AMTD Review 1

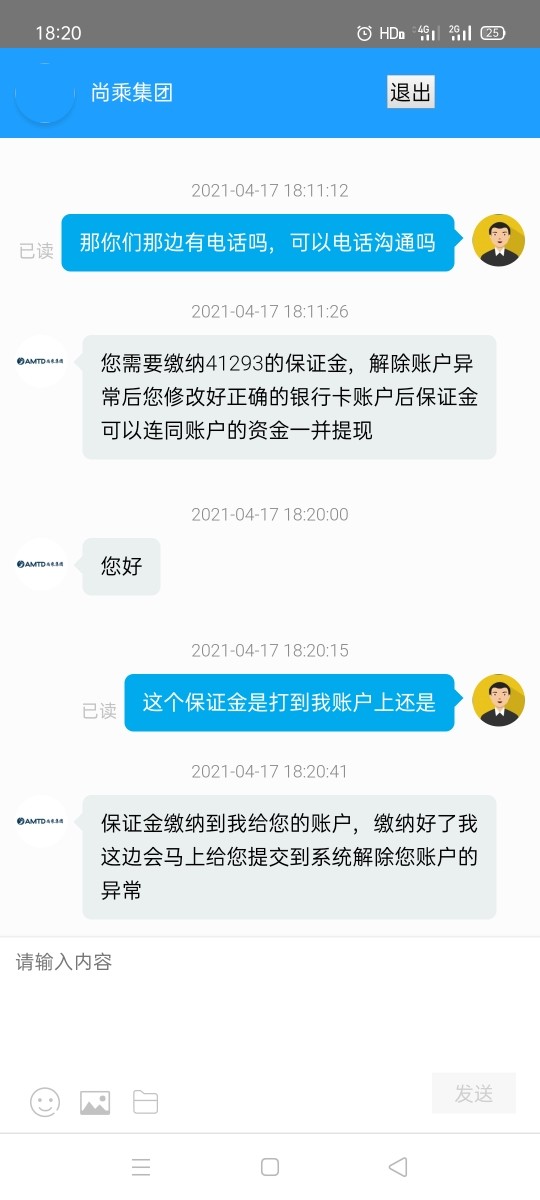

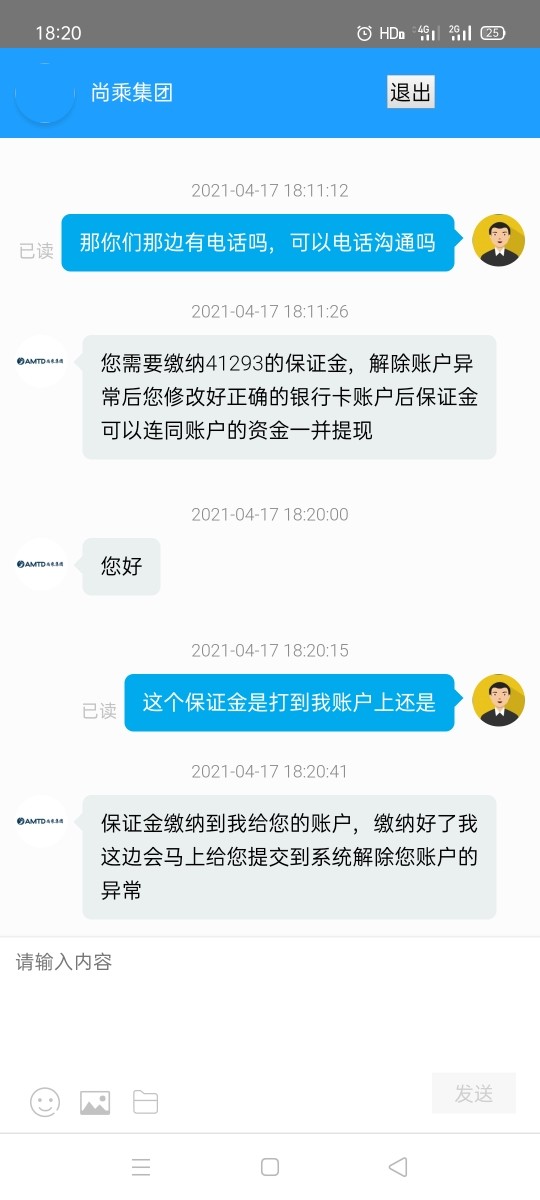

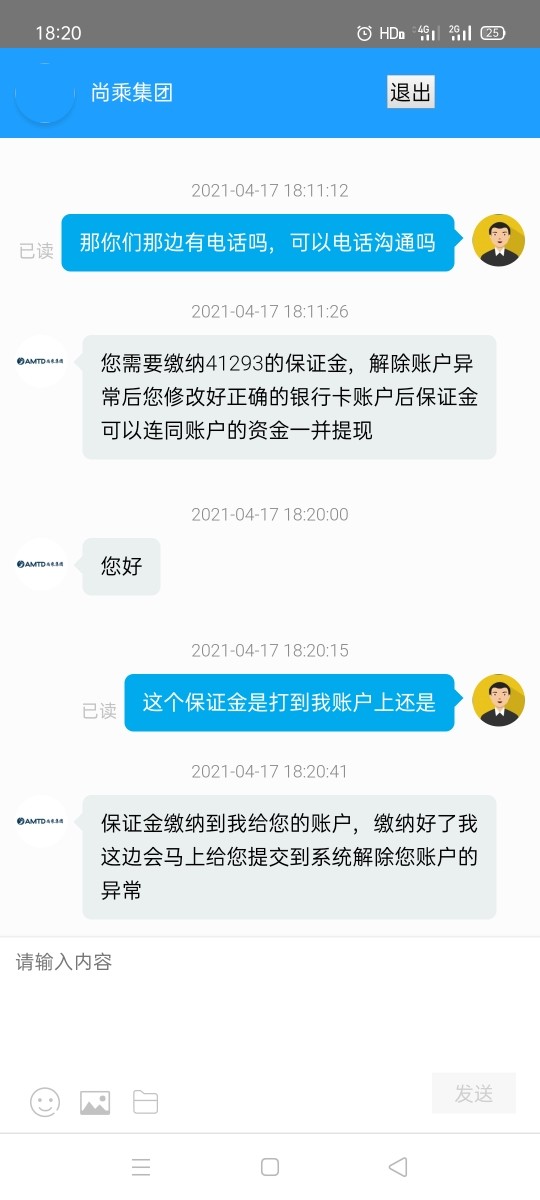

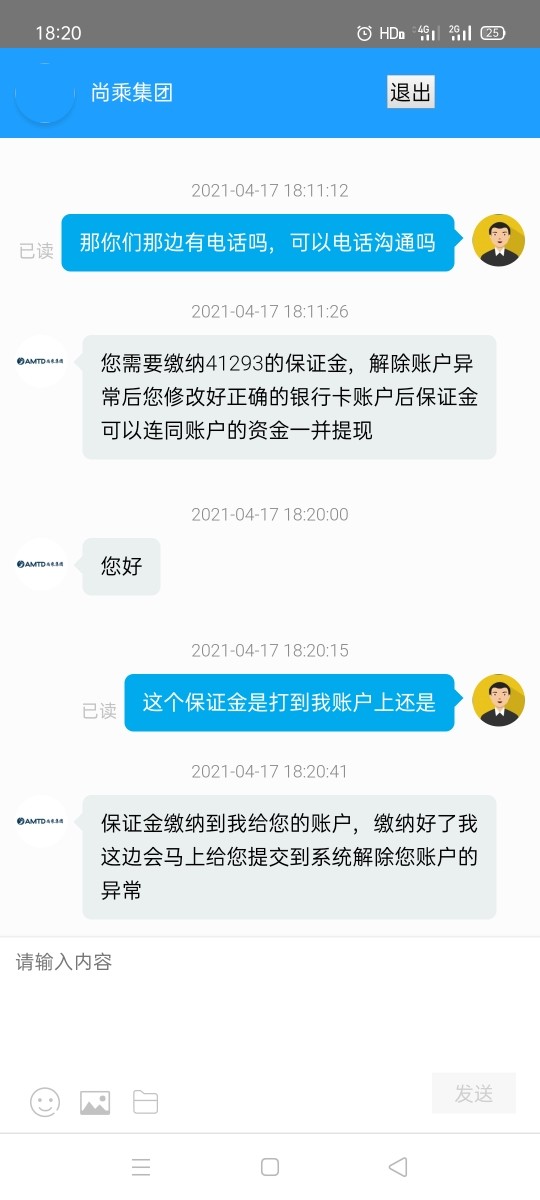

I've never heared of suck kind of thing like unable to withdraw while othre platforms allow withdrawals. Please give us an explanation.

AMTD Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I've never heared of suck kind of thing like unable to withdraw while othre platforms allow withdrawals. Please give us an explanation.

This amtd review presents a comprehensive analysis of AMTD Group, a prominent financial services company operating primarily in Hong Kong's corporate insurance brokerage and risk solutions sector. As AMTD Group's subsidiary company, AMTD Strategic Capital Group has established itself as the largest local corporate insurance brokerage and risk solutions firm in Hong Kong. It ranks among the top five firms in terms of revenue within this specialized market segment.

The company brings over 15 years of operational history and extensive industry experience to the table. It offers comprehensive insurance products across various market segments. AMTD has cultivated long-term partnerships with dozens of global insurance companies and brokerage partners, demonstrating its established market presence. The senior management team possesses decades of industry experience. They have maintained business relationships with major clients for over 10 years, indicating strong client retention and trust.

While AMTD Group operates primarily in the insurance brokerage space rather than traditional forex trading, this review examines the company's overall service delivery, client satisfaction, and market positioning. The evaluation is based on available public information and industry positioning data. Trading-related metrics are limited due to the company's primary focus on insurance and risk management solutions.

Important Notice

This review is based on publicly available information about AMTD Group's insurance brokerage and risk solutions services. The evaluation methodology relies on company disclosures, industry positioning data, and available market information. It's important to note that AMTD Group operates primarily as a corporate insurance brokerage firm rather than a traditional forex or financial trading platform.

Due to the nature of available information, this assessment focuses on the company's overall business model, market position, and service delivery capabilities within the insurance brokerage sector. Potential clients should verify current service offerings and regulatory status directly with the company before making any business decisions.

| Criterion | Score | Justification |

|---|---|---|

| Account Conditions | N/A | Specific account condition information not available in source materials |

| Tools and Resources | N/A | Detailed information about trading tools and resources not provided |

| Customer Service and Support | N/A | Specific customer service metrics not detailed in available information |

| Trading Experience | N/A | Trading experience data not available due to insurance brokerage focus |

| Trust and Reliability | 7/10 | Strong market position and 15+ years operation history |

| User Experience | N/A | Specific user experience metrics not available in source materials |

AMTD Group represents a well-established presence in Hong Kong's financial services landscape. Its subsidiary AMTD Strategic Capital Group holds the distinction of being the largest local corporate insurance brokerage and risk solutions firm in the territory. The company has built its reputation over more than 15 years of continuous operation. It develops extensive industry expertise and market knowledge that positions it uniquely within Hong Kong's competitive financial services sector.

The organization's business model centers on providing comprehensive insurance products across various market segments. It leverages partnerships with dozens of global insurance companies and brokerage partners. This extensive network enables AMTD to offer diverse solutions tailored to corporate clients' specific risk management needs. The company's senior management team brings decades of cumulative industry experience. They have maintained business relationships with major clients for over a decade, which speaks to both the quality of service delivery and client satisfaction levels.

According to available information, AMTD Strategic Capital Group holds the unique position of being the only local player ranked among the top five corporate insurance brokerage and risk solutions firms in Hong Kong by revenue. This market positioning reflects the company's competitive strength and ability to compete effectively against both local and international players in the Hong Kong market. The firm's focus on corporate clients and risk solutions indicates a specialized approach to serving business customers rather than individual retail clients.

Specific regulatory information for AMTD Group's operations is not detailed in available source materials. As a Hong Kong-based corporate insurance brokerage firm, the company would typically operate under relevant Hong Kong financial services regulations. Specific licensing details are not provided in the available information.

AMTD Group offers comprehensive insurance products across various market segments through its subsidiary AMTD Strategic Capital Group. The company provides corporate insurance brokerage and risk solutions services. It leverages partnerships with global insurance companies to deliver tailored solutions to business clients.

The company holds a leading position as the largest local corporate insurance brokerage firm in Hong Kong. It ranks among the top five firms by revenue in this sector. This positioning demonstrates significant market share and competitive strength within the specialized corporate insurance market.

AMTD has established long-term cooperation agreements with dozens of global insurance companies and brokerage partners. The senior management team has maintained business relationships with major clients for over 10 years. This indicates strong client retention and satisfaction levels.

With over 15 years of operation history, AMTD Group has demonstrated longevity and stability in the Hong Kong financial services market. This extensive operational track record provides evidence of the company's ability to navigate various market conditions and maintain business continuity.

This amtd review highlights that while the company operates primarily in insurance brokerage rather than traditional financial trading, its established market presence and long operational history indicate a stable and well-positioned organization within its chosen market segment.

The specific account conditions and structures offered by AMTD Group are not detailed in the available source materials. As a corporate insurance brokerage and risk solutions firm, AMTD's client engagement model likely differs significantly from traditional financial trading platforms that offer individual trading accounts with specific deposit requirements and account tiers.

Given AMTD's focus on corporate clients and insurance brokerage services, the company's engagement structure would typically involve customized service agreements tailored to each corporate client's specific insurance and risk management needs. The absence of standardized account condition information suggests that AMTD operates on a consultative, relationship-based model rather than offering standardized account packages common in retail trading platforms.

The company's approach to client onboarding and service delivery appears to emphasize long-term business relationships. This is evidenced by the senior management team maintaining business relationships with major clients for over 10 years. This relationship-focused approach indicates that account conditions and service terms are likely negotiated individually based on client requirements and business scope.

For potential clients interested in AMTD's services, the account establishment process would likely involve direct consultation with the company's experienced team to determine appropriate service structures and engagement terms. The company's extensive industry experience and established market position suggest that account conditions would be competitive within the corporate insurance brokerage sector.

This amtd review notes that the lack of publicly available account condition details is typical for B2B service providers in the insurance brokerage sector. Service terms are often customized rather than standardized. Interested parties should contact AMTD directly for specific information about engagement terms and service conditions.

Information regarding specific tools and resources offered by AMTD Group is not detailed in the available source materials. As a corporate insurance brokerage and risk solutions firm, AMTD's toolkit would likely focus on risk assessment, insurance product comparison, and client consultation resources rather than traditional trading tools and platforms.

The company's extensive partnerships with dozens of global insurance companies and brokerage partners suggest that AMTD has access to comprehensive market data and insurance product databases. These resources would enable the firm to provide clients with detailed market analysis and product comparisons across multiple insurance providers and coverage options.

Given AMTD's position as the largest local corporate insurance brokerage firm in Hong Kong, the company likely maintains sophisticated systems for managing client relationships, tracking insurance policies, and monitoring risk exposures. The senior management team's decades of industry experience would contribute to the development of proprietary methodologies and analytical frameworks for assessing corporate risk profiles and recommending appropriate insurance solutions.

The firm's ability to maintain business relationships with major clients for over 10 years suggests that AMTD provides valuable analytical tools and ongoing support resources that contribute to client satisfaction and retention. These might include regular risk assessments, market updates, claims management support, and strategic insurance planning services.

While specific details about technological platforms or analytical tools are not available in the source materials, AMTD's market leadership position and long operational history indicate that the company has invested in appropriate systems and resources to support its corporate client base effectively.

Specific customer service and support metrics for AMTD Group are not detailed in the available source materials. However, several indicators suggest the company maintains strong client relationships and service delivery standards based on its market position and client retention patterns.

The most significant indicator of AMTD's customer service quality is the senior management team's ability to maintain business relationships with major clients for over 10 years. This long-term client retention suggests that the company provides consistent, high-quality service that meets or exceeds client expectations over extended periods. Such retention rates in the competitive Hong Kong corporate insurance market indicate effective relationship management and responsive service delivery.

AMTD's position as the largest local corporate insurance brokerage firm in Hong Kong and its ranking among the top five firms by revenue suggests that the company has developed effective client service processes and support structures. Achieving and maintaining market leadership typically requires superior customer service capabilities and the ability to respond effectively to client needs and concerns.

The company's extensive network of partnerships with dozens of global insurance companies and brokerage partners likely enables AMTD to provide comprehensive support to clients across various insurance needs and market conditions. This broad network would allow the firm to offer diverse solutions and maintain service continuity even when specific insurance markets or providers experience challenges.

Given AMTD's focus on corporate clients and complex risk solutions, the company's customer service approach likely emphasizes personalized consultation and ongoing relationship management rather than standardized support processes common in retail financial services.

Traditional trading experience metrics are not applicable to AMTD Group's business model. The company operates primarily as a corporate insurance brokerage and risk solutions firm rather than a financial trading platform. However, the user experience in terms of insurance brokerage services can be evaluated based on available information about the company's market position and client relationships.

AMTD's operational approach focuses on providing comprehensive insurance solutions through established partnerships with global insurance companies rather than facilitating direct trading activities. The company's 15+ years of operation history and market leadership position suggest that clients experience effective service delivery and successful outcomes in their insurance and risk management needs.

The firm's ability to maintain business relationships with major clients for over 10 years indicates that the client experience meets professional standards and delivers value that justifies long-term engagement. This client retention pattern suggests that AMTD provides a smooth, professional experience in managing corporate insurance needs and risk assessments.

AMTD's extensive partnerships with dozens of global insurance companies likely enable the firm to provide clients with efficient access to diverse insurance products and competitive pricing. This broad network would contribute to a positive client experience by offering comprehensive options and streamlined procurement processes.

The company's position as the only local player ranked among the top five corporate insurance brokerage firms in Hong Kong by revenue indicates that clients receive competitive service levels that compare favorably with international competitors. This amtd review notes that while traditional trading metrics don't apply, the company's market success suggests effective client experience management within its specialized sector.

AMTD Group demonstrates several indicators of trust and reliability based on its operational history and market position. The company's 15+ years of continuous operation in Hong Kong's competitive financial services market provides evidence of business stability and the ability to maintain operations through various economic cycles and market conditions.

The firm's position as the largest local corporate insurance brokerage and risk solutions firm in Hong Kong, ranking among the top five by revenue, indicates strong market confidence and competitive capability. Achieving and maintaining such market leadership requires consistent performance and client satisfaction over extended periods.

One of the strongest indicators of AMTD's reliability is the senior management team's success in maintaining business relationships with major clients for over 10 years. This long-term client retention demonstrates the company's ability to deliver consistent value and maintain professional standards that meet corporate client expectations. Such retention rates are particularly significant in the corporate insurance sector, where clients have access to numerous alternative providers.

The company's extensive network of partnerships with dozens of global insurance companies and brokerage partners suggests that AMTD has established credible relationships within the international insurance industry. These partnerships typically require meeting professional standards and maintaining good standing within the industry community.

While specific regulatory details are not provided in the available source materials, AMTD's operation as a leading corporate insurance brokerage firm in Hong Kong would require compliance with relevant financial services regulations and professional standards governing insurance brokerage activities.

User experience evaluation for AMTD Group must be considered within the context of the company's corporate insurance brokerage focus rather than traditional retail financial services. The available information suggests that clients experience professional, relationship-focused service delivery based on the company's market position and client retention patterns.

The most significant indicator of positive user experience is AMTD's ability to maintain business relationships with major clients for over 10 years. This retention pattern suggests that corporate clients find value in the company's services and experience satisfactory outcomes in their insurance and risk management needs. Such long-term relationships typically develop when clients experience responsive service, effective problem-solving, and successful insurance solutions.

AMTD's market leadership as the largest local corporate insurance brokerage firm in Hong Kong indicates that the company has developed user experience capabilities that compete effectively with both local and international providers. The firm's ranking among the top five by revenue suggests that clients choose AMTD over competitors, indicating competitive service delivery and user satisfaction.

The company's extensive partnerships with dozens of global insurance companies likely contribute to a positive user experience by providing clients with comprehensive options and access to diverse insurance solutions. This broad network would enable AMTD to address various client needs efficiently and offer competitive alternatives across different insurance categories.

Given the corporate focus of AMTD's business, the user experience likely emphasizes personalized consultation, detailed risk assessment, and ongoing relationship management rather than self-service platforms common in retail financial services. The senior management team's decades of industry experience would contribute to sophisticated service delivery and knowledgeable consultation capabilities.

This amtd review reveals a well-established company with significant market presence in Hong Kong's corporate insurance brokerage sector. AMTD Group, through its subsidiary AMTD Strategic Capital Group, has achieved market leadership as the largest local corporate insurance brokerage and risk solutions firm in Hong Kong. It demonstrates competitive strength and client confidence over 15+ years of operation.

The company appears best suited for corporate clients seeking comprehensive insurance brokerage services and risk management solutions rather than individual traders or retail financial services users. AMTD's strength lies in its extensive industry experience, established partnerships with global insurance companies, and demonstrated ability to maintain long-term client relationships spanning over a decade.

While this evaluation is limited by the availability of specific service details and traditional financial trading metrics, AMTD's market position and operational longevity suggest a reliable provider within its specialized sector. Potential clients should engage directly with the company to obtain detailed information about current service offerings and engagement terms suited to their specific corporate insurance and risk management needs.

FX Broker Capital Trading Markets Review