Ontega 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Ontega review reveals concerning findings about this offshore forex and CFD broker. Traders should carefully consider these issues before investing any money. Based on extensive analysis of user feedback and market data, Ontega receives an overall rating of 1 out of 5 stars. This rating reflects significant issues across multiple operational areas.

The broker offers four different account types. They also provide educational courses and materials for traders interested in forex and CFD markets. However, these limited positive features are overshadowed by overwhelmingly negative user experiences and questionable business practices. With only 15 user reviews available, the feedback paints a troubling picture of poor customer service, unreliable trading conditions, and concerns about the company's legitimacy.

Ontega primarily targets beginners and inexperienced traders interested in forex and CFD trading. However, the evidence suggests this demographic would be better served by more established and regulated alternatives. The lack of transparent regulatory information and consistently poor user satisfaction scores raise serious red flags about the broker's reliability and trustworthiness. These issues are particularly concerning in the competitive forex market.

Important Disclaimers

This Ontega review is based on available user feedback, market analysis, and publicly accessible information as of 2025. Traders should note that Ontega operates from offshore jurisdictions. Specific regulatory information has not been clearly disclosed in available materials. This lack of regulatory transparency presents potential legal and financial risks for clients.

Our evaluation methodology incorporates user reviews, industry feedback, and comparative analysis with established brokers. Given the limited available information and concerning user reports, potential clients should exercise extreme caution. They should conduct thorough due diligence before considering any engagement with this broker.

Rating Framework

Broker Overview

Ontega presents itself as a forex and CFD broker operating in offshore jurisdictions. However, specific establishment dates and comprehensive company background information remain unclear in available documentation. The company focuses on providing trading services for currency pairs and contracts for difference. They target retail traders seeking exposure to international financial markets.

The broker's business model centers around facilitating forex and CFD trading. However, detailed information about their operational structure, parent company relationships, and corporate governance remains limited. This lack of transparency regarding fundamental business details raises immediate concerns about the company's commitment to client protection and regulatory compliance.

According to available information, Ontega operates without clearly disclosed regulatory oversight from major financial authorities. The absence of specific regulatory information represents a significant risk factor for potential clients. Regulated brokers typically provide greater client protections, including segregated client funds and dispute resolution mechanisms. These protections appear to be absent in Ontega's operational framework.

Regulatory Status: Available information does not specify regulatory oversight from recognized financial authorities. This creates potential compliance and client protection concerns.

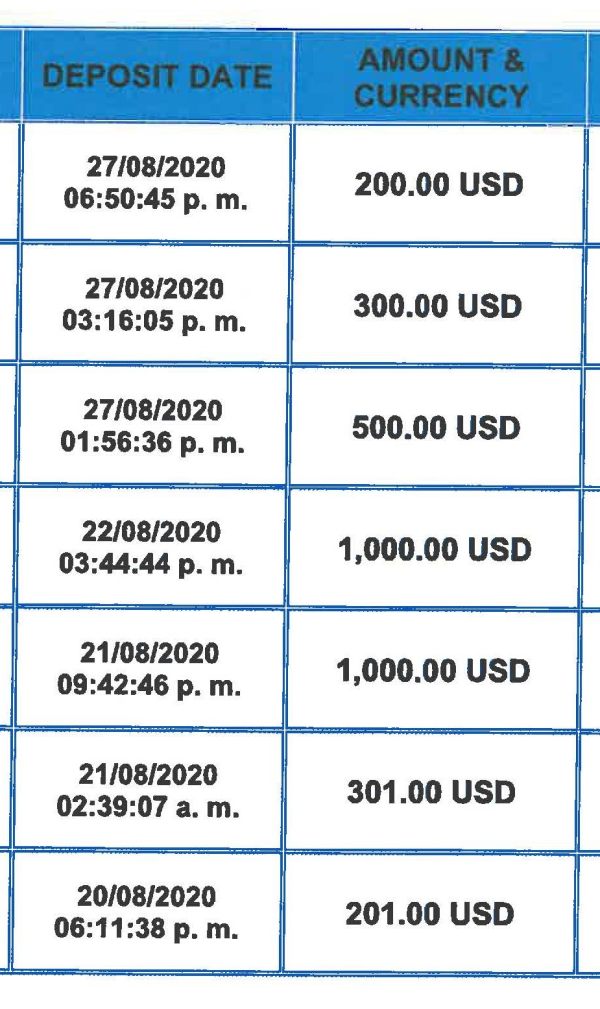

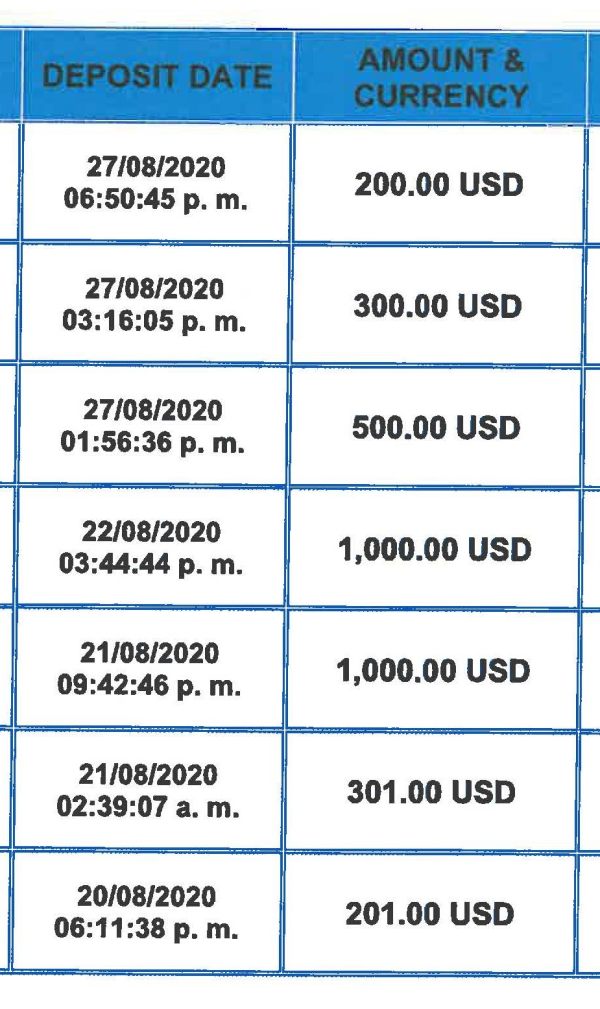

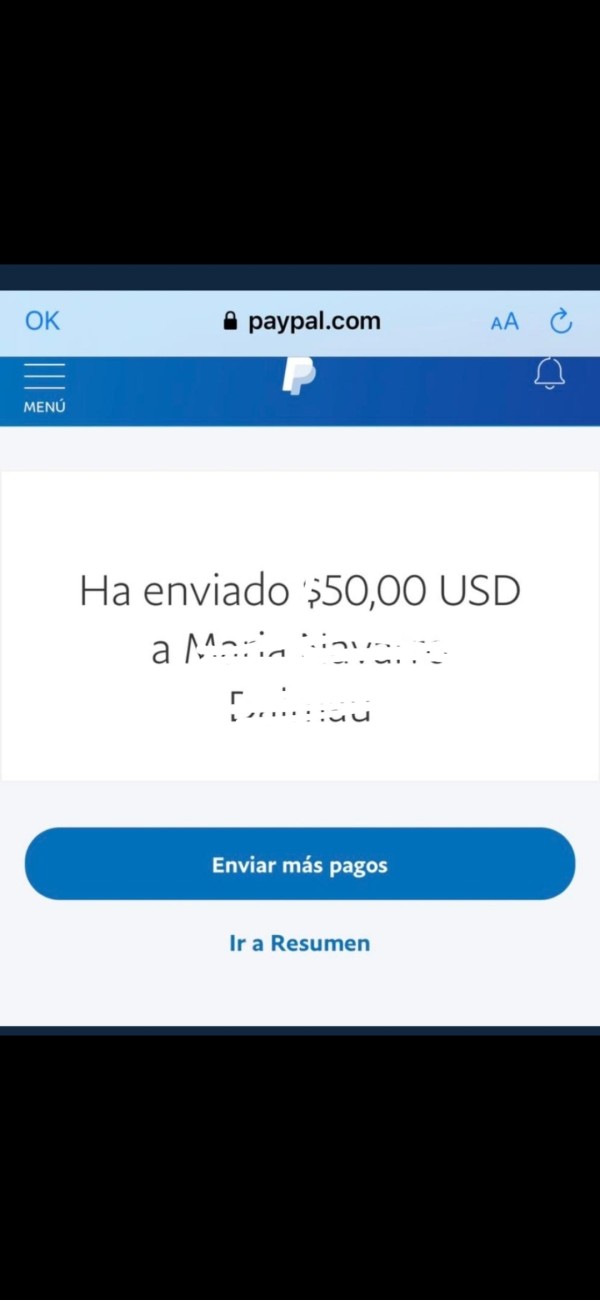

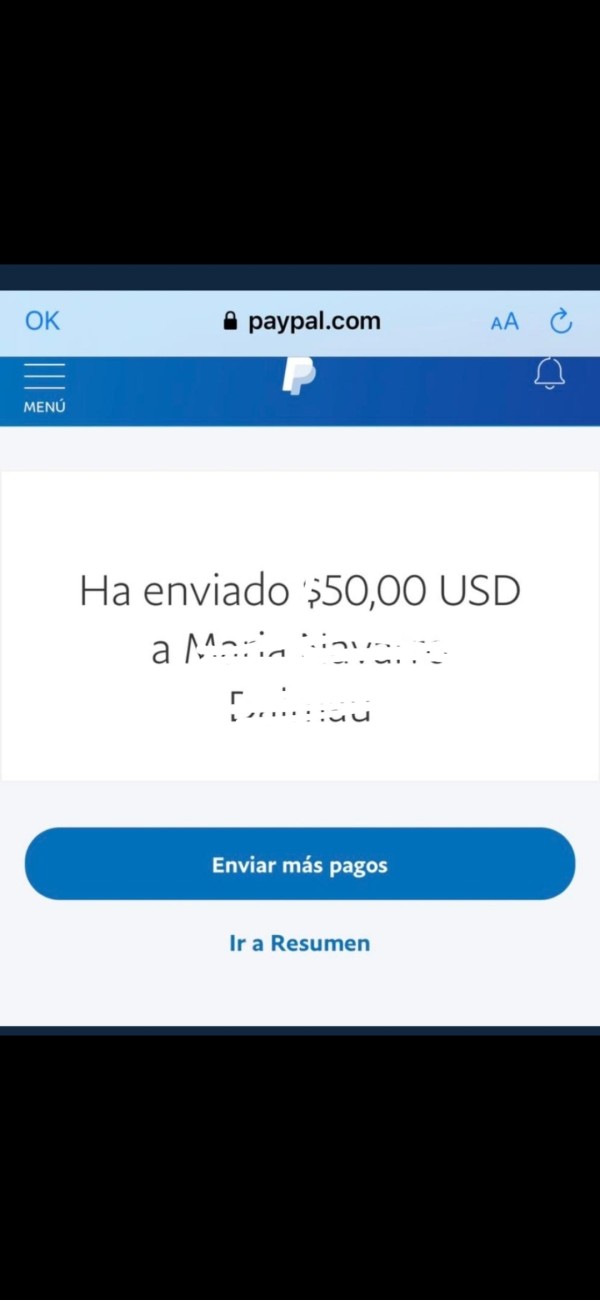

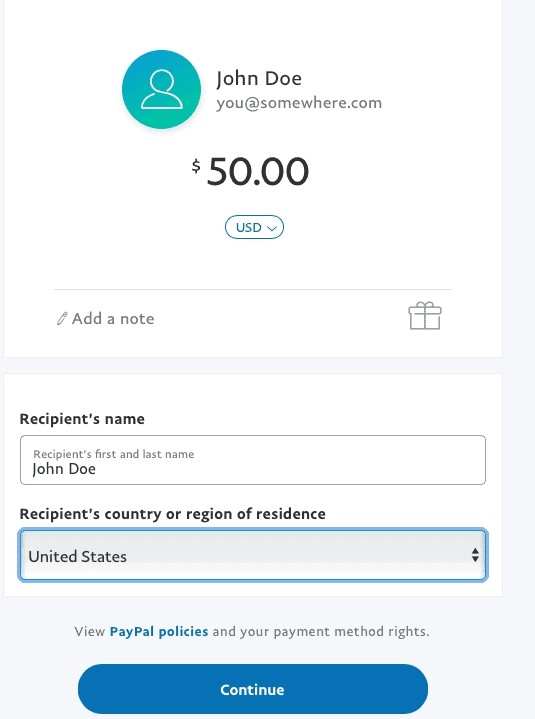

Deposit and Withdrawal Methods: Specific deposit and withdrawal options have not been detailed in available materials. Standard industry methods are presumably available.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types have not been specified. This information is not available in accessible documentation.

Promotional Offers: Current bonus and promotional structures have not been detailed in available information. The broker may offer introductory incentives.

Trading Assets: The platform focuses on forex currency pairs and CFD instruments. However, the complete range of available assets requires direct verification with the broker.

Cost Structure: Specific information about spreads, commissions, and additional fees has not been comprehensively detailed. Available materials require direct inquiry for accurate pricing information.

Leverage Options: Maximum leverage ratios available to clients have not been specified. This information is not available in accessible documentation.

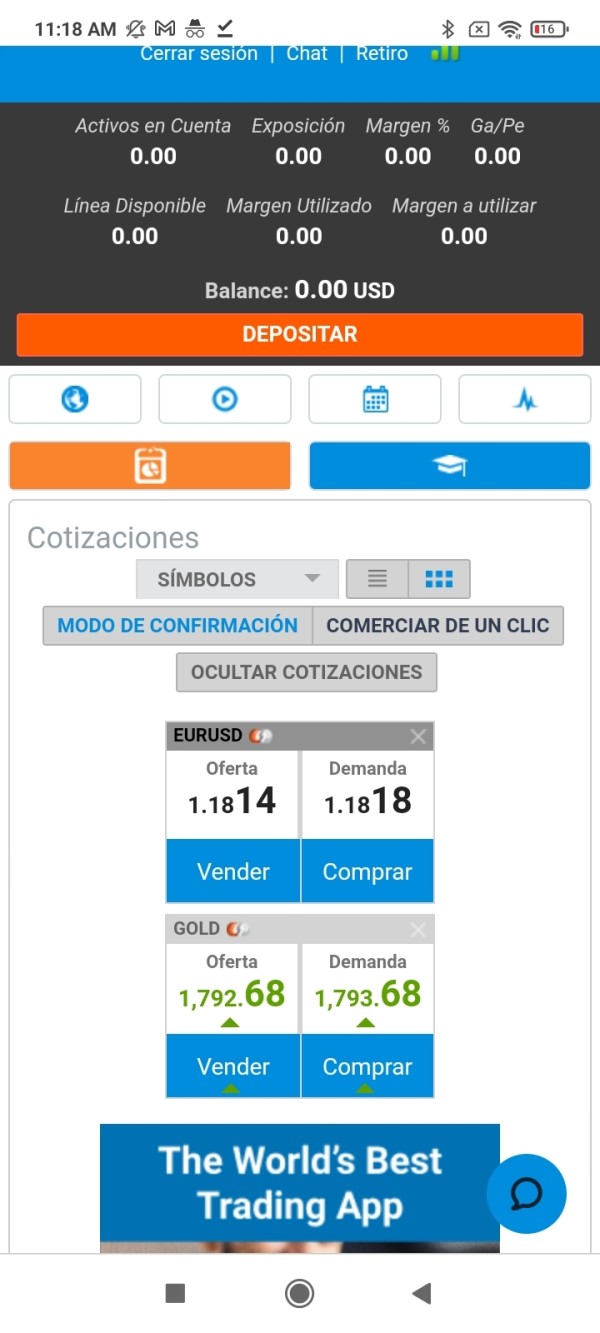

Platform Selection: Trading platform options and technological infrastructure details have not been comprehensively outlined. Available materials lack this important information.

Geographic Restrictions: Specific jurisdictional limitations and service availability have not been detailed. This information is not available in accessible materials.

Customer Support Languages: Available customer service language options have not been specified. Current documentation lacks this information.

This Ontega review highlights the concerning lack of transparency regarding fundamental operational details. Reputable brokers typically disclose this information prominently.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

Ontega's account structure offers four different account types. However, detailed specifications for each tier remain unclear in available documentation. The lack of transparency regarding minimum deposit requirements, account features, and tier-specific benefits creates significant uncertainty. Potential clients attempting to evaluate suitability for their trading needs face this challenge.

The account opening process details have not been comprehensively outlined. This makes it difficult for traders to understand verification requirements, documentation needs, and timeline expectations. This opacity contrasts sharply with industry-leading brokers who provide clear, step-by-step guidance. These brokers offer comprehensive support through their onboarding procedures.

User feedback regarding account conditions has been predominantly negative. Clients express frustration about unclear terms, unexpected limitations, and difficulties accessing promised features. The absence of detailed account specifications and transparent fee structures contributes to client dissatisfaction. This situation creates potential for misunderstandings about trading conditions.

Special account features have not been detailed in available materials. These include Islamic accounts, professional trader classifications, or institutional services. This Ontega review finds that the broker's account offerings lack the comprehensive structure and transparency expected from reputable forex brokers. This is particularly concerning in 2025.

Ontega provides educational courses and materials for traders. This represents one of the few positive aspects identified in this evaluation. The educational content appears designed to support beginners and traders seeking to develop their market knowledge. However, specific curriculum details and content quality assessments are not available in current documentation.

The broader tools and resources ecosystem appears limited compared to industry standards. Advanced trading tools, comprehensive market analysis resources, and sophisticated research capabilities have not been prominently featured in available materials. This suggests potential limitations for more experienced traders seeking robust analytical support.

User feedback regarding tools and resources has been mixed. Some users appreciate the educational materials but express general disappointment about the overall resource availability. The absence of detailed information about automated trading support, API access, and third-party integration capabilities suggests limited technological sophistication.

Research and analysis resources have not been comprehensively detailed. These include economic calendars, market commentary, and technical analysis tools. This creates uncertainty about the broker's commitment to providing comprehensive trading support beyond basic educational materials.

Customer Service Analysis (Score: 1/10)

Customer service represents Ontega's most significant weakness according to available user feedback. The overwhelming majority of client reviews highlight poor response times, inadequate problem resolution, and general dissatisfaction with support quality. These issues contribute to the broker's extremely low overall rating.

Specific customer service channels, availability hours, and response time commitments have not been clearly outlined. Available documentation lacks this information. This lack of transparency about support infrastructure raises concerns about the broker's commitment to client service and problem resolution capabilities.

User testimonials consistently report difficulties reaching qualified support representatives. They also report extended waiting periods for issue resolution and unsatisfactory responses to legitimate client concerns. These service failures create significant operational risks for active traders who require reliable support. They need help with technical issues, account problems, or trading disputes.

The absence of detailed information about multilingual support, escalation procedures, and specialized support for different client types suggests a limited customer service infrastructure. This infrastructure may struggle to meet diverse client needs effectively.

Trading Experience Analysis (Score: 2/10)

User feedback regarding trading experience reveals significant concerns about platform stability, execution quality, and overall trading conditions. Reports of slippage, requotes, and platform reliability issues create substantial concerns. These issues affect the broker's ability to provide consistent, professional trading services.

Platform stability and execution speed have been particular points of criticism. Users report technical difficulties that interfere with trading activities. These operational issues can result in financial losses and create frustrating experiences. Traders attempting to execute their strategies effectively face these challenges.

Order execution quality appears problematic based on user reports. Users express concerns about price manipulation, delayed executions, and unfavorable fill prices. These execution issues represent fundamental problems that can significantly impact trading profitability and client satisfaction.

Mobile trading capabilities and platform functionality details have not been comprehensively outlined. However, user feedback suggests limitations in technological infrastructure and trading tool availability. This Ontega review finds that the trading experience falls well below industry standards. The broker fails to meet expectations for reliability and quality.

Trust and Safety Analysis (Score: 1/10)

Trust and safety represent critical concerns for Ontega. These issues stem primarily from the absence of clear regulatory oversight and transparency issues regarding company operations. The lack of specific regulatory information creates significant uncertainty about client protections and fund security measures.

Fund safety measures have not been clearly detailed in available materials. These include client money segregation, insurance coverage, and regulatory protections. This absence of fundamental safety information raises serious questions. It creates concerns about the broker's commitment to client asset protection.

Company transparency remains problematic. Limited information is available about corporate structure, ownership, financial stability, and operational governance. Reputable brokers typically provide comprehensive disclosure about these fundamental aspects. They openly share information about their business operations.

Industry reputation and regulatory standing appear questionable based on available information and user feedback. The ongoing discussions about the broker's legitimacy and safety create substantial concerns. Potential clients considering engagement with this service provider should be aware of these issues.

User Experience Analysis (Score: 1/10)

Overall user satisfaction with Ontega is extremely poor. The majority of available reviews express significant dissatisfaction across multiple operational areas. The consistently negative feedback pattern suggests systemic issues rather than isolated problems. These problems affect individual clients throughout the organization.

User interface design and platform usability have not been comprehensively detailed. However, available feedback suggests limitations in user-friendly design and intuitive navigation. These usability issues can create additional barriers for traders attempting to execute their strategies effectively.

Registration and verification processes have not been clearly outlined. This creates uncertainty about onboarding requirements and timeline expectations. User feedback suggests potential difficulties in account setup and verification procedures. These issues may delay trading activities.

The target user demographic appears to be beginners and inexperienced traders. However, the poor user satisfaction scores suggest that even this intended audience finds the service inadequate. Common user complaints include poor customer service, technical issues, and concerns about fund security and withdrawal processes.

Conclusion

This comprehensive Ontega review reveals significant concerns that strongly suggest traders should exercise extreme caution. They should carefully consider these issues before choosing this broker. With an overall rating of 1.8 out of 10, Ontega falls well below acceptable standards for safety, reliability, and service quality. These standards are essential in the competitive forex brokerage industry.

The broker's few positive aspects include educational materials and multiple account types. However, these features are overwhelmingly outweighed by serious deficiencies in customer service, regulatory transparency, and trading experience quality. The absence of clear regulatory oversight and consistently poor user feedback create substantial risks. Potential clients should be aware of these significant concerns.

For traders seeking reliable, regulated, and professionally managed forex and CFD services, numerous better alternatives exist in the market. The evidence suggests that Ontega is not suitable for any trader demographic. This is particularly true for those seeking secure, transparent, and professionally supported trading environments.