Zentrade 2025 Review: Everything You Need to Know

Executive Summary

This zentrade review gives you a complete look at Zentrade, a forex broker that offers trading services across multiple financial markets. Based on data we found and feedback from users, Zentrade shows both good and bad points for people who want to trade. The broker lets you access over 30 forex currency pairs and uses the popular MT4 trading platform, which makes it easy for traders who want different trading choices.

But our research shows big problems with customer service quality and getting your money out, as shown by user complaints about hard withdrawal steps and poor customer support response times. With a Trust Score of 75, Zentrade puts itself in the middle level of forex brokers, though user experiences are very different from person to person.

The platform mainly targets small to medium-sized traders looking for different trading assets, offering forex pairs, CFDs, and precious metals trading. While the broker gives you basic trading tools through MT4, the overall user experience seems to change a lot, with special problems in customer service delivery and fund management processes that potential clients should think about carefully before opening an account.

Important Notice

Traders should know that regulatory information for Zentrade is not fully detailed in public sources, so you need to check regulations that apply in your area yourself. Different regional companies may work under different regulatory rules, and traders must check on their own what regulatory status applies to their location.

This review uses publicly available information and user feedback collected from various sources. The analysis here has not involved direct testing or on-site investigation of the broker's services. Potential clients should do their own research and consider getting independent financial advice before making trading decisions.

Rating Framework

Broker Overview

Zentrade works as a forex broker that provides trading services across multiple financial instruments, though specific details about when it started and complete company background are not detailed in available sources. The broker's main business model focuses on helping with forex, CFD, and precious metals trading for retail clients, putting itself as a multi-asset trading platform.

The company offers access to over 30 foreign exchange currency pairs alongside contracts for difference and precious metals trading opportunities. Working mainly through the MetaTrader 4 platform, Zentrade provides traders with familiar trading infrastructure, though specific regulatory oversight details remain unclear in publicly available documentation.

According to available information, the broker targets traders seeking different asset exposure, especially those interested in combining traditional forex trading with precious metals and CFD opportunities. However, the lack of detailed regulatory information and mixed user feedback suggests potential clients should be extra careful when looking at this zentrade review and considering account opening procedures.

Regulatory Regions: Specific regulatory areas for Zentrade are not clearly detailed in available sources, so traders need to check on their own what oversight applies in their regions.

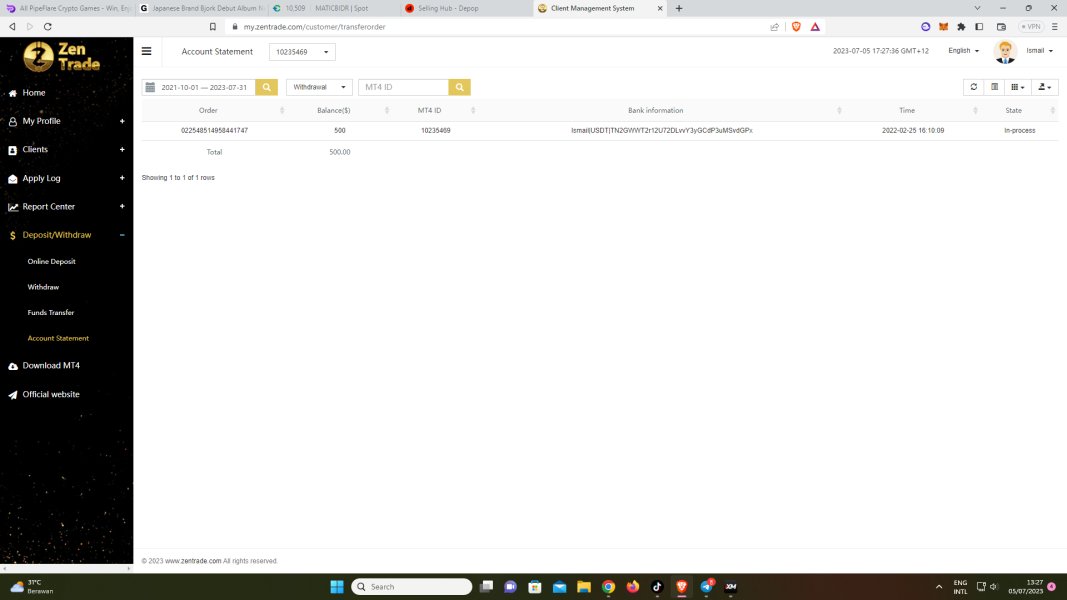

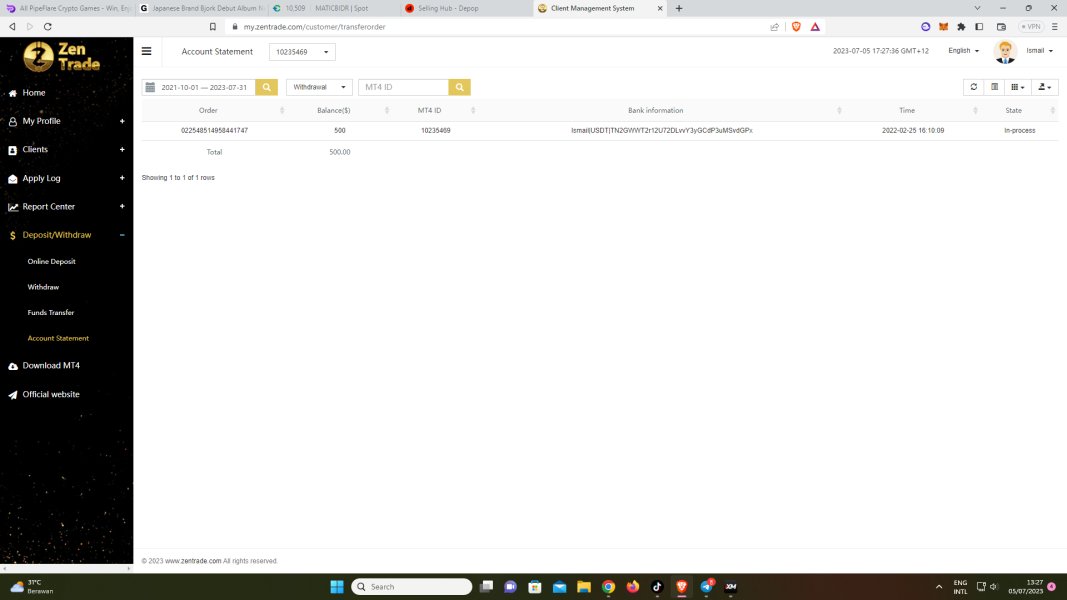

Deposit and Withdrawal Methods: User feedback shows limited payment options, with special concerns raised about withdrawal processing difficulties and long timeframes for getting funds back.

Minimum Deposit Requirements: Specific minimum deposit amounts are not detailed in available public information, so you need to contact the broker directly for account opening requirements.

Bonuses and Promotions: Current promotional offerings and bonus structures are not specified in available sources, suggesting limited or hidden promotional activities.

Tradeable Assets: The platform provides access to over 30 forex currency pairs, various CFDs across different markets, and precious metals trading opportunities, offering reasonable variety for multi-asset strategies.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not fully available in public sources, so you need to ask directly for complete fee schedules.

Leverage Ratios: Specific leverage offerings are not detailed in available information, though this is typically regulated by applicable area requirements.

Platform Options: Trading happens through the MetaTrader 4 platform, providing standard charting, analysis, and order execution capabilities familiar to most forex traders.

This zentrade review shows the need for more transparency in several key operational areas that potential clients should investigate directly with the broker.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by Zentrade show limited transparency in publicly available information, contributing to a moderate rating in this category. Without specific details about account types, minimum deposit requirements, or special account features, potential traders face uncertainty when deciding whether the broker's offerings match their trading capital and strategy requirements.

The absence of clearly defined account opening procedures in available sources suggests that future clients must talk directly with the broker to understand specific terms and conditions. This lack of transparency especially affects traders who prefer to compare multiple brokers before making decisions, as complete account condition comparisons become challenging.

User feedback about account-related experiences is notably limited in available sources, preventing a thorough assessment of how account conditions perform in practical trading situations. The broker's approach to special account types, such as Islamic accounts or professional trading accounts, remains unspecified, potentially limiting access for traders with specific religious or professional requirements.

This zentrade review emphasizes that the unclear account conditions structure requires potential clients to invest additional time in direct communication with the broker to fully understand available options and their associated terms.

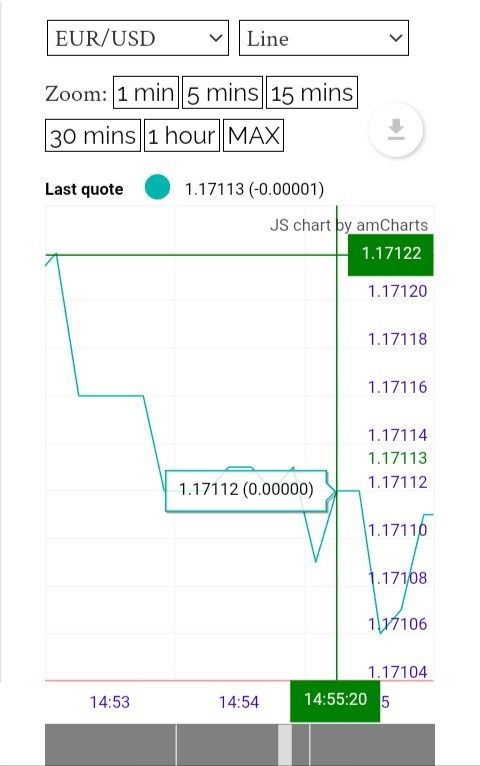

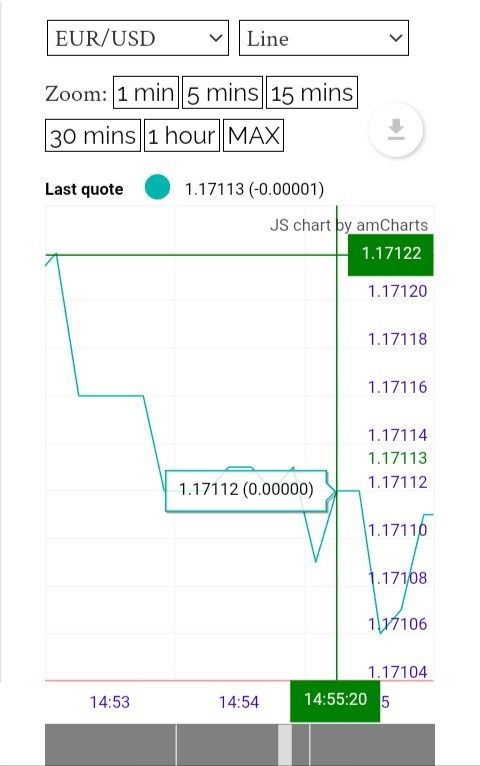

Zentrade demonstrates reasonable capability in trading tools and resources, mainly through its provision of the MetaTrader 4 platform, which offers complete charting, technical analysis, and automated trading capabilities. The platform's widespread industry acceptance provides traders with familiar functionality and extensive third-party support for custom indicators and expert advisors.

The broker's asset coverage, including over 30 forex currency pairs, CFDs, and precious metals, provides adequate variety opportunities for traders seeking multi-market exposure. This range allows for both traditional forex strategies and more complex portfolio approaches incorporating different asset classes, though specific details about exotic pairs or niche CFD markets remain unspecified.

However, information about additional research resources, educational materials, or proprietary analysis tools is not detailed in available sources. Modern traders often expect complete market analysis, economic calendars, and educational content to support their trading decisions, and the absence of clear information about these resources represents a potential limitation.

The lack of detailed information about mobile trading capabilities, advanced order types, or integration with third-party analysis tools suggests that traders heavily dependent on sophisticated trading infrastructure should investigate these aspects directly with the broker before committing to the platform.

Customer Service and Support Analysis

Customer service represents a significant concern area for Zentrade based on available user feedback, with multiple reports showing poor service quality and inadequate support responsiveness. Users have specifically highlighted difficulties in getting timely assistance, particularly about account-related inquiries and technical support issues.

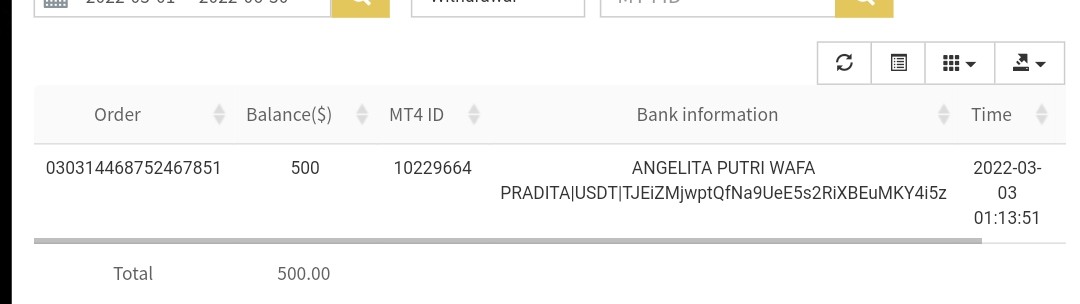

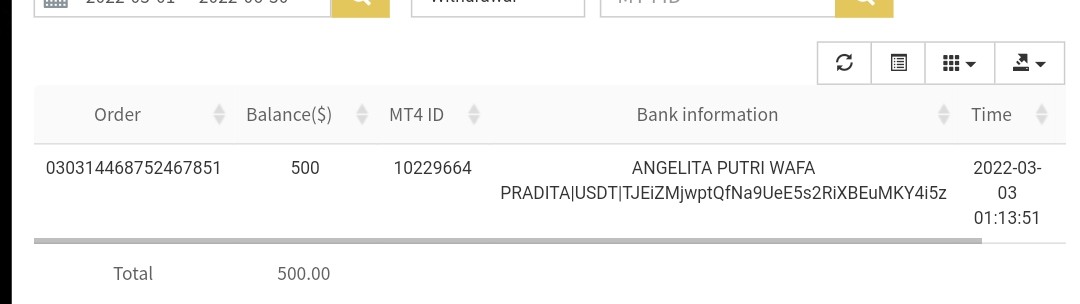

The withdrawal process appears to be a particular pain point, with user feedback consistently mentioning extended processing times and communication difficulties when attempting to access funds. These reports suggest systematic issues in customer support operations that directly impact the practical trading experience and fund management capabilities.

Response time concerns extend beyond withdrawal issues, with users reporting general communication challenges when seeking assistance through available support channels. The absence of detailed information about support availability hours, multiple language options, or specialized support teams further adds to these service quality concerns.

Problem resolution capabilities appear limited based on user experiences, with several reports showing unresolved issues and inadequate follow-up on customer complaints. This pattern suggests that traders requiring reliable customer support should carefully consider these limitations when evaluating Zentrade as their primary trading platform.

Trading Experience Analysis

The trading experience with Zentrade presents a mixed picture based on available user feedback, with both positive and negative aspects reported across different areas of platform performance. Users have provided varied assessments of platform stability and execution quality, suggesting inconsistent performance that may depend on market conditions or individual account circumstances.

MetaTrader 4 platform functionality generally receives adequate feedback for basic trading operations, though specific performance metrics about order execution speed, slippage rates, or requote frequency are not detailed in available sources. The platform's standard features provide essential trading capabilities, but advanced trading requirements may need additional verification.

User experiences with the trading environment show considerable variation, with some traders reporting satisfactory execution while others express concerns about platform reliability during volatile market conditions. This inconsistency in reported experiences suggests that trading performance may vary significantly between different users or market conditions.

Mobile trading capabilities and platform accessibility across different devices are not fully detailed in available feedback, though MT4's standard mobile functionality would typically provide basic trading access. This zentrade review indicates that traders requiring guaranteed platform performance should consider conducting thorough testing before committing significant capital.

Trust and Security Analysis

Trust and security considerations for Zentrade present notable concerns based on available information and user feedback patterns. With a Trust Score of 75, the broker falls into a moderate trust category, though user experiences suggest potential issues with fund security and operational transparency that warrant careful consideration.

The absence of clearly detailed regulatory oversight information creates uncertainty about investor protection measures and compliance standards. Modern forex trading typically requires clear regulatory frameworks to ensure client fund segregation, dispute resolution mechanisms, and operational oversight, and the lack of specific regulatory details represents a significant transparency gap.

User feedback about fund security shows concerning patterns, with multiple reports of withdrawal difficulties and communication problems that directly impact trader confidence in fund safety. These experiences suggest potential systematic issues in fund management processes that could affect trader ability to access their capital when needed.

Company transparency appears limited based on available public information, with key operational details, regulatory status, and corporate structure not fully disclosed. This lack of transparency, combined with negative user experiences, suggests that traders prioritizing security and regulatory protection should carefully evaluate these factors before selecting Zentrade as their primary trading platform.

User Experience Analysis

Overall user satisfaction with Zentrade shows significant variation based on available feedback, with experiences ranging from acceptable to highly problematic depending on specific service areas and individual circumstances. The most consistent negative feedback centers around customer service interactions and fund withdrawal processes, which directly impact the practical usability of the platform.

Interface design and platform usability benefit from MT4's established user experience, though broker-specific enhancements or customizations are not detailed in available sources. Registration and account verification processes lack detailed documentation, requiring direct engagement with the broker to understand specific requirements and timeframes.

Fund operation experiences represent the most significant user experience challenge, with withdrawal difficulties creating substantial frustration and practical trading limitations. These issues extend beyond simple processing delays to include communication problems and unclear resolution procedures that compound user frustration.

Common user complaints focus primarily on customer service responsiveness and withdrawal processing efficiency, suggesting that the broker's operational infrastructure may not adequately support user needs during critical service interactions. The user profile best suited for Zentrade appears to be small to medium-sized traders seeking different trading assets, though even this target demographic faces the service quality challenges identified in user feedback.

Conclusion

Zentrade presents a mixed proposition for forex traders, offering reasonable asset variety and familiar MT4 platform access while facing significant challenges in customer service delivery and operational transparency. The broker's provision of over 30 forex pairs, CFDs, and precious metals creates adequate trading opportunities for diversification-focused strategies, though service quality concerns limit its overall appeal.

The most suitable users for Zentrade appear to be small to medium-sized traders seeking multi-asset exposure who can tolerate potential service limitations in exchange for asset variety. However, traders prioritizing reliable customer support, transparent withdrawal processes, and complete regulatory protection should carefully consider the documented user experience challenges.

Primary advantages include different trading assets and established MT4 platform functionality, while significant disadvantages include poor customer service quality, withdrawal processing difficulties, and limited operational transparency. Potential clients should conduct thorough research and consider these factors carefully before committing trading capital to the platform.