CDG 2025 Review: Everything You Need to Know

Executive Summary

CDG Global presents itself as a rapidly developing brokerage firm specializing in forex, precious metals, and stock trading. However, this CDG review reveals concerning patterns in user feedback and service quality that potential clients should carefully consider. According to available information from WikiFX and other sources, CDG Global operates as an investment service boutique with international presence. The company offers market execution trading conditions across multiple asset classes including forex, metals, and stocks.

The broker targets institutional and corporate users interested in forex and precious metals investment. It positions itself as a professional trading solution for experienced traders and businesses. Key features include market execution type trading and support for multiple currencies including USD and EUR. However, user feedback suggests significant challenges in service delivery and customer satisfaction that cannot be ignored.

Based on comprehensive analysis of available data and user reports, CDG Global appears to face substantial operational challenges. Potential clients should carefully consider these issues before engaging with their services.

Important Disclaimers

Regional Entity Differences: CDG Global's regulatory information is not clearly specified in available sources. This lack of clarity may lead to compliance issues across different jurisdictions. Potential clients should independently verify the broker's regulatory status in their respective countries before opening accounts.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback, publicly available information, and market data. Due to limited official documentation, some assessments rely on user reports and third-party evaluations that may not reflect complete operational details.

Rating Framework

Broker Overview

CDG Global operates as an investment service boutique claiming international presence. The company focuses on helping businesses and institutions execute trades across various financial markets. According to information from WikiFX, the company positions itself as a rapidly developing brokerage firm. However, specific founding details and company history remain unclear in available documentation.

The broker's primary business model centers on providing investment services with market execution capabilities. CDG Global targets professional traders and institutional clients who require sophisticated trading solutions. The company emphasizes its focus on forex trading, precious metals, and stock investments. This approach suggests a diversified strategy for financial market access.

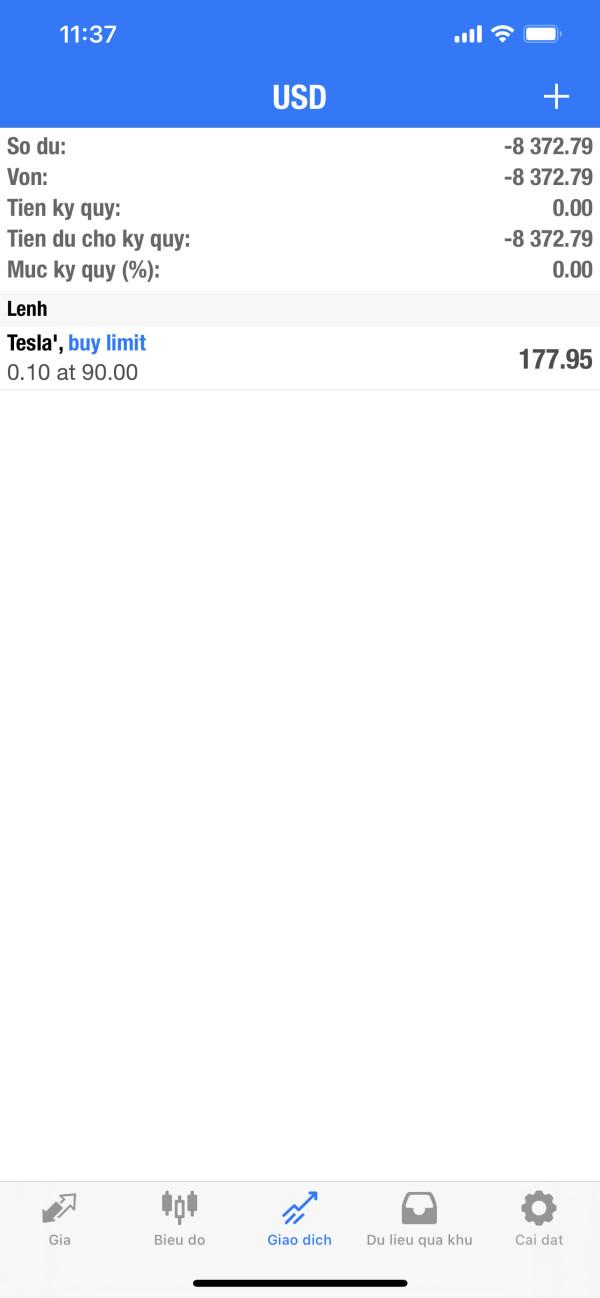

Trading Infrastructure and Assets: This CDG review finds that CDG Global offers market execution trading with support for major currencies including USD and EUR. The platform provides access to forex pairs, precious metals, and stock instruments for traders seeking diversified portfolios. However, specific details about trading platforms and execution quality remain limited in available sources. The broker sets margin call levels at 50% and stop-out levels at 20%. These parameters indicate standard risk management practices for leveraged trading environments.

Regulatory Framework: Available documentation does not specify clear regulatory oversight for CDG Global. This represents a significant concern for potential clients seeking regulated trading environments.

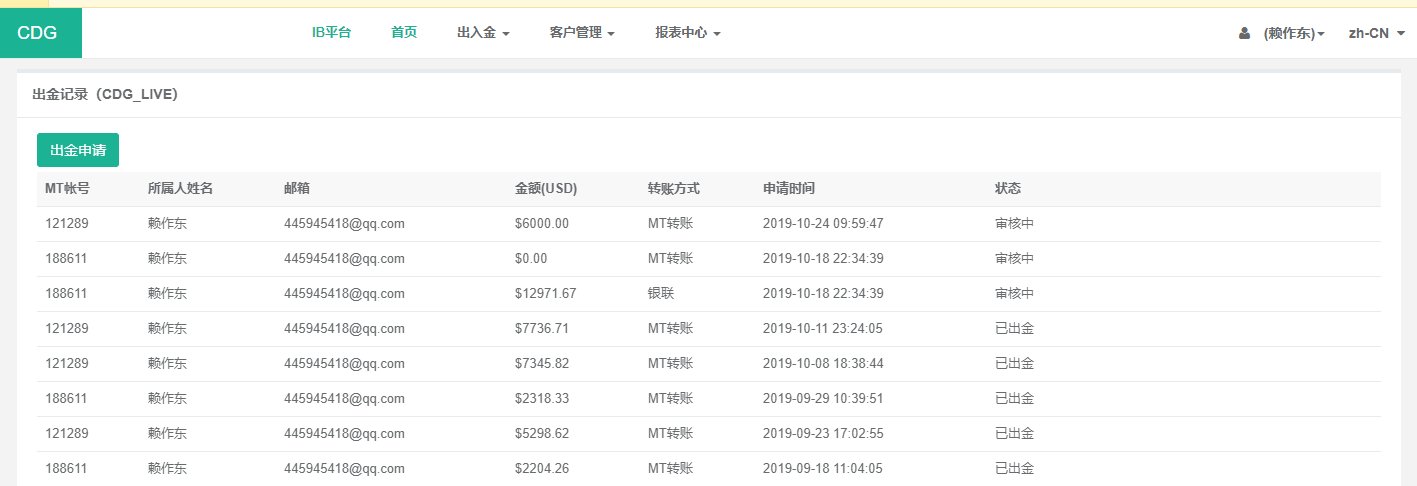

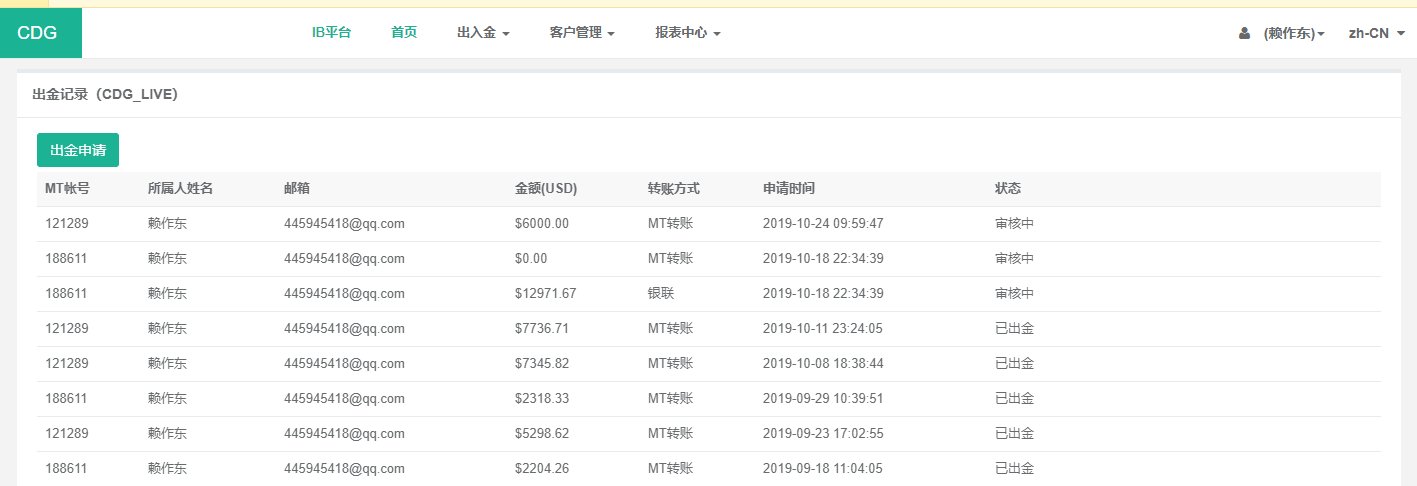

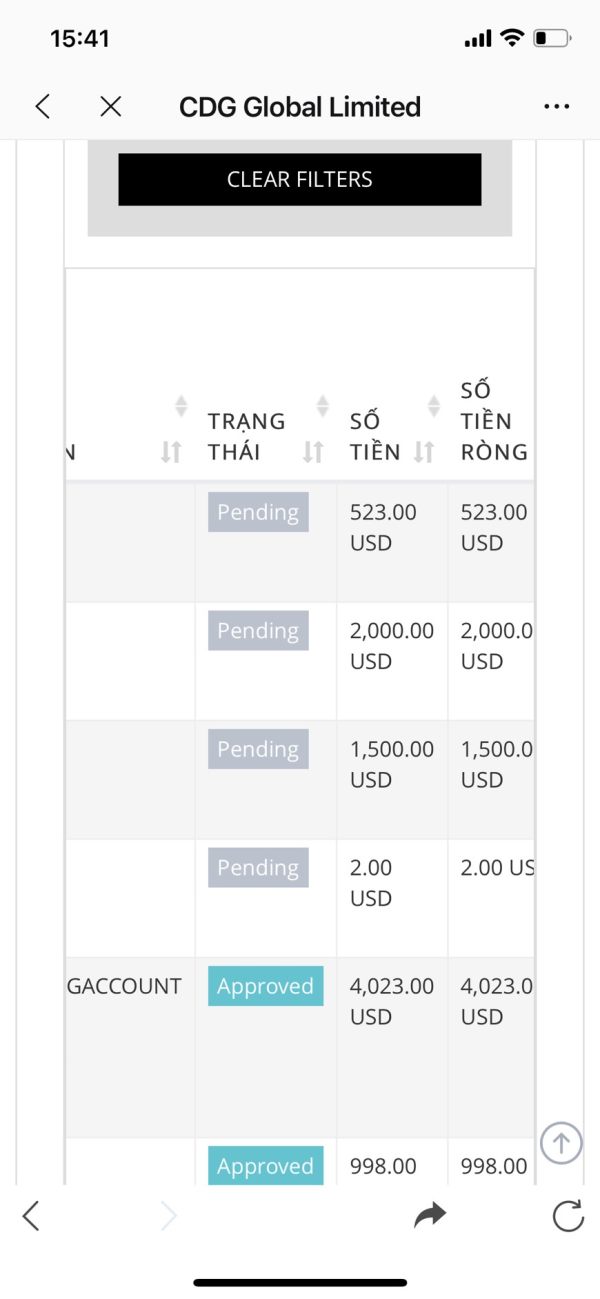

Deposit and Withdrawal Methods: Specific information regarding funding methods, processing times, and associated fees is not detailed in available sources. This limitation reduces transparency for prospective account holders who need clear financial procedures.

Minimum Deposit Requirements: Concrete minimum deposit amounts are not specified in available documentation. This makes it difficult for potential clients to assess accessibility and plan their initial investments.

Promotional Offers: Current bonus structures and promotional campaigns are not outlined in available materials. This suggests limited marketing incentives for new clients.

Tradeable Assets: CDG Global provides access to forex pairs, precious metals including gold and silver, and stock instruments. This offering provides moderate diversification for trading portfolios across different market sectors.

Cost Structure: Detailed information about spreads, commissions, and overnight financing charges is not comprehensively available in current documentation. This limitation reduces cost transparency for potential clients.

Leverage Ratios: Specific maximum leverage offerings are not clearly stated in available sources. However, margin requirements suggest leveraged trading capabilities are available.

Platform Options: Trading platform specifications and software solutions are not detailed in accessible documentation. This raises questions about technological infrastructure and user experience quality.

Geographic Restrictions: Specific country limitations and service availability are not clearly outlined in current materials. International clients may face uncertainty about service access.

Customer Support Languages: Available support languages are not specified in accessible documentation. This potentially limits international client service capabilities and communication effectiveness.

This CDG review highlights significant information gaps that prospective clients should address directly with the broker before account opening.

Comprehensive Rating Analysis

Account Conditions Analysis

CDG Global's account structure lacks transparency in available documentation. This presents challenges for potential clients seeking clear trading conditions and account specifications. The broker offers market execution trading with margin call levels set at 50% and stop-out levels at 20%. These settings indicate standard risk management protocols commonly used in the industry.

However, specific account types, minimum deposit requirements, and tier-based benefits are not detailed in accessible sources. The absence of comprehensive account information suggests either limited product development or inadequate marketing transparency that could affect client decisions. Currency support includes USD and EUR, providing basic international accessibility for traders. Additional currency options remain unspecified in current documentation.

Account opening procedures and verification requirements are not outlined in available materials. This potentially complicates the onboarding process for new clients who need clear guidance. Without detailed account specifications, this CDG review cannot adequately assess the competitiveness of CDG Global's account conditions. Prospective clients should request comprehensive account documentation directly from the broker to make informed decisions.

The trading tools and educational resources offered by CDG Global remain largely unspecified in available documentation. This represents a significant limitation for traders seeking comprehensive market analysis capabilities and learning materials. While the broker provides access to forex, metals, and stocks, specific analytical tools, charting capabilities, and research resources are not detailed. Educational materials, market commentary, and trading guides appear to be either limited or not prominently featured in the broker's public information.

The absence of detailed tool specifications makes it difficult to assess whether CDG Global provides institutional-grade resources. These resources would be particularly important for the broker's target market of businesses and professional traders. Automated trading support, API access, and third-party tool integration capabilities are not mentioned in available sources. This potentially limits advanced trading strategies and automated execution systems.

The lack of comprehensive tool information suggests either underdeveloped infrastructure or poor communication of available resources to potential clients.

Customer Service and Support Analysis

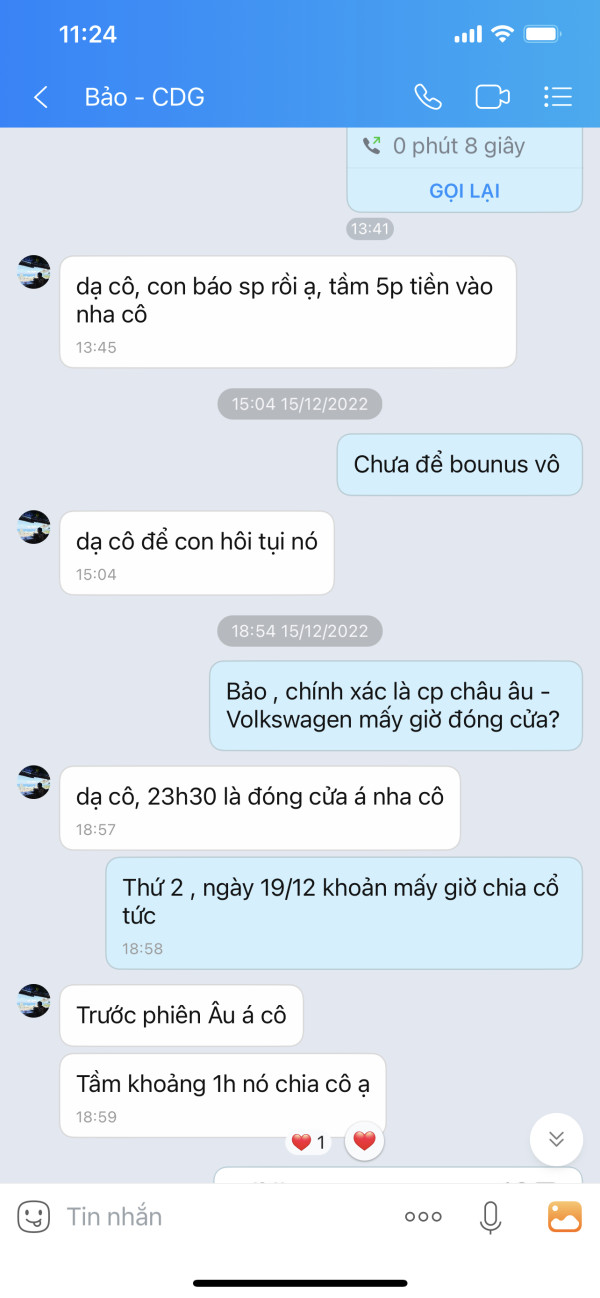

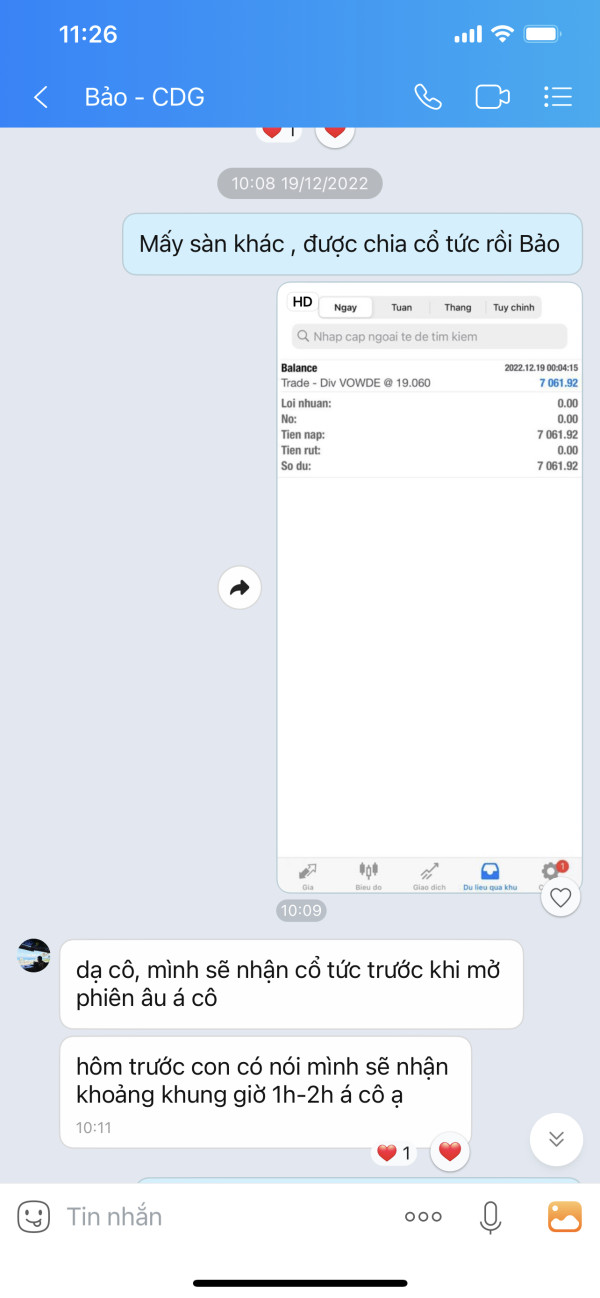

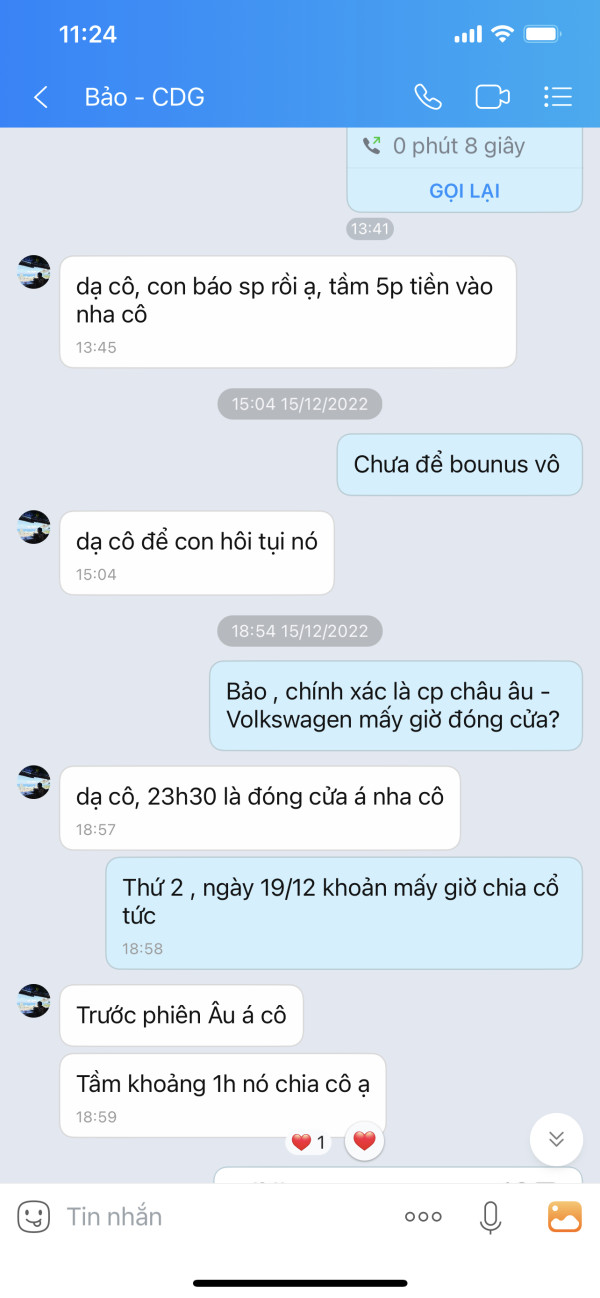

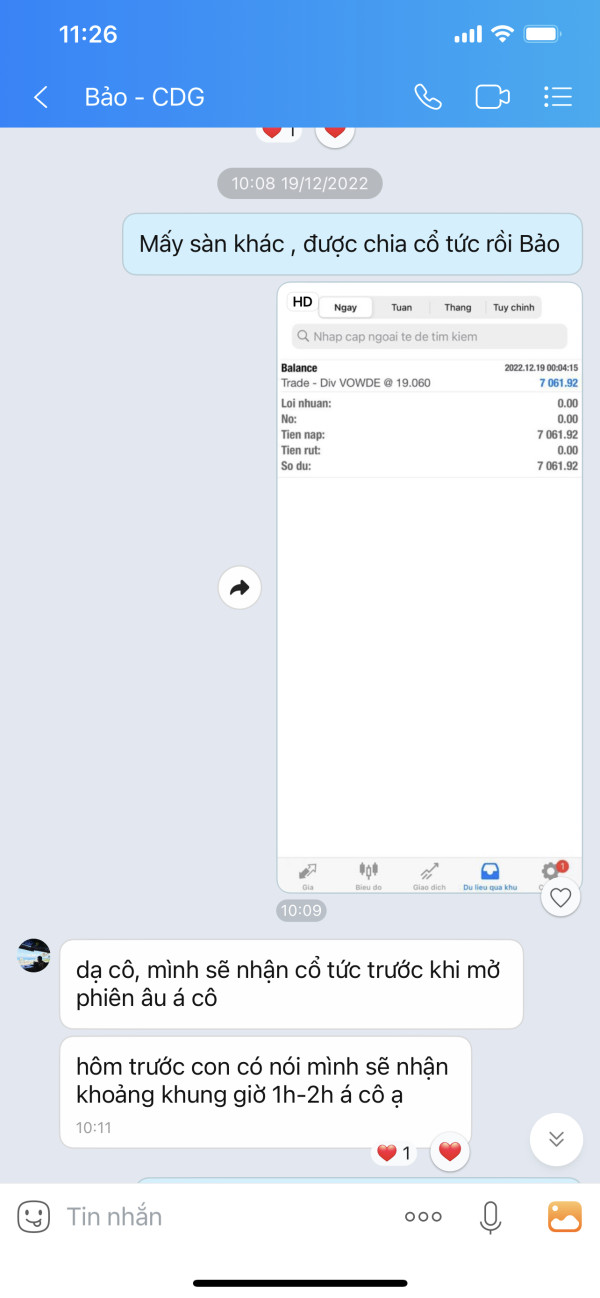

Customer service quality emerges as a significant concern in this CDG review. User feedback indicates substantial deficiencies in support delivery that affect overall client satisfaction. Available reports suggest slow response times and inadequate problem resolution capabilities. These issues create frustration for clients requiring timely assistance with trading or account matters.

Support channel availability, including phone, email, and live chat options, is not clearly specified in available documentation. Response time commitments and service level agreements are not outlined for client reference. The absence of detailed customer service information suggests either limited support infrastructure or inadequate communication of available services.

Multilingual support capabilities remain unspecified in current materials. This potentially limits service quality for international clients who require assistance in their native languages. Operating hours and regional support availability are not detailed in accessible sources. These gaps raise questions about global service coverage and accessibility.

User feedback indicates particular challenges with operational processes. This suggests systemic support issues requiring significant attention and improvement efforts.

Trading Experience Analysis

The trading experience provided by CDG Global faces significant limitations due to unclear platform specifications and limited user feedback. Market execution capabilities are mentioned in available documentation, but specific platform stability details are missing. Order execution speed and technical performance metrics are not detailed in available sources either.

Trading platform options, including desktop, web-based, and mobile solutions, are not comprehensively outlined in accessible documentation. This lack of platform information makes it difficult to assess the technological infrastructure supporting client trading activities effectively. Order types, execution quality, and slippage characteristics remain unspecified in current materials. These details are crucial for traders to understand actual trading conditions.

Mobile trading capabilities and cross-device synchronization features are not detailed in available materials. This potentially limits flexibility for active traders who need seamless access across multiple devices. The absence of specific trading environment information suggests either underdeveloped platform offerings or inadequate marketing communication.

This CDG review finds that the limited trading experience information represents a significant barrier to informed broker selection. Potential clients seeking reliable trading infrastructure may find insufficient details to make confident decisions.

Trust and Security Analysis

Trust and security concerns represent the most significant challenges identified in this evaluation of CDG Global. The absence of clear regulatory information in available sources raises fundamental questions about oversight and client protection measures that are essential for safe trading. Established brokers typically prominently display regulatory credentials, making the lack of such information particularly concerning for potential clients.

Fund security measures, segregated account policies, and investor compensation schemes are not detailed in accessible documentation. This transparency gap creates uncertainty about client asset protection and regulatory compliance standards that traders rely on. Third-party auditing, financial reporting, and operational transparency appear limited based on available information. These elements are crucial for building trust with institutional and individual clients.

Industry reputation and recognition from established financial organizations are not evident in current sources. This suggests either limited market presence or insufficient marketing of credentials and achievements. The absence of clear trust indicators makes it difficult for potential clients to assess the safety of their investments.

Negative incident handling and dispute resolution procedures are not outlined in available materials. This potentially complicates problem resolution for affected clients who may face trading or account issues.

User Experience Analysis

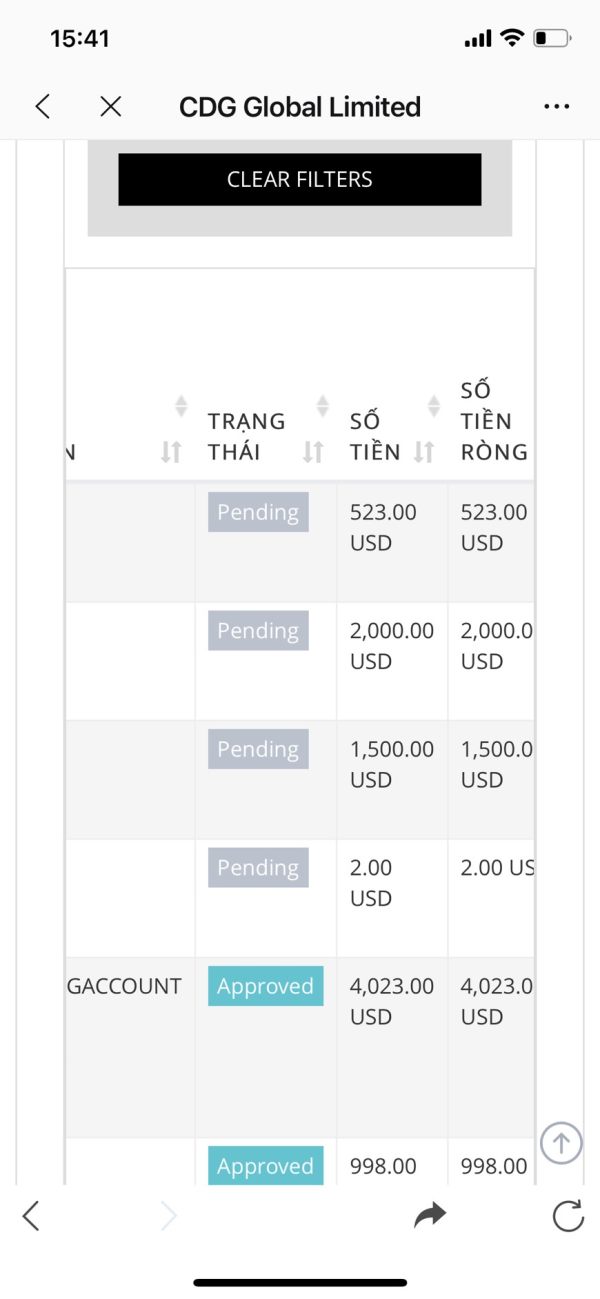

User experience analysis reveals predominantly negative feedback patterns that should concern potential clients. Reports indicate an average satisfaction rating of approximately 1 out of 5 stars based on available user reviews. This low satisfaction level suggests systemic issues affecting multiple aspects of the client experience across different service areas.

Interface design and platform usability information is not detailed in available sources. This limits assessment of user-friendly features and navigation capabilities that are important for daily trading activities. Registration and account verification processes are not clearly outlined in current documentation. This potentially creates barriers for new client onboarding and initial account setup.

Common user complaints appear to focus on operational efficiency issues. These include slow processing times and inadequate service delivery that affect overall client satisfaction. These feedback patterns suggest challenges in meeting client expectations for professional trading services and support.

The target demographic of institutional and corporate users interested in forex and precious metals trading may have particularly high service expectations. Current operations appear to struggle meeting these elevated standards based on available feedback. Improvement recommendations would include enhancing operational efficiency, improving communication transparency, and developing more responsive customer support systems.

Conclusion

This comprehensive CDG review reveals significant concerns about CDG Global's current service delivery and operational capabilities that potential clients must carefully consider. While the broker positions itself as a professional investment service boutique targeting institutional clients, substantial gaps exist in multiple areas. The combination of transparency issues, customer satisfaction problems, and regulatory clarity concerns creates considerable risks for potential clients.

The broker may be suitable for highly experienced institutional users who can conduct thorough due diligence and manage elevated operational risks effectively. However, individual traders and smaller institutions should exercise extreme caution when considering this broker. The combination of limited regulatory information, poor user feedback, and inadequate service transparency suggests significant challenges.

Primary advantages include market execution capabilities and access to diverse asset classes including forex, metals, and stocks. However, significant disadvantages encompass poor customer experience, limited transparency, and unclear regulatory oversight that outweigh potential benefits. Potential clients should demand comprehensive documentation and regulatory verification before considering account opening with CDG Global.

Most traders would likely be better served by established, well-regulated alternatives that provide clearer transparency and stronger client protection measures.