Is Oyi safe?

Pros

Cons

Is Oyi Safe or a Scam?

Introduction

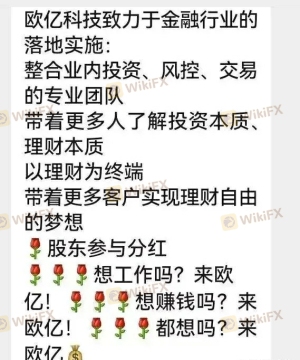

Oyi is a forex broker that has recently emerged in the trading landscape, primarily targeting traders looking for a diverse range of financial instruments, including forex, stocks, commodities, and cryptocurrencies. However, the rise of such platforms has made it imperative for traders to conduct thorough evaluations before engaging with them. With the potential for scams and unreliable services in the forex market, traders must be cautious and informed. This article aims to provide an objective analysis of Oyi's credibility, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

To ensure a comprehensive evaluation, we have employed a structured approach that includes reviewing regulatory information, examining user feedback, and analyzing the broker's operational practices. By synthesizing this information, we aim to answer the critical question: is Oyi safe for trading?

Regulation and Legitimacy

One of the primary factors to consider when assessing any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to industry standards and practices. Unfortunately, Oyi operates without valid regulatory oversight, which poses significant risks to its users.

Regulatory Information Overview

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that Oyi is not subject to the rigorous compliance checks that reputable brokers undergo, leaving traders vulnerable to potential fraud and mismanagement. Regulatory bodies, such as the FCA (Financial Conduct Authority) or ASIC (Australian Securities and Investments Commission), play a crucial role in protecting traders' interests by ensuring that brokers maintain transparency and adhere to fair trading practices. The lack of oversight for Oyi raises concerns about the safety of funds held with the broker, making it essential for traders to approach this platform with caution.

Company Background Investigation

Oyi's operational history is relatively short, having been established only 1-2 years ago. The company operates from China, but details regarding its ownership structure and management team are sparse.

The lack of transparency concerning the company's leadership and operational practices is a significant red flag. A well-established broker typically provides information about its founders, management team, and their professional backgrounds. In this case, Oyi's limited information makes it difficult to assess the experience and credibility of its leadership. Furthermore, the absence of clear corporate governance can lead to concerns about accountability and ethical practices.

Trading Conditions Analysis

When evaluating whether Oyi is safe, it is crucial to examine the trading conditions it offers. Traders should be aware of the fees, spreads, and overall cost structure associated with trading on the platform.

Core Trading Costs Comparison

| Cost Type | Oyi | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | 1.5 pips | 1.2 pips |

| Commission Model | $7 per lot | $5 per lot |

| Overnight Interest Range | N/A | Varies |

Oyi requires a minimum deposit of $500 to start trading, which may be considered high compared to other brokers. The average spread for major currency pairs is reported to be 1.5 pips, slightly above the industry average. Additionally, the commission structure is not particularly competitive, which could impact traders' profitability.

Moreover, traders should be wary of any unusual fees or policies that may not be disclosed upfront. The complexity of the fee structure can lead to unexpected costs, further complicating the trading experience.

Client Fund Security

The safety of client funds is paramount when determining if Oyi is safe. Unfortunately, Oyi's lack of regulation raises significant concerns regarding its fund security measures.

Traders should look for brokers that implement strict fund segregation practices, ensuring that client funds are kept separate from the broker's operational funds. Additionally, investor protection schemes can provide a safety net in the event of broker insolvency. However, Oyi does not appear to offer such protections, leaving traders exposed to potential financial risks.

There have been reports of difficulties in fund withdrawals, which further exacerbate concerns about the security of client funds. Traders must be cautious and consider these factors seriously before proceeding with Oyi.

Customer Experience and Complaints

Customer feedback is a critical aspect of assessing whether Oyi is safe. Negative reviews and complaints can provide insights into the broker's reliability and customer service quality.

Common Complaint Types

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal issues | High | Poor |

| Lack of customer support | Medium | Average |

| Unclear fee structures | Medium | Average |

Many users have reported significant challenges regarding fund withdrawals, which raises red flags about the broker's operational integrity. Complaints about unresponsive customer support further highlight the issues traders may face when attempting to resolve problems.

For instance, one user reported being unable to withdraw their funds for several months, leading to frustration and distrust. Such experiences can severely impact traders' confidence in the platform, making it essential for potential users to weigh these factors carefully.

Platform and Execution

The trading platform's performance is another vital consideration in determining if Oyi is safe. Traders expect a reliable, user-friendly interface that allows them to execute trades efficiently.

However, reports of poor order execution quality, including slippage and high rejection rates, have surfaced. These issues can significantly affect trading outcomes, particularly for those employing high-frequency trading strategies or relying on precise entry and exit points.

Risk Assessment

A comprehensive risk assessment is essential for traders considering Oyi. The lack of regulation, combined with negative user experiences and potential fund security issues, contributes to an overall high-risk profile.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Security Risk | High | No client fund segregation |

| Customer Service Risk | Medium | Poor response to complaints |

| Trading Execution Risk | High | Reports of slippage and rejections |

To mitigate these risks, traders should consider using smaller amounts for initial deposits and thoroughly researching alternative brokers with better regulatory oversight and customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that Oyi presents several red flags that traders should consider seriously. The absence of regulatory oversight, coupled with negative user experiences and potential fund security issues, raises significant concerns about whether Oyi is safe for trading.

For traders looking for reliable alternatives, it is advisable to consider brokers regulated by top-tier authorities, such as the FCA or ASIC, which provide better protections for client funds and a more transparent trading environment.

Ultimately, while Oyi may offer a range of trading options, the associated risks make it a questionable choice for traders seeking a safe and secure trading experience.

Is Oyi a scam, or is it legit?

The latest exposure and evaluation content of Oyi brokers.

Oyi Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Oyi latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.