FXOpen was founded in 2005 with headquarters located in London, UK. Initially starting as an educational center, the firm quickly transitioned into brokerage services, establishing itself as an innovative player in the forex market. FXOpen made history as the first forex broker to offer ECN trading via the MetaTrader 4 platform. With over 1 million customers from around 100 countries, it has become recognized for its commitment to providing fair and transparent trading conditions.

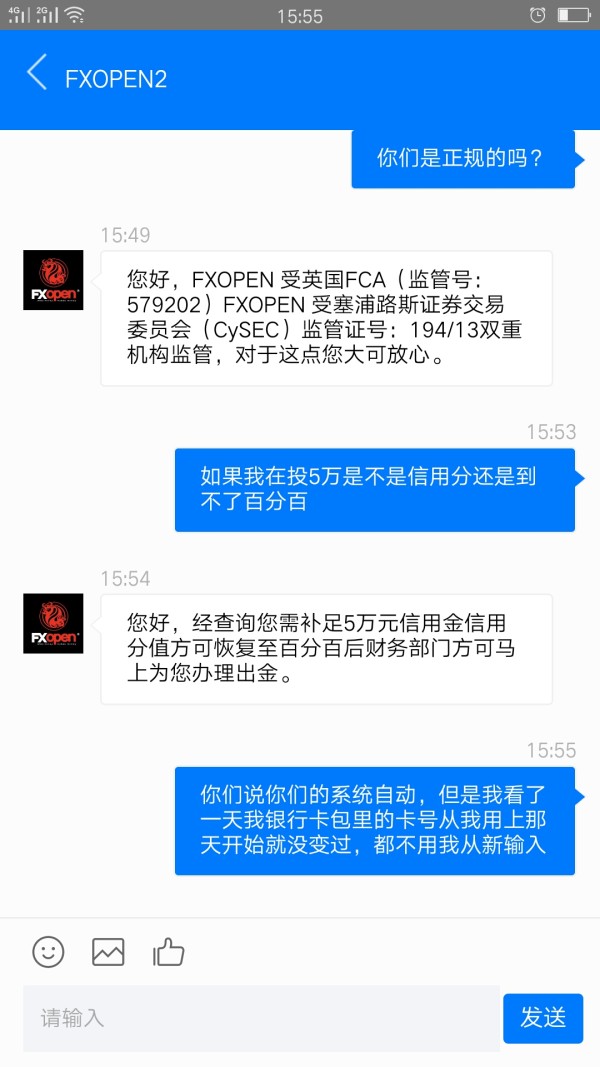

FXOpen operates under a variety of account types, including ECN, STP, Crypto, and Micro accounts, catering to diverse trading strategies. Traders have the opportunity to engage with over 700 tradable assets across multiple sectors such as forex, commodities, cryptocurrencies, and indices. Currently regulated by the FCA (UK), CySEC (Cyprus), and historically by ASIC (Australia), FXOpen adheres to the compliance codes of these regulatory bodies; however, the revocation of its ASIC license poses new questions regarding its operational integrity.

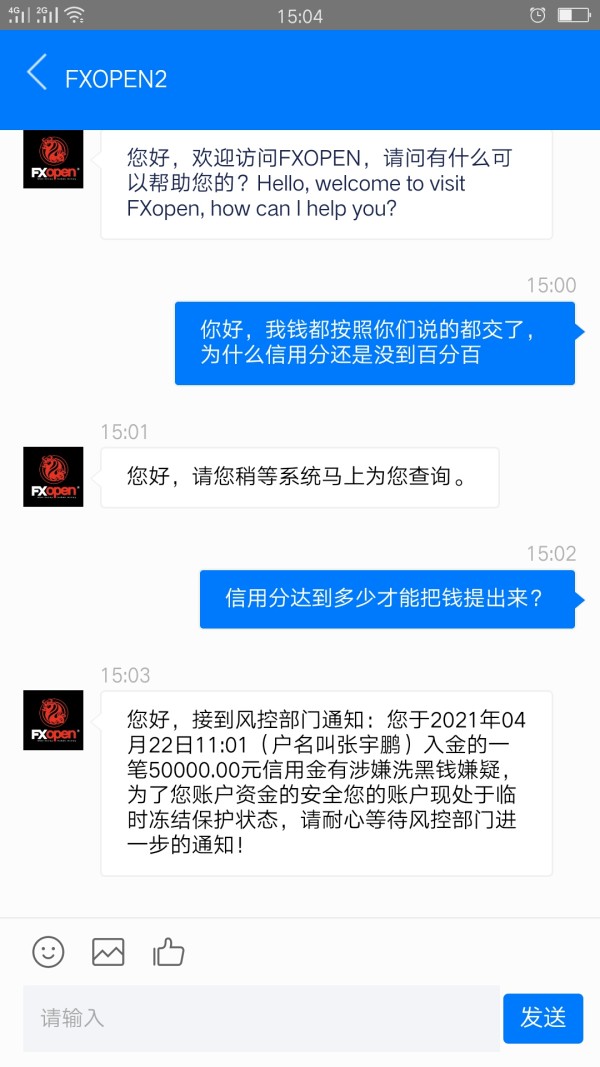

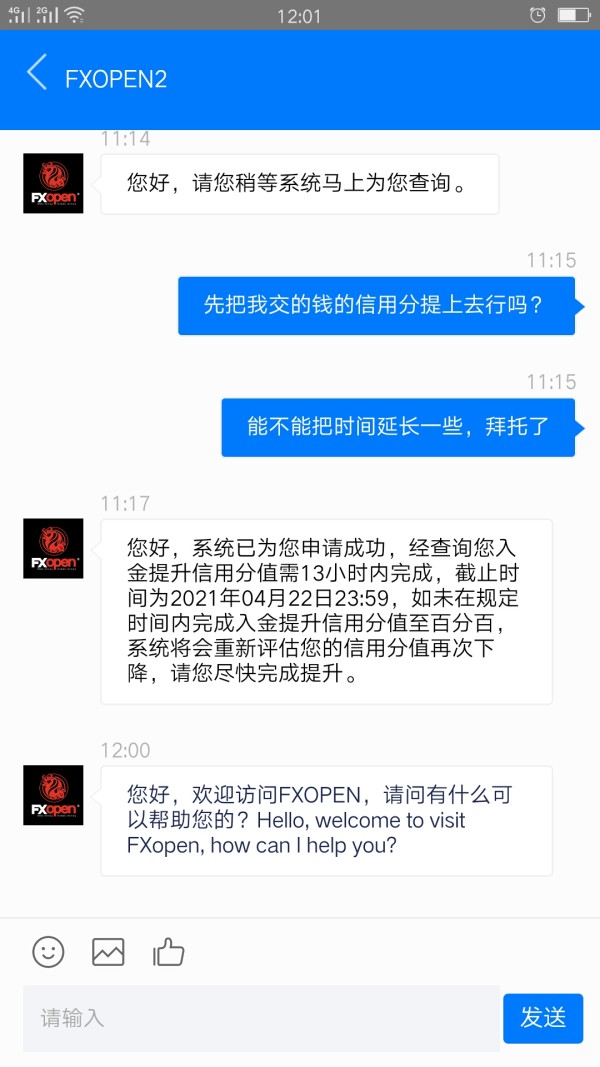

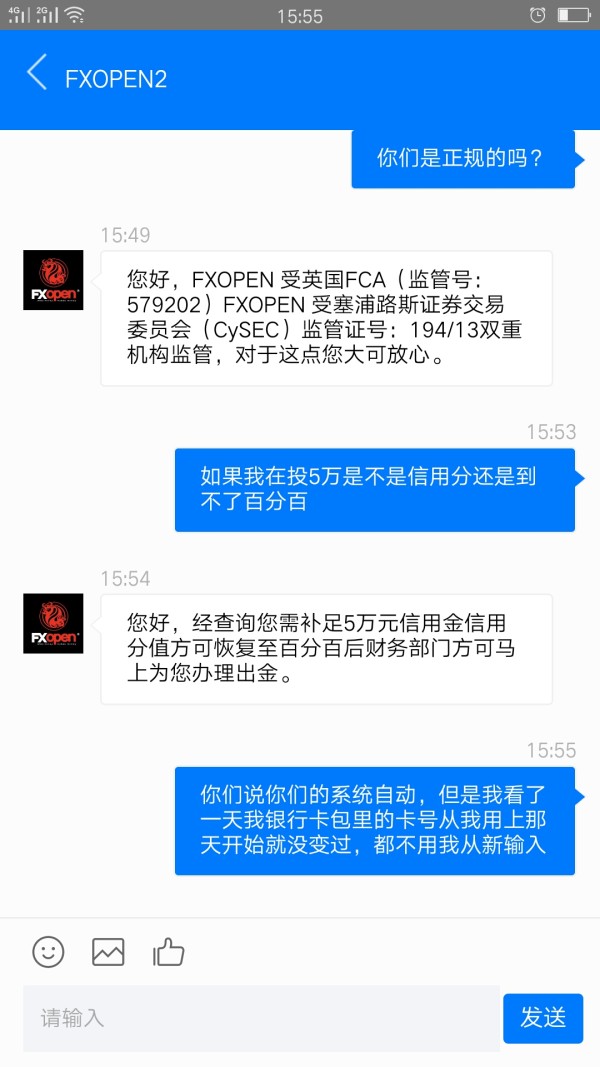

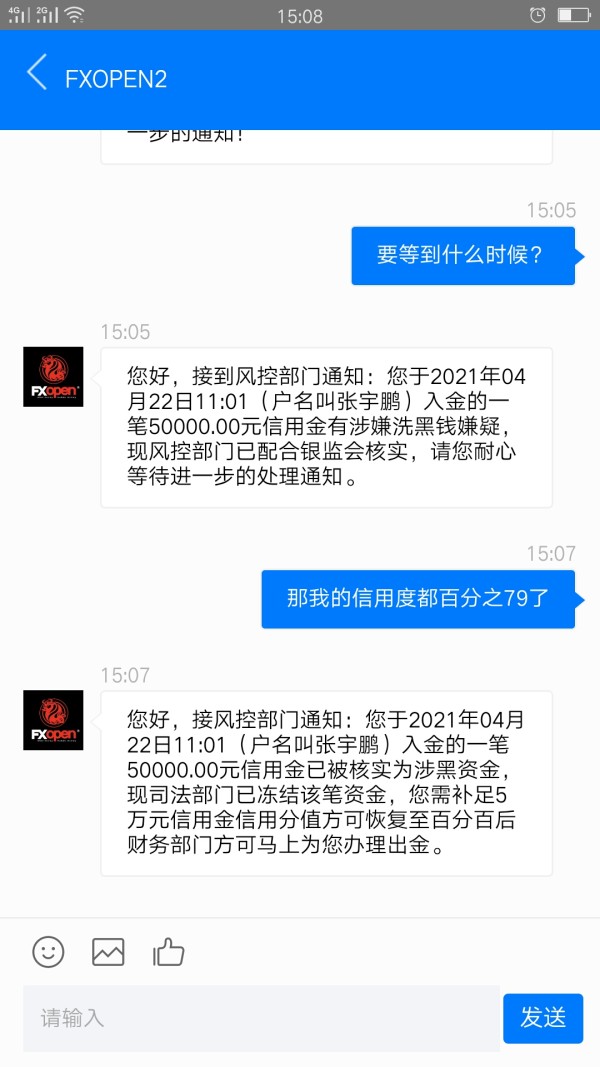

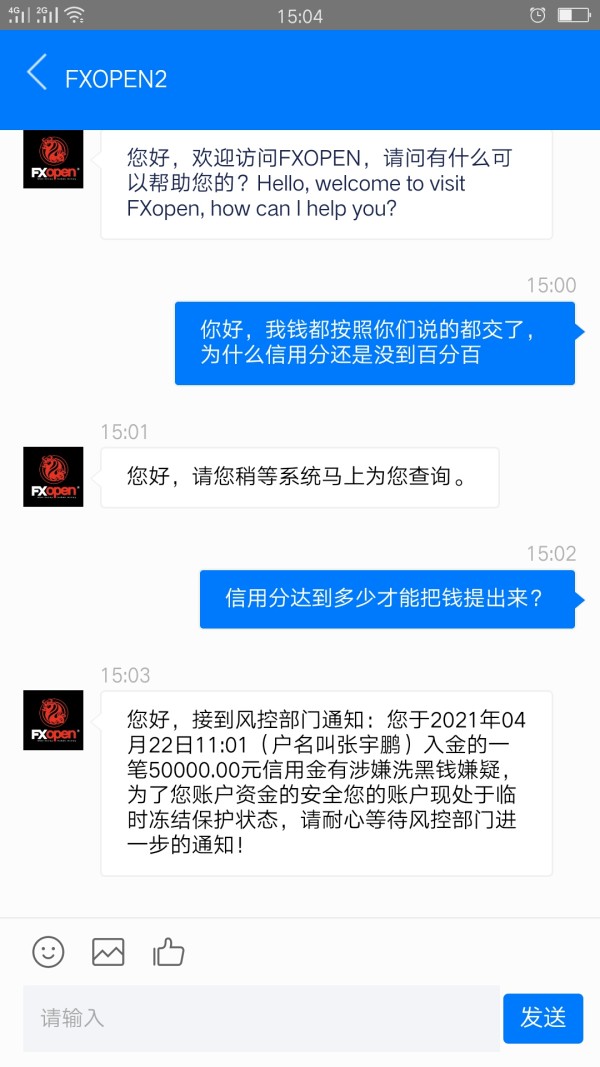

FXOpen boasts regulation by tiers considered trustworthy, including the FCA and CySEC. However, its history of regulatory challenges—like the revocation of its ASIC license—underscores significant risk factors for potential clients, particularly those in the Australian market. Reports of FXOpen being classified as a "suspicious clone" by Australian authorities further challenge its credibility and raise red flags for traders looking for reliability.

- Verify FXOpen‘s regulatory status on the FCA and CySEC websites.

- Check for broader financial service disclosures on trading forums and revision sites.

- Monitor social media for any recent updates regarding FXOpen’s business practices and user experiences.

Industry Reputation and Summary

"I started with FXOpen in 2019 and have had a great experience until recent withdrawal complications arose. Its a shame to see the reputation slipping." - A user review on Forex Peace Army.

Trading Costs Analysis

Advantages in Commissions

FXOpen advertises low commissions with spreads that can start from 0.0 pips on the ECN account. Many active traders favor this model, particularly those engaging in high-frequency and scalping strategies. The flexibility of having various account types with differing fee structures allows traders to choose options that best align with their financial strategies.

The "Traps" of Non-Trading Fees

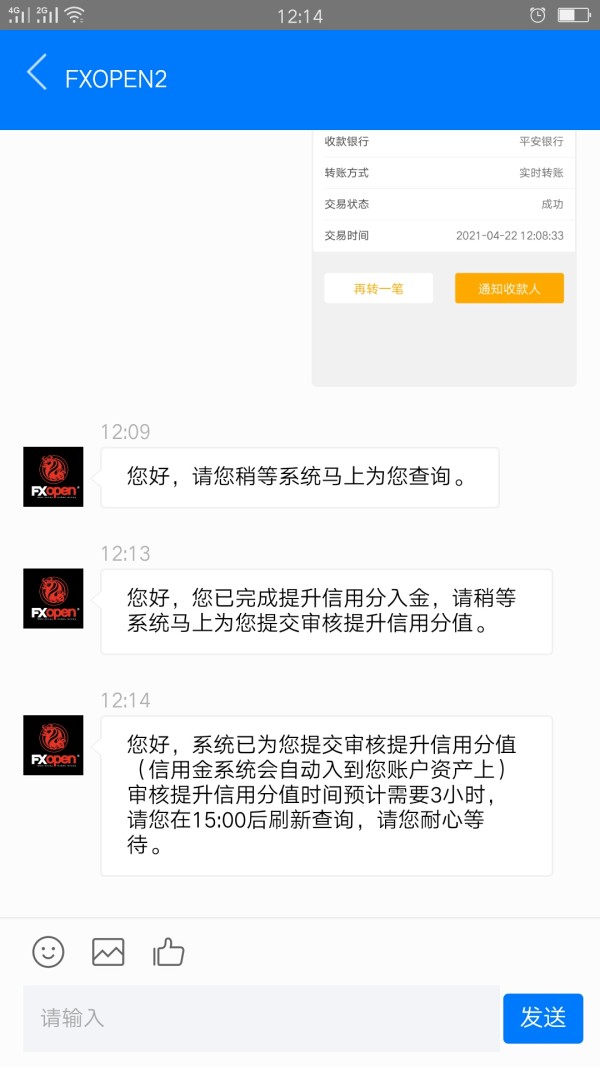

However, users frequently report hidden fees, especially related to withdrawal methods. For example, $30 fees were mentioned in some reviews when using certain withdrawal methods, which can turn low-cost trading attractive into a less favorable scenario when accounting non-trading fees like funding and withdrawal costs.

Cost Structure Summary

Overall, FXOpen presents competitive trading costs, but inexperienced traders should remain cautious about potential unforeseen fees that could affect profitability.

FXOpen provides a wide array of platforms, including the well-respected MetaTrader 4 and MetaTrader 5, as well as its proprietary Tick Trader platform. These platforms accommodate various styles of trading—manual, automated, and algorithmic—appealing to professionals and novices alike.

While FXOpen is equipped with excellent analytical tools and a user-friendly interface on its platforms, missing robust educational resources can hinder beginners ability to capitalize on the overall trading experience.

"The Tick Trader platform offers extensive tools for quick decision making, but, for someone like me who is new to trading, the interface feels overwhelming." - A novice trader experience shared online.

User Experience Analysis

User Interface and Accessibility

Traders commend FXOpen's platform capabilities, but the platform complexity can sometimes be a disadvantage for beginners unfamiliar with trading metrics and graphical interfaces.

Feedback Analysis

User experiences with FXOpen's interface are varied; many appreciate the functionality, while some have pointed out frustrations regarding the learning curve and functionality accessibility.

Customer Support Analysis

Assessment of Support Quality

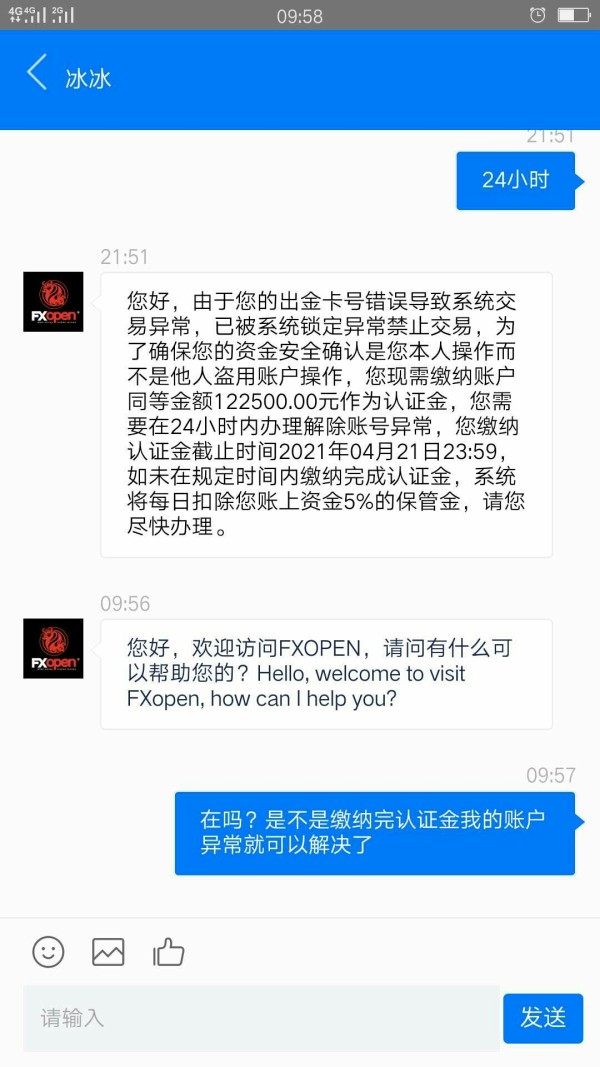

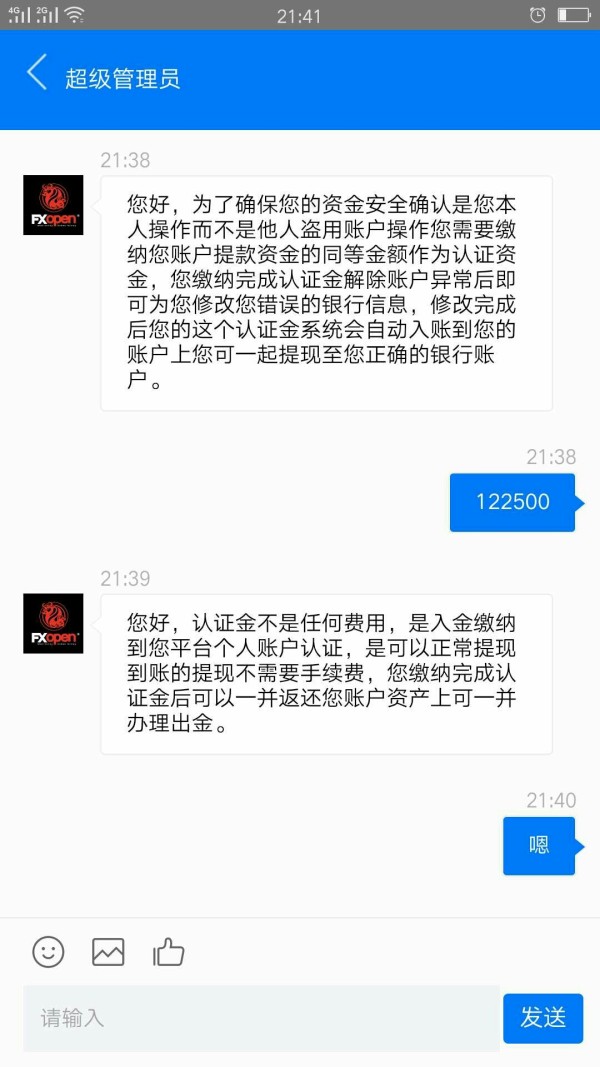

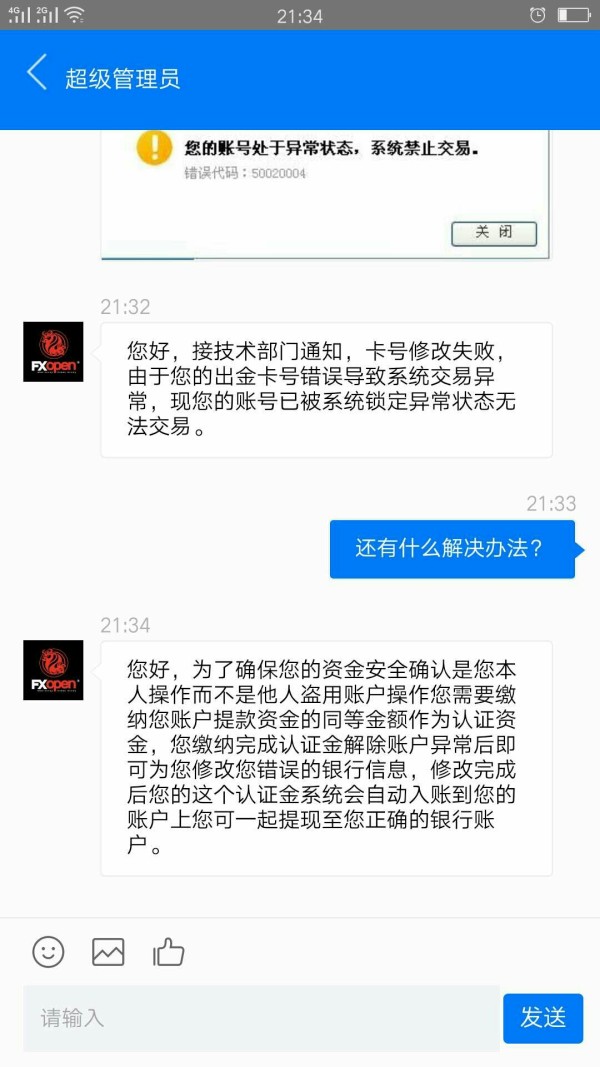

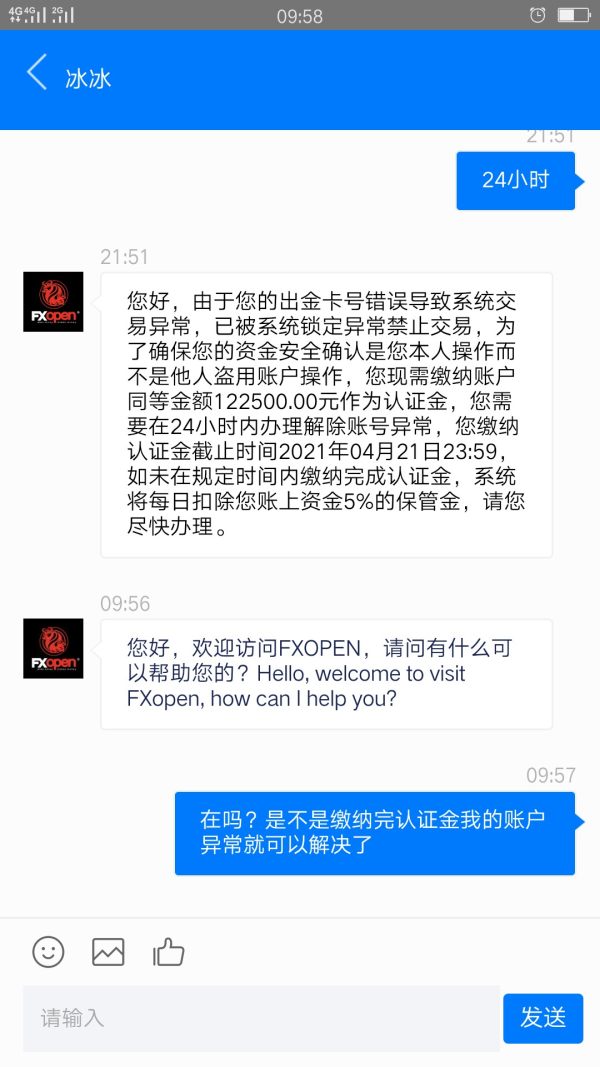

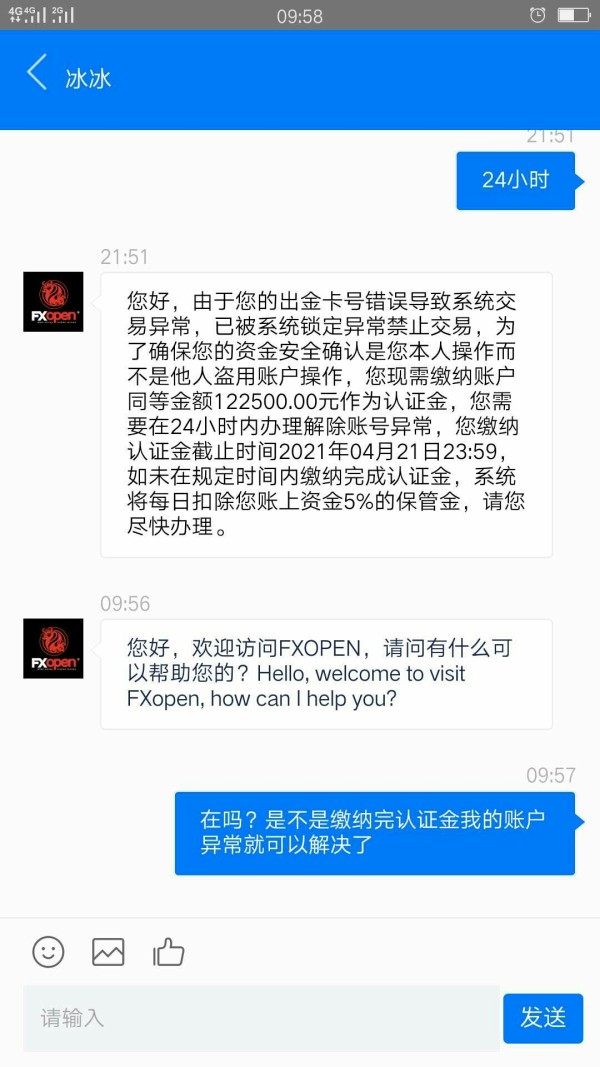

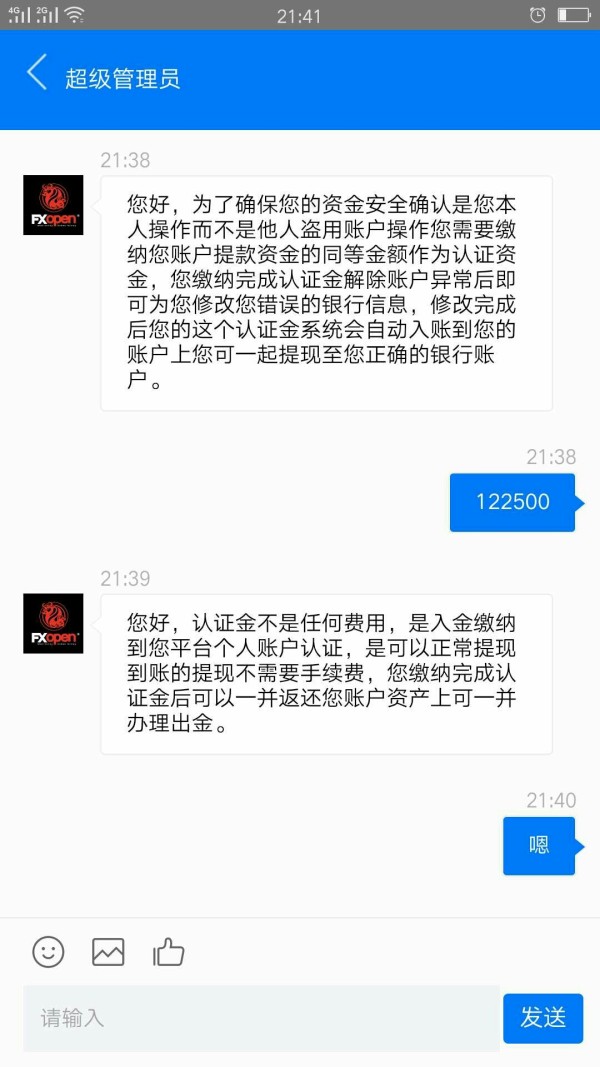

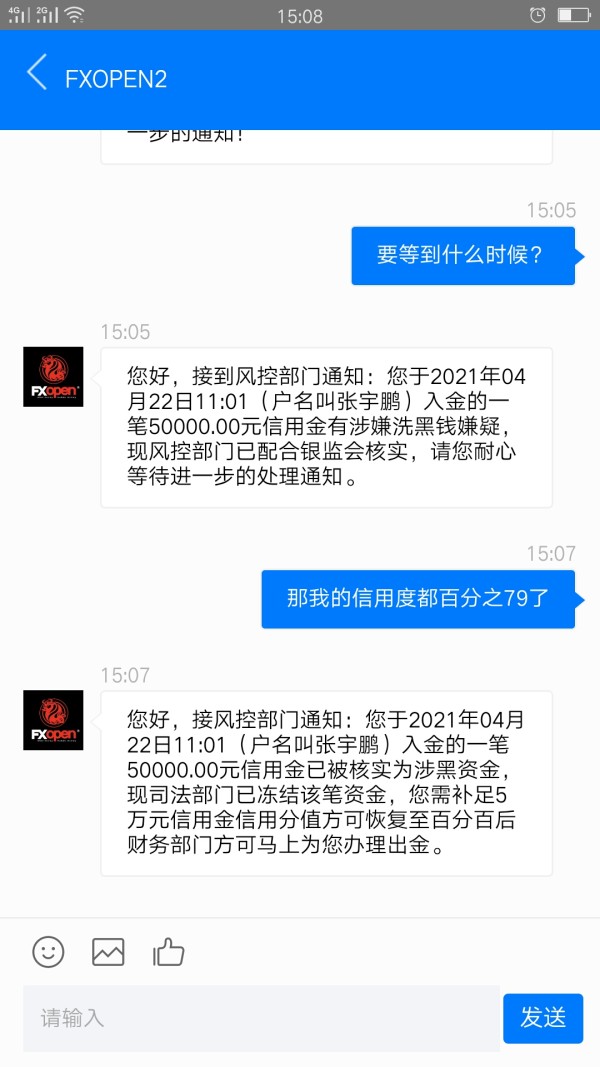

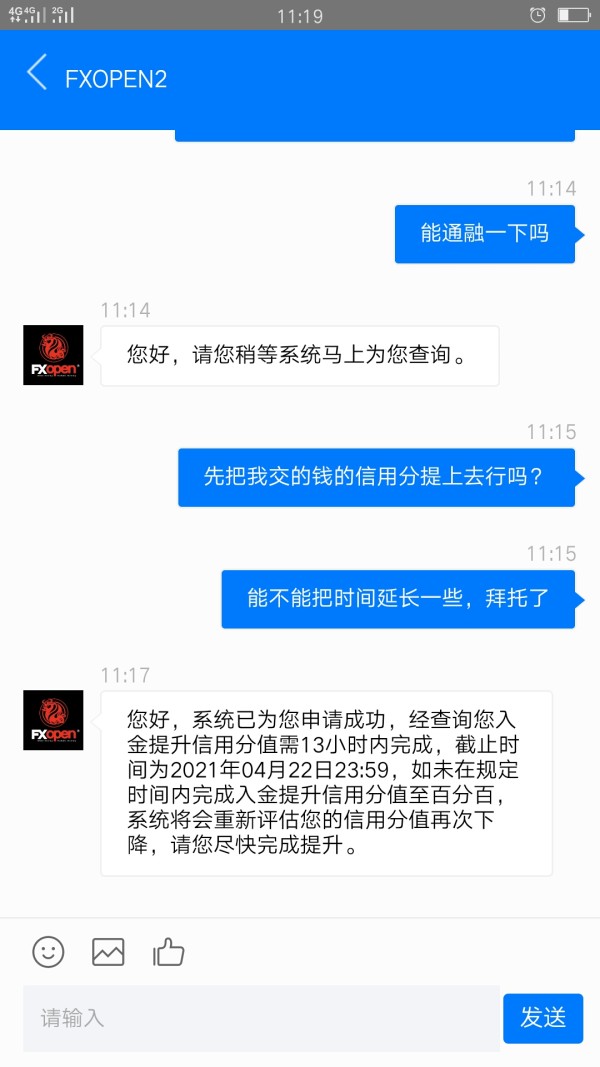

Although FXOpen offers multiple channels for customer support, including live chat and email, users often report inconsistent quality of responses. Early responses may be quick; however, complex queries often receive delayed resolutions, leading to user dissatisfaction.

Evaluation of Response Times

Its crucial to note that while support is available 24/5, the variance in user experiences with promptness and effectiveness can lead to diminished trust in FXOpen's commitment to customer service.

Account Conditions Analysis

Review of Account Types Offered

FXOpen offers a variety of account options including ECN, STP, Micro, and Islamic accounts. Each account is constructed with specific features to cater to different trader needs, but associated fee structures can differ significantly, particularly for withdrawals.

Fee Structures Across Accounts

While entry thresholds are low, users should be wary of funding methods tied to additional fees, which could disproportionately affect account profitability for fledgling traders.

Minimum Deposit Insights

"I appreciated that I could start with just $1, but the fees correlated with withdrawals have made me reconsider my options." - A trader's experience.

Quality Control

Strategy for Handling Information Conflicts: Information conflicts are acknowledged, especially regarding user complaints and regulatory credibility. Users should utilize the sources outlined above for independent verification.

Conclusion

FXOpen stands as a multi-regulated broker offering a competitive environment for active and established traders. However, concerns regarding withdrawal processes and regulatory compliance necessitate a cautious approach. By engaging thoroughly with the platform and independently verifying commitments, traders can better navigate the opportunities and complexities FXOpen presents.

Note: Engage with other traders and consult additional resources before proceeding with FXOpen to establish a comprehensive understanding of its offerings and potential risks associated with trading on the platform.