Is GUOTAI JUNAN FUTURES safe?

Business

License

Is Guotai Junan Futures Safe or a Scam?

Introduction

Guotai Junan Futures is a prominent player in the forex and futures trading market, primarily operating within China. Established as a subsidiary of Guotai Junan Securities Co., Ltd., it has positioned itself as a significant provider of financial services, including futures brokerage and investment consulting. However, the rapid growth of online trading platforms has led traders to be increasingly cautious about the legitimacy and safety of the brokers they choose. As the forex market is rife with both reputable firms and potential scams, it is essential for traders to thoroughly evaluate their options. This article will employ a comprehensive framework to assess whether Guotai Junan Futures is a safe choice for traders or if it raises red flags indicating potential fraud.

Regulation and Legitimacy

The regulatory status of a brokerage is crucial in determining its safety and reliability. Guotai Junan Futures operates under the oversight of the China Financial Futures Exchange (CFFEX), which is known for its stringent regulatory requirements. Below is a summary of the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFFEX | 0001 | China | Verified |

The CFFEX is a reputable regulatory body that ensures brokers adhere to industry standards and protect clients' interests. Guotai Junan Futures has been in operation for several years, and while it is regulated, it is important to note that not all regulatory environments offer the same level of investor protection. Some reports indicate issues such as withdrawal difficulties, which could undermine the broker's reputation. Therefore, while Guotai Junan Futures is regulated, potential clients should remain vigilant and conduct their due diligence.

Company Background Investigation

Guotai Junan Futures was founded in 2000 and has since evolved into a leading institution in the Chinese futures market. The company is a wholly-owned subsidiary of Guotai Junan Securities, one of the largest securities firms in China. This ownership structure adds a layer of stability and credibility to the firm. The management team consists of experienced professionals with extensive backgrounds in finance and investment, which enhances the company's operational integrity.

The firm's transparency is noteworthy, as it provides detailed information about its services and regulatory compliance on its official website. However, like many brokers, it may not disclose all operational challenges or client complaints openly. This lack of complete transparency can be a concern for potential investors, who may seek more comprehensive insights into the firm's historical performance and any past controversies.

Trading Conditions Analysis

When evaluating whether Guotai Junan Futures is safe, it is essential to examine its trading conditions, including fees and commissions. The brokerage offers competitive spreads and commission structures, but traders should be aware of any hidden fees that could impact their overall trading costs. Below is a comparison of the core trading costs:

| Fee Type | Guotai Junan Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (1-2 pips) | 1-3 pips |

| Commission Model | $0 - $10 per trade | $5 - $15 per trade |

| Overnight Interest Range | 0.5% - 2% | 0.5% - 3% |

While the spreads offered by Guotai Junan Futures are competitive, traders should carefully review the commission structure, as any unexpected fees can significantly affect profitability. Furthermore, the absence of a demo account may deter some traders from testing the platform before committing real funds.

Client Fund Security

The security of client funds is paramount when assessing the safety of a brokerage. Guotai Junan Futures implements various measures to ensure the protection of client deposits, including fund segregation and adherence to regulatory requirements. Client funds are held in separate accounts, which minimizes the risk of loss in case of financial difficulties faced by the brokerage.

Additionally, the company offers certain investor protection policies, although the specifics may vary. It is crucial for traders to inquire about the details of these protections and to be aware of any historical security incidents. Reports of clients facing difficulties in withdrawing funds raise concerns about the broker's operational integrity, and potential traders should weigh these risks carefully.

Customer Experience and Complaints

Evaluating customer feedback is vital in determining whether Guotai Junan Futures is safe. While many users report satisfactory experiences, there are notable complaints regarding withdrawal issues and customer service responsiveness. Below is a summary of the primary complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Slow response time |

| Customer Service Issues | Medium | Average responsiveness |

| Trading Platform Stability | Low | Generally stable |

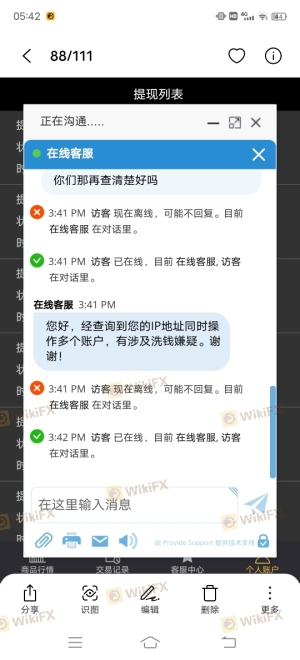

A few user experiences highlight the challenges faced by clients when attempting to withdraw funds. For instance, some users reported being asked to pay additional fees before they could access their capital. This pattern raises concerns about the overall reliability of the brokerage and suggests that potential clients should proceed with caution.

Platform and Execution

The trading platform provided by Guotai Junan Futures is generally well-received, offering a user-friendly interface and a range of trading tools. However, the quality of order execution is a critical factor in determining whether the broker is a safe choice. Traders have reported occasional slippage and order rejections, which can impact trading outcomes. It is essential to analyze whether these issues are systemic or isolated incidents.

Moreover, there are no significant indications of platform manipulation; however, traders should remain vigilant and monitor their trading experiences closely. Ensuring a reliable and stable trading environment is crucial for maintaining trust in the brokerage.

Risk Assessment

Using Guotai Junan Futures carries certain risks that traders should be aware of. Below is a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Regulated but with withdrawal issues reported |

| Operational Risk | High | Complaints about customer service and fund access |

| Market Risk | Medium | Standard market risks apply |

To mitigate these risks, traders should consider starting with smaller investments, utilizing risk management tools, and keeping abreast of market developments. Additionally, maintaining open lines of communication with the brokerage can help address any concerns promptly.

Conclusion and Recommendations

In conclusion, while Guotai Junan Futures is regulated by the CFFEX and offers a range of financial services, potential clients should remain cautious. Reports of withdrawal difficulties and customer service issues raise concerns about the overall safety of the brokerage. Therefore, it is essential for traders to conduct thorough research and consider their risk tolerance before engaging with Guotai Junan Futures.

For those seeking a reliable alternative, it may be prudent to explore other well-regulated brokers with a strong track record of customer satisfaction and transparent operations. Ultimately, the decision to engage with Guotai Junan Futures should be based on careful consideration of the risks involved and the broker's overall reputation in the industry.

Is GUOTAI JUNAN FUTURES a scam, or is it legit?

The latest exposure and evaluation content of GUOTAI JUNAN FUTURES brokers.

GUOTAI JUNAN FUTURES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GUOTAI JUNAN FUTURES latest industry rating score is 1.66, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.66 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.