Is FTFGOLD GLOBAL safe?

Business

License

Is FTFGold Global Safe or Scam?

Introduction

FTFGold Global positions itself as a prominent player in the foreign exchange market, claiming to offer a comprehensive trading platform for forex and wealth management services. However, the increasing number of reported scams in the trading industry necessitates that traders exercise caution when evaluating brokers. The legitimacy of a broker can significantly impact a trader's financial security and overall trading experience. In this article, we will investigate whether FTFGold Global is a safe broker or merely a scam, based on a thorough analysis of its regulatory status, company background, trading conditions, and customer feedback.

To conduct this investigation, we employed a multi-faceted assessment framework that considers regulatory compliance, company history, trading conditions, customer fund safety, and user experiences. By synthesizing data from various reputable sources, we aim to provide a balanced view of FTFGold Global and help traders make informed decisions.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety. FTFGold Global claims to be regulated in the United States, citing a National Futures Association (NFA) membership. However, upon further examination, it appears that this claim is misleading. FTFGold Global is not registered with any reputable regulatory body, which raises significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0540120 | USA | Not Authorized |

The absence of regulation means that FTFGold Global operates without oversight, leaving traders vulnerable to potential fraud. Legitimate brokers in the U.S. are required to maintain a minimum operational capital of $20 million and adhere to strict regulatory standards, which FTFGold Global does not seem to meet. The lack of regulatory compliance is a significant red flag, indicating that the broker may not be safe for traders.

Company Background Investigation

FTFGold Global Limited is an offshore broker, which presents inherent risks associated with such entities. Offshore brokers often lack transparency regarding their ownership and operational structure, making it difficult for traders to ascertain who is managing their funds. FTFGold Global has not provided adequate information about its management team or corporate history, further complicating the evaluation of its credibility.

The company's website lacks transparency, failing to disclose essential details such as the identities of its executives or the firm's physical address. This lack of information is concerning, as it raises questions about the broker's accountability and operational integrity. A reputable broker should provide clear and accessible information about its ownership and management team.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial for determining its overall cost-effectiveness and transparency. FTFGold Global's fee structure is ambiguous, with no clear information available on minimum deposit requirements or spreads. This lack of transparency can lead to unexpected costs for traders.

| Fee Type | FTFGold Global | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clearly defined trading costs raises concerns about potential hidden fees. Traders may find themselves facing unexpected charges, which could significantly impact their trading profitability. This lack of clarity in trading conditions further supports the notion that FTFGold Global may not be a safe option for traders.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. FTFGold Global does not appear to implement robust measures to protect client deposits. The broker does not offer segregated accounts, which means that client funds may not be kept separate from the company's operational funds. This practice increases the risk of losing funds in the event of the broker's insolvency.

Moreover, FTFGold Global does not provide any investor protection mechanisms, which are typically offered by regulated brokers to safeguard client assets. The absence of such protections raises significant concerns about the safety of funds deposited with this broker. Traders should be wary of any broker that does not prioritize client fund safety, as it could indicate potential risks associated with their operations.

Customer Experience and Complaints

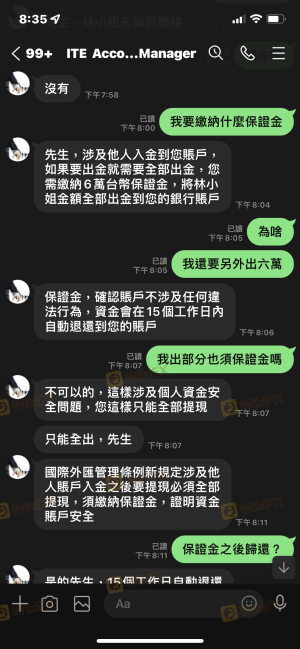

Analyzing customer feedback is essential for understanding the overall experience of traders with a particular broker. Reports indicate that FTFGold Global has received numerous negative reviews from users, primarily centered around withdrawal issues and poor customer service. Many clients have expressed frustration over their inability to withdraw funds, which is a common complaint among unregulated brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Poor Customer Support | Medium | Inadequate |

In some cases, traders have reported being unable to access their funds for extended periods, leading to concerns about the broker's reliability. The lack of timely responses from customer support further exacerbates these issues, leaving clients feeling neglected and frustrated. These patterns of complaints suggest that FTFGold Global may not be a safe broker for traders seeking reliable service and support.

Platform and Trade Execution

A broker's trading platform is a critical component of the trading experience. FTFGold Global claims to offer the popular MetaTrader 4 platform; however, there are concerns regarding its overall performance and reliability. Reports of slippage and execution delays have been noted by users, which can significantly impact trading outcomes.

Additionally, there are indications of potential platform manipulation, as some users have reported experiencing sudden changes in quoted prices during volatile market conditions. Such issues can lead to significant financial losses for traders and raise doubts about the broker's integrity.

Risk Assessment

Using FTFGold Global presents various risks that traders should consider before engaging with the broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of segregated accounts |

| Customer Service Risk | Medium | Poor responsiveness |

| Execution Risk | High | Reports of slippage and manipulation |

To mitigate these risks, traders are advised to conduct thorough research before committing funds to any broker. It may also be prudent to start with a small deposit, if at all, and to monitor the broker's responsiveness and reliability closely.

Conclusion and Recommendations

In conclusion, the evidence suggests that FTFGold Global exhibits several characteristics commonly associated with scam brokers. The lack of regulatory oversight, inadequate transparency, poor customer feedback, and questionable trading conditions raise significant concerns about the safety of this broker. Therefore, it is crucial for traders to exercise caution when considering FTFGold Global as their trading platform.

For those seeking reliable alternatives, it is recommended to explore brokers that are regulated by reputable authorities, offer transparent trading conditions, and maintain a solid reputation for customer service. Brokers such as Forex.com, IG, and OANDA are examples of safer options that prioritize client security and provide a more trustworthy trading environment. Always prioritize safety and due diligence when selecting a trading broker.

Is FTFGOLD GLOBAL a scam, or is it legit?

The latest exposure and evaluation content of FTFGOLD GLOBAL brokers.

FTFGOLD GLOBAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FTFGOLD GLOBAL latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.