Regarding the legitimacy of OnePro forex brokers, it provides CMA and WikiBit, (also has a graphic survey regarding security).

Is OnePro safe?

Pros

Cons

Is OnePro markets regulated?

The regulatory license is the strongest proof.

CMA Derivatives Trading License (EP)

Capital Market Authority

Capital Market Authority

Current Status:

RevokedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

JRG INTERNATIONAL BROKERAGE DMCC

Effective Date:

--Email Address of Licensed Institution:

codo@jrgfutures.comSharing Status:

No SharingWebsite of Licensed Institution:

www.jrgfutures.comExpiration Time:

--Address of Licensed Institution:

2106 , Fortune Executive Tower , Cluster T, JLT, Dubai.Phone Number of Licensed Institution:

43532353Licensed Institution Certified Documents:

Is OnePro A Scam?

Introduction

OnePro, also known as OnePro Global, is a forex broker that has emerged on the trading scene since its establishment in 2019. Positioned as an online trading platform, it offers a range of financial instruments, including forex, commodities, and CFDs. However, the rise in the number of unregulated brokers in the forex market necessitates a cautious approach from traders. The potential for scams is high, and it is crucial for traders to thoroughly evaluate the legitimacy and reliability of any broker before committing their hard-earned money.

This article aims to provide a comprehensive analysis of OnePro by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The evaluation is based on a review of multiple online sources, including regulatory bodies, user reviews, and financial analysis websites, to present a balanced view of whether OnePro is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a critical factor in determining its legitimacy. Regulation provides a layer of protection for traders, ensuring that brokers adhere to specific standards of conduct and financial practices. OnePro claims to be regulated by the Financial Services Commission (FSC) in Mauritius, but its history with other regulatory bodies raises concerns about its compliance and overall trustworthiness.

| Regulatory Body | License Number | Regulating Region | Verification Status |

|---|---|---|---|

| FSC Mauritius | GB 20025905 | Mauritius | Verified |

| ASIC | 001286818 | Australia | Revoked |

| SCA | 607019 | UAE | Revoked |

The above table summarizes the regulatory status of OnePro. While it is registered with the FSC in Mauritius, the revocation of its licenses from both the Australian Securities and Investments Commission (ASIC) and the Securities and Commodities Authority (SCA) indicates a history of non-compliance. The revocation of these licenses is a significant red flag, suggesting that OnePro may not adhere to the stringent standards typically expected of regulated brokers.

The quality of regulation is paramount; brokers operating without proper oversight can engage in dubious practices, putting client funds at risk. The revocation of licenses typically occurs due to violations of regulatory standards, which raises questions about OnePro's business practices and commitment to compliance.

Company Background Investigation

OnePro Global is a relatively new entrant in the forex brokerage industry, having been established in 2019. The company claims to operate from multiple jurisdictions, including Mauritius and New Zealand. However, the lack of transparency regarding its ownership structure and management team is concerning.

While OnePro presents itself as a globally recognized broker, it has faced scrutiny regarding its operational legitimacy. The absence of detailed information about its founders, management team, and corporate structure raises questions about the company's transparency. A reputable broker typically provides clear information about its ownership and management, allowing potential clients to assess the qualifications and experience of those at the helm.

Moreover, the company's claims of being regulated in multiple jurisdictions, including Australia and New Zealand, appear misleading given the revocation of its licenses in those regions. This lack of clarity regarding its corporate governance and operational history further diminishes its credibility in the eyes of potential traders.

Trading Conditions Analysis

The trading conditions offered by a broker play a crucial role in determining its attractiveness to traders. OnePro offers various account types, including standard, VIP, ECN, and Islamic accounts, with a minimum deposit requirement of $100. However, the overall fee structure and potential hidden costs warrant careful examination.

| Fee Type | OnePro | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.6 pips | 1.0-1.5 pips |

| Commission Model | Not disclosed | $5-7 per lot |

| Overnight Interest Range | Not disclosed | Varies by broker |

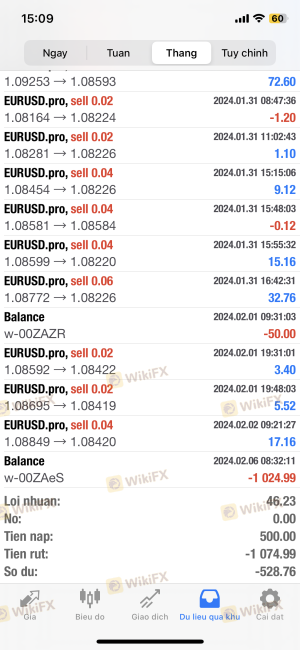

The table above compares OnePro's fees with industry averages. While the spread on major currency pairs is somewhat competitive, the lack of transparency regarding commissions and overnight interest rates is concerning. Many traders have reported unexpected fees and poor execution, which could indicate hidden costs that are not clearly disclosed upfront.

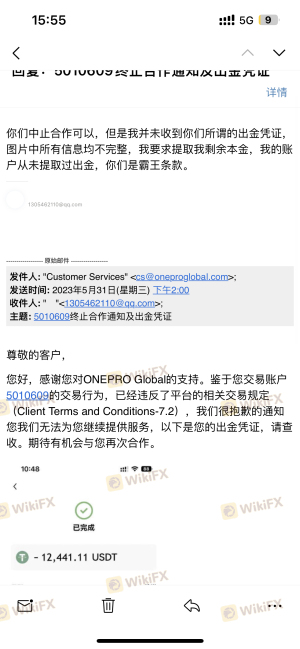

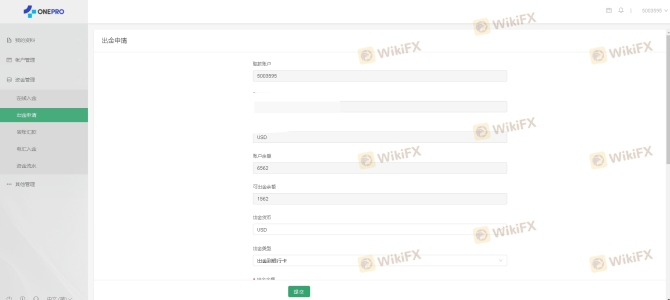

Furthermore, traders should be cautious of any unusual fee structures that may arise, particularly when it comes to withdrawal processes. Complaints about withdrawal delays and unexpected fees have been prevalent among users, raising concerns about the broker's overall reliability and fairness in its fee practices.

Customer Funds Security

The security of customer funds is paramount when choosing a forex broker. OnePro claims to implement various safety measures, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable given the broker's regulatory status and the history of complaints regarding fund withdrawals.

OnePro's commitment to fund security is highlighted by its claims of segregating client funds from its operational capital. This practice is essential for protecting traders' investments in the event of the broker facing financial difficulties. Nevertheless, the lack of independent verification regarding these claims raises doubts about their authenticity.

Additionally, the absence of a clear investor compensation scheme further complicates the safety of client funds. In the event of insolvency or operational issues, traders may find themselves without recourse to recover their investments, underscoring the importance of choosing a broker with robust investor protection policies.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability and service quality. OnePro has garnered a significant number of complaints from users, particularly regarding withdrawal issues and poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inconsistent responses |

| Poor Customer Support | Medium | Slow response times |

| Account Management Issues | High | Unresolved complaints |

The table above summarizes the main types of complaints received by OnePro and the company's response quality. Many users have reported significant delays in processing withdrawal requests, leading to frustration and distrust. Additionally, the quality of customer support has been criticized, with many users noting slow response times and inadequate resolutions to their issues.

For example, one user reported depositing $3,000 and experiencing difficulties withdrawing their funds even after repeated requests. Such experiences highlight the potential risks associated with trading with OnePro and raise concerns about the broker's commitment to maintaining a positive relationship with its clients.

Platform and Trade Execution

The performance of the trading platform is another critical aspect of a broker's service. OnePro offers the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading tools. However, user experiences with the platform have been mixed.

Many traders have reported issues with order execution, including slippage and high rejection rates. These problems can significantly impact trading performance and profitability, particularly in fast-moving markets. Additionally, the lack of a demo account option raises concerns about the broker's transparency and willingness to allow potential clients to test its platform before committing real funds.

Risk Assessment

Using OnePro involves several risks that traders should be aware of before opening an account. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Revoked licenses raise concerns about compliance. |

| Withdrawal Issues | High | Numerous complaints about delayed or denied withdrawals. |

| Platform Reliability | Medium | Reports of slippage and execution issues. |

| Transparency Issues | High | Lack of clear information about fees and policies. |

Given these risks, potential traders should exercise caution when considering OnePro as their broker. It is advisable to explore alternative options that offer clearer regulatory oversight, better customer support, and a more transparent fee structure.

Conclusion and Recommendations

In conclusion, the evidence suggests that OnePro exhibits several characteristics commonly associated with scam brokers. The revocation of its regulatory licenses, numerous customer complaints, and lack of transparency raise significant red flags. While the broker offers various trading instruments and account types, the potential risks involved in trading with OnePro outweigh the benefits.

Traders should be particularly cautious and consider seeking alternative brokers with a solid regulatory framework and a proven track record of customer satisfaction. Recommended alternatives include brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC, which provide greater assurance of fund safety and reliable service.

Overall, while OnePro may present itself as a legitimate trading platform, the underlying concerns regarding its regulatory status and customer feedback warrant a careful and informed approach.

Is OnePro a scam, or is it legit?

The latest exposure and evaluation content of OnePro brokers.

OnePro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OnePro latest industry rating score is 1.87, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.87 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.