Oyi 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive oyi review examines a Chinese forex broker that operates without valid regulatory oversight. The broker presents significant risks to potential users who might consider trading with them. Oyi positions itself as a multi-asset trading platform, offering access to forex, stocks, commodities, cryptocurrencies, and indices through popular trading platforms including MetaTrader 4, MetaTrader 5, and web-based trading solutions.

While the broker advertises diverse asset classes and multiple platform options, our analysis reveals concerning gaps in regulatory compliance and transparency. User feedback consistently highlights withdrawal difficulties and questionable business practices. These issues raise red flags about the broker's reliability and trustworthiness that potential traders should consider carefully.

The platform may appeal to traders seeking exposure to various asset classes. However, the absence of proper regulatory protection creates substantial risks that could result in financial losses. Potential users should exercise extreme caution when considering Oyi, particularly given the documented withdrawal issues and lack of regulatory safeguards that protect client funds and trading rights.

Based on available information and user experiences, Oyi appears unsuitable for traders prioritizing security and regulatory protection. The broker may attract those willing to accept higher risks for access to diverse trading instruments, though this approach carries significant dangers.

Important Disclaimers

This oyi review is based on publicly available information and user feedback collected from various sources. Trading with unregulated brokers carries inherent risks that can result in complete loss of invested funds. Potential users should conduct their own due diligence before making any financial commitments to ensure they understand all associated risks.

As a Chinese company, Oyi may operate under different regulatory frameworks across various jurisdictions. The legal protections available to traders may vary significantly depending on their location and local laws. The absence of valid regulatory oversight means that standard investor protections typically provided by licensed brokers may not apply to users of this platform.

This review does not constitute investment advice, and readers should consult with qualified financial professionals before making trading decisions. All trading involves risk that can result in financial losses, and past performance does not guarantee future results under any circumstances.

Overall Rating Framework

Broker Overview

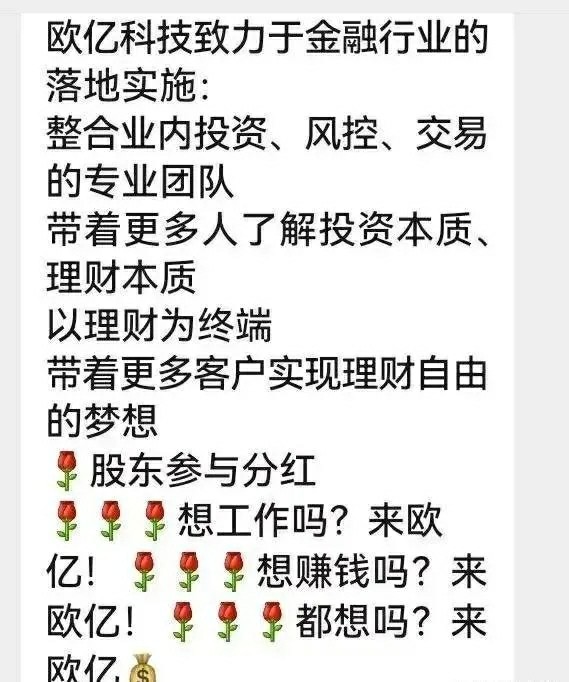

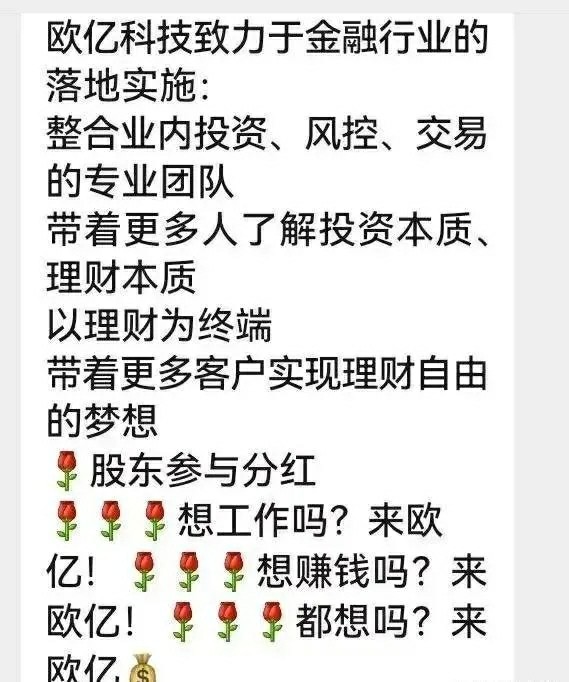

Oyi operates as a Chinese forex broker offering multiple trading account types and access to various financial markets. The company positions itself as a comprehensive trading solution that provides access to traditional forex pairs alongside stocks, commodities, cryptocurrencies, and market indices. However, specific details about the company's founding date and corporate structure remain unclear in available documentation, which raises transparency concerns.

The broker's business model centers on multi-asset trading, attempting to attract traders interested in diversified portfolio approaches. While this strategy can appeal to traders seeking one-stop trading solutions, the lack of regulatory oversight significantly undermines the platform's credibility and safety profile for potential users. The absence of proper licensing creates legal and financial risks that traders should carefully consider before opening accounts.

Oyi's platform offerings include the industry-standard MetaTrader 4 and MetaTrader 5 platforms, along with proprietary web-based trading solutions. This oyi review notes that while platform diversity can benefit traders with different preferences, the underlying concerns about regulatory compliance overshadow these potential advantages significantly. The broker's asset coverage spans traditional forex markets, equity indices, commodity futures, and emerging cryptocurrency markets, suggesting an ambitious scope that may exceed the company's operational capabilities given its regulatory status.

Regulatory Status: Oyi operates without valid regulatory oversight from recognized financial authorities. This creates significant legal and financial risks for users who have limited recourse in case of disputes or financial difficulties.

Deposit and Withdrawal Methods: Specific information about accepted deposit and withdrawal methods is not detailed in available sources. User feedback suggests significant difficulties with fund withdrawal processes that potential traders should consider carefully.

Minimum Deposit Requirements: No specific minimum deposit amounts are mentioned in available documentation. This indicates a lack of transparency in account opening requirements that professional brokers typically provide.

Bonus and Promotional Offers: Details about promotional offers, welcome bonuses, or trading incentives are not specified in current information sources. The absence of clear promotional terms raises questions about the broker's marketing practices.

Tradeable Assets: The platform offers access to forex currency pairs, stock indices, commodity markets, cryptocurrency trading, and various financial derivatives across multiple asset classes. This diversity may appeal to traders seeking varied investment opportunities.

Cost Structure: Specific information about spreads, commissions, and trading fees remains undisclosed. User feedback suggests potential hidden costs that may not be clearly communicated upfront to new account holders.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation. This lack of transparency makes it difficult for traders to assess risk management capabilities.

Platform Choices: Traders can access markets through MetaTrader 4, MetaTrader 5, and web-based trading platforms. These options provide flexibility for different trading styles and preferences among users.

Geographic Restrictions: Specific regional limitations or prohibited jurisdictions are not clearly outlined in available information. This creates uncertainty about legal access for international traders.

Customer Support Languages: Available customer service languages are not specified in current documentation. The lack of multilingual support information may limit accessibility for international users.

This oyi review emphasizes that the lack of detailed information about these fundamental aspects raises concerns about the broker's transparency and commitment to client disclosure.

Account Conditions Analysis

The account conditions offered by Oyi present several concerns that potential traders should carefully consider before opening accounts. Without clear information about minimum deposit requirements, account types, or specific trading conditions, users face uncertainty about what to expect when beginning their trading journey. This lack of transparency contrasts sharply with regulated brokers that must provide clear, standardized disclosures about account terms and conditions to protect consumer interests.

User feedback consistently highlights withdrawal difficulties as a primary concern, suggesting that while deposits may be processed smoothly, extracting funds becomes problematic for many clients. This pattern indicates potential issues with the broker's liquidity management or business model sustainability that could affect all users. The absence of detailed account opening procedures and verification requirements also raises questions about the broker's compliance with anti-money laundering and know-your-customer standards that legitimate financial institutions must follow.

Compared to regulated competitors, Oyi's account conditions lack the transparency and consumer protections that traders typically expect from professional brokers. The unavailability of information about special account features, such as Islamic accounts or professional trader classifications, further limits the broker's appeal to diverse trading communities. This limitation may exclude traders with specific religious or professional requirements from using the platform effectively.

This oyi review notes that the combination of unclear terms and user withdrawal complaints creates a high-risk environment for potential account holders. These factors make it difficult to recommend the broker for serious trading activities that require reliable fund access.

Oyi's platform offerings demonstrate both strengths and limitations in terms of trading tools and resources available to users. The broker provides access to MetaTrader 4 and MetaTrader 5, two industry-standard platforms that offer comprehensive charting capabilities, technical analysis tools, and support for automated trading systems. Additionally, the web-based trading platform provides accessibility for traders who prefer browser-based solutions without software downloads, which can be convenient for users with limited device storage or those trading from multiple locations.

The multi-asset approach allows traders to diversify across forex, stocks, commodities, cryptocurrencies, and indices from a single platform. This consolidation can be advantageous for portfolio diversification strategies and simplified account management. The support for Expert Advisors and automated trading systems through the MetaTrader platforms adds appeal for algorithmic traders and those utilizing systematic trading approaches that require reliable execution capabilities.

However, the analysis reveals significant gaps in educational resources and research materials that professional brokers typically provide. Unlike established brokers that provide market analysis, educational webinars, trading guides, and economic calendars, Oyi appears to offer limited educational support for traders. This deficiency particularly impacts novice traders who rely on broker-provided resources to develop their trading skills and market understanding effectively.

The absence of detailed information about research capabilities, market analysis tools, or educational programs suggests that Oyi focuses primarily on platform access rather than comprehensive trader development and support services. This approach may limit the broker's value proposition for traders seeking ongoing education and market insights.

Customer Service and Support Analysis

Customer service represents one of the most problematic aspects of Oyi's operations, based on available user feedback and documentation from multiple sources. Users consistently report difficulties in reaching effective customer support, particularly when dealing with withdrawal requests and account-related issues that require immediate attention. The lack of clearly defined customer service channels, response time commitments, or service level agreements indicates insufficient attention to client support infrastructure that professional brokers typically maintain.

Response times appear to be lengthy, with users reporting delays in receiving assistance for urgent account matters that may affect their trading activities. The quality of support provided has drawn criticism from users who describe unhelpful responses and inability to resolve fundamental issues like fund withdrawals. This pattern suggests either inadequate training of support staff or systemic issues with the broker's operational capabilities that affect all customer interactions.

The absence of information about multilingual support capabilities limits the broker's accessibility to international traders who may not speak the primary language. Professional brokers typically provide support in multiple languages and maintain clear communication protocols to serve diverse client bases effectively. The lack of such services may exclude potential users from different linguistic backgrounds.

Most concerning are user reports indicating that customer service representatives are unable or unwilling to facilitate withdrawal requests. This suggests either liquidity problems or deliberately obstructive practices that could affect all users. The inability to effectively resolve client concerns undermines trust and indicates serious operational deficiencies that potential users should carefully consider before opening accounts.

Trading Experience Analysis

The trading experience with Oyi presents a mixed picture of claimed capabilities versus user-reported realities that potential traders should understand. While the broker advertises execution speeds of 0ms, which would be exceptional in the industry, user feedback does not consistently support these performance claims. The lack of verified performance data, including slippage statistics, requote frequencies, and actual execution quality metrics, makes it difficult to assess the true trading environment that users can expect.

Platform stability appears adequate for basic trading functions, given the use of established MetaTrader infrastructure that has proven reliable across the industry. However, users have not provided substantial positive feedback about exceptional trading conditions or superior execution quality that would distinguish Oyi from competitors. The absence of detailed trading statistics or third-party performance verification raises questions about the accuracy of advertised execution capabilities that the broker promotes.

Mobile trading experience information is limited, which is increasingly important as traders require reliable mobile access to manage positions and respond to market opportunities. The lack of comprehensive mobile platform details suggests potential limitations in this area that could affect active traders. Modern trading requires seamless mobile functionality that allows users to monitor and adjust positions from any location.

User feedback indicates possible hidden costs or unexpected fees that may impact overall trading profitability beyond advertised spreads and commissions. This oyi review emphasizes that the uncertainty around true trading costs and execution quality creates risks for traders who require predictable trading conditions for their strategies. The lack of transparency in cost structures makes it difficult for traders to accurately calculate their potential profits and losses.

Trustworthiness Analysis

Trustworthiness represents the most significant concern in this comprehensive assessment of Oyi's operations and business practices. The broker operates without valid regulatory oversight from recognized financial authorities, which eliminates the fundamental protections that licensed brokers must provide to clients. This regulatory void means that standard safeguards such as segregated client funds, compensation schemes, and dispute resolution mechanisms are not available to users who encounter problems.

The absence of clear information about company ownership, management structure, and corporate governance raises additional transparency concerns that affect user confidence. Reputable brokers typically provide detailed corporate information, regulatory compliance documentation, and clear disclosure of business operations to build trust with potential clients. Oyi demonstrates significant deficiencies in these areas that make it difficult for users to assess the company's legitimacy and stability.

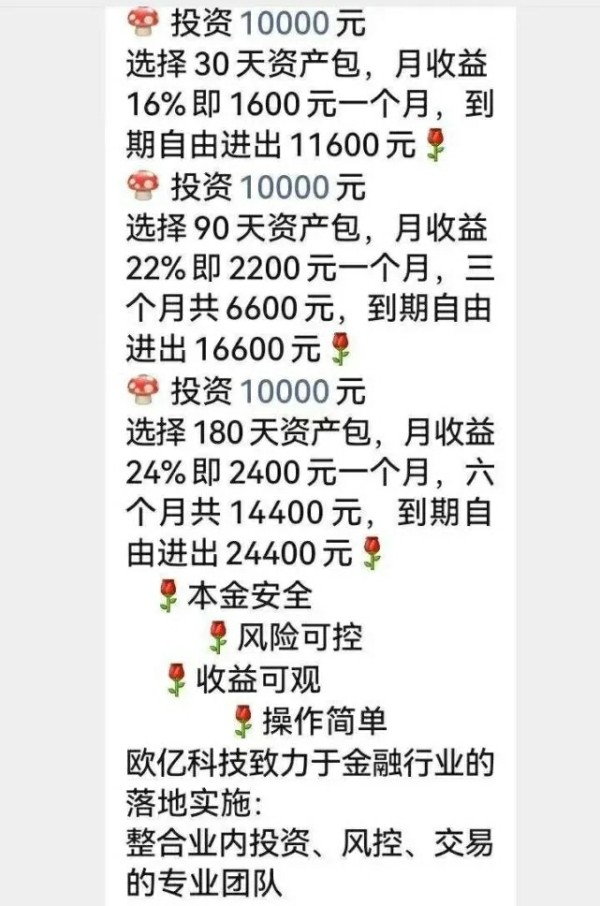

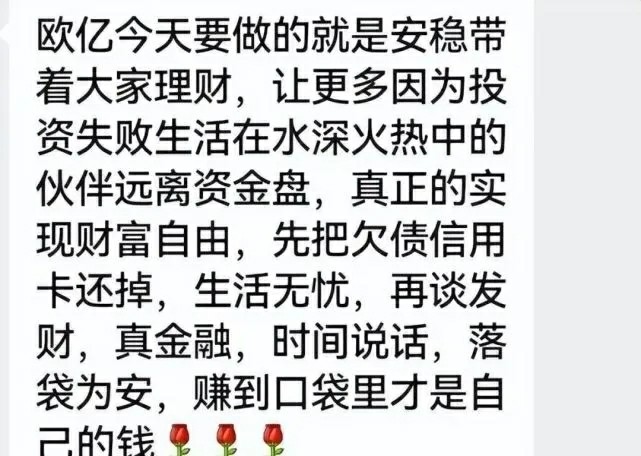

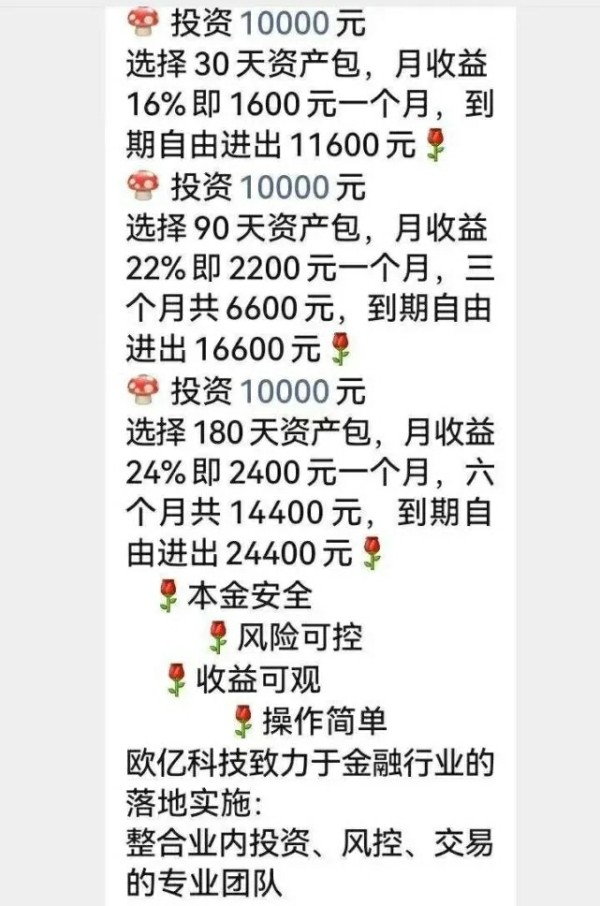

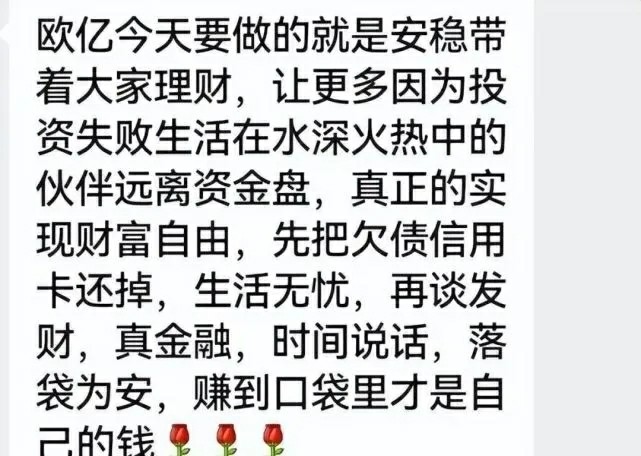

User feedback consistently points to practices that suggest fraudulent behavior, particularly regarding withdrawal difficulties and unresponsive customer service that fails to resolve client concerns. The pattern of accepting deposits while creating barriers to withdrawals is a common characteristic of problematic brokers that traders should recognize as a major warning sign. This behavior indicates potential issues with business model sustainability or intentional deceptive practices.

The lack of third-party audits, financial reporting, or independent verification of business practices further undermines confidence in the broker's operations and financial stability. Without regulatory requirements for transparency and accountability, users have no reliable way to assess the broker's financial stability or operational integrity. Industry reputation appears poor based on available user reviews and feedback, with negative experiences significantly outweighing positive reports from actual users.

User Experience Analysis

Overall user satisfaction with Oyi appears significantly below industry standards, based on available feedback and documented user experiences from multiple sources. The predominant user complaints center on withdrawal difficulties, which represent fundamental failures in broker-client relationships that affect the core purpose of trading platforms. When traders cannot reliably access their own funds, the entire trading experience becomes problematic regardless of other platform features or capabilities.

Interface design and platform usability information is limited, though the use of MetaTrader platforms suggests reasonable functionality for basic trading operations that most users can navigate. However, the underlying concerns about fund security and withdrawal processes overshadow any positive aspects of platform design or functionality. Users prioritize fund safety and accessibility above interface convenience when choosing trading platforms.

The registration and account verification processes lack clear documentation, creating uncertainty for potential users about requirements and timelines for account activation. Professional brokers typically provide transparent information about account opening procedures, verification requirements, and expected processing times to set appropriate user expectations. The absence of such information creates frustration and uncertainty for new users attempting to begin trading.

User demographics appear to include traders willing to accept higher risks in exchange for access to diverse asset classes, though the overall risk-reward profile appears unfavorable given the documented issues. The broker may attract traders from regions with limited access to regulated alternatives, though this does not address the fundamental safety concerns that affect all users. Regional limitations in broker access do not justify accepting unregulated platforms with documented problems.

Common user complaints focus overwhelmingly on withdrawal problems, suggesting systematic issues rather than isolated incidents that might occur with any broker. The consistency of these reports across different users and time periods indicates structural problems with the broker's operations that potential users should take seriously when making platform selection decisions.

Conclusion

This comprehensive oyi review reveals a broker that presents significant risks to potential users despite offering access to diverse trading instruments and popular platform options. While Oyi provides multiple asset classes and established trading platforms that may appeal to some traders, the absence of regulatory oversight and consistent user complaints about withdrawal difficulties create an environment unsuitable for most trading activities. The documented issues with fund access and customer service make it difficult to recommend this platform for serious trading pursuits.

The broker might appeal to high-risk tolerance traders seeking exposure to multiple asset classes through a single platform. However, the documented issues with fund withdrawals and customer service make it difficult to recommend for serious trading activities that require reliable fund access. The lack of transparency in key areas such as costs, account conditions, and corporate structure further undermines confidence in the platform's reliability and long-term viability.

For traders prioritizing security, regulatory protection, and reliable fund access, numerous regulated alternatives provide better risk-adjusted opportunities with proper oversight and consumer protections. The combination of regulatory concerns and user experience issues suggests that potential benefits from Oyi's platform offerings are significantly outweighed by the associated risks and uncertainties. Traders should carefully consider these factors before making any financial commitments to unregulated platforms like Oyi.