Regarding the legitimacy of Richains forex brokers, it provides VFSC and WikiBit, .

Is Richains safe?

Business

License

Is Richains markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Richains Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Richains Safe or a Scam?

Introduction

Richains is a forex broker established in 2017, specializing in providing trading services in the foreign exchange market. Based in Vanuatu, Richains has positioned itself as a regional player in the highly competitive forex trading landscape. However, with the prevalence of scams and fraudulent activities in the online trading sector, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy and safety of brokers like Richains. This article aims to investigate whether Richains is a safe trading platform or if it exhibits characteristics of a scam. Our assessment is based on a comprehensive review of regulatory information, company background, trading conditions, customer experiences, and security measures.

Regulation and Legitimacy

The regulatory status of a broker is a key indicator of its legitimacy and trustworthiness. Richains claims to be regulated by the Vanuatu Financial Services Commission (VFSC), but recent reports indicate that its license has been revoked. This raises significant concerns about the broker's compliance with financial regulations and the level of investor protection it offers. Below is a summary of Richains' regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 40128 | Vanuatu | Revoked |

The importance of regulation cannot be overstated. A well-regulated broker is subject to strict oversight, ensuring that it adheres to high standards of financial conduct. The revocation of Richains' license suggests a lack of compliance with these standards, which could expose traders to higher risks. Furthermore, the absence of negative regulatory disclosures during the evaluation period does not mitigate the concerns raised by the revoked license. Therefore, when assessing whether Richains is safe, the lack of active regulation is a significant red flag.

Company Background Investigation

Richains was founded in 2017 and has since aimed to provide forex trading services to a diverse clientele. However, the company's background raises questions about its stability and transparency. The ownership structure is not entirely clear, and there is limited information available regarding the management team and their professional qualifications. This lack of transparency can be alarming for potential investors, as it makes it difficult to ascertain the credibility of the individuals behind the broker.

Moreover, the companys operational history is relatively short, which may not provide enough evidence of its ability to navigate financial crises effectively. A longer operational history often indicates resilience and reliability in the face of market challenges. Therefore, when considering whether Richains is safe, the company's limited history and unclear ownership structure may suggest potential vulnerabilities.

Trading Conditions Analysis

An essential aspect of evaluating any forex broker is understanding the trading conditions it offers. Richains utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and extensive features. However, the broker's overall fee structure and trading costs warrant closer inspection.

| Cost Type | Richains | Industry Average |

|---|---|---|

| Major Currency Pair Spread | ||

| Commission Structure | ||

| Overnight Interest Range |

The absence of detailed information regarding spreads, commissions, and overnight interest rates on Richains' website makes it challenging to assess the competitiveness of its trading costs. Furthermore, any unusual or hidden fees could significantly impact a trader's profitability. The lack of clarity surrounding these costs raises concerns about transparency, which is a critical factor when determining whether Richains is safe.

Customer Funds Security

The security of customer funds is paramount in the forex trading industry. Richains claims to implement various measures to protect client funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures remains uncertain, particularly in light of its revoked regulatory status.

Traders should be aware of the importance of segregated accounts, which ensure that client funds are kept separate from the broker's operational funds. This practice protects investors in the event of a broker's insolvency. Additionally, negative balance protection policies are crucial in preventing traders from losing more than their initial investment. Unfortunately, there have been no detailed disclosures regarding Richains' adherence to these security measures, making it difficult to ascertain whether Richains is safe for trading.

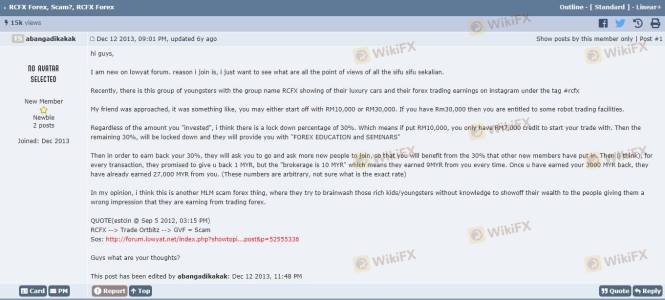

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing a broker's reliability. Richains has received a limited number of complaints, with one significant case involving investors claiming they were defrauded of RM 703,000 after investing in a forex trading company. This raises questions about the broker's responsiveness to customer grievances and the overall quality of its customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Fraud Allegations | High | Unclear |

The severity of complaints regarding fraud is particularly concerning, as it suggests a potential pattern of unethical behavior. The company's response to such allegations will be crucial in determining its commitment to resolving issues and maintaining client trust. Therefore, when evaluating Richains' safety, the nature and severity of complaints should not be overlooked.

Platform and Trade Execution

The performance of a trading platform is critical for a seamless trading experience. Richains employs the MT4 platform, which is generally well-regarded for its stability and execution speed. However, reports of slippage and order rejections can significantly impact traders' experiences and profitability.

While Richains does not appear to have widespread complaints regarding platform manipulation, the lack of transparency about its execution practices raises concerns. Traders must be vigilant about potential issues that could arise from poor execution quality. Thus, the overall reliability of Richains' platform remains a crucial factor in assessing whether Richains is safe.

Risk Assessment

When considering whether to trade with Richains, it's essential to evaluate the overall risk profile associated with the broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Revoked license raises compliance concerns. |

| Financial Stability | Medium | Limited operational history may indicate vulnerabilities. |

| Customer Trust | High | Complaints regarding fraud could undermine credibility. |

Given these assessments, it is evident that potential traders face significant risks when considering Richains as their forex broker. It is advisable to implement risk mitigation strategies, such as starting with smaller investments and closely monitoring trading activities.

Conclusion and Recommendations

In conclusion, the investigation into Richains raises several red flags regarding its safety and legitimacy as a forex broker. The revoked regulatory license, unclear company background, and concerning customer complaints suggest that traders should exercise extreme caution. While Richains may offer a functional trading platform, the potential risks associated with trading with this broker cannot be ignored.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that have established regulatory frameworks, transparent fee structures, and positive customer feedback. Some reputable alternatives include brokers like IG Group, OANDA, or Forex.com, which have demonstrated a commitment to regulatory compliance and customer satisfaction. Ultimately, the decision to trade with Richains should be made with careful consideration of the associated risks, as it remains unclear whether Richains is safe for trading.

Is Richains a scam, or is it legit?

The latest exposure and evaluation content of Richains brokers.

Richains Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Richains latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.