Regarding the legitimacy of morningfx forex brokers, it provides VFSC and WikiBit, .

Is morningfx safe?

Business

License

Is morningfx markets regulated?

The regulatory license is the strongest proof.

VFSC Derivatives Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

DIRECT TRANSACTION MARKETS LIMITED

Effective Date:

2023-02-20Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is MorningFX A Scam?

Introduction

MorningFX is a forex broker that has positioned itself as a provider of online trading services since its establishment in 2019. With a focus on the Chinese market and a digital-first approach, MorningFX offers various trading instruments, including forex, indices, metals, and oil. However, as the forex market continues to attract both seasoned and novice traders, it is crucial for individuals to carefully evaluate the legitimacy and safety of brokers like MorningFX. This article investigates the safety of MorningFX, analyzing its regulatory standing, company background, trading conditions, customer experiences, and potential risks. The assessment is based on a review of various online sources, user feedback, and regulatory information.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its legitimacy and the safety of its clients' funds. MorningFX claims to be regulated by the Vanuatu Financial Services Commission (VFSC) and also indicates a connection with the National Futures Association (NFA). However, the quality and reliability of such regulatory bodies can vary significantly. Below is a summary of the core regulatory information for MorningFX:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | 14677 | Vanuatu | Active |

| National Futures Association (NFA) | 0510311 | USA | Suspicious Clone |

While MorningFX holds a license from the VFSC, it is important to note that this is considered a low-tier regulatory authority. The NFA's classification of MorningFX as a "suspicious clone" raises further concerns about its legitimacy. A broker's regulatory status is critical as it provides a level of oversight and protection for clients. The VFSC is known for its lenient regulations, which may not offer the same level of investor protection as more stringent regulatory bodies like the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). Therefore, while MorningFX is technically regulated, the quality of oversight is questionable, leading to concerns about whether MorningFX is safe for traders.

Company Background Investigation

MorningFX operates under the umbrella of Morning Markets Ltd., a company incorporated in China. Established in 2019, the company has a relatively short history in the competitive forex market. The ownership structure and management team are not widely disclosed, which can be a red flag for potential investors. A lack of transparency regarding the company's history, management experience, and operational practices can lead to doubts about the broker's reliability.

The management team's backgrounds are crucial in assessing the broker's credibility. A well-experienced team can indicate a higher level of professionalism and commitment to regulatory compliance. However, the absence of information about the management team at MorningFX raises concerns about their qualifications and the company's operational integrity. Furthermore, the level of transparency regarding the company's financial health and operational practices is inadequate. This lack of information makes it difficult for potential clients to assess whether MorningFX is safe for their trading activities.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. MorningFX presents a competitive structure with various account types and leverage options. However, an in-depth examination reveals potential issues.

MorningFX's fee structure includes spreads and commissions that can vary based on account types. Heres a comparison of core trading costs:

| Fee Type | MorningFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (0.00) | 1.0 - 2.0 pips |

| Commission Structure | Variable | $5 - $10 per lot |

| Overnight Interest Range | Variable | 0.5% - 1.5% |

While the spreads appear competitive, the variability and lack of transparency regarding commissions and overnight interest rates could lead to unexpected costs for traders. Such ambiguity can be concerning, as it may indicate hidden fees that could affect overall trading profitability. Therefore, while the trading conditions may seem appealing at first glance, traders should be cautious and consider whether MorningFX is safe based on its fee structure and transparency.

Customer Funds Security

The security of client funds is a critical aspect of evaluating a forex broker. MorningFX claims to implement various measures to ensure the safety of its clients' funds. However, the effectiveness and reliability of these measures must be scrutinized.

MorningFX should ideally offer segregated accounts for client funds, ensuring that they are kept separate from the company's operational funds. This practice protects clients' money in case of the broker's insolvency. Furthermore, the presence of investor protection schemes can provide additional security for traders. However, there is limited information available regarding MorningFX's practices in this area.

Historical issues related to fund security can also indicate the reliability of a broker. Complaints from users about withdrawal difficulties and account management issues have surfaced, raising concerns about whether MorningFX is safe for traders. The absence of a robust framework for fund protection and the lack of transparency regarding client fund management practices are significant red flags.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews and complaints about MorningFX have highlighted several patterns that potential clients should be aware of.

Common complaints include withdrawal difficulties, account management issues, and a lack of responsive customer support. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Delayed or No Response |

| Account Lockouts | Medium | Vague Explanations |

| Poor Customer Support | High | Slow Response Times |

One notable case involved a trader who reported being unable to withdraw funds after achieving significant profits, with customer support providing little to no assistance. Such experiences can be alarming for prospective users, as they indicate potential operational shortcomings. This leads to the question of whether MorningFX is safe for trading, given the troubling feedback from existing clients.

Platform and Execution

The trading platform's performance is crucial for a smooth trading experience. MorningFX utilizes the MetaTrader 5 (MT5) platform, which is known for its user-friendly interface and robust features. However, the platform's execution quality, including slippage and order rejection rates, must be assessed.

Traders have reported mixed experiences with order execution on the MorningFX platform. Instances of slippage during volatile market conditions and occasional order rejections have been noted, which can negatively impact trading outcomes. Signs of potential platform manipulation, such as frequent requotes or unexplained price fluctuations, have also raised concerns among users. Therefore, while MT5 is a reputable platform, the execution quality on MorningFX may not meet the standards expected by traders, further questioning whether MorningFX is safe for trading.

Risk Assessment

Engaging with any forex broker carries inherent risks, and MorningFX is no exception. A comprehensive risk assessment is essential for potential traders.

Heres a summary of the key risk areas associated with MorningFX:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Weak regulatory oversight from VFSC |

| Operational Risk | Medium | Complaints about fund withdrawals and customer support |

| Market Risk | High | Exposure to high volatility in forex markets |

Given the high-risk rating in regulatory and operational categories, traders should approach MorningFX with caution. To mitigate these risks, it is advisable to start with a small investment and thoroughly research the broker's practices before committing significant capital.

Conclusion and Recommendations

After a thorough investigation into MorningFX, it is evident that while the broker offers attractive trading conditions, there are significant concerns regarding its regulatory standing, transparency, and customer feedback. The classification of MorningFX as a "suspicious clone" by the NFA is particularly alarming, indicating potential risks for traders.

In conclusion, while MorningFX may appeal to some traders, it is essential to consider the potential risks and issues highlighted in this analysis. For those seeking reliable trading partners, it may be wise to explore alternative brokers with stronger regulatory oversight and positive user experiences. If safety and reliability are paramount, consider brokers regulated by top-tier authorities such as the FCA or ASIC, which provide enhanced protections for traders. Ultimately, the question remains: Is MorningFX safe? The evidence suggests that traders should proceed with caution.

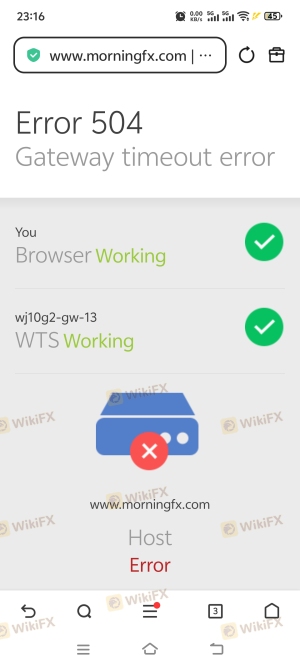

Is morningfx a scam, or is it legit?

The latest exposure and evaluation content of morningfx brokers.

morningfx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

morningfx latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.