispute resolution or complaint handling, further undermining confidence in the platform's operational integrity.

User Experience Analysis (2/10)

User experience evaluation is greatly limited by the lack of comprehensive user feedback and operational openness. The overall user satisfaction assessment is hampered by minimal available reviews and testimonials from actual platform users.

Interface design and usability cannot be properly evaluated due to limited access to the actual trading platform. User-friendly design is crucial for effective trading, and the inability to assess these aspects represents a big limitation in evaluating the platform's suitability for traders.

Registration and verification processes are not clearly documented, making it difficult for potential users to understand what steps are required to begin trading. Clear onboarding procedures are essential for user satisfaction and regulatory compliance.

Fund operation experiences, including deposit and withdrawal processes, timelines, and associated fees, are not well documented in available sources. These operational aspects are crucial for user satisfaction and platform credibility.

Common user complaints and concerns cannot be properly assessed due to limited user feedback available through public sources. This lack of user voice in the evaluation process makes it difficult to identify potential issues or strengths in the platform's service delivery.

Conclusion

This comprehensive Oinvest review shows big concerns about the broker's current operational status and openness. While Oinvest first entered the market in 2018 with promises of secure trading and financial freedom, the current evidence suggests big operational challenges that potential users should carefully consider.

The platform appears most suitable for traders who prioritize basic trading access over comprehensive services and regulatory protection. However, given the regulatory uncertainties, limited openness, and concerning reports about operational status, most traders would be better served by established brokers with clear regulatory approval and proven track records.

Key advantages include the initial focus on security and user-friendly marketing approach. However, big disadvantages include unclear regulatory status, limited operational openness, concerning domain sale situation, and minimal customer support documentation.

Based on these factors, traders should exercise extreme caution and thoroughly research alternative brokers before considering Oinvest for their trading activities.