leobor Review 11

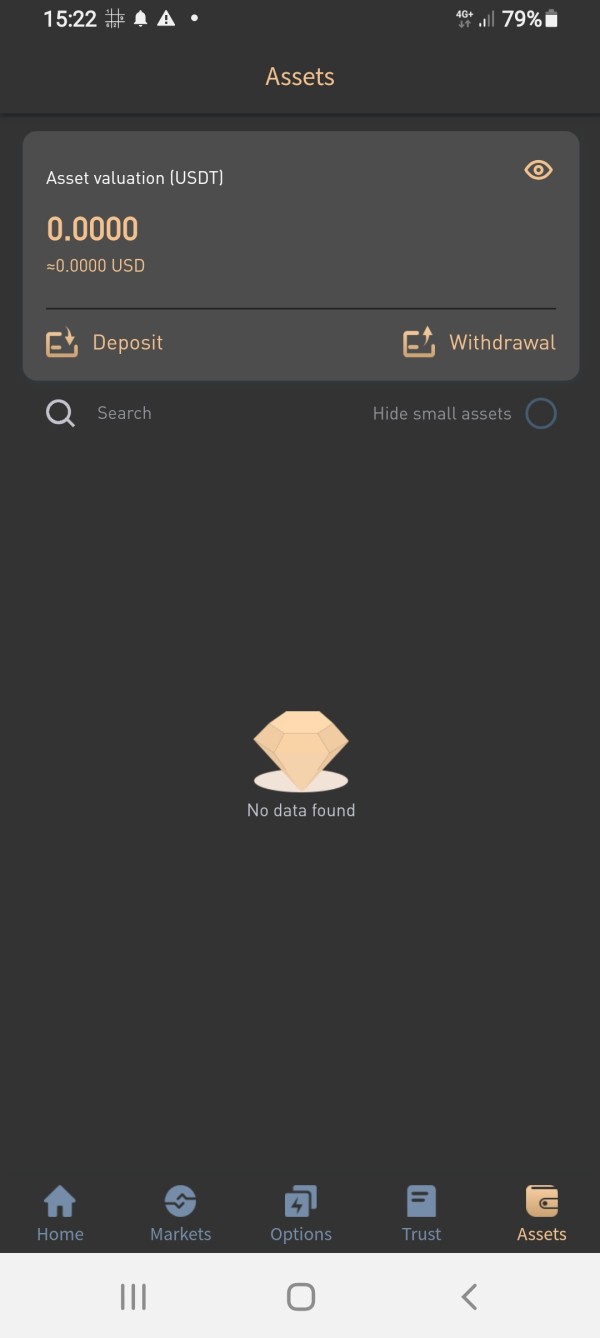

they closed my count I can't find anything

please help me how I can retrieve my money again

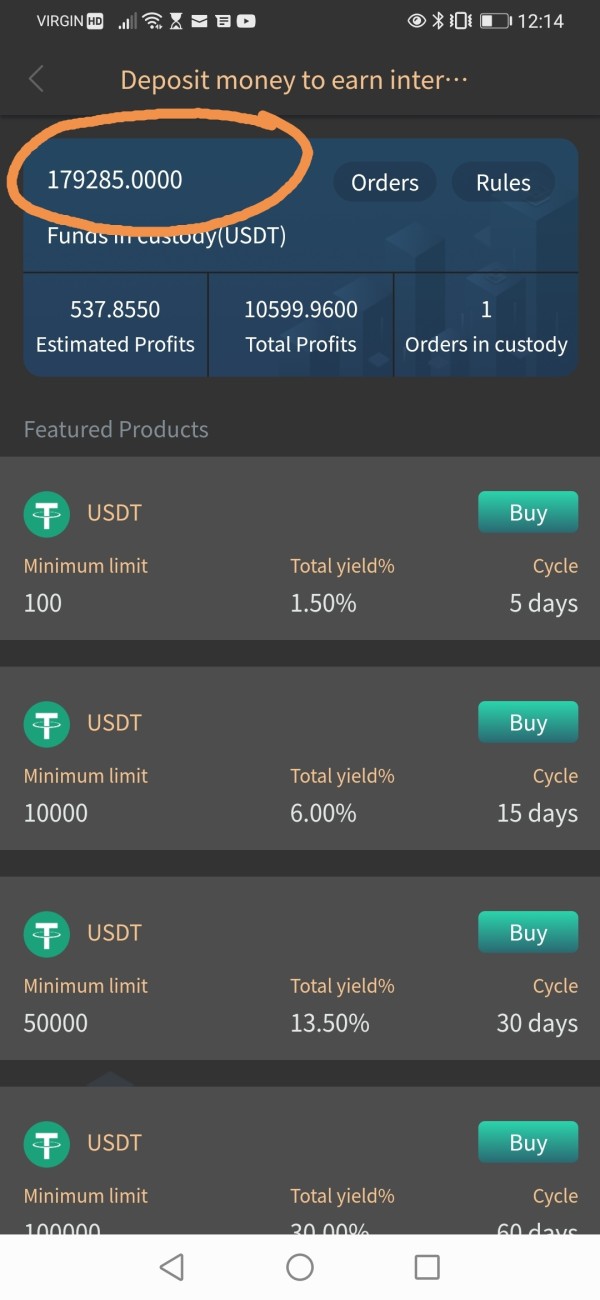

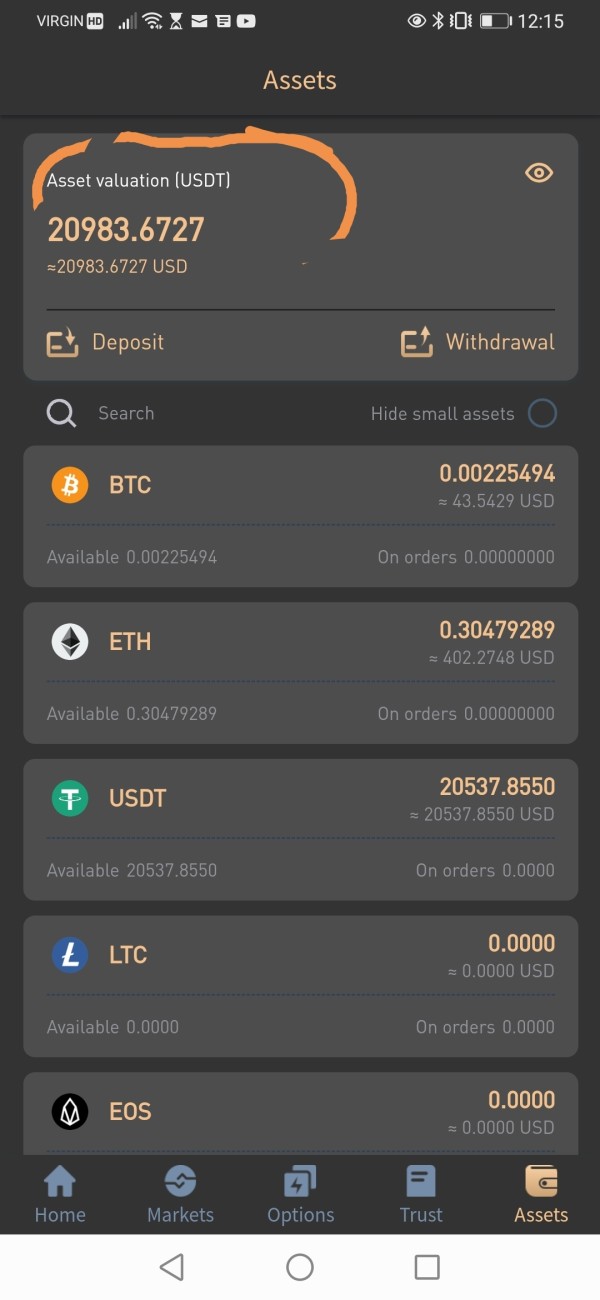

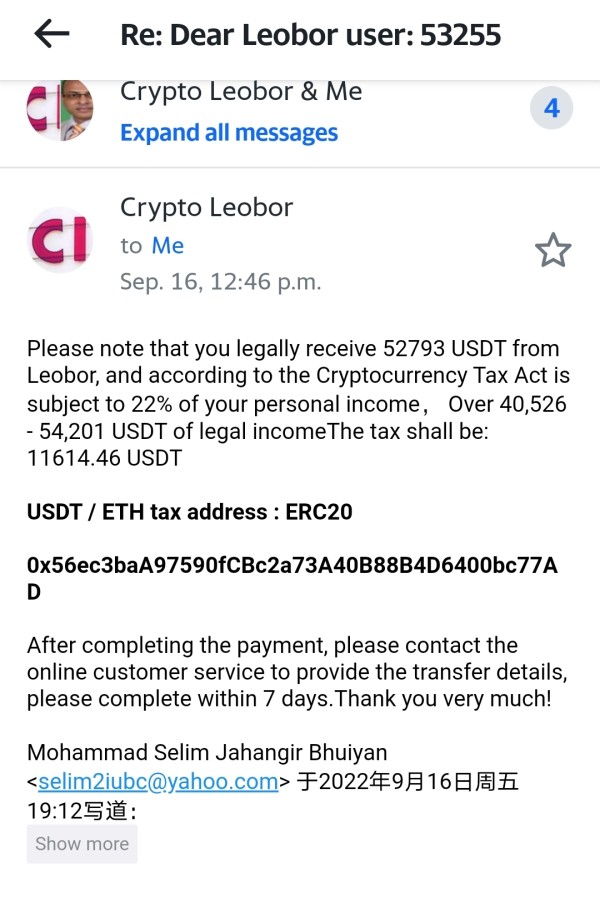

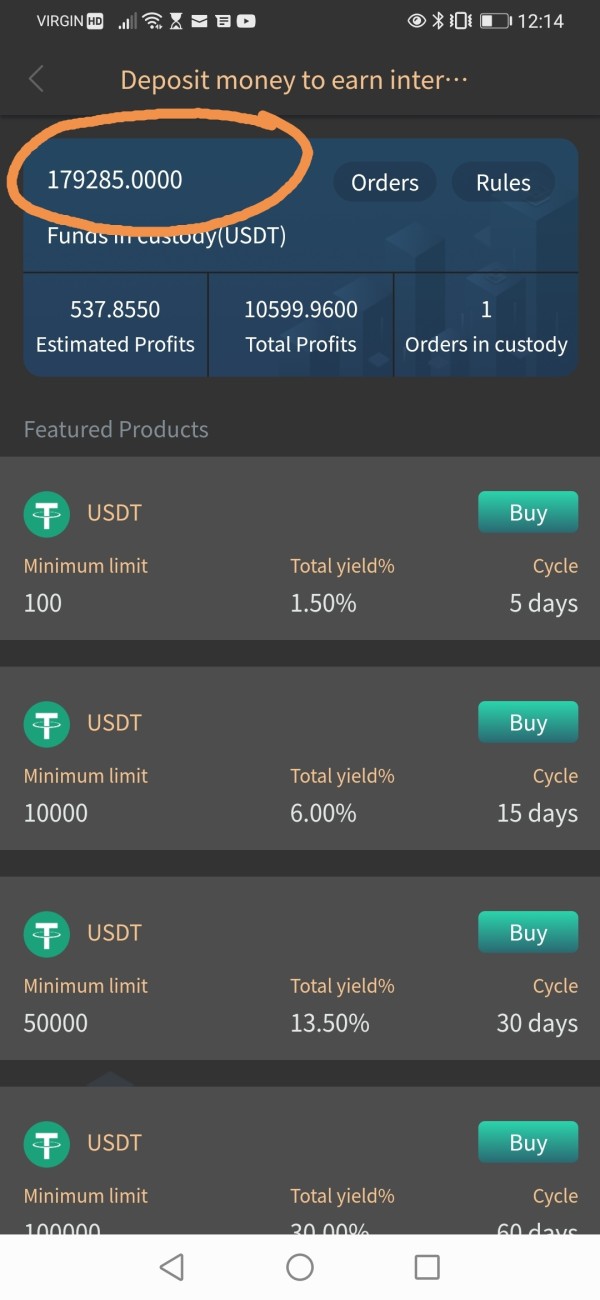

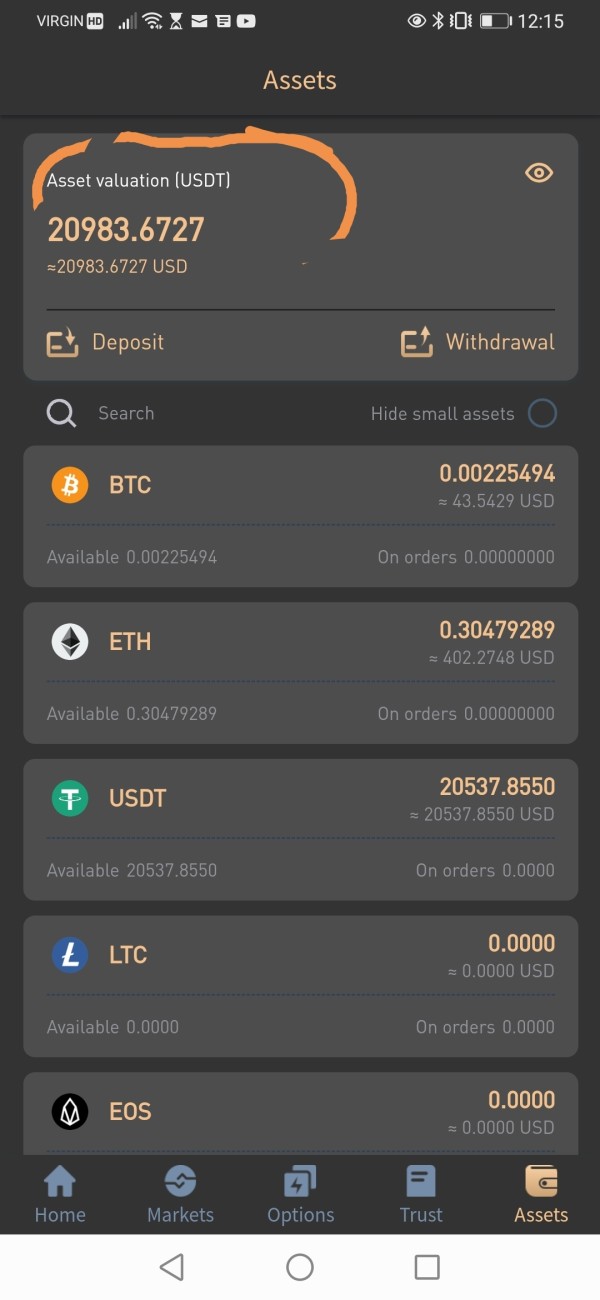

Dear Sir, I am writing to this email as a victim of the situation. Due to COVID 19 I lost my business, besides I borrowed huge loans from friends and banks. I am trying to overcome this situation and pay off my loan as early as possible. One of my friend introduced his friend to start online trading. I listen to her. I started a business and she taught me how to trade and all the business staff. First few days my investment was almost double and she told me to take money and deposit it in my bank and lead a regular lifestyle. She plans for me to invest more investment and pay off my loan. I listen to her and trust her. So she advised me to borrow a 100K loan from Leobor. Please note that all business trades I did with Leobor only. She told me the same day you can repay the loan and keep my profit to pay off the loan. When I tried to repay the loan then they said (Leobor) I have to pay from a different loan other than Leobor account. Otherwise I can’t operate (withdraw any funds) my account. I borrowed money from a lending company which has a very high interest rate for 15 days and I paid a 100K loan to Leobor. They said now I can withdraw money from my account. When I tried to withdraw, they rejected me as I have not paid taxes to the IRS. They sent me a crypto address {USDT / ETH tax address : ERC20; 0x56ec3baA97590fCBc2a73A4B88B4D6400bc7} to pay the tax to the IRS. They threatened that the IRS will arrest me within 7 days if I don't pay the tax. I communicated with the IRS and they said it's a scam and advised me not to pay.

I sent a complaint against the company, Leobor, from 11/18/2022, and there has been no response yet, and today the company blocked my account. Please help, I suffer from debt Because of dealing with Leobor. Please help me. I'm feeling down

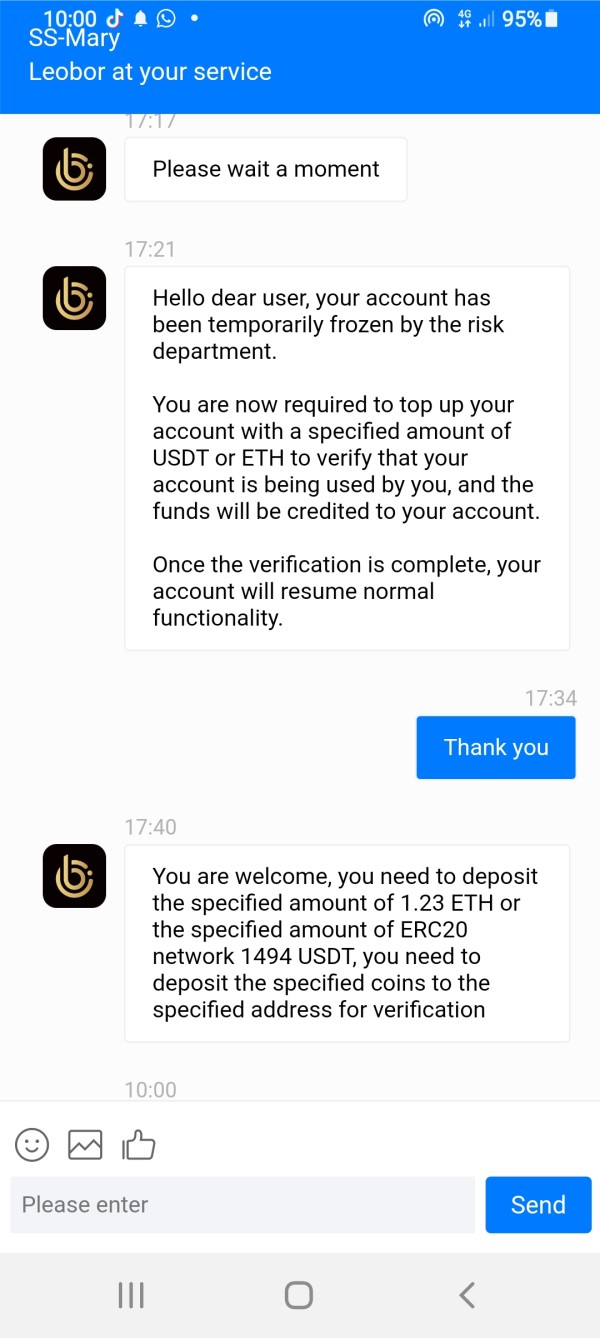

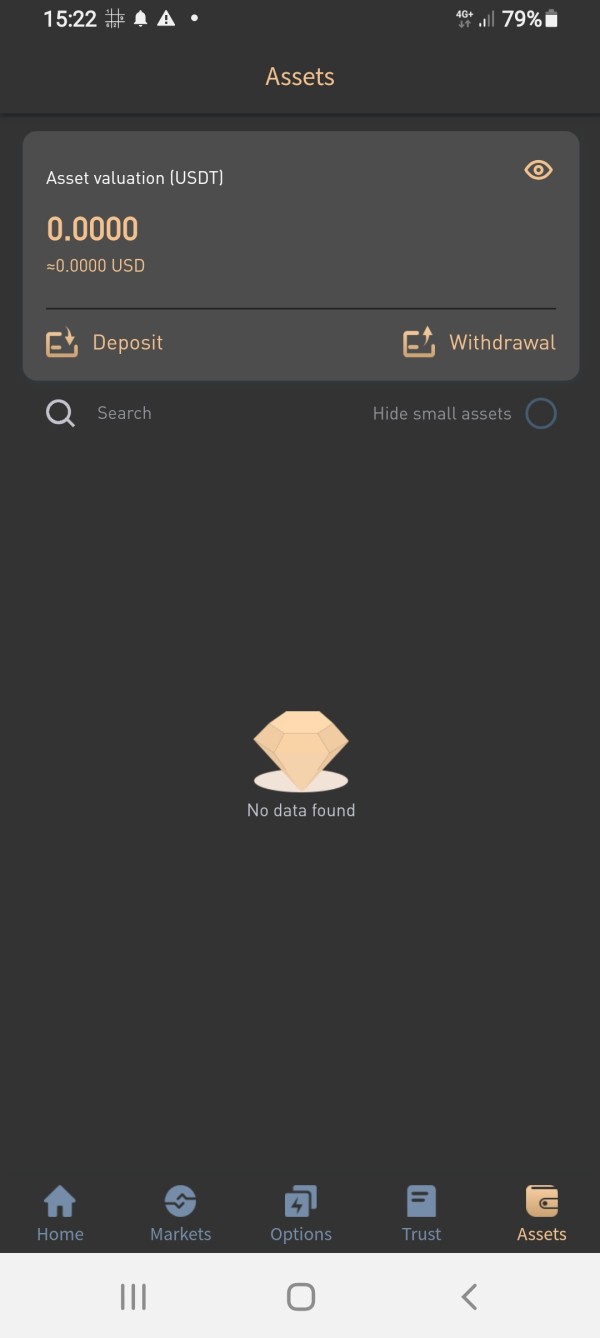

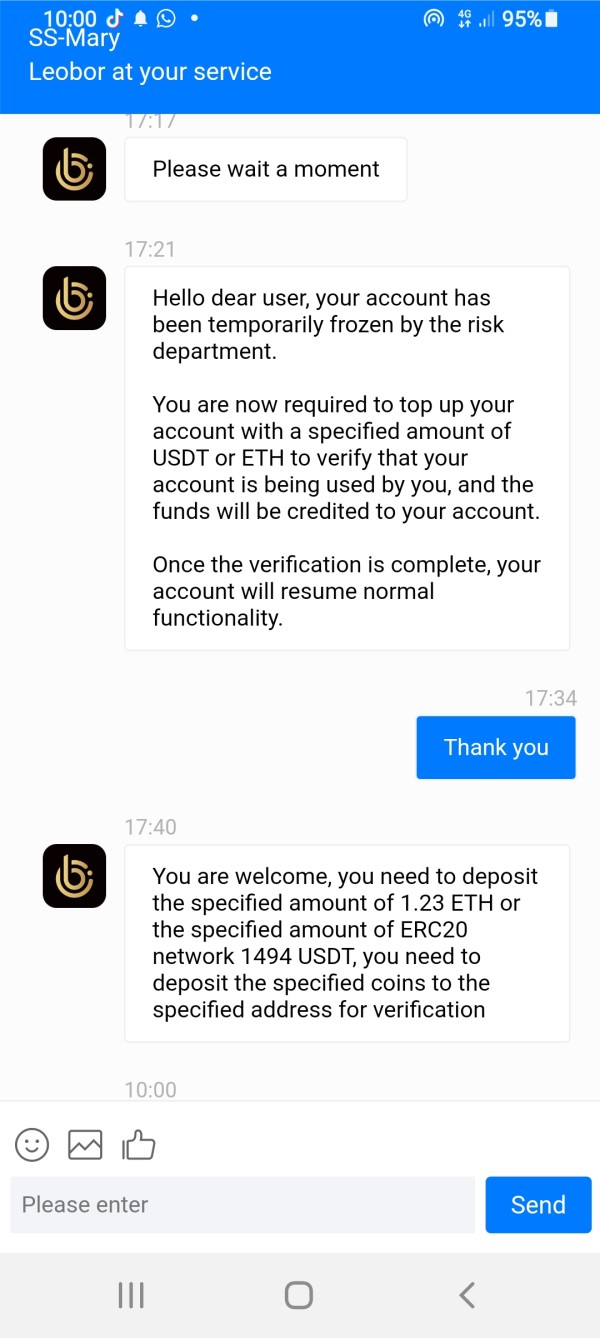

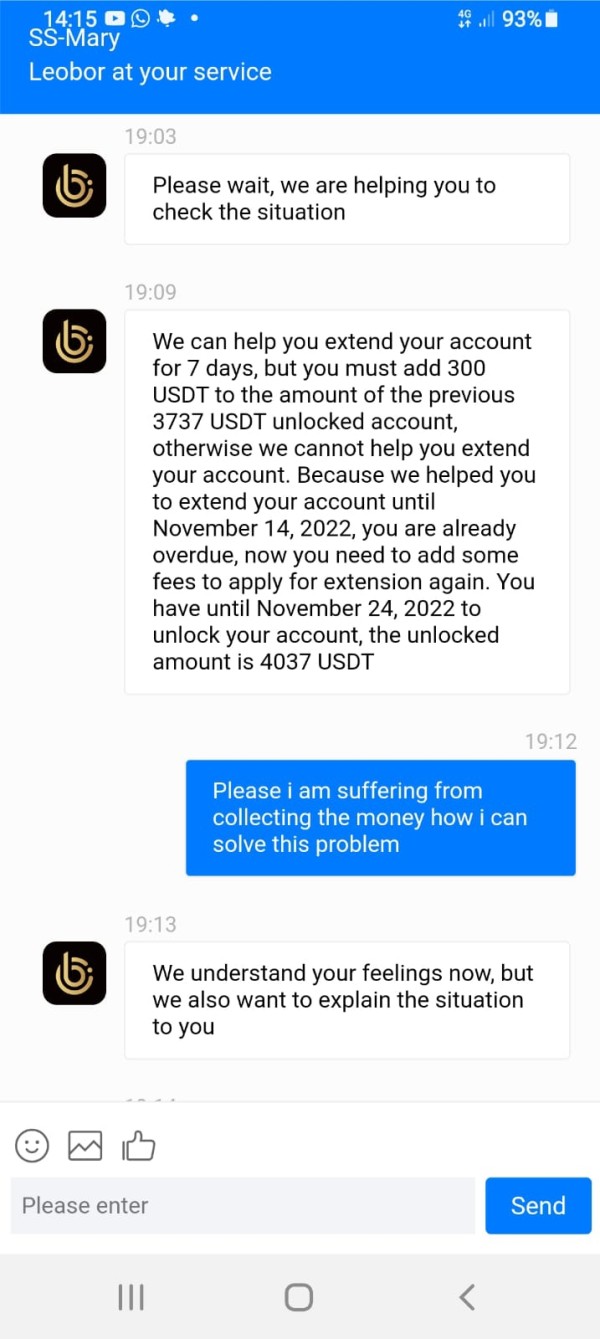

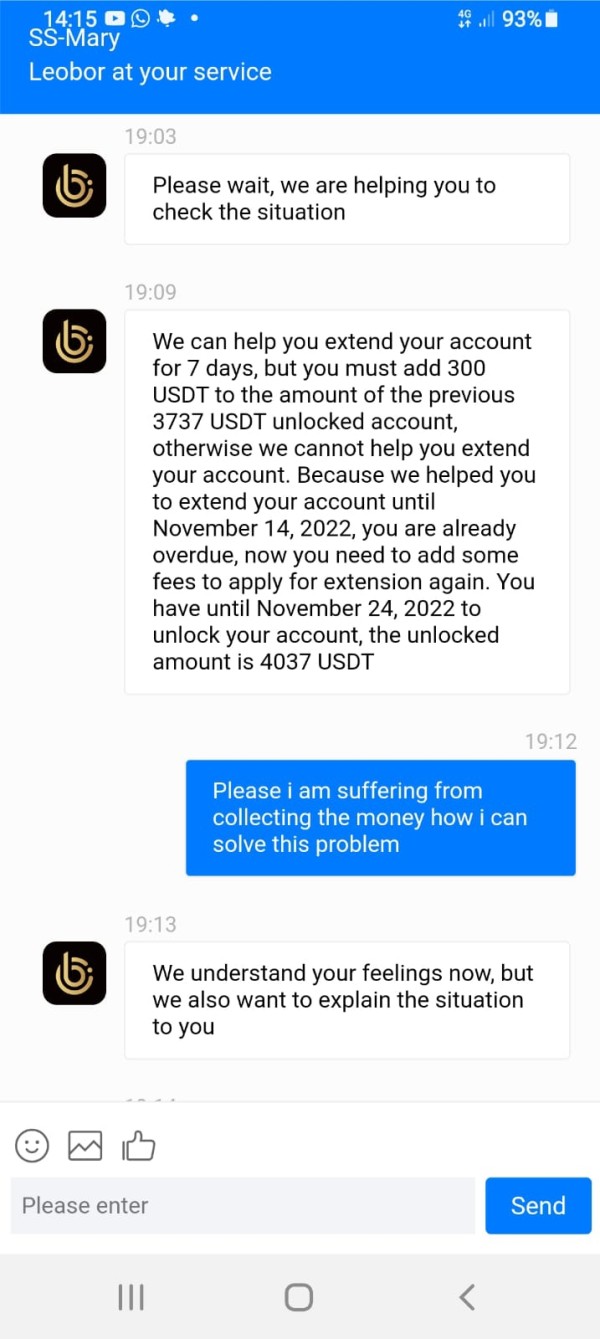

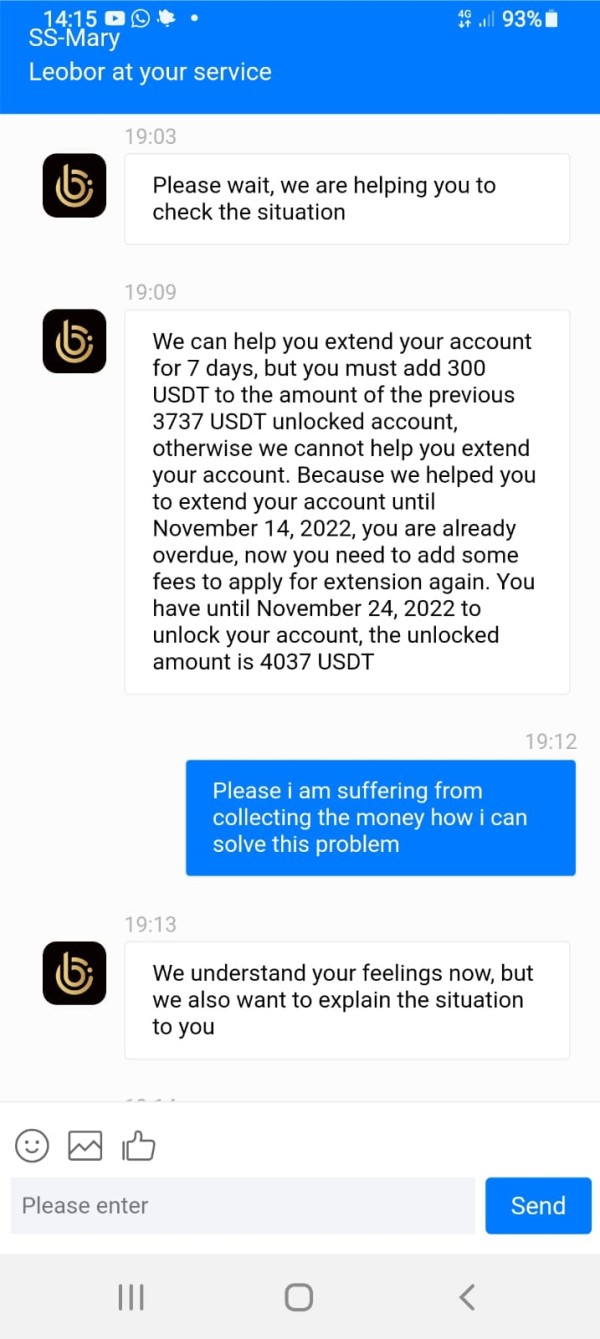

I am khalil safwat from Egypt work in Romania I started investing in leobor forex global company from short time and i gained money till my account becam 51551$ I started to withdrawal some money but I find message please pay 10202$ as taxes for my income I borrowed this money from my friends and paid it and I started to ask for when I can withdrawal money from my account I received message you'll account in looked and I have to pay 3737$ I don't know why it looked and from the taxes money I told the customer service I don't have any more mony but they said to my it's your problem and if you refuse to pay the money your account will close forever and I will lose all my money Yesterday I coated with leobor customer service they extended the time to pay for 7 days but ask for 300$ more now they need me to pay 4037$ to activate my account Please help me to solve this problem because I don't have more money I am a father of two sons one of them study engineering and the second one will start studying medicine I need money to them I started investing to gain money to help my family I swear in God i have no more mony to pay for activate my account Please help me as you can Thank you God bless you

I just want someone to help me to recover my account and to pay any amount he takes plus an extra percentage, and if I can't find someone to help me in the solution, I just want to get back the money I borrowed and go back to my normal life without debts thank you

I can you help me money

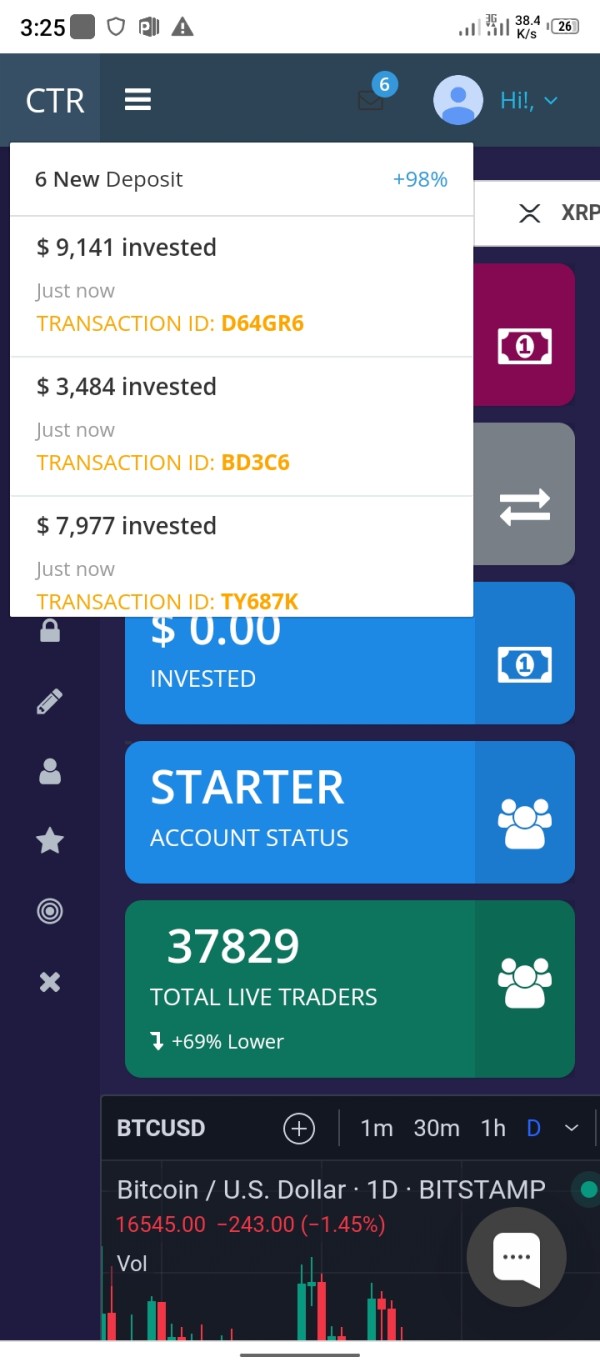

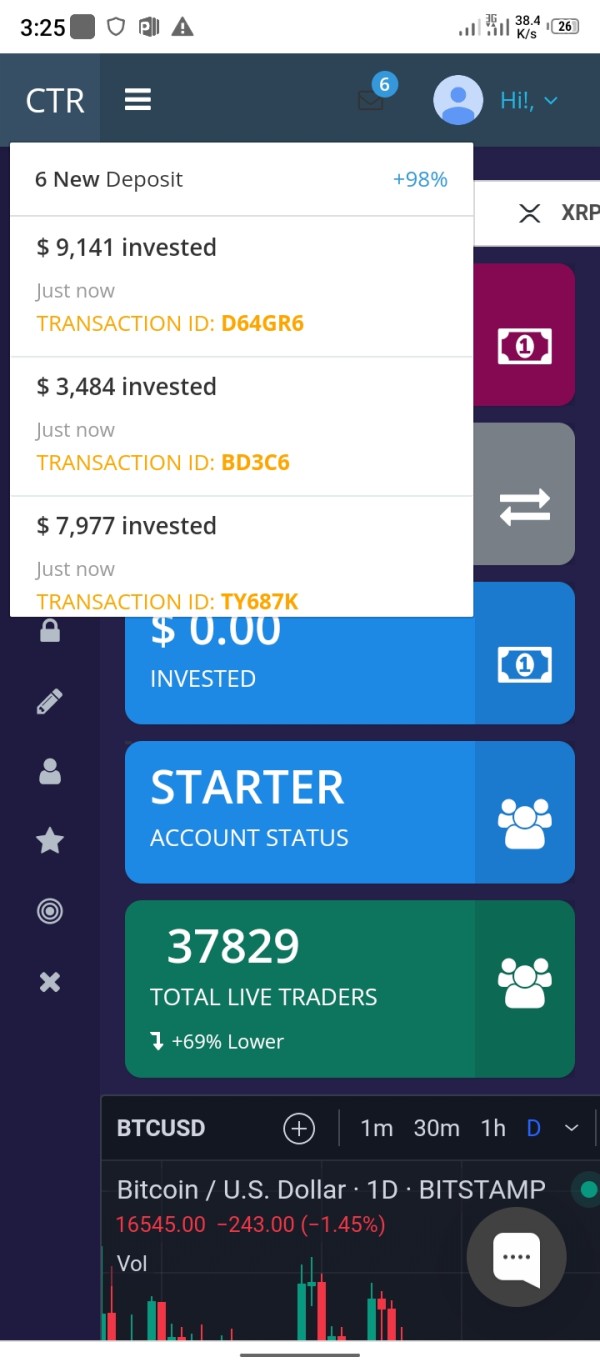

Return of Assets and Investigation of Potential Class Action for Assetsclaimback Online Trading Platform shows that 85% of investment platform are scams Leobor have. scammed investors of over 2.2million dollars them since beginning of 2022. I personally lost 76,000$ and we won’t stop until justice is prevail