Raynar Group Review 4

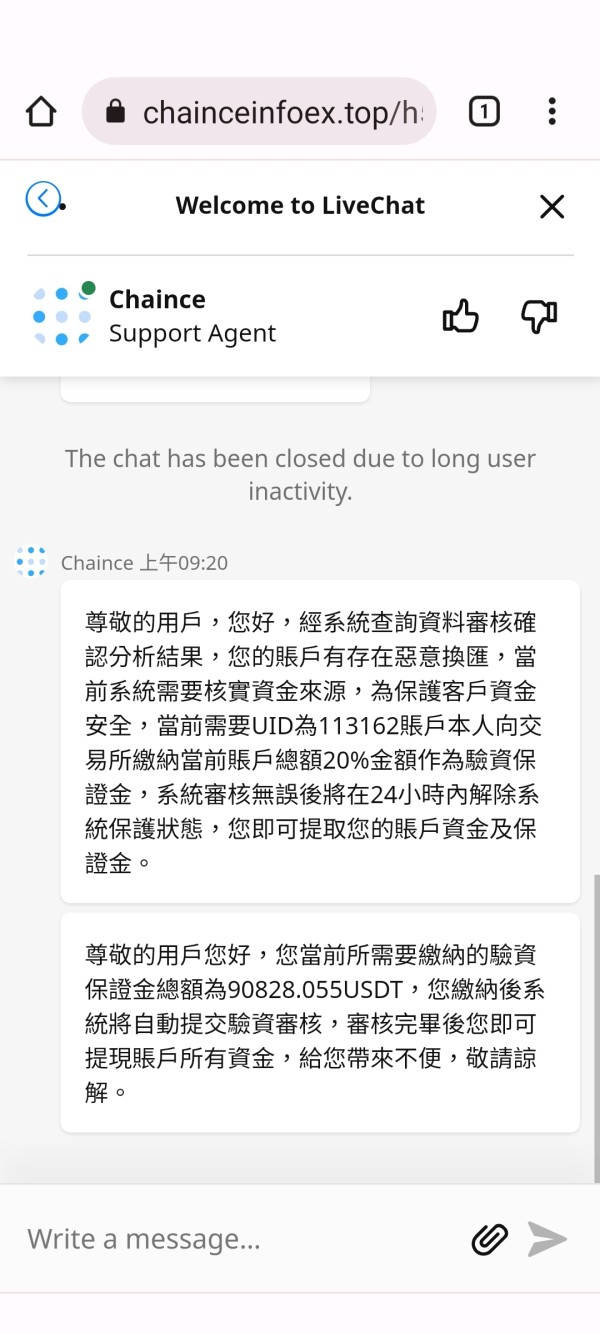

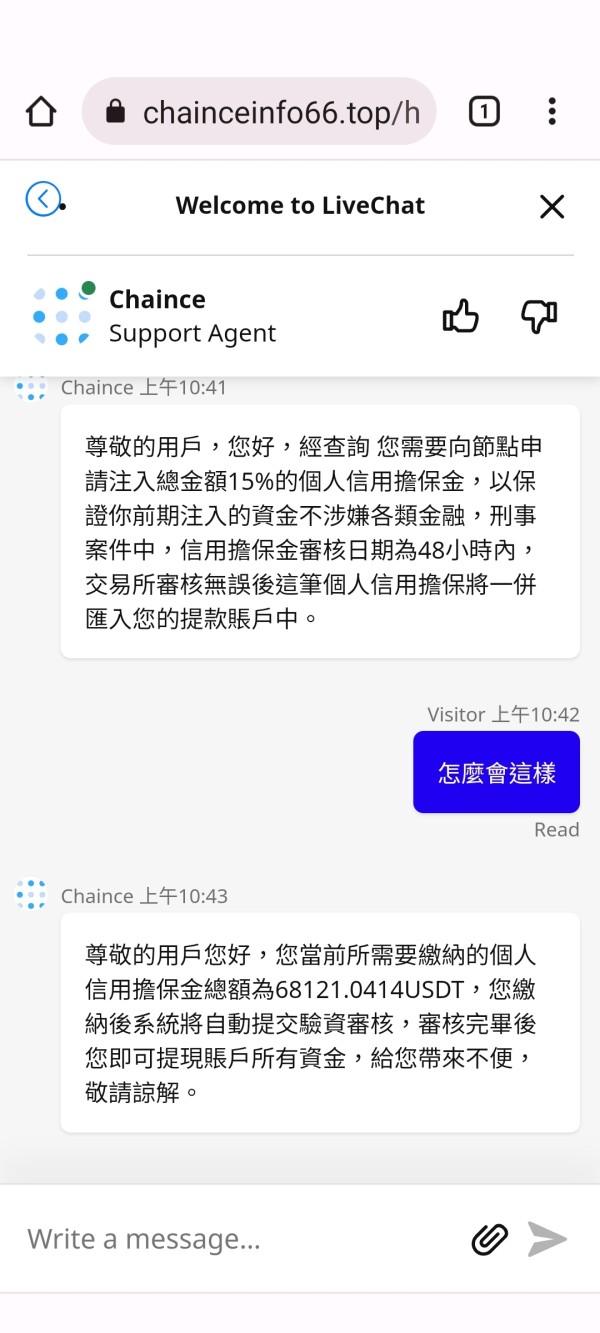

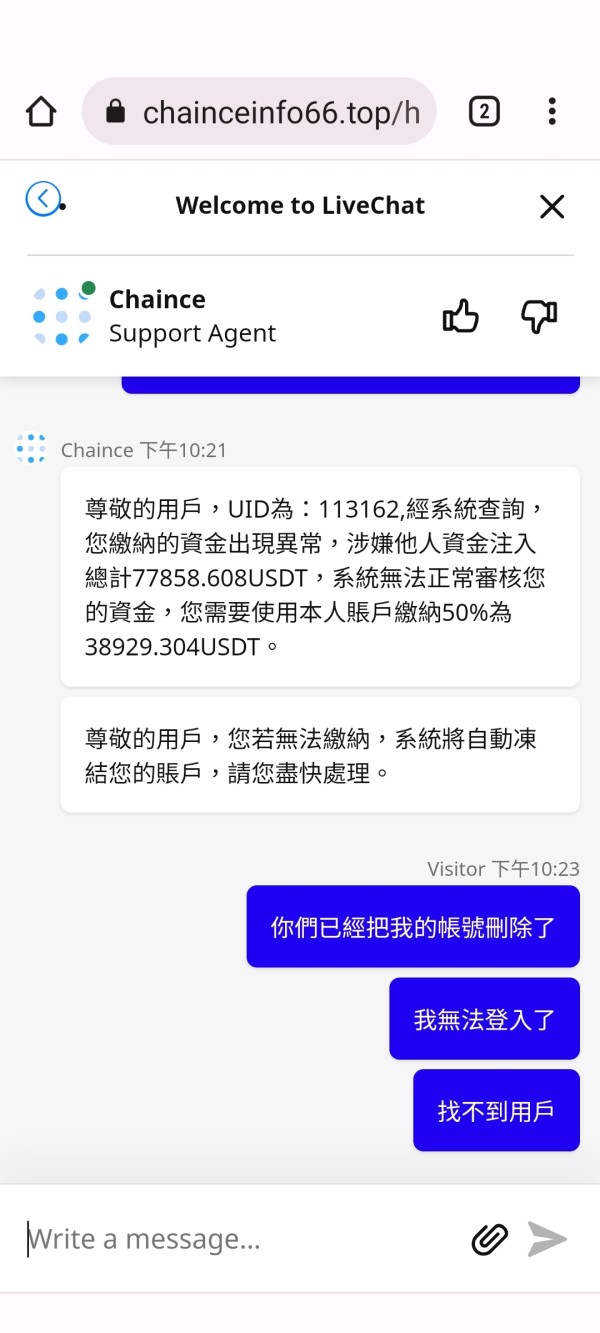

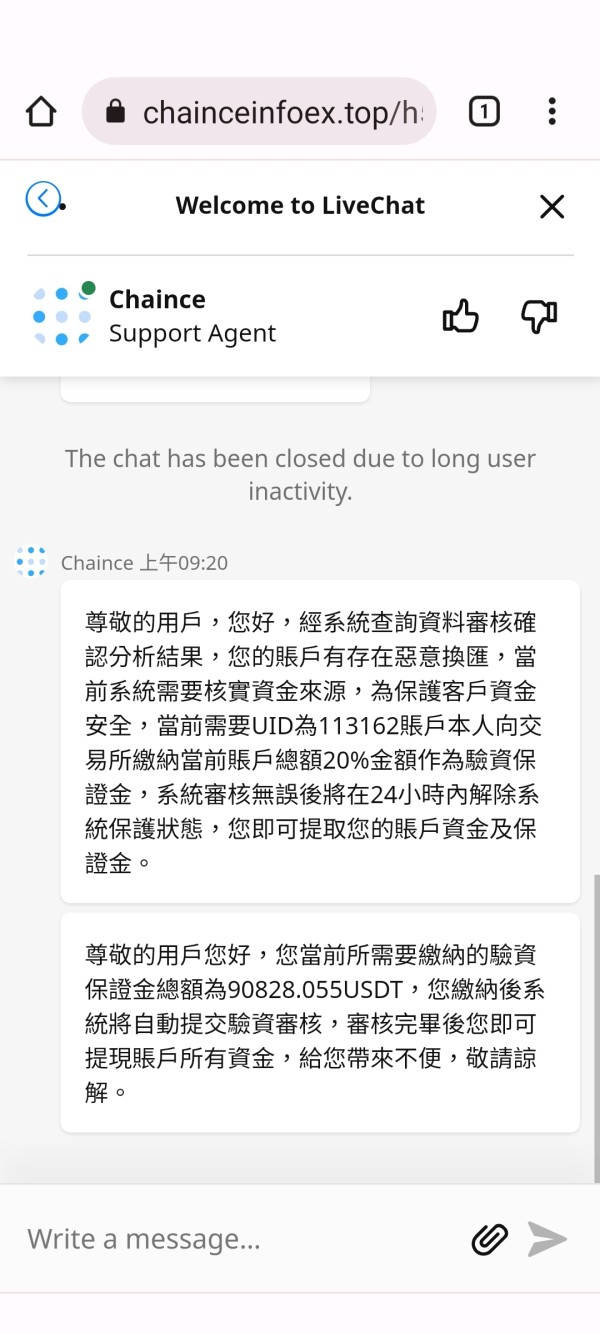

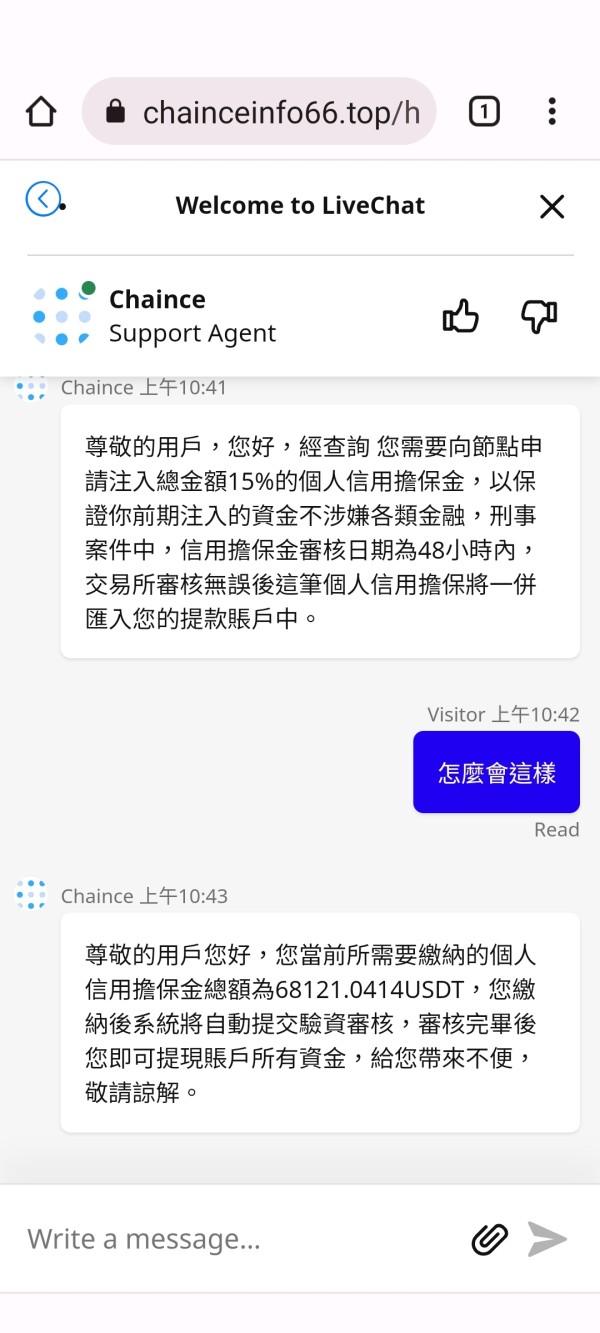

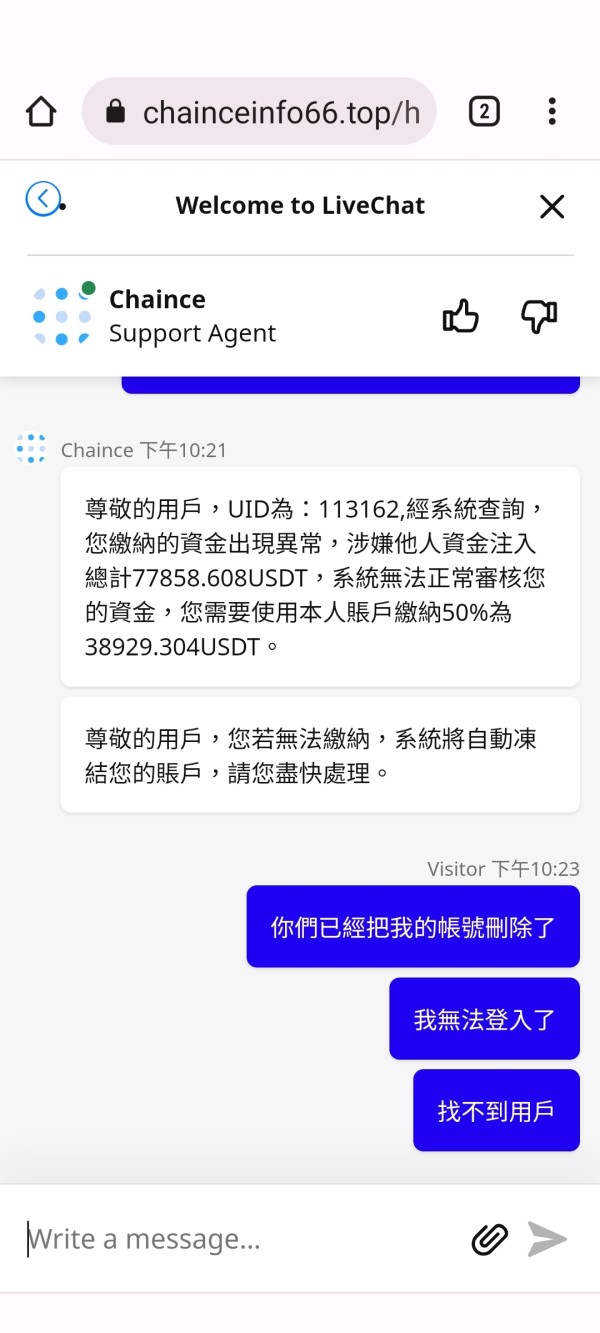

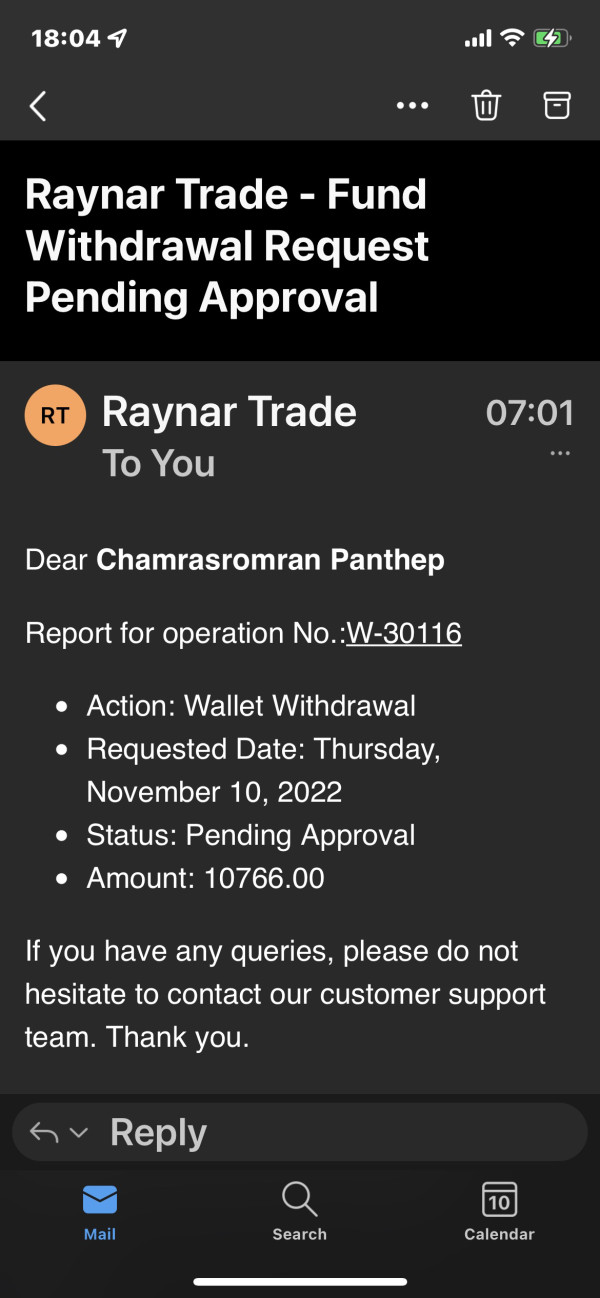

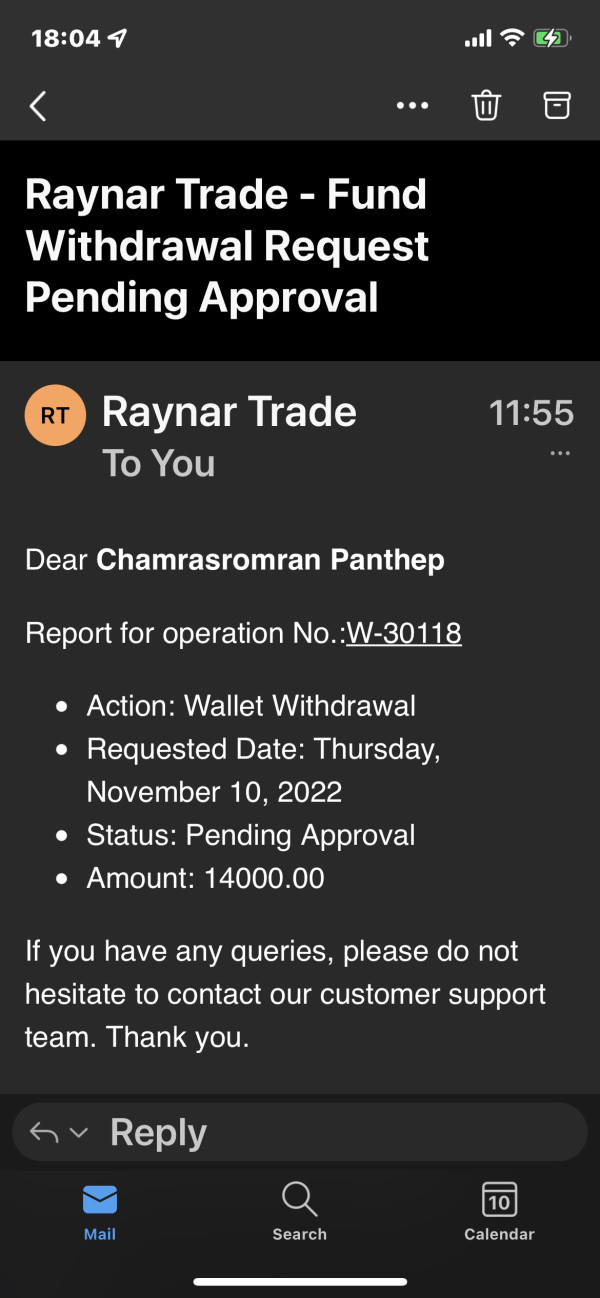

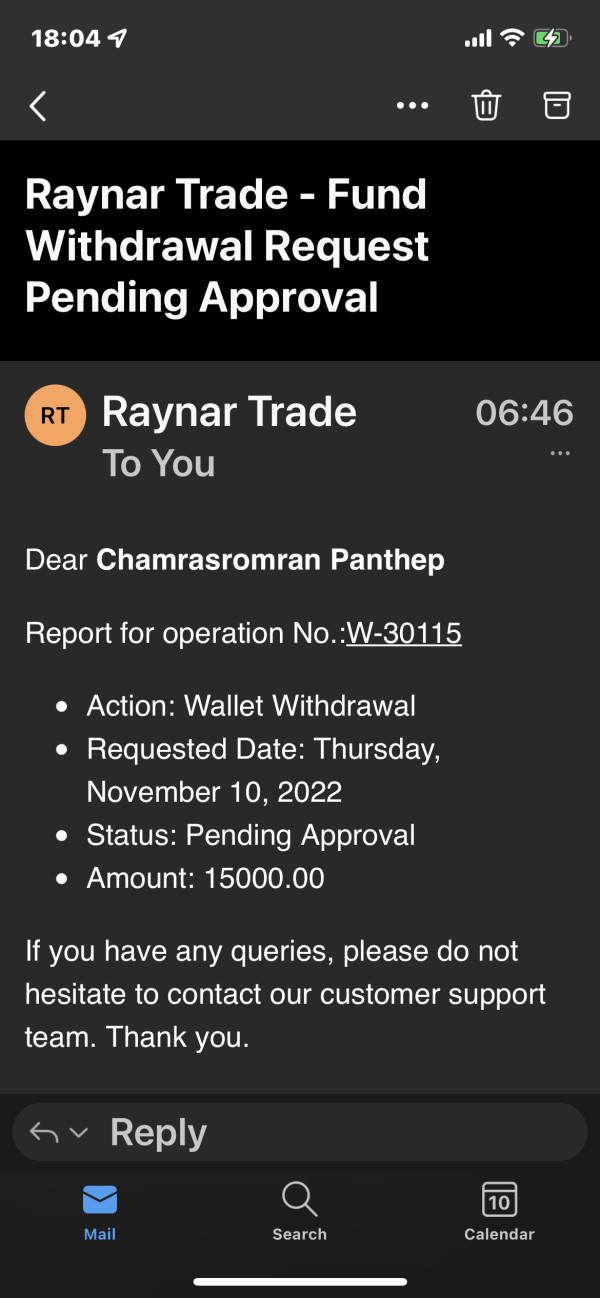

A boy in Hong Kong who claimed to be Li Yuxiang added my IG on 6/04. He was very enthusiastically in chat and quickly developed into a lover. He greeted three meals a day, shared daily photos, or talked on the phone, and chatted. He mentioned that he usually studies cryptocurrencies, and then he began to teach me to transfer money from the MAX platform to the OKX wallet, and then to the Exchange platform Chaince, using futures trading with an initial amount of about NT$200,000 and a profit of about US$410. After slowly making a profit, he encouraged me to put the stock money into cryptocurrency to obtain higher profits, because he kept guaranteeing that he could definitely withdraw it every other month, so I completely trusted him and borrowed 1.54 million from the bank, and borrowed another 2 million from friends, hoping to maximize the benefits. The profit increased from a few hundred dollars to several thousand, or even tens of thousands of dollars, and Mr. Li also invested 30,000 dollars to invest together, so I fully believe that we can create wealth together. Until July 25, when the last transaction was about to be withdrawn, the platform required a capital verification deposit of more than US$99,000. In only one week, I moved out the available deposit and completed the payment together with Mr. Li. As a result, the platform came to notify again that due to frequent transactions, another deposit of about US$60,000 was required to prove that the source of funds was legitimate. Before and after, Mr. Li paid a deposit of 77,000 US dollars for me, so I trusted him very much. When I used all my savings and took out all my savings on 8/02, the platform claimed that some of the funds were not paid by me, but This amount happened to be the fund that Mr. Li helped to pay, so it is necessary to provide a security deposit of about 40,000 US dollars, and the deadline for payment is before 12 o'clock in the evening on 8/04. Generally, when we pay, we only show the address of the wallet on the chain. How can the platform know that those are Mr. Li’s? That’s night, the platform directly deleted my account, and I realized that I had been cheated. And when I told Mr. Li that there was really nothing I could do to pay, he got furious and angry. 8/05, that is, today, the website of the exchange has been moved. Looking back on this process, every time the exchange changed its website, Mr. Li notified me as soon as possible, not the platform. And although he got stuck with more than 70,000 U.S. dollars in funds, he didn't want to solve it, but kept asking me to find the money again. Isn't this unreasonable? Obviously, Mr. Li is related to this whole platform, please be careful.

Open for 3 months and run away at the end of 2022

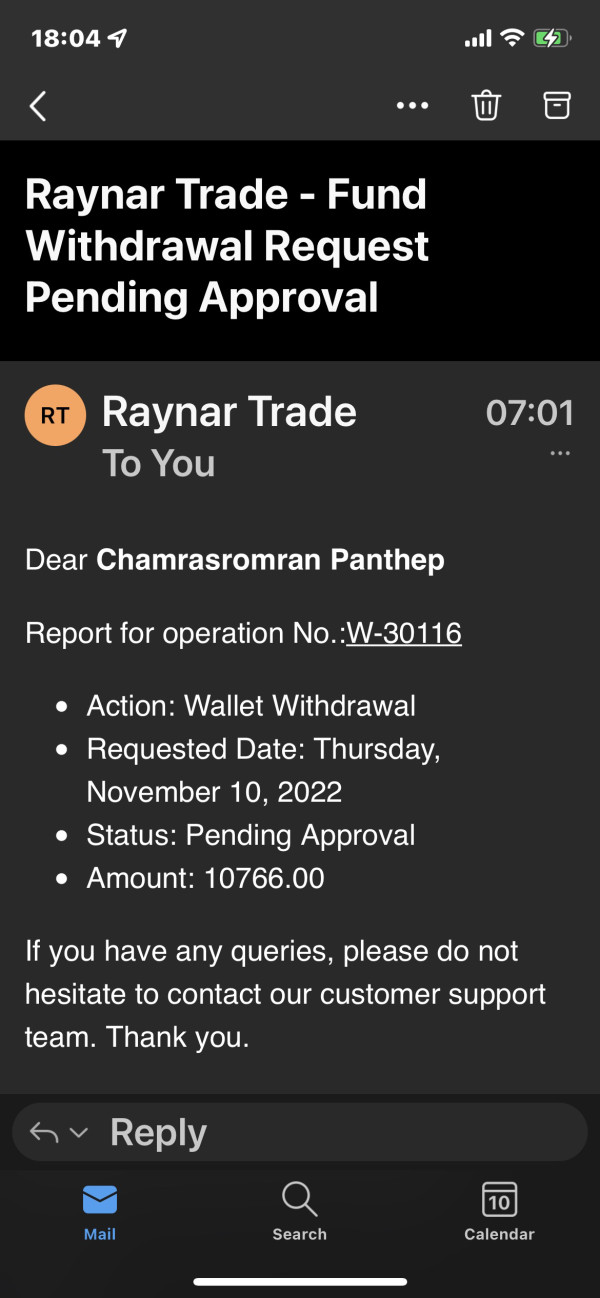

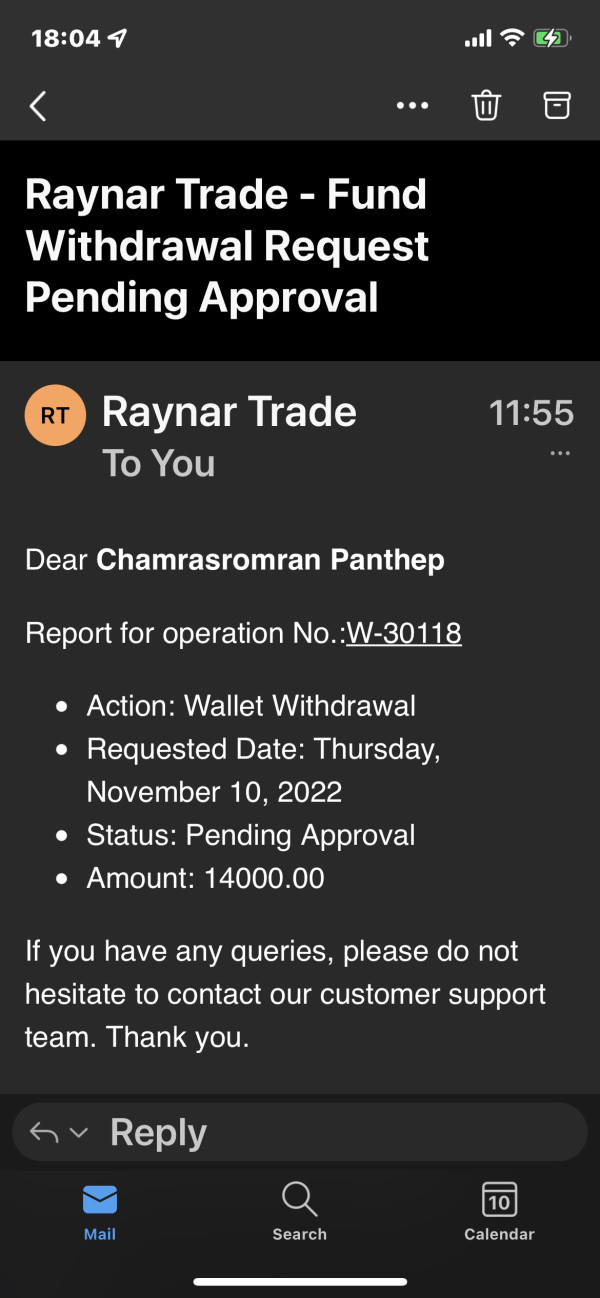

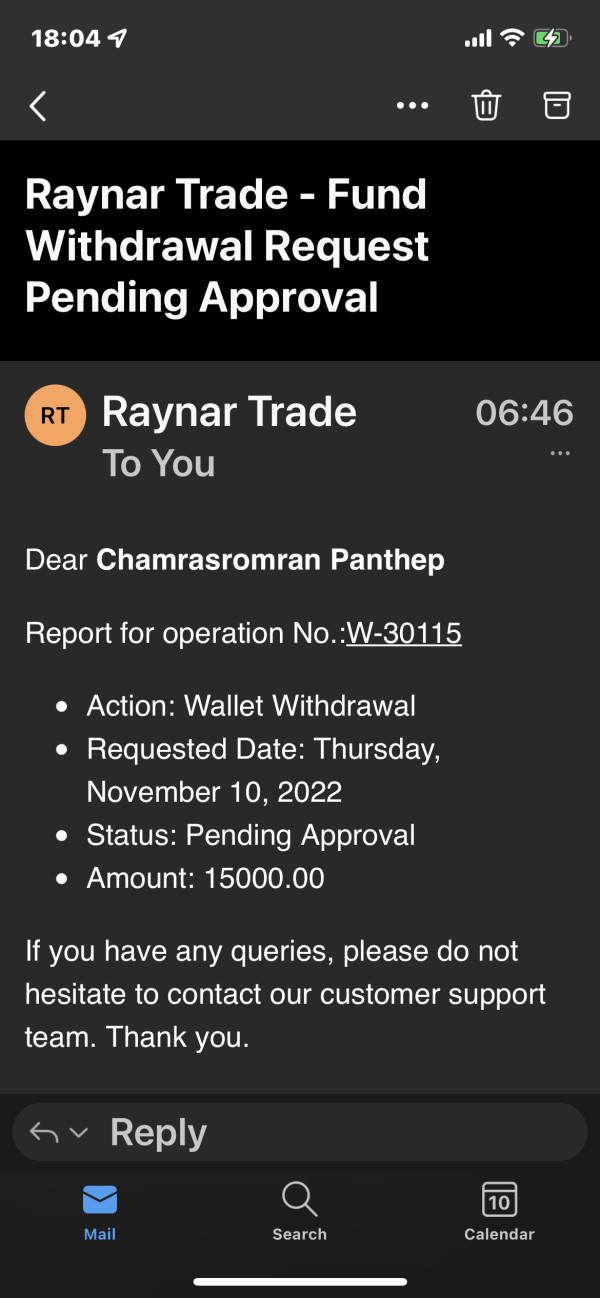

Raynar told us to be able to withdraw “our” money with over$55,000 we have to pay 20% to initiate our account! we already has money with them and kept blaming exchange agent. if this is not a scam what is. will some one help me I am ready to pay 25% from my money in Raynar’s account

Raynar Group proved hugely advantageous for me due to leverage and bonus. They provide up to a 1:1000 leverage ratio to their clients and the second thing is the high welcome bonus.