Moscow Exchange Review 2

how come it be like this. 0.01 lot to clear an account with 3k usd. this is totally insane. cheating broker

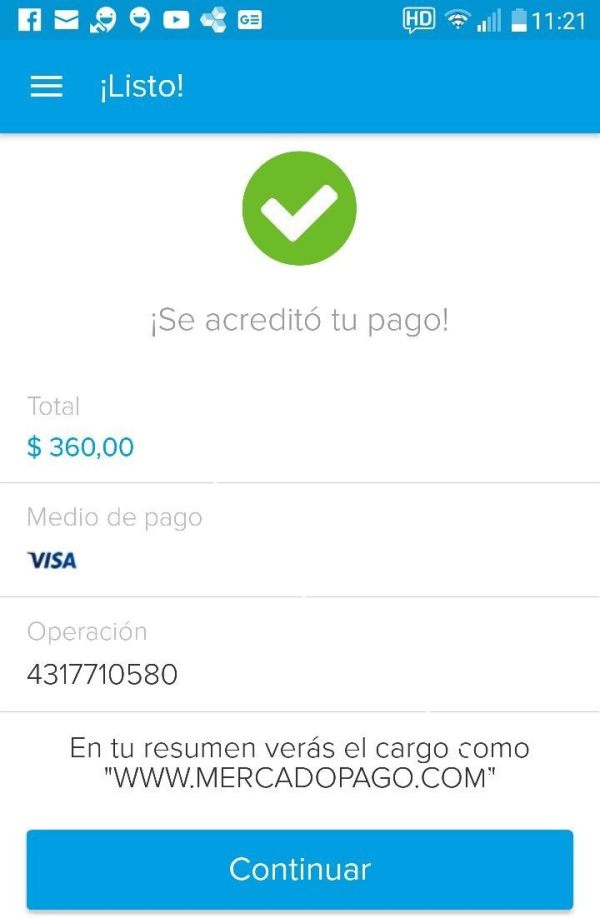

I deposited $360 and it asked me to deposit $300 again by advertisement. But them I could not operate.

Moscow Exchange Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

how come it be like this. 0.01 lot to clear an account with 3k usd. this is totally insane. cheating broker

I deposited $360 and it asked me to deposit $300 again by advertisement. But them I could not operate.

The Moscow Exchange stands as Russia's largest financial marketplace. It has operated comprehensive trading markets across multiple asset classes for over 32 years, establishing itself as a cornerstone of the regional financial sector. This moscow exchange review evaluates the exchange's capabilities, regulatory framework, and suitability for international traders seeking exposure to Russian financial markets.

MOEX offers extensive trading opportunities across equities, bonds, derivatives, foreign exchange, money markets, and precious metals. The exchange operates under the supervision of the Central Bank of Russia. This provides regulatory oversight for its diverse range of financial instruments and ensures compliance with Russian market standards. MOEX also functions as Russia's central securities depository through its National Settlement Depository subsidiary.

The platform primarily targets institutional investors and retail traders seeking diversified exposure to Russian markets and Eastern European investment opportunities. With over three decades of operational history and comprehensive market data, MOEX has established itself as a significant player in the regional financial landscape. However, traders should carefully consider the unique regulatory environment and market conditions specific to Russian financial markets before engaging with the platform.

This review focuses specifically on the moscow exchange's main market operations within the Russian regulatory framework. Traders should note that Russian financial markets operate under distinct regulatory conditions that may differ significantly from Western markets. These differences particularly affect international access, settlement procedures, and regulatory compliance requirements that market participants must navigate.

The evaluation presented here is based on publicly available information and official exchange documentation. Market conditions, regulatory requirements, and access provisions may change over time. Potential users should verify current terms and availability before engaging with the platform to ensure they have the most up-to-date information.

| Dimension | Score | Justification |

|---|---|---|

| Account Conditions | Not Rated/10 | Specific account terms, minimum deposits, and fee structures not detailed in available information |

| Tools and Resources | 8/10 | Comprehensive range of financial instruments including equities, bonds, derivatives, FX, money markets, and precious metals |

| Customer Service and Support | Not Rated/10 | Customer service quality and support channels not specified in available documentation |

| Trading Experience | Not Rated/10 | Platform interface and user experience details not provided in source materials |

| Trust and Regulation | 9/10 | Regulated by Central Bank of Russia with over 32 years of operational history |

| User Experience | Not Rated/10 | User feedback and satisfaction metrics not available in current information |

The moscow exchange represents Russia's premier financial marketplace. It was established with over 32 years of operational experience in the Russian financial sector, building a strong foundation of market expertise and institutional knowledge. Headquartered in Moscow, MOEX operates as the country's largest exchange, facilitating trading across multiple asset classes while maintaining central securities depository services. The exchange has evolved to become the cornerstone of Russian capital markets. It provides essential infrastructure for both domestic and international market participants seeking access to Russian financial instruments.

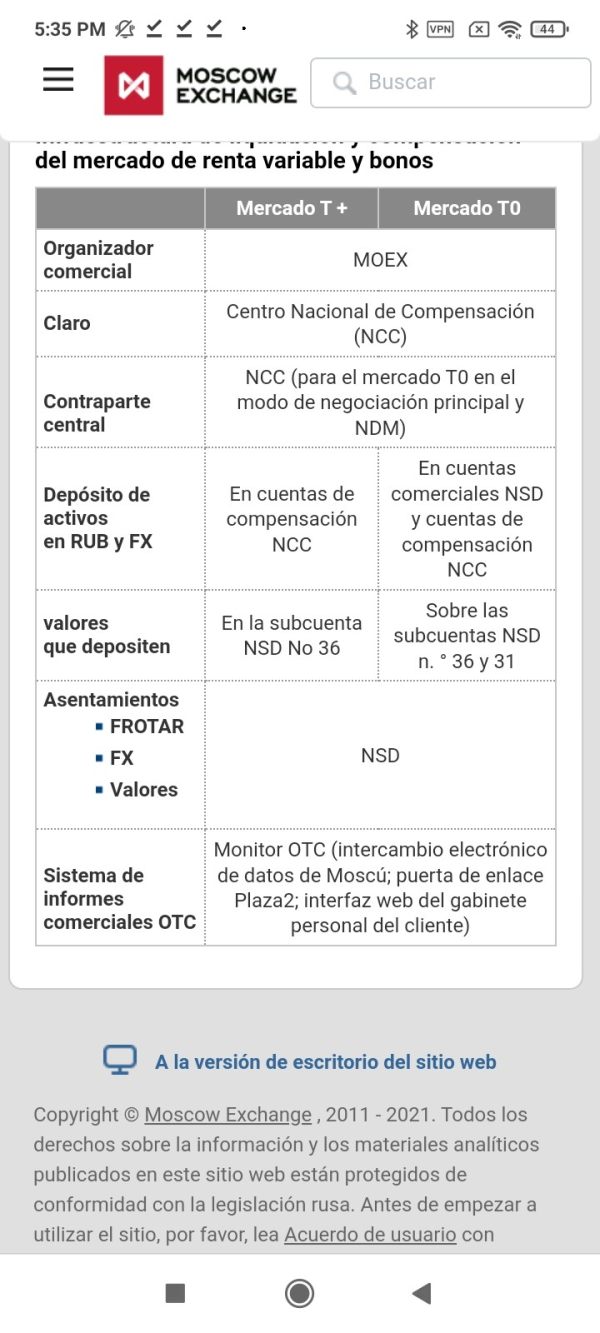

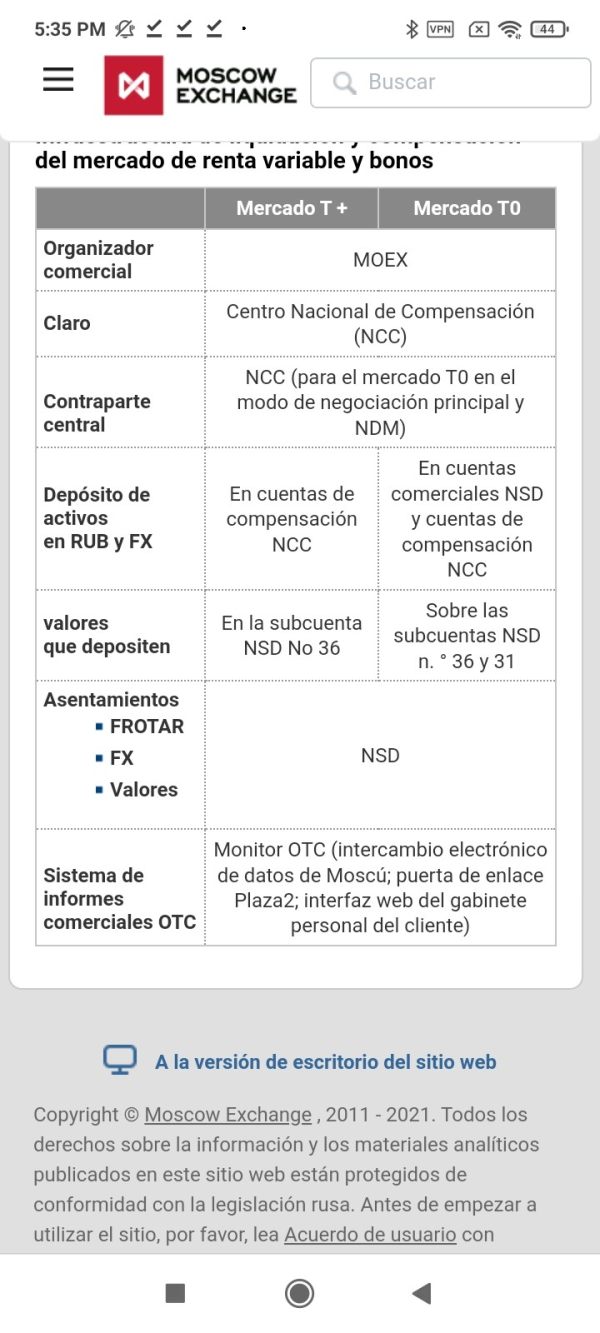

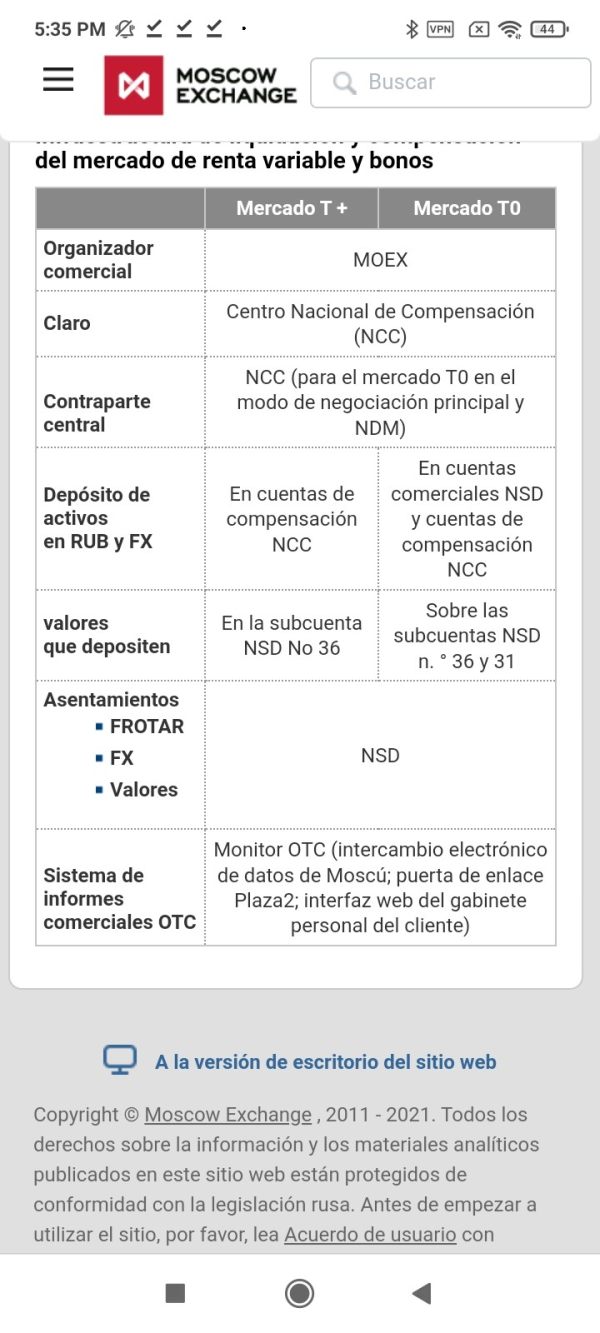

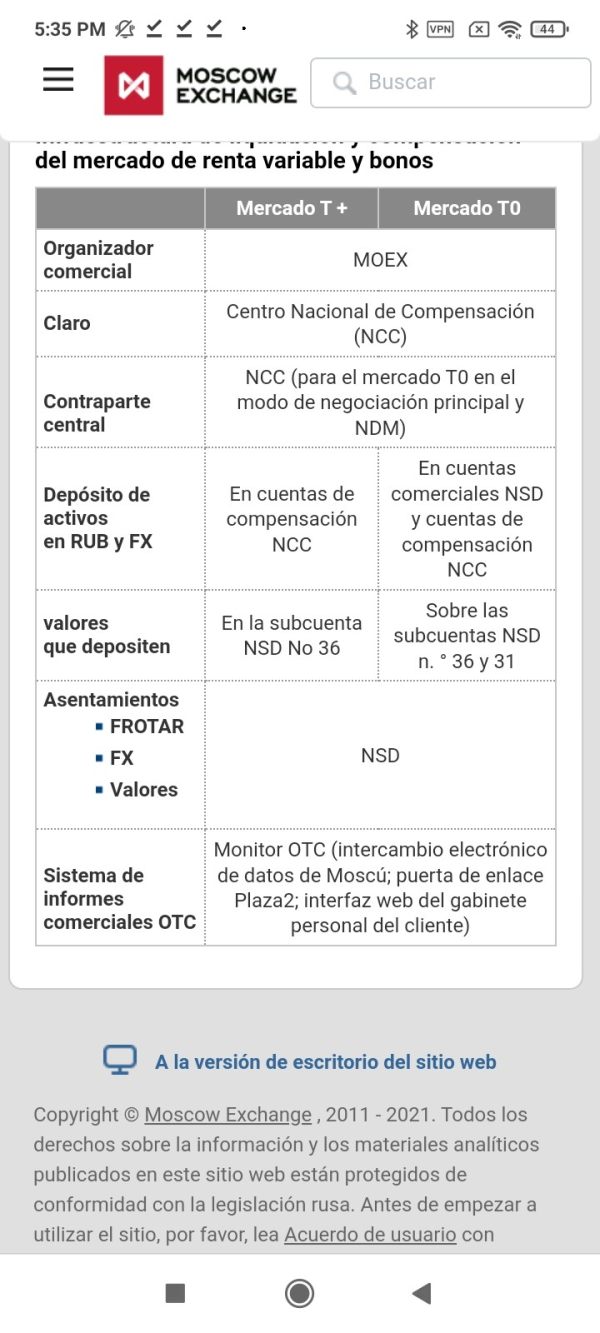

According to available information, MOEX operates comprehensive trading markets spanning equities, bonds, derivatives, foreign exchange markets, money markets, and precious metals trading. The exchange's business model encompasses both trading facilitation and post-trade services through its subsidiaries. These subsidiaries include the National Settlement Depository and National Clearing Centre, which provide crucial infrastructure for market operations. This integrated approach allows MOEX to provide end-to-end transaction processing and settlement services for Russian financial markets.

The exchange operates under the regulatory oversight of the Central Bank of Russia. This ensures compliance with Russian financial regulations and maintains market integrity standards across all trading activities. Historical data spanning over 32 years provides valuable insights into the exchange's development and resilience within the regional financial landscape. However, specific performance metrics and current operational statistics are not detailed in the available documentation for this comprehensive assessment.

Regulatory Jurisdiction: The moscow exchange operates under the supervision and regulation of the Central Bank of Russia. This ensures compliance with Russian financial market regulations and maintains oversight of trading activities across all asset classes offered on the platform.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal procedures, accepted payment methods, and processing timeframes is not detailed in the available documentation. Potential traders would require direct inquiry with authorized brokers to obtain this essential information for account management.

Minimum Deposit Requirements: Minimum deposit amounts and account funding requirements are not specified in the current information. These requirements may vary depending on the specific broker providing access to MOEX trading services and the type of account being established.

Bonuses and Promotions: Information regarding promotional offers, trading incentives, or bonus structures is not mentioned in the available documentation for this moscow exchange review. Traders should inquire directly with authorized brokers about any available promotional programs or incentive structures.

Tradeable Assets: MOEX provides trading access to a comprehensive range of financial instruments. These include equities, government and corporate bonds, various derivatives products, foreign exchange markets, money market instruments, and precious metals trading opportunities for diverse investment strategies.

Cost Structure: Specific details regarding trading fees, commissions, spreads, and other cost components are not provided in the available information. These costs would typically be determined by the individual brokers providing market access rather than standardized exchange-wide fee structures.

Leverage Ratios: Information about available leverage levels and margin requirements is not specified in the current documentation. These terms may vary based on asset class and individual broker arrangements for market access.

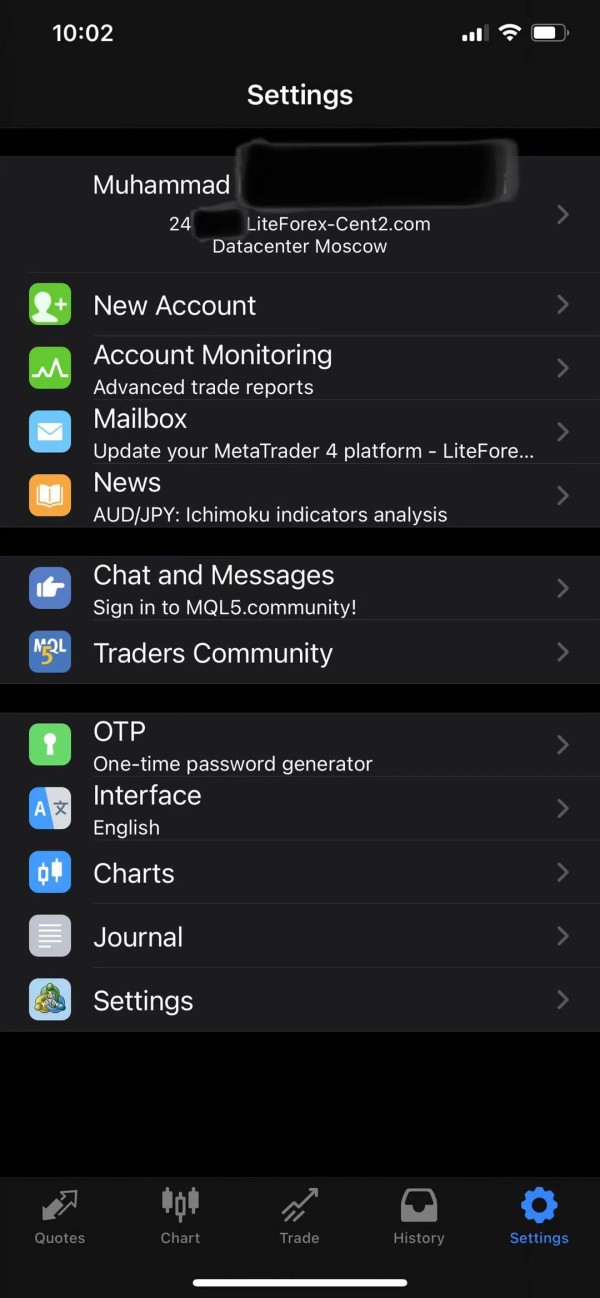

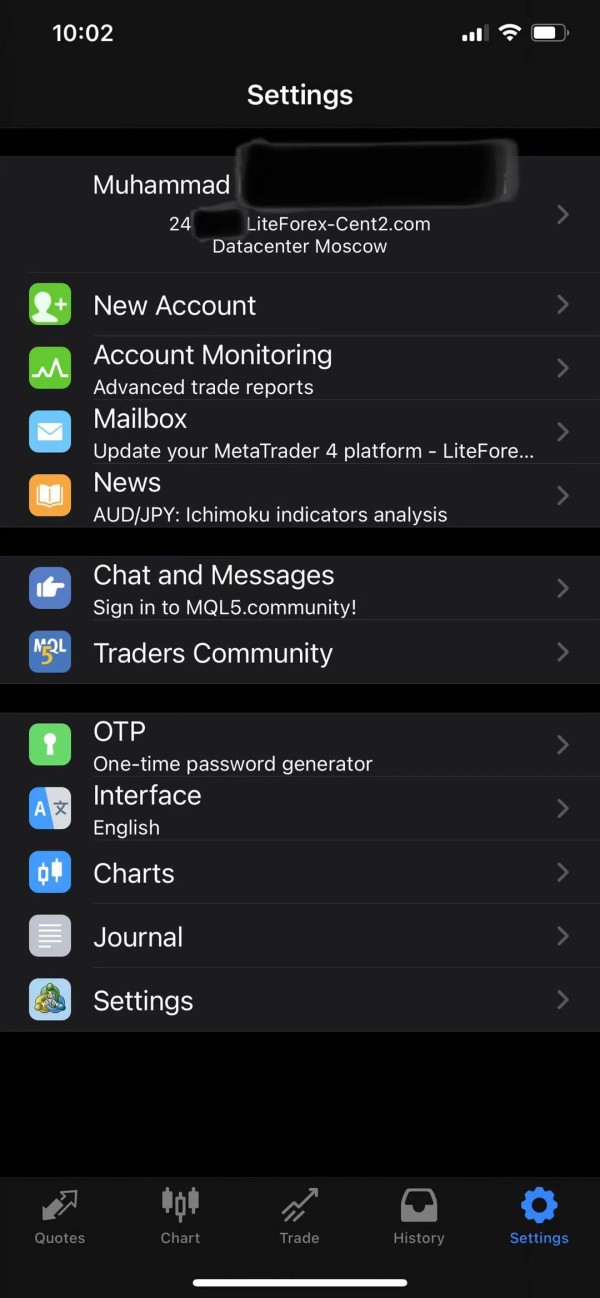

Platform Options: Details regarding specific trading platforms, software options, and technological infrastructure are not elaborated in the available source materials. Traders would need to research authorized brokers to understand available platform options and technological capabilities.

Geographic Restrictions: Specific information about regional access limitations or geographic restrictions is not detailed in the current documentation. Access requirements may vary based on regulatory considerations and individual broker policies for international clients.

Customer Service Languages: Supported languages for customer service and support are not specified in the available information. Language support would likely depend on the individual broker providing market access rather than direct exchange services.

The specific account conditions for trading on the moscow exchange are not comprehensively detailed in the available documentation. This makes a definitive rating challenging for this moscow exchange review and requires additional research from potential users. Access to MOEX typically requires engagement with authorized brokers who provide direct market access. This suggests that account terms may vary significantly depending on the chosen intermediary and their specific service offerings.

The exchange operates as an institutional marketplace where retail traders generally access markets through qualified brokers rather than maintaining direct accounts with the exchange itself. This structure means that minimum deposit requirements, account types, and specific trading conditions would be determined by individual brokerage firms. The terms would not follow standardized exchange-wide parameters, creating variability in account conditions across different service providers.

Without specific information about account opening procedures, verification requirements, or minimum balance thresholds, it's not possible to evaluate the accessibility or competitiveness of account conditions. Potential traders would need to research authorized MOEX brokers to understand specific account terms and requirements. This research process is essential for making informed decisions about market access and service selection.

The institutional nature of the exchange suggests that account conditions may be more suitable for sophisticated investors or those working with professional intermediaries. However, specific accessibility criteria are not detailed in available materials, limiting comprehensive evaluation of account condition competitiveness.

The moscow exchange demonstrates strong capabilities in terms of available financial instruments and market diversity. The exchange provides access to a comprehensive range of asset classes including equities, bonds, derivatives, foreign exchange markets, money markets, and precious metals. This indicates a well-developed trading infrastructure capable of supporting diverse investment strategies and portfolio requirements.

The breadth of available instruments suggests that MOEX can serve diverse investment strategies and portfolio requirements effectively. The inclusion of both traditional securities and derivatives markets indicates sophisticated market infrastructure. This infrastructure is capable of supporting various trading approaches and risk management strategies for different types of market participants.

However, specific information about research resources, market analysis tools, educational materials, or automated trading support is not detailed in the available documentation. The exchange's role as a central securities depository through its National Settlement Depository subsidiary suggests robust post-trade infrastructure and settlement capabilities. These capabilities are essential for efficient market operations and transaction processing.

The 32-year operational history indicates substantial experience in market operations and infrastructure development. However, specific technological capabilities and trading tools are not elaborated in current materials, limiting detailed assessment of available resources. This extensive experience likely translates to reliable market operations and comprehensive instrument availability for traders seeking exposure to Russian markets.

Information regarding customer service quality, support channels, and assistance availability is not specified in the available documentation for this moscow exchange review. As an institutional exchange operating primarily through authorized brokers, direct customer service from MOEX may be limited compared to retail-focused platforms. This structure affects how traders access support and resolve issues related to their trading activities.

The exchange's operational model suggests that customer support would typically be provided by individual brokers rather than directly by the exchange itself. This structure means that service quality, response times, and support availability would vary depending on the chosen broker relationship. Traders should carefully evaluate broker support capabilities when selecting market access providers.

Without specific information about help desk operations, technical support capabilities, or problem resolution procedures, it's not possible to evaluate the quality of customer service and support comprehensively. The institutional focus suggests that support may be oriented toward professional market participants rather than individual retail traders. This orientation could affect the type and level of support available to different user categories.

Response times, service availability hours, and support channel options are not detailed in available materials. This makes comprehensive evaluation of customer service capabilities challenging based on current information and requires direct inquiry with authorized brokers for specific support details.

Specific details about the trading experience, platform performance, and user interface are not provided in the available documentation. This limits the ability to assess this dimension comprehensively for potential users of the moscow exchange. The exchange's role as Russia's largest financial marketplace suggests substantial infrastructure and operational capabilities that support trading activities.

Order execution quality, platform stability, and trading speed metrics are not detailed in current materials. The exchange's long operational history and central role in Russian financial markets likely indicate established trading infrastructure. However, specific performance characteristics are not quantified in available documentation, making detailed assessment challenging.

Information about mobile trading capabilities, platform features, and user interface design is not available in the source materials. The institutional nature of the exchange suggests that trading access would typically be provided through professional-grade platforms rather than retail-focused interfaces. This could affect the user experience for different types of traders and their specific needs.

Without user experience data or platform performance metrics, evaluation of the trading experience relies primarily on the exchange's institutional reputation and operational scale. This approach provides limited insight into specific moscow exchange review criteria related to user satisfaction or platform functionality for individual traders.

The moscow exchange demonstrates strong regulatory credentials through its supervision by the Central Bank of Russia. This provides institutional oversight and regulatory compliance monitoring for all exchange operations. This regulatory framework offers important protections for market participants and ensures adherence to Russian financial market standards across all trading activities.

The exchange's 32-year operational history indicates substantial stability and continuity in the Russian financial market landscape. This extensive operational experience suggests proven capabilities in market management, crisis handling, and regulatory compliance over multiple market cycles. The longevity demonstrates resilience and adaptability in changing market conditions.

As Russia's largest exchange operating comprehensive trading markets across multiple asset classes, MOEX has established institutional credibility within the regional financial sector. The exchange's role as a central securities depository further reinforces its systemic importance and regulatory oversight. This dual role enhances the exchange's significance in the Russian financial infrastructure.

However, specific information about investor protection measures, insurance coverage, or financial safeguards beyond regulatory supervision is not detailed in available materials. The regulatory environment may differ from international standards familiar to traders in other jurisdictions, requiring careful consideration of regulatory differences.

Comprehensive user experience evaluation is limited by the lack of available user feedback, satisfaction surveys, or experience testimonials in the source materials. The exchange's institutional focus suggests that user experience may be oriented toward professional market participants rather than individual retail traders. This orientation could affect interface design and service delivery approaches.

Interface design, ease of use, and accessibility features are not described in available documentation. The requirement to access MOEX through authorized brokers means that user experience would largely depend on the chosen intermediary's platform and service quality. This indirect access model affects how users interact with exchange services and trading capabilities.

Registration and verification processes, account management procedures, and fund operation experiences are not detailed in current materials. The institutional trading model suggests that onboarding and operational procedures may be more complex than typical retail trading platforms. This complexity could affect user experience for different types of market participants.

Without specific user feedback or experience metrics, assessment of overall user satisfaction relies on the exchange's operational reputation and market position. This approach provides limited insight into direct user experience data for this comprehensive evaluation and requires additional research from potential users.

The moscow exchange represents a significant institutional marketplace within the Russian financial sector. It offers comprehensive access to diverse asset classes under Central Bank of Russia regulation, providing important regulatory oversight and market integrity. While the exchange demonstrates strong credentials in terms of regulatory oversight and instrument diversity, limited transparency regarding specific trading conditions and user experience factors constrains comprehensive evaluation for potential users.

This platform appears most suitable for institutional investors and sophisticated traders seeking exposure to Russian financial markets through authorized broker relationships. The exchange's extensive operational history and regulatory framework provide important foundations for market integrity and operational stability. However, potential users should carefully research specific broker arrangements and current market access conditions before engaging with the platform.

The main advantages include comprehensive asset class coverage and established regulatory oversight from the Central Bank of Russia. The primary limitations involve limited transparency about specific user terms and the requirement for broker-mediated access rather than direct trading relationships with the exchange itself.

FX Broker Capital Trading Markets Review