Is Raynar Group safe?

Business

License

Is Raynar Group Safe or Scam?

Introduction

Raynar Group is a relatively new player in the forex market, having been established in 2022 and based in Ukraine. It positions itself as an online trading platform that offers access to various financial instruments, including forex, commodities, and indices. However, as with any trading platform, it is critical for traders to exercise caution and thoroughly evaluate the credibility and reliability of the broker they choose. The forex industry has seen its fair share of scams, making it essential for traders to consider factors such as regulation, company history, trading conditions, and customer feedback. This article aims to provide a comprehensive analysis of Raynar Group, focusing on its regulatory status, operational history, trading conditions, customer experiences, and overall safety.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific standards and practices that protect client funds. Unfortunately, Raynar Group does not hold any regulatory licenses from recognized financial authorities. This lack of oversight raises significant concerns about the safety of funds deposited with the broker.

| Regulatory Authority | License Number | Regulating Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that traders are not afforded the protections typically guaranteed by licensed brokers. For example, regulated brokers are usually required to maintain segregated accounts for client funds and provide negative balance protection. In contrast, Raynar Group's unregulated status indicates that it operates without such safeguards, putting client investments at risk. Additionally, the lack of regulatory oversight can lead to issues such as difficulty in withdrawing funds, which has been reported by several users. Thus, the question arises: is Raynar Group safe? The evidence suggests otherwise.

Company Background Investigation

Raynar Group is operated by Raynar Group LLC, with its headquarters located in Kyiv, Ukraine. The company is relatively young, having been established in 2022, which raises questions about its operational history and experience in the forex market. A deeper dive into the company's management reveals a lack of transparency regarding its ownership structure and the qualifications of its leadership team.

The absence of detailed information about the management team is a significant red flag. A reputable broker typically provides information about its founders and executives, along with their professional backgrounds. In the case of Raynar Group, potential clients are left in the dark, which is concerning. Furthermore, the company's website lacks essential legal documents, such as terms and conditions and risk disclosures, which are usually standard practice for legitimate brokers. This opacity in operations and management raises further doubts about whether Raynar Group can be considered safe for trading.

Trading Conditions Analysis

When assessing a broker, understanding its trading conditions is vital. Raynar Group offers three types of trading accounts, with minimum deposits starting from $500. However, the broker's fee structure appears to be somewhat opaque, with limited information available regarding spreads and commissions.

| Fee Type | Raynar Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity surrounding trading fees is concerning. Many users have reported unexpected charges and withdrawal fees, which are often hidden in the fine print. Such practices are common among unregulated brokers and can lead to significant financial losses for traders. Therefore, it is crucial for potential clients to question: is Raynar Group safe? The evidence suggests that traders may face challenges related to unexpected costs and unclear fee structures.

Client Fund Safety

The security of client funds is paramount in the trading industry. Regulated brokers are required to implement measures such as segregated accounts and investor protection schemes to ensure that client funds are safe. Unfortunately, Raynar Group does not provide any information regarding such safety measures.

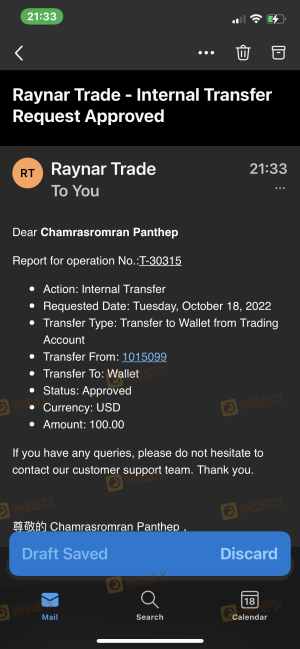

Given that Raynar Group operates without regulation, there is no guarantee that client funds are protected. This lack of transparency regarding fund safety is alarming, especially considering that several users have raised concerns about their inability to withdraw funds from their accounts. In the absence of regulatory oversight, traders are left vulnerable to potential financial losses, leading to the question: is Raynar Group safe? Based on the available evidence, it appears that client funds may not be secure.

Customer Experience and Complaints

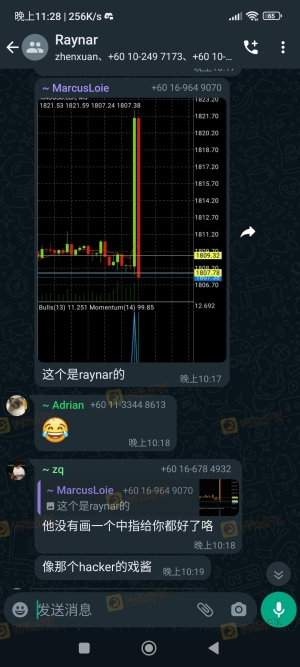

Analyzing customer feedback provides valuable insights into a broker's reliability and service quality. Reviews of Raynar Group indicate a pattern of complaints, particularly concerning withdrawal difficulties and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Poor |

| Unexpected Fees | High | Poor |

Common complaints include users reporting that they were unable to withdraw their funds after making deposits, often citing various reasons from the broker for the delays. In some cases, users have alleged that they were pressured into making additional deposits to access their funds, a tactic commonly associated with scam operations. This raises significant concerns about the integrity of Raynar Group, leading to the critical question: is Raynar Group safe? The overwhelming evidence of customer dissatisfaction suggests that it may not be.

Platform and Trade Execution

The trading platform's performance and reliability are essential factors for any trader. While Raynar Group claims to offer a trading platform, reviews suggest that users have experienced issues with platform stability and execution quality.

Many users report encountering problems with order execution, including slippage and rejections, particularly during volatile market conditions. Such issues can significantly impact trading outcomes and raise suspicions about the broker's practices. If a broker manipulates its trading platform, it poses a severe risk to traders' investments. Therefore, it is crucial for potential clients to consider: is Raynar Group safe? The evidence of execution issues and platform instability raises serious concerns.

Risk Assessment

Engaging with Raynar Group carries inherent risks that potential clients must consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation, high potential for fraud. |

| Fund Safety Risk | High | Lack of client fund protection measures. |

| Withdrawal Risk | High | Reports of withdrawal difficulties and delays. |

| Execution Risk | Medium | Issues with order execution and slippage. |

Given these risks, it is crucial for traders to approach Raynar Group with caution. To mitigate these risks, potential clients should consider conducting thorough research and exploring alternative regulated brokers before making any commitments.

Conclusion and Recommendations

In conclusion, the evidence surrounding Raynar Group strongly indicates that it is not a safe trading option. The lack of regulation, transparency issues, concerning customer feedback, and potential risks associated with fund safety and trade execution paint a troubling picture. Therefore, it is advisable for traders to exercise extreme caution when considering this broker.

For those seeking reliable alternatives, it is recommended to consider brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers are more likely to provide a safe trading environment, ensuring that client funds are protected and that traders have access to transparent trading conditions. Ultimately, the question remains: is Raynar Group safe? The overwhelming consensus suggests that it is not, and traders would be wise to look elsewhere for their trading needs.

Is Raynar Group a scam, or is it legit?

The latest exposure and evaluation content of Raynar Group brokers.

Raynar Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Raynar Group latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.