Is GEMFOREX safe?

Pros

Cons

Is Gemforex A Scam?

Introduction

Gemforex is a forex and CFD broker that has gained attention in the trading community, particularly in Japan and parts of Asia. Established in 2010, it aims to provide a platform for both novice and experienced traders to engage in the foreign exchange market. However, as with any financial service, it is crucial for traders to conduct thorough due diligence before committing their funds. The foreign exchange market is rife with risks, and the choice of a broker can significantly affect the trading experience and financial outcomes. This article will assess whether Gemforex is a legitimate trading platform or a potential scam by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks.

Regulation and Legitimacy

When evaluating a broker‘s credibility, regulatory oversight is a fundamental aspect. Gemforex operates under the regulatory framework of the Seychelles Financial Services Authority (FSA). However, this regulatory body is often criticized for its lenient standards compared to more established regulators like the FCA in the UK or ASIC in Australia. Here is a summary of Gemforex’s regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 116 | Seychelles | Active |

The significance of regulation cannot be understated. A well-regulated broker is bound by strict compliance requirements that protect clients' interests. Unfortunately, the Seychelles FSA is known for its lack of rigorous oversight, allowing brokers to operate with minimal scrutiny. This raises concerns about the safety of trading with Gemforex. While the broker claims to provide account segregation and negative balance protection, these assurances do not carry the same weight as those offered by brokers regulated by top-tier authorities. Historical compliance records also indicate that Gemforex has faced scrutiny for its operations, which may further question its legitimacy. Therefore, it is essential to consider these factors when asking, "Is Gemforex safe?"

Company Background Investigation

Gemforex was founded in 2010, initially under the name Gem Trade, and has since rebranded. The company is registered in Seychelles, a location often associated with offshore trading firms. The ownership structure of Gemforex is somewhat opaque, with limited publicly available information about its management team. This lack of transparency can be a red flag for potential investors.

The management team's professional backgrounds are not extensively documented, which raises concerns about their experience and capability to manage a financial services firm effectively. While the company has been operational for over a decade, the absence of detailed insights into its leadership and governance may deter cautious investors. Transparency is a critical factor in building trust with potential clients, and Gemforex appears to fall short in this regard. This lack of clarity prompts further investigation into whether Gemforex can be deemed a safe trading option.

Trading Conditions Analysis

Gemforex offers competitive trading conditions, which can be attractive to traders. However, the specifics of the fee structure warrant careful examination. The broker provides various account types, each with different minimum deposit requirements and trading conditions.

| Fee Type | Gemforex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 1.0 - 1.5 pips |

| Commission Model | $3 per lot | Varies |

| Overnight Interest Range | Varies | 2% - 5% |

The spreads offered by Gemforex are generally in line with industry averages, but the commission structure, especially for the raw account, can add to trading costs. Additionally, the broker's policy on overnight fees has raised concerns among users, particularly regarding the lack of clarity on how these fees are calculated. Traders must be aware of any hidden costs that could erode their profits. This analysis of trading conditions raises the question: Is Gemforex safe? The answer remains uncertain as potential traders must weigh the benefits against the possible drawbacks.

Customer Fund Security

The security of customer funds is paramount when selecting a forex broker. Gemforex claims to implement measures such as fund segregation, which is a standard practice among regulated brokers. However, the effectiveness of these measures is contingent upon the regulatory environment in which the broker operates. The Seychelles FSA does not offer the same level of investor protection as more robust regulatory bodies.

Moreover, there have been historical reports of fund withdrawal issues and delays experienced by users of Gemforex. Such incidents cast doubt on the broker's commitment to safeguarding client funds. While the company asserts that it employs measures to protect customer assets, the lack of a strong regulatory framework raises questions about the actual effectiveness of these measures. Thus, potential investors should be cautious and consider whether Gemforex is safe for their trading activities.

Customer Experience and Complaints

Customer feedback provides valuable insight into a broker's reliability. Reviews of Gemforex reveal a mixed bag of experiences. While some users praise the trading platform's functionality and ease of use, others report significant issues, particularly regarding withdrawals.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Service | Medium | Generic replies |

| Account Closure Issues | High | Unresolved |

Common complaints include delays in processing withdrawals, lack of effective customer support, and difficulties in account management. For instance, several users have reported waiting weeks for their funds to be released, leading to frustration and mistrust. The company's response to these complaints has often been perceived as inadequate, with generic replies that fail to address specific concerns. Such patterns of feedback raise alarms about the overall user experience and reliability of Gemforex, prompting further inquiries into whether Gemforex is safe for traders.

Platform and Execution

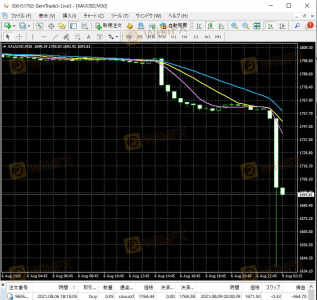

The trading platform offered by Gemforex, based on MetaTrader 4 and 5, is widely regarded as user-friendly and equipped with essential trading tools. However, the platform's performance, particularly in terms of order execution speed and slippage, is critical for active traders.

The execution quality has been scrutinized, with reports of slippage during high volatility periods. This can significantly impact trading outcomes, especially for scalpers or those employing high-frequency trading strategies. Additionally, there have been allegations of platform manipulation, although concrete evidence remains scarce. Nevertheless, the concerns surrounding execution quality and potential manipulation further complicate the question of whether Gemforex is safe for trading.

Risk Assessment

When evaluating the overall risk associated with trading with Gemforex, several factors must be considered. The broker's regulatory status, customer feedback, and trading conditions all contribute to a comprehensive risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Weak oversight from Seychelles FSA |

| Fund Security Risk | Medium | Mixed reviews on fund withdrawal |

| Execution Risk | Medium | Reports of slippage and manipulation |

To mitigate these risks, traders should consider using smaller position sizes and diversifying their investments. Additionally, seeking out alternative brokers with stronger regulatory frameworks may provide enhanced security and peace of mind.

Conclusion and Recommendations

In conclusion, while Gemforex offers certain attractive features, the overall assessment raises significant concerns about its safety and reliability. The lack of robust regulatory oversight, mixed customer feedback, and historical issues with fund withdrawals suggest that traders should approach this broker with caution.

For those considering entering the forex market, it may be prudent to explore alternatives that are regulated by reputable authorities, such as FCA or ASIC. Brokers like FP Markets or Pepperstone are recommended for their strong regulatory frameworks and positive user experiences. Ultimately, the question remains: Is Gemforex safe? The evidence points to a cautious approach, prompting potential traders to carefully evaluate their options before proceeding.

Is GEMFOREX a scam, or is it legit?

The latest exposure and evaluation content of GEMFOREX brokers.

GEMFOREX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GEMFOREX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.