Dmgm 2025 Review: Everything You Need to Know

In this comprehensive review of Dmgm, we delve into the broker's offerings, user experiences, and overall reliability based on recent findings. Overall, the feedback regarding Dmgm is predominantly negative, with numerous reports of unregulated practices and poor customer service. Key findings reveal that Dmgm lacks proper regulatory oversight, which raises significant concerns for potential investors.

Note: It's crucial to acknowledge that Dmgm operates in different regions, and the lack of regulation can vary based on the specific entity. This review aims to provide a fair and accurate assessment based on available information.

Rating Overview

We evaluate brokers based on extensive research and user feedback to ensure an accurate representation of their services.

Broker Overview

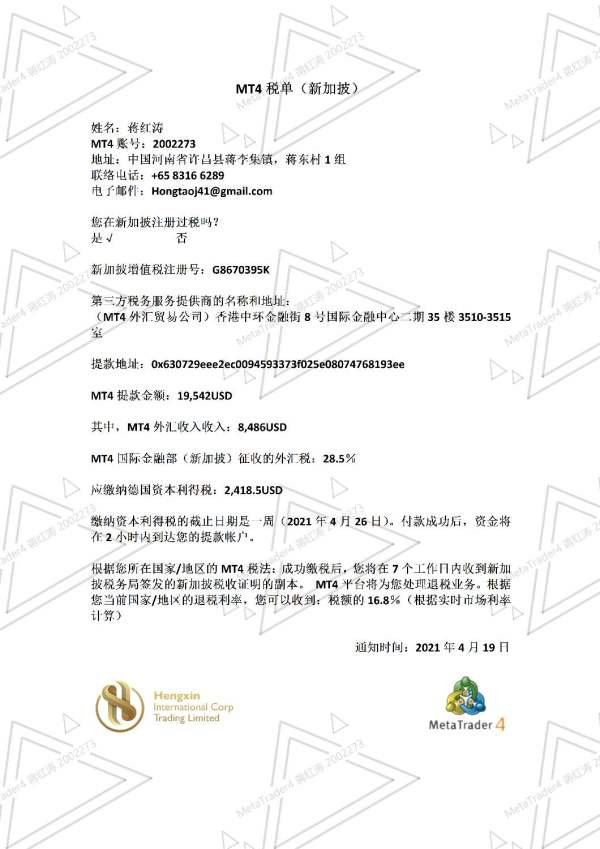

Dmgm, also known as Dmgmfx, has emerged as a forex and CFD broker, but its reputation is marred by allegations of being unregulated and potentially fraudulent. Established in an unspecified year, Dmgm claims to offer trading on the popular MetaTrader 4 platform, facilitating access to a range of financial instruments, including forex pairs, commodities, and indices. However, the absence of a clear regulatory framework raises serious concerns about the safety of client funds.

Detailed Analysis

Regulatory Regions:

Dmgm operates without any valid regulatory oversight, which is a significant red flag. Multiple sources indicate that the broker does not belong to any recognized regulatory body, leading to skepticism regarding its legitimacy. According to Forex Peace Army, the broker's website is reportedly down, suggesting operational issues.

Deposit/Withdrawal Currencies/Cryptocurrencies:

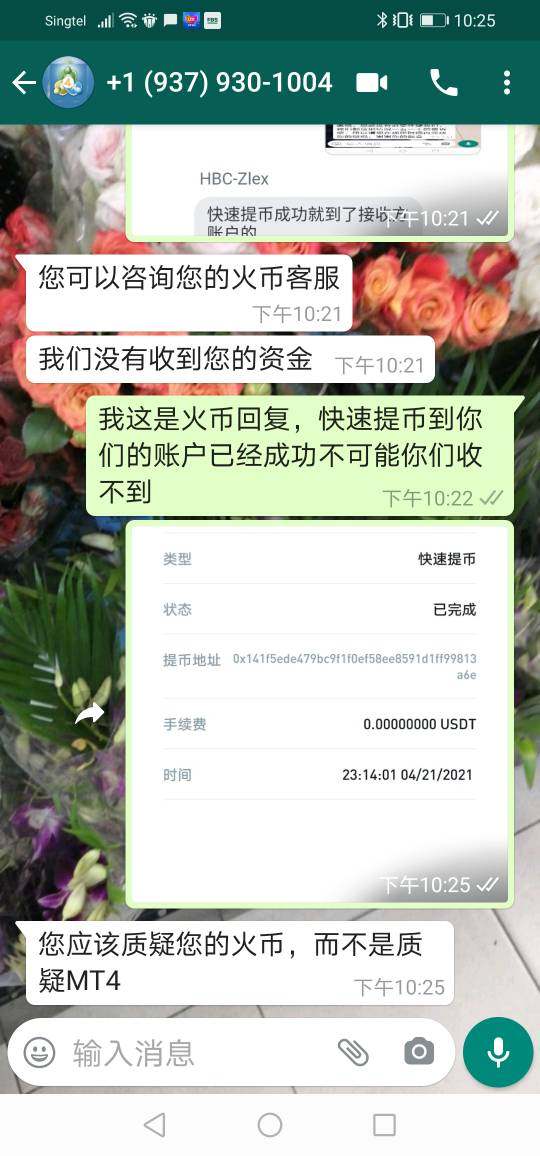

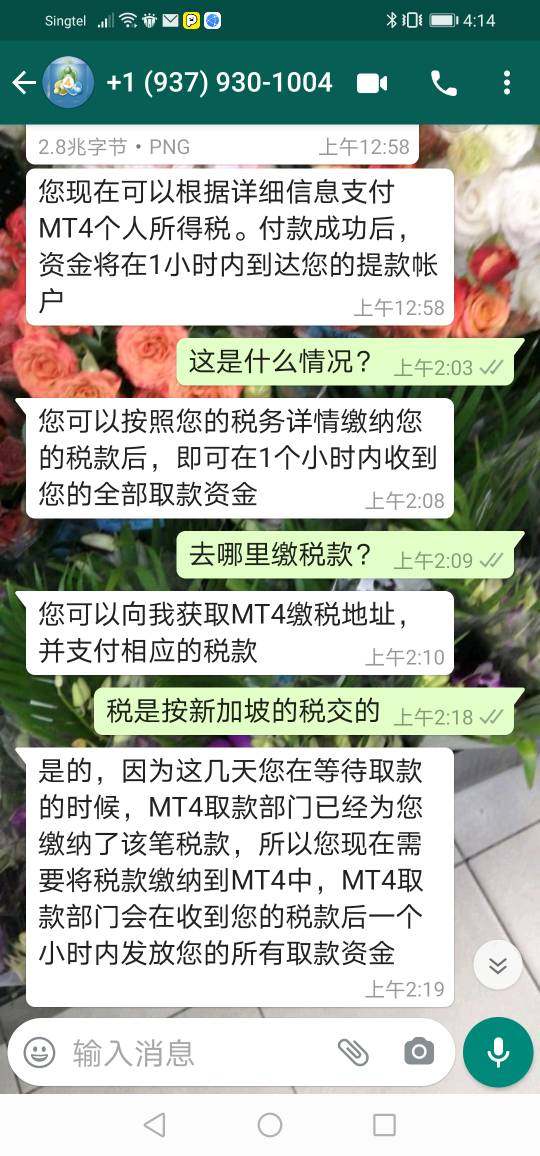

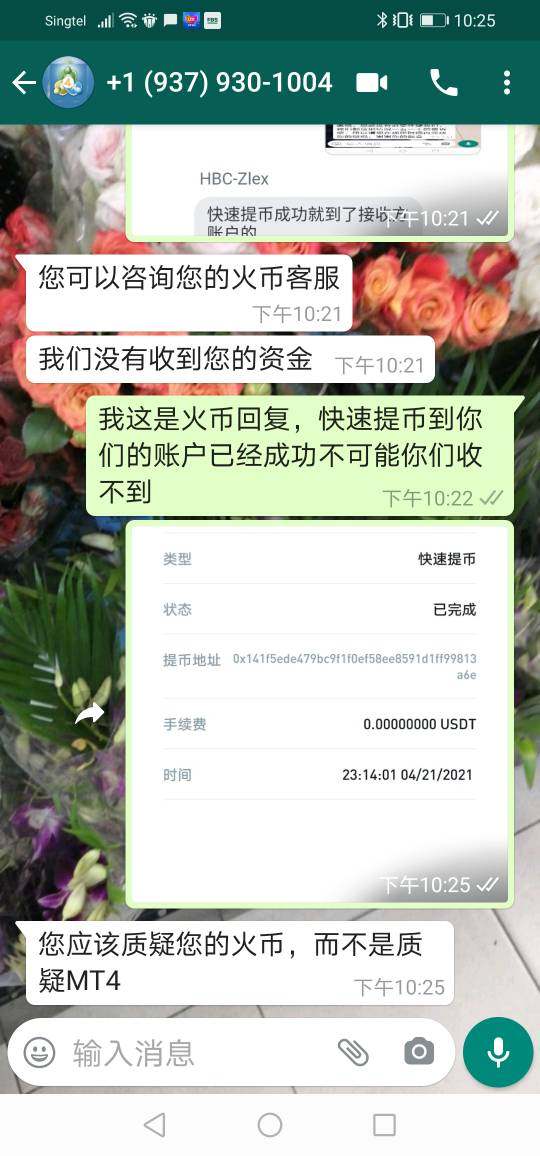

While specific details regarding accepted currencies are sparse, it is indicated that Dmgm allows deposits via traditional banking methods. However, the lack of transparency surrounding withdrawal processes has led to numerous complaints from users who report difficulties in accessing their funds.

Minimum Deposit:

The minimum deposit requirement for opening an account with Dmgm is not explicitly stated in the available reviews, which adds to the confusion and lack of clarity surrounding their services.

Bonuses/Promotions:

There is little to no information regarding bonuses or promotional offers from Dmgm, which is unusual for brokers looking to attract new clients. This absence may further suggest a lack of competitive offerings compared to more reputable brokers.

Tradable Asset Classes:

Dmgm claims to provide access to various financial instruments, including forex pairs, commodities, and indices. However, reviews indicate that the actual range of available assets is limited, which might not meet the expectations of traders looking for diverse trading options.

Costs (Spreads, Fees, Commissions):

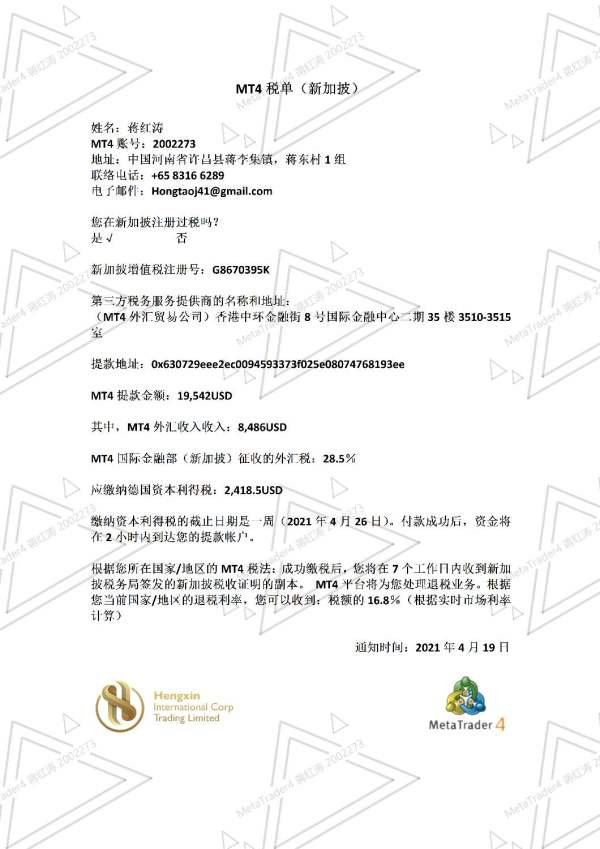

The specifics regarding spreads and commissions remain unclear, with many users reporting hidden fees and unclear cost structures. This lack of transparency is concerning and could lead to unexpected losses for traders.

Leverage:

Dmgm reportedly offers high leverage options, which can be enticing for traders. However, the absence of regulatory oversight means that traders are exposed to significant risks without the safety nets typically provided by regulated brokers.

Allowed Trading Platforms:

Dmgm primarily operates on the MetaTrader 4 platform, a widely recognized trading software. However, the lack of additional tools or platforms may deter traders seeking advanced trading features.

Restricted Areas:

Dmgm appears to target a global audience, but the absence of regulatory backing raises questions about its operations in various jurisdictions. Potential clients should be cautious, especially in regions where forex trading regulations are stringent.

Available Customer Support Languages:

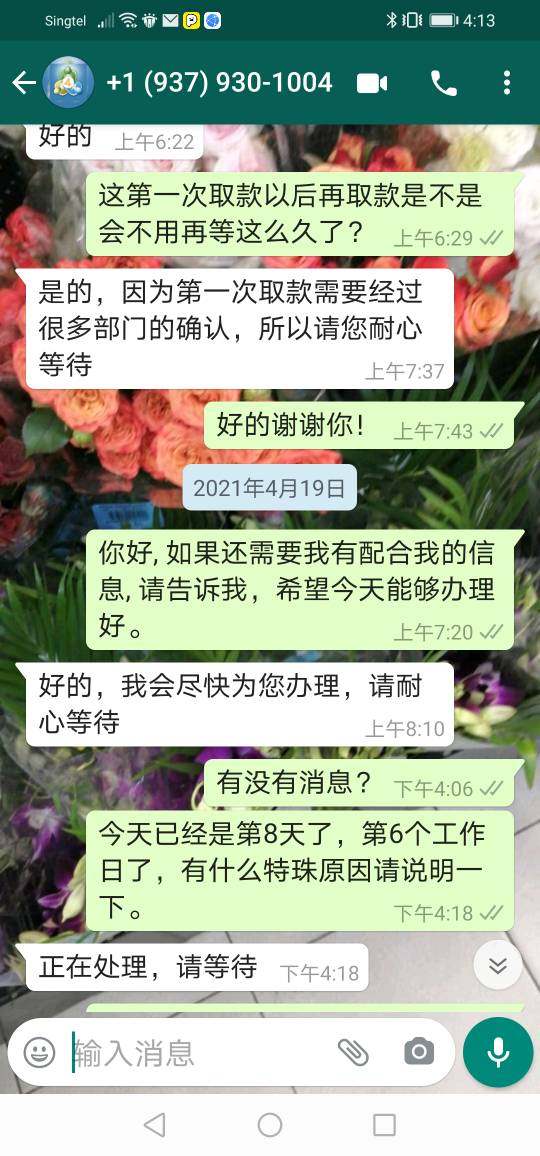

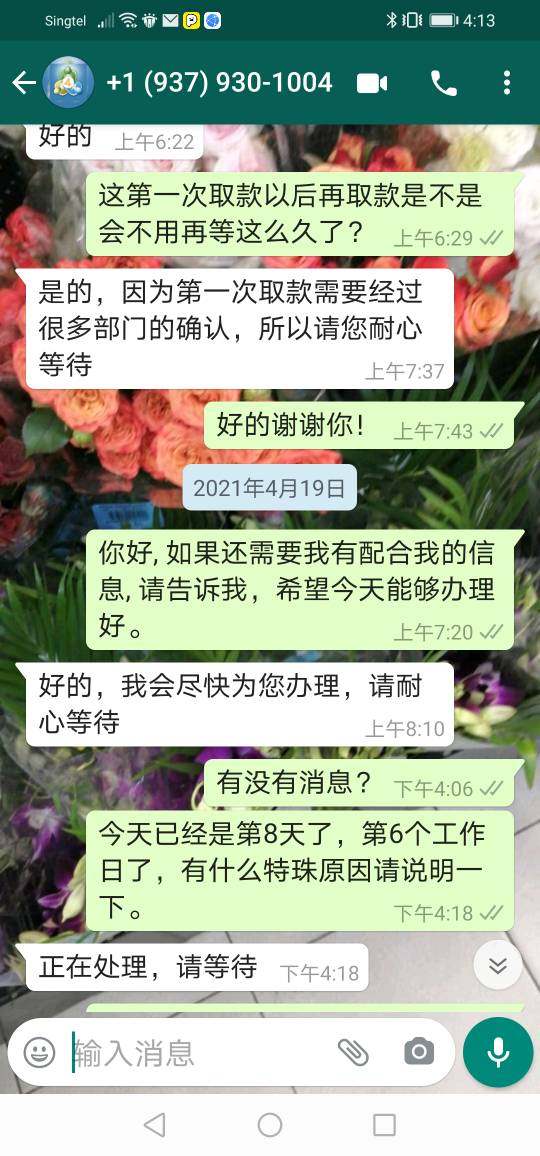

Customer support appears to be a weak point for Dmgm, with limited channels available for assistance. Many users have reported delays in response times, further compounding their frustrations.

Repeated Rating Overview

Detailed Breakdown

-

Account Conditions: Users have expressed dissatisfaction with account conditions, reporting a lack of clarity regarding fees and minimum deposits, leading to confusion and frustration.

Tools and Resources: The resources available for traders are minimal, with many reviews indicating that Dmgm does not provide sufficient educational materials or market analysis tools.

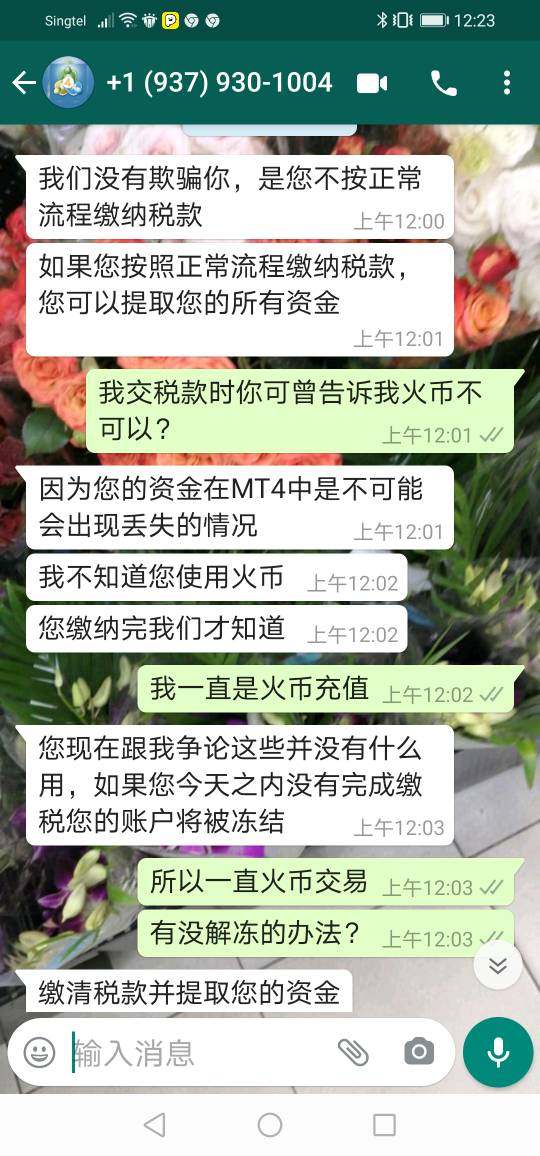

Customer Service and Support: Customer support has been heavily criticized, with reports of slow response times and inadequate assistance. Many users have struggled to get their queries addressed effectively.

Trading Setup (Experience): The trading experience on the MetaTrader 4 platform is basic, lacking advanced features that many traders expect from a modern brokerage.

Trustworthiness: The most concerning aspect of Dmgm is its lack of regulation. Without proper oversight, traders are left vulnerable to potential fraud and poor practices.

User Experience: Overall user experiences have been largely negative, with many traders reporting difficulties in withdrawing funds and a general lack of transparency from the broker.

In conclusion, the Dmgm review paints a troubling picture of a broker that lacks the necessary regulatory framework and transparency expected in the trading industry. Potential investors are strongly advised to exercise caution and consider more reputable alternatives before engaging with Dmgm.