Stpl 2025 Review: Everything You Need to Know

Executive Summary

This Stpl review gives a fair look at a broker that works mainly through STP and ECN trading models. STP means Straight Through Processing, while ECN stands for Electronic Communication Network. Stpl says it's a trading platform that gives direct market access. Your trades can be matched with other clients or anyone connected to the same network.

This method creates spreads that change but promises better order fills than traditional dealing desk operations. The broker's main strength is its trading execution model. It uses Metaquotes Software platforms like MT4 and MT5 with ECN bridge connections.

You should know that STP orders go through ECN bridges to ECN pools. This can sometimes cause re-quotes even with the ECN connection. The platform lets you trade in mini, micro, and standard lots. This makes it work for traders with different amounts of money.

This Stpl review finds the broker works best for skilled traders who care about execution quality. They also need to understand how variable spread environments work.

Important Notice

This review looks at the technical details and trading conditions the broker provides. Our method focuses on platform features, trading setup, and execution models from available documents. We don't have much specific information about regulatory status and detailed user feedback from available sources. This review focuses on technical aspects and trading conditions that we can study objectively.

Rating Framework

Broker Overview

Stpl works as a forex trading platform that focuses on direct market access through its STP and ECN trading setup. The broker's business model connects traders to networks where trades can be matched with other clients or network participants. This approach makes Stpl different from traditional market makers by offering spreads that change while trying to provide better order execution.

The platform's design is built around the idea that trading partners within the network create a more active pricing environment. The broker uses Metaquotes Software, specifically MT4 and MT5 platforms, to deliver its trading services. While these platforms are well-known in the industry, Stpl admits that true ECN functionality happens through ECN bridges that send STP orders to ECN pools.

This technical setup supports various trading features and works with different trading styles through mini, micro, and standard lot options. The platform's design helps traders who understand market dynamics and can adapt to variable spread conditions that come with network-based trading environments.

Regulatory Status: Specific regulatory information is not detailed in available documentation. This represents a big information gap for potential traders checking the broker's compliance status.

Deposit and Withdrawal Methods: Available sources don't provide full details about funding options, processing times, or fees for deposit and withdrawal transactions. Information about minimum deposit amounts is not specified in the available information. This makes it hard to assess accessibility for different trader groups.

Bonus and Promotions: Current promotional offerings and bonus structures are not detailed in available documentation. This suggests either no active promotions or limited marketing focus on incentives.

Tradeable Assets: The platform mainly focuses on forex trading. Full asset coverage including CFDs or other instruments is not extensively detailed in available sources.

Cost Structure: The broker operates on a variable spread model due to its network-based trading approach. Traders should expect spread changes based on market conditions and network liquidity. Occasional re-quotes are possible during volatile periods.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available documentation. This is important information for risk management planning.

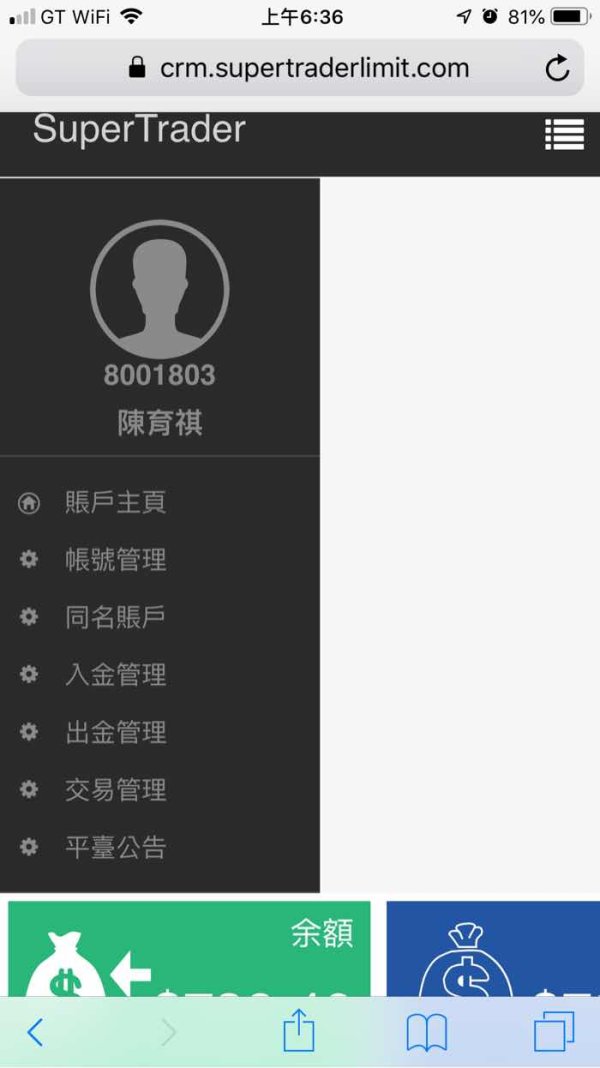

Platform Selection: Stpl uses Metaquotes Software platforms like MT4 and MT5. These provide traders with established and widely-used trading interfaces that support various trading strategies and automated systems.

Geographic Restrictions: Information about restricted areas or regional limitations is not specified in available sources. Available support languages and communication channels are not detailed in current documentation.

This Stpl review notes that several important details require direct contact with the broker for complete information.

Account Conditions Analysis

Stpl's account structure works with various trading preferences through its support for mini, micro, and standard lot trading options. This flexibility lets traders with different capital levels participate in the market according to their risk tolerance and investment capacity. The availability of multiple lot sizes suggests the broker aims to serve both retail traders starting with smaller positions and bigger traders requiring standard lot capabilities.

However, specific details about account types, their special features, and related benefits are not fully outlined in available documentation. The absence of clear information about minimum deposit requirements, account maintenance fees, or tiered account structures makes it hard for potential clients to make informed decisions. They can't easily figure out which account option might best suit their trading needs.

The account opening process and required documentation are not detailed in available sources. This could impact user experience for future clients. Also, information about special account features, such as Islamic accounts, professional trader accounts, or managed account options, is not readily available.

This Stpl review finds that while the basic lot size options provide some flexibility, the overall account conditions framework lacks the transparency typically expected in full broker evaluations.

Stpl's trading setup is built around Metaquotes Software, using both MT4 and MT5 platforms that are industry standards for forex trading. These platforms give traders full charting capabilities, technical analysis tools, and support for automated trading through Expert Advisors. The choice to use established platforms shows a focus on reliability and user familiarity rather than developing their own trading software.

The platforms support multiple trading features that work with various trading strategies and styles. Traders can access real-time market data, execute different order types, and use the extensive library of technical indicators available within the MT4/MT5 system. The platform's compatibility with third-party tools and plugins further enhances its utility for sophisticated trading approaches.

However, available documentation does not detail additional research resources, market analysis tools, or educational materials that might complement the trading platforms. The absence of information about their own research, daily market commentary, or economic calendars suggests that traders may need to find analytical resources on their own. While the core trading platform functionality appears strong, the broader ecosystem of trading support tools and resources remains unclear from available information.

Customer Service and Support Analysis

Customer service information for Stpl is notably limited in available documentation. This makes it difficult to assess the quality and accessibility of support services. The absence of detailed information about support channels, operating hours, and response times represents a big gap in evaluating the broker's client service capabilities.

Good customer support is important in forex trading, where technical issues or account problems can have immediate financial effects. Without clear information about available support methods such as live chat, phone support, email tickets, or full FAQ sections, potential clients cannot properly assess whether the broker can provide timely assistance when needed. The lack of information about multilingual support capabilities also raises questions about the broker's accessibility to international clients.

Also, there is no available data about support quality metrics, customer satisfaction ratings, or examples of problem resolution processes. This information gap makes it challenging for traders to evaluate whether Stpl can provide the level of service support they might require during their trading activities.

Trading Experience Analysis

The trading experience with Stpl centers around its STP and ECN execution model, which aims to provide direct market access through network connectivity. According to available information, trades can be matched with other clients or network participants. This creates a variable spread environment that reflects real-time market conditions.

This approach potentially offers more authentic market pricing compared to fixed-spread dealing desk operations. However, the technical implementation through MT4/MT5 platforms with ECN bridges introduces some execution complexities. Since these platforms are not originally designed for true ECN functionality, STP orders must be routed through ECN bridges to reach ECN pools.

This process can occasionally result in re-quotes, even when connected to ECN networks. This may impact trading experience during fast-moving market conditions. The platform supports various trading features and accommodates different lot sizes, providing flexibility for diverse trading strategies.

The variable spread structure means that trading costs change with market conditions. Experienced traders often prefer this for its transparency, though it requires more sophisticated cost management compared to fixed-spread environments. This Stpl review finds that the trading experience is most suitable for traders who understand network-based execution and can adapt to dynamic pricing conditions.

Trust and Reliability Analysis

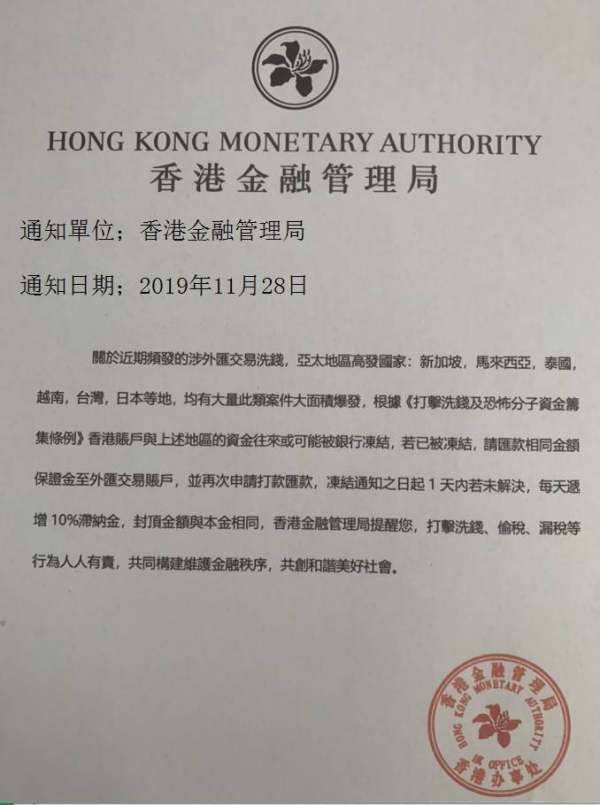

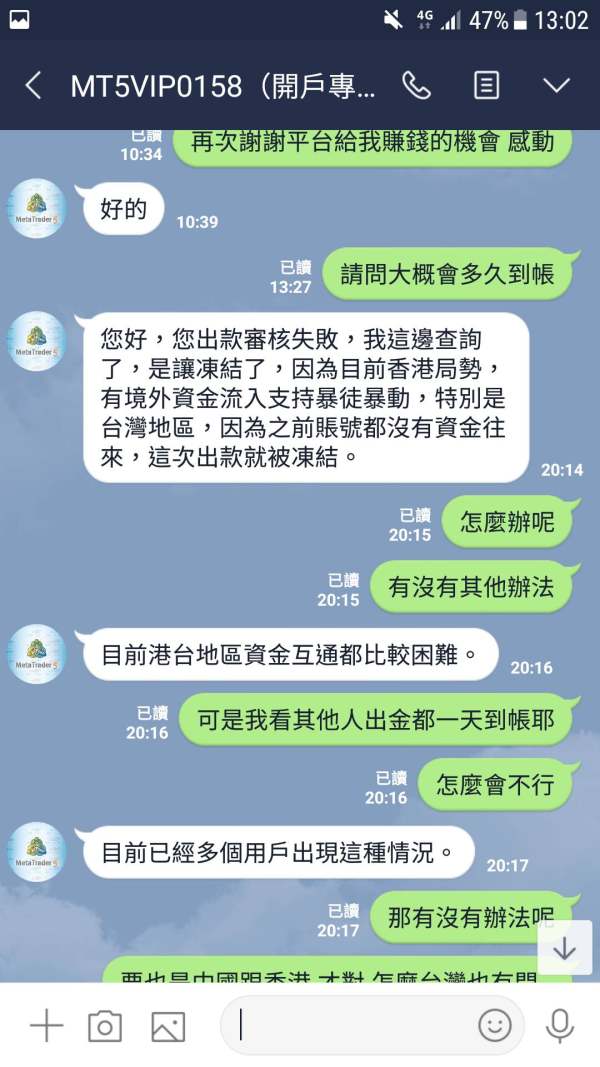

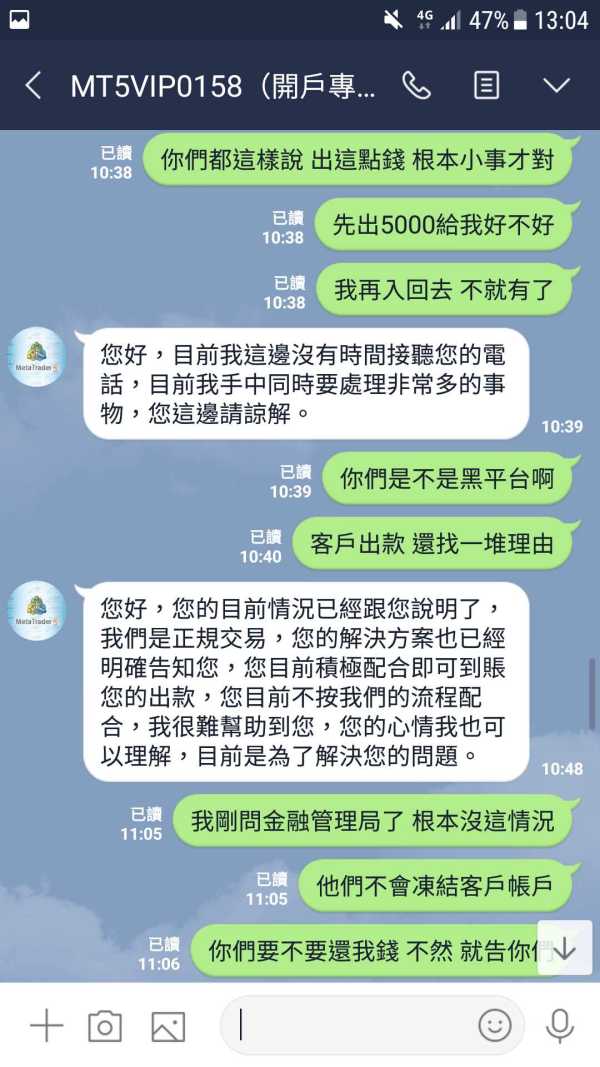

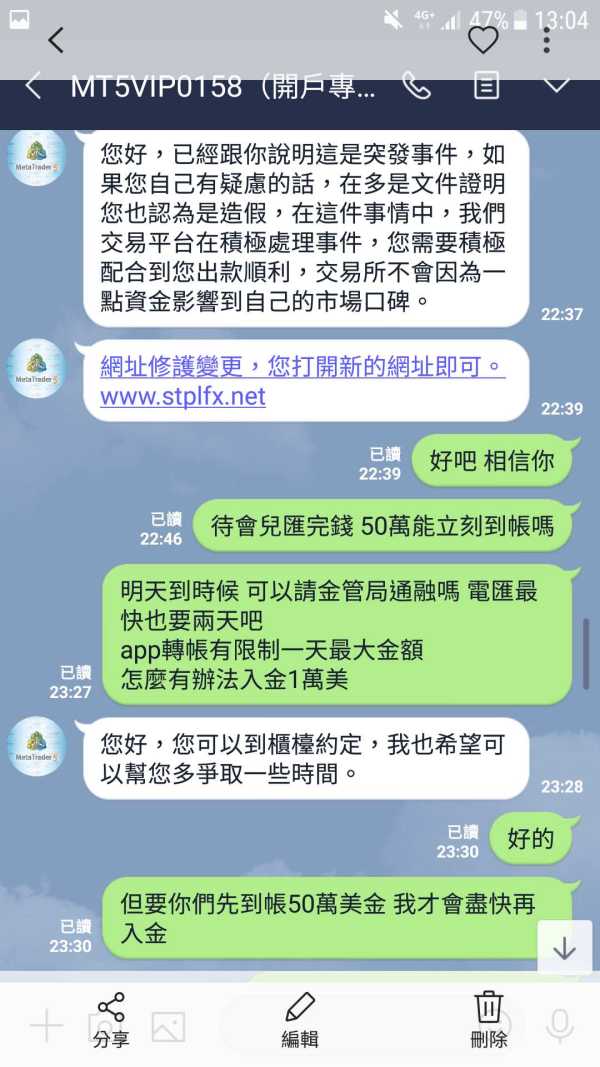

The evaluation of Stpl's trustworthiness faces big challenges due to limited available information about regulatory compliance, company background, and operational transparency. The absence of detailed regulatory information in available documentation raises important questions about oversight and client protection measures. These are typically fundamental to broker evaluation.

Trust in forex brokers typically relies on clear regulatory status, transparent company ownership, segregated client funds, and established operational history. Without full information about these critical trust factors, potential clients cannot properly assess the broker's reliability and safety measures. The lack of detailed company background, including founding date, management team, and operational areas, further complicates trust assessment.

Also, there is not enough information about client fund protection measures, such as segregated accounts, deposit insurance, or compensation schemes that provide security for trader funds. The absence of third-party audits, regulatory compliance reports, or industry certifications also limits the ability to verify the broker's operational standards and financial stability.

User Experience Analysis

Evaluating user experience for Stpl is limited by the lack of full user feedback and interface details in current documentation. User experience includes multiple touchpoints including platform usability, account management, funding processes, and overall satisfaction with services provided.

The choice to use MT4/MT5 platforms provides some user experience baseline, as these platforms are familiar to many forex traders and offer standardized functionality. However, user experience extends beyond platform choice to include factors such as account opening efficiency, verification processes, customer service interactions, and the overall ease of conducting trading-related activities. Without access to user reviews, satisfaction surveys, or detailed interface descriptions, it's challenging to assess how effectively Stpl delivers on user experience expectations.

The absence of information about common user complaints, feature requests, or service improvement initiatives also limits understanding of the broker's responsiveness to client needs and market feedback.

Conclusion

This Stpl review presents a fair assessment of a broker that offers STP and ECN trading execution through established MT4/MT5 platforms. The broker's strength lies in its network-based trading approach that provides variable spreads and aims for reliable order fills. This makes it potentially suitable for experienced traders who understand and prefer direct market access models.

However, big information gaps about regulatory status, full user feedback, and detailed service offerings limit the ability to provide a fully complete evaluation. The broker appears most appropriate for experienced traders who prioritize execution quality and can navigate variable spread environments effectively. Potential clients should conduct thorough research to address the information limitations identified in this review.