PFG 2025 Review: Everything You Need to Know

Summary

This detailed pfg review looks at PFG Advisors. The company is a financial services firm that started in 2014 and works in 39 states across the United States. PFG Advisors has 106 licensed advisors who manage about $1.613 billion in assets for 6,466 clients, making it a mid-sized investment advisory company. The firm keeps a moderate profile with 88% of workers recommending it, but it gets an overall rating of 3 out of 5 stars based on different performance measures.

PFG Advisors mainly helps clients who want forex and investment services across multiple U.S. states. The company positions itself as a regional investment advisor with strong asset management abilities. Their business model focuses on giving personalized investment advisory services, though specific details about trading platforms and account structures stay limited in public information. With over ten years of operation and substantial assets under management, PFG Advisors has become a legitimate player in the investment advisory sector, but potential clients should know about the broader industry context and regulatory considerations when looking at their services.

Important Disclaimers

Regional Entity Differences: PFG Advisors works across 39 states with different regulatory requirements and licensing obligations. The company keeps a licensed staff of 106 advisors, but specific licensing details and state-by-state operational differences may affect service availability and regulatory oversight. Potential clients should check local licensing and regulatory compliance before working with the firm.

Review Methodology: This evaluation uses publicly available information, regulatory filings, and employee feedback data. The assessment has not included direct testing of trading platforms or customer service experiences. Information accuracy depends on how current and complete the available sources are, and actual user experiences may vary significantly from the data presented in this review.

Rating Framework

Broker Overview

Company Background and Establishment

PFG Advisors started in 2014 as a registered investment advisory firm. The company built its operations to serve clients across 39 U.S. states. PFG Advisors has grown to manage $1.613 billion in assets through a team of 106 licensed advisors, serving a client base of 6,466 individuals and entities. This substantial asset base makes PFG Advisors a significant regional player in the investment advisory space, with an average client account size of about $242,000, suggesting a focus on wealthy individual investors and institutional clients.

The firm operates from multiple locations to serve its diverse geographic footprint. It maintains regulatory compliance across various state jurisdictions. With over a decade of operational history, PFG Advisors has shown stability and growth in the competitive investment advisory market. However, it's important to note that the broader PFG brand has a complex history in the financial services industry, with the previous Peregrine Financial Group entity facing significant regulatory issues and closure in 2012 due to fraudulent activities.

Business Model and Services

PFG Advisors operates mainly as an investment advisory firm. The company focuses on forex and related investment services for clients across its operational states. PFG Advisors' business model centers on providing personalized investment advice and portfolio management services through its network of licensed advisors. While specific details about trading platforms and technological infrastructure are not detailed in available sources, the firm's substantial asset base suggests a comprehensive service offering that meets the needs of its diverse client base.

This pfg review finds that the company's operational scope spans multiple asset classes, though forex appears to be a primary focus area. The firm's ability to maintain and grow its client base to over 6,400 accounts shows a viable business model and competitive service offering, despite limited public information about specific product features and trading conditions.

Regulatory and Operational Scope

PFG Advisors maintains operations across 39 states. Specific regulatory details and licensing numbers are not prominently disclosed in available information. The firm's multi-state presence requires compliance with various state-level regulations and licensing requirements, managed through its team of 106 licensed advisors.

Service Offerings and Asset Classes

The company mainly focuses on forex and related investment services. Specific details about available trading instruments, asset classes, and investment products are not detailed in source materials. The substantial asset base suggests a comprehensive offering that appeals to various investor types and risk profiles.

Account Structure and Requirements

Specific information about minimum deposit requirements, account types, and opening procedures is not available in current source materials. The average account size of about $242,000 suggests the firm may cater to higher-net-worth individuals, though this cannot be confirmed without additional account structure details.

Cost Structure and Fees

Detailed information about spreads, commissions, management fees, and other cost structures is not provided in available sources. Potential clients should request comprehensive fee schedules directly from the firm before making investment decisions.

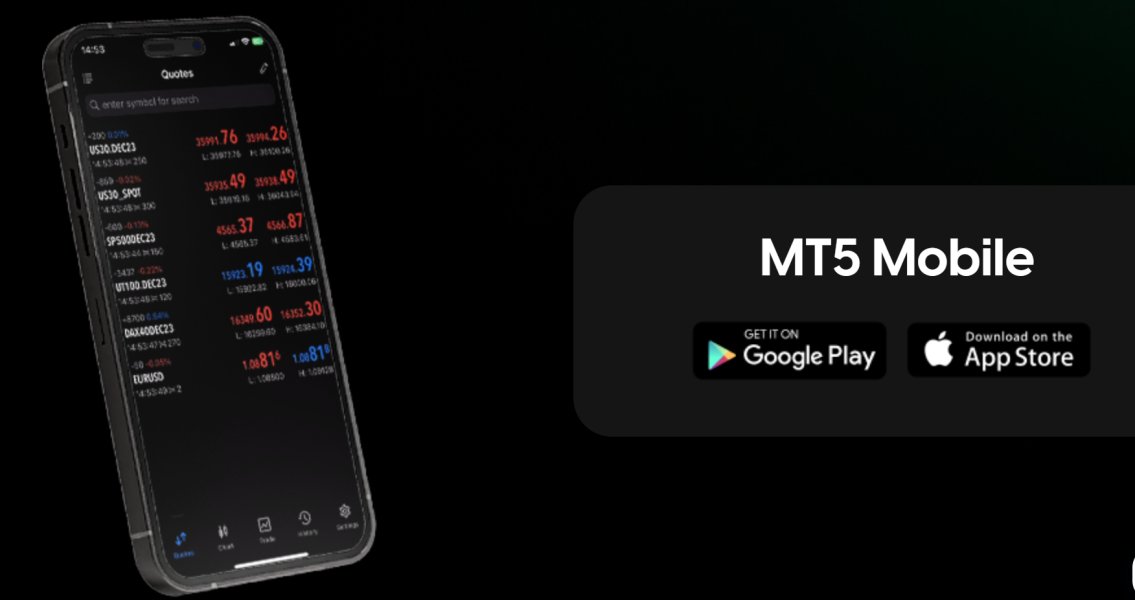

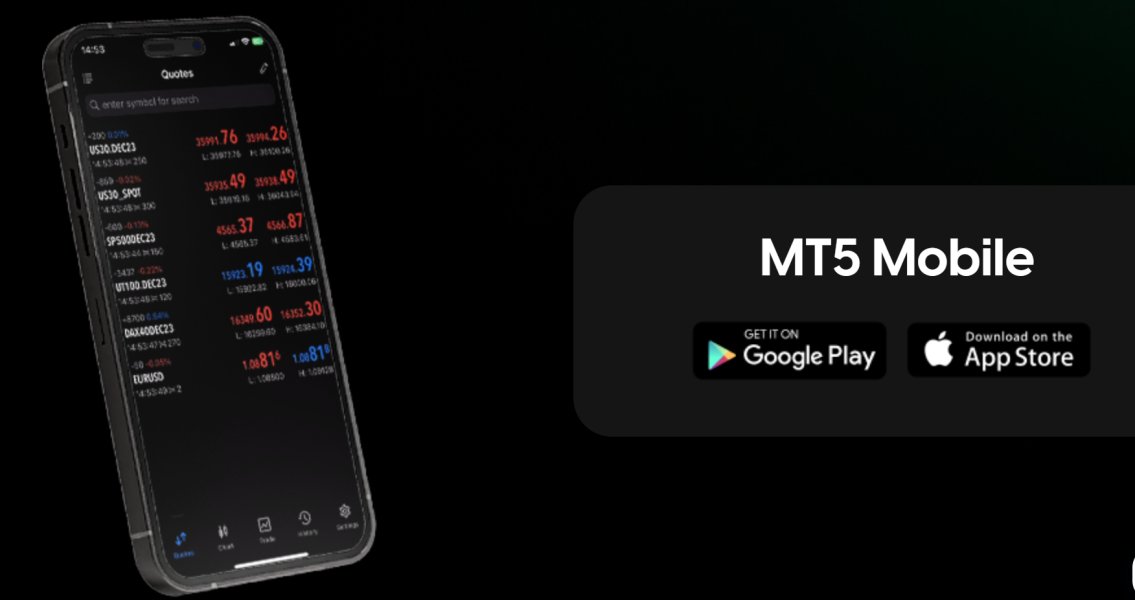

Trading Platforms and Technology

Specific details about trading platforms, technological infrastructure, and digital tools are not documented in available information. The firm's ability to manage substantial assets suggests adequate technological capabilities, though platform specifics remain unclear.

Geographic and Service Limitations

The firm operates exclusively within 39 U.S. states. Specific geographic restrictions and service limitations are not detailed in available sources. International clients or those in non-covered states may face access restrictions.

This pfg review emphasizes the need for potential clients to contact the firm directly for detailed information about services, costs, and operational specifics not covered in publicly available materials.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of PFG Advisors' account conditions faces significant limitations due to the absence of specific information about account types, structures, and requirements in available sources. While the firm manages $1.613 billion across 6,466 client accounts, suggesting an average account size of about $242,000, this metric alone cannot provide a comprehensive assessment of account conditions and accessibility.

The substantial average account size may show that PFG Advisors caters to higher-net-worth individuals or institutional clients. This could suggest higher minimum deposit requirements compared to retail-focused brokers. However, without specific information about account tiers, minimum deposits, or special account features such as Islamic accounts for Muslim traders, it's impossible to provide a definitive evaluation of the firm's account conditions.

The lack of publicly available information about account opening procedures, verification requirements, and account maintenance fees represents a significant transparency gap that potential clients should address through direct communication with the firm. This pfg review cannot provide a numerical rating for account conditions due to insufficient data, highlighting the importance of requesting detailed account information directly from PFG Advisors before making any investment decisions.

Assessment of PFG Advisors' trading tools and educational resources is severely limited by the absence of specific information in available sources. The firm employs 106 licensed advisors to serve its client base, but the nature and quality of analytical tools, research resources, and educational materials provided to clients remain undocumented in publicly accessible information.

The presence of a substantial number of licensed advisors suggests that clients may receive personalized guidance and professional analysis. This could serve as a valuable resource for investment decision-making. However, without specific information about proprietary research, third-party analysis tools, automated trading capabilities, or educational programs, it's impossible to evaluate the comprehensiveness and quality of the firm's resource offerings.

Modern traders typically expect access to advanced charting tools, real-time market analysis, economic calendars, and educational materials ranging from basic trading concepts to advanced strategies. The absence of information about such resources in this evaluation reflects either limited public disclosure by the firm or a potential gap in service offerings that prospective clients should investigate thoroughly before committing to the platform.

Customer Service and Support Analysis

The evaluation of PFG Advisors' customer service capabilities is constrained by limited available information about support channels, response times, and service quality metrics. The firm maintains 88% employee satisfaction with recommendations, but this internal metric doesn't directly translate to customer service quality experienced by clients.

With 106 licensed advisors serving 6,466 clients, the firm maintains an advisor-to-client ratio of about 1:61. This could potentially allow for more personalized attention compared to larger institutional brokers. This ratio suggests that clients may have access to dedicated advisory support, though the specific structure of client-advisor relationships and support availability remains unclear.

The absence of information about customer service channels such as phone support, live chat, email response times, or multi-language capabilities represents a significant gap in this assessment. Additionally, without data on customer satisfaction surveys, complaint resolution procedures, or service availability hours, potential clients cannot make informed decisions about the level of support they can expect. The firm's multi-state operation across 39 states may also create variations in service delivery that require clarification from prospective clients.

Trading Experience Analysis

Assessment of the trading experience offered by PFG Advisors is significantly hampered by the lack of specific information about trading platforms, execution quality, and technological infrastructure. The firm manages substantial assets exceeding $1.6 billion, but this metric alone cannot provide insights into platform stability, order execution speed, or user interface quality.

The absence of information about trading platform options, whether proprietary or third-party solutions like MetaTrader, represents a critical gap for potential clients who prioritize technological capabilities in their trading decisions. Modern traders typically expect features such as advanced charting tools, one-click trading, mobile accessibility, and reliable platform uptime, none of which can be evaluated based on available information.

Without data on execution speeds, slippage rates, platform downtime statistics, or mobile trading capabilities, this pfg review cannot provide meaningful insights into the actual trading experience clients might expect. The firm's focus on advisory services through licensed professionals may show a more traditional, relationship-based approach rather than a technology-driven trading environment, but this assumption requires verification through direct consultation with the firm.

Trust and Regulation Analysis

The trust and regulatory assessment of PFG Advisors reveals both positive elements and concerning gaps in transparency. The firm operates as a registered investment advisor across 39 states with 106 licensed advisors, showing compliance with basic regulatory requirements. However, the absence of specific regulatory identification numbers, detailed compliance information, or third-party regulatory ratings limits the depth of this evaluation.

A significant concern in evaluating PFG-related entities stems from the historical context of Peregrine Financial Group. This entity faced closure in 2012 due to a major fraud scandal involving missing customer funds exceeding $200 million. While PFG Advisors appears to be a separate entity established in 2014, the shared naming convention requires careful verification of corporate relationships and regulatory standing.

The firm's ability to maintain operations across multiple states and manage substantial client assets suggests adequate regulatory compliance and operational controls. However, the limited public disclosure of regulatory details, audit information, or third-party compliance ratings represents a transparency gap that potential clients should address through direct verification with relevant regulatory bodies and the firm itself.

User Experience Analysis

The user experience evaluation for PFG Advisors draws mainly from employee feedback data. This shows 88% of staff recommending the company, though the overall rating stands at 3 out of 5 stars. While employee satisfaction can show organizational stability and potentially positive client treatment, it doesn't directly reflect the client-facing user experience.

The firm's client base of 6,466 accounts with an average size of about $242,000 suggests a user profile oriented toward wealthy individuals and potentially institutional clients. This client demographic typically expects high-touch service, personalized attention, and sophisticated investment solutions, which the firm's advisor-heavy structure may be designed to provide.

However, critical aspects of user experience such as account opening procedures, platform usability, mobile accessibility, and digital service delivery remain undocumented in available sources. The 17% of reviews characterized as "constructive" suggests areas for improvement exist, though specific pain points are not detailed. Modern investors increasingly expect seamless digital experiences alongside traditional advisory services, making the absence of user experience data a significant limitation in this assessment.

Conclusion

This comprehensive pfg review reveals PFG Advisors as a substantial regional investment advisory firm with significant assets under management and a multi-state operational presence. However, the evaluation is significantly constrained by limited publicly available information about key operational aspects including trading platforms, account conditions, fee structures, and client service specifics.

The firm appears most suitable for investors seeking traditional advisory services with personalized attention, given its substantial advisor network and higher average account sizes. However, potential clients should conduct thorough due diligence, particularly regarding regulatory compliance, service specifics, and any potential connections to the broader PFG brand history. The main advantages include established operations and significant asset management scale, while the primary drawbacks center on limited transparency and insufficient public disclosure of operational details.