Macro Securities Review 1

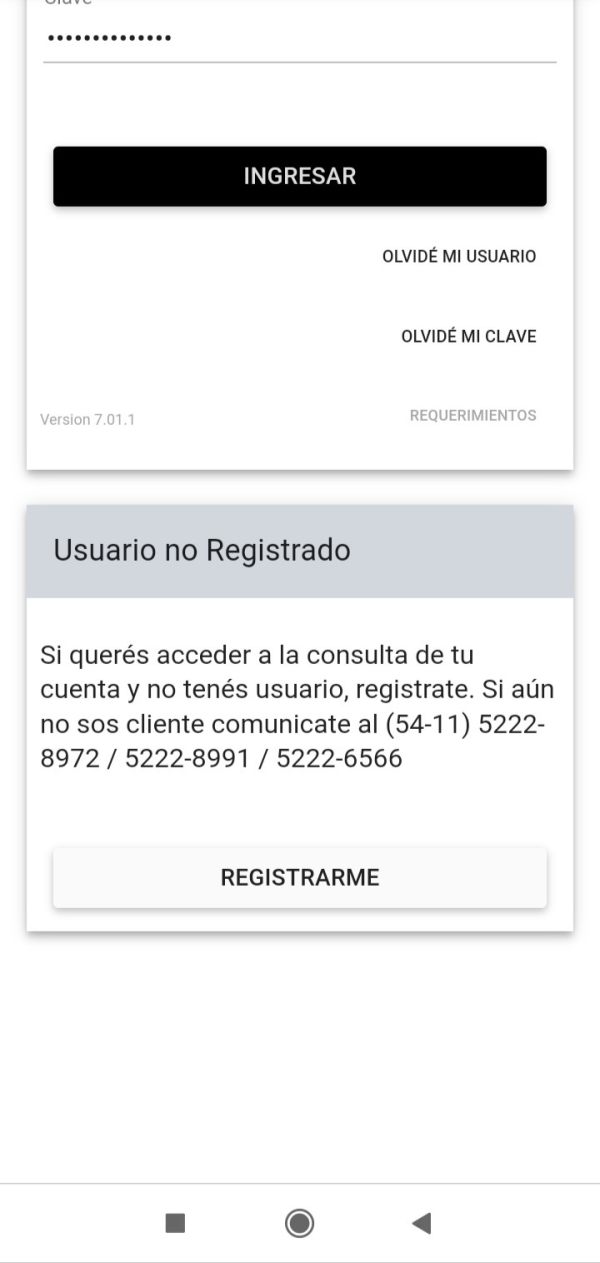

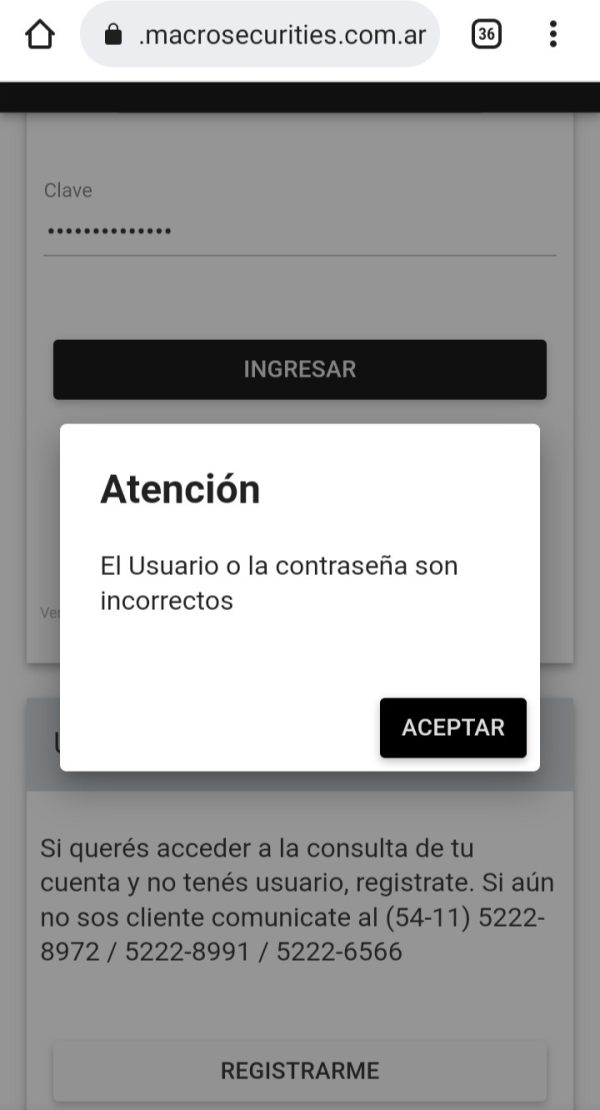

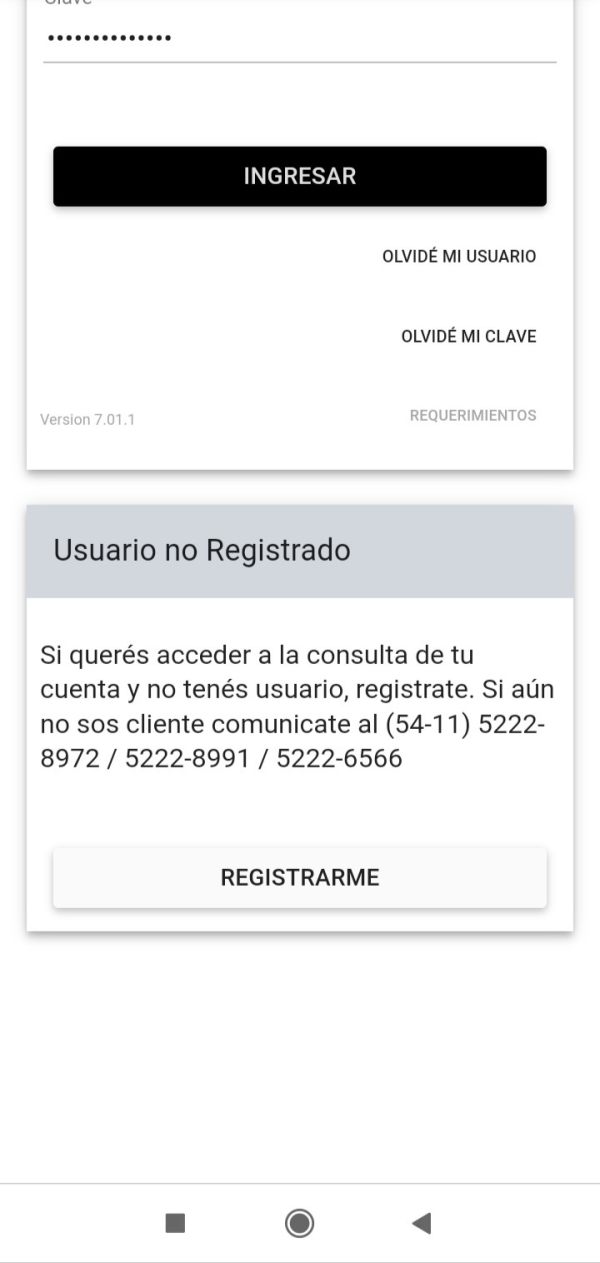

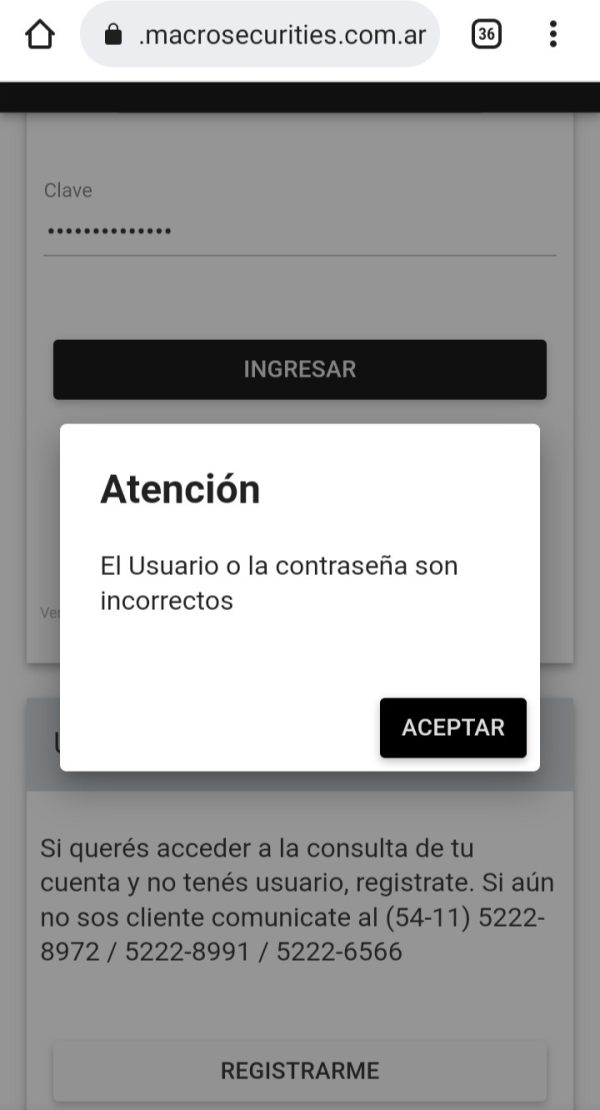

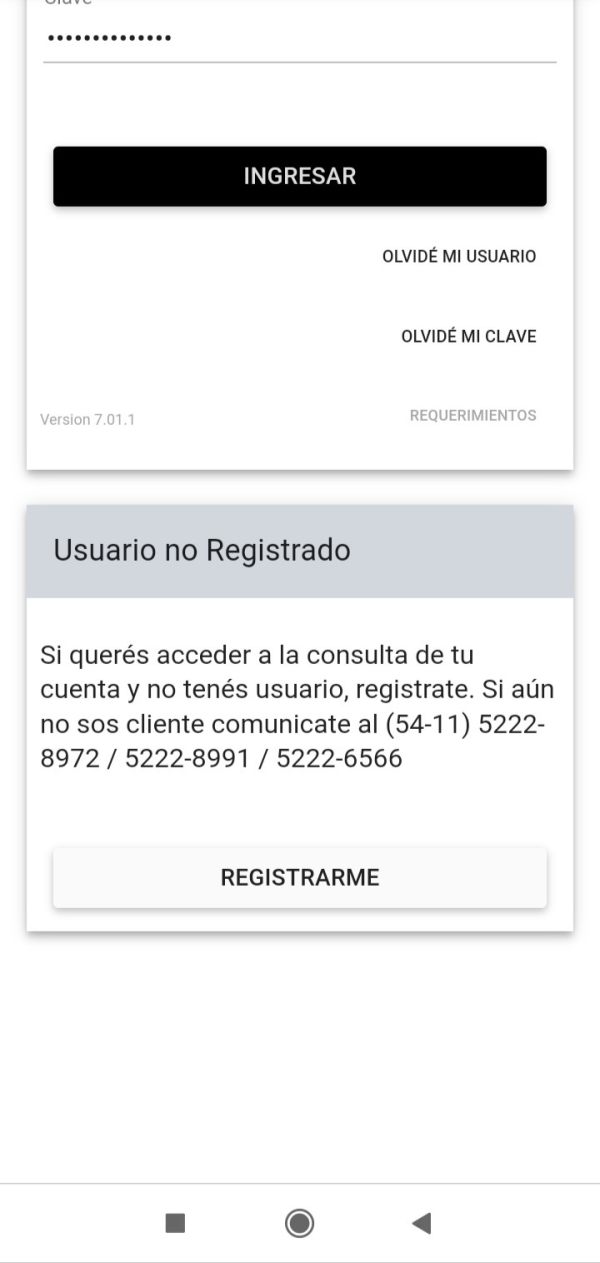

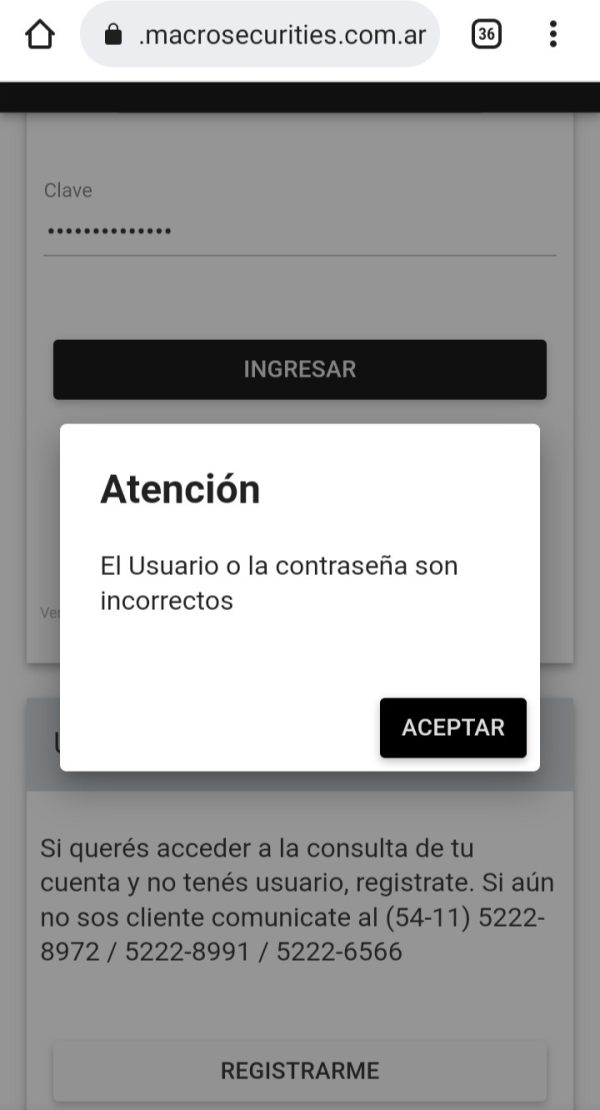

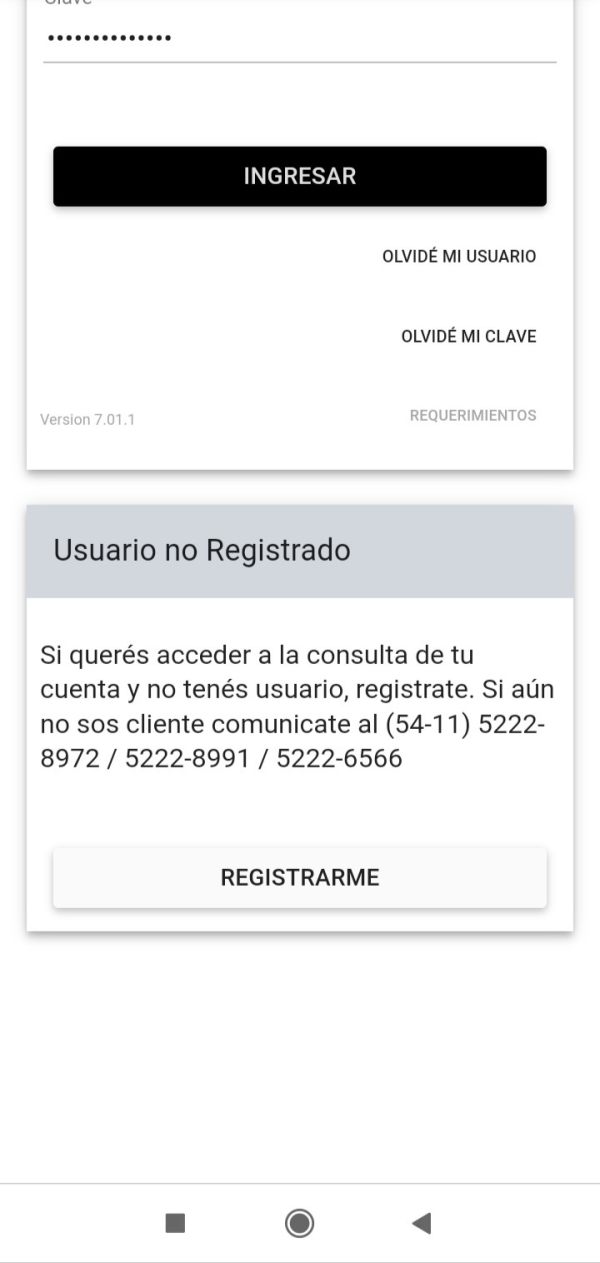

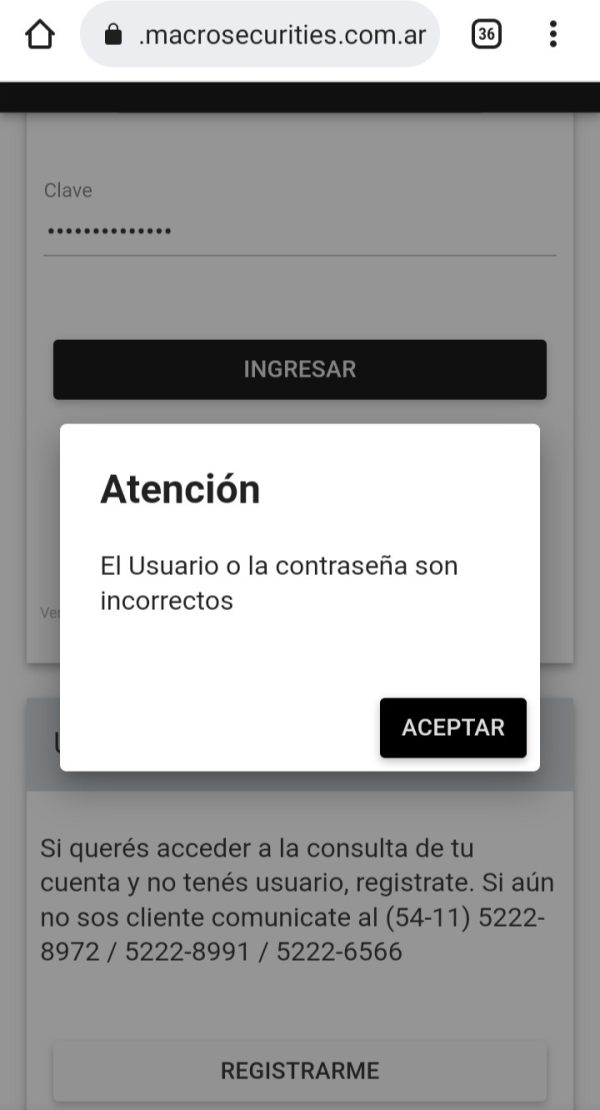

They are ignoring me and saying that the username or password is incorrect, knowing that the day before I was connected and had withdrawn $1600. Please help

Macro Securities Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They are ignoring me and saying that the username or password is incorrect, knowing that the day before I was connected and had withdrawn $1600. Please help

Macro Securities stands as a leading financial services company in the Argentine capital markets. The company offers a comprehensive range of investment services including securities trading, investment research, and custody services. This macro securities review reveals a company that has established itself as a prominent player in Argentina's financial landscape. The firm provides diverse services from forex trading to personal financial advisory and mutual fund management.

The broker caters primarily to investors seeking professional investment advisory services, market research reports, and comprehensive financial planning solutions. Macro Securities offers brokerage intermediation, personal finance services, mutual funds, and regular market reports to its client base. However, our analysis indicates that while the company maintains a strong presence in the Argentine market, certain regulatory information and specific operational details remain unclear in publicly available sources.

The company's service portfolio encompasses forex trading, investment banking, mutual fund management, and personal financial advisory services. This broad approach positions it as a full-service financial institution rather than a traditional retail forex broker. The wide range of services may appeal to investors seeking integrated financial solutions but could potentially lack the specialized focus that some traders prefer.

This macro securities review is based on publicly available information and company materials. Macro Securities appears to operate primarily within the Argentine market. The company's services, regulatory status, and operational procedures may differ significantly from international brokers operating in other jurisdictions. Potential clients should be aware that the company's regulatory framework and investor protection measures may vary from those typically found in major financial centers.

The evaluation presented in this review is compiled from available company information and does not include direct user trading experiences or comprehensive regulatory verification. Prospective clients are strongly advised to conduct their own due diligence and verify all relevant information before engaging with any financial services provider.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | N/A | Specific account types, minimum deposits, and account features not detailed in available materials |

| Tools and Resources | 7/10 | Strong offering in investment advisory services and market research reports |

| Customer Service | N/A | Customer service channels, response times, and support quality not specified |

| Trading Experience | N/A | Platform performance, execution quality, and user interface details unavailable |

| Trust and Safety | 4/10 | Limited publicly available regulatory information raises transparency concerns |

| User Experience | 5/10 | Mixed user feedback with some concerns about overall experience |

Macro Securities operates as an Argentine financial services company specializing in capital markets activities. The company has positioned itself as a comprehensive financial services provider. It offers securities trading, investment research, and custody services to clients seeking exposure to Argentine and potentially broader Latin American markets. While the exact founding date is not specified in available materials, the company has established itself as a recognized entity in Argentina's financial sector.

The business model encompasses multiple financial services including forex trading, financial planning, investment banking, mutual fund management, and personal financial advisory services. This diversified approach suggests that Macro Securities aims to serve as a one-stop financial services provider rather than focusing exclusively on retail forex trading. The company distinguishes itself from many international online brokers through this comprehensive approach.

Regarding trading platforms and available asset classes, Macro Securities offers access to forex markets, investment banking products, and mutual funds. The company provides brokerage intermediation services and maintains a focus on delivering market research and analysis to support client investment decisions. However, specific details about trading platforms, technology infrastructure, and the full range of tradeable instruments are not comprehensively detailed in publicly available information. This may require direct contact with the company for clarification.

Regulatory Status: Available information does not specify particular regulatory agencies or license numbers overseeing Macro Securities' operations. While the company operates in Argentina's financial sector, specific regulatory compliance details and investor protection measures are not clearly outlined in accessible materials.

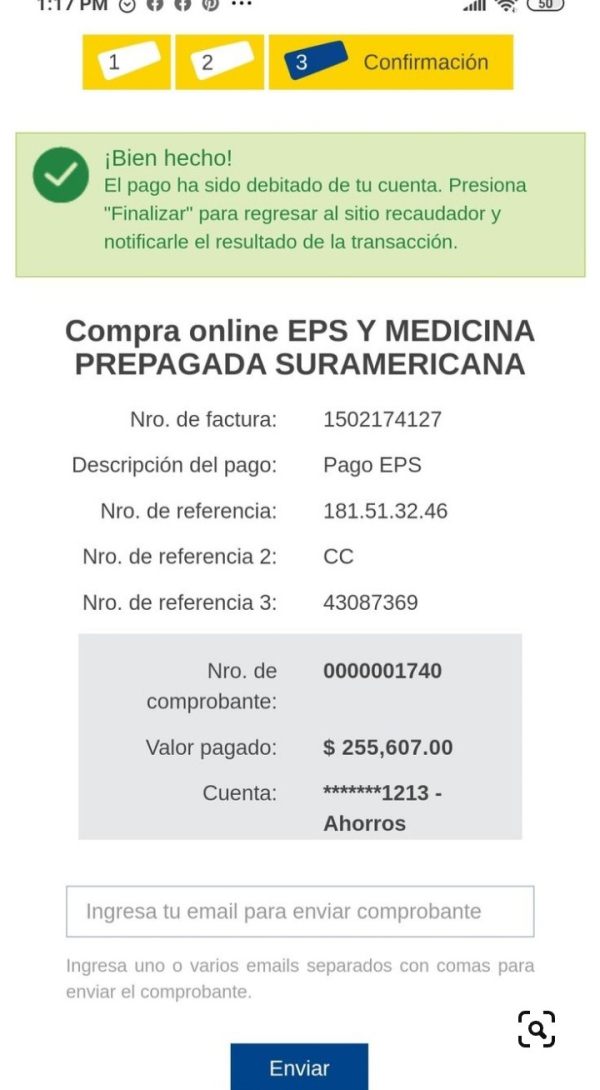

Deposit and Withdrawal Methods: Specific funding options, processing times, and associated fees for deposits and withdrawals are not detailed in available company information.

Minimum Deposit Requirements: The minimum initial deposit required to open an account with Macro Securities is not specified in publicly available materials.

Bonus and Promotions: No information regarding welcome bonuses, promotional offers, or incentive programs is mentioned in available company materials.

Tradeable Assets: The company provides access to forex markets, investment banking products, mutual funds, and offers financial planning services. Additional asset classes and specific instruments available for trading require further clarification.

Cost Structure: Details regarding spreads, commissions, overnight fees, and other trading costs are not specified in available information. This makes cost comparison challenging.

Leverage Ratios: Maximum leverage ratios and margin requirements are not detailed in accessible company materials.

Platform Options: Specific trading platforms, mobile applications, and technological features offered by Macro Securities are not comprehensively described in available information.

Geographic Restrictions: Information about countries or regions where services are restricted or unavailable is not specified.

Customer Service Languages: Available customer support languages and service hours are not detailed in accessible materials.

This macro securities review highlights the need for potential clients to contact the company directly for comprehensive operational details.

The account conditions offered by Macro Securities remain largely unspecified in publicly available information. This makes it challenging to provide a comprehensive evaluation of this crucial aspect. Without clear details about account types, minimum deposit requirements, account features, or tier-based benefits, potential clients cannot adequately assess whether the broker's account structure aligns with their trading needs and financial capacity.

The absence of specific information about account opening procedures, documentation requirements, and verification processes creates uncertainty for prospective clients. Additionally, details about account maintenance fees, inactivity charges, or special account features are not readily available. This could impact the overall cost-effectiveness of maintaining an account with the broker.

The lack of transparency regarding account conditions may concern potential clients who prefer to understand all terms and conditions before committing to a broker relationship. This macro securities review cannot provide a definitive rating for account conditions due to insufficient publicly available information. The situation highlights the importance of direct communication with the company for clarification.

Macro Securities demonstrates strength in providing investment advisory services and market research reports. This represents a significant value proposition for clients seeking professional market insights. The company's focus on delivering comprehensive market analysis and investment guidance suggests a commitment to supporting informed decision-making among its client base.

The availability of regular market reports indicates that Macro Securities maintains an active research department capable of producing timely market analysis. This resource can be particularly valuable for investors operating in Argentine markets or those seeking exposure to Latin American financial markets where local expertise provides significant advantages.

However, specific details about trading tools, technical analysis platforms, charting capabilities, educational resources, or automated trading support are not comprehensively outlined in available materials. The absence of information about advanced trading tools, risk management features, or platform customization options may limit the appeal for more sophisticated traders. These traders require comprehensive analytical capabilities.

While the company's strength in advisory services and market research is noteworthy, the overall tools and resources offering would benefit from greater transparency regarding technical trading capabilities and educational support materials.

Customer service information for Macro Securities is not comprehensively detailed in available materials. This makes it difficult to assess the quality and accessibility of client support services. The absence of specific information about customer service channels, such as phone support, live chat, email responsiveness, or in-person consultation options, creates uncertainty about the level of support clients can expect.

Response time commitments, service quality standards, and problem resolution procedures are not specified. This may concern potential clients who prioritize reliable customer support. Additionally, information about multilingual support capabilities, service hours, and regional support availability is not clearly outlined.

The lack of detailed customer service information may indicate either limited support infrastructure or insufficient transparency about available support options. For a financial services provider operating in the advisory space, comprehensive customer support is typically essential for maintaining client relationships and addressing complex financial inquiries.

Without specific user feedback about customer service experiences or documented service level commitments, this aspect of Macro Securities' offering remains unclear. Prospective clients need to verify this information directly.

The trading experience offered by Macro Securities cannot be comprehensively evaluated due to limited information about platform performance, execution quality, and user interface characteristics. Without specific details about trading platform stability, order execution speeds, or system reliability, potential clients cannot adequately assess the technical quality of the trading environment.

Information about mobile trading capabilities, platform functionality, order types, and trading tools is not sufficiently detailed in available materials. The absence of user feedback regarding platform performance, execution quality, or system downtime makes it challenging to evaluate the practical trading experience clients might expect.

Additionally, details about market access, trading hours, liquidity provision, and execution policies are not clearly specified. For active traders, these factors significantly impact trading effectiveness and overall satisfaction with the broker relationship.

This macro securities review cannot provide a definitive assessment of trading experience quality due to insufficient publicly available information about platform capabilities and user experiences. The situation emphasizes the need for potential clients to request demonstration access or detailed platform information directly from the company.

The trust and safety evaluation of Macro Securities reveals significant concerns due to limited publicly available regulatory information. While the company operates in Argentina's financial sector, specific regulatory oversight details, license numbers, and compliance frameworks are not clearly documented in accessible materials. This may raise transparency concerns among potential clients.

Information about client fund protection measures, segregated account policies, insurance coverage, or dispute resolution mechanisms is not comprehensively outlined. These safety measures are typically crucial for client confidence and regulatory compliance in the financial services industry.

The absence of clear regulatory information may indicate either limited regulatory oversight or insufficient transparency about compliance status. Additionally, without detailed information about the company's financial stability, operational history, or industry reputation, clients may find it challenging to assess the overall safety of their investments.

Third-party ratings, industry recognition, or independent audits that could support trust assessment are not mentioned in available materials. This lack of transparency regarding safety measures and regulatory compliance significantly impacts the trust rating in this review.

User experience evaluation for Macro Securities is complicated by mixed feedback and limited comprehensive user testimonials in available materials. While the company offers diverse financial services, specific user satisfaction metrics, interface design quality, and overall service experience details are not clearly documented.

The registration and account verification process efficiency is not detailed. This makes it difficult to assess the ease of getting started with the company. Similarly, information about the user-friendliness of available platforms, navigation simplicity, and overall service accessibility remains unclear.

Available information suggests that user feedback is mixed, with some concerns about the overall user experience. However, without specific details about common user complaints, satisfaction ratings, or improvement initiatives, it's challenging to provide a comprehensive user experience assessment.

The lack of detailed user experience information and mixed feedback patterns suggest that potential clients should carefully evaluate their specific needs and expectations before engaging with Macro Securities' services.

This macro securities review reveals a company that maintains a notable presence in Argentina's financial services sector. Macro Securities offers a comprehensive range of investment and advisory services. The company appears well-positioned to serve investors seeking professional investment guidance, market research, and integrated financial planning solutions within the Argentine market context.

The company's strengths lie in its diverse service portfolio, including investment advisory services and market research capabilities. These can provide significant value to clients seeking professional financial guidance. However, the limited availability of specific operational details, regulatory information, and user experience data creates challenges for potential clients attempting to make informed decisions.

Macro Securities may be most suitable for investors who prioritize professional advisory services and market research over advanced trading platforms or those specifically interested in Argentine market exposure. However, the lack of transparency regarding regulatory oversight and mixed user feedback suggests that prospective clients should conduct thorough due diligence and direct communication with the company before proceeding with any investment decisions.

FX Broker Capital Trading Markets Review