Regarding the legitimacy of MarquisFX forex brokers, it provides VFSC and WikiBit, .

Is MarquisFX safe?

Business

License

Is MarquisFX markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

MARQUIS FX LIMITED

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is MarquisFX Safe or Scam?

Introduction

MarquisFX is an online forex broker that positions itself as a reliable platform for traders seeking to navigate the foreign exchange market. As the landscape of forex trading continues to evolve, it is crucial for traders to conduct thorough evaluations of brokers to ensure their investments are secure. With numerous reports of scams and fraudulent activities plaguing the industry, understanding the legitimacy of a broker like MarquisFX is paramount. This article employs a comprehensive evaluation framework, drawing insights from various sources, including regulatory information, company history, trading conditions, and customer feedback, to assess whether MarquisFX is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. Unfortunately, MarquisFX operates without oversight from any major regulatory authority. The broker is registered in Vanuatu, a jurisdiction known for its lax regulatory environment. This lack of regulation raises significant concerns about the safety of traders' funds and the broker's operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | N/A | Vanuatu | Unregulated |

The absence of a robust regulatory framework means that MarquisFX is not subject to the stringent oversight that reputable brokers are required to adhere to. Furthermore, the VFSC has been criticized for its ineffective enforcement of regulations, leading to a scenario where brokers can operate with minimal accountability. Traders should be cautious when dealing with unregulated brokers, as the process of recovering funds can be challenging if disputes arise.

Company Background Investigation

MarquisFX Limited, the entity behind MarquisFX, is based in Vanuatu. The company claims to offer a user-friendly trading experience and a variety of trading instruments. However, detailed information about the company's history, ownership structure, and management team is scarce. The lack of transparency regarding the company's operations raises questions about its credibility.

The management teams background is also not well-documented, making it difficult to assess their expertise and experience in the forex industry. This opacity can be a red flag for potential investors, as a reputable broker should provide clear information about its leadership and operational history. Transparency in these areas is vital for building trust and ensuring that traders know who they are dealing with.

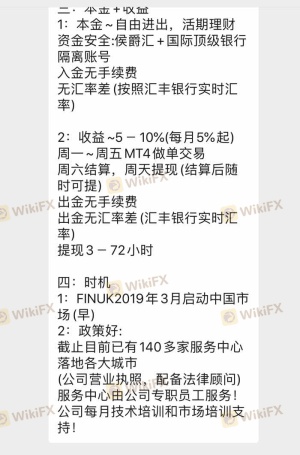

Trading Conditions Analysis

MarquisFX offers a single account type with a minimum deposit requirement of $100, which is relatively low compared to industry standards. However, the trading conditions, including spreads and commissions, warrant close examination. The broker advertises a spread of around 1.2 pips for major currency pairs, yet some reviews suggest that spreads can be as high as 2.5 pips, which is above the industry average.

| Fee Type | MarquisFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 - 2.5 pips | 1.0 - 2.0 pips |

| Commission Model | No commission, spread-based | Varies (commission or spread) |

| Overnight Interest Range | Varies | Varies |

The commission-free model may seem appealing, but higher spreads can lead to increased trading costs, impacting overall profitability. Additionally, the presence of hidden fees, such as deposit charges, further complicates the cost structure. Traders should carefully evaluate these conditions and consider how they align with their trading strategies.

Client Fund Safety

When assessing whether MarquisFX is safe, examining its client fund safety measures is essential. The broker does not provide sufficient information regarding the segregation of client funds, which is a critical practice for protecting traders' investments. Segregated accounts ensure that clients' funds are kept separate from the broker's operational funds, providing a layer of security in case of financial difficulties.

Moreover, there is no mention of investor protection schemes or negative balance protection policies, which further heightens the risk for traders. In the event of insolvency, clients may face challenges in recovering their funds. The lack of historical data regarding fund security incidents adds to the uncertainty surrounding MarquisFXs practices.

Customer Experience and Complaints

Customer feedback plays a significant role in assessing the reliability of a broker. Reviews of MarquisFX reveal a mixed bag of experiences, with some traders reporting satisfactory service, while others express concerns over withdrawal issues and lack of responsiveness from customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Customer Support | Medium | Limited availability |

| Spread Discrepancies | Medium | No clear explanation |

Common complaints include difficulties in processing withdrawals, which is a significant red flag when evaluating whether MarquisFX is safe. A brokers ability to facilitate timely withdrawals is crucial for maintaining trust. Additionally, the quality of customer support has been criticized, with reports of delayed responses and inadequate assistance. These issues can lead to frustration and a lack of confidence in the broker's operations.

Platform and Trade Execution

MarquisFX utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. However, the performance of the platform, including order execution quality, slippage rates, and rejection of orders, is an area that demands scrutiny. Reports of slippage and execution delays can significantly impact trading outcomes, especially for high-frequency traders.

Traders have noted instances of slippage during volatile market conditions, which raises concerns about the broker's liquidity and execution practices. If order execution is not reliable, it can lead to unexpected losses and diminish overall trading performance.

Risk Assessment

Engaging with MarquisFX presents several risks that traders should consider before proceeding. The combination of unregulated status, lack of transparency, and mixed customer feedback contributes to an overall risk rating that leans towards the high end.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker in Vanuatu |

| Fund Safety Risk | High | Lack of segregated accounts and investor protection |

| Customer Service Risk | Medium | Reports of slow response and withdrawal issues |

| Execution Risk | Medium | Potential slippage and order rejections |

To mitigate these risks, traders are advised to conduct thorough due diligence, including testing the platform with a small deposit and reviewing the terms and conditions carefully.

Conclusion and Recommendations

Based on the evidence presented, it is clear that traders should approach MarquisFX with caution. The lack of regulation, transparency issues, and mixed customer feedback suggest that MarquisFX is not entirely safe for trading. While it may offer appealing trading conditions, the potential risks outweigh the benefits.

For traders seeking a safer trading environment, it is advisable to consider regulated brokers with a proven track record of reliability and customer service. Alternatives such as brokers regulated by the FCA or ASIC may offer better protection and oversight. Ultimately, conducting comprehensive research and considering personal risk tolerance will be key in making informed trading decisions.

Is MarquisFX a scam, or is it legit?

The latest exposure and evaluation content of MarquisFX brokers.

MarquisFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MarquisFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.