SPX Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive spx markets review reveals a broker with limited publicly available information. This makes it challenging to provide a complete assessment of their services. Based on available data, SPX Markets appears to focus primarily on S&P 500 index trading and related options, positioning itself as a specialized platform for traders interested in SPX instruments.

The broker provides access to historical data and technical analysis tools. They do this primarily through partnerships with established financial data providers like Investing.com and MarketWatch.

The platform seems to cater to professional traders and sophisticated investors who specifically seek exposure to S&P 500 index products and options trading. However, the lack of comprehensive regulatory information, customer feedback, and detailed trading conditions raises concerns about transparency. While the broker offers some analytical resources and historical data support through third-party providers, the absence of clear regulatory oversight and limited customer testimonials make it difficult to recommend without reservations.

The target audience appears to be experienced traders familiar with options markets. These traders are particularly interested in SPX trading strategies. However, potential clients should proceed with caution given the limited available information about the broker's operational structure and regulatory compliance.

Important Notice

This review is based on limited publicly available information about SPX Markets. Due to insufficient data regarding regulatory status, customer service quality, and comprehensive trading conditions, this evaluation may not reflect the complete picture of the broker's services.

Potential clients should conduct additional due diligence and directly contact the broker for detailed information about their services, regulatory compliance, and trading terms.

Cross-regional entity differences may exist but cannot be verified due to lack of specific regulatory information in available sources. This assessment relies primarily on market analysis tools and general information rather than comprehensive user feedback or detailed operational data.

Rating Overview

Broker Overview

SPX Markets presents itself as a specialized trading platform focusing on S&P 500 index products and related derivatives. While specific establishment details and company background information are not readily available in public sources, the broker appears to concentrate its services on providing access to SPX options and index trading opportunities.

The company's business model seems centered around offering sophisticated traders access to S&P 500 related instruments. However, comprehensive details about its operational structure remain unclear.

The broker's primary focus appears to be facilitating trading in S&P 500 Index products, with particular emphasis on options trading. According to available information, the platform provides access to Cboe SPX products, suggesting integration with established options exchanges. This spx markets review indicates that the broker positions itself within the specialized segment of index and options trading.

The lack of detailed company background information makes it difficult to assess the full scope of their business operations and corporate structure.

The absence of clear regulatory information and limited public disclosure about the company's history, management team, and operational jurisdictions represents a significant information gap. Potential clients should consider this when evaluating this broker.

Regulatory Status

Available sources do not provide specific information about SPX Markets' regulatory status or oversight jurisdictions. This lack of regulatory transparency represents a significant concern for potential clients seeking regulated trading environments.

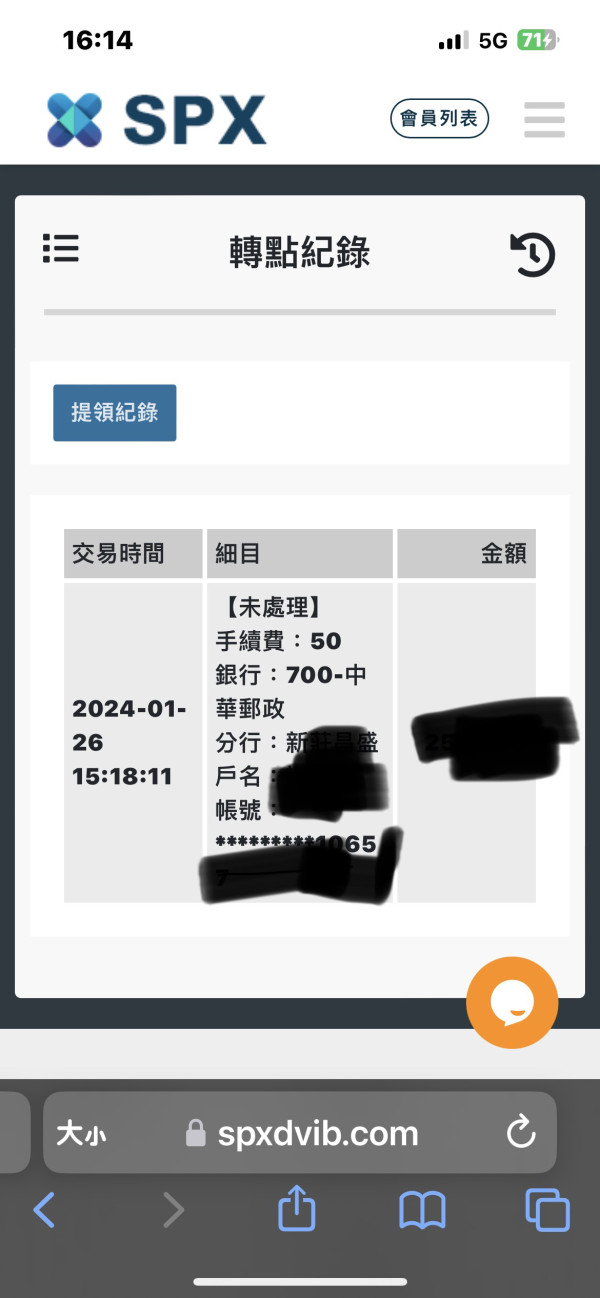

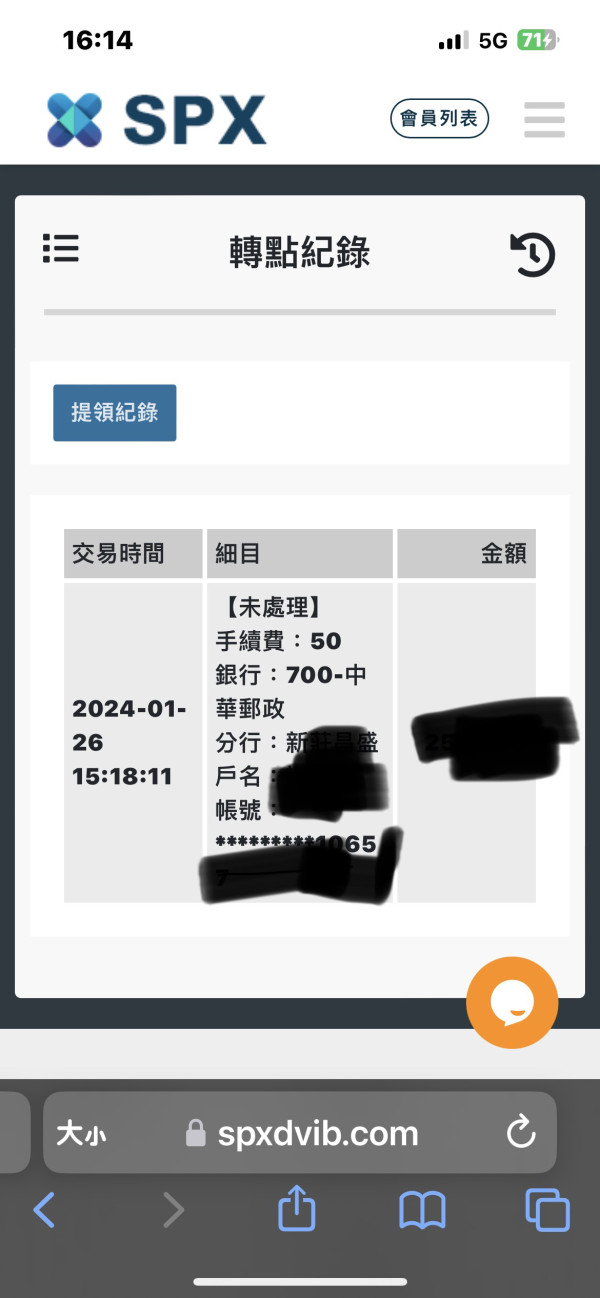

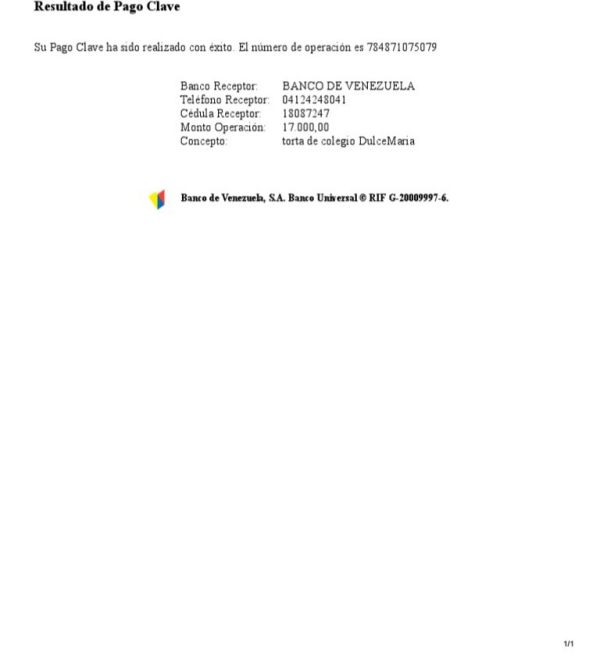

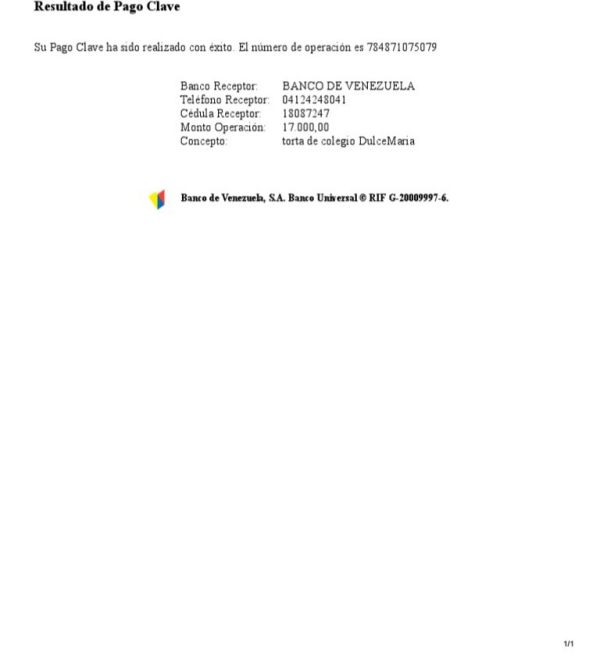

Deposit and Withdrawal Methods

Information regarding available deposit and withdrawal methods is not specified in accessible sources. This makes it impossible to evaluate the convenience and security of funding options.

Minimum Deposit Requirements

Specific minimum deposit requirements are not mentioned in available documentation. This prevents assessment of account accessibility for different trader categories.

No information about promotional offers, bonuses, or special trading incentives is available in current sources.

Tradeable Assets

The primary focus appears to be on S&P 500 Index and related options products. The broker seems to specialize in providing access to these specific instruments rather than offering a broad range of asset classes.

Cost Structure

Detailed information about spreads, commissions, and other trading costs is not available in accessible sources. This makes it impossible to evaluate the broker's competitiveness in terms of pricing.

Leverage Ratios

Specific leverage offerings and margin requirements are not mentioned in available materials.

The broker appears to provide access to Cboe SPX trading platforms. However, comprehensive platform features and capabilities are not detailed in available sources.

This spx markets review highlights significant information gaps. Potential clients should address these through direct communication with the broker before making trading decisions.

In-Depth Rating Analysis

Account Conditions Analysis

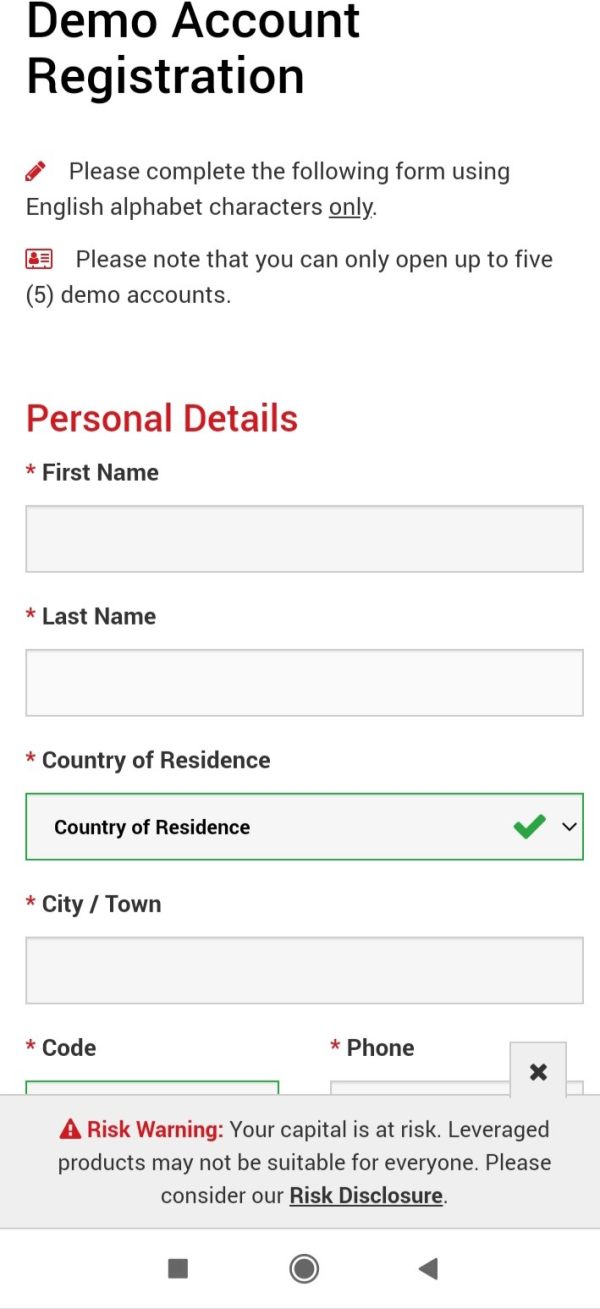

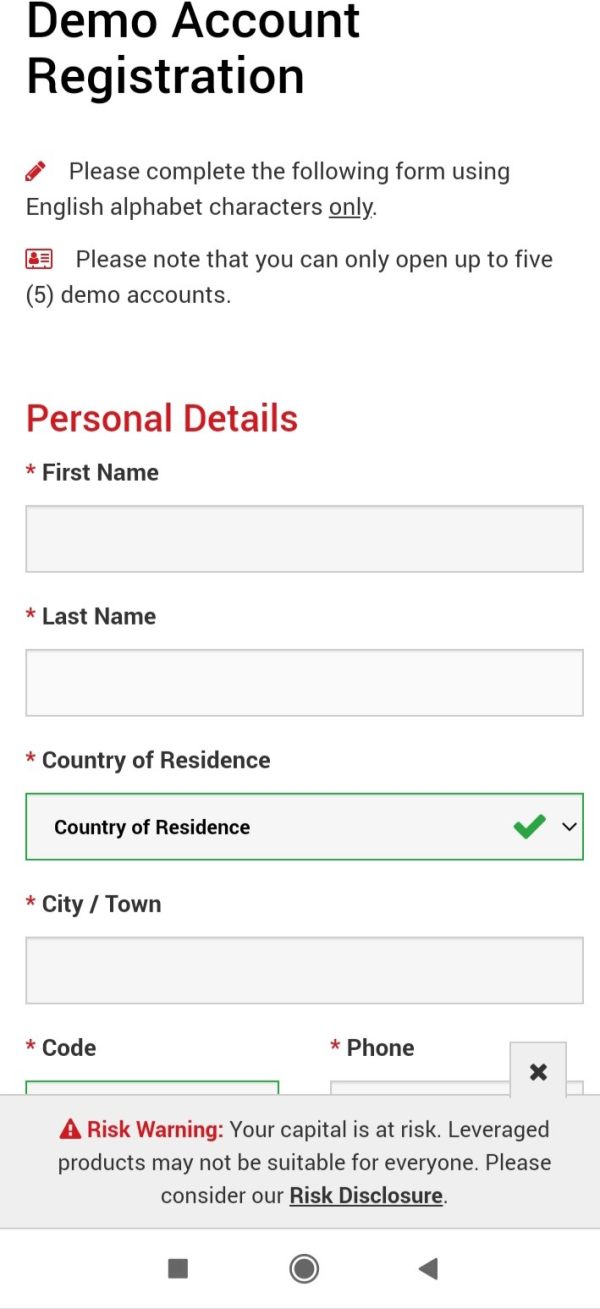

The evaluation of SPX Markets' account conditions faces significant limitations due to insufficient publicly available information. Without access to detailed account specifications, it becomes challenging to assess the broker's offerings in terms of account types, minimum deposit requirements, and special features that might differentiate various account tiers.

The absence of clear information about account opening procedures, verification requirements, and available account currencies represents a substantial information gap. Professional traders typically require detailed knowledge of account structures, including any Islamic account options, professional account benefits, or institutional account features. Unfortunately, this spx markets review cannot provide comprehensive insights into these crucial aspects due to source limitations.

The lack of transparency regarding account conditions raises questions about the broker's commitment to clear communication with potential clients. Established brokers typically provide detailed account information on their websites and marketing materials, making the absence of such information notable. Potential clients should directly contact the broker to obtain comprehensive account condition details before making any commitments.

SPX Markets demonstrates some strength in providing analytical tools and resources. They particularly excel in offering S&P 500 historical data and technical analysis capabilities. According to available information, the broker offers access to comprehensive historical data through partnerships with established financial information providers including Investing.com and MarketWatch.

This collaboration with recognized data providers suggests a commitment to offering quality analytical resources.

The availability of S&P 500 historical data represents a valuable resource for traders developing and backtesting strategies. Technical analysis tools appear to be integrated into the platform's offerings, though specific details about the sophistication and range of these tools are not extensively documented. The partnership with Vestinda for additional analytical capabilities indicates an effort to provide comprehensive market analysis resources.

However, the lack of detailed information about educational resources, research reports, and advanced analytical tools limits the complete assessment of the broker's resource offerings. Professional traders often require access to economic calendars, market news, expert analysis, and educational materials, none of which are clearly documented in available sources.

Customer Service and Support Analysis

The assessment of SPX Markets' customer service capabilities faces significant limitations due to the absence of detailed information about support channels, availability, and service quality. Without access to specific customer service details, it becomes impossible to evaluate crucial aspects such as response times, communication channels, and support team expertise.

Professional trading environments typically require robust customer support systems including live chat, telephone support, email assistance, and potentially dedicated account management for higher-tier clients. The availability of multilingual support and extended service hours are also important considerations for international traders. Unfortunately, none of these aspects are adequately addressed in available sources.

The lack of customer feedback and testimonials further complicates the evaluation of service quality. Established brokers typically showcase customer reviews, support team qualifications, and service level commitments. The absence of such information in this case raises questions about the broker's customer service infrastructure and capabilities.

Trading Experience Analysis

Evaluating the trading experience offered by SPX Markets proves challenging due to limited information about platform performance, execution quality, and user interface design. The broker's focus on S&P 500 related products suggests a specialized trading environment, though specific details about platform stability, execution speeds, and order management capabilities are not available in accessible sources.

The mention of Cboe SPX platform access indicates integration with established options trading infrastructure. This could provide professional-grade execution capabilities. However, without detailed information about platform features, mobile trading options, or advanced order types, it becomes difficult to assess the complete trading experience.

This spx markets review cannot adequately evaluate crucial aspects such as slippage rates, requote frequency, or platform downtime statistics due to information limitations. Professional traders typically require detailed performance metrics and platform specifications before committing to a trading relationship, information that appears to be lacking in this case.

Trust and Reliability Analysis

The assessment of SPX Markets' trustworthiness faces significant challenges due to the absence of clear regulatory information and limited transparency about company operations. Without specific details about regulatory oversight, licensing jurisdictions, or compliance frameworks, it becomes difficult to evaluate the broker's reliability from a regulatory perspective.

Established brokers typically provide clear information about their regulatory status. This includes license numbers, regulatory body oversight, and compliance certifications. The absence of such information raises questions about the broker's regulatory standing and commitment to transparency.

Client fund protection measures, segregation policies, and insurance coverage details are also not available in accessible sources.

The lack of third-party reviews, industry recognition, or professional certifications further complicates the trust assessment. Reputable brokers often showcase their industry standing through awards, certifications, and positive reviews from independent sources. The absence of such validation in available materials represents a significant concern for potential clients seeking reliable trading partners.

User Experience Analysis

The evaluation of user experience at SPX Markets is limited by the absence of comprehensive user feedback and detailed interface information. Without access to actual user testimonials, satisfaction surveys, or detailed platform demonstrations, it becomes challenging to assess the overall user experience quality.

The broker's apparent focus on professional traders interested in SPX options suggests a target audience of sophisticated users. These users likely have specific requirements for platform functionality and user interface design. However, without detailed information about registration processes, platform navigation, or user support resources, this assessment remains incomplete.

The lack of information about mobile trading capabilities, platform customization options, and user education resources further limits the user experience evaluation. Professional traders typically require comprehensive platform features and intuitive interfaces, aspects that cannot be adequately assessed based on available information.

Conclusion

This comprehensive spx markets review reveals a broker with significant information limitations. These limitations make it difficult to provide a complete recommendation. While SPX Markets appears to offer specialized services for S&P 500 index and options trading, the lack of transparent regulatory information, detailed trading conditions, and customer feedback raises substantial concerns.

The broker seems most suitable for experienced traders specifically interested in SPX products. These traders must be willing to conduct extensive due diligence before engaging with the platform. The availability of historical data and technical analysis tools represents a positive aspect, but these benefits are overshadowed by the lack of comprehensive information about crucial operational aspects.

Potential clients should exercise significant caution and conduct thorough independent research. This includes direct communication with the broker to obtain detailed information about regulatory status, trading conditions, and customer support capabilities before making any trading decisions.