JDNX 2025 Review: Everything You Need to Know

Executive Summary

JDNX has emerged as a relatively new forex broker. It is rapidly gaining attention in the competitive online trading landscape. This comprehensive jdnx review examines a broker that positions itself as a provider of diversified financial products and services to global traders. The company offers access to various trading instruments including CFDs, over-the-counter options, and traditional forex pairs. It targets investors who seek exposure to foreign exchange and derivatives markets.

JDNX operates under multiple regulatory frameworks including FSP, SEC, FINRA, and FINTRAC. This suggests a commitment to compliance across different jurisdictions. Customer service has been characterized as "decent" in preliminary assessments. However, comprehensive user feedback remains limited given the broker's relatively recent market entry. The broker utilizes the JD Trader platform as its primary trading interface. It provides access to assets spanning forex, stocks, precious metals like gold, and cryptocurrencies including Bitcoin.

While JDNX shows promise as an emerging player in the forex brokerage space, potential clients should note that detailed information regarding specific trading conditions, fee structures, and comprehensive user experiences remains limited in publicly available sources.

Important Notice

JDNX has regulatory presence across multiple jurisdictions including FSP, SEC, FINRA, and FINTRAC oversight. Traders should carefully review the specific regulatory requirements and protections applicable to their region of residence. Regulatory differences between jurisdictions may result in varying levels of investor protection, compensation schemes, and compliance standards.

This review is based on publicly available information and limited user feedback sources. The broker has a relatively recent market presence, so some trading conditions, user experiences, and operational details may not be comprehensively covered in available materials. Prospective clients are advised to conduct their own due diligence. They should verify current terms and conditions directly with the broker.

Rating Framework

Broker Overview

JDNX operates as an online forex and CFD broker. It is designed to serve global traders seeking access to international financial markets. The company has positioned itself as a provider of diversified financial products and services. It is rapidly gaining recognition in the competitive brokerage landscape. While specific establishment details are not mentioned in available sources, JDNX appears to focus on delivering comprehensive trading solutions that encompass multiple asset classes and trading instruments.

The broker's business model centers on providing access to CFDs, over-the-counter options, stock options, and traditional forex trading opportunities. This jdnx review reveals that the company targets investors particularly interested in participating in foreign exchange and derivatives markets. This suggests a focus on more sophisticated trading strategies beyond basic currency exchange.

JDNX utilizes the JD Trader platform as its primary trading interface. It offers access to multiple asset categories including forex pairs, derivatives, stocks, precious metals, and cryptocurrencies. The broker operates under the oversight of several regulatory bodies including FSP, SEC, FINRA, and FINTRAC. This indicates efforts to maintain compliance across different international jurisdictions and provide varying levels of regulatory protection to clients based on their location.

Regulatory Coverage: JDNX operates under multiple regulatory frameworks. These include FSP, SEC, FINRA, and FINTRAC, providing oversight across different jurisdictions.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in available sources.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available documentation.

Bonus and Promotional Offers: Details regarding promotional offers or bonus programs are not mentioned in available sources.

Tradeable Assets: The broker provides access to a diverse range of instruments. These include forex currency pairs, CFDs, stock options, precious metals such as gold, and cryptocurrencies including Bitcoin, catering to traders seeking portfolio diversification.

Cost Structure: Specific information regarding spreads, commissions, and fee structures is not detailed in available sources. This requires direct inquiry with the broker for current pricing.

Leverage Options: Available leverage ratios are not specified in accessible documentation.

Platform Options: JDNX primarily utilizes the JD Trader platform for client trading activities.

Geographic Restrictions: Specific regional limitations or restrictions are not detailed in available sources.

Customer Support Languages: Available customer service language options are not specified in accessible materials.

This jdnx review highlights the need for potential clients to directly contact the broker for comprehensive details regarding trading conditions and account specifications.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions dimension for JDNX receives a non-applicable rating. This is due to limited information availability in accessible sources. While the broker clearly offers trading services across multiple asset classes, specific details regarding account types, their distinctive features, and associated benefits are not comprehensively documented in available materials.

Minimum deposit requirements are not specified in current documentation. These typically serve as a crucial factor in broker selection. This absence of detailed account condition information represents a significant information gap for potential clients conducting comparative analysis between brokers. The account opening process, verification requirements, and timeline for account activation are similarly not detailed in available sources.

Special account features such as Islamic accounts for Sharia-compliant trading, professional accounts for qualified investors, or managed account services are not mentioned in accessible documentation. This jdnx review emphasizes the importance of directly contacting the broker to obtain comprehensive account condition details before making trading decisions.

Specific user feedback regarding account opening experiences, deposit processes, or account management features is not available. This makes it challenging to provide a meaningful assessment of this dimension. Prospective clients should prioritize obtaining detailed account information directly from JDNX representatives. They need to ensure alignment with their trading requirements and expectations.

JDNX demonstrates strength in the tools and resources dimension. It earns a 7/10 rating based on its diversified instrument offerings. The broker provides access to CFDs, over-the-counter options, and stock options. This indicates a commitment to offering sophisticated trading instruments beyond basic forex pairs. This variety enables traders to implement complex strategies and achieve portfolio diversification across multiple asset classes.

The inclusion of precious metals like gold and cryptocurrency options such as Bitcoin reflects the broker's awareness of evolving market demands. It shows understanding of trader preferences for alternative investments. These offerings position JDNX competitively within the modern brokerage landscape where traders increasingly seek exposure to non-traditional assets alongside conventional forex pairs.

However, specific information regarding research and analysis resources, educational materials, or market commentary is not detailed in available sources. The absence of information about automated trading support, expert advisors, or algorithmic trading capabilities represents a notable information gap. Additionally, details about charting tools, technical indicators, or fundamental analysis resources are not specified in accessible documentation.

Comprehensive user feedback regarding tool effectiveness, platform functionality, or resource quality is not available. This assessment relies primarily on the breadth of instrument offerings rather than depth of analytical support. The 7/10 rating reflects the positive aspect of diversified trading opportunities. It acknowledges the lack of detailed information about supporting tools and educational resources.

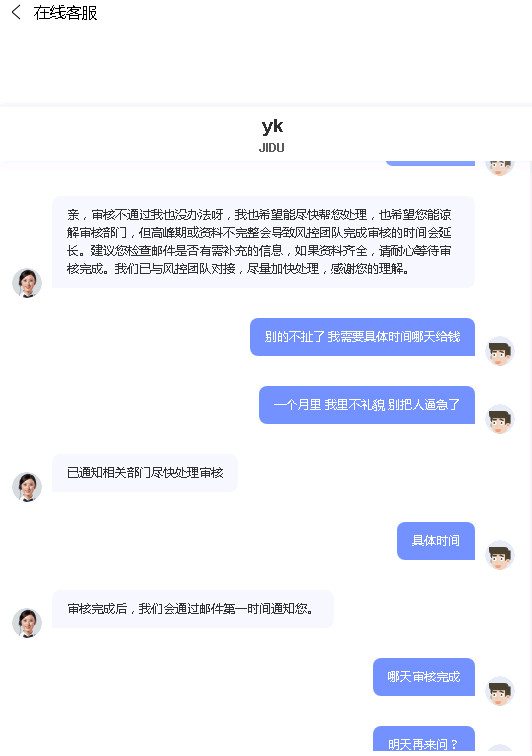

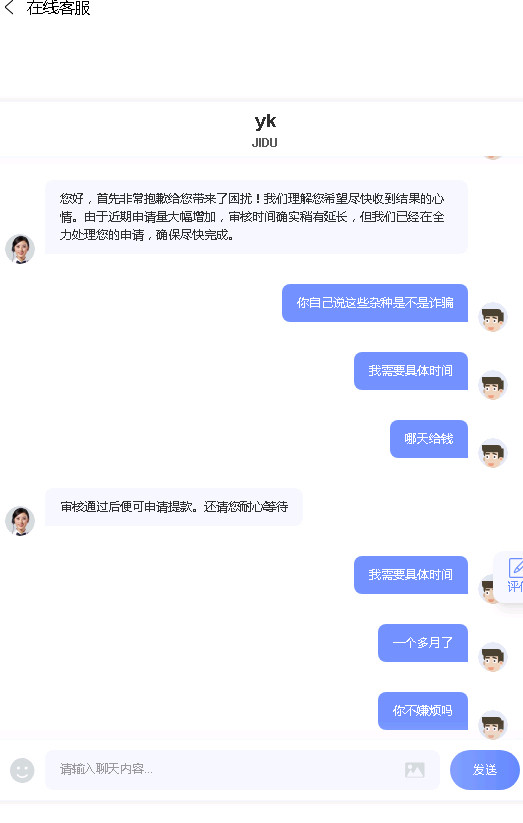

Customer Service and Support Analysis

Customer service and support receives an 8/10 rating. This is based on available characterization of JDNX's service quality as "decent." This positive assessment suggests that the broker has established functional customer support systems. However, detailed information about specific service channels, response times, and support quality metrics is not comprehensively documented in available sources.

The relatively high rating reflects the importance of customer service in the brokerage industry and the positive initial assessment available. Specific details regarding available communication channels such as live chat, phone support, email assistance, or ticket systems are not mentioned in accessible documentation. Response time expectations, support availability hours, and escalation procedures for complex issues are similarly not detailed.

Multilingual support capabilities are not specified in available sources. These are crucial for a broker serving global traders. The geographic coverage of customer support and whether dedicated support is available for different regional markets remains unclear from accessible documentation.

Specific user feedback cases, problem resolution examples, or detailed service quality metrics are not available. This assessment relies on the general positive characterization available. The 8/10 rating acknowledges the positive service reputation. It recognizes the need for more comprehensive information about support infrastructure and service delivery standards.

Trading Experience Analysis

The trading experience dimension cannot be adequately assessed due to insufficient information in available sources. This results in a non-applicable rating. While JDNX utilizes the JD Trader platform, specific details regarding platform stability, execution speed, and overall trading environment quality are not documented in accessible materials.

Platform functionality, user interface design, and trading tool effectiveness are crucial factors in determining trading experience quality. These elements are not detailed in available sources. Order execution quality, slippage rates, and requote frequency are not specified in accessible documentation. All of these are critical components of trading experience.

Mobile trading capabilities are not mentioned in available sources. These have become essential for modern traders. The availability of mobile applications, their functionality compared to desktop platforms, and user experience on mobile devices remain unclear from current documentation.

Technical performance metrics such as uptime statistics, server response times, and platform reliability data are not provided in available materials. This jdnx review cannot provide meaningful assessment of trading experience without access to user feedback regarding actual trading conditions, platform performance, or execution quality.

The absence of comprehensive trading experience information represents a significant limitation for potential clients seeking to evaluate the broker's operational capabilities and trading environment quality.

Trust and Reliability Analysis

JDNX receives a 7/10 rating for trust and reliability. This is primarily based on its regulatory oversight by multiple authorities including FSP, SEC, FINRA, and FINTRAC. This multi-jurisdictional regulatory presence suggests the broker's commitment to compliance and operational transparency across different markets. It provides varying levels of investor protection depending on client location.

The involvement of established regulatory bodies like the SEC and FINRA adds credibility to the broker's operations. These are known for stringent oversight requirements. However, specific license numbers, registration details, and the exact scope of regulatory coverage for different client categories are not detailed in available sources.

Fund safety measures, segregation of client funds, and insurance coverage details are not specified in accessible documentation. The absence of information regarding deposit protection schemes, compensation funds, or other safety mechanisms represents a notable information gap for trust assessment.

Company transparency regarding ownership structure, financial statements, and operational history is not detailed in available sources. Industry reputation, third-party assessments, and any history of regulatory actions or sanctions are similarly not documented in accessible materials.

The 7/10 rating reflects the positive aspect of multi-regulatory oversight. It acknowledges the need for more comprehensive information about specific safety measures, transparency practices, and regulatory compliance details to provide a complete trust assessment.

User Experience Analysis

User experience assessment receives a non-applicable rating. This is due to limited information availability in accessible sources. While JDNX targets global traders interested in forex and derivatives markets, specific user satisfaction data, interface design quality, and overall user experience metrics are not documented in available materials.

Registration and verification processes are not detailed in accessible sources. These significantly impact initial user experience. The complexity of account opening, documentation requirements, and verification timelines remain unclear from available information.

Platform usability, navigation intuitiveness, and learning curve considerations are not specified in current documentation. The user interface design of the JD Trader platform, its accessibility features, and customization options are not detailed in available sources.

Fund operation experiences are not documented in accessible materials. This includes deposit and withdrawal processes, transaction speeds, and user satisfaction with financial operations. Common user complaints, recurring issues, or areas for improvement are not mentioned in available sources.

Comprehensive user feedback, satisfaction surveys, or detailed user journey analysis are not available. This dimension cannot be meaningfully assessed without this information. The absence of user experience information represents a significant limitation for potential clients seeking to understand the practical aspects of trading with JDNX.

Conclusion

This comprehensive jdnx review reveals a broker that shows promise as an emerging player in the forex and CFD trading space. JDNX demonstrates strengths in regulatory compliance through its oversight by multiple authorities including FSP, SEC, FINRA, and FINTRAC. It offers a diversified range of trading instruments spanning forex, CFDs, options, precious metals, and cryptocurrencies.

The broker appears well-suited for global traders seeking diverse investment opportunities beyond traditional forex pairs. It particularly serves those interested in derivatives and alternative assets. The positive assessment of customer service quality and multi-regulatory oversight provides a foundation for trader confidence.

However, significant information gaps regarding specific trading conditions, detailed user experiences, and comprehensive operational details limit the ability to provide a complete assessment. Prospective clients should prioritize obtaining detailed information directly from JDNX regarding account conditions, fee structures, and platform capabilities before making trading decisions.