Regarding the legitimacy of Ontega forex brokers, it provides VFSC and WikiBit, .

Is Ontega safe?

Pros

Cons

Is Ontega markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Green Pole Ltd

Effective Date:

2021-01-28Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Ontega A Scam?

Introduction

Ontega is a forex broker that has garnered attention in the trading community since its establishment in 2018. Operating under the banner of Green Pole Ltd and registered in Vanuatu, Ontega offers a range of trading services, including forex and CFDs. However, the broker's credibility has been called into question due to various complaints and concerns regarding its operational practices. For traders, evaluating the legitimacy of a forex broker is crucial, as it can significantly impact their investment safety and overall trading experience. This article aims to provide an objective assessment of Ontega, focusing on its regulatory status, company background, trading conditions, and customer experiences. The evaluation is based on a comprehensive review of multiple sources, including user feedback and industry reports, ensuring a balanced perspective on whether Ontega is safe for trading.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety and reliability of a forex broker. Ontega claims to be regulated by the Vanuatu Financial Services Commission (VFSC). However, the regulatory environment in Vanuatu is often regarded as less stringent compared to more established jurisdictions like the UK or Australia. The following table summarizes the core regulatory information for Ontega:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 14627 | Vanuatu | Revoked |

The VFSC has revoked Ontega's license due to numerous complaints from traders, indicating a significant concern regarding the broker's operational integrity. The lack of a robust regulatory framework raises questions about the level of protection available to traders. Tier 1 regulators, such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC), impose strict requirements on brokers, including the necessity for segregated client funds and compensation schemes. In contrast, the VFSC's oversight does not offer the same level of protection, making it essential for traders to approach Ontega with caution. The revocation of the license further amplifies concerns regarding whether Ontega is safe for trading, as traders may find it challenging to seek recourse in the event of disputes or fund mismanagement.

Company Background Investigation

Ontega is operated by Green Pole Ltd, a company registered in Vanuatu. The broker has been in operation since 2018, but its ownership structure and management team remain somewhat opaque. While the company claims to provide a user-friendly trading platform, the lack of transparency regarding its ownership and operational history is concerning. A thorough investigation reveals that Green Pole Ltd is linked to other brokerage brands, which raises potential red flags about its business practices.

The management team behind Ontega lacks publicly available profiles, making it difficult to assess their qualifications and experience in the financial services industry. This lack of transparency can be a significant deterrent for potential traders, as it raises questions about the broker's commitment to ethical standards and responsible trading practices. Additionally, the absence of detailed information about the company's operational history may lead traders to wonder whether they are dealing with a legitimate organization or a potentially fraudulent entity. Given these factors, it is crucial for traders to carefully consider whether Ontega is safe for their investment needs.

Trading Conditions Analysis

When assessing a forex broker, understanding the trading conditions is paramount. Ontega's trading platform offers a variety of financial instruments, including forex pairs, commodities, and CFDs. However, the broker's fee structure and transparency regarding trading costs have raised concerns among users. The following table compares Ontega's core trading costs with industry averages:

| Fee Type | Ontega | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable, often high (e.g., 2 pips for EUR/USD) | 1-1.5 pips |

| Commission Model | None disclosed | Typically low to moderate |

| Overnight Interest Range | Up to 0.5% | Varies, generally lower |

Ontega's spreads are reported to be significantly higher than the industry average, which could erode potential profits for traders. Additionally, the lack of clarity regarding commission structures and overnight fees raises further questions about the broker's transparency. Traders are often wary of brokers that do not provide clear information about their fee models, as this can lead to unexpected costs that may affect overall profitability. Given these concerns, it is vital for traders to evaluate whether Ontega is safe for their trading activities, especially if they are sensitive to trading costs.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Ontega claims to have certain measures in place to protect client funds; however, the specifics of these measures are not adequately detailed. The broker does not provide information regarding the segregation of client funds, which is a standard practice among reputable brokers. Without segregated accounts, client funds may be at risk in the event of the broker's insolvency.

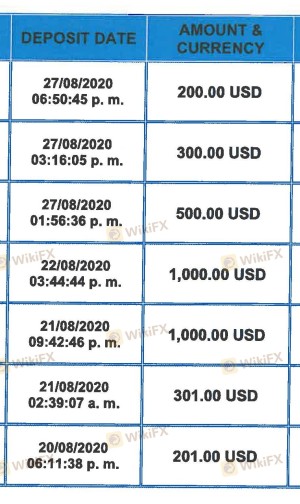

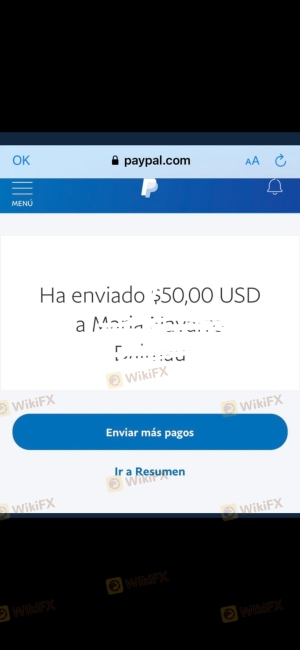

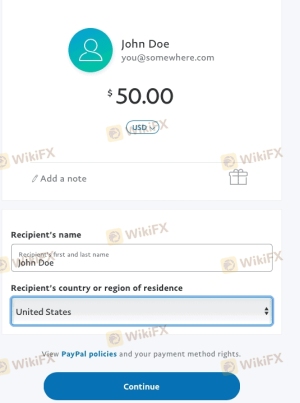

Moreover, Ontega does not offer investor protection schemes, which further diminishes the safety net for traders. Historical complaints indicate that many users have experienced difficulties in withdrawing their funds, raising significant alarms about the broker's operational practices. Reports of fund mismanagement and unresponsive customer service have led many to question whether Ontega is safe for trading. Given the lack of transparency and the absence of robust client fund protection measures, potential investors should exercise extreme caution when considering Ontega as their trading platform.

Customer Experience and Complaints

Customer feedback is an invaluable resource when assessing a broker's reliability. Numerous complaints have surfaced regarding Ontega, with many users expressing dissatisfaction with their trading experience. Common complaint categories include withdrawal issues, unresponsive customer support, and misleading promotional practices. The following table summarizes the primary complaint types along with their severity and the company's response:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Often unresponsive |

| Misleading Promotions | Medium | Limited acknowledgment |

| Platform Performance | High | Inconsistent support |

Many traders have reported significant delays in withdrawing their funds, with some claiming that their requests were ignored altogether. This lack of responsiveness from Ontega's customer support team has left many users feeling frustrated and vulnerable. Furthermore, allegations of misleading promotions have surfaced, where traders were promised certain bonuses or protections that were not honored. These patterns of complaints raise serious concerns about whether Ontega is safe and whether traders can expect a reliable and supportive trading environment.

Platform and Trade Execution

The trading platform's performance and execution quality are critical factors for traders. Ontega utilizes a proprietary web-based trading platform, which has received mixed reviews from users. Many have reported issues with platform stability, including frequent crashes and slow response times. Additionally, concerns regarding order execution quality, such as slippage and order rejections, have been raised.

Traders have expressed worries that the platform may manipulate prices or execute trades unfavorably, leading to losses that could have been avoided with a more reliable system. The absence of widely-used platforms like MetaTrader 4 or 5, which offer advanced features and tools, further exacerbates these concerns. Given the importance of a robust trading platform for successful trading, the issues reported by users raise questions about whether Ontega is safe for conducting trades.

Risk Assessment

The overall risk of using Ontega as a trading platform is significant. The following table summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates under weak regulation with a revoked license. |

| Fund Safety Risk | High | No segregation of client funds; potential withdrawal issues. |

| Platform Reliability Risk | Medium | Reports of platform instability and execution issues. |

| Customer Support Risk | High | Unresponsive support leading to unresolved complaints. |

Given these risk factors, potential traders should approach Ontega with caution. It is advisable to conduct thorough research and consider alternative brokers with stronger regulatory oversight and better customer reviews. Traders should also implement risk management strategies to mitigate potential losses when trading with Ontega.

Conclusion and Recommendations

In conclusion, the evidence gathered raises serious concerns about the legitimacy and safety of trading with Ontega. The broker's weak regulatory status, lack of transparency, and numerous customer complaints suggest that it may not be a reliable platform for traders. While Ontega offers a range of trading instruments and a user-friendly interface, the risks associated with this broker far outweigh the potential benefits.

For traders seeking a secure trading environment, it is advisable to consider alternative brokers with robust regulatory frameworks and positive customer feedback. Brokers regulated by tier 1 authorities, such as the FCA or ASIC, provide greater assurance regarding fund safety and operational integrity. In light of the findings, it is prudent to conclude that Ontega is not safe for trading, and potential investors should exercise extreme caution when considering this broker for their trading needs.

Is Ontega a scam, or is it legit?

The latest exposure and evaluation content of Ontega brokers.

Ontega Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ontega latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.