Tickz 2025 Review: Everything You Need to Know

Summary

Tickz has garnered mixed reviews from users and experts alike, reflecting a blend of positive experiences and significant concerns about its regulatory status and transparency. Key features highlighted include its user-friendly interface and a wide range of trading tools. However, the lack of robust regulatory oversight raises red flags for potential traders.

Note: It is important to be aware that Tickz operates under different entities across various regions, which can affect the trading experience. This review aims to provide a fair and accurate assessment based on multiple sources.

Rating Overview

How We Rate Brokers: Our ratings are based on comprehensive analysis from multiple sources, including user reviews and expert opinions.

Broker Overview

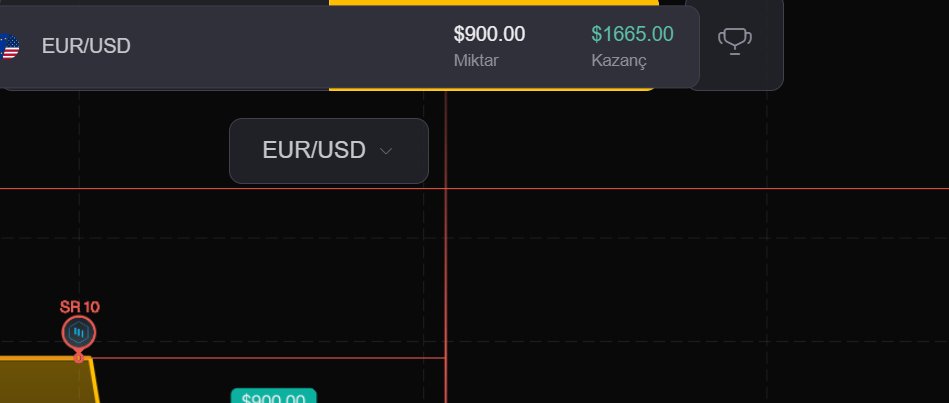

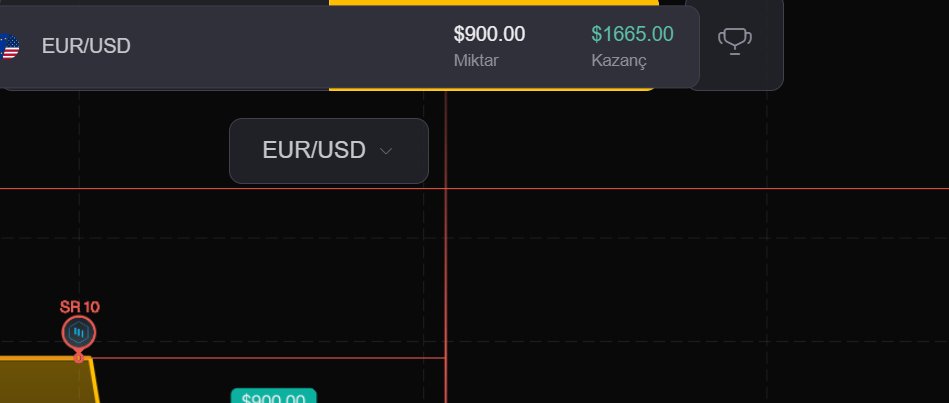

Founded in 2020, Tickz is operated by Trusteo Ltd, which is registered in the Comoros Union and regulated by the Mwali International Services Authority. The platform primarily offers a user-friendly trading experience, featuring an intuitive interface designed for both novice and experienced traders. Tickz supports various asset classes, including forex, stocks, and commodities, making it a versatile option for traders.

The platform does not specify which trading software it employs, but it is known to offer a mobile app that facilitates trading on the go.

Detailed Analysis

Regulatory Landscape

Tickz operates under the Mwali International Services Authority, which, while providing some level of oversight, is not as reputable as regulatory bodies in more prominent financial centers like the UK‘s FCA or the US’s CFTC. This lack of stringent regulation has led to concerns about the safety of funds and the overall trustworthiness of the platform. According to WikiBit, Tickz has a score of just 1.13 out of 10, indicating a high level of risk associated with trading on this platform.

Deposit and Withdrawal Options

Tickz allows deposits in various currencies, including major fiat currencies and cryptocurrencies, but specific details on the withdrawal process remain vague. Users have reported delays and a lack of information regarding withdrawal fees, which is a common concern in the industry.

Minimum Deposit and Bonuses

The minimum deposit required to start trading on Tickz is not explicitly stated across sources, suggesting variability in terms of account types. Some reviews mention bonuses for new users, but the details are sparse, and users are advised to read the terms carefully.

Trading Costs

Tickz claims to offer competitive spreads and no hidden fees, which is a significant advantage for traders. However, detailed information about commissions and fees is lacking, making it difficult to assess the overall trading costs accurately.

Tickz provides leverage options, but the specifics are not well-defined in the available reviews. The absence of a clear explanation regarding leverage can be a deterrent for potential traders looking for transparency.

Supported Regions and Customer Support

Tickz is available in over 100 countries, but traders should verify if their location is supported, as binary options trading is subject to different regulations globally. Customer support is available in multiple languages, but user experiences suggest that response times can vary.

Repeated Rating Overview

Detailed Breakdown

Account Conditions

Tickz offers a range of account types, but specific conditions and minimum deposit requirements are unclear. This ambiguity can lead to frustration among users who expect straightforward information.

The platform provides various trading tools, including advanced technical analysis features. Users have praised these tools for their effectiveness, indicating a solid offering in this area.

Customer Service and Support

Customer support is available in multiple languages, but user feedback suggests that response times can be inconsistent. Some users have reported satisfactory experiences, while others have faced delays.

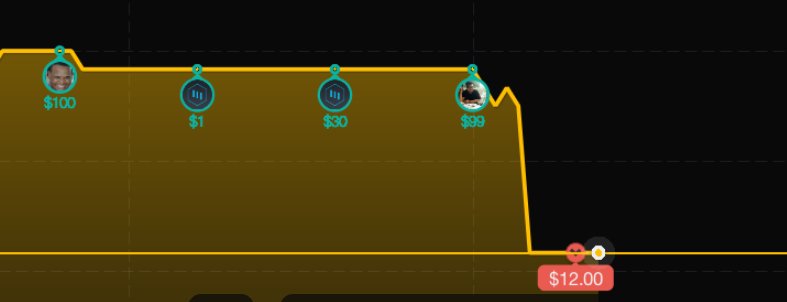

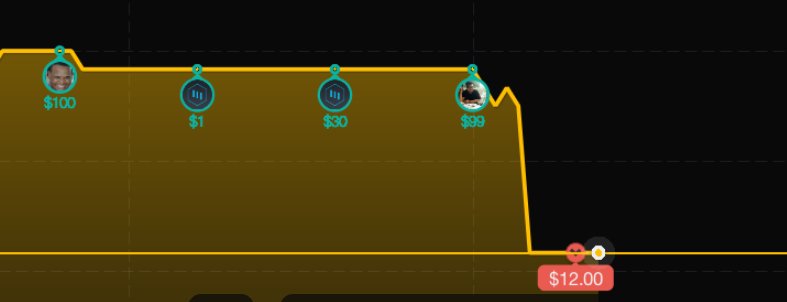

Trading Experience

The trading experience on Tickz has been described as user-friendly, particularly for beginners. However, the lack of transparency regarding certain operational aspects can detract from overall satisfaction.

Trustworthiness

Tickz's regulatory status is a significant concern, with many sources highlighting the risks associated with trading on a platform regulated by a lesser-known authority. This has led to a lower trust rating, which could deter potential users.

User Experience

Overall user experiences are mixed. While some users report positive outcomes, others express concerns about transparency and regulatory oversight, which could impact their trading decisions.

In conclusion, while Tickz offers an appealing trading platform with various tools and resources, potential users should proceed with caution due to its regulatory status and the lack of transparency in critical areas. Thorough research and consideration of personal risk tolerance are essential before engaging with Tickz.