Is SPX Markets safe?

Business

License

Is SPX Markets Safe or a Scam?

Introduction

SPX Markets is an online brokerage that has positioned itself in the forex and CFD trading market, offering a range of trading instruments including forex pairs, cryptocurrencies, and commodities. As the trading landscape becomes increasingly saturated, the need for traders to carefully evaluate the legitimacy and trustworthiness of brokers like SPX Markets is paramount. With numerous reports of scams and fraudulent practices in the industry, it is essential for traders to conduct thorough due diligence before committing their funds. This article aims to provide an objective analysis of SPX Markets, examining its regulatory status, company background, trading conditions, and overall safety profile. The investigation is based on a review of available data, user feedback, and regulatory warnings.

Regulation and Legitimacy

The regulatory status of a brokerage is a crucial factor in determining its safety. SPX Markets claims to be regulated by the Vanuatu Financial Services Commission (VFSC). However, the quality of this regulation is often questioned due to the lax standards typically associated with offshore regulatory bodies. Below is a summary of SPX Markets' regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 14616 | Vanuatu | Regulated, but low-tier |

The VFSC requires minimal capital to issue licenses, which raises concerns about the effectiveness of its oversight. Furthermore, SPX Markets has received warnings from several regulatory authorities, including the British Columbia Securities Commission (BCSC) and the UKs Financial Conduct Authority (FCA), indicating potential fraudulent activities. Such warnings suggest that SPX Markets may not adhere to the necessary compliance standards expected of reputable brokers, thus making it a risky option for traders. Overall, the regulatory environment surrounding SPX Markets does not inspire confidence, leading to the conclusion that SPX Markets is not safe for trading.

Company Background Investigation

SPX Markets is owned by Secure Currency Limited, which has its registered address in Vanuatu. The company was established in 2020, and its operational history is relatively short. The ownership structure lacks transparency, with limited information available about the company's management team or their professional backgrounds. This lack of transparency can be a red flag for potential investors, as it raises questions about accountability and governance.

Moreover, the company's claims of being based in the UK appear misleading, as it does not hold any valid UK regulatory license. This misrepresentation can further diminish trust among potential clients. In terms of transparency and information disclosure, SPX Markets has not provided sufficient details about its operations, which is concerning for traders looking for reliable brokers. The company's reluctance to disclose critical information about its management and operational practices adds to the skepticism surrounding its legitimacy. Thus, the overall assessment indicates that SPX Markets is not safe for trading.

Trading Conditions Analysis

When evaluating the trading conditions offered by SPX Markets, it is essential to analyze the fee structure and any hidden costs that may affect profitability. The brokerage offers various account types, each with different minimum deposit requirements. However, the overall cost structure is relatively high compared to industry standards. Below is a comparison of core trading costs:

| Fee Type | SPX Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.6 pips | 1.2 pips |

| Commission Model | Not specified | Varies |

| Overnight Interest Range | High | Moderate |

While SPX Markets advertises competitive spreads, the lack of clarity on commissions and overnight interest rates raises concerns about potential hidden fees. Additionally, the high minimum deposit requirement of €1,000 for the basic account may deter new traders, making it less accessible compared to other brokers. This fee structure, combined with the absence of a clear commission model, suggests that traders may face unexpected costs, further supporting the notion that SPX Markets is not safe for investment.

Client Funds Security

The safety of client funds is a critical consideration when assessing any brokerage. SPX Markets claims to implement various security measures; however, the lack of regulatory oversight raises concerns about the actual effectiveness of these measures. The brokerage does not provide clear information on fund segregation, investor protection, or negative balance protection policies. In the absence of these safeguards, traders' funds could be at risk, especially given the reports of withdrawal issues associated with the broker.

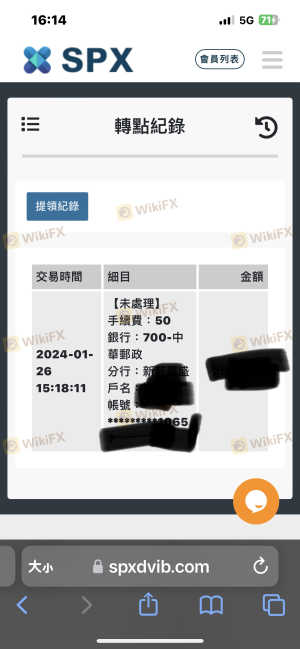

Historically, there have been complaints from clients regarding difficulties in withdrawing funds, which raises significant red flags about the safety of their investments. The lack of a compensation scheme or insurance for client funds further exacerbates the risk. Given these factors, it is evident that the security of client funds with SPX Markets is questionable, reinforcing the conclusion that SPX Markets is not safe for trading.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing the reliability of a brokerage. Reviews of SPX Markets often highlight common complaints, including withdrawal difficulties, lack of responsiveness from customer support, and aggressive marketing tactics. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Average |

| Misleading Information | High | Poor |

Many users report that once they deposit funds, they face significant challenges when attempting to withdraw their money, often citing excuses from the brokerage. This pattern of complaints indicates a concerning trend that potential clients should consider seriously. Additionally, the company's lack of effective communication and resolution strategies further contributes to the negative perception among users, leading to the conclusion that SPX Markets is not safe for trading.

Platform and Trade Execution

The trading platform offered by SPX Markets is web-based and lacks the robust features commonly found in industry-standard platforms like MetaTrader 4 or 5. Users have reported issues with platform stability, execution quality, and instances of slippage. These factors can significantly impact a trader's experience and profitability. The absence of transparent metrics regarding order execution quality and slippage rates raises suspicions about potential manipulation or unfair practices.

Overall, the performance and reliability of the trading platform are critical elements that contribute to the assessment of SPX Markets' safety. Given the reported issues and lack of transparency, it is reasonable to conclude that SPX Markets is not safe for traders seeking a reliable and efficient trading environment.

Risk Assessment

Engaging with SPX Markets presents several risks that potential traders should consider. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated and receives warnings from authorities. |

| Financial Risk | High | Reports of withdrawal issues and lack of fund protection. |

| Operational Risk | Medium | Platform instability and poor customer support. |

The high level of regulatory risk, coupled with financial and operational risks, creates a precarious environment for traders. To mitigate these risks, it is advisable for traders to seek alternative, well-regulated brokers that provide a transparent trading experience and adequate protections for their funds.

Conclusion and Recommendations

In conclusion, the evidence gathered indicates that SPX Markets is not safe for trading. The lack of robust regulatory oversight, coupled with a history of client complaints and operational issues, raises significant concerns about the legitimacy and reliability of the broker. Traders are advised to exercise caution and consider alternative options that prioritize transparency and regulatory compliance. For those seeking trustworthy brokers, consider options that are regulated by top-tier authorities such as the FCA, ASIC, or SEC, which offer stronger protections and a more reliable trading environment.

Is SPX Markets a scam, or is it legit?

The latest exposure and evaluation content of SPX Markets brokers.

SPX Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SPX Markets latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.