Max Market FX Ltd 2025 Review: Everything You Need to Know

Summary

This max market fx ltd review presents a comprehensive analysis of a broker that raises significant concerns for potential traders. Max Market FX Ltd was established in October 2020 and positions itself as a trading platform serving both novice and professional traders with over 120 trading instruments through the MT5 platform. However, our evaluation reveals critical red flags that cannot be overlooked.

The broker operates without reliable regulatory oversight. This immediately places it in the category of high-risk trading platforms. Despite offering a diverse range of trading instruments including forex, commodities, and cryptocurrencies through the popular MetaTrader 5 platform, the absence of proper regulatory compliance severely undermines its credibility. The platform targets global forex markets. However, it lacks the transparency and regulatory backing that serious traders require.

Based on available information and user feedback analysis, Max Market FX Ltd demonstrates characteristics commonly associated with fraudulent brokers. The lack of clear information regarding account conditions, deposit requirements, spreads, and commission structures further compounds these concerns. While the variety of trading instruments might appear attractive to some traders, the fundamental trust issues make this broker unsuitable for any serious trading activities.

Important Notice

This review is based on publicly available information and user feedback collected from various sources. Traders should be aware that broker services and conditions may vary across different regions, though specific regulatory jurisdictions for Max Market FX Ltd have not been clearly identified in available documentation.

Our evaluation methodology incorporates multiple data points including regulatory status, user testimonials, platform features, and industry standards. However, the limited transparency from Max Market FX Ltd regarding its operations and regulatory compliance has constrained our ability to provide comprehensive verification of all claimed services and features.

Rating Framework

Broker Overview

Max Market FX Ltd entered the forex market in October 2020. The company established itself as a UK-headquartered trading platform with global aspirations. The company positions itself as a comprehensive trading solution for both entry-level traders seeking to learn the markets and experienced professionals requiring advanced trading tools. Despite its relatively recent establishment, the broker claims to serve a diverse international client base through its online trading platform.

The broker's business model centers on providing access to global financial markets through a single trading interface. Max Market FX Ltd markets itself as a bridge between retail traders and institutional-grade trading opportunities, though the specifics of its operational structure and business partnerships remain unclear. The company's approach appears to focus on volume-based trading across multiple asset classes rather than specializing in particular market segments.

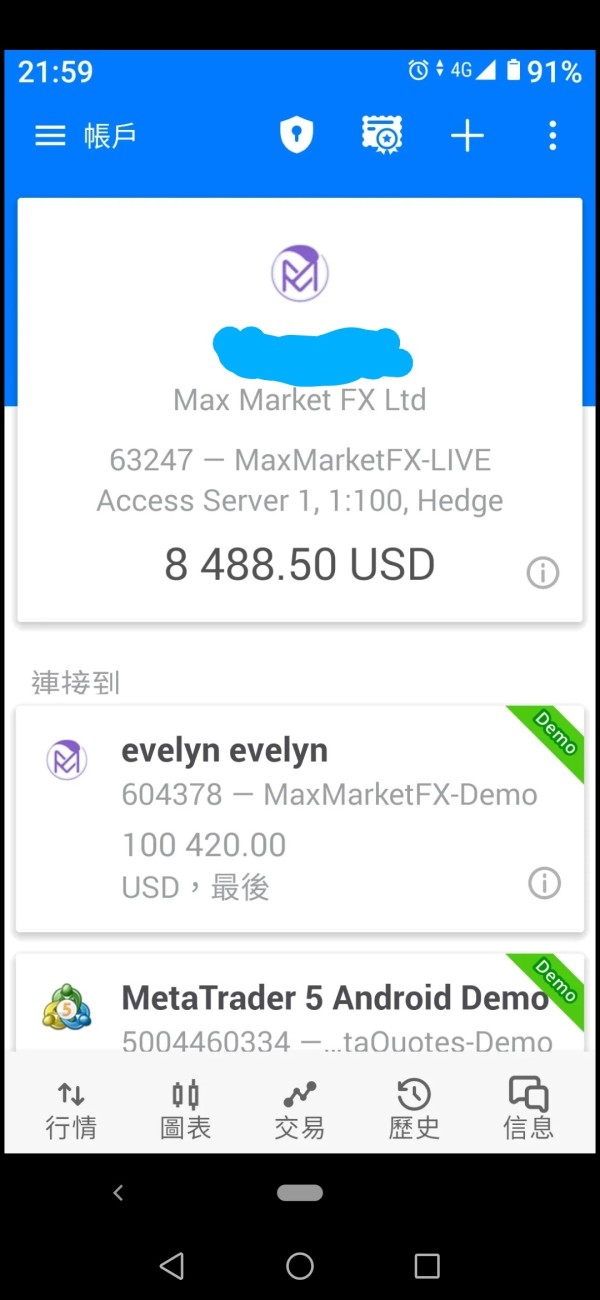

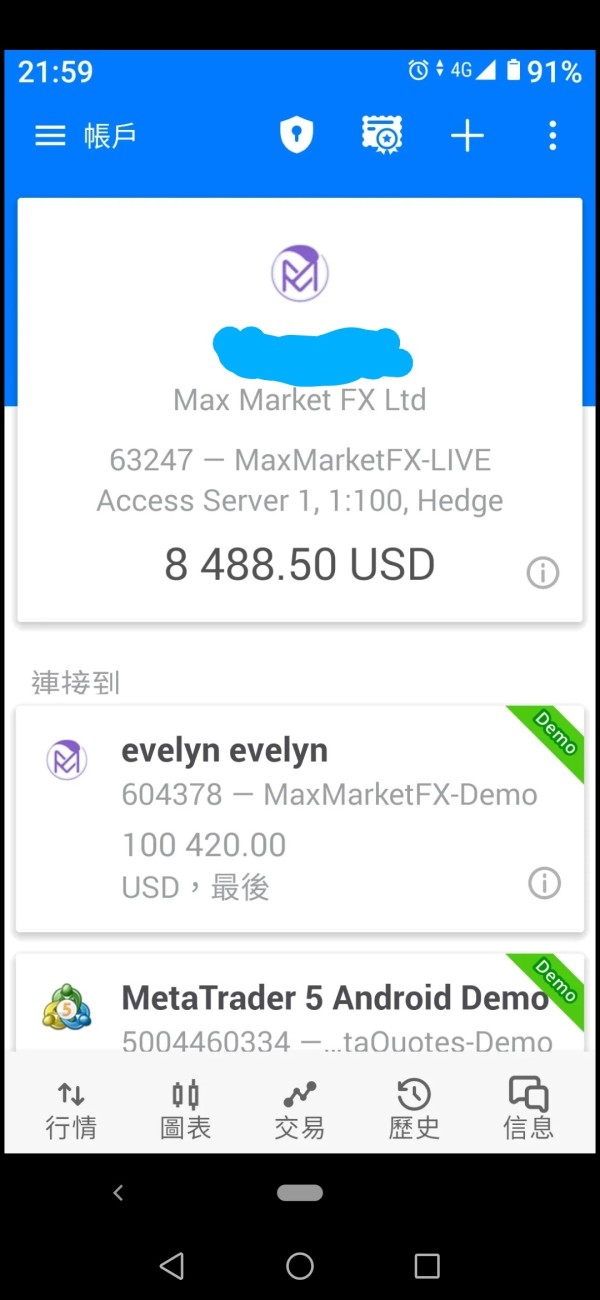

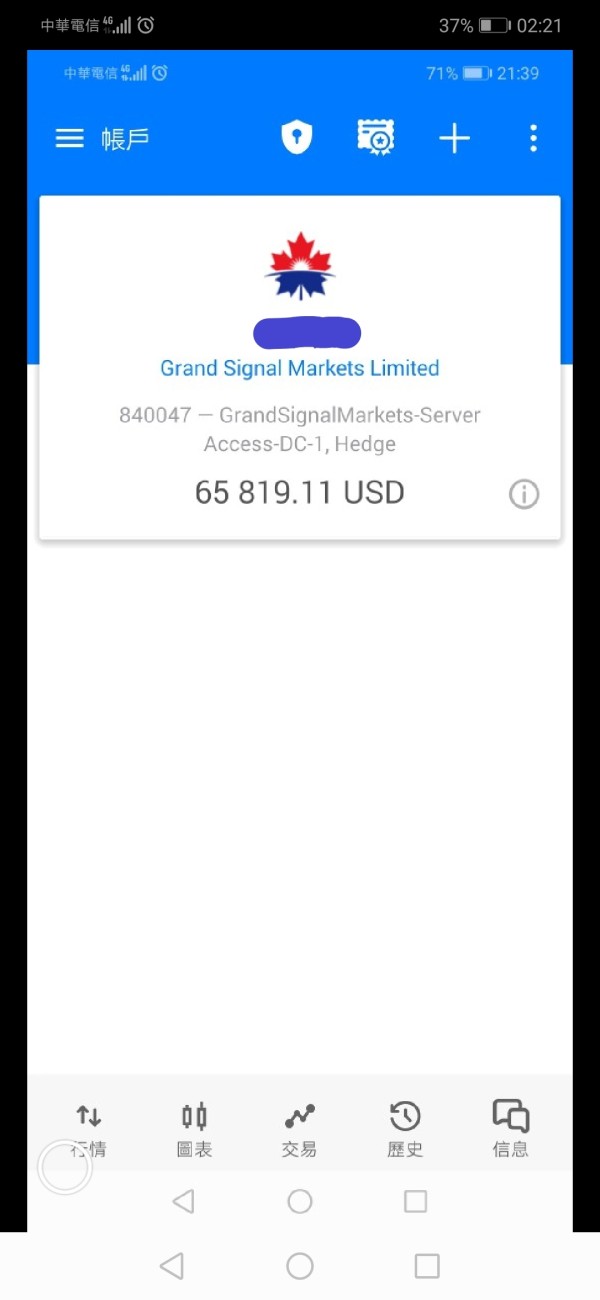

From a technical standpoint, Max Market FX Ltd utilizes the MetaTrader 5 platform as its primary trading interface. This platform supports various asset classes including foreign exchange pairs, commodities, and cryptocurrency instruments. The platform offers access to over 120 different trading instruments. This suggests a broad market coverage strategy. However, detailed information about the company's liquidity providers, execution methods, and risk management procedures is notably absent from publicly available materials, which raises questions about operational transparency in this max market fx ltd review.

Regulatory Status: Available documentation does not specify any legitimate regulatory oversight for Max Market FX Ltd. This absence of regulatory information represents a significant concern for potential clients seeking secure trading environments.

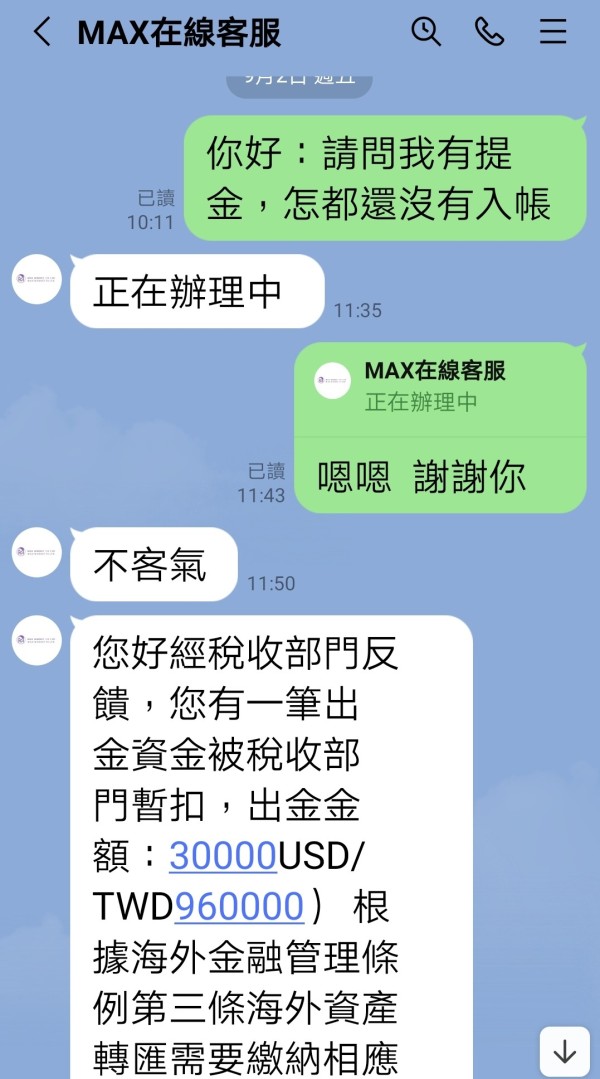

Deposit and Withdrawal Methods: Specific information regarding accepted payment methods, processing times, and associated fees has not been disclosed in available sources. This creates uncertainty about fund management procedures.

Minimum Deposit Requirements: The broker has not published clear minimum deposit thresholds for different account types. This makes it difficult for potential clients to understand entry-level requirements.

Promotional Offers: Details regarding welcome bonuses, loyalty programs, or trading incentives are not specified in available documentation. This suggests either absence of such programs or lack of transparency in marketing materials.

Available Trading Assets: The platform provides access to forex currency pairs, commodity markets, and cryptocurrency trading opportunities. The total includes over 120 different instruments across these categories.

Cost Structure: Critical information regarding spreads, commission rates, overnight financing charges, and other trading costs remains undisclosed. This prevents accurate cost analysis for potential traders.

Leverage Options: Specific leverage ratios available to different client categories have not been clearly communicated in accessible broker documentation.

Platform Selection: Max Market FX Ltd exclusively offers the MetaTrader 5 platform. This provides users with advanced charting tools, automated trading capabilities, and comprehensive market analysis features.

Geographic Restrictions: Information regarding restricted jurisdictions or regional limitations on service availability has not been specified in available materials.

Customer Support Languages: The range of languages supported by customer service teams remains unspecified in this max market fx ltd review.

Detailed Rating Analysis

Account Conditions Analysis (2/10)

The account conditions offered by Max Market FX Ltd present numerous concerns that significantly impact our evaluation. The broker fails to provide transparent information about account types, minimum deposit requirements, or specific features that differentiate various account categories. This lack of clarity makes it impossible for potential traders to make informed decisions about which account structure might suit their trading needs and financial capabilities.

Without clear documentation of account opening procedures, verification requirements, or ongoing maintenance obligations, traders face uncertainty about what to expect when engaging with this broker. The absence of information regarding special account features, such as Islamic accounts for traders requiring swap-free trading conditions, further demonstrates the broker's limited transparency in communicating its service offerings.

Industry standards typically require brokers to clearly outline account specifications. These include minimum deposits, maximum leverage, and any restrictions or benefits associated with different account tiers. Max Market FX Ltd's failure to meet these basic transparency requirements raises serious questions about its operational legitimacy and commitment to serving client interests effectively.

The lack of user feedback regarding account experiences compounds these concerns. Potential clients cannot benefit from real-world insights about account functionality, limitations, or advantages. This information vacuum makes it extremely difficult to assess whether the broker's account conditions align with industry standards or provide competitive value to traders in this max market fx ltd review.

Max Market FX Ltd demonstrates relative strength in its trading tools and resources offering. This is primarily through its provision of over 120 trading instruments accessible via the MetaTrader 5 platform. The MT5 platform provides traders with comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors, representing industry-standard functionality that meets most traders' technical requirements.

The diversity of available trading instruments spans forex pairs, commodities, and cryptocurrencies. This offers traders opportunities to diversify their portfolios and explore different market sectors within a single platform. This variety can be particularly valuable for traders seeking to implement multi-asset strategies or those looking to expand their trading horizons beyond traditional forex markets.

However, the evaluation is limited by the absence of information regarding additional research resources, market analysis tools, or educational materials that many brokers provide to support trader development. Quality brokers typically offer daily market commentary, economic calendars, trading webinars, and educational resources to help clients improve their trading skills and market understanding.

The lack of detailed information about platform customization options, advanced order types, or integration with third-party analysis tools also limits our ability to fully assess the comprehensive value of the broker's tool offerings. While the MT5 platform provides solid foundational capabilities, the absence of supplementary resources and unclear platform optimization features prevent a higher rating in this category.

Customer Service and Support Analysis (3/10)

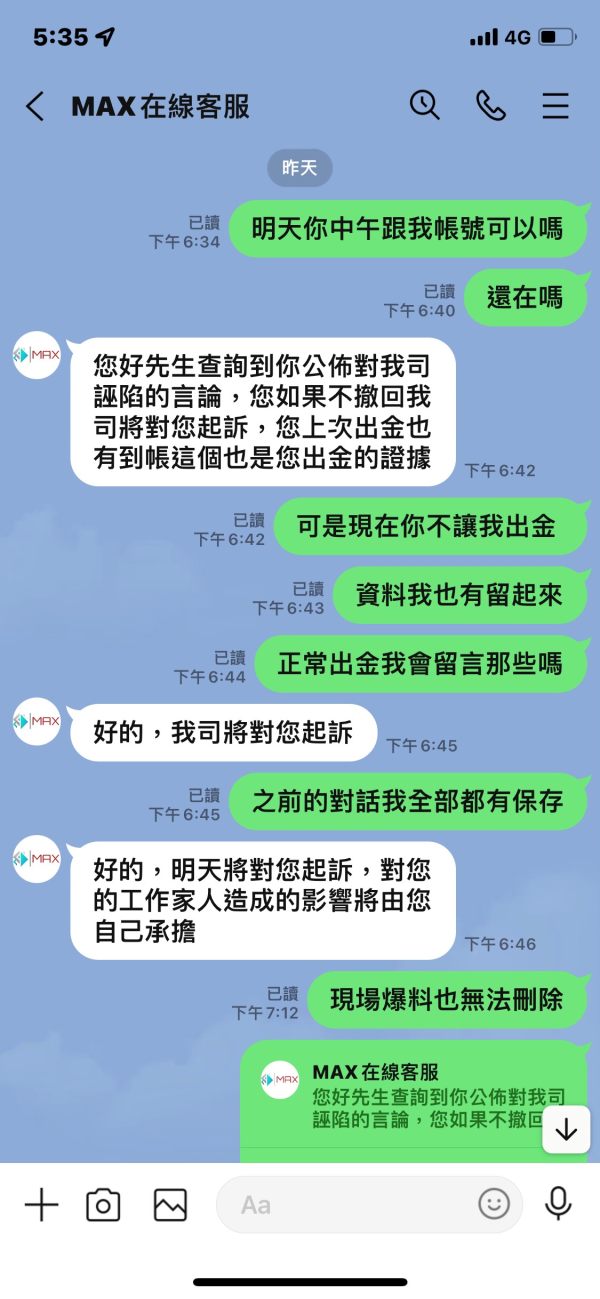

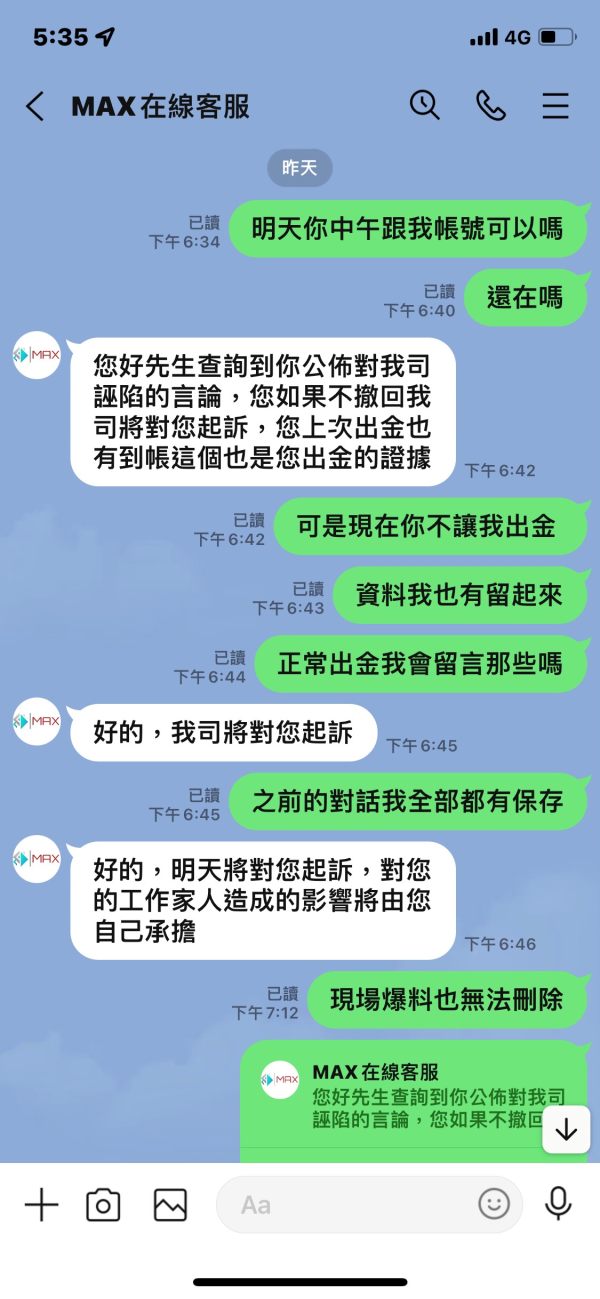

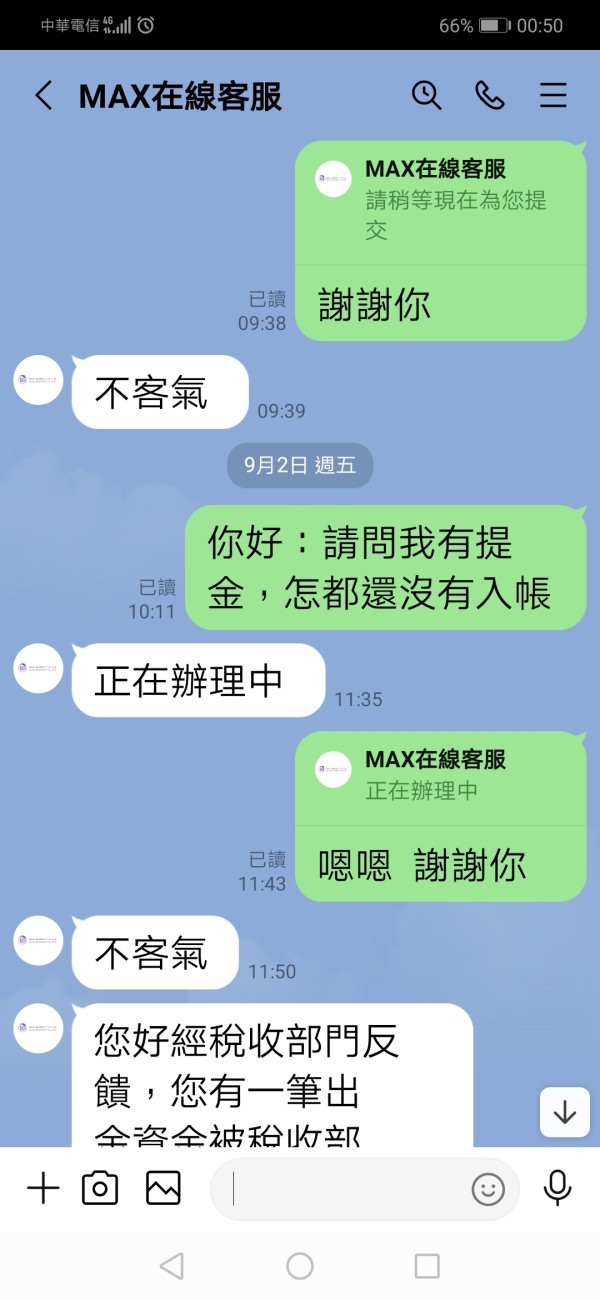

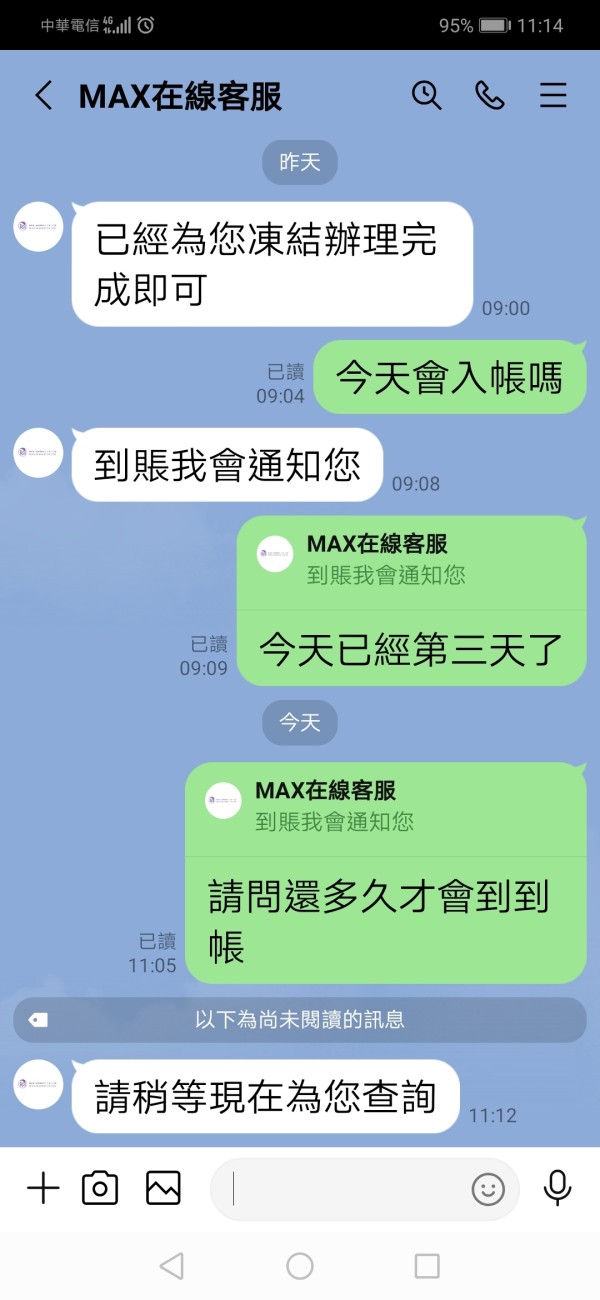

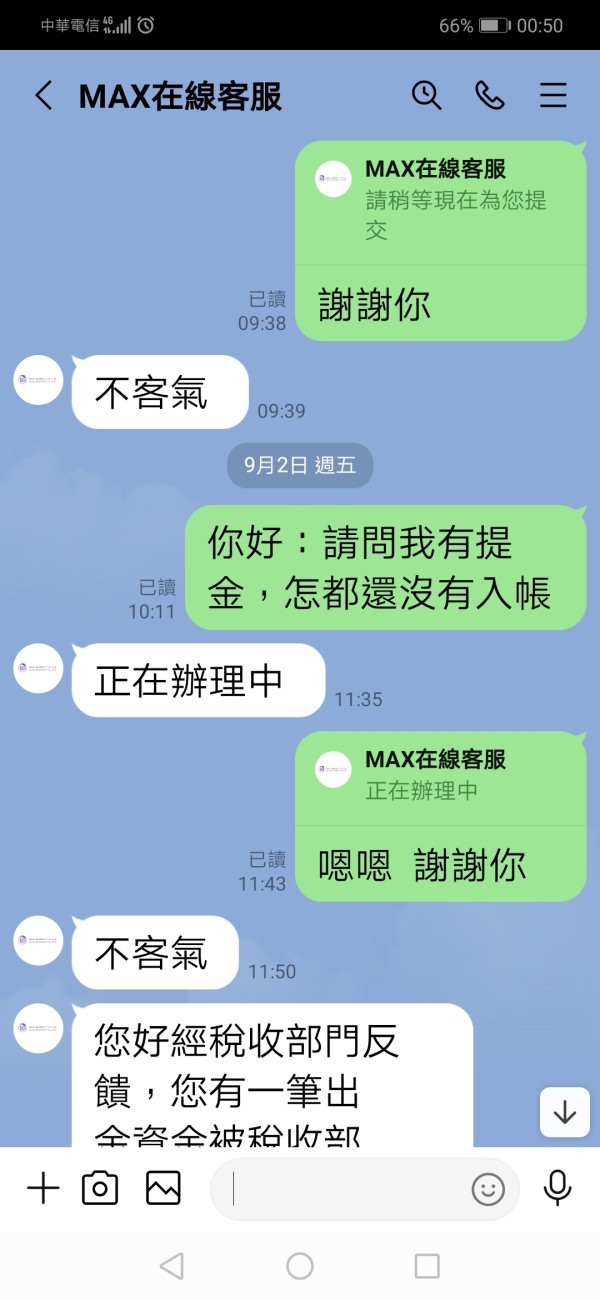

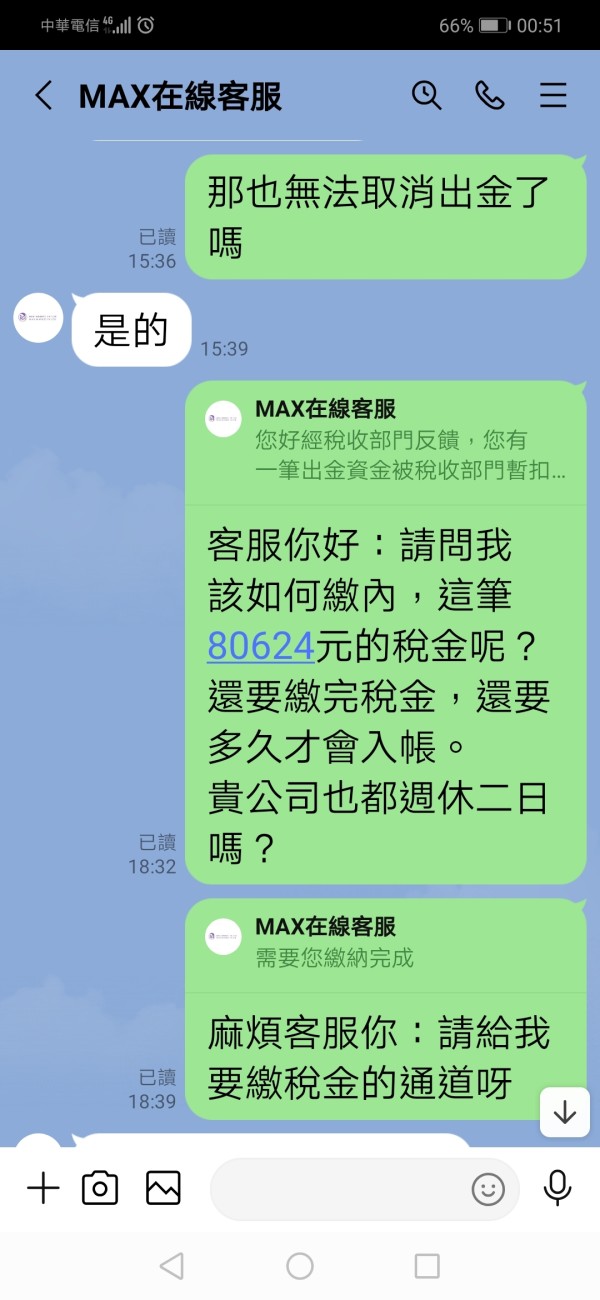

Customer service represents a critical weakness in Max Market FX Ltd's offering. There is virtually no publicly available information about support channels, availability, or service quality standards. Professional forex brokers typically provide multiple contact methods including live chat, telephone support, email assistance, and comprehensive FAQ sections to address trader inquiries and resolve issues promptly.

The absence of clear information about customer service hours, response time commitments, or multilingual support capabilities raises serious concerns about the broker's commitment to client service. Traders require reliable access to support services, particularly during volatile market conditions or when experiencing technical difficulties that could impact their trading activities.

Without documented service level agreements, escalation procedures, or quality assurance measures, potential clients have no basis for evaluating whether Max Market FX Ltd can provide adequate support when needed. The lack of user testimonials or reviews specifically addressing customer service experiences further compounds these concerns.

Industry leaders typically maintain 24/5 or 24/7 support availability with guaranteed response times and multiple language options to serve international client bases effectively. Max Market FX Ltd's failure to communicate its service standards or demonstrate commitment to client support significantly undermines its credibility as a professional trading platform.

Trading Experience Analysis (5/10)

The trading experience offered by Max Market FX Ltd receives a moderate rating. This is primarily due to its utilization of the MetaTrader 5 platform, which provides a familiar and functional trading environment for most forex traders. MT5 offers robust charting capabilities, multiple timeframes, comprehensive technical indicators, and support for automated trading strategies through Expert Advisors.

However, the overall trading experience evaluation is significantly hampered by the lack of specific information about execution quality, order processing speeds, or slippage management. These factors are crucial for determining whether traders can effectively implement their strategies and achieve expected results when executing trades through the platform.

The absence of information about trading conditions such as minimum order sizes, maximum position limits, or restrictions on trading strategies like scalping or hedging creates uncertainty about the practical trading environment. Professional traders require clear understanding of these parameters to assess whether a broker's platform can accommodate their preferred trading approaches.

Without user feedback regarding platform stability, execution reliability, or mobile trading functionality, it becomes difficult to evaluate the real-world trading experience that clients can expect. The lack of information about server locations, latency optimization, or backup systems also raises questions about the broker's technical infrastructure and commitment to providing consistent trading conditions in this max market fx ltd review.

Trustworthiness Analysis (1/10)

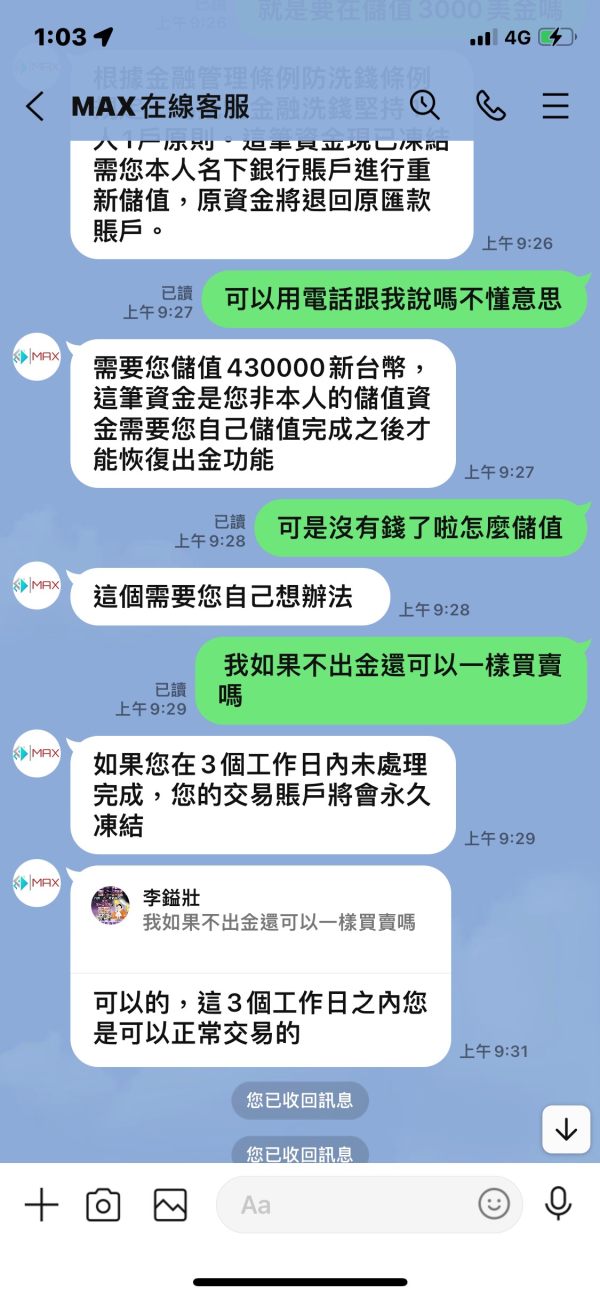

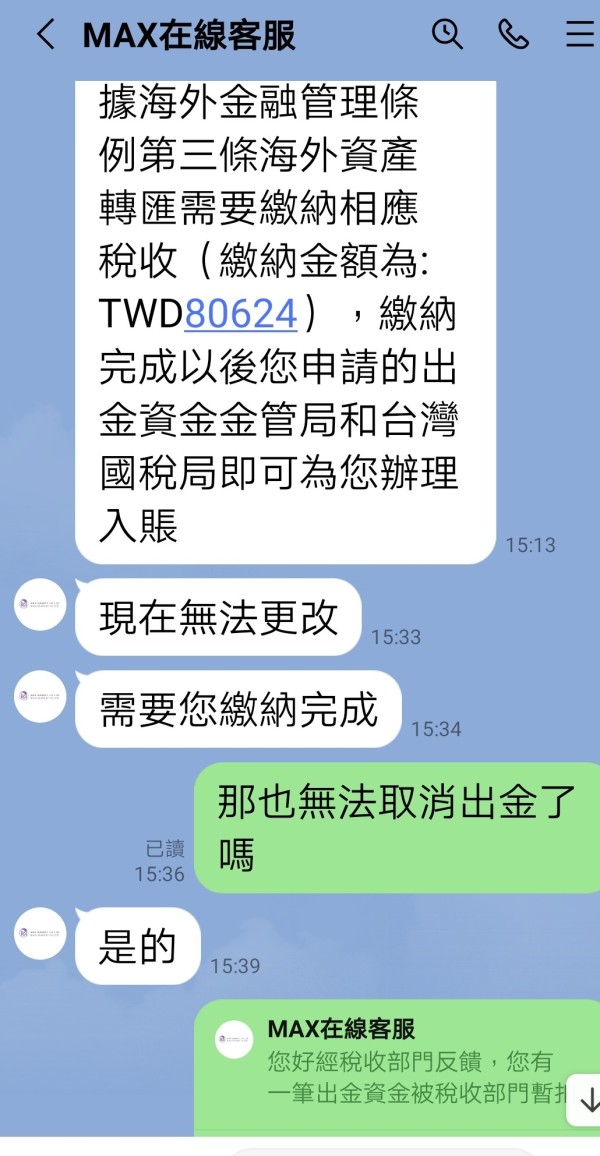

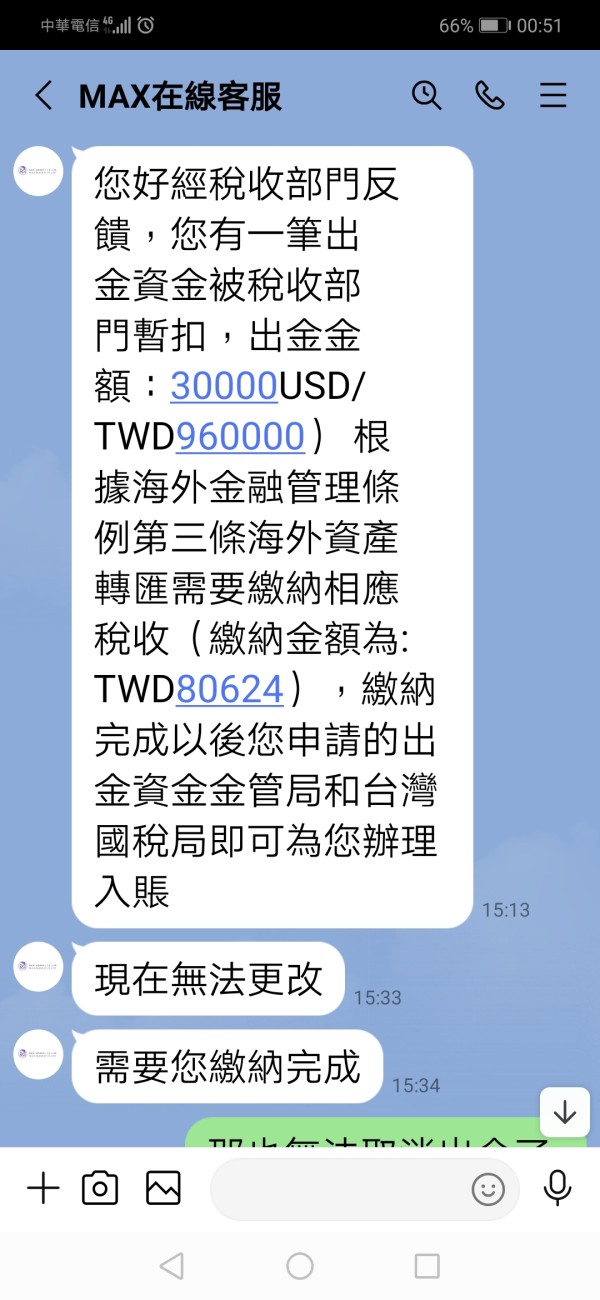

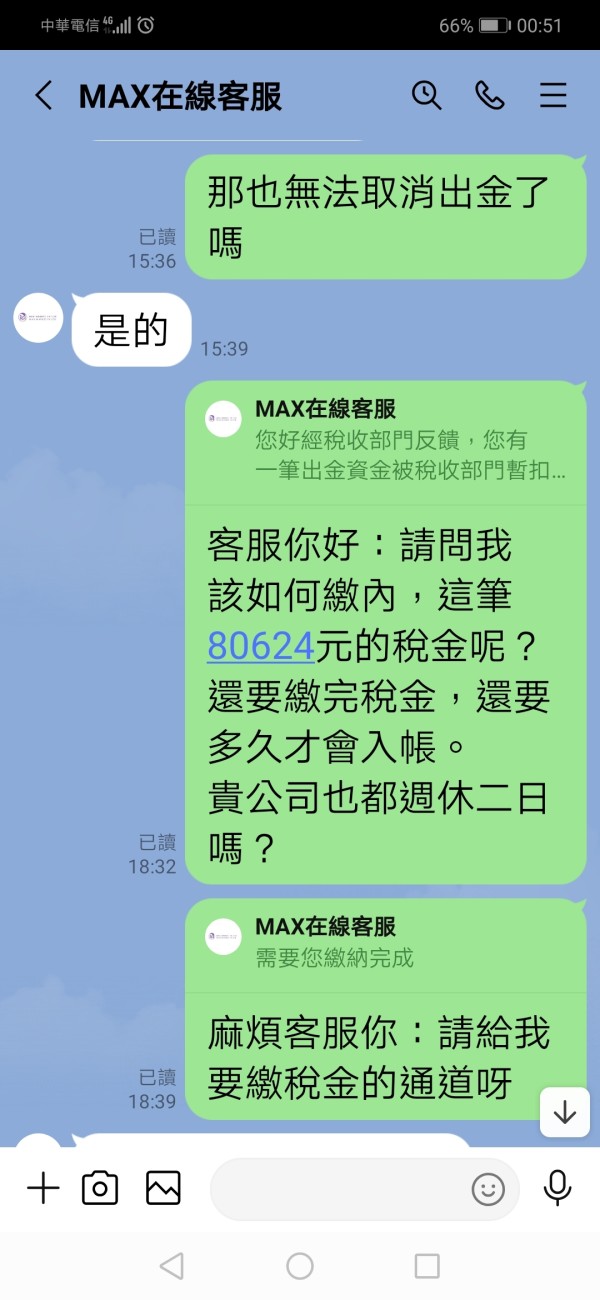

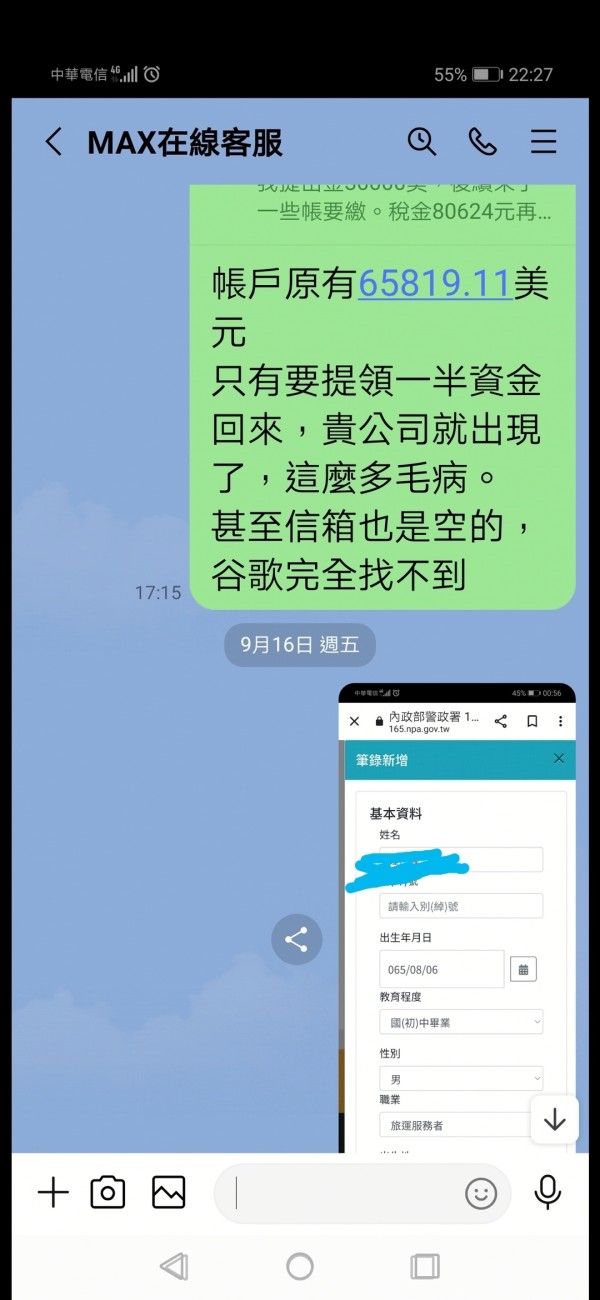

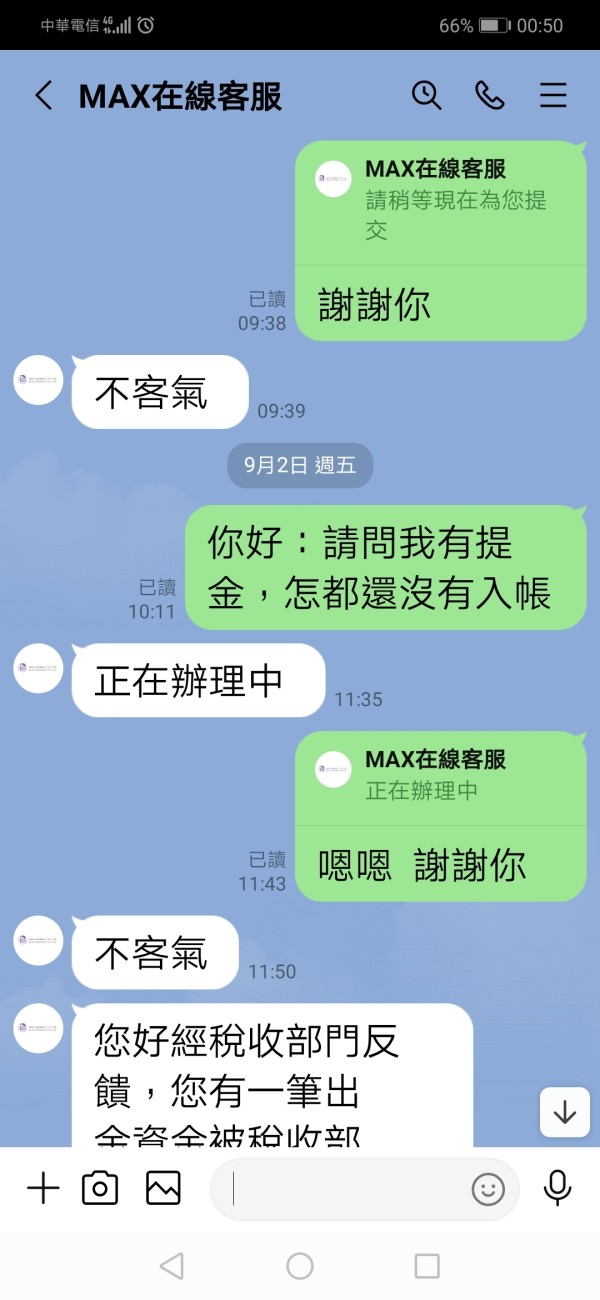

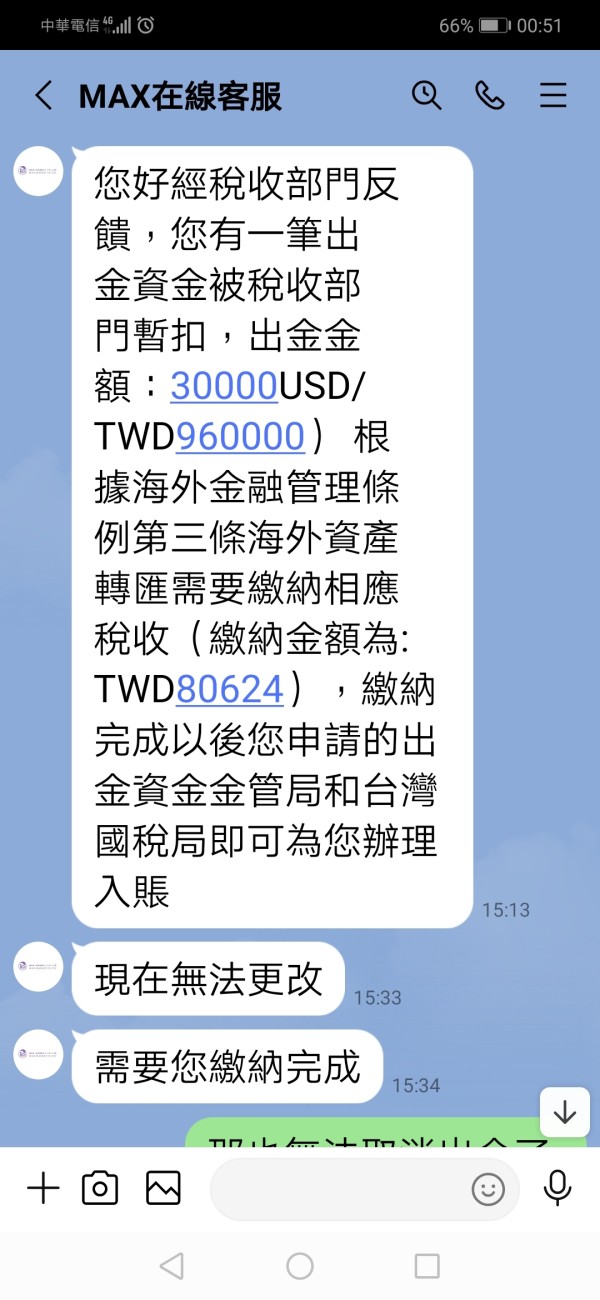

Trustworthiness represents the most critical concern in our evaluation of Max Market FX Ltd. It earns the lowest possible rating due to fundamental issues that significantly impact trader safety and confidence. The broker operates without verifiable regulatory oversight from recognized financial authorities, which immediately places it outside the protection frameworks that legitimate brokers must maintain.

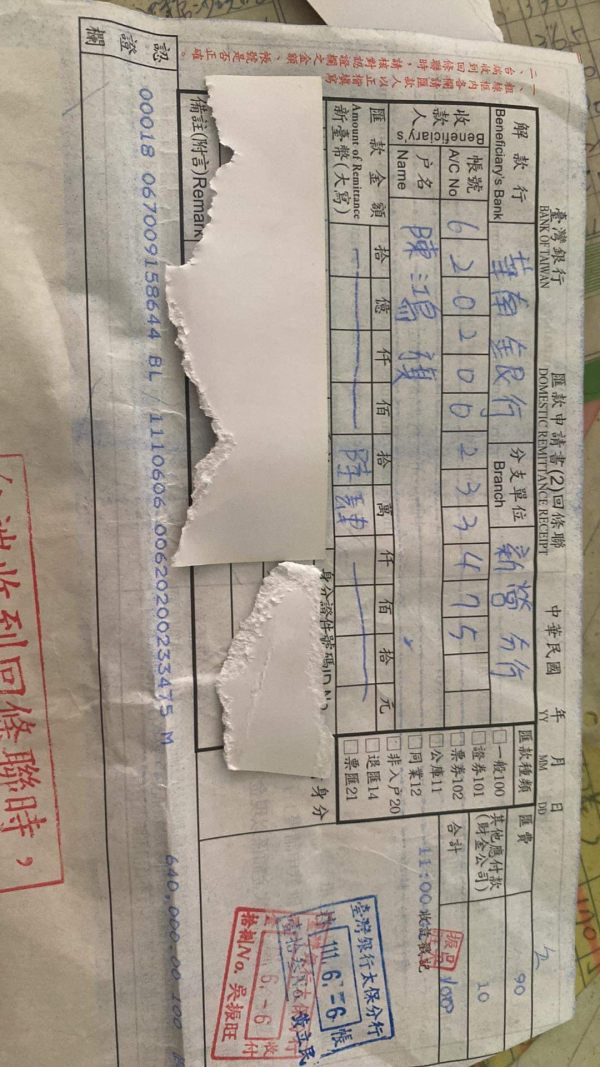

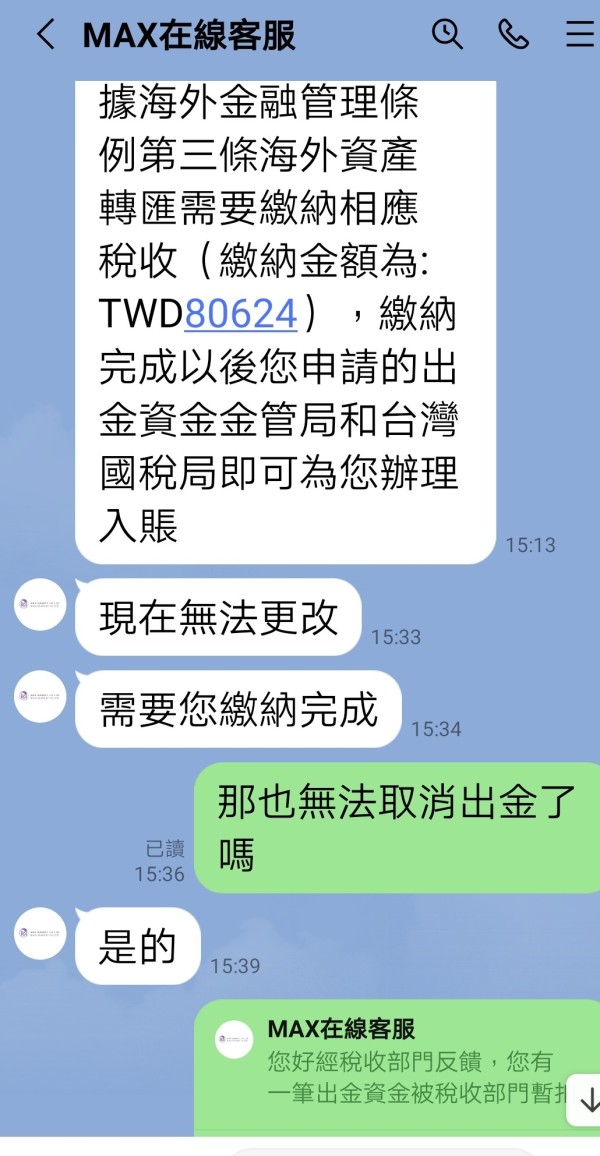

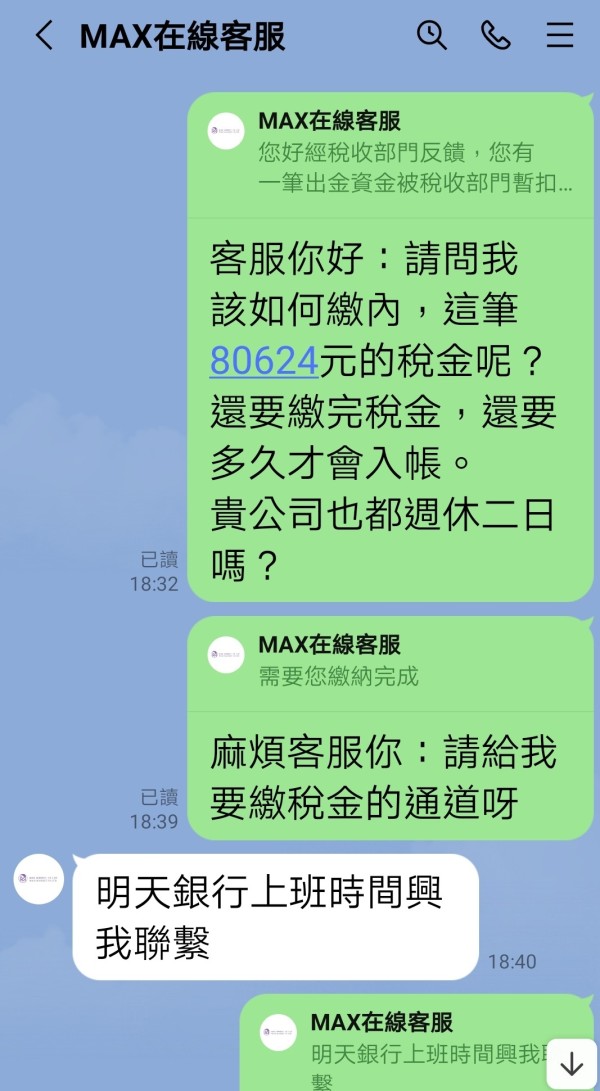

The absence of regulatory compliance means that client funds lack the protection measures typically required by financial authorities. These include segregated account requirements, compensation schemes, or regular financial audits. This regulatory vacuum creates substantial risk for traders who deposit funds with the broker, as there are no institutional safeguards or recourse mechanisms available if problems arise.

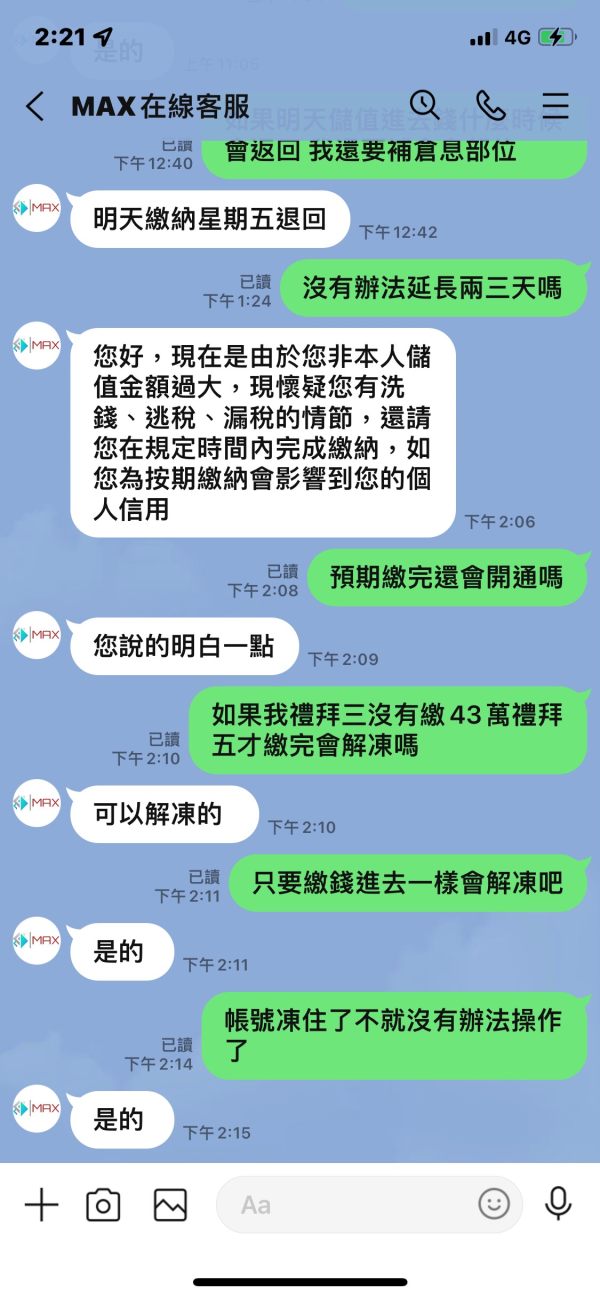

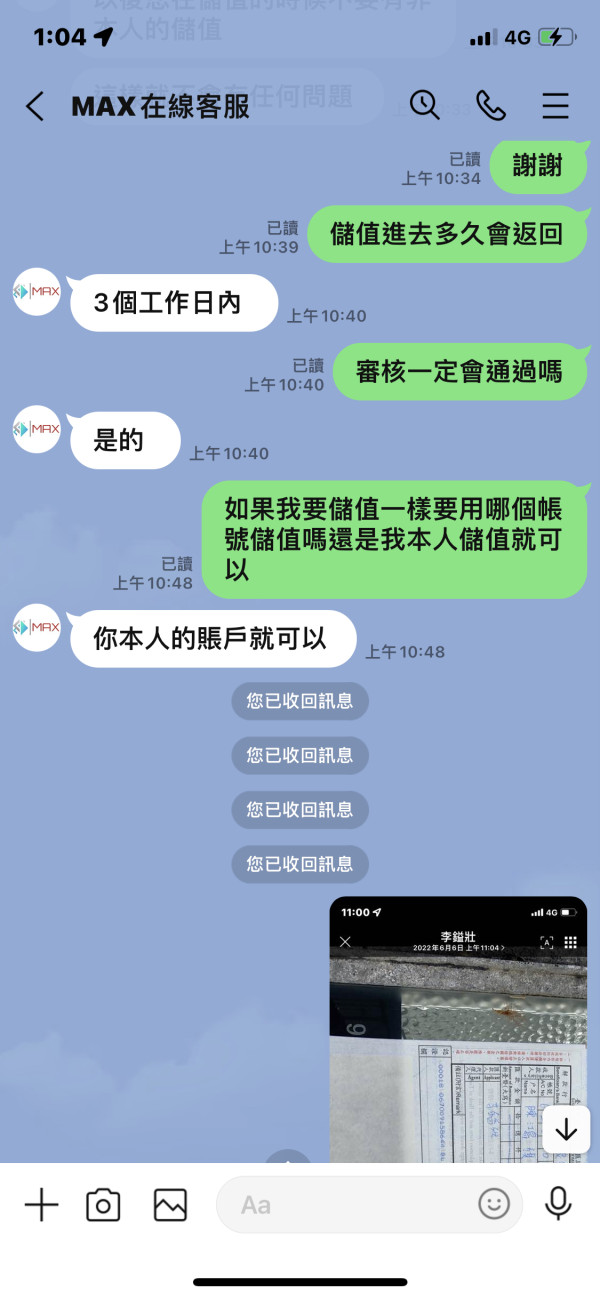

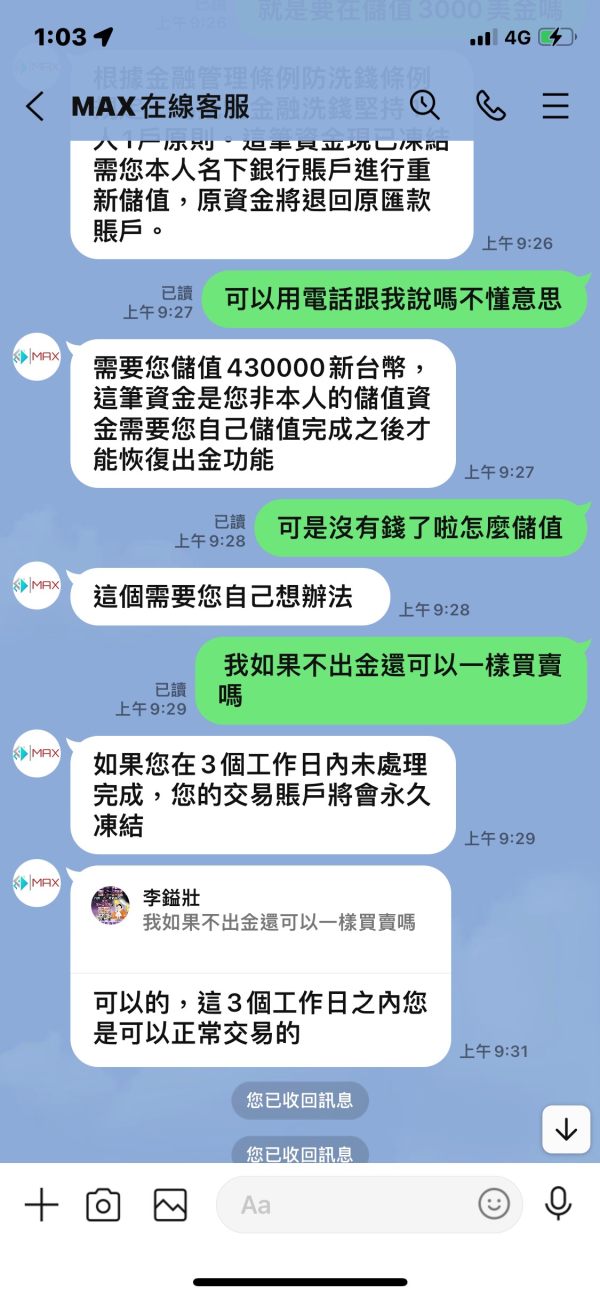

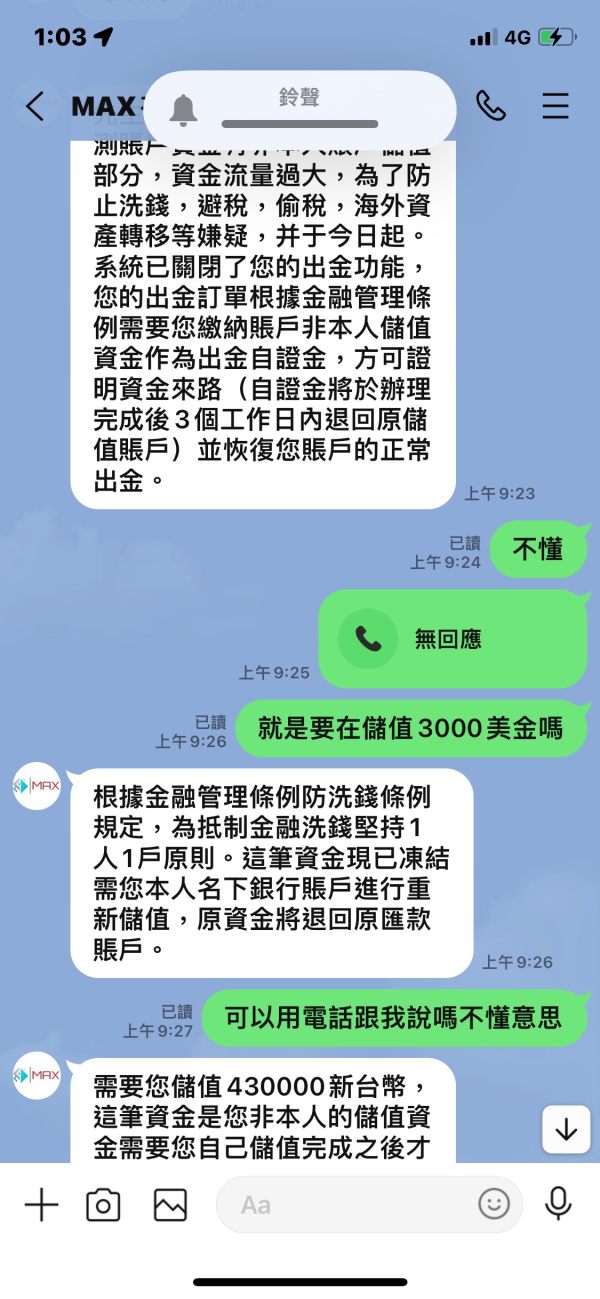

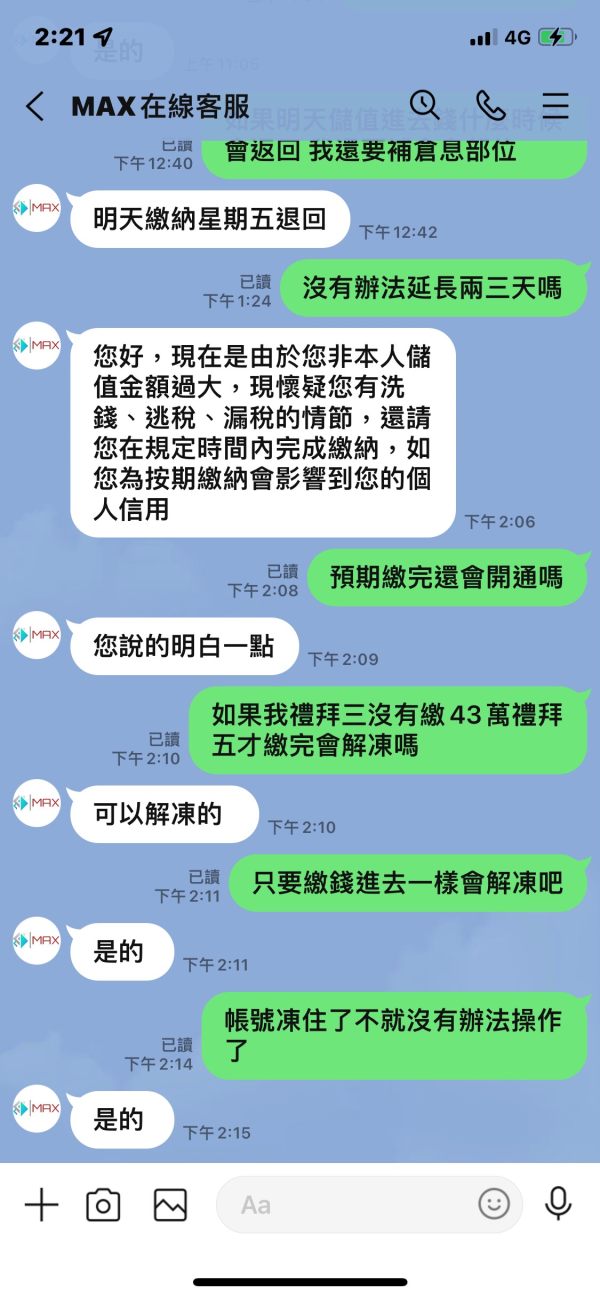

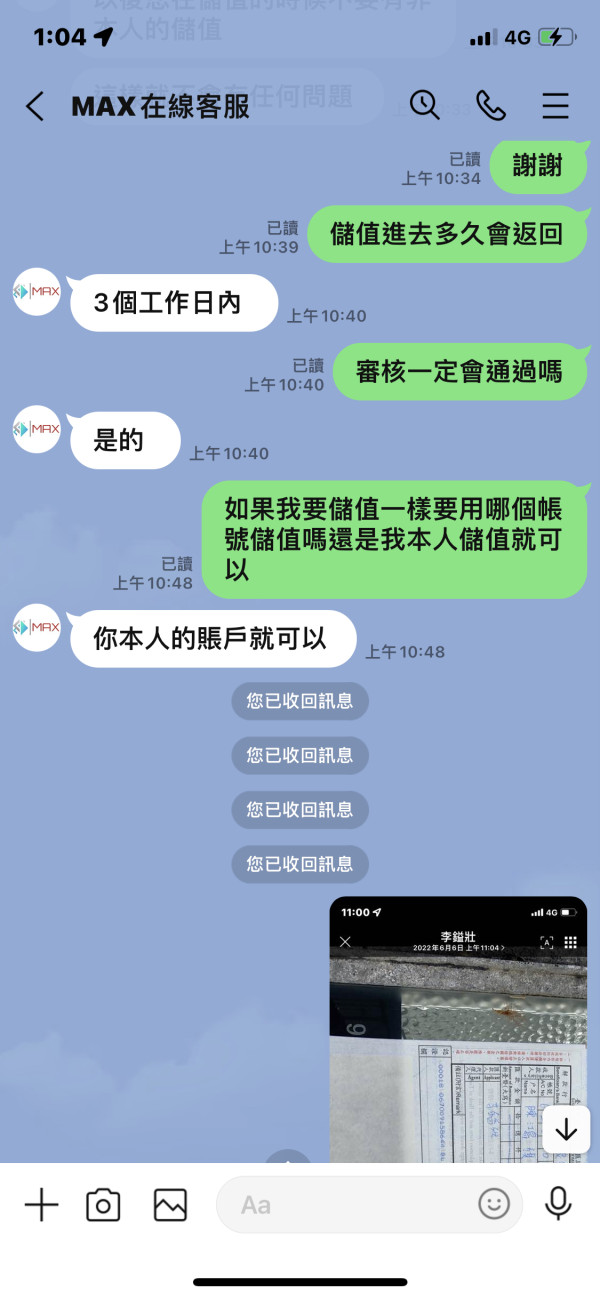

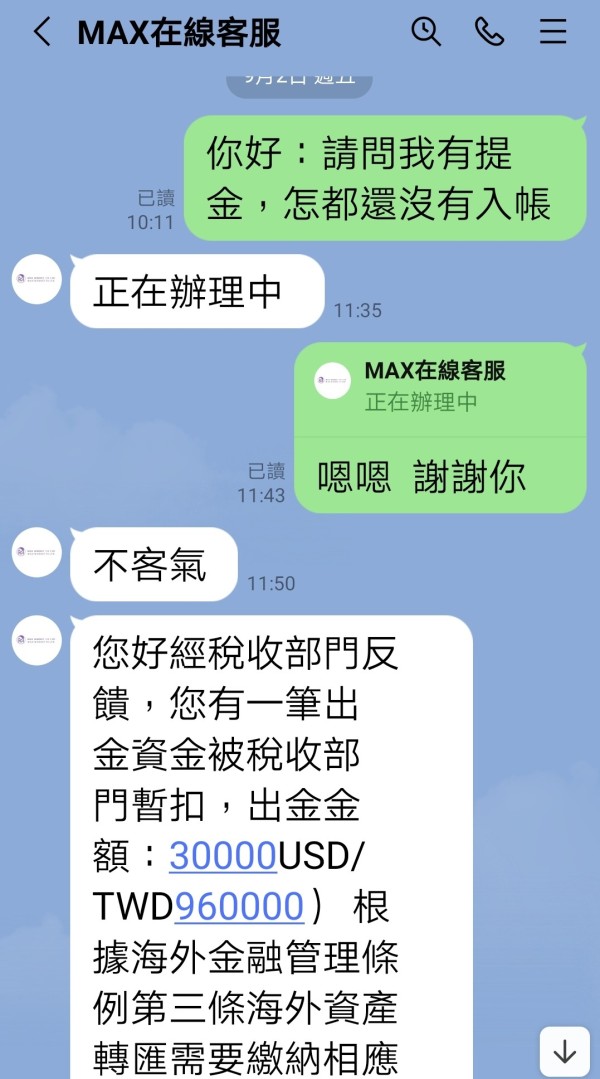

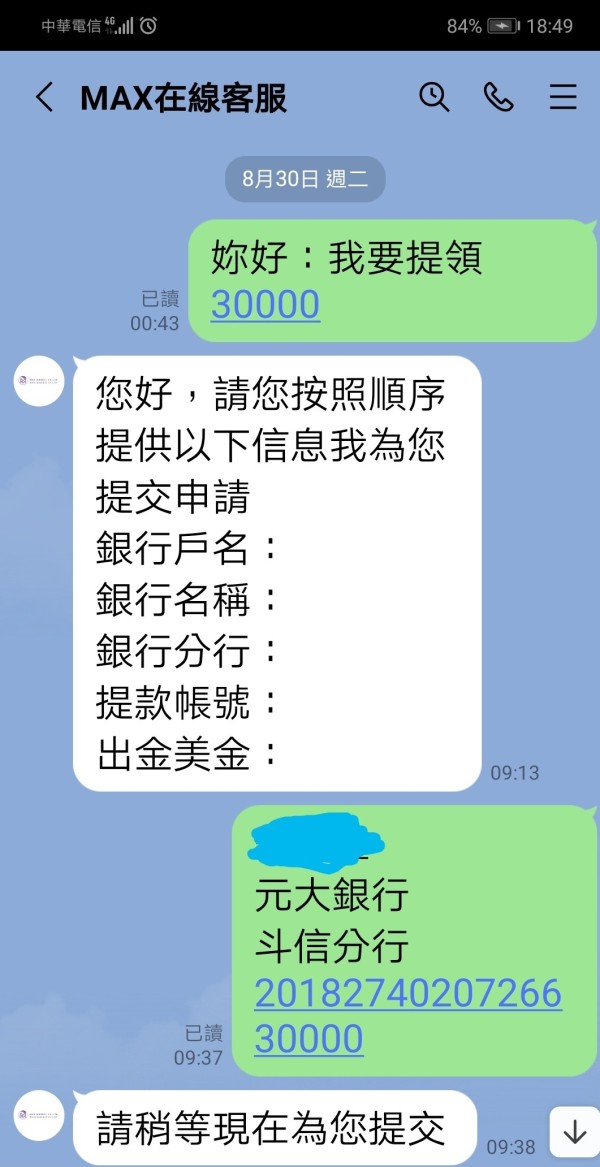

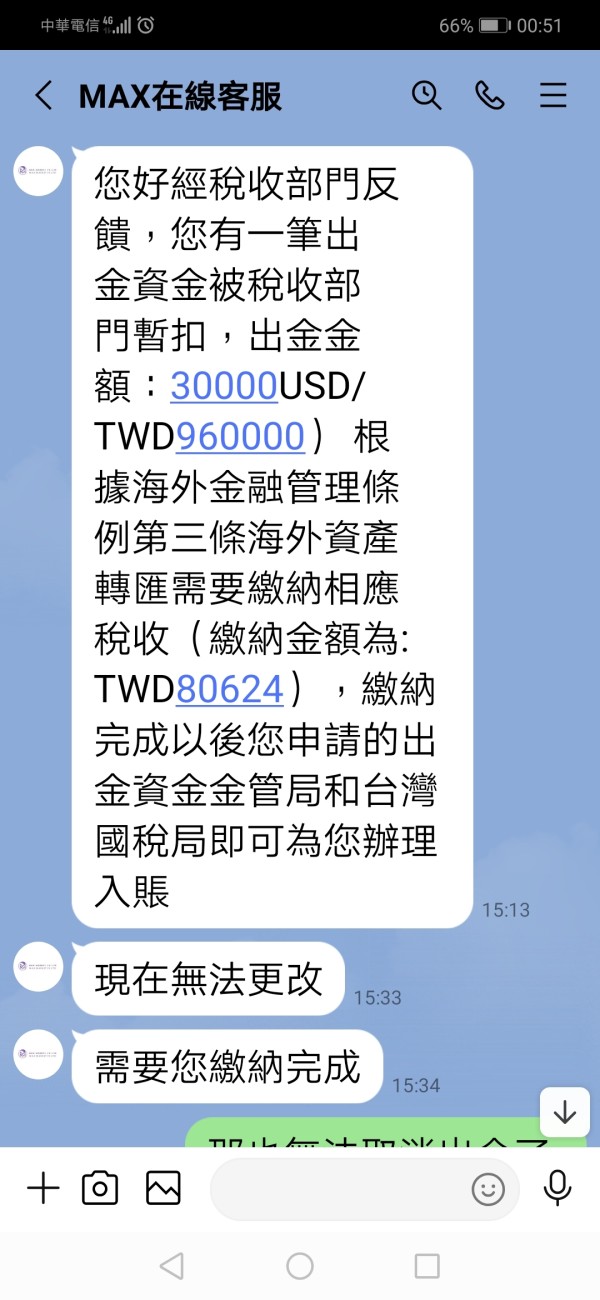

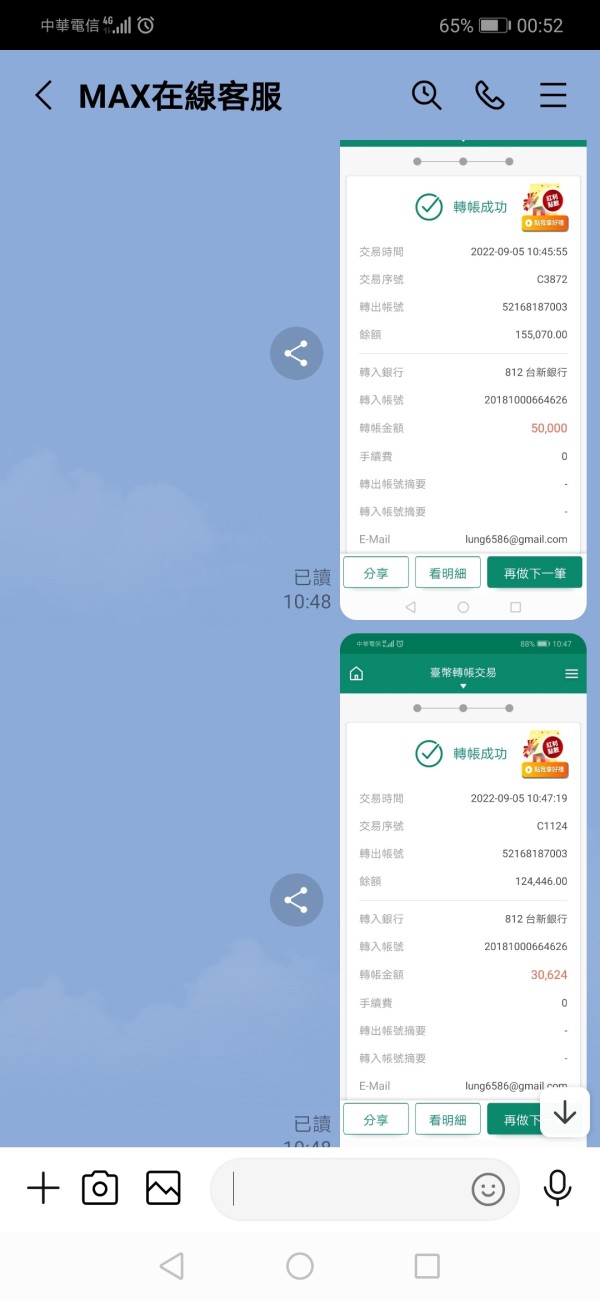

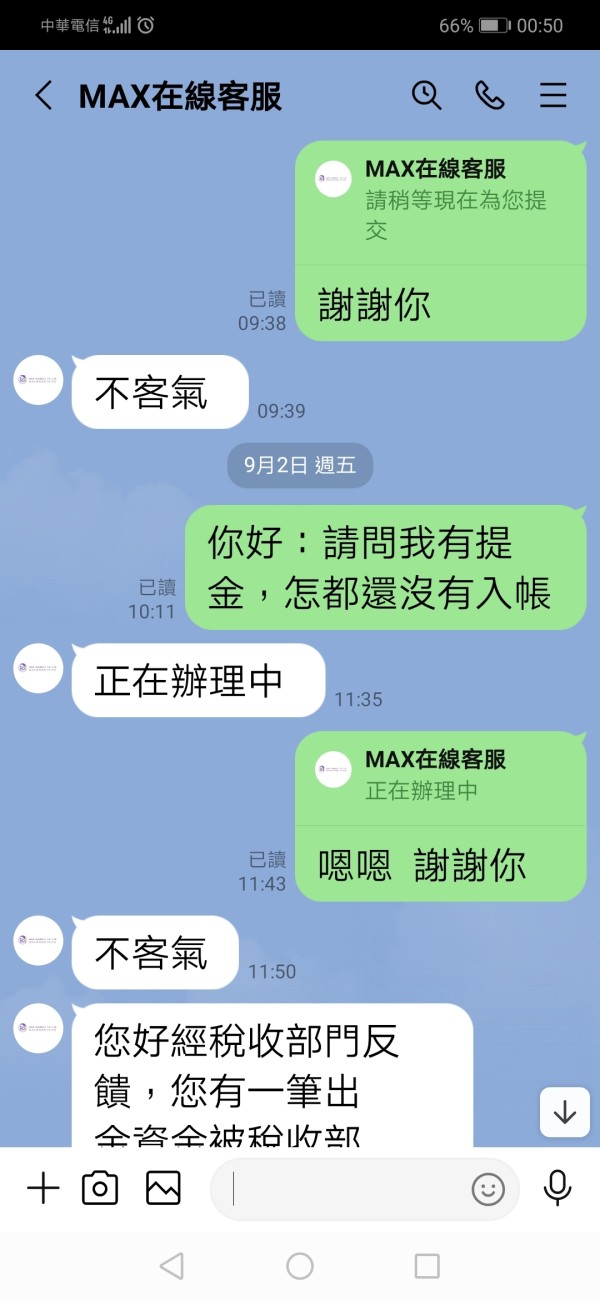

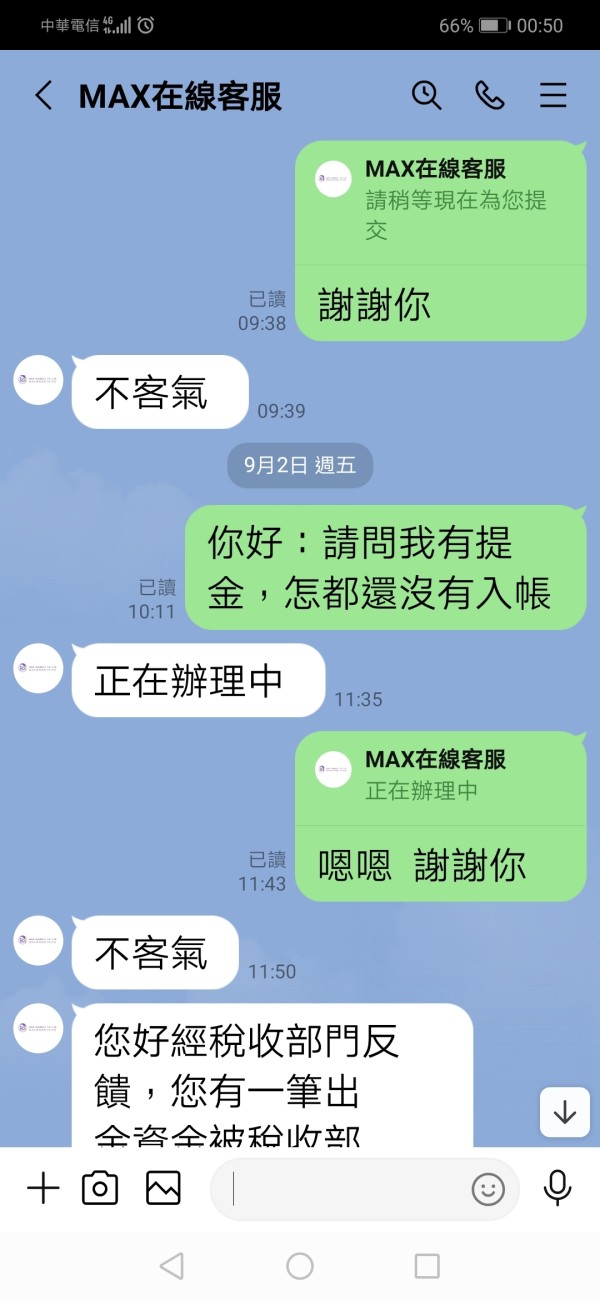

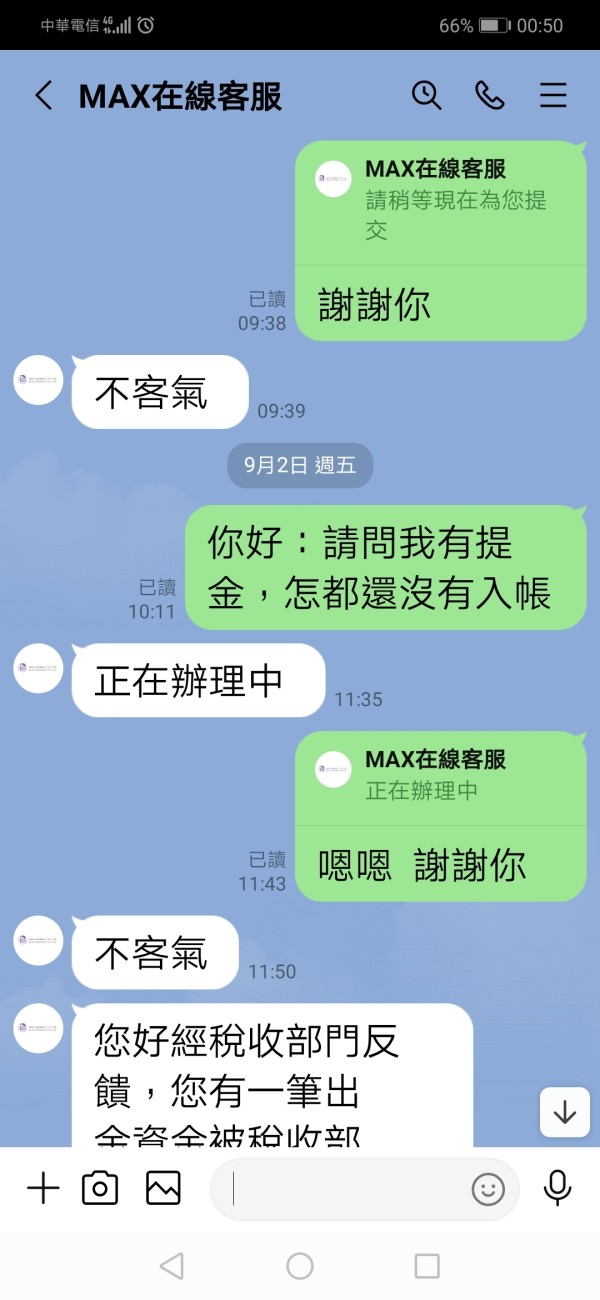

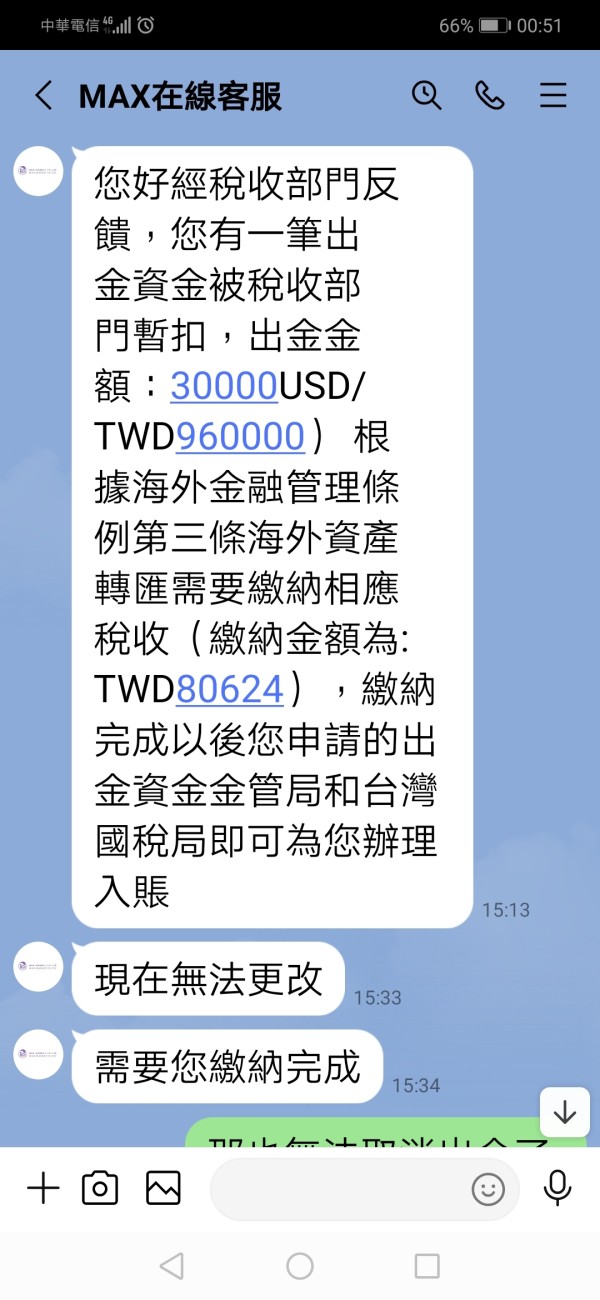

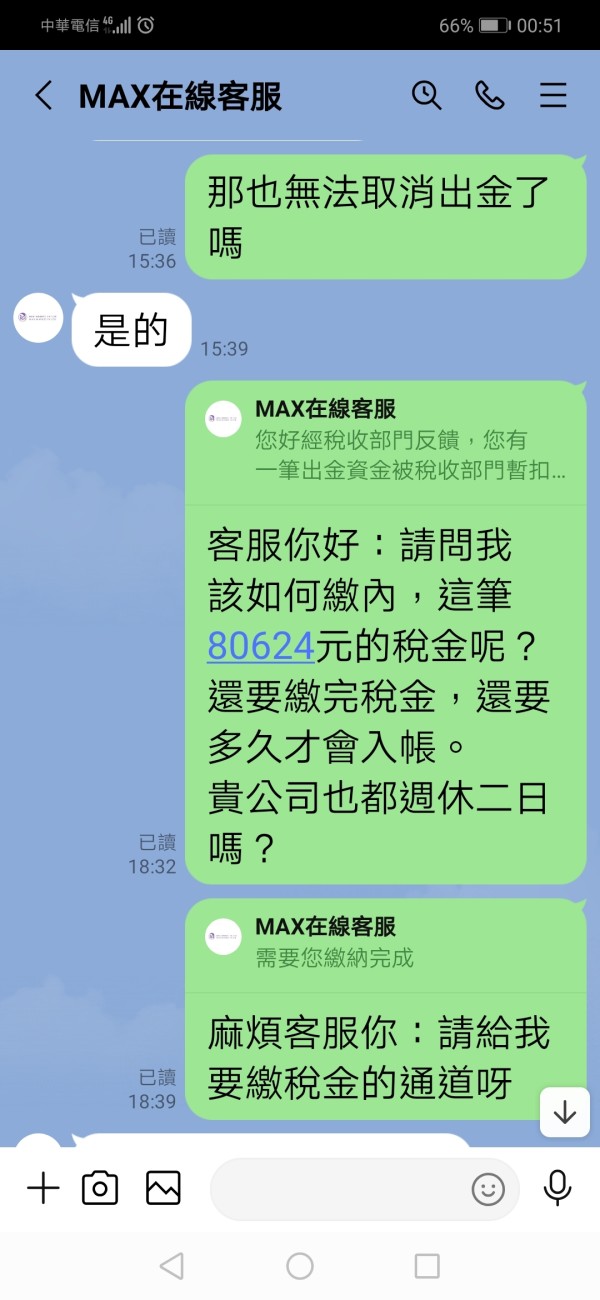

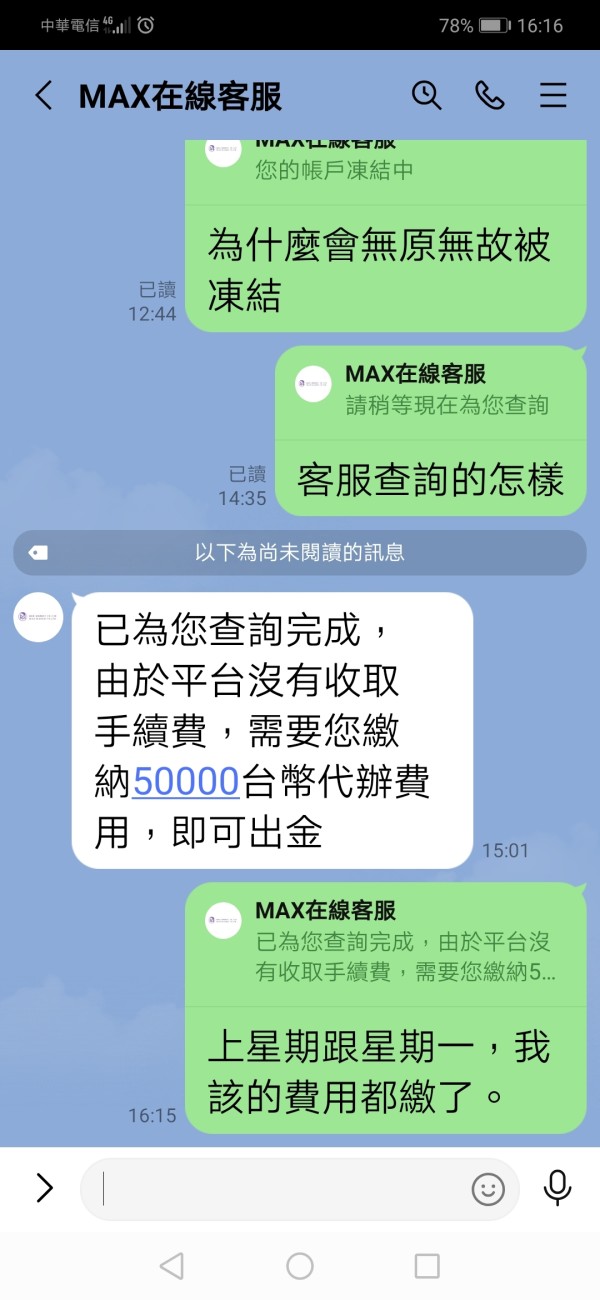

Industry reports and analysis suggest that Max Market FX Ltd exhibits characteristics commonly associated with fraudulent brokers. These include lack of transparency about company ownership, unclear operational procedures, and absence of verifiable contact information. These red flags align with patterns observed in broker scam operations that target unsuspecting traders.

The broker's failure to provide clear information about its corporate structure, financial backing, or operational history further undermines trustworthiness. Legitimate brokers typically maintain transparent communication about their regulatory status, company leadership, and business operations to build client confidence and demonstrate their commitment to ethical business practices.

User Experience Analysis (3/10)

User experience evaluation for Max Market FX Ltd is significantly constrained by the limited availability of genuine user feedback and testimonials about the broker's services. Without substantial user input, it becomes challenging to assess real-world satisfaction levels, common issues, or positive aspects of the trading experience that clients encounter.

The lack of clear information about account registration procedures, verification requirements, and onboarding processes creates uncertainty about the initial user experience. Professional brokers typically maintain streamlined, transparent procedures that help new clients understand requirements and complete account setup efficiently while maintaining necessary security protocols.

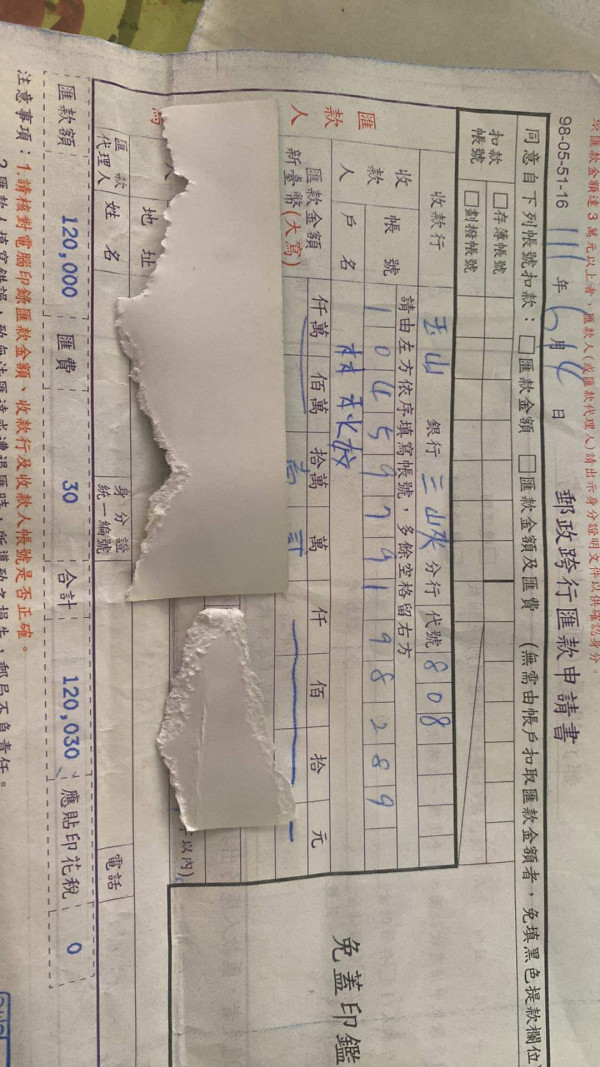

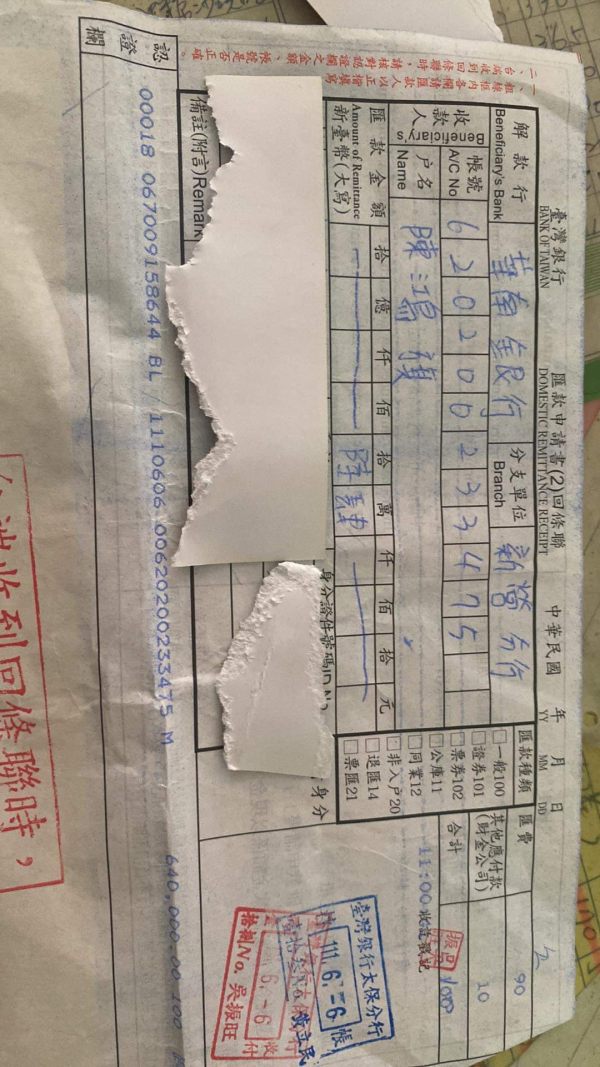

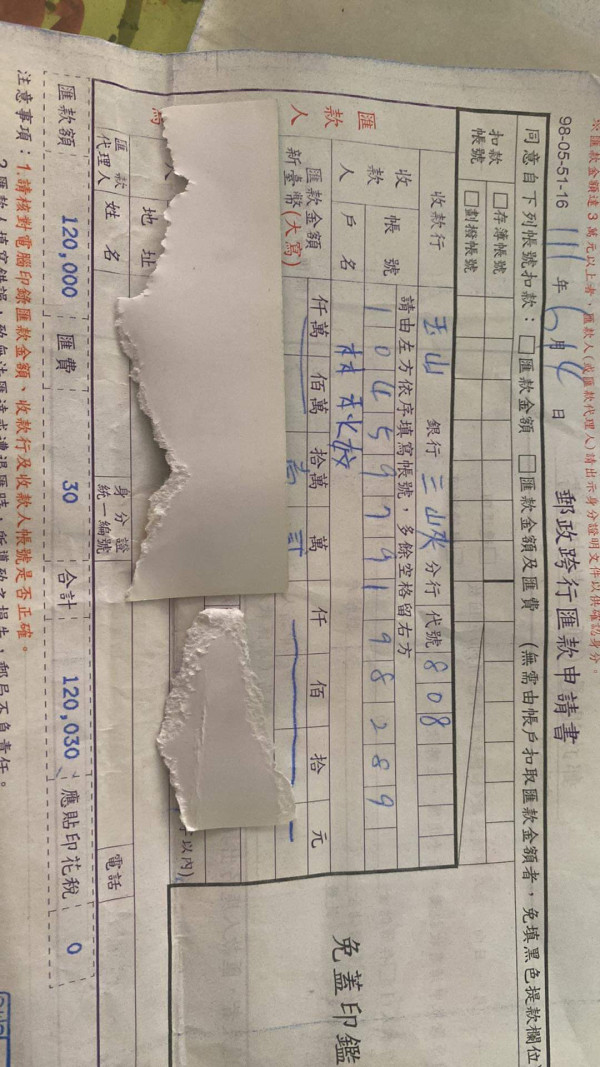

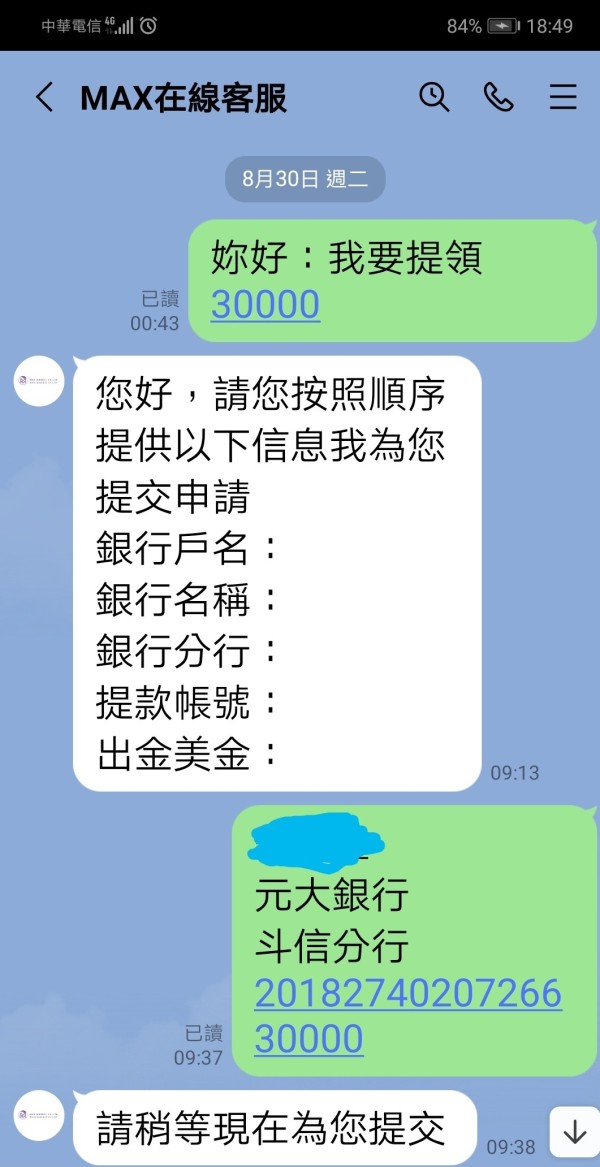

Fund management represents another area where user experience information is lacking. There is no clear documentation about deposit processing times, withdrawal procedures, or fee structures that directly impact client satisfaction. These operational aspects significantly influence overall user experience and satisfaction with broker services.

The absence of information about platform customization options, user interface optimization, or mobile trading functionality further limits the user experience evaluation. Modern traders expect flexible, intuitive platforms that can be adapted to their preferences and trading styles, but Max Market FX Ltd provides insufficient information to assess these capabilities effectively.

Conclusion

This comprehensive max market fx ltd review reveals significant concerns that make Max Market FX Ltd unsuitable for any trader seeking a reliable and secure trading environment. The broker's lack of regulatory oversight, combined with characteristics commonly associated with fraudulent operations, creates unacceptable risks for potential clients regardless of their experience level or trading objectives.

While the broker offers some positive aspects, such as access to over 120 trading instruments through the MT5 platform, these features cannot compensate for the fundamental trust and safety issues that dominate our evaluation. The absence of transparent information about costs, account conditions, and operational procedures further undermines the broker's credibility.

We strongly recommend that traders avoid Max Market FX Ltd and instead choose regulated brokers that provide transparent operations, client fund protection, and verifiable track records in the forex industry. The risks associated with unregulated brokers far outweigh any potential benefits, particularly given the availability of legitimate alternatives that offer similar or superior trading tools within properly regulated frameworks.