Tomahawk 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive tomahawk review examines a broker that has faced significant scrutiny in the forex trading community. Tomahawk Finance operates as an online trading platform established in 2009. The company offers access to multiple asset classes including forex currency pairs, CFDs, stocks, indices, and commodities like gold, silver, and oil. The broker provides MetaTrader5 and MT Mobile platforms for trading execution.

However, our analysis reveals concerning patterns in user feedback and transparency issues that potential clients should carefully consider. The broker's reputation has been questioned by multiple users. Particular concerns have been raised about regulatory oversight and operational transparency. While Tomahawk offers a range of trading instruments and familiar platform options, the negative user experiences and lack of clear regulatory information present significant red flags.

The platform primarily targets investors seeking multi-asset trading capabilities with basic platform functionality requirements. However, the numerous complaints and trust-related issues make this broker suitable only for extremely risk-tolerant traders. These traders must have thoroughly researched the potential implications of trading with an unregulated entity.

Important Notice

Due to the absence of clear regulatory information in available sources, investors should be aware that legal protections may vary significantly across different jurisdictions. The regulatory status of this broker remains unclear. This could impact client fund protection and dispute resolution mechanisms.

This evaluation is based on available user feedback and publicly accessible information. The assessment does not include direct trading experience with the platform. Potential clients should conduct their own due diligence before making any investment decisions.

Rating Framework

Broker Overview

Tomahawk Finance entered the online trading market in 2009. The company positioned itself as a multi-asset broker serving retail traders worldwide. The company operates as an online trading intermediary, though specific headquarters information is not clearly disclosed in available materials. The broker's business model focuses on providing access to various financial instruments through popular trading platforms. This targets both novice and experienced traders seeking diversified portfolio options.

The platform's longevity in the market suggests some level of operational continuity. However, this should not be confused with regulatory compliance or operational excellence. According to available information, Tomahawk has maintained its services for over a decade. During this time, the online trading landscape has evolved significantly in terms of regulatory requirements and industry standards.

The broker offers trading access through MetaTrader5 and MT Mobile platforms. This provides clients with familiar trading environments. The asset portfolio includes forex currency pairs, contracts for difference, individual stocks, market indices, and precious metals including gold and silver, as well as energy commodities like oil. However, specific details about the regulatory framework under which these services operate remain unclear in the available documentation.

This tomahawk review notes that while the broker offers a comprehensive range of trading instruments, the lack of transparent regulatory information raises important questions. These questions about client protection and operational oversight should be carefully considered by potential users.

Regulatory Status: Available sources do not provide specific information about regulatory oversight or licensing authorities. This absence of clear regulatory disclosure represents a significant concern for potential clients seeking protected trading environments.

Deposit and Withdrawal Methods: Specific information about available funding methods is not detailed in accessible sources. The lack of transparent information about payment processing options may indicate limited banking relationships or operational constraints.

Minimum Deposit Requirements: Concrete minimum deposit amounts are not specified in available materials. This makes it difficult for potential clients to assess entry-level investment requirements.

Bonuses and Promotions: Current promotional offerings or bonus structures are not mentioned in the available information. This suggests either absence of such programs or limited marketing transparency.

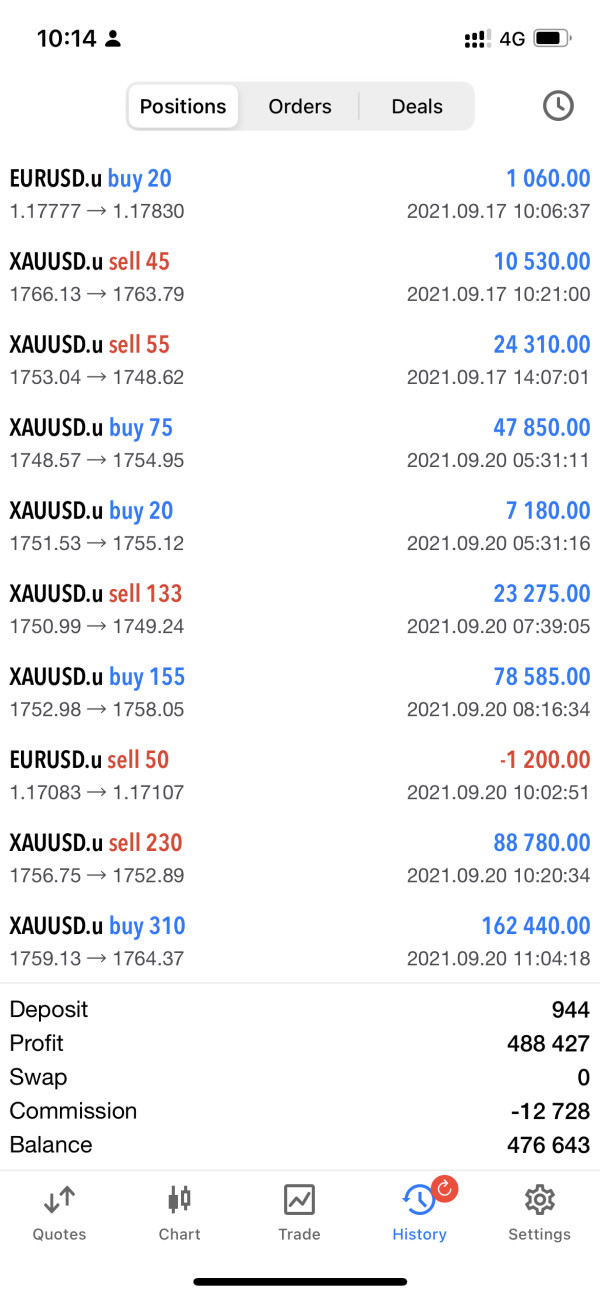

Tradeable Assets: The platform provides access to forex currency pairs, contracts for difference, individual stocks, market indices, precious metals including gold and silver, and energy commodities such as oil. This diverse asset selection potentially appeals to traders seeking portfolio diversification opportunities.

Cost Structure: Specific information regarding spreads, commissions, and other trading costs is not detailed in available sources. The absence of transparent pricing information makes it challenging for traders to assess the true cost of trading with this broker.

Leverage Ratios: Available materials do not specify the maximum leverage ratios offered across different asset classes. This represents a significant information gap for risk assessment purposes.

Platform Options: Trading is facilitated through MetaTrader5 and MT Mobile applications. This provides clients with industry-standard trading interfaces and mobile accessibility for on-the-go trading activities.

This tomahawk review emphasizes that the lack of detailed operational information across multiple critical areas represents a transparency concern. Potential clients should carefully evaluate this before proceeding with account opening procedures.

Account Conditions Analysis

The account conditions offered by Tomahawk Finance present several areas of concern based on available information and user feedback. Specific account types and their distinguishing features are not clearly outlined in accessible materials. This makes it difficult for potential clients to understand what options are available or how they differ from one another.

User feedback indicates confusion regarding account opening procedures. Several reports suggest that the process lacks clarity and transparency. The absence of clear minimum deposit requirements in available documentation further compounds these concerns. Traders cannot adequately assess the financial commitment required to begin trading.

The lack of information about special account features, such as Islamic accounts for Sharia-compliant trading, suggests either limited accommodation for diverse client needs or insufficient disclosure of available options. This represents a significant disadvantage compared to more established brokers who typically provide comprehensive account information upfront.

Available user testimonials point to negative experiences with account setup and management. Particular criticism is directed at the lack of clear terms and conditions. The absence of transparent account condition information makes it extremely difficult for traders to make informed decisions about whether this broker meets their specific trading requirements and risk tolerance levels.

This tomahawk review concludes that the poor transparency around account conditions, combined with negative user feedback, results in a below-average rating for this crucial aspect of broker evaluation.

Tomahawk Finance's trading infrastructure centers around the MetaTrader5 platform. This provides clients with access to industry-standard trading tools and analytical capabilities. MT5 offers comprehensive charting packages, technical indicators, and automated trading support through Expert Advisors. This represents a solid foundation for trading operations.

However, user feedback suggests that the platform's functionality may not be fully optimized or properly maintained. Reports indicate issues with feature completeness and platform performance that could impact trading effectiveness. The MT Mobile application extends trading access to smartphones and tablets. However, specific performance metrics and user satisfaction data for the mobile platform are not available in current sources.

The availability of research and analytical resources beyond the basic MT5 package is not clearly documented. Many competitive brokers provide additional market analysis, economic calendars, and educational materials. Such supplementary resources are not mentioned in available Tomahawk Finance materials.

Educational resources, which are increasingly important for broker differentiation and client development, appear to be absent or inadequately promoted. The lack of visible educational content suggests that the broker may not prioritize client development and trading education. This could be particularly problematic for novice traders.

Automated trading support through MT5's Expert Advisor functionality should theoretically be available. However, user experiences with algorithmic trading implementation are not documented in available feedback. The overall assessment suggests that while basic trading tools are present, the comprehensive resource package falls short of industry standards.

Customer Service and Support Analysis

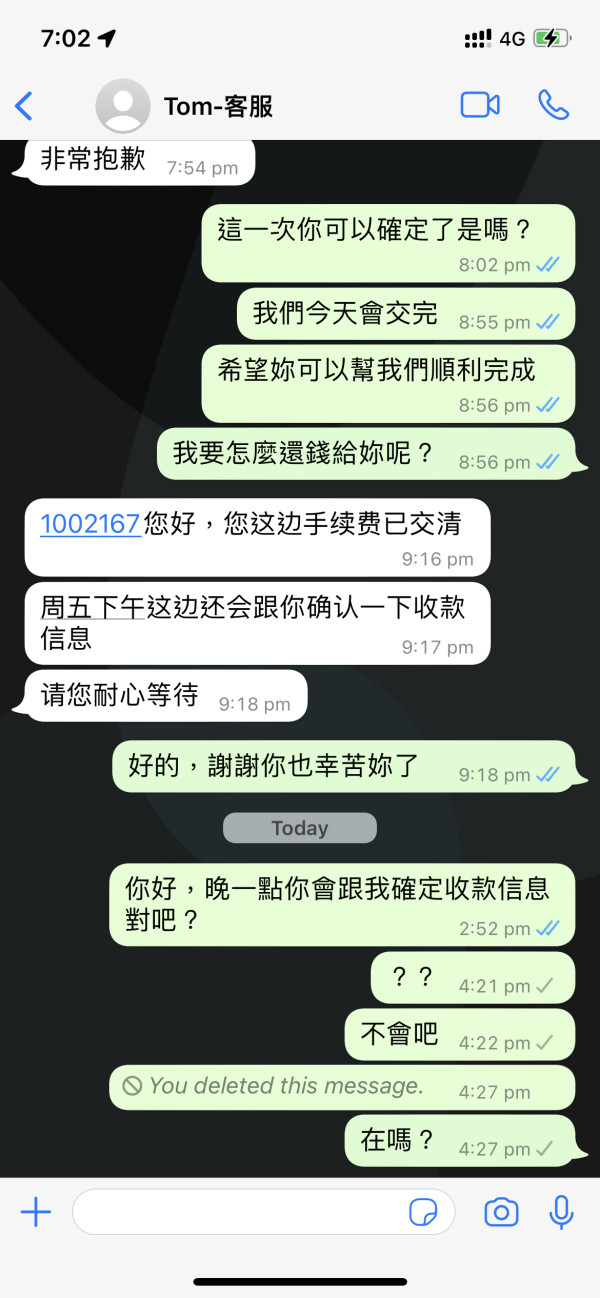

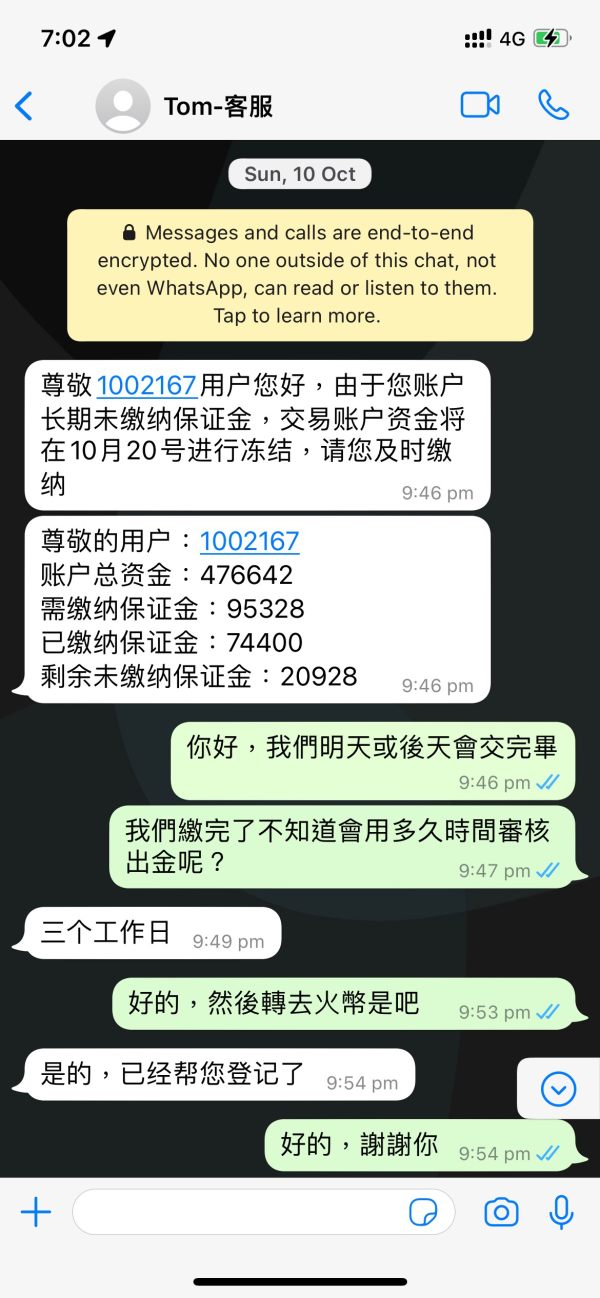

Customer service quality represents one of the most significant concerns identified in this evaluation. User feedback consistently indicates poor customer support experiences. Particular criticism is directed at response times and problem-resolution capabilities. The lack of adequate customer service can severely impact trading operations, especially during critical market conditions.

Available user testimonials suggest that customer service representatives may lack the expertise or authority to effectively address client concerns. This creates frustration for traders who require timely assistance with account issues, technical problems, or trading-related questions. The absence of efficient problem-resolution mechanisms represents a substantial operational weakness.

Response time issues appear to be a recurring theme in user complaints. Reports indicate extended delays in receiving assistance. In the fast-paced trading environment, delayed customer support can result in missed opportunities or unresolved technical issues that impact trading performance.

The availability of multiple communication channels and multilingual support options is not clearly documented in available sources. Most competitive brokers provide 24/7 support through various channels including live chat, email, and telephone. Such comprehensive support infrastructure does not appear to be prominently featured or effectively implemented by Tomahawk Finance.

Customer service hours and availability across different time zones are not specified in accessible materials. This could be problematic for international clients trading in various market sessions. The overall customer service assessment reveals significant deficiencies that could substantially impact the client experience and trading operations.

Trading Experience Analysis

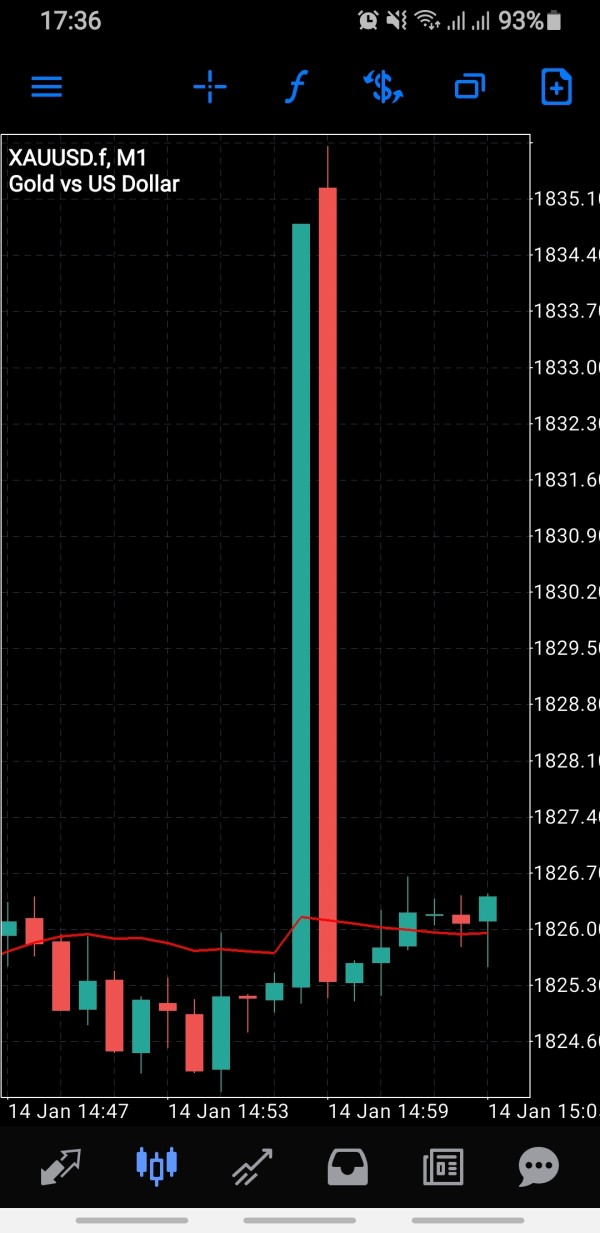

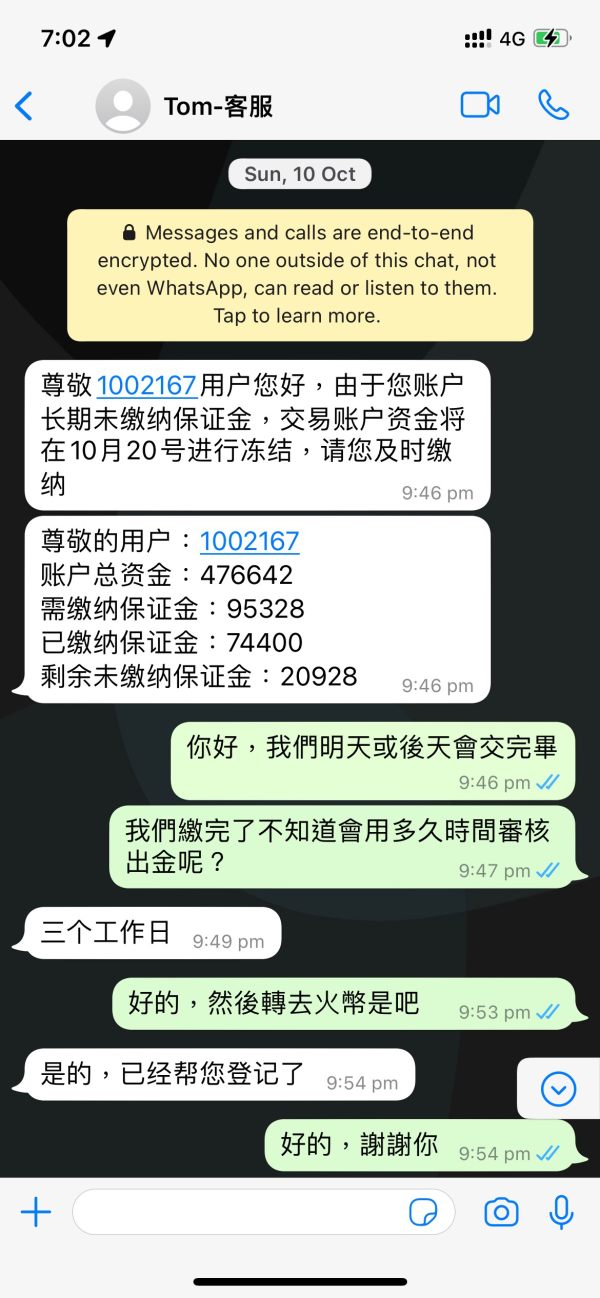

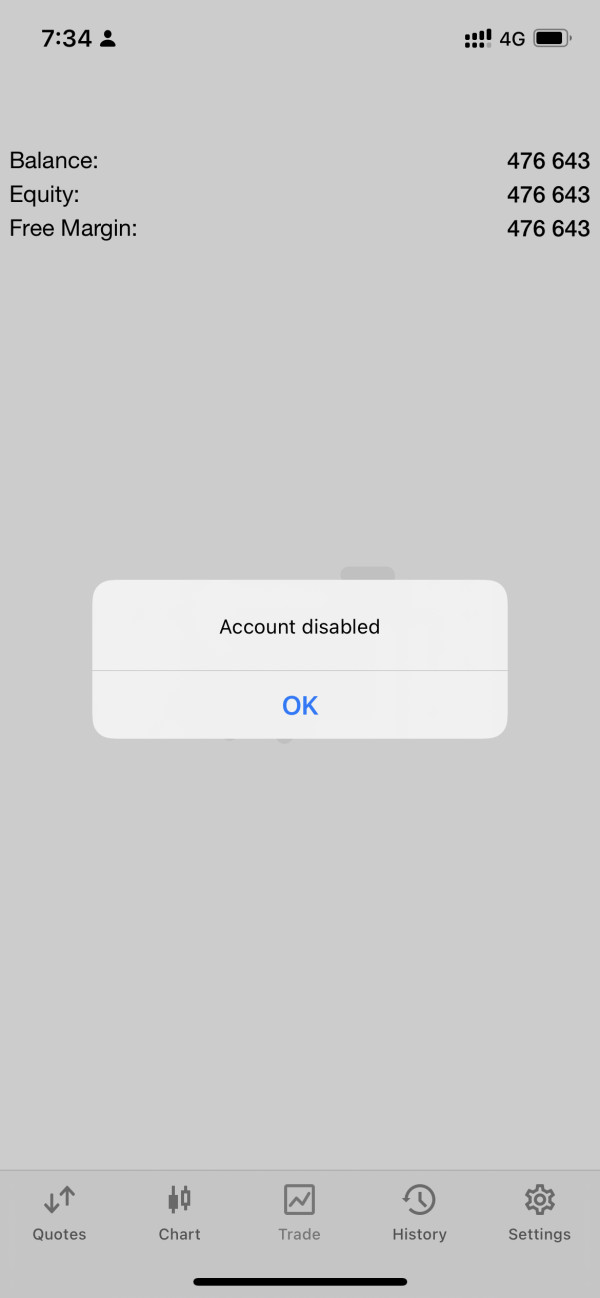

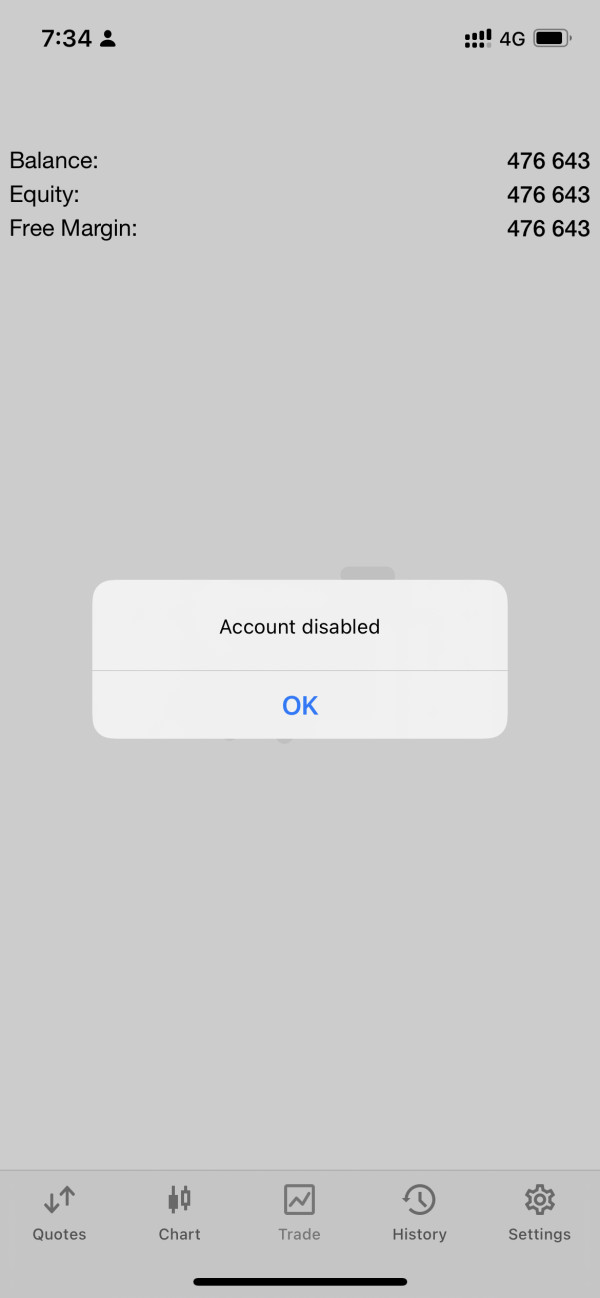

The trading experience with Tomahawk Finance appears to be significantly impacted by platform stability and performance issues based on user feedback. Reports suggest that the trading environment may suffer from technical problems that could affect order execution and overall trading effectiveness.

Platform stability concerns are particularly troubling. Unreliable trading infrastructure can result in missed trading opportunities, execution delays, or system failures during critical market movements. User feedback indicates that the platform's stability does not meet the standards expected in professional trading environments.

Order execution quality, including potential issues with slippage and requotes, is not specifically documented in available sources. However, the general pattern of negative user feedback suggests that execution quality may not meet trader expectations. This is particularly concerning during volatile market conditions when precise execution becomes crucial.

The completeness of platform functionality has been questioned by users. Reports indicate that certain features may not work as expected or may be missing entirely. This functional incompleteness can significantly impact trading strategies that rely on specific platform capabilities or advanced order types.

Mobile trading experience through MT Mobile is theoretically available. However, specific user feedback about mobile platform performance, reliability, and feature parity with the desktop version is not documented in available sources. The overall trading experience assessment reveals concerning patterns that suggest potential operational and technical deficiencies.

This tomahawk review indicates that trading experience quality falls below industry standards. Particular concerns about platform reliability and functional completeness could significantly impact trading operations.

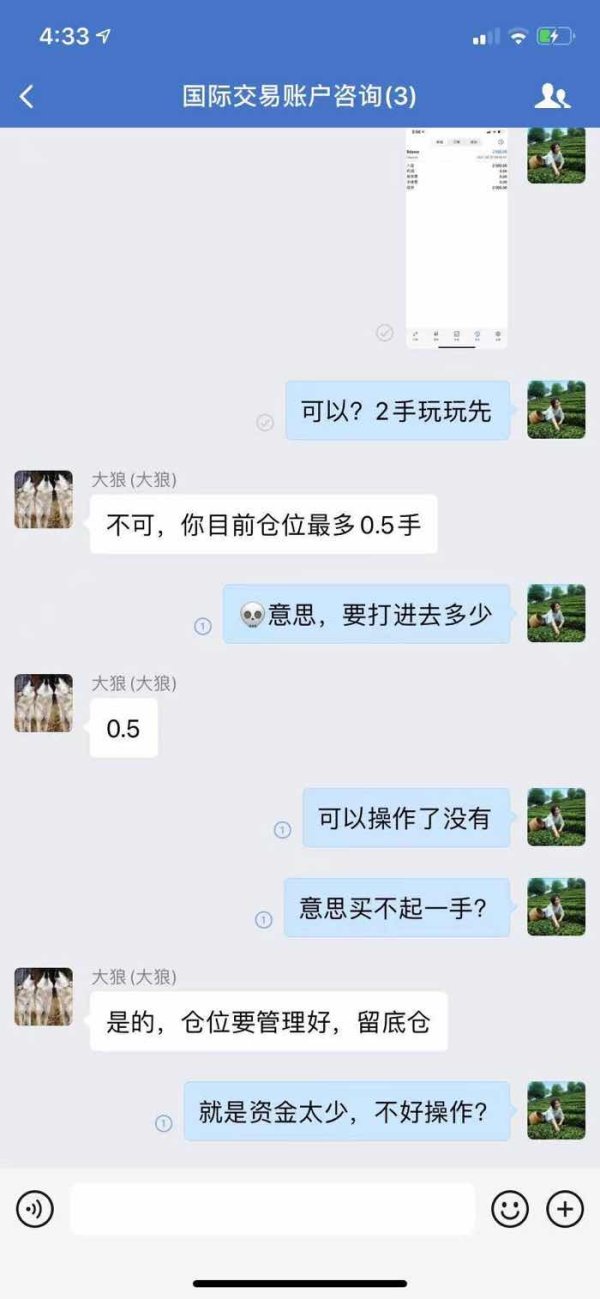

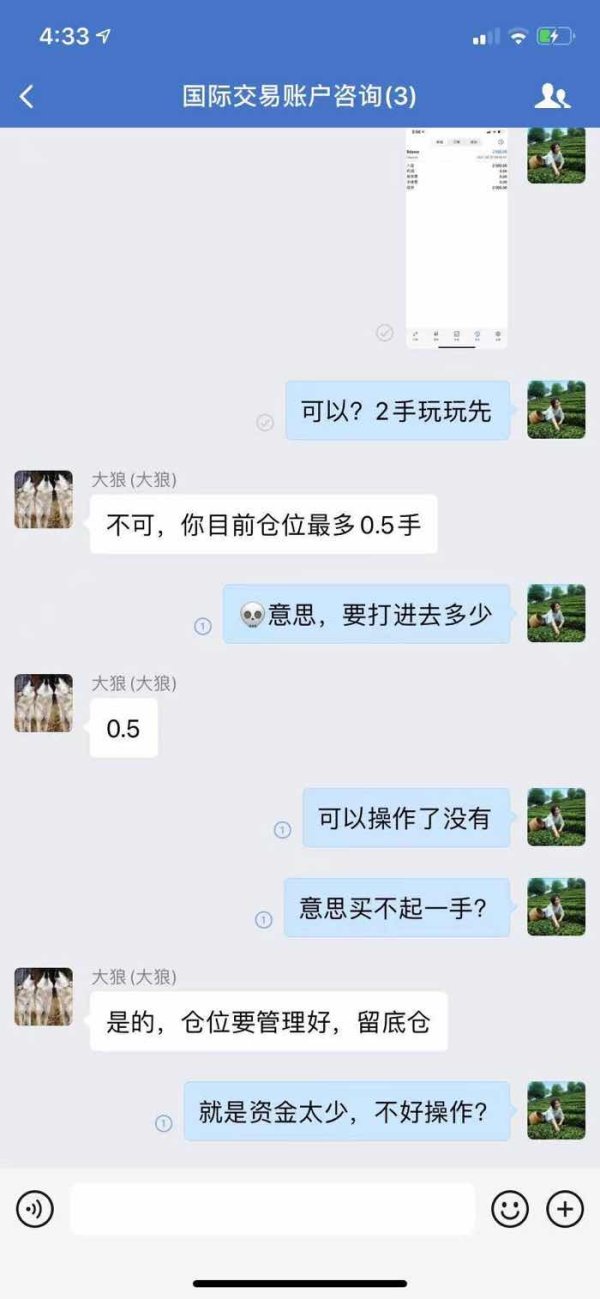

Trust and Reliability Analysis

Trust and reliability represent the most concerning aspects of Tomahawk Finance's operations. The absence of clear regulatory information in available sources raises fundamental questions about client protection and operational oversight. Regulatory compliance is a cornerstone of trustworthy broker operations. The lack of transparent regulatory disclosure represents a major red flag.

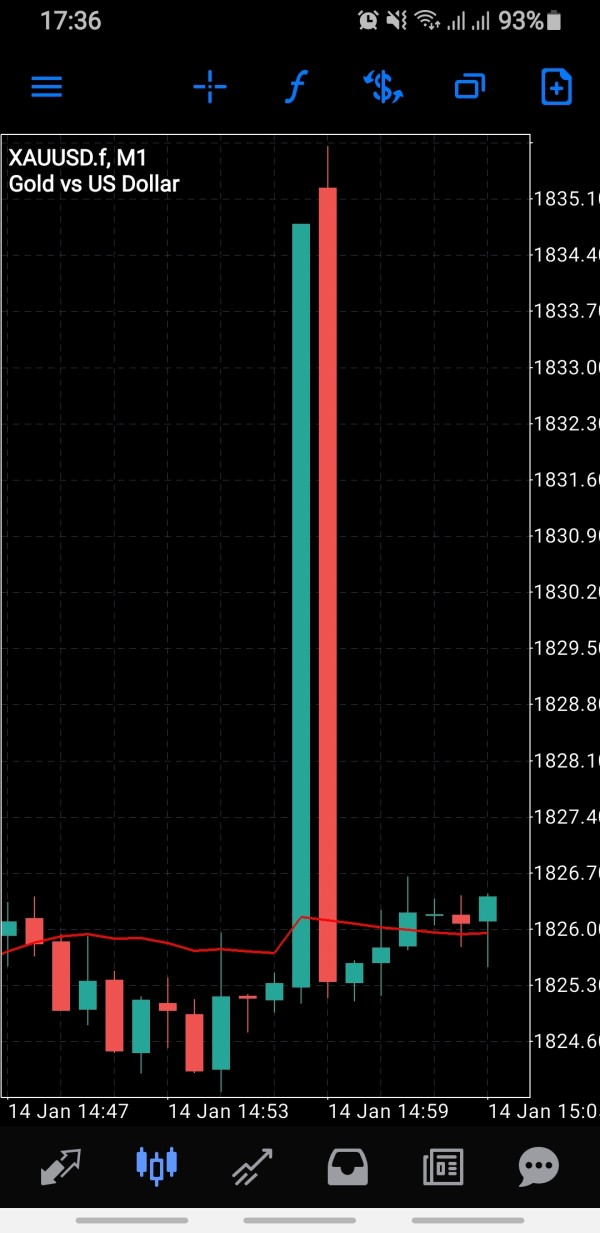

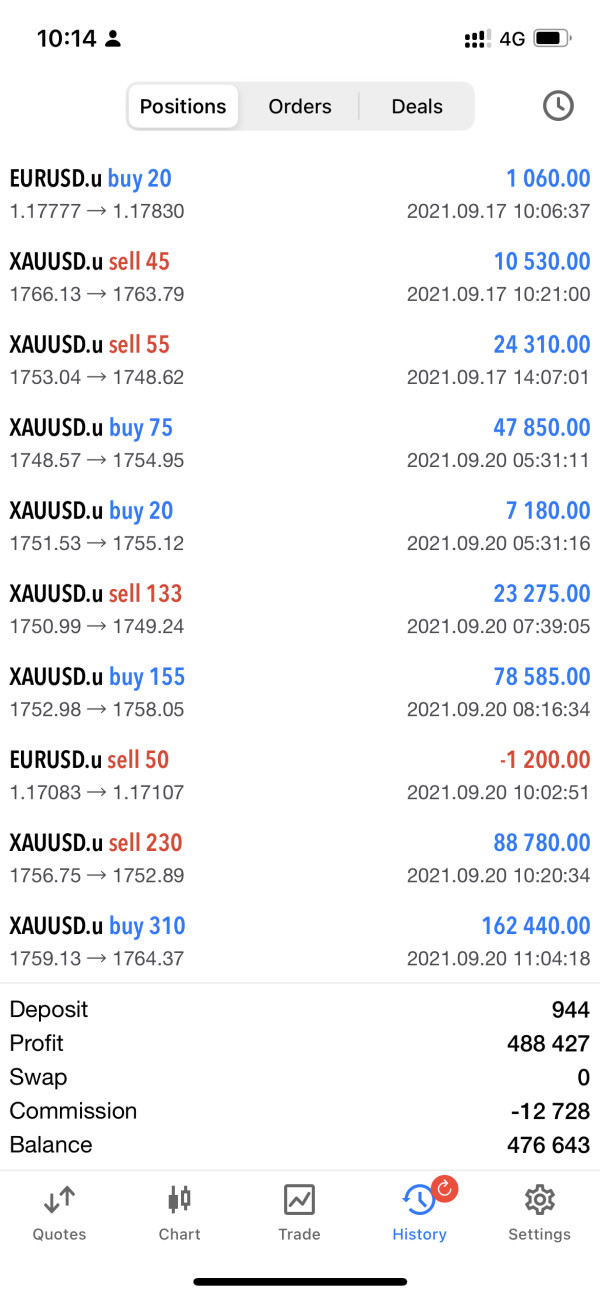

Allegations of fraudulent activity have been reported by users. This significantly undermines confidence in the broker's legitimacy and operational integrity. Such serious accusations, even if unproven, create substantial reputational damage and raise important questions about the broker's business practices and client treatment.

Fund safety measures and client money protection protocols are not clearly documented or disclosed. Reputable brokers typically maintain segregated client accounts and provide clear information about fund protection measures. Such safeguards are not evident in Tomahawk Finance's available documentation.

Company transparency issues extend beyond regulatory disclosure to include lack of clear information about company ownership, management structure, and operational procedures. This opacity makes it extremely difficult for potential clients to assess the broker's credibility and long-term viability.

The broker's industry reputation has been significantly damaged by negative user experiences and fraud allegations. The absence of positive third-party endorsements or industry recognition further compounds trust concerns. The overall trust assessment reveals fundamental deficiencies that make this broker unsuitable for risk-averse traders seeking secure trading environments.

User Experience Analysis

Overall user satisfaction with Tomahawk Finance appears to be significantly below industry standards based on available feedback and testimonials. The pattern of negative reviews and user complaints suggests systematic issues with service delivery and client satisfaction. These issues extend across multiple operational areas.

Interface design and usability concerns have been raised by users. However, specific details about navigation problems or design flaws are not comprehensively documented. User-friendly interface design is crucial for effective trading operations. Any deficiencies in this area can substantially impact trading efficiency and user satisfaction.

Registration and verification processes appear to be problematic based on user feedback. Reports indicate that account opening procedures may be unnecessarily complex or poorly explained. Streamlined onboarding processes are standard in the industry. Complications in this area can create immediate negative impressions and operational difficulties.

Fund operation experiences, including deposit and withdrawal processes, are not specifically detailed in available user feedback. However, the general pattern of negative reviews suggests that financial transactions may also be affected by operational deficiencies.

Common user complaints center around platform functionality, customer service quality, and transparency issues. The concentration of negative feedback across multiple operational areas suggests systematic problems rather than isolated incidents. This is particularly concerning for potential new clients.

The user profile best suited for this broker would be limited to extremely risk-tolerant traders who are willing to accept significant operational and reputational risks. These traders would need to accept these risks in exchange for access to multi-asset trading capabilities. However, even for such traders, the numerous concerns identified make this broker a questionable choice compared to more reputable alternatives.

Conclusion

This comprehensive evaluation reveals that Tomahawk Finance presents significant concerns across multiple critical areas of broker assessment. The combination of regulatory uncertainty, negative user feedback, and transparency issues creates a risk profile that makes this broker unsuitable for most retail traders. These traders seek secure and reliable trading environments.

The broker may appeal to traders specifically seeking multi-asset trading capabilities through familiar platforms like MetaTrader5. However, the numerous operational and reputational concerns significantly outweigh these limited advantages. The lack of regulatory oversight and transparency represents fundamental deficiencies that cannot be overlooked.

The primary advantages include platform diversity and multi-asset access. The disadvantages encompass regulatory uncertainty, poor customer service, platform reliability issues, and damaged reputation due to fraud allegations. The risk-reward assessment heavily favors avoiding this broker in favor of more reputable and properly regulated alternatives that provide better client protection and service quality.