FM Global 2025 Review: Everything You Need to Know

Executive Summary

FM Global stands as one of the most established entities in the financial services sector. The company has nearly two centuries of operational experience behind it. This fm global review reveals a company that has built its reputation on exceptional financial strength and maintains significant recognition within the industry. According to available assessments, FM Global demonstrates robust financial stability with an A+ rating from AM Best, alongside positive evaluations from Fitch and S&P Global Ratings.

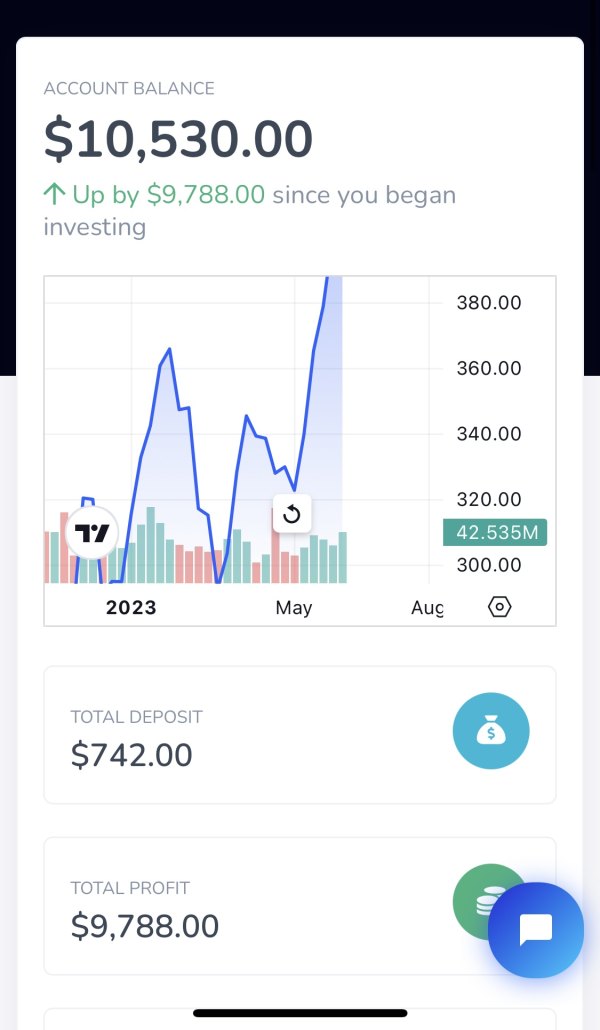

The company primarily serves large enterprises and sophisticated traders interested in forex, commodities, and contracts for difference. FM Global's platform offerings include the widely-used MT4 trading platform, enabling users to access multiple financial instruments across various asset classes. Employee satisfaction metrics indicate that 82% of staff provide positive evaluations. This reflects strong internal culture and operational management.

FM Global's positioning in the highly protected risk property insurance market demonstrates its specialized focus. The company serves institutional clients with complex risk management needs. The company operates as a mutual insurance company headquartered in Johnston, Rhode Island, with a particular emphasis on business continuity solutions and commercial property insurance for large-scale enterprises.

Important Notice

FM Global operates across multiple jurisdictions globally. The company has a documented presence spanning over 50 years in the Asia-Pacific region. Potential clients should be aware that services, regulatory oversight, and operational frameworks may vary significantly between different geographical regions. The regulatory landscape for FM Global's trading services requires careful examination, as specific regulatory information was not detailed in available materials.

This review is compiled based on publicly available information, user feedback, and company background data. Traders and investors should conduct independent verification of all services, terms, and regulatory status before engaging with any financial service provider. The assessment methodology incorporates user reviews, company financial metrics, and market positioning analysis to provide a comprehensive evaluation framework.

Rating Framework

Broker Overview

FM Global represents a unique entity in the financial services landscape. The company has been established nearly two centuries ago with a focus on serving large enterprise clients. The company operates as a mutual insurance company based in Johnston, Rhode Island, specializing in commercial property insurance and business continuity solutions. This extensive operational history demonstrates significant market experience and institutional knowledge that extends well beyond typical forex brokerage services.

The company's business model centers on highly protected risk property insurance markets. FM Global maintains a significant market position in this area. The company's approach to risk management and financial services reflects its deep understanding of enterprise-level financial needs and sophisticated risk assessment methodologies. The company's mutual structure provides a unique operational framework that differs from traditional publicly-traded financial service providers.

In terms of trading services, FM Global offers access to the MetaTrader 4 platform. This enables clients to trade across multiple asset categories including foreign exchange, indices, commodities, and contracts for difference. The platform integration allows users to access diverse financial markets through a single interface. However, specific regulatory oversight details for trading services were not comprehensively detailed in available materials, requiring potential clients to conduct independent verification of regulatory status in their respective jurisdictions.

This fm global review highlights the company's positioning as a specialized service provider rather than a traditional retail forex broker. The company shows particular strength in serving institutional and enterprise-level clients with complex financial service requirements.

Regulatory Oversight: Specific regulatory information for FM Global's trading services was not detailed in available materials. Potential clients need independent verification.

Deposit and Withdrawal Methods: Available materials did not specify the range of deposit and withdrawal options offered by FM Global for trading accounts.

Minimum Deposit Requirements: Specific minimum deposit amounts were not disclosed in the source materials reviewed.

Promotional Offers: Information regarding bonuses, promotional campaigns, or special offers was not included in available documentation.

Tradeable Assets: FM Global provides access to foreign exchange markets, stock indices, commodities, and contracts for difference through their trading platform infrastructure.

Cost Structure: Detailed information about spreads, commissions, and fee structures was not comprehensively covered in available materials.

Leverage Options: Specific leverage ratios and margin requirements were not detailed in the source documentation.

Platform Selection: The company offers MetaTrader 4 as their primary trading platform solution.

Geographic Restrictions: Specific regional limitations or service availability restrictions were not detailed in available materials.

Customer Support Languages: Information about supported languages for customer service was not specified in source documentation.

This fm global review section highlights the need for potential clients to conduct direct inquiries with the company. Clients need comprehensive details about trading conditions and service specifications.

Account Conditions Analysis

The available materials provide limited insight into FM Global's specific account structures and conditions. Unlike traditional retail forex brokers that typically offer multiple account tiers with varying features and minimum deposits, FM Global's account information was not comprehensively detailed in accessible documentation. This lack of specific account information suggests that the company may operate with a more personalized approach to account setup, potentially tailored to individual client requirements rather than standardized retail offerings.

The absence of detailed account opening procedures in available materials indicates that prospective clients may need to engage directly with FM Global representatives. This helps them understand available account options. This approach aligns with the company's focus on serving large enterprise clients who typically require customized solutions rather than standardized retail products. The account setup process likely involves more comprehensive due diligence and documentation requirements compared to typical retail forex brokers.

Special account features such as Islamic-compliant trading accounts were not mentioned in available materials. Similarly, information about account protection measures, segregated client funds, or insurance coverage for trading accounts was not detailed. The company's strong financial ratings suggest robust operational frameworks, but specific client protection mechanisms for trading accounts require direct verification.

This fm global review emphasizes the importance of direct communication with the company to understand available account options. The standardized account information typically found with retail brokers was not readily available in public materials.

FM Global's trading infrastructure centers around the MetaTrader 4 platform. This provides access to multiple financial instruments including forex, indices, commodities, and contracts for difference. The MT4 platform offers comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. This platform choice demonstrates alignment with industry standards and provides users with familiar trading environments.

The range of tradeable instruments available through FM Global's platform enables portfolio diversification across different asset classes. Forex trading capabilities allow access to major, minor, and exotic currency pairs, while commodities trading provides exposure to precious metals, energy products, and agricultural products. Index trading offers opportunities to trade major global stock indices, and contract for difference availability extends trading possibilities to individual stocks and other financial instruments.

However, specific information about proprietary research resources, market analysis tools, or educational materials was not detailed in available documentation. Many established brokers provide comprehensive research departments, daily market commentary, economic calendars, and educational resources to support trader development. The absence of detailed information about these supplementary resources in available materials suggests that potential clients should inquire directly about available research and educational support.

Automated trading support through the MT4 platform enables algorithmic trading strategies and expert advisor implementation. The platform's programming language, MQL4, allows for custom indicator development and automated trading system creation, providing flexibility for sophisticated trading approaches.

Customer Service and Support Analysis

Customer service information for FM Global was not comprehensively detailed in available materials. This makes it challenging to assess the quality and availability of support services. Traditional forex brokers typically provide multiple communication channels including live chat, telephone support, email assistance, and sometimes video calling capabilities. The absence of specific customer service details in available documentation requires potential clients to investigate support options directly.

Response time expectations, which are crucial for active traders who may need immediate assistance with trading issues or technical problems, were not specified in source materials. Many established brokers provide 24/5 support during market hours, with some offering 24/7 assistance. The lack of specific support hour information suggests that service availability may vary or require direct verification.

Multilingual support capabilities were not detailed in available materials. For international clients, language support can be a significant factor in choosing a broker, particularly for complex technical issues or account-related inquiries. The company's global presence suggests potential multilingual capabilities, but specific language offerings require direct confirmation.

The quality of customer service often reflects in user reviews and testimonials. While overall user satisfaction appears positive based on available feedback, specific experiences with customer support resolution were not detailed in accessible materials. Problem resolution efficiency and staff expertise levels represent important factors for trader satisfaction but require direct investigation through client testimonials or trial interactions.

Trading Experience Analysis

The trading experience analysis for FM Global faces limitations due to insufficient specific data about platform performance metrics in available materials. Platform stability and execution speed represent critical factors for active traders, particularly those engaging in scalping strategies or trading during high-volatility market conditions. The MT4 platform generally provides reliable performance, but specific performance metrics for FM Global's implementation were not detailed.

Order execution quality, including fill rates, slippage statistics, and rejection rates, represents crucial information for evaluating trading conditions. Professional traders typically require transparent execution statistics to assess whether a broker's execution environment suits their trading strategies. The absence of specific execution data in available materials necessitates direct inquiry or demo account testing to evaluate execution quality.

Platform functionality completeness through the MT4 offering provides standard features expected by most traders. These include advanced charting, technical indicators, and automated trading capabilities. However, additional platform features such as advanced order types, one-click trading, or proprietary tools were not specifically detailed in available documentation.

Mobile trading experience information was not provided in source materials. Mobile trading represents an increasingly important aspect of modern trading infrastructure. Many traders require reliable mobile platforms for position monitoring and trade management while away from desktop environments.

This fm global review section highlights the need for potential clients to conduct thorough testing of trading conditions. Demo accounts or direct platform evaluation should be completed before committing to live trading environments.

Trust and Security Analysis

FM Global demonstrates exceptional financial strength credentials with an A+ rating from AM Best. The company also has positive evaluations from Fitch and S&P Global Ratings. These ratings indicate robust financial stability and operational reliability, which are fundamental requirements for any financial service provider. The company's nearly two-century operational history provides additional confidence in its long-term stability and institutional knowledge.

The company's mutual insurance structure provides a unique operational framework that differs from traditional publicly-traded brokers. Mutual companies operate for the benefit of their policyholders and members rather than external shareholders, potentially creating better alignment between company interests and client outcomes. This structure has historically provided stability during market stress periods.

However, specific regulatory oversight information for FM Global's trading services was not comprehensively detailed in available materials. Regulatory compliance represents a crucial factor in broker evaluation, as proper oversight provides client protection, dispute resolution mechanisms, and operational standards enforcement. Potential clients should independently verify regulatory status and oversight in their respective jurisdictions.

Client fund protection measures, such as segregated account requirements or insurance coverage for client deposits, were not specifically detailed in available documentation. These protections represent standard industry practices for reputable brokers and require direct verification. The company's strong financial ratings suggest robust operational frameworks, but specific client protection mechanisms need independent confirmation.

Industry reputation appears positive based on available ratings and assessments. Specific industry awards or recognition were not detailed in source materials. The absence of reported negative events or regulatory actions in available materials suggests clean operational history, though comprehensive due diligence requires broader research.

User Experience Analysis

User satisfaction metrics indicate generally positive experiences with FM Global. Available feedback suggests satisfactory service levels. Employee satisfaction ratings of 82% positive evaluations reflect strong internal culture and operational management, which often correlates with better client service delivery. Companies with satisfied employees typically provide more consistent and professional client experiences.

The available user feedback includes both positive testimonials and constructive suggestions for improvement. This balanced feedback pattern suggests authentic user experiences rather than curated reviews. However, specific details about user interface design, platform navigation, or ease of use were not comprehensively covered in available materials.

Registration and account verification processes were not detailed in source materials. This makes it difficult to assess the convenience and efficiency of onboarding procedures. Modern brokers typically provide streamlined digital onboarding with document upload capabilities and automated verification systems. The lack of specific information about these processes suggests potential clients should inquire directly about account opening requirements and timelines.

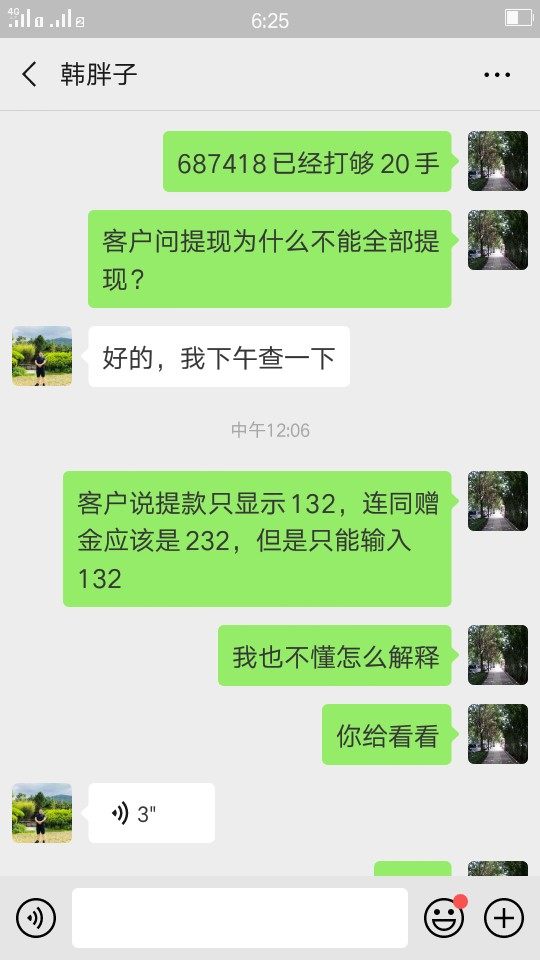

Fund management experiences, including deposit and withdrawal processing times, payment method availability, and transaction fees, were not detailed in available documentation. These operational aspects significantly impact user satisfaction and require direct verification. Efficient fund management processes represent essential features for active traders who need reliable access to their capital.

Common user concerns or frequently reported issues were not specifically identified in available materials. Understanding typical user challenges helps potential clients set appropriate expectations and evaluate whether a broker's service profile matches their requirements and preferences.

Conclusion

This fm global review reveals a financially robust company with nearly two centuries of operational experience and strong industry recognition. FM Global demonstrates exceptional financial strength credentials through its A+ rating from AM Best and positive evaluations from major rating agencies. The company's mutual insurance structure and focus on large enterprise clients distinguishes it from typical retail forex brokers.

The company appears well-suited for institutional clients and sophisticated traders who require access to multiple asset classes through the MT4 platform. The availability of forex, indices, commodities, and contract for difference trading provides portfolio diversification opportunities for qualified investors. However, the limited availability of detailed information about account conditions, regulatory oversight, and specific service features suggests that FM Global operates with a more personalized approach requiring direct client engagement.

Primary advantages include strong financial stability, positive user satisfaction indicators, and access to established trading platforms. The main limitations involve insufficient publicly available information about regulatory oversight, account conditions, and detailed service specifications. Potential clients should conduct comprehensive due diligence including direct communication with the company to verify regulatory status, account options, and service availability in their respective jurisdictions before making trading decisions.