IFF-TRADING Review 2

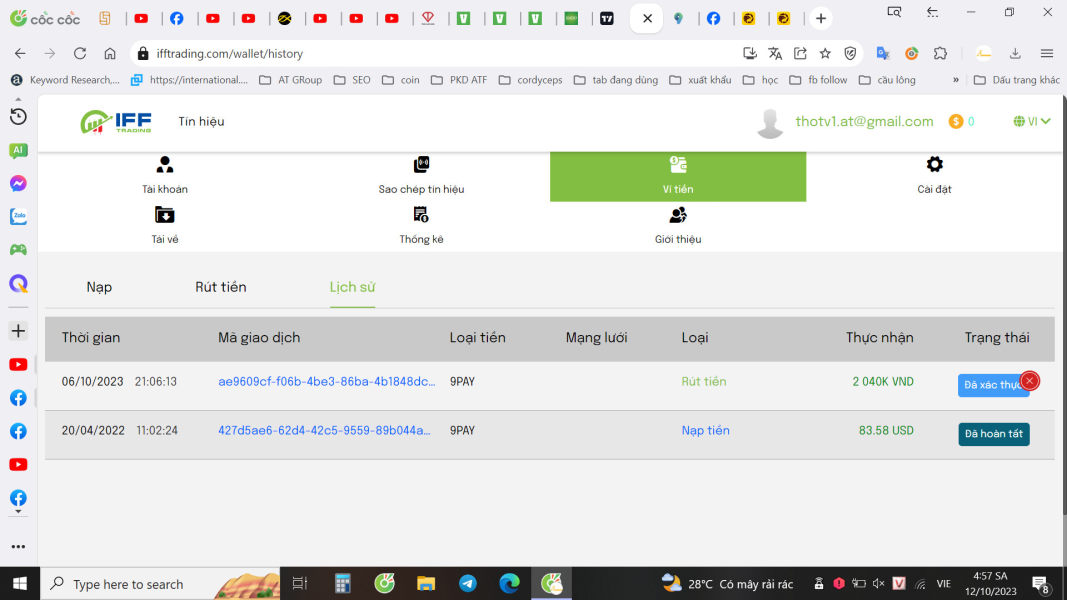

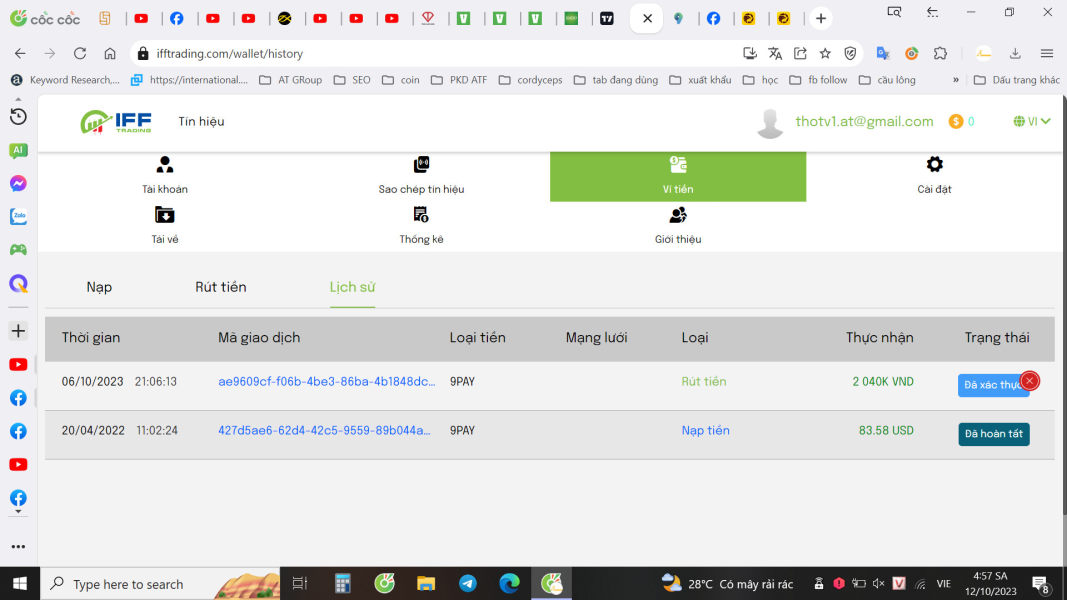

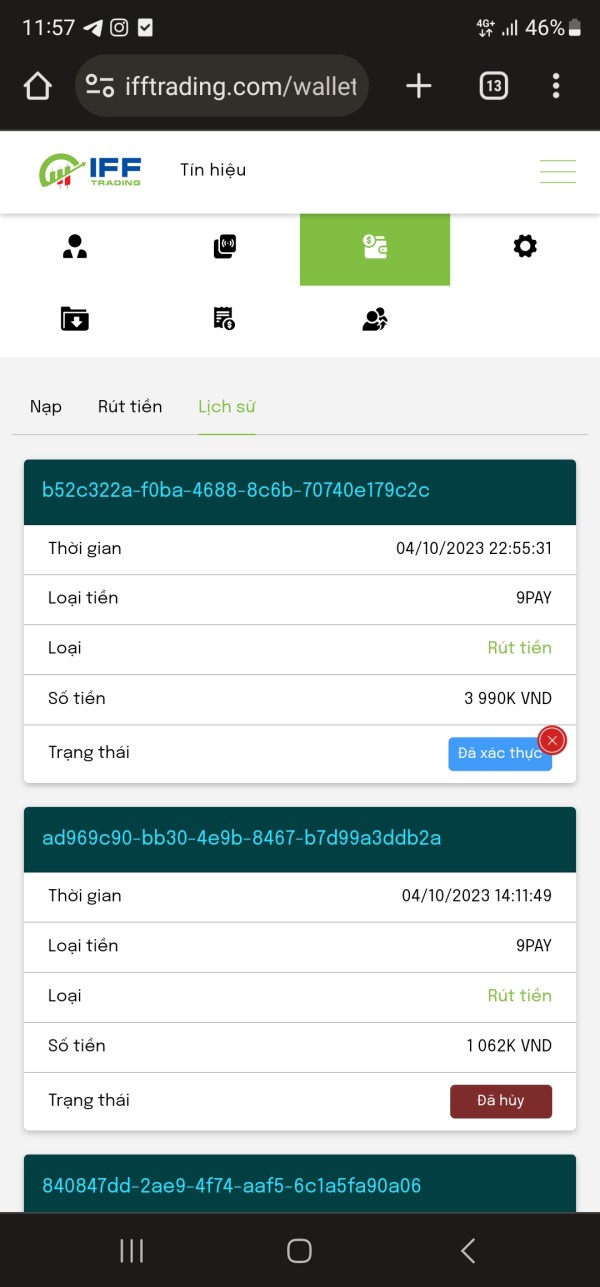

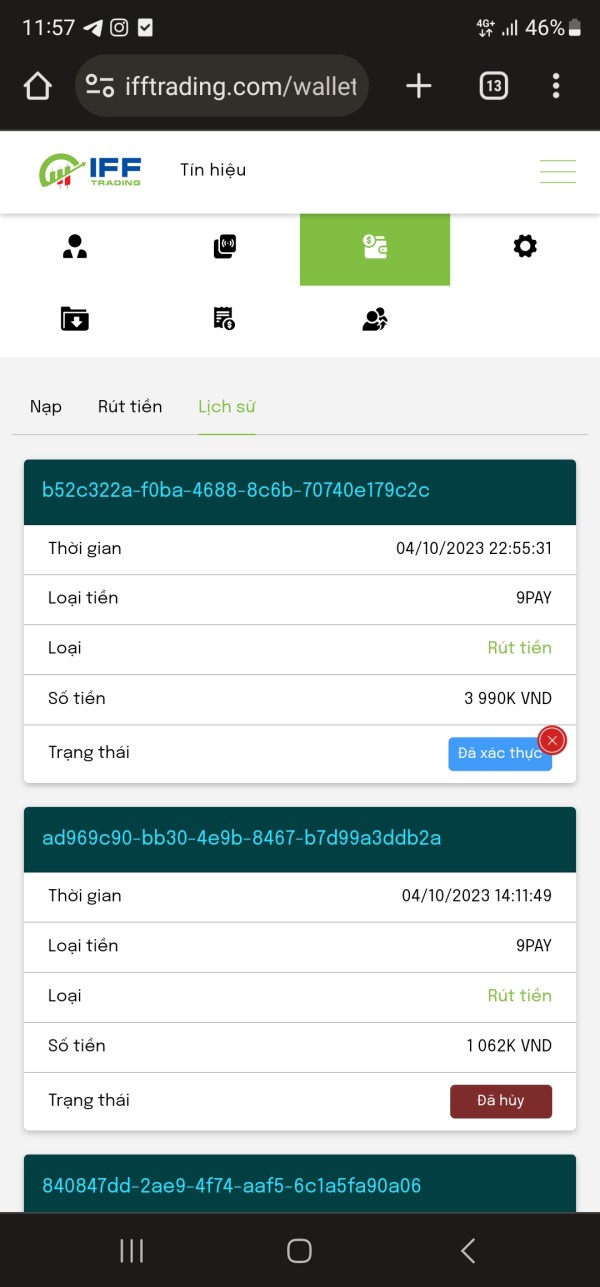

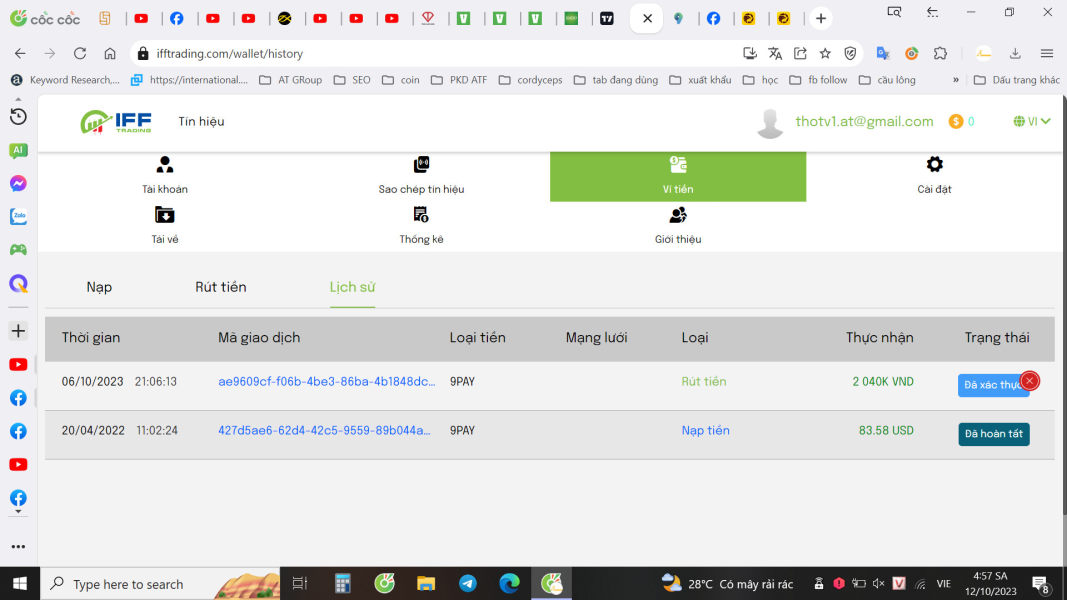

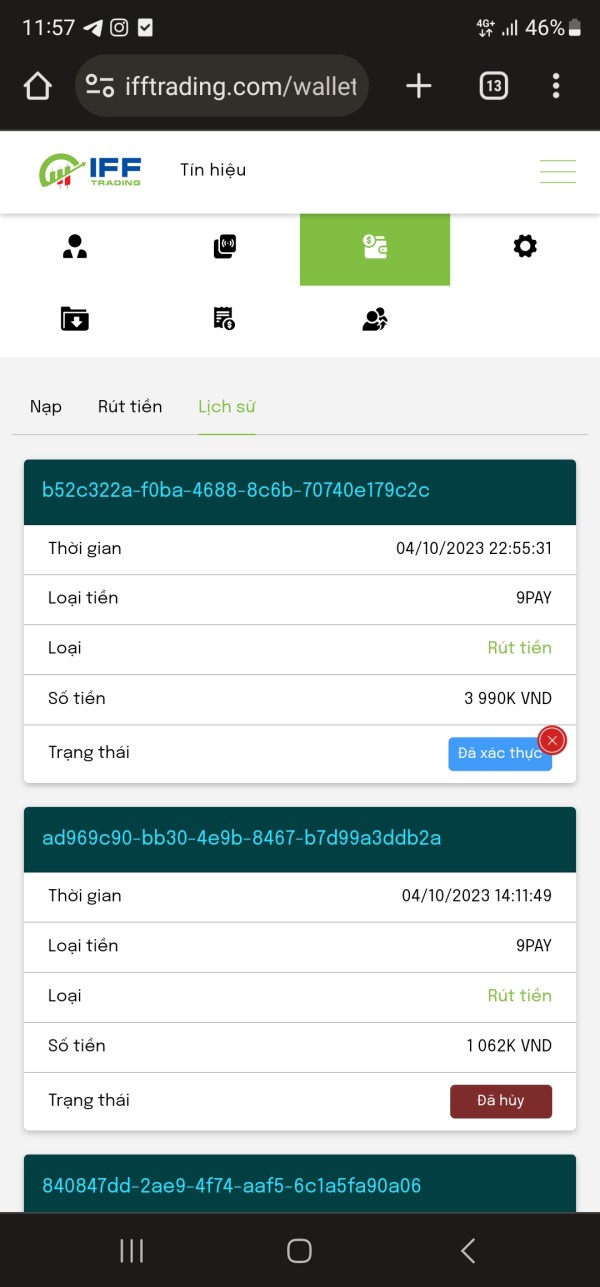

I made a withdrawal from October 6, 2023, the order was confirmed but I did not see the money in my bank account.

Verified, but cannot be extracted. Please check the help. Please.

IFF-TRADING Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Business

License

I made a withdrawal from October 6, 2023, the order was confirmed but I did not see the money in my bank account.

Verified, but cannot be extracted. Please check the help. Please.

This iff-trading review shows major concerns about the broker's legitimacy and regulatory compliance. IFF-TRADING operates as an offshore forex broker registered in Saint Vincent and the Grenadines, which means it lacks oversight from major financial regulators that protect traders. The platform offers popular trading software including MetaTrader 4, MetaTrader 5, and cTrader, but users must register before they can see platform previews. This requirement raises transparency concerns.

The broker mainly targets forex traders. Those with strict regulatory requirements should be extremely careful when considering this broker. User feedback consistently highlights worries about the company's lack of transparency and questionable legal status, which creates significant risks for potential clients.

Despite offering recognizable trading platforms, the absence of proper regulatory oversight and numerous red flags regarding legitimacy make this broker unsuitable for traders prioritizing safety. Based on available information and user experiences, IFF-TRADING presents more risks than benefits, with particular concerns around regulatory compliance, customer service transparency, and overall trustworthiness in the competitive forex market.

Regional Entity Differences: IFF-TRADING operates as an offshore company registered in Saint Vincent and the Grenadines. This jurisdiction is known for minimal financial regulation and oversight, which means it does not provide the same level of investor protection as major regulatory bodies like the FCA, CySEC, or ASIC.

Review Methodology: This evaluation is based on available user feedback and publicly accessible information. Due to the broker's limited transparency and offshore registration, some information may be incomplete or unverifiable, so traders should conduct additional due diligence before making any investment decisions.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 3/10 | Specific account conditions not disclosed in available information |

| Tools and Resources | 6/10 | Offers MT4, MT5, and cTrader platforms, but lacks comprehensive tool information |

| Customer Service | 4/10 | User concerns about transparency and response times |

| Trading Experience | 5/10 | Mixed feedback on platform functionality versus legitimacy concerns |

| Trust and Safety | 2/10 | Lack of regulation and concentrated negative reviews on legitimacy |

| User Experience | 4/10 | Registration process transparency issues and mixed user feedback |

IFF-TRADING presents itself as a forex trading platform registered in Saint Vincent and the Grenadines. The company operates as an offshore broker without major financial regulatory oversight, which immediately raises concerns for potential clients. The company's establishment date and detailed corporate background remain unclear from available sources.

The broker appears to focus exclusively on forex trading services. This approach positions the company in the competitive online trading market without the regulatory backing that many traders consider essential for safety and protection. The business model centers around providing access to popular third-party trading platforms rather than developing proprietary software.

This approach allows the broker to offer familiar trading environments that experienced forex traders recognize. The platform selection particularly emphasizes the MetaTrader suite and cTrader platform, which are industry standards. However, the lack of regulatory supervision means that standard investor protections and operational oversight that traders expect from regulated brokers are absent.

This iff-trading review finds that while the platform selection appears adequate, the fundamental issues surrounding regulatory compliance and corporate transparency overshadow any potential benefits. The offshore registration strategy, while legal, places the broker outside the protective framework that major financial regulators provide.

Regulatory Status: IFF-TRADING operates without major financial regulation. The company is registered in Saint Vincent and the Grenadines, an offshore jurisdiction known for minimal oversight and limited investor protection mechanisms.

Deposit and Withdrawal Methods: Specific information about funding methods and withdrawal processes not detailed in available sources.

Minimum Deposit Requirements: Exact minimum deposit amounts not specified in accessible information.

Bonus and Promotions: No promotional offers or bonus structures mentioned in available documentation.

Trading Assets: Primarily focused on forex trading. No detailed information about CFDs, commodities, or other asset classes appears in available sources.

Cost Structure: Specific details about spreads, commissions, overnight fees, and other trading costs not disclosed in accessible information. This lack of transparency raises concerns about pricing clarity for potential clients.

Leverage Ratios: Maximum leverage offerings not specified in available documentation.

Platform Options: Provides access to MetaTrader 4, MetaTrader 5, and cTrader platforms. Users must register to preview platform features, which limits transparency for potential clients.

Geographic Restrictions: Specific country limitations not detailed in available sources.

Customer Support Languages: Supported languages for customer service not specified in accessible information.

This iff-trading review highlights the concerning lack of transparent information about essential trading conditions and operational details.

The account conditions offered by IFF-TRADING remain largely undisclosed. This lack of transparency immediately impacts the broker's credibility and makes it difficult for potential clients to make informed decisions. Available sources do not provide information about different account types, their respective features, or the specific benefits each tier might offer.

The minimum deposit requirements are not specified in accessible information. This prevents traders from understanding the financial commitment required to begin trading with the broker. Additionally, the account opening process has received criticism from users who express concerns about the registration procedure's transparency and the requirement to register before accessing basic platform information.

Without clear information about account features, trading conditions, or special functionalities, potential clients cannot adequately compare IFF-TRADING's offerings with other brokers. This iff-trading review finds that the lack of transparent account condition disclosure significantly undermines the broker's appeal to serious forex traders who require detailed information before committing funds.

IFF-TRADING's tool and resource offering centers around providing access to three well-established trading platforms. These platforms include MetaTrader 4, MetaTrader 5, and cTrader, which are industry standards that offer comprehensive charting tools, technical analysis capabilities, and automated trading support. The availability of these platforms represents the broker's strongest asset, as they provide familiar and powerful trading environments that experienced traders recognize.

However, the broker's approach to platform access raises concerns. Users must complete registration before previewing platform features or capabilities, which limits transparency and prevents potential clients from evaluating the trading environment before committing to the registration process. Additionally, available sources do not mention supplementary research tools, market analysis resources, or educational materials that many traders consider essential for successful trading.

The absence of information about proprietary tools, market research, economic calendars, or trading signals suggests that IFF-TRADING relies entirely on third-party platform capabilities. The broker does not appear to add value through additional resources beyond the basic platform access. While the platform selection receives positive user feedback for functionality, the overall tool and resource package appears limited compared to more comprehensive broker offerings in the competitive forex market.

Customer service represents a significant weakness in IFF-TRADING's offering. User feedback consistently highlights concerns about transparency and responsiveness, which are essential elements of quality customer support. Available information does not specify the customer support channels available, whether the broker offers live chat, email support, or telephone assistance.

This lack of clarity about support accessibility immediately raises questions about the broker's commitment to client service. User evaluations express particular concern about response times and the quality of problem resolution when issues arise, which suggests systemic problems with the support infrastructure. The feedback suggests that customers experience difficulties obtaining clear answers about trading conditions, account features, and operational procedures.

The absence of information about multilingual support capabilities means that international clients cannot determine whether they will receive assistance in their preferred language. Additionally, support operating hours are not specified, leaving traders uncertain about when they can expect assistance during critical trading situations. These service limitations, combined with negative user feedback about transparency and responsiveness, significantly impact the broker's overall customer service rating and user satisfaction.

The trading experience with IFF-TRADING presents a mixed picture that reflects the broader concerns about the broker's operations. Users report satisfaction with the stability and performance of the MetaTrader and cTrader platforms, which provide reliable execution environments and comprehensive trading tools that professional traders expect. These platforms offer advanced charting capabilities, multiple order types, and professional-grade analysis tools.

However, the trading experience is significantly impacted by concerns about spread stability and overall execution quality. Available information does not provide specific data about average spreads, slippage rates, or requote frequencies, making it difficult to assess the true cost and quality of trade execution for potential clients. This lack of transparency about execution statistics raises questions about the broker's commitment to providing competitive trading conditions.

The requirement to register before accessing platform demonstrations limits traders' ability to evaluate the trading environment before committing to the broker. Additionally, mobile trading capabilities and platform customization options are not detailed in available sources, which limits traders' understanding of the full trading experience. This iff-trading review finds that while the platform infrastructure may be adequate, the overall trading experience is undermined by transparency issues and legitimacy concerns that affect trader confidence.

Trust and safety represent IFF-TRADING's most significant weaknesses. The broker faces fundamental concerns about regulatory compliance and operational legitimacy that create substantial risks for potential clients. The broker's registration in Saint Vincent and the Grenadines places it outside the oversight of major financial regulators, meaning that standard investor protections, segregated client funds, and compensation schemes are not available.

This regulatory gap leaves traders without recourse in case of disputes or operational failures. User feedback concentrates heavily on legitimacy and transparency concerns, with multiple reviews questioning the broker's legal status and operational practices, which creates an environment of uncertainty and risk. The lack of regulatory oversight means that essential safety measures such as segregated client accounts, regular audits, and operational compliance monitoring are not mandated or verified by independent authorities.

The broker's transparency issues extend beyond regulatory compliance to include unclear corporate information, undisclosed operational procedures, and limited disclosure about risk management practices. Available sources do not mention participation in investor compensation schemes, independent audits, or third-party verification of operational practices, which are standard safety measures in the regulated forex industry. These factors combine to create a trust environment that falls far short of industry standards and regulatory expectations.

User experience with IFF-TRADING reflects the broader concerns about transparency and legitimacy that characterize the broker's operations. While some users report positive experiences with platform functionality and trading execution, the overall feedback pattern reveals significant dissatisfaction with the registration process and information disclosure practices that affect the overall user journey. The requirement to register before accessing basic platform information creates unnecessary barriers and reduces transparency.

The user interface design and platform accessibility are not detailed in available sources. This makes it impossible to evaluate the broker's commitment to user-friendly design and intuitive navigation, which are essential elements of a positive user experience. Additionally, the verification process and account funding procedures lack clear documentation, creating uncertainty for potential clients about operational requirements and timelines.

Common user complaints focus on the lack of transparency about trading conditions, unclear communication from customer support, and concerns about the broker's legitimacy and regulatory status. The concentration of negative feedback around transparency and trust issues suggests that the broker has not successfully addressed fundamental user concerns about safety and operational clarity, which significantly impacts user satisfaction. Improvements in transparency, regulatory compliance, and communication clarity would be necessary to enhance the overall user experience significantly.

This comprehensive iff-trading review reveals a broker facing significant challenges related to regulatory compliance, transparency, and user trust. While IFF-TRADING offers access to popular trading platforms including MT4, MT5, and cTrader, these advantages are overshadowed by fundamental concerns about legitimacy and operational oversight that create substantial risks for potential clients. The broker's offshore registration and lack of major regulatory supervision make it unsuitable for traders who prioritize safety and regulatory protection.

The primary weaknesses include absent regulatory oversight, limited transparency about trading conditions and costs, poor customer service feedback, and concentrated negative reviews focusing on legitimacy concerns. These factors combine to create an environment where potential benefits are outweighed by significant risks and uncertainties that could impact trader safety and success. The lack of proper regulatory framework means that traders have limited recourse in case of disputes or operational issues.

IFF-TRADING is not recommended for traders seeking regulated, transparent, and trustworthy forex trading services. Serious traders should consider regulated alternatives that provide comprehensive investor protection and transparent operational practices, which are essential for safe and successful forex trading in today's competitive market.

FX Broker Capital Trading Markets Review