OneRoyal 2025 Review: Everything You Need to Know

Summary

This comprehensive oneroyal review shows a concerning picture of a globally regulated Forex and CFD broker. Despite offering multiple trading platforms and diverse asset classes, the company struggles significantly with customer satisfaction. With a disappointing 1.4-star rating from 4 customer reviews, OneRoyal proves that regulatory compliance alone doesn't guarantee quality service delivery.

The broker provides access to MT4 and MT5 trading platforms across forex, commodities, indices, shares, and cryptocurrency markets. It positions itself as a multi-asset trading solution. However, the overwhelmingly negative user feedback suggests serious problems in service quality that potential traders should carefully consider.

OneRoyal targets experienced investors and forex traders seeking diverse trading opportunities. But the poor customer satisfaction ratings indicate that even seasoned traders may encounter significant challenges with this broker's services.

Important Notice

This review acknowledges that OneRoyal operates under multiple regulatory jurisdictions including ASIC, CySEC, SVGFSA, and VFSC. Different regulatory entities may offer varying levels of protection and compliance requirements for users. Traders should understand that regulatory standards and customer protections can differ significantly between these jurisdictions, potentially affecting their trading experience and recourse options.

This evaluation is based on comprehensive analysis of publicly available information, user feedback from multiple sources, and documented customer experiences. The assessment aims to provide an objective overview while recognizing that individual trading experiences may vary based on account type, geographical location, and specific regulatory oversight applicable to each trader's circumstances.

Rating Framework

Broker Overview

OneRoyal positions itself as a globally regulated Forex and CFD broker operating across multiple jurisdictions to serve international trading communities. According to [TradingBrokers.com], the company offers various account types and promotional activities designed to attract traders seeking exposure to international financial markets.

The broker's business model focuses on providing multi-asset trading opportunities to clients interested in forex and other financial instruments through established trading platforms. While specific founding details are not extensively documented in available materials, OneRoyal has established regulatory presence across several key financial jurisdictions to facilitate global trading operations.

The broker supports both MT4 and MT5 trading platforms, providing access to forex, commodities, indices, stocks, and cryptocurrency markets. [TradingFinder.com] indicates that OneRoyal operates under regulation from ASIC (Australia), CySEC (Cyprus), SVGFSA (Saint Vincent and the Grenadines), and VFSC (Vanuatu), creating a multi-jurisdictional regulatory framework.

This oneroyal review finds that while the broker offers diverse trading opportunities across asset classes, the regulatory complexity may create varying levels of protection and service standards depending on the client's geographical location and applicable regulatory oversight.

Regulatory Coverage: OneRoyal maintains regulatory oversight from ASIC, CySEC, SVGFSA, and VFSC. This provides multi-jurisdictional compliance coverage across different geographical markets.

Minimum Deposit Requirements: The broker sets a relatively accessible minimum deposit threshold of $50, making it potentially suitable for traders with limited initial capital.

Promotional Offerings: OneRoyal provides deposit-matching promotions and bonus programs. However, these are subject to specific eligibility criteria and withdrawal conditions as detailed on their website.

Available Trading Assets: The platform supports trading across forex pairs, commodities, major indices, individual stocks, and cryptocurrency instruments, offering diversified market exposure.

Cost Structure: [Multiple sources] indicate OneRoyal advertises tight spreads. Though specific commission information and detailed fee structures are not comprehensively disclosed in available materials.

Leverage Information: Specific leverage ratios and margin requirements are not detailed in the available documentation reviewed for this assessment.

Platform Options: Traders can access markets through both MetaTrader 4 and MetaTrader 5 platforms. Additional AI-enhanced trading tools are mentioned in promotional materials.

Geographic Restrictions: Specific regional limitations and service availability restrictions are not clearly outlined in the reviewed materials.

This oneroyal review notes that while basic operational information is available, many crucial details regarding trading conditions remain insufficiently documented in publicly accessible sources.

Account Conditions Analysis

OneRoyal's account structure presents a mixed picture for potential traders, with some accessible features overshadowed by significant transparency concerns. The $50 minimum deposit requirement represents one of the more positive aspects, positioning the broker as accessible to traders with limited initial capital.

This low barrier to entry could appeal to newcomers testing the platform or experienced traders seeking to evaluate services without substantial financial commitment. However, the lack of comprehensive information about different account types and their specific features creates uncertainty about what traders can expect from their chosen account level.

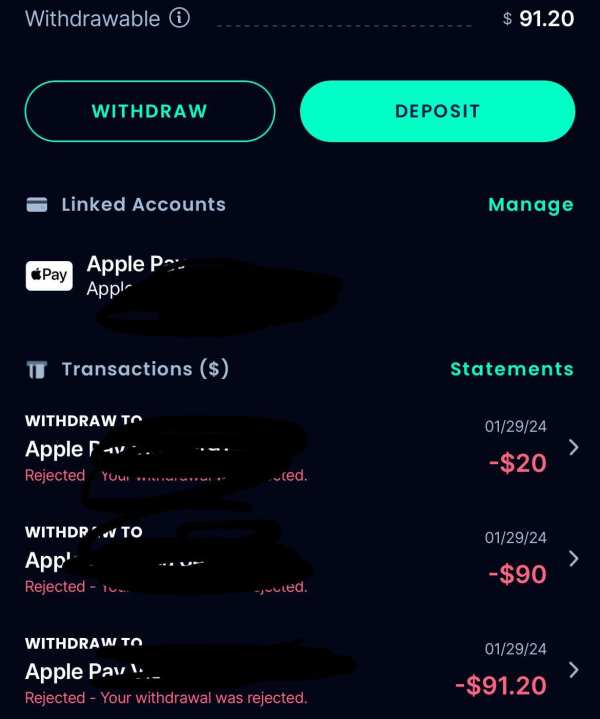

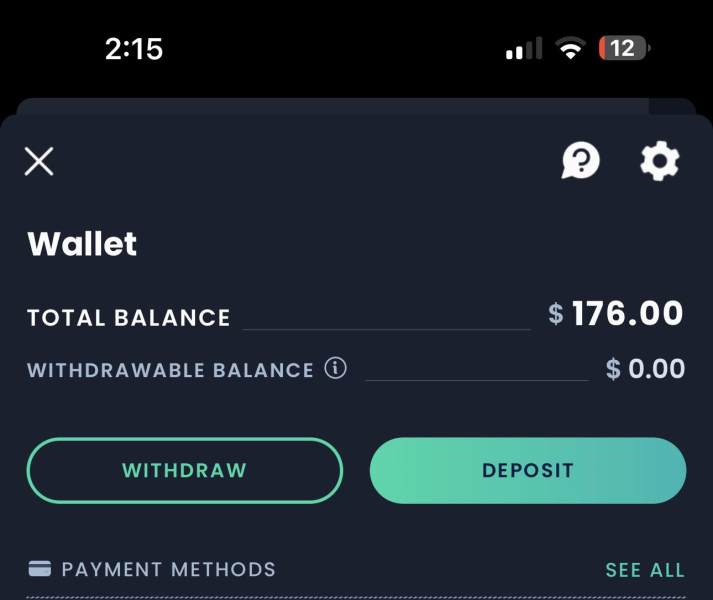

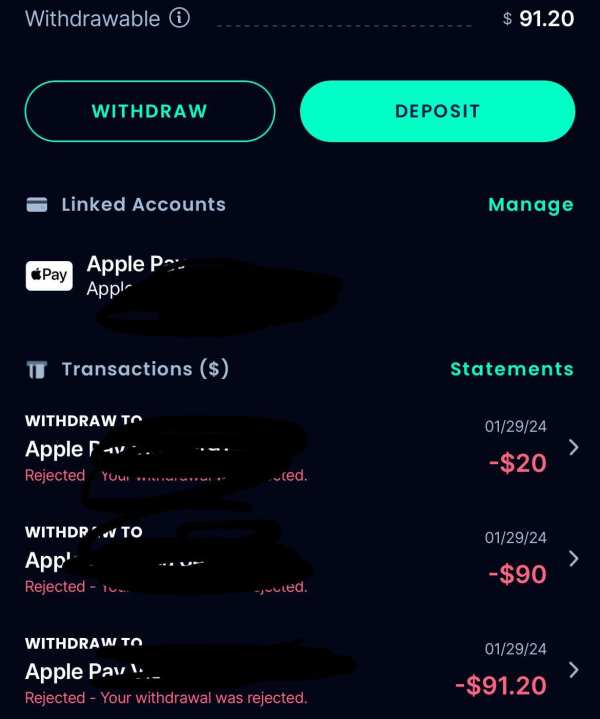

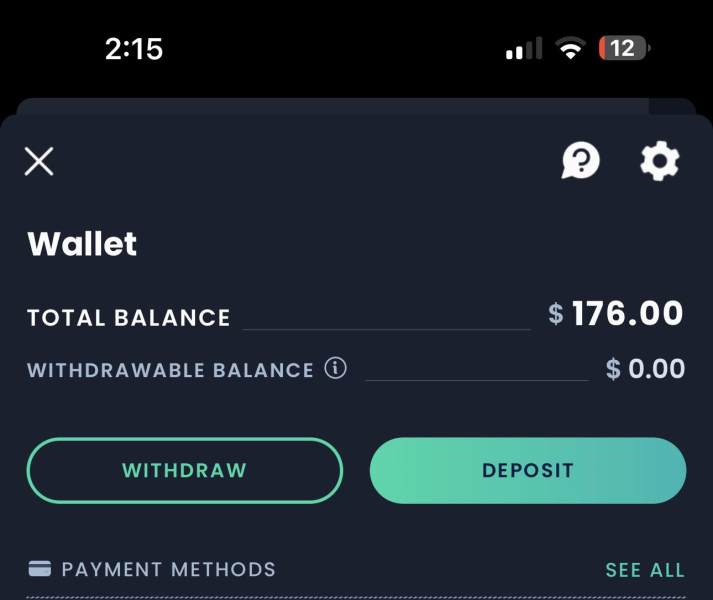

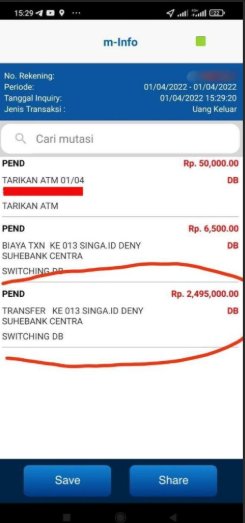

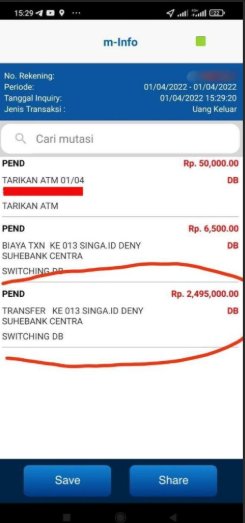

The absence of clear commission structure information significantly undermines the account conditions evaluation. [User feedback] suggests that many clients express frustration with unexpected fees and charges that were not clearly communicated during the account opening process.

This lack of transparency regarding costs creates potential for unpleasant surprises and makes it difficult for traders to accurately calculate their total trading costs. Additionally, the account opening process efficiency and verification requirements are not well-documented, leaving potential clients uncertain about timeline expectations and required documentation.

The poor user ratings strongly suggest that account-related services, including account management and support, fall short of industry standards. This oneroyal review finds that while the low minimum deposit appears attractive, the overall account conditions suffer from insufficient transparency and poor customer satisfaction, making it difficult to recommend the broker based on account features alone.

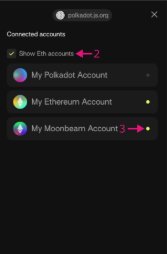

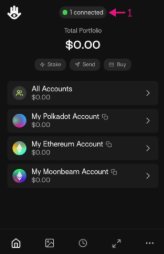

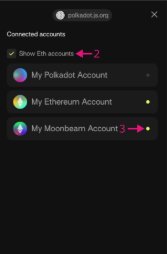

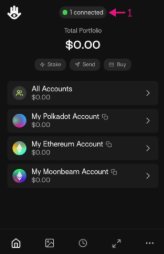

OneRoyal's technology infrastructure centers around the industry-standard MT4 and MT5 platforms, which provide traders with familiar and robust trading environments. [TradingFinder.com] highlights that the broker offers AI-enhanced trading tools, suggesting some investment in advanced technology solutions.

These platforms typically provide comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors, giving traders access to professional-grade trading functionality. However, the evaluation of educational and research resources reveals significant gaps in available information.

While many successful brokers distinguish themselves through comprehensive market analysis, educational content, and research support, OneRoyal's offerings in these areas are not well-documented or prominently featured. This absence of clear educational support may particularly disadvantage newer traders who rely on broker-provided learning resources to develop their trading skills and market understanding.

The AI tools mentioned in promotional materials could represent a competitive advantage, but without detailed information about their functionality, effectiveness, or user experience, it's difficult to assess their actual value. User feedback doesn't specifically highlight these tools as standout features, suggesting either limited adoption or underwhelming performance.

The overall tools and resources package appears adequate for basic trading needs but lacks the comprehensive support ecosystem that characterizes leading brokers in the competitive forex market.

Customer Service and Support Analysis

Customer service represents OneRoyal's most significant weakness, as evidenced by the critically low 1.4-star user rating that primarily reflects customer support failures. [User reviews] consistently highlight poor responsiveness, inadequate problem resolution, and communication difficulties that leave traders frustrated and unsupported.

This level of customer dissatisfaction suggests systemic issues within the support infrastructure rather than isolated incidents. The specific customer service channels, availability hours, and multilingual support capabilities are not clearly documented in available materials, which itself represents a transparency issue.

Effective customer support requires clear communication about how clients can access help, when support is available, and what level of assistance they can expect. The lack of this basic information compounds the negative impression created by poor user ratings.

Response time appears to be a particular concern based on user feedback patterns, with many customers expressing frustration about delayed responses to urgent trading-related inquiries. In the fast-paced forex market, slow customer support can directly impact trading outcomes and financial results.

The poor customer service ratings suggest that OneRoyal has not invested adequately in support infrastructure or staff training, creating a significant competitive disadvantage and potential risk for traders who may need assistance during critical market situations.

Trading Experience Analysis

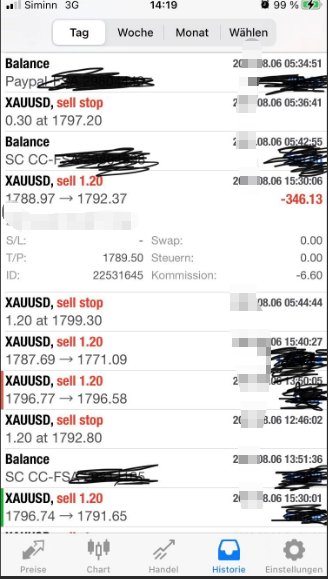

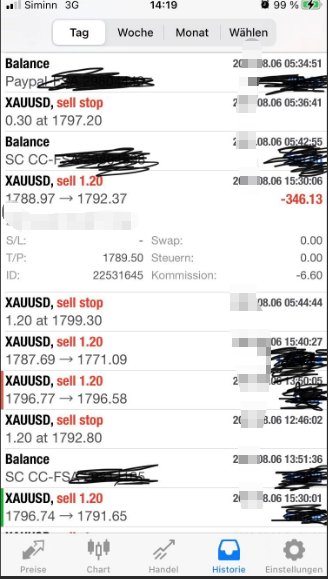

The trading experience evaluation reveals mixed signals, with OneRoyal advertising competitive features that are undermined by poor user satisfaction. The broker promotes tight spreads across its trading instruments, which could provide cost advantages for active traders if delivered consistently.

However, the lack of detailed information about execution quality, order processing speed, and platform stability makes it difficult to verify these claims or assess the actual trading environment quality. Platform stability and execution reliability are crucial factors that directly impact trading outcomes, yet specific performance metrics and uptime statistics are not readily available in the reviewed materials.

[User feedback] suggests that traders have experienced frustrations with the trading experience, though specific technical issues are not well-documented in available reviews. The absence of positive user testimonials about trading performance is notable given that satisfied traders typically highlight smooth execution and reliable platform performance.

Mobile trading capabilities and cross-device synchronization are increasingly important for modern traders, but OneRoyal's mobile platform performance and features are not comprehensively detailed. This oneroyal review finds that while the underlying MT4 and MT5 platforms provide solid technical foundations, the overall trading experience appears to suffer from implementation issues or service quality problems that contribute to the poor user satisfaction ratings.

Trust and Reliability Analysis

OneRoyal's regulatory framework provides a foundation for trust through licenses from ASIC, CySEC, SVGFSA, and VFSC, representing oversight from established financial authorities. These regulatory relationships suggest compliance with certain operational standards and client protection measures, though the level of protection varies significantly between jurisdictions.

ASIC and CySEC generally provide stronger consumer protections compared to SVGFSA and VFSC, creating potential disparities in client safety depending on which entity oversees their account. However, regulatory compliance alone doesn't guarantee trustworthiness, as demonstrated by the poor user ratings that suggest significant trust issues among actual clients.

[User feedback] indicates concerns about transparency, communication, and service delivery that undermine confidence in the broker's reliability. The disconnect between regulatory status and customer satisfaction suggests that while OneRoyal meets minimum compliance requirements, it may not exceed basic standards in ways that build genuine client trust.

Fund security measures and client money handling procedures are not extensively detailed in available materials, representing another transparency gap that affects trust assessment. Leading brokers typically provide clear information about segregated accounts, insurance coverage, and fund protection measures.

The absence of prominent security assurances, combined with poor user experiences, creates legitimate concerns about the broker's commitment to client protection beyond minimum regulatory requirements.

User Experience Analysis

The user experience evaluation reveals OneRoyal's most critical failure, with the 1.4-star rating representing severe widespread dissatisfaction across multiple service areas. This extremely low rating suggests that the majority of clients encounter significant problems that substantially detract from their overall experience.

Such poor ratings typically indicate systemic issues rather than isolated incidents, suggesting fundamental problems with service delivery, communication, or platform functionality. Interface design and platform usability information is limited in available materials, but the poor overall ratings suggest that user-friendly design may not be a strength.

Modern traders expect intuitive interfaces, streamlined processes, and responsive design across devices. The lack of positive feedback about user experience elements suggests that OneRoyal may not have invested adequately in user experience optimization or interface design improvements.

Registration and verification processes, fund management procedures, and general account administration appear to be sources of user frustration based on the poor ratings patterns. Efficient onboarding and smooth operational procedures are essential for positive user experiences, particularly in the competitive forex market where traders have numerous alternative options.

The consistently poor user feedback suggests that OneRoyal faces significant challenges in meeting basic user expectations across multiple touchpoints in the customer journey.

Conclusion

This comprehensive oneroyal review reveals a broker that, despite regulatory compliance and platform availability, fails to deliver satisfactory service quality to its clients. The critically low 1.4-star user rating represents a significant red flag that potential traders should carefully consider before opening accounts.

While OneRoyal offers access to popular trading platforms and diverse asset classes, these technical capabilities are overshadowed by poor customer service, transparency issues, and widespread user dissatisfaction. The broker may be more suitable for highly experienced traders who can navigate potential service challenges independently, but even seasoned traders should carefully weigh the risks associated with the documented service quality issues.

Overall, the significant gap between OneRoyal's regulatory status and actual customer satisfaction suggests that traders would benefit from exploring alternative brokers with stronger track records of client satisfaction and service excellence.