Is PSB safe?

Pros

Cons

Is PSB Safe or Scam?

Introduction

PSB, a broker based in Russia, has been operating in the forex market since its establishment in 2016. With its affiliation to Promsvyazbank, which has a long-standing history in the banking sector, PSB aims to provide a reliable trading environment for its clients. However, potential traders must exercise caution when evaluating forex brokers, as the landscape is rife with both legitimate and fraudulent entities. A thorough assessment of a broker's regulatory status, financial practices, and customer feedback is essential for ensuring a safe trading experience. This article investigates the safety and legitimacy of PSB by examining its regulatory compliance, company background, trading conditions, customer fund security, user experiences, and overall risk assessment.

Regulation and Legitimacy

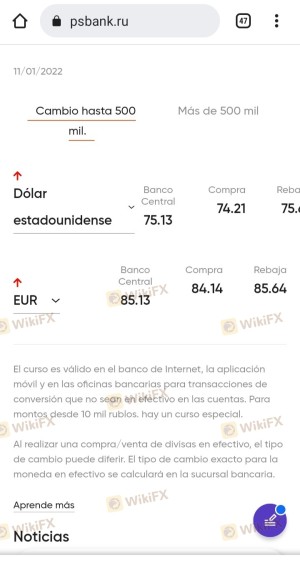

The regulatory landscape is crucial for determining the safety of a forex broker. PSB claims to be regulated by the Central Bank of Russia (CBR), which provides a level of oversight; however, the effectiveness of this regulation has been called into question. The following table outlines key regulatory information regarding PSB:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Central Bank of Russia | 045-14023-020000 | Russia | Active |

While PSB holds a license from the CBR, the effectiveness of Russian regulations has been debated, particularly in light of numerous complaints about brokers operating under this jurisdiction. The lack of comprehensive international regulatory oversight raises concerns regarding investor protection and the broker's operational transparency. Furthermore, historical compliance issues have emerged, with reports of unregulated practices and customer complaints suggesting a potential lack of accountability.

Company Background Investigation

PSB was established in 2016 as a subsidiary of Promsvyazbank, a prominent Russian bank. This connection provides a semblance of credibility, as the parent company has been involved in financial services for over two decades. However, the rapid transition from banking to brokerage raises questions about the depth of experience PSB possesses in the forex trading arena.

The management team at PSB is composed of individuals with backgrounds in finance and banking, yet the specific qualifications and experiences of key personnel are not extensively documented. Transparency regarding the company's internal operations and decision-making processes is limited, which can be a red flag for potential investors. The availability of information about the company's structure and governance can significantly impact a trader's confidence in the broker.

Trading Conditions Analysis

When evaluating whether PSB is safe, understanding its trading conditions is vital. The broker's fee structure and trading costs can significantly affect a trader's profitability. PSB employs a relatively straightforward fee model, but it is essential to scrutinize any unusual charges that may arise. Below is a comparison of core trading costs:

| Fee Type | PSB | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.9 pips | 1.1 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The spread offered by PSB is notably higher than the industry average, suggesting that traders may incur higher transaction costs. Additionally, the absence of a commission structure may lead to hidden fees embedded within the spread. Such pricing practices can diminish the overall trading experience and raise concerns about the broker's transparency.

Customer Fund Security

Fund security is a critical aspect of evaluating whether PSB is safe. The broker claims to implement various measures to safeguard client funds, including the use of segregated accounts. This practice ensures that client funds are kept separate from the broker's operational funds, providing a layer of protection in the event of financial difficulties.

Moreover, PSB offers negative balance protection, which prevents traders from losing more than their deposited funds. This policy is particularly important during volatile market conditions. However, there have been historical instances where clients reported difficulties in withdrawing their funds, raising questions about the broker's adherence to its stated security policies.

Customer Experience and Complaints

Customer feedback is invaluable when assessing the reliability of a broker like PSB. User experiences have been mixed, with some traders praising the platform's functionality while others express dissatisfaction with customer service and withdrawal processes. The following table summarizes common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Responsiveness | Medium | Average |

| Hidden Fees | Medium | Limited |

Many users have reported challenges in withdrawing their funds, with some alleging that their accounts were frozen without clear justification. Such issues can significantly impact a trader's confidence in the broker and raise concerns about potential scams.

Platform and Execution

The efficacy of the trading platform is another critical factor in determining whether PSB is safe. The broker utilizes the MetaTrader 5 platform, known for its advanced features and user-friendly interface. However, there have been reports of execution delays and slippage, which can adversely affect trading outcomes.

Traders have also raised concerns about the overall reliability of the platform, with some suggesting that they experienced instances of order rejections and manipulation. Such issues can be indicative of deeper operational problems within the brokerage.

Risk Assessment

Using PSB entails certain risks that potential traders should be aware of. The following risk assessment summarizes critical risk areas associated with the broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of effective oversight raises concerns about accountability. |

| Withdrawal Risk | High | Historical complaints regarding fund withdrawals may indicate potential issues. |

| Trading Cost Risk | Medium | Higher spreads than industry averages can impact profitability. |

To mitigate these risks, traders are advised to conduct thorough research, maintain realistic expectations, and consider diversifying their investments across multiple brokers.

Conclusion and Recommendations

In conclusion, while PSB presents itself as a legitimate forex broker, several factors warrant caution. The combination of high spreads, mixed customer feedback, and historical withdrawal issues raises questions about the broker's overall safety. Therefore, it is essential for traders to approach PSB with a degree of skepticism.

For those seeking to trade with a reliable broker, it may be prudent to consider alternatives that offer better regulatory oversight and more favorable trading conditions. Brokers such as XM, IG, or OANDA may provide a more secure trading environment with robust customer support and transparent fee structures. Ultimately, thorough due diligence is critical in ensuring a safe trading experience in the forex market.

Is PSB a scam, or is it legit?

The latest exposure and evaluation content of PSB brokers.

PSB Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PSB latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.