MorningFX 2025 Review: Everything You Need to Know

Executive Summary

This morningfx review gives a fair look at a China-based online forex trading platform. The platform has gotten attention for both its good features and regulatory problems. MorningFX says it offers high-leverage trading chances with access to many different types of investments, giving leverage up to 1:400 and using the popular MetaTrader 5 platform to make trades.

The platform shows some good points in how clear its trading environment is and the different assets it offers. But our study shows big problem areas that potential clients must think about carefully. The broker works under VFSC regulation, which may not give the same level of protection for investors as top regulatory areas do. Also, warnings from the National Futures Association about suspicious clone activities and mixed user feedback create a complex risk situation that needs careful checking.

MorningFX mainly targets investors who want high-leverage trading chances across forex, indices, energy goods, and precious metals. But the presence of regulatory warnings and user complaints about possible fraud suggests that this platform may work better for experienced traders who can handle higher-risk situations while doing thorough research.

Important Disclaimers

This review uses publicly available information and user feedback collected from different sources as of 2025. Readers should know that MorningFX works under VFSC regulation, which may be very different from regulatory standards in other areas, especially those with stricter oversight requirements.

The regulatory landscape for online forex brokers changes a lot across different regions. What may be okay in one area might not meet the standards of another. Also, the presence of warnings from regulatory bodies such as the NFA should be carefully thought about when looking at this broker for trading activities.

Rating Framework

Broker Overview

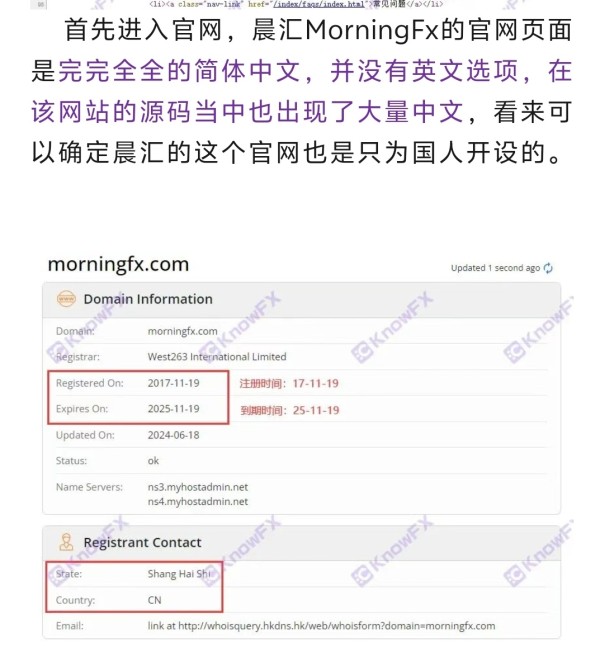

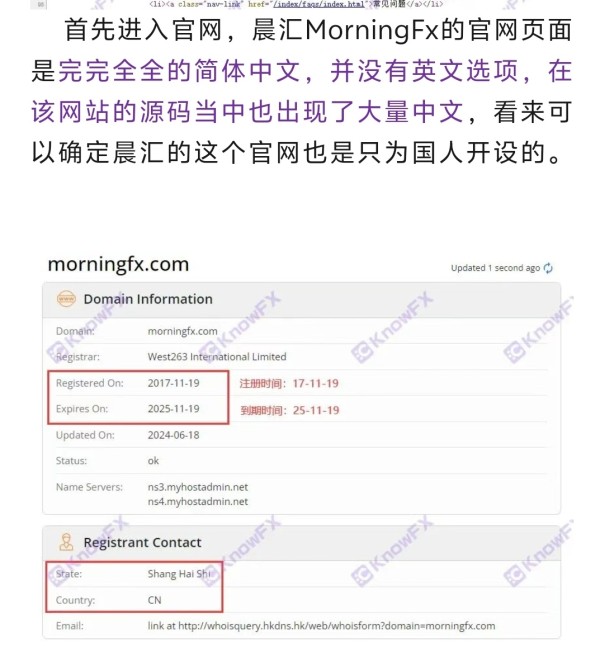

MorningFX is a China-based online forex trading platform that has made its place in the competitive retail trading market. The company focuses on giving access to foreign exchange markets along with other asset classes including indices, energy goods, and precious metals. While specific founding details stay unclear from available sources, the platform has positioned itself to serve traders who want higher leverage ratios and diverse trading chances.

The broker's business model centers around offering retail traders access to global financial markets through the MetaTrader 5 platform. This platform has become an industry standard for forex and CFD trading. This morningfx review shows that the company works under a market maker model, giving liquidity for client trades while offering leverage ratios that can reach up to 1:400, much higher than what many regulated brokers in major areas typically provide.

MorningFX works under the regulatory oversight of the Vanuatu Financial Services Commission. This is an area known for more flexible regulatory requirements compared to major financial centers. The platform mainly serves international clients who want access to forex trading, precious metals, energy goods, and stock indices, positioning itself as a complete trading solution for retail investors willing to accept the related regulatory and operational risks.

Regulatory Jurisdiction: MorningFX works under VFSC regulation. However, the National Futures Association has issued warnings about suspicious clone activities connected with the platform, raising big concerns about legitimacy and operational transparency.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods was not detailed in available sources. This represents a big information gap for potential clients.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available documentation. This makes it difficult for future traders to plan their initial investment requirements.

Promotional Offers: Details about bonus structures, promotional campaigns, or incentive programs are not mentioned in available sources. This suggests either limited promotional activities or not enough public disclosure.

Tradeable Assets: The platform gives access to four main asset categories: foreign exchange pairs, stock indices, energy goods, and precious metals. This offers reasonable variety for retail traders.

Cost Structure: Specific information about spreads, commissions, overnight financing charges, and other trading costs stays unclear from available sources. This represents a critical information deficit for cost-conscious traders.

Leverage Ratios: Maximum leverage reaches 1:400. This is much higher than regulations permit in major areas like the European Union or United States, targeting traders who want amplified market exposure.

Platform Options: MorningFX uses MetaTrader 5 as its primary trading platform. This gives clients access to advanced charting tools, automated trading capabilities, and comprehensive market analysis features.

Geographic Restrictions: Specific information about restricted areas or geographic limitations was not available in reviewed sources.

Customer Support Languages: Available customer service languages are not specified in accessible documentation. This creates uncertainty about multilingual support capabilities.

This morningfx review highlights big information gaps that potential clients should address through direct inquiry before committing funds.

Account Conditions Analysis

The account conditions offered by MorningFX present a mixed picture with limited transparency about specific terms and requirements. Available information suggests that the broker gives access to trading accounts without clearly defined tier structures or detailed specifications about account types. This lack of transparency creates uncertainty for potential clients trying to evaluate whether the platform meets their specific trading requirements.

Minimum deposit requirements stay unspecified in available documentation. This makes it impossible to assess the accessibility of the platform for traders with varying capital levels. This information gap is particularly concerning for retail traders who need to understand upfront costs before committing to a trading relationship. The absence of clear deposit requirements may indicate either flexible entry points or not enough disclosure practices.

The account opening process details are not readily available. This raises questions about verification requirements, documentation needs, and timeframes for account activation. Professional trading platforms typically give clear guidance about these processes, and the lack of available information represents a big transparency deficit.

Specialized account features such as Islamic accounts, professional trader classifications, or institutional account options are not mentioned in available sources. This morningfx review cannot definitively assess whether such options exist, but the lack of public information suggests limited account customization options or inadequate marketing disclosure about available features.

MorningFX's trading infrastructure centers around the MetaTrader 5 platform. This provides a solid foundation for technical analysis and trade execution. MT5 offers comprehensive charting capabilities, multiple timeframes, and extensive technical indicator libraries that can support various trading strategies. The platform also includes automated trading functionality through Expert Advisors, allowing for algorithmic trading approaches.

However, beyond the core MT5 platform, specific information about additional trading tools stays limited. Many competitive brokers supplement their platform offerings with proprietary tools, advanced market scanners, economic calendars, or specialized analysis software. The absence of detailed information about such supplementary tools suggests either limited additional resources or not enough disclosure about available features.

Research and analysis resources appear to be limited based on available information. Professional trading platforms typically give market commentary, fundamental analysis reports, technical analysis insights, and economic research to support client decision-making. The lack of specific information about such resources may indicate a gap in the broker's educational and analytical support structure.

Educational resources for new traders are not detailed in available sources. This represents a potential weakness for clients who want to develop their trading skills. Comprehensive broker platforms often include webinars, educational articles, video tutorials, and trading guides to support client development and success.

Customer Service and Support Analysis

Customer service quality represents a critical concern area for MorningFX based on available user feedback and regulatory warnings. The presence of user complaints and regulatory alerts about suspicious activities creates big questions about the reliability and responsiveness of customer support services. These concerns are particularly important given the financial nature of the services provided.

Specific information about customer service channels, including phone support, email assistance, live chat availability, or help desk systems, is not detailed in available sources. This lack of transparency about support mechanisms makes it difficult for potential clients to understand how they would receive assistance if problems arise during their trading activities.

Response times for customer inquiries and support requests are not specified in available documentation. Professional trading platforms typically give clear service level agreements about response times, but such information appears to be absent from MorningFX's public disclosures.

The availability of multilingual support stays unclear. This could present barriers for international clients who require assistance in their native languages. Given the platform's apparent targeting of international markets, the absence of clear language support information represents a potential service limitation.

Operating hours for customer support services are not specified. This creates uncertainty about when clients can expect to receive assistance. This is particularly important for forex trading, which operates across multiple time zones and requires support availability during various market hours.

Trading Experience Analysis

The trading experience on MorningFX centers around the MetaTrader 5 platform. This generally gives stable and reliable trade execution capabilities. MT5's robust architecture supports various order types, multiple timeframes, and comprehensive market analysis tools that can enhance the overall trading experience for both novice and experienced traders.

Platform stability appears to be adequate based on the MT5 foundation. However, specific performance metrics about uptime, execution speed, or system reliability are not available in reviewed sources. The absence of detailed performance data makes it difficult to assess how the platform performs during high-volatility market conditions or peak trading hours.

Order execution quality, including information about slippage rates, requote frequency, or execution speed benchmarks, is not detailed in available documentation. These factors significantly impact trading profitability and overall user satisfaction, making their absence a notable information gap for potential clients evaluating the platform.

Mobile trading capabilities through MT5 mobile applications should give reasonable flexibility for traders who need to manage positions while away from desktop computers. However, specific information about mobile platform features, functionality, or performance is not detailed in available sources.

The trading environment's transparency, including real-time spread display, execution statistics, or trade reporting features, stays unclear from available information. This morningfx review cannot definitively assess these crucial aspects of the trading experience due to limited available data.

Trust and Safety Analysis

Trust and safety concerns represent the most significant risk factors associated with MorningFX. The National Futures Association's warnings about suspicious clone activities create serious questions about the platform's legitimacy and operational integrity. Such warnings from established regulatory bodies should be considered carefully by potential clients evaluating the platform for trading activities.

The broker operates under VFSC regulation. This provides a lower level of investor protection compared to major regulatory areas such as the FCA, ASIC, or CySEC. VFSC oversight may not include the same stringent capital requirements, segregation mandates, or compensation schemes that traders might expect from more established regulatory frameworks.

Client fund protection measures, including segregated account requirements, insurance coverage, or compensation scheme participation, are not detailed in available sources. This represents a critical information gap about the safety of client deposits and the protection available in case of broker insolvency or operational difficulties.

Company transparency about ownership structure, financial statements, or operational disclosures appears limited based on available information. Professional trading platforms typically give clear information about corporate structure and financial stability, but such details are not readily accessible for MorningFX.

The presence of user complaints about potential fraudulent activities, combined with regulatory warnings, creates a concerning pattern that potential clients must carefully evaluate. These factors significantly impact the overall trust rating and suggest elevated risks associated with platform usage.

User Experience Analysis

User experience feedback for MorningFX presents a mixed picture with both positive and negative elements reported by traders. Some users acknowledge the platform's high leverage offerings and asset diversity, while others express concerns about potential fraudulent activities and operational transparency. This divergence in user opinions suggests varying experiences that may depend on individual trading approaches and expectations.

Interface design and usability information is limited to the MT5 platform capabilities. These generally provide a professional and comprehensive trading environment. However, specific feedback about the broker's website usability, account management interface, or client portal functionality is not detailed in available sources.

The registration and verification process details are not clearly outlined in available documentation. This makes it difficult to assess the user-friendliness of account opening procedures. Professional platforms typically streamline these processes while maintaining appropriate compliance standards, but specific information about MorningFX's approach is not available.

Funding and withdrawal experiences represent critical user experience factors. However, specific feedback about transaction processing times, fee structures, or procedural complexity is not detailed in reviewed sources. These operational aspects significantly impact overall user satisfaction and platform usability.

Common user complaints appear to focus on concerns about potential fraudulent activities and regulatory warnings. These create uncertainty about the platform's reliability and operational integrity. These concerns significantly impact the overall user experience assessment and suggest elevated risks for potential clients.

Conclusion

This morningfx review reveals a trading platform that offers certain competitive features, including high leverage ratios up to 1:400 and access to multiple asset classes through the reliable MT5 platform. However, significant concerns about regulatory warnings, user complaints, and transparency deficits create a complex risk profile that requires careful consideration.

The platform may be suitable for experienced traders with higher risk tolerance who can conduct thorough due diligence and implement appropriate risk management strategies. However, the presence of NFA warnings about suspicious clone activities and mixed user feedback suggests that more conservative investors might prefer platforms with stronger regulatory oversight and clearer operational transparency.

The main advantages include competitive leverage offerings and a transparent trading environment through MT5. The primary disadvantages center on regulatory concerns, limited transparency, and user complaints about potential fraudulent activities. Potential clients should carefully weigh these factors against their individual risk tolerance and trading requirements before making platform selection decisions.