BP Prime 2025 Review: Everything You Need to Know

Executive Summary

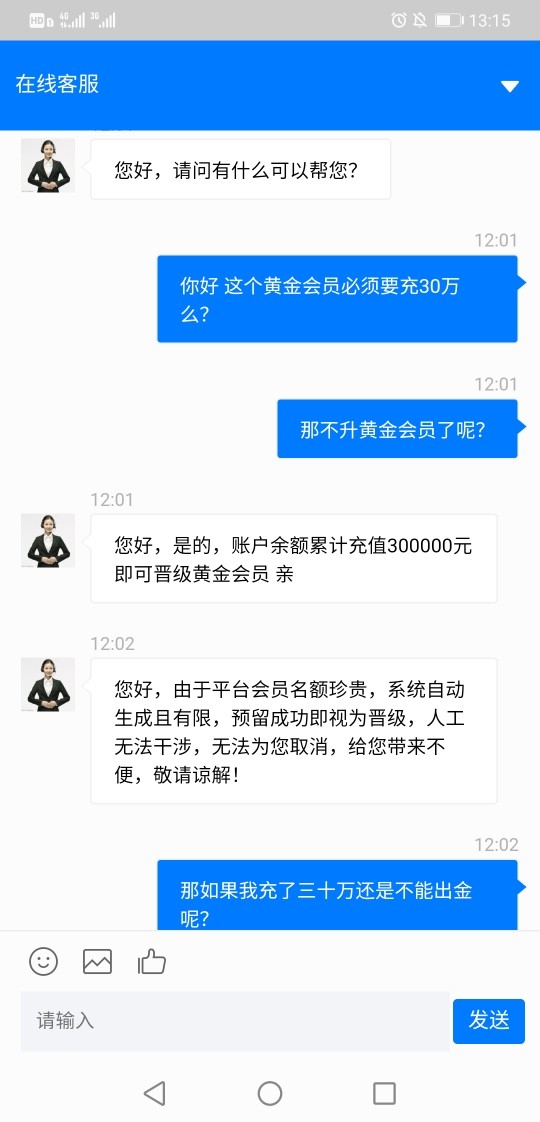

BP Prime is an FCA-regulated online CFD broker. It has been operating since 2013 and offers trading services across multiple asset classes including forex, commodities, indices, and cryptocurrencies. This bp prime review reveals a broker with mixed user feedback. Fast order execution and reliable customer support stand out as primary strengths, while withdrawal-related issues have generated some user dissatisfaction.

The broker serves active traders who want diverse trading opportunities across various financial instruments. Operating under FCA regulation provides regulatory oversight, though user experiences vary significantly. According to available reports, BP Prime delivers competitive trading conditions with low spreads and efficient order processing. This makes it suitable for traders who prioritize execution speed and platform reliability.

However, this evaluation must be balanced against reported concerns regarding withdrawal processes. These issues have affected overall user satisfaction. The broker's position in the market reflects both its regulatory standing and the mixed nature of user feedback. This positions it as a moderate choice for traders willing to weigh both positive features and potential operational challenges.

Important Disclaimers

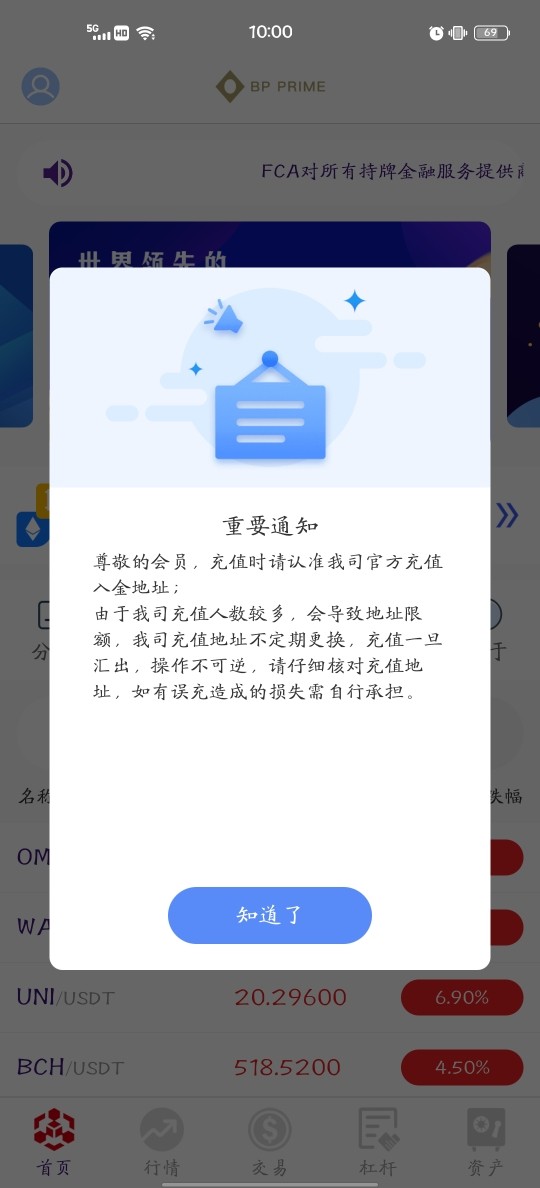

BP Prime operates under different regulatory frameworks across various jurisdictions. Users must ensure compliance with their local financial regulations and legal requirements. The regulatory status and available services may vary depending on the trader's geographical location and residency status.

This comprehensive review is based on publicly available information, user feedback, and industry reports available as of 2025. The assessment aims to provide an objective overview of BP Prime's services, features, and user experience. Individual trading experiences may vary based on specific circumstances and trading requirements.

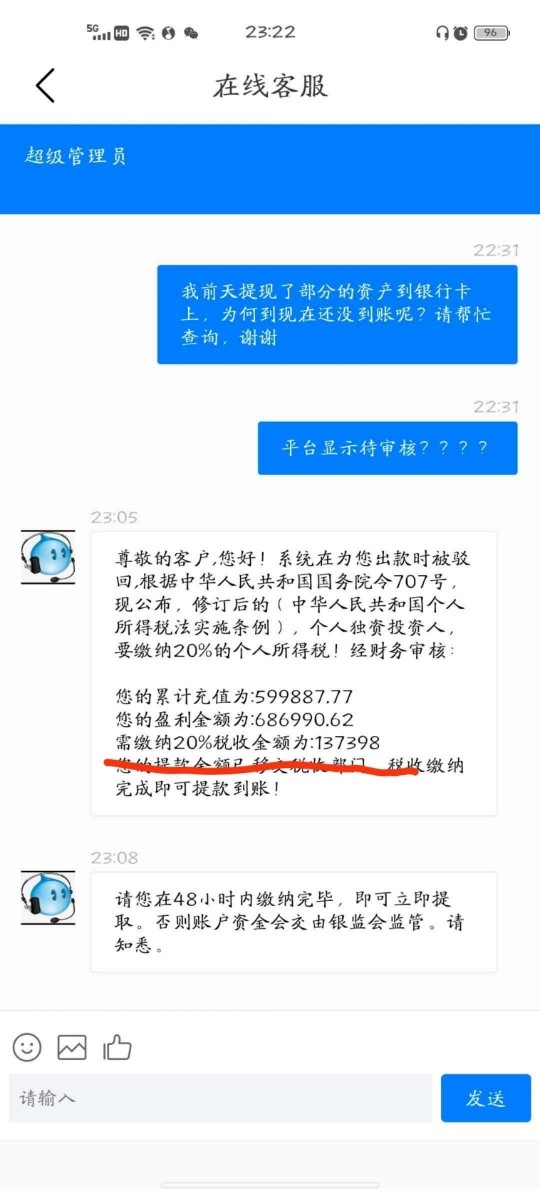

Overall Rating Framework

Broker Overview

BP Prime was established in 2013. It operates under the management of Black Pearl Securities Limited, with headquarters located in London, United Kingdom. The company has positioned itself as a specialized online CFD broker. It focuses primarily on forex and CFD trading services for retail and institutional clients. With over a decade of market presence, BP Prime has built its reputation around providing accessible trading solutions across multiple asset classes.

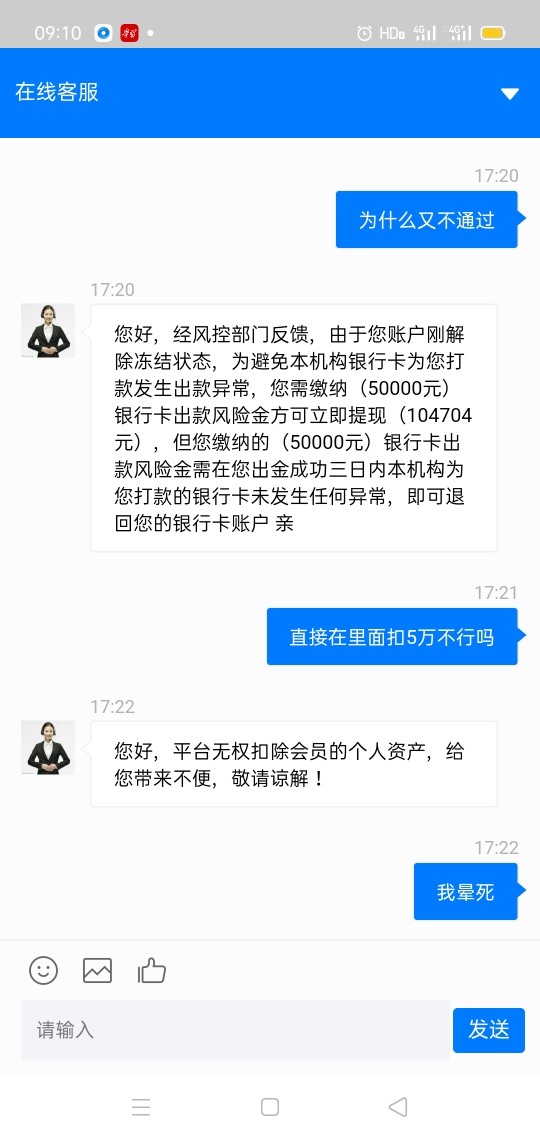

The broker operates under a CFD trading model. This allows clients to speculate on price movements without owning underlying assets. This business approach enables traders to access various markets including foreign exchange, commodities, stock indices, and cryptocurrency markets through a single trading platform. According to industry reports, this bp prime review indicates the company has maintained steady operations. It has adapted to evolving market conditions and regulatory requirements.

BP Prime offers trading services through the widely recognized MetaTrader 4 platform. It provides access to forex pairs, commodity CFDs, index CFDs, and cryptocurrency CFDs. The broker operates under the supervision of the UK's Financial Conduct Authority. This provides regulatory oversight and client protection measures. This regulatory framework ensures adherence to strict financial standards and operational transparency requirements. These govern UK-based financial service providers.

Regulatory Coverage: BP Prime operates under the regulation of the Financial Conduct Authority in the United Kingdom. This ensures compliance with stringent financial service standards and provides client protection measures including segregated client funds and compensation scheme coverage.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods was not detailed in available resources. Standard options typically include bank transfers and electronic payment systems.

Minimum Deposit Requirements: Detailed minimum deposit requirements were not specified in available documentation. This requires direct inquiry with the broker for current account opening requirements.

Bonus and Promotional Offers: Information regarding current bonus structures or promotional campaigns was not mentioned in available resources. This suggests either absence of such programs or limited promotional activity.

Tradeable Assets: The broker provides access to a comprehensive range of tradeable instruments. These include major and minor forex pairs, commodity CFDs covering precious metals and energy products, major stock indices, and cryptocurrency CFDs for digital asset exposure.

Cost Structure: BP Prime advertises competitive low spreads across its instrument range. Specific spread values and commission structures require direct verification with the broker for current pricing information.

Leverage Options: Specific leverage ratios available to different account types were not detailed in available resources. FCA regulation typically limits retail client leverage according to ESMA guidelines.

Platform Selection: Trading is conducted primarily through the MetaTrader 4 platform. It offers comprehensive charting tools, technical indicators, and automated trading capabilities for both desktop and mobile devices.

Geographic Restrictions: Specific information regarding geographic restrictions or service limitations was not available in reviewed resources.

Customer Support Languages: Available customer support languages were not specified in reviewed documentation.

This bp prime review highlights that while basic service information is available, many specific operational details require direct verification with the broker. This is needed for the most current and accurate information.

Detailed Rating Analysis

Account Conditions Analysis

BP Prime's account structure appears designed to accommodate different trader profiles. Specific details about account types and their distinctive features were not comprehensively detailed in available resources. The broker's approach to account conditions seems to emphasize flexibility. It allows traders to access multiple asset classes through unified account structures rather than requiring separate specialized accounts for different instruments.

The minimum deposit requirements and account opening procedures were not specifically outlined in reviewed materials. This suggests potential variability based on account type or geographic location. This lack of transparent pricing information may require prospective clients to contact the broker directly. They need detailed account specifications and requirements.

Regarding special account features such as Islamic accounts for Shariah-compliant trading, specific information was not available in the reviewed resources. This represents a significant information gap for traders who require such specialized account types. They need these for religious or cultural reasons.

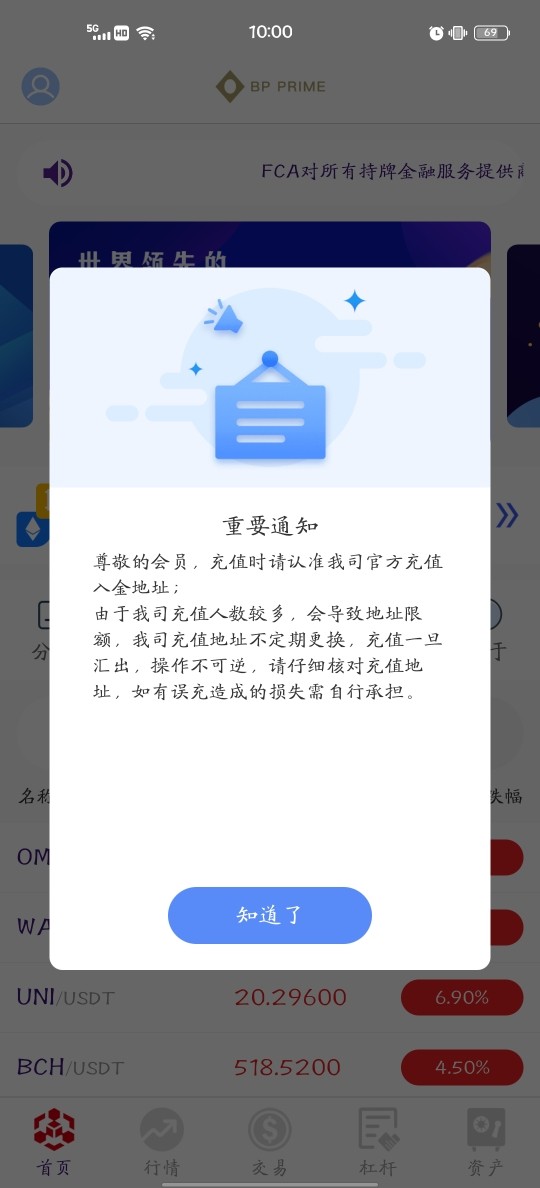

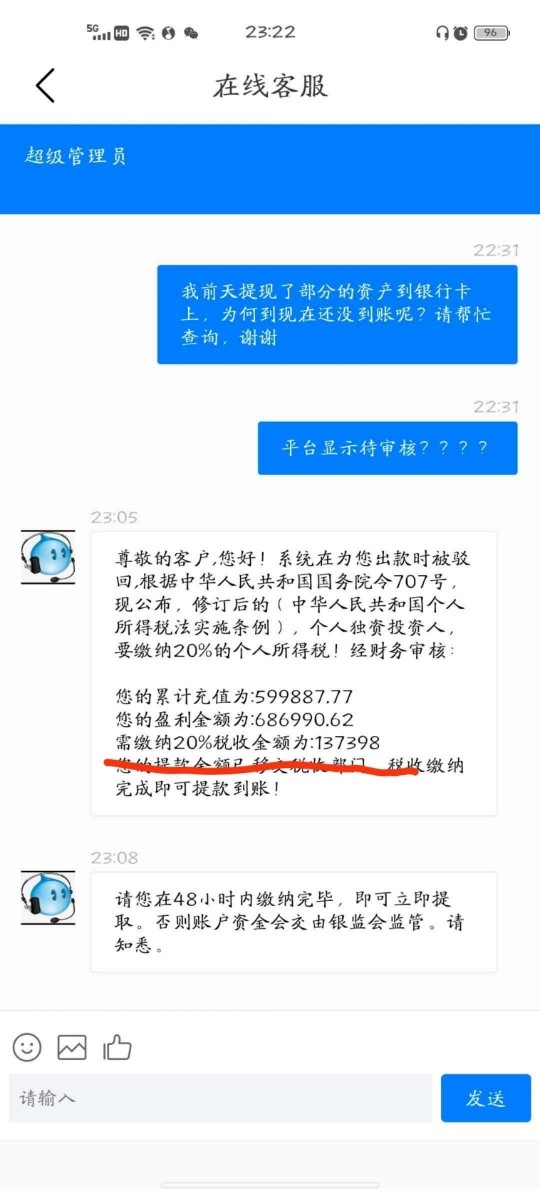

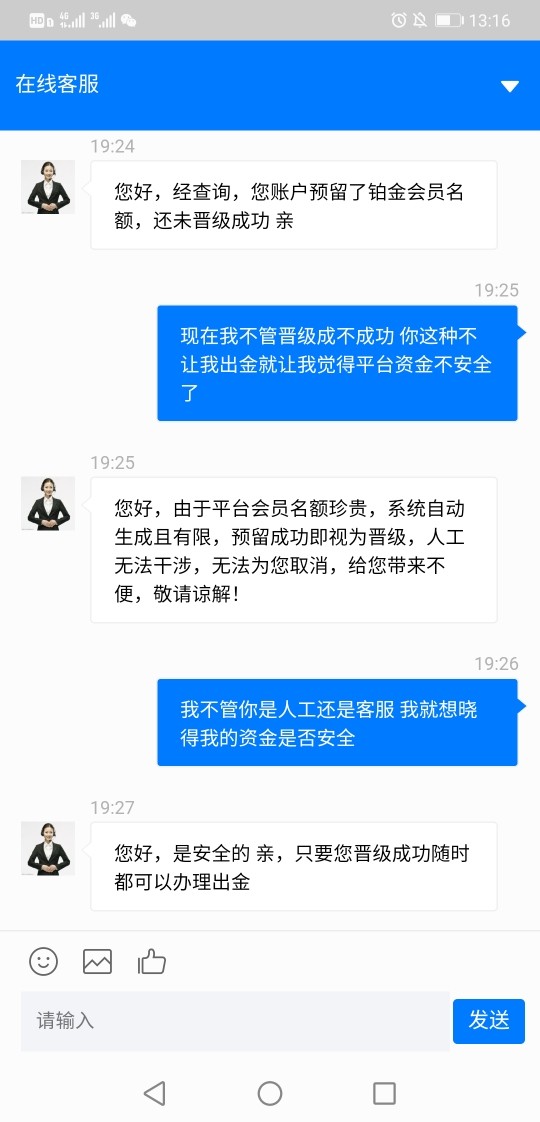

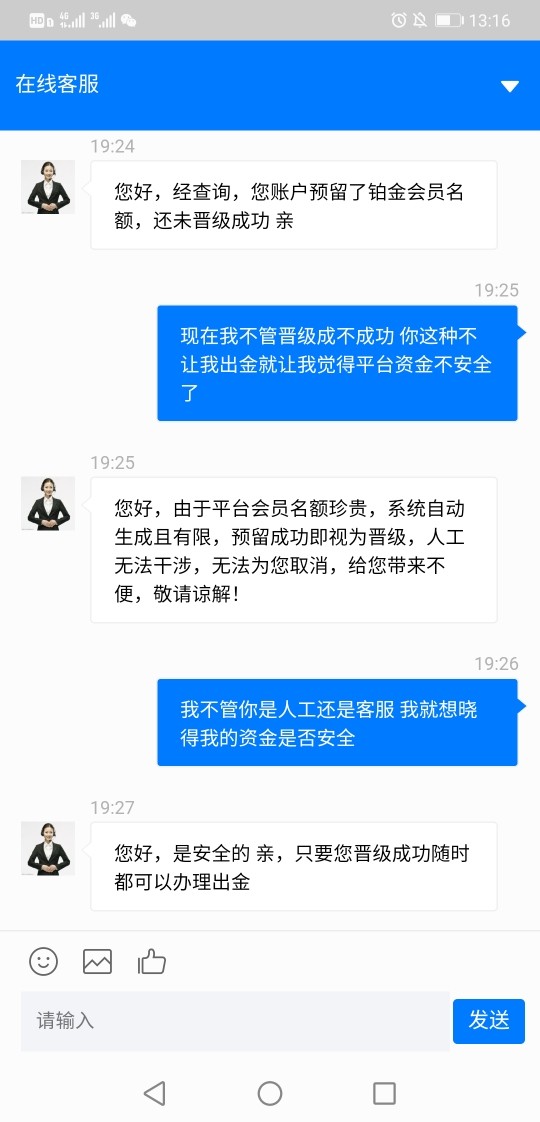

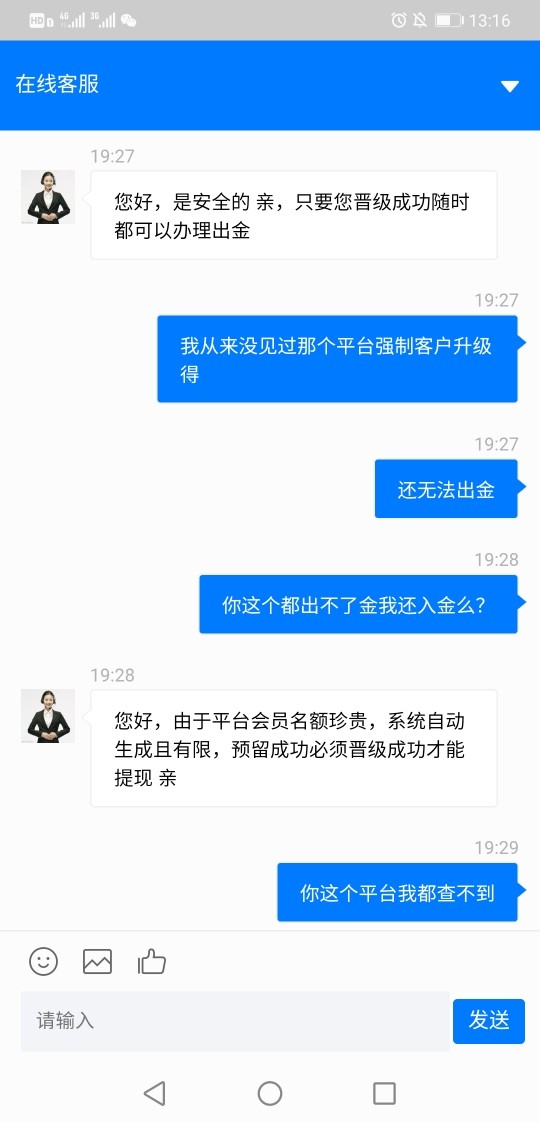

User feedback regarding withdrawal processes has impacted the overall assessment of account conditions. Operational efficiency in fund management directly affects the practical value of account features. The reported withdrawal concerns suggest that while account opening may be straightforward, the full account lifecycle experience may present challenges. This affects some users.

For this bp prime review, the account conditions receive a moderate rating. This is due to the combination of apparent flexibility in basic account structures offset by transparency concerns and reported operational issues. These affect the overall account management experience.

BP Prime's trading infrastructure centers around the MetaTrader 4 platform. This provides traders with a comprehensive suite of trading tools and analytical resources. The MT4 platform offers advanced charting capabilities, technical indicators, and automated trading support through Expert Advisors. This creates a robust trading environment for both manual and algorithmic trading strategies.

The broker's asset coverage spans multiple markets including forex, commodities, indices, and cryptocurrencies. This provides traders with diversification opportunities across different market sectors. This multi-asset approach allows for portfolio diversification and cross-market trading strategies. These can be particularly valuable during varying market conditions.

However, specific information regarding proprietary research resources, market analysis, or educational materials was not detailed in available sources. This represents a potential limitation for traders who rely heavily on broker-provided market insights. They also depend on educational content to support their trading decisions.

The absence of detailed information about advanced trading tools beyond the standard MT4 offering suggests something important. BP Prime may focus primarily on providing reliable platform access rather than developing extensive proprietary trading resources or analytical tools.

User feedback indicates satisfaction with the available trading tools. This is particularly regarding platform stability and functionality, though the limited scope of additional resources may restrict the broker's appeal. This affects traders seeking comprehensive analytical support and educational materials.

Customer Service and Support Analysis

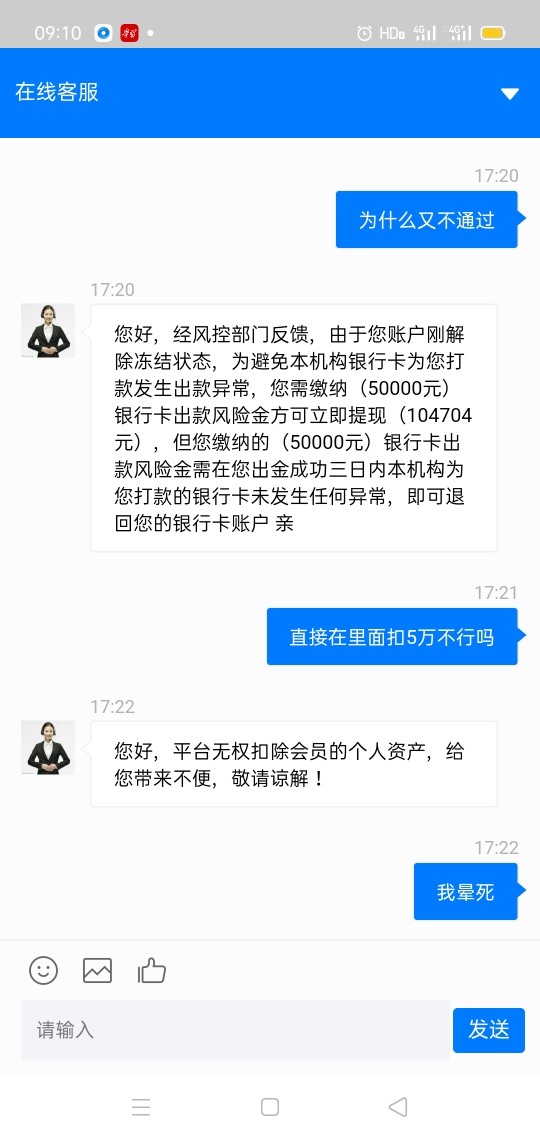

Customer service represents a mixed area for BP Prime. User feedback indicates both strengths and areas of concern. According to available reports, the broker provides reliable customer support with good responsiveness to general inquiries and technical issues. This suggests a competent support infrastructure for routine trading matters.

The support team appears to handle standard trading questions and platform-related issues effectively. Users note professional interactions and helpful responses to typical trading concerns. This indicates that BP Prime maintains adequate staffing and training for their customer service operations.

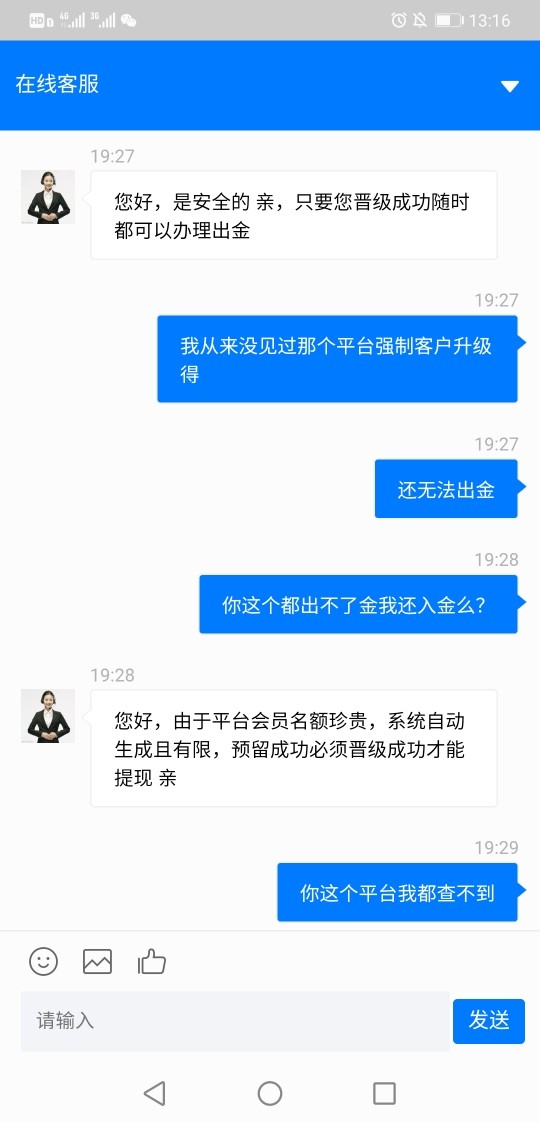

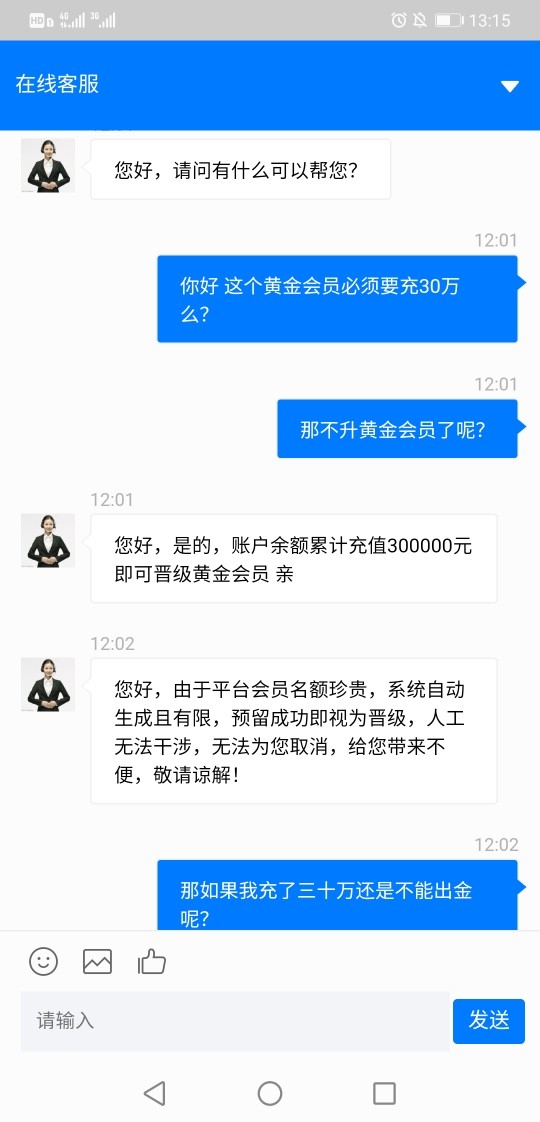

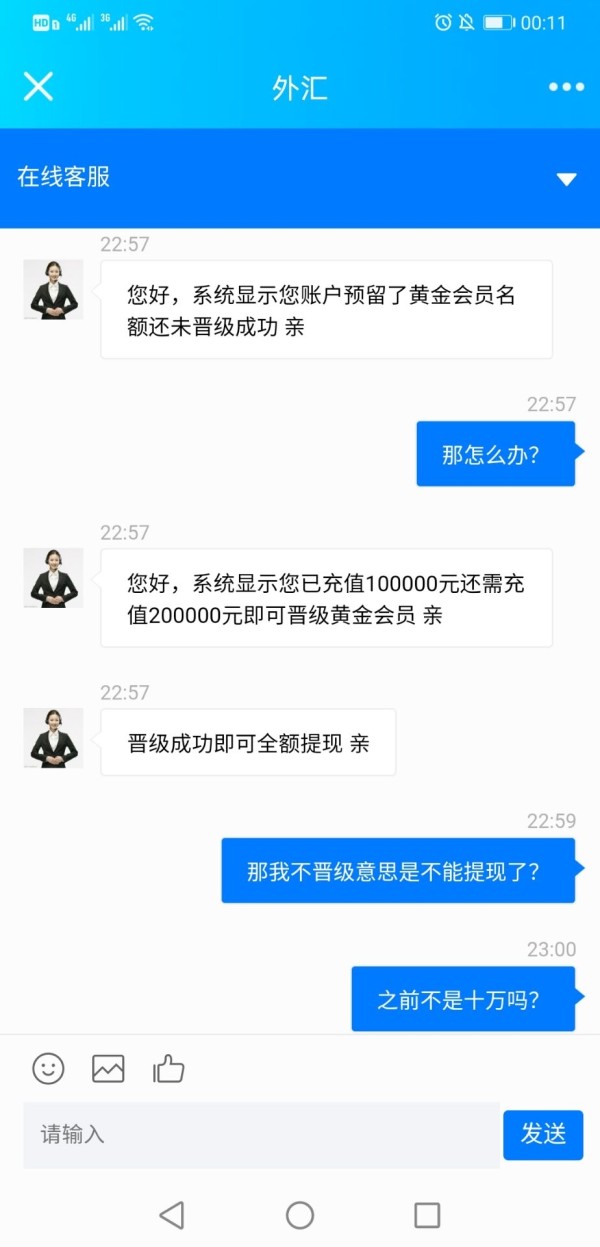

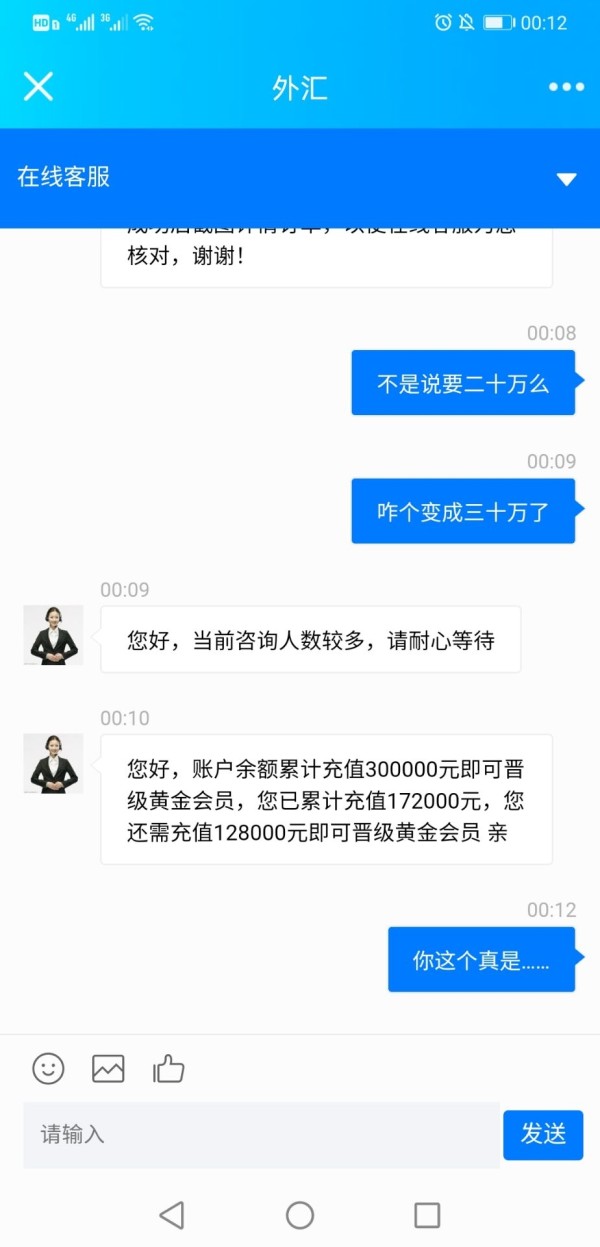

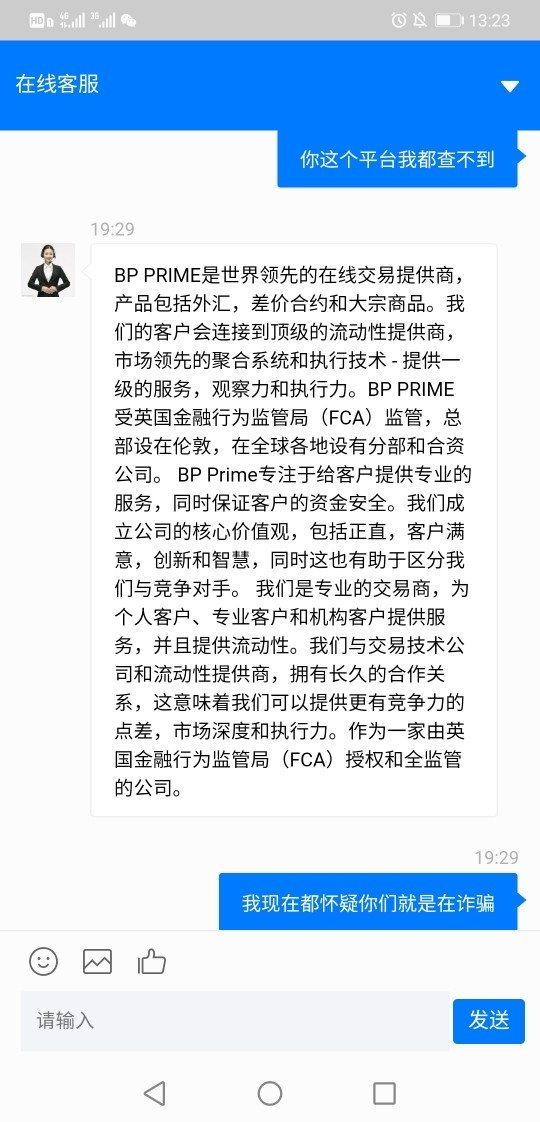

However, withdrawal-related issues have generated negative feedback from some users. This suggests that while general customer service performs well, specific operational processes may create customer satisfaction challenges. These withdrawal concerns appear to be significant enough to impact overall service perception among affected users.

Specific information regarding customer service availability hours, supported languages, and communication channels was not detailed in available resources. This lack of transparency about service accessibility may create uncertainty for international clients. It also affects those requiring support outside standard business hours.

The customer service experience appears to vary significantly based on the type of issue. Routine trading support receives positive feedback while financial operations support faces criticism, creating an inconsistent overall service experience. This affects user confidence and satisfaction.

Trading Experience Analysis

The trading experience with BP Prime receives generally positive user feedback. This is particularly regarding order execution speed and platform performance. Users consistently report fast order execution, which is crucial for active trading strategies and market timing. This indicates that the broker maintains robust technical infrastructure to support efficient trade processing.

Platform stability appears strong based on user reports. The MetaTrader 4 environment provides reliable access to markets without significant downtime or technical disruptions. This stability is essential for maintaining trading continuity and protecting against missed opportunities. These could result from platform failures.

Order execution quality receives favorable user assessment. There are minimal reports of problematic slippage or requotes that could negatively impact trading results. This suggests that BP Prime maintains fair execution practices and adequate liquidity arrangements. These support smooth trade completion.

The low spread environment advertised by the broker contributes to a competitive trading cost structure. Specific spread comparisons with other brokers would require detailed analysis of current pricing across different instruments and market conditions.

Mobile trading experience and advanced platform features were not specifically detailed in available user feedback. This represents potential areas where additional information would benefit prospective clients. The overall trading environment appears well-suited for active traders who prioritize execution speed and platform reliability.

This bp prime review indicates that while the core trading experience meets user expectations for performance and execution quality, the broader trading environment assessment is limited. This is due to available information about advanced features and mobile capabilities.

Trustworthiness Analysis

BP Prime's trustworthiness profile is anchored by its FCA regulation. This provides a solid foundation of regulatory oversight and client protection measures. The Financial Conduct Authority maintains strict standards for financial service providers, including requirements for client fund segregation, capital adequacy, and operational transparency. These enhance overall broker credibility.

The company's establishment in 2013 provides over a decade of operational history. Specific information about the company's track record, industry reputation, or recognition within the financial services sector was not detailed in available resources. This operational longevity suggests sustained business viability, though additional context about growth and stability would strengthen the trust assessment.

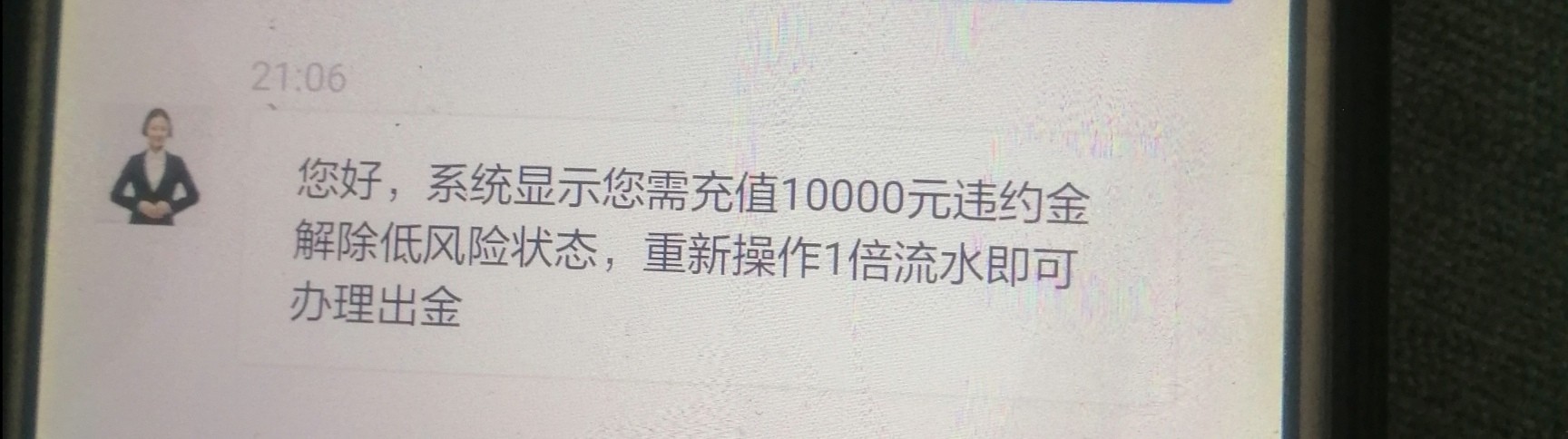

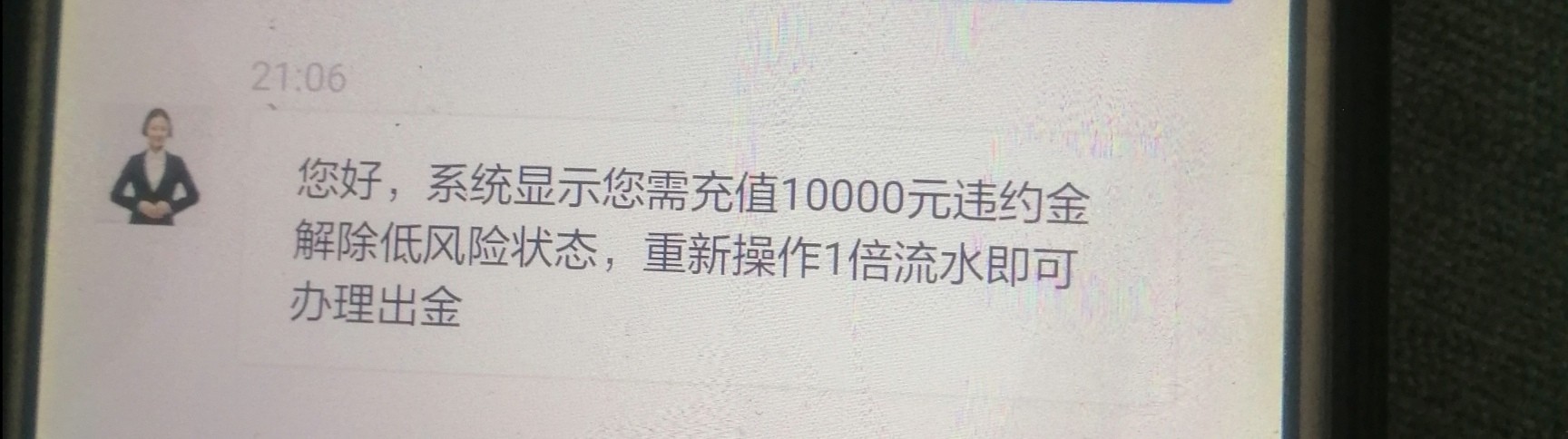

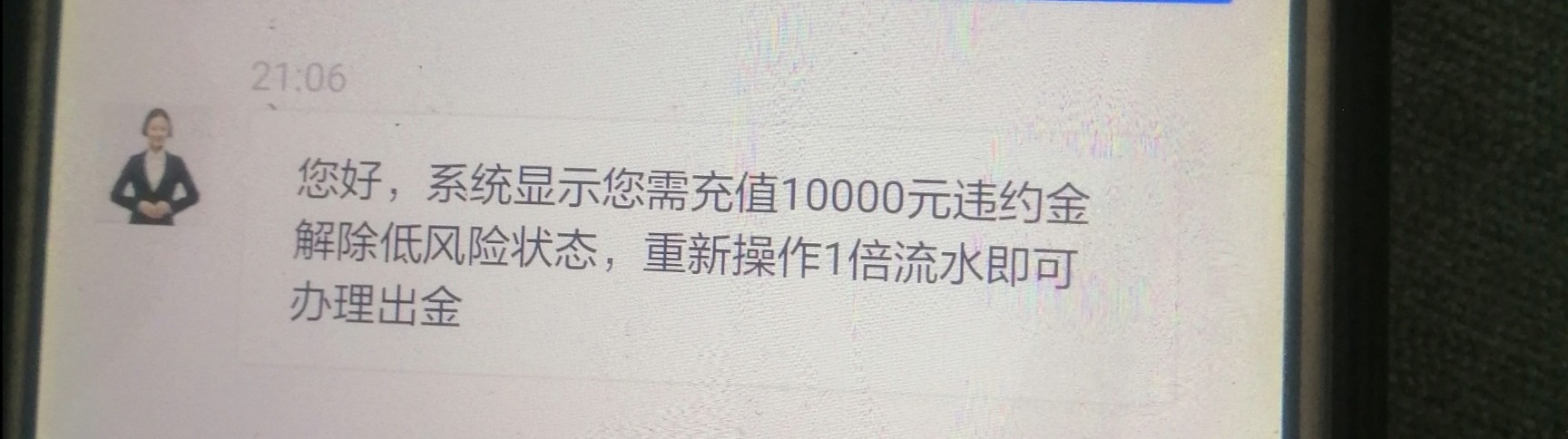

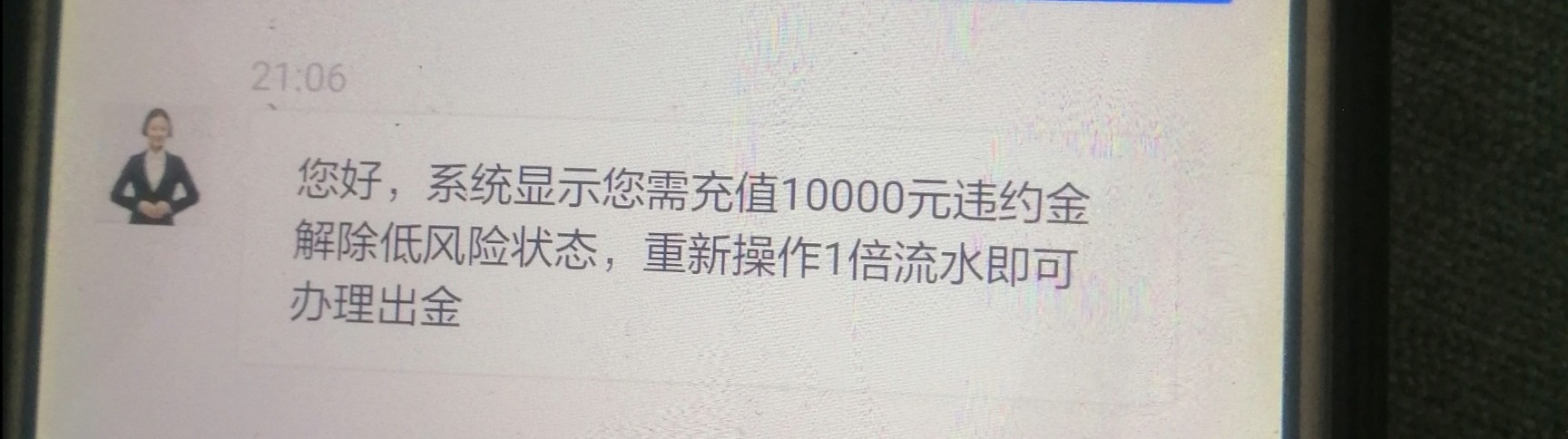

However, the reported withdrawal issues from some users create concerns about operational reliability. These impact overall trustworthiness. When clients experience difficulties accessing their funds, it directly undermines confidence in the broker's operational integrity and customer commitment. This occurs regardless of regulatory standing.

Transparency regarding company ownership, financial statements, or third-party auditing was not available in reviewed materials. This represents a limitation in assessing the company's financial stability and operational transparency. This goes beyond basic regulatory compliance.

The combination of regulatory oversight and operational concerns creates a mixed trustworthiness profile. Regulatory protection provides baseline security while operational issues create uncertainty about service reliability and customer treatment. This occurs in challenging situations.

User Experience Analysis

Overall user satisfaction with BP Prime appears moderate. Experiences vary significantly based on the specific services utilized and individual circumstances. The broker seems to perform well in core trading functions while facing challenges in ancillary services. These affect overall user experience.

Interface design and platform usability receive indirect positive feedback through user satisfaction with trading operations. This suggests that the MetaTrader 4 implementation provides an accessible and functional trading environment. However, specific details about user interface customization, navigation, or learning curve for new users were not available in reviewed feedback.

The registration and account verification processes were not specifically detailed in available user feedback. This represents an information gap about the initial user experience and onboarding efficiency. These could significantly impact new client satisfaction.

Fund management represents the primary source of user dissatisfaction. Withdrawal issues create negative experiences that overshadow positive trading features. These operational concerns appear significant enough to influence overall user recommendations and satisfaction ratings.

User demographics appear to favor active traders who prioritize execution speed and platform reliability over comprehensive service features. This suggests that BP Prime may be better suited for experienced traders with specific performance requirements. It may be less suitable for beginners seeking extensive support and educational resources.

The improvement opportunities center primarily around enhancing withdrawal process transparency and efficiency. This could significantly improve overall user satisfaction while maintaining the positive aspects of the trading experience. Users currently appreciate these aspects.

Conclusion

BP Prime presents a mixed profile as an FCA-regulated online CFD broker with notable strengths in trading execution and platform reliability. It also has operational challenges that impact overall user satisfaction. The broker's regulatory standing provides essential client protections, while its focus on fast order execution and reliable customer support creates positive trading conditions. These benefit active traders.

The broker appears best suited for experienced traders who prioritize execution speed and platform performance over comprehensive educational resources or extensive customer service features. Active traders focusing on forex, commodities, indices, and cryptocurrency markets may find BP Prime's multi-asset approach and execution quality appealing. These support their trading strategies.

However, the reported withdrawal issues represent a significant concern that prospective clients must carefully consider. Fund accessibility is fundamental to any trading relationship. While the broker demonstrates competence in core trading functions, the operational challenges in fund management create uncertainty about the complete service experience. This could affect long-term client relationships.