Bridge Markets 2025 Review: Everything You Need to Know

Executive Summary

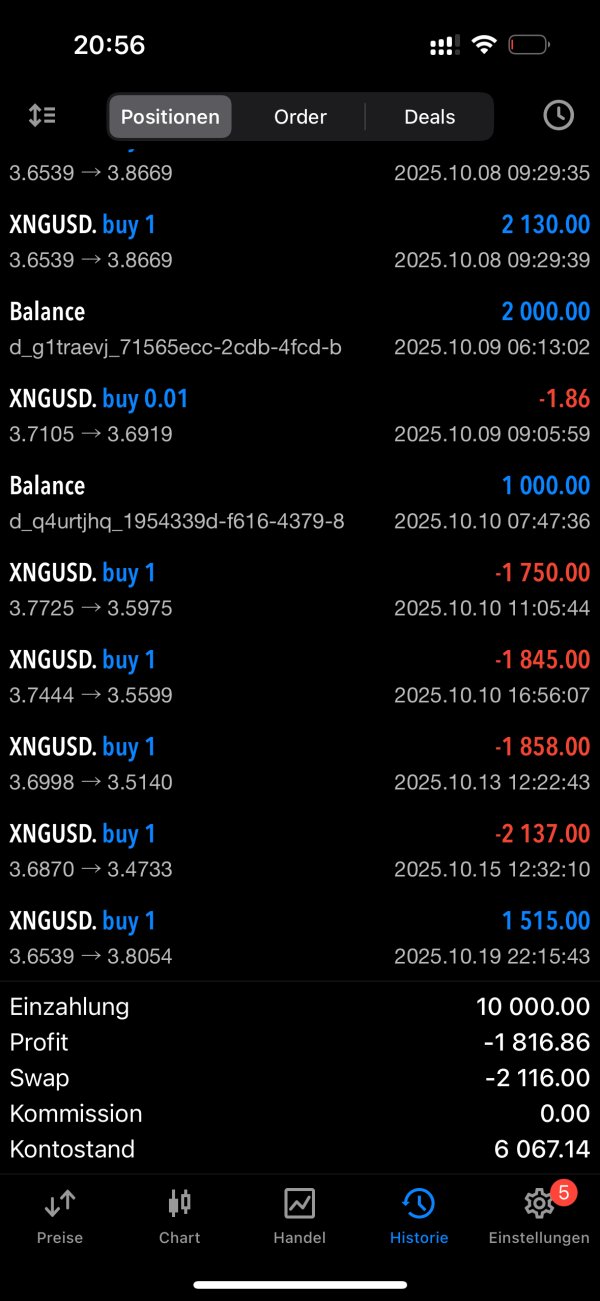

This detailed bridge markets review looks at a forex broker that works without any rules watching over it. Bridge Markets LTD says it gives complete financial solutions in the trading market, letting people trade forex, precious metals, stocks, and cryptocurrencies through the Meta Trader 5 platform.

The broker focuses on personal customer service. They say they mix clear business practices with new technology, but the lack of rule-watching raises big questions about keeping traders safe and protecting their money.

Bridge Markets targets skilled traders who want different trading choices. However, being unregulated means people need to think carefully about risks before choosing this broker.

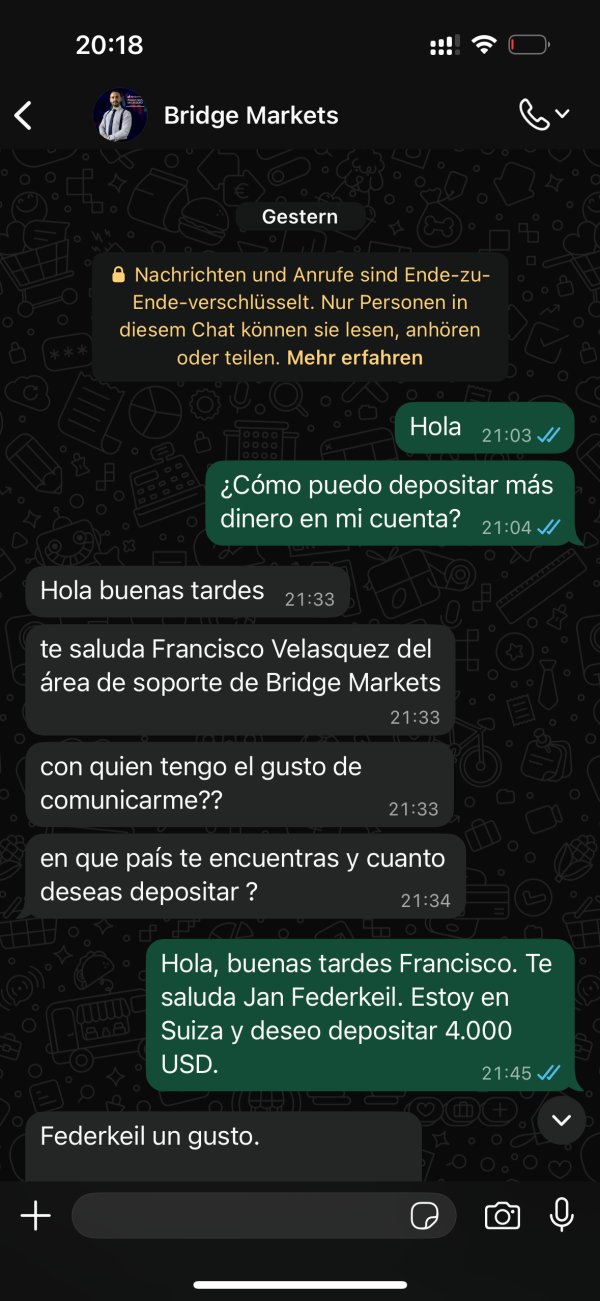

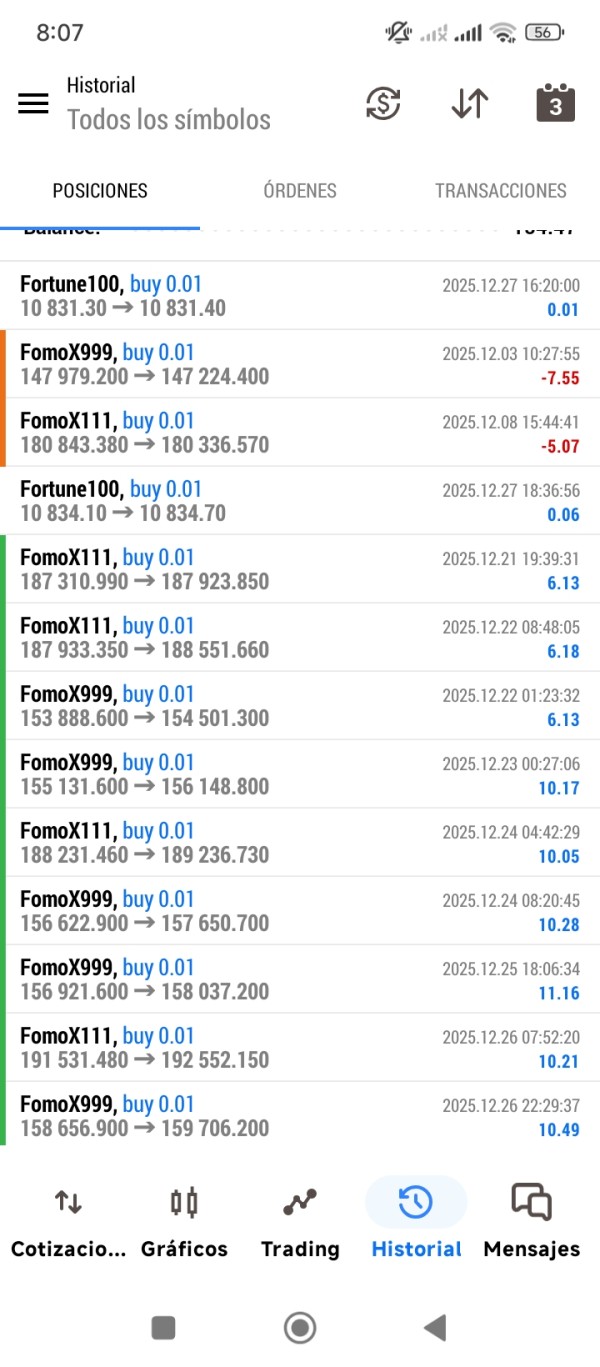

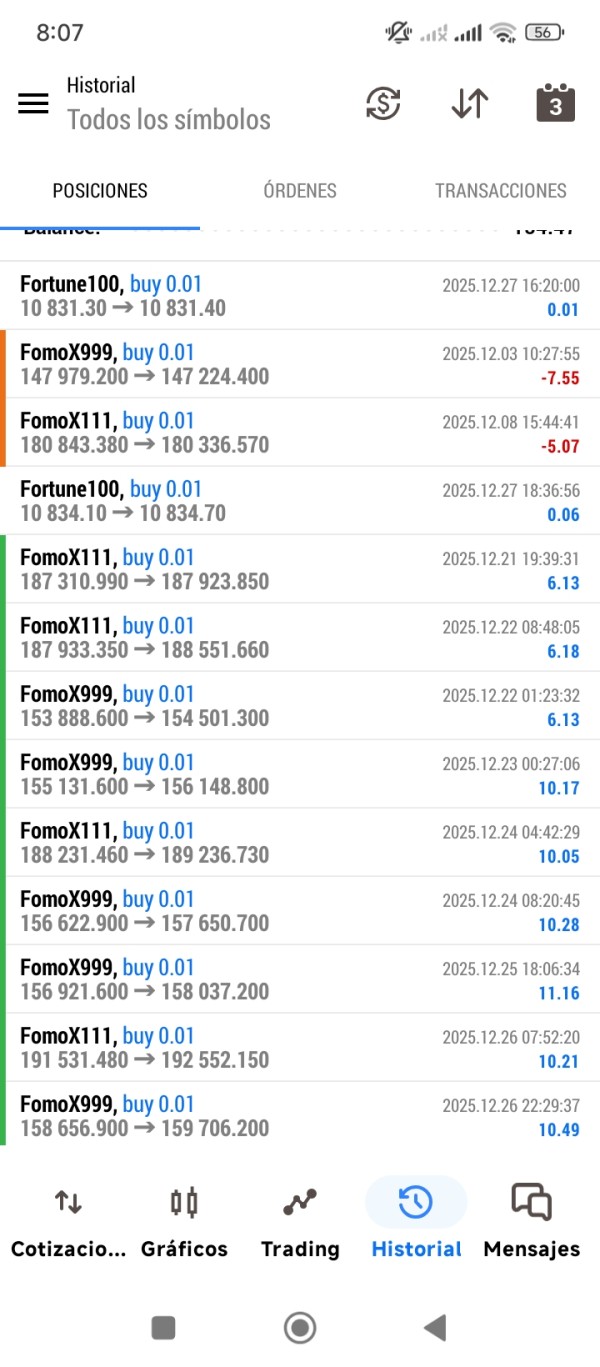

User reviews show mixed results. Some people had good experiences, but others worry about possible fake activities happening on the platform.

The platform focuses on smart market analysis and fast trade completion. This appeals to traders who think strategically, but not having clear rules remains a big worry for people who care about risk.

This bridge markets review uses information anyone can find and feedback from users. We did not actually test trading on the platform for this review.

Important Notice

Regional Entity Differences: Bridge Markets works without rule oversight, which may create different legal problems in various countries. Traders should know that no rule supervision means less protection under financial services rules that usually control licensed brokers.

Review Methodology: This review comes from public information, user stories, and official company messages. We did not actually test trading or try the platform hands-on for this review, so readers should do their own research before making trading choices.

Rating Framework

Broker Overview

Bridge Markets LTD says it gives complete financial solutions focused on the trading market world. The company talks about mixing clear business practices, new technology, and expert team help to make confident and exact trading experiences possible.

Their business plan centers on giving access to world financial markets through one platform approach. Bridge Markets claims to offer smart market analysis, fast trade completion, and community support for financial growth, and the company targets what it calls "high-level trading for strategic minds."

The platform uses the Meta Trader 5 trading system. This gives access to multiple asset types including foreign exchange, precious metals, stock markets, and cryptocurrency trading, but this bridge markets review notes that Bridge Markets works without supervision from known financial authorities.

Regulatory Status: Bridge Markets works without oversight from known financial rule authorities. No specific rule body supervision or licensing information shows up in current papers.

Deposit and Withdrawal Methods: Specific information about available funding methods, processing times, and fees is not detailed in available materials.

Minimum Deposit Requirements: Current papers do not specify minimum account funding levels or initial deposit requirements for account activation. Details about bonus programs, promotional rewards, or special trading conditions are not provided in accessible information sources.

Promotional Offerings: The platform provides access to four main asset categories: foreign exchange pairs, precious metals, equity securities, and digital cryptocurrencies.

Tradeable Assets: Specific information about spreads, commission structures, overnight financing rates, and other trading costs is not clearly outlined in available papers. This requires direct inquiry for accurate pricing details.

Cost Structure: Maximum leverage offerings and margin requirements are not specified in current informational materials.

Leverage Ratios: Bridge Markets uses Meta Trader 5 as its main trading platform, giving users established trading technology and analytical tools.

Platform Options: Information about restricted areas or regional trading limitations is not detailed in available sources.

Geographic Restrictions: Specific language support options for customer service are not outlined in accessible papers. However, this bridge markets review notes the emphasis on personal service approaches.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

Bridge Markets mentions offering four different account types, though specific details about each level's features, benefits, and requirements remain unclear in available papers. The absence of clear information about minimum deposit amounts makes it difficult for potential traders to judge accessibility and suitability for their investment capacity.

Account opening procedures and verification requirements are not clearly detailed. This creates uncertainty about onboarding timelines and documentation needs, and the lack of clear information about special account features, such as Islamic accounts, VIP services, or institutional offerings, limits traders' ability to evaluate whether the broker meets specific trading requirements.

User feedback about account conditions appears limited. Mixed responses about overall service quality show up in reviews, and the absence of detailed account specifications in this bridge markets review reflects the general lack of transparency in the broker's public communications about trading conditions and account structures.

Compared to regulated brokers that typically provide comprehensive account information, Bridge Markets' limited disclosure about account types and conditions represents a significant information gap. Potential traders should consider this when evaluating broker options.

Bridge Markets provides access to the Meta Trader 5 platform, which offers comprehensive trading tools, technical analysis capabilities, and automated trading support. The platform's established reputation and feature set provide traders with familiar functionality and advanced charting capabilities for market analysis and trade execution.

The broker claims to offer real-time market analysis. However, specific details about research quality, frequency, and analytical depth are not clearly outlined in available materials, and the emphasis on smart market analysis suggests investment in research capabilities, but without detailed information about analyst credentials or research methods.

Educational resources and trader development programs are not specifically mentioned in current papers. This may limit support for traders seeking to enhance their market knowledge and trading skills, and the absence of clear information about webinars, tutorials, or educational content represents a potential gap in trader support services.

Automated trading support through Meta Trader 5 provides algorithmic trading capabilities. However, specific information about expert advisor policies, VPS services, or automated trading restrictions is not detailed in available materials.

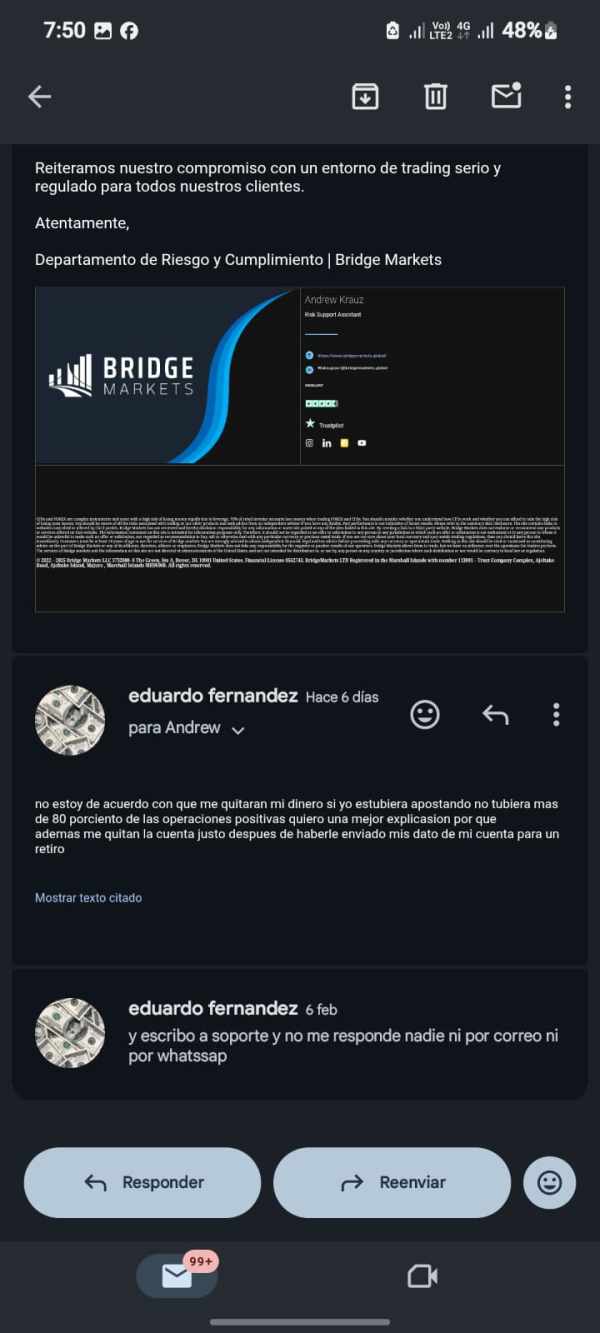

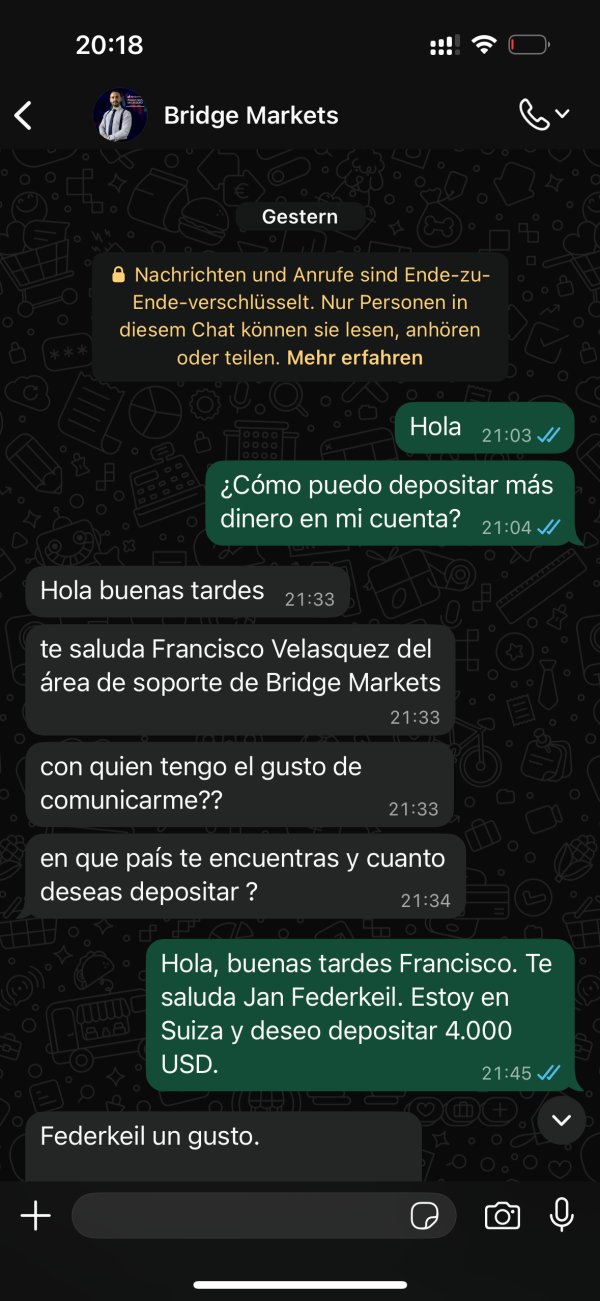

Customer Service and Support Analysis (6/10)

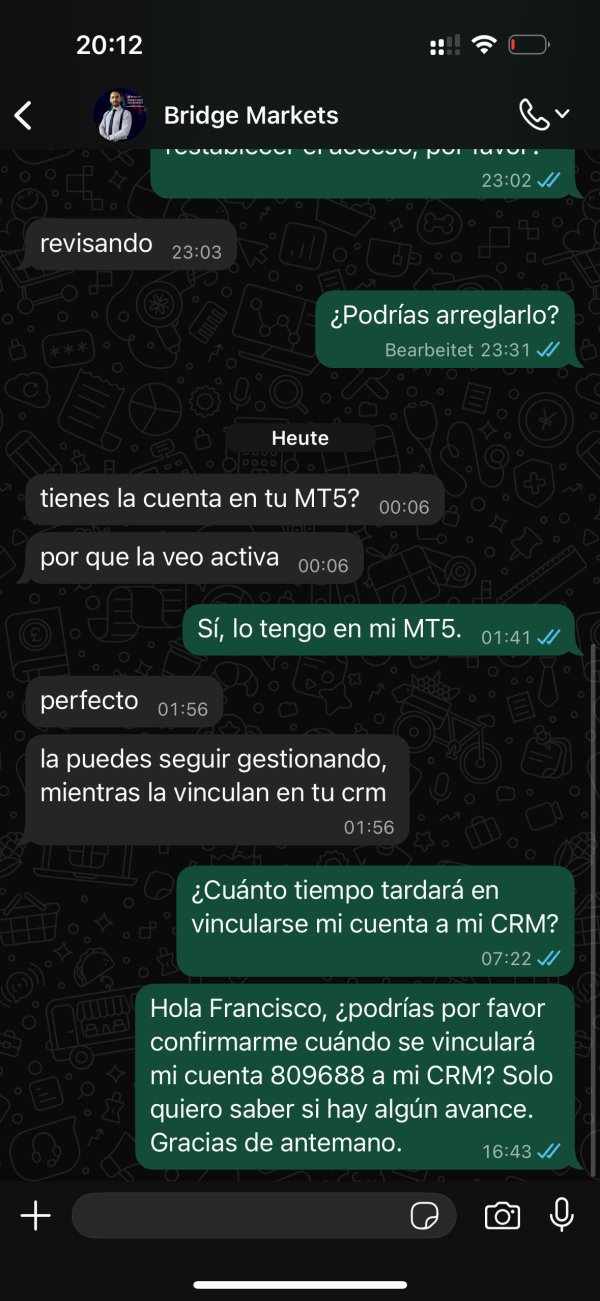

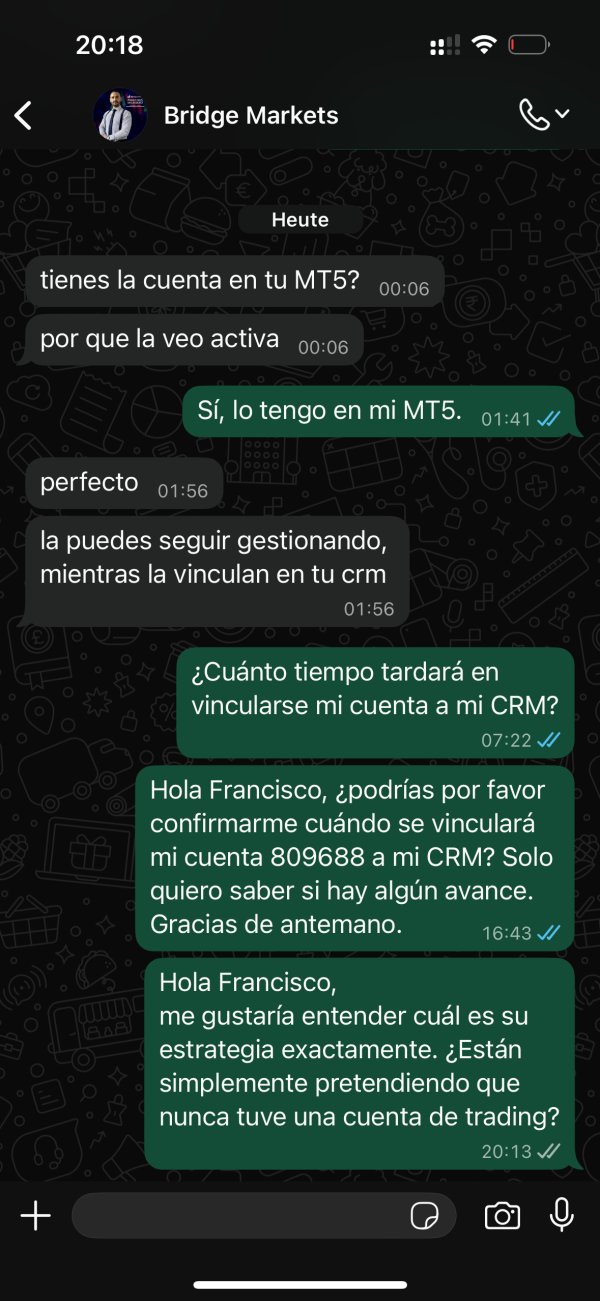

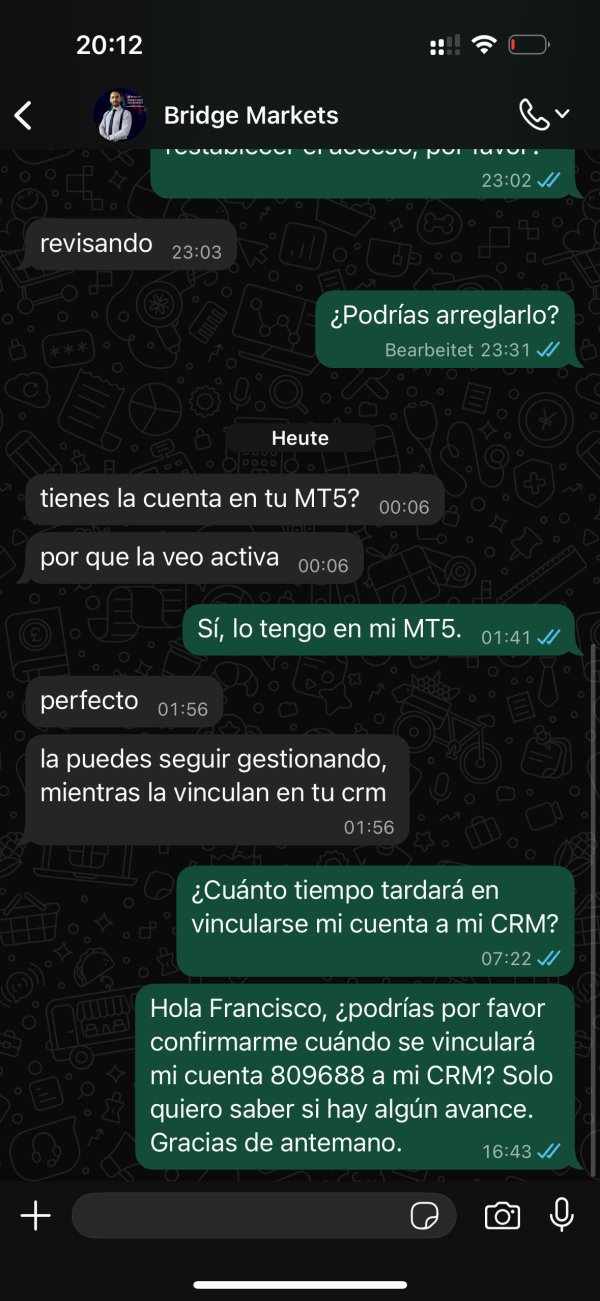

Bridge Markets emphasizes personal customer service as a key difference, though specific details about support channels, availability, and response times are not clearly outlined in accessible papers. The company mentions wanting to chat via Skype, suggesting at least some direct communication options for users.

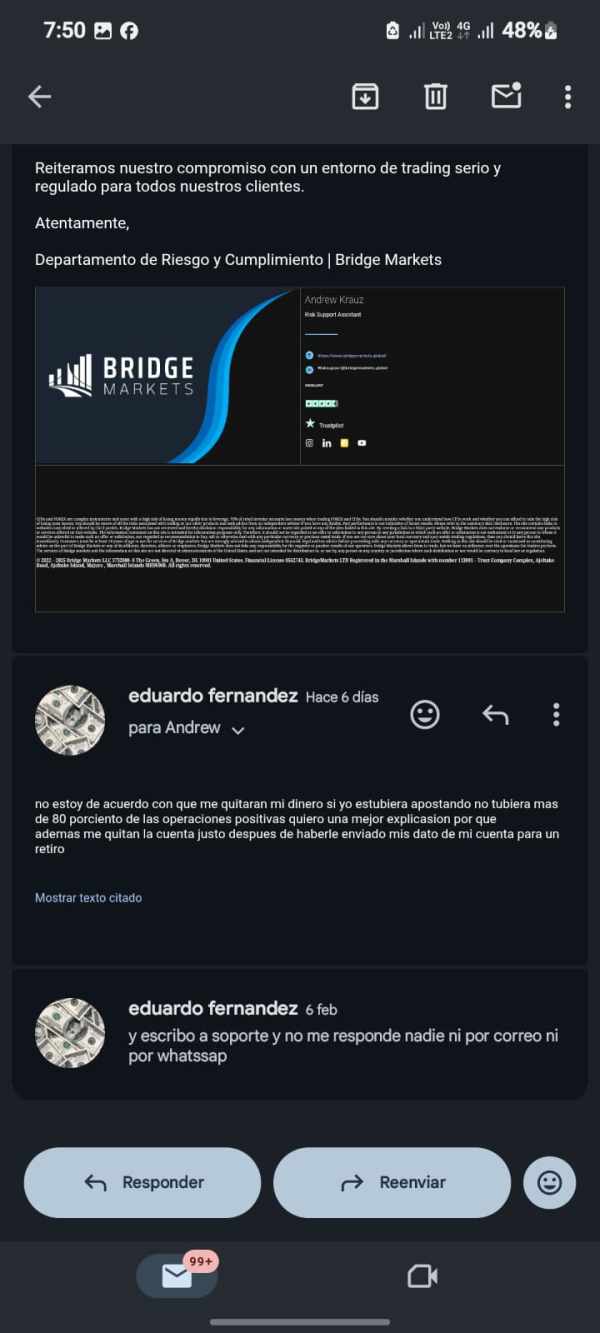

User feedback about service quality presents mixed views. Some positive experiences balance against concerns about service reliability and responsiveness, and the variability in user experiences suggests inconsistent service delivery that may depend on individual circumstances or timing.

Response time commitments and service level agreements are not specified in available materials. This makes it difficult to assess expected support quality and availability, and the absence of clear information about escalation procedures or complaint resolution processes represents a transparency gap in customer service operations.

Multi-language support capabilities and customer service hours are not detailed in current papers. However, the international nature of forex trading typically requires comprehensive language support and extended service availability for global trader bases.

Trading Experience Analysis (5/10)

Platform stability and execution speed feedback from users is limited in available sources, making it difficult to assess actual trading performance and system reliability. The use of Meta Trader 5 provides established platform technology, though server performance and execution quality depend on broker-specific infrastructure implementation.

Order execution quality, including information about slippage rates, requote frequency, and rejection rates, is not specifically addressed in available papers. These execution metrics are crucial for trader evaluation but remain unclear in current materials about Bridge Markets' trading environment.

Platform functionality completeness through Meta Trader 5 provides standard trading capabilities. However, broker-specific customizations, additional tools, or platform enhancements are not detailed in accessible information sources.

Mobile trading experience and application availability are not specifically mentioned in current papers. Meta Trader 5 typically includes mobile platform access, but broker-specific mobile features or optimizations remain unclear in this bridge markets review assessment.

User feedback about overall trading environment presents mixed views. Some positive experiences balance against concerns about platform reliability and execution quality, suggesting variable performance that may depend on market conditions or individual trading patterns.

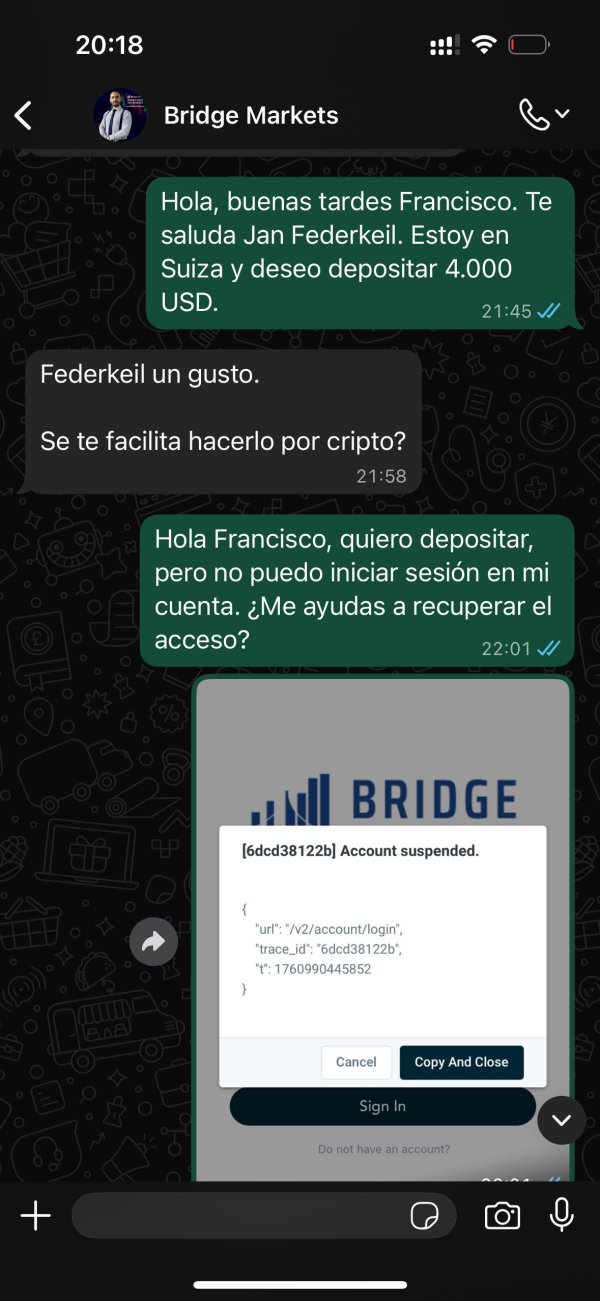

Trust and Security Analysis (3/10)

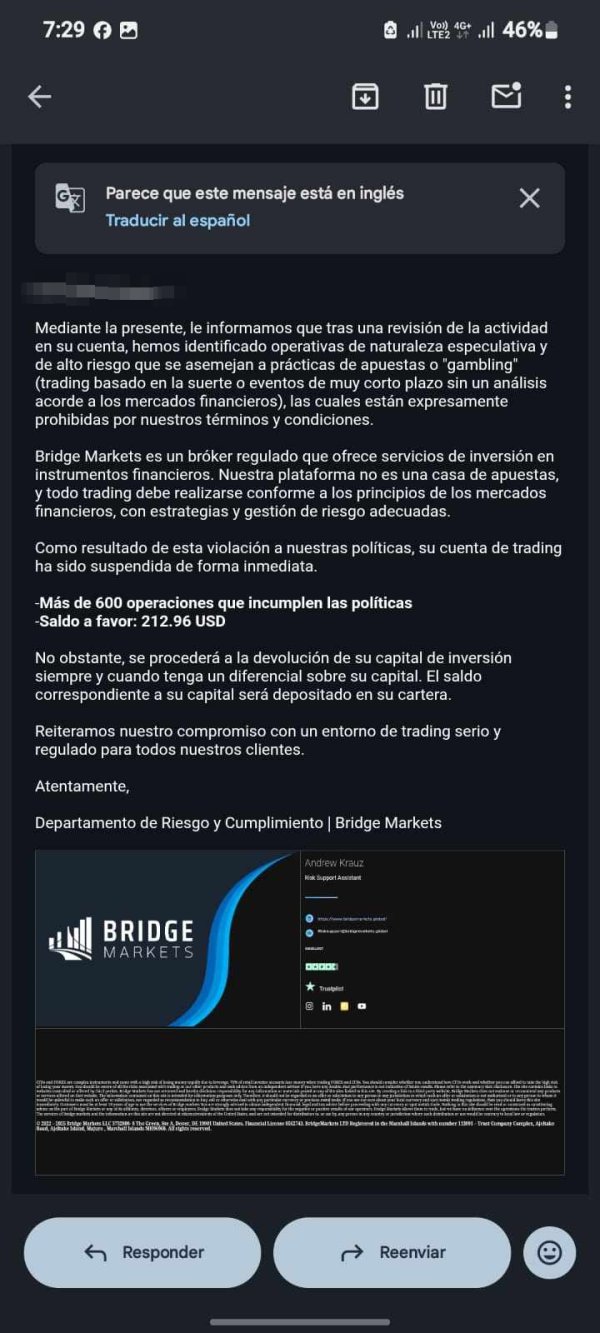

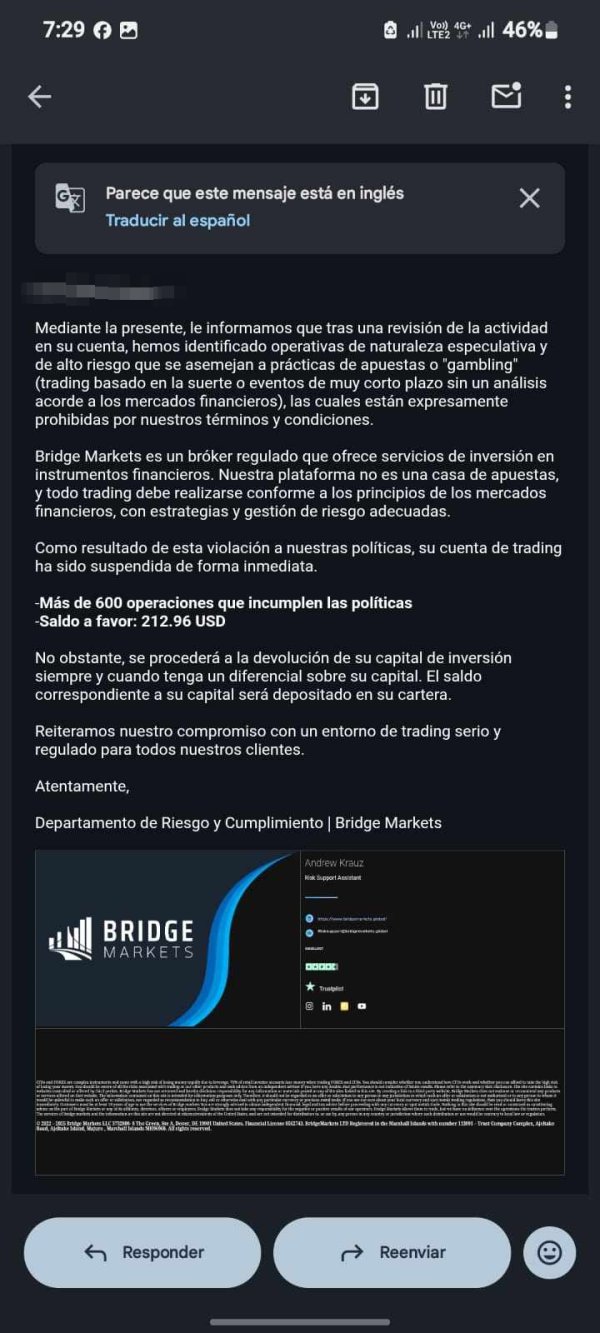

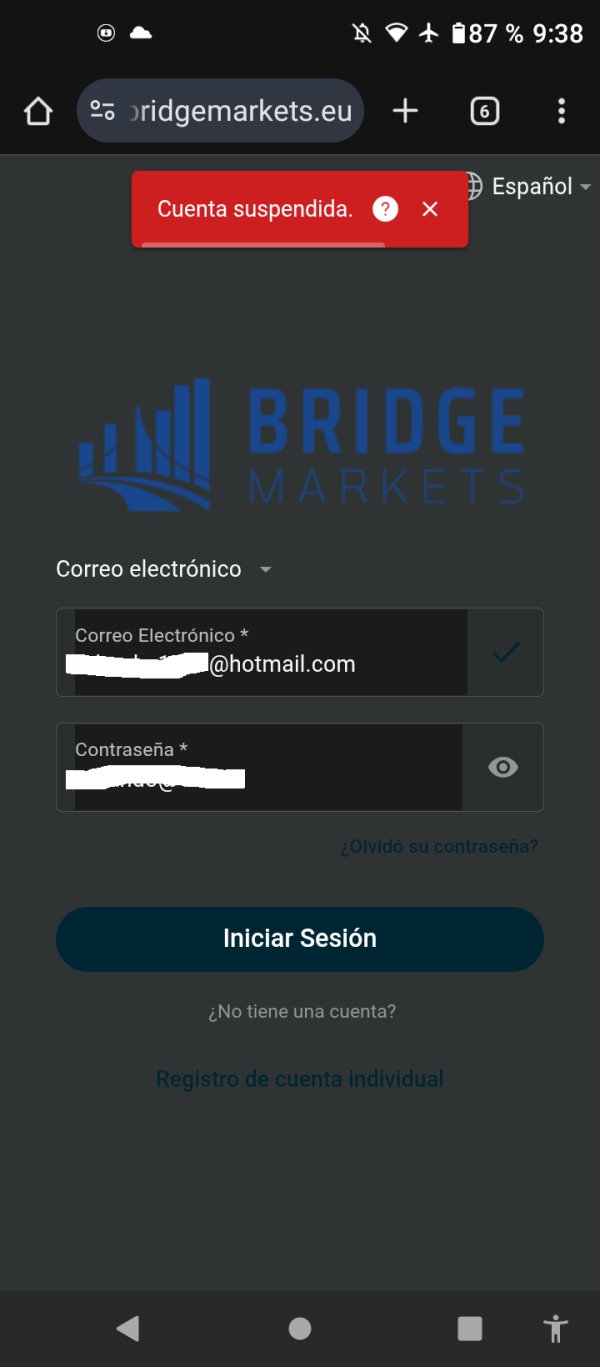

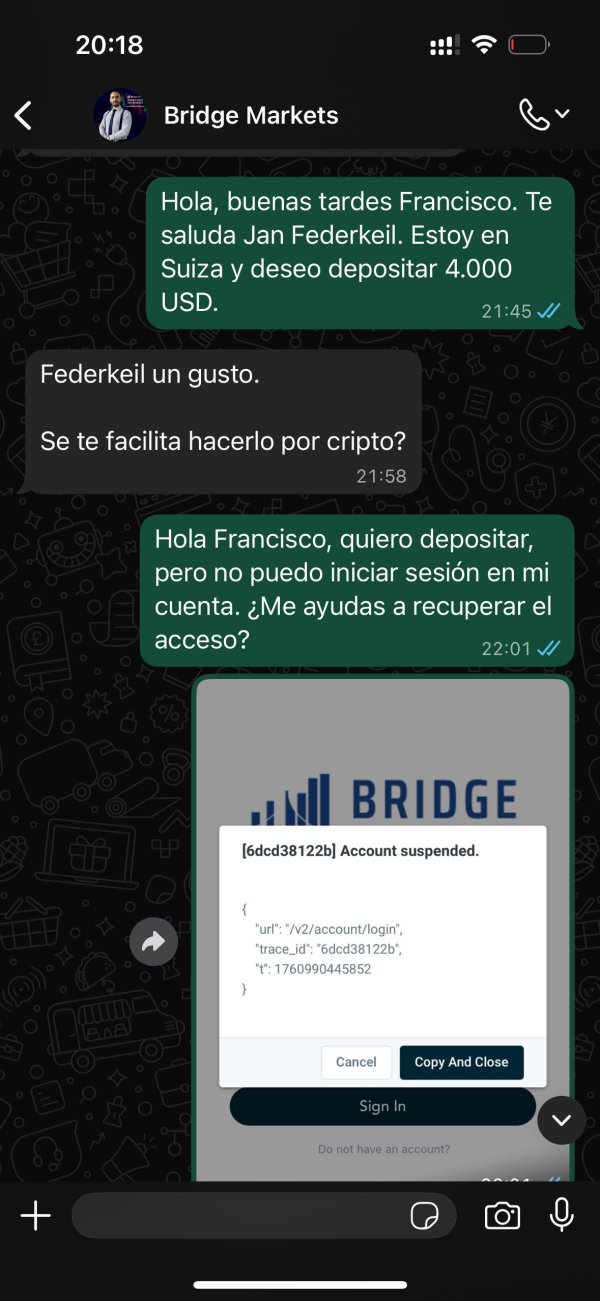

The most significant concern in this evaluation is Bridge Markets' unregulated status, operating without supervision from known financial rule authorities. This absence of regulatory oversight means reduced trader protection, no compensation schemes, and limited recourse options in case of disputes or operational issues.

Fund security measures, including segregated accounts, deposit insurance, or third-party custody arrangements, are not detailed in available papers. The lack of clear information about client fund protection represents a significant transparency gap that affects trust assessment.

Company transparency about ownership, financial statements, operational history, and business practices is limited in publicly accessible information. This opacity makes it difficult to assess company stability, financial strength, and long-term viability as a trading partner.

Industry reputation appears affected by user reports suggesting potential fake concerns. However, the extent and validity of these claims require careful evaluation, and negative user feedback about trustworthiness creates additional concerns about the broker's reliability and operational integrity.

The absence of third-party audits, regulatory reporting, or independent verification of business practices further compounds trust concerns. These mechanisms typically provide validation of broker operations and financial stability.

User Experience Analysis (5/10)

Overall user satisfaction presents a mixed picture based on available feedback, with experiences ranging from positive interactions to significant concerns about service quality and reliability. This variability suggests inconsistent user experience delivery that may depend on individual circumstances or operational periods.

Interface design and platform usability benefit from Meta Trader 5's established user experience. However, broker-specific customizations or enhancements are not detailed in available materials, and the platform's familiar interface may appeal to experienced traders while potentially requiring learning curves for newcomers.

Registration and verification processes are not clearly detailed in accessible papers. This creates uncertainty about onboarding complexity and timeline requirements, and clear information about account opening procedures would enhance user experience evaluation capabilities.

Fund operation experiences, including deposit and withdrawal processes, are not specifically addressed in available user feedback. This makes it difficult to assess transaction efficiency and reliability, and these operational aspects significantly impact overall user satisfaction and platform usability.

Common user complaints appear to center on trustworthiness concerns and potential fraud risks. These reflect the broader issues associated with unregulated broker operations, and these concerns significantly impact user confidence and overall experience assessment.

Conclusion

This bridge markets review reveals a broker operating in the challenging position of providing trading services without regulatory supervision. While Bridge Markets offers diverse asset trading through the established Meta Trader 5 platform and emphasizes personal customer service, the fundamental lack of regulatory oversight presents significant risk considerations for potential traders.

The broker may appeal to experienced traders seeking diversified asset access and willing to accept higher risk profiles. However, the absence of regulatory protection means reduced safeguards compared to licensed alternatives, and users considering Bridge Markets should thoroughly understand the implications of trading with an unregulated entity and ensure their risk tolerance aligns with this operational structure.

The primary advantages include multi-asset trading opportunities and established platform technology. The main disadvantages center on regulatory absence and mixed user feedback about trustworthiness, and potential traders should prioritize comprehensive due diligence and consider regulated alternatives before making platform decisions.