UITT 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

UITT is an online broker that has been gaining attention for its high leverage trading options across various asset classes, including forex, cryptocurrencies, commodities, and equity shares. This appeal primarily attracts experienced traders and risk-tolerant investors who are more interested in maximizing returns through significant leverage, potentially reaching up to 1:400. However, the broker's operations are marked by a lack of regulatory oversight, which raises pertinent questions regarding fund safety and withdrawal processes. Mixed reviews from users point to possible withdrawal challenges and allegations of hidden fees, creating a climate of uncertainty for prospective clients. As a result, this review aims to provide a thorough analysis of UITT, evaluating both the advantages it offers to seasoned traders and the risks that come with its unregulated status.

⚠️ Important Risk Advisory & Verification Steps

- Warning: This broker lacks regulatory oversight. Consider the following before proceeding:

- Conduct due diligence regarding broker registration and user experiences.

- Verify regulatory claims on authoritative financial sites.

- Be cautious of the potential for hidden fees and withdrawal difficulties.

Verification Steps

- Check Regulatory Status: Visit official financial regulatory websites like the SEC or FCA to confirm whether UITT is regulated.

- Read User Reviews: Look for reviews on multiple platforms, especially those that share user experiences regarding withdrawals and customer support.

- Contact Customer Support: Gauge response times and clarity when raising potential concerns with the broker.

Rating Framework

Broker Overview

Company Background and Positioning

UITT is a relatively new entity in the online brokerage landscape, operational for approximately 5-10 years, with its headquarters reportedly situated in the United Kingdom. Despite its appealing trading conditions featuring high leverage, its lack of robust regulatory backing casts a long shadow on its reliability. Given that many brokers tend to incorporate strong regulatory compliance as a competitive differentiator, UITT's approach raises significant concerns among potential clients, specifically around fund safety and trustworthiness.

Core Business Overview

UITT provides a range of trading services primarily in foreign exchange, commodities, indices, and cryptocurrencies. Clients can leverage significant amounts, allowing for trades worth up to 400 times the amount deposited, which offers the potential for high returns. However, this high leverage comes with greater risks, especially for inexperienced traders. The broker mentions offering various analytical tools and trading signals, yet user feedback suggests that these tools might be lacking in quality and depth.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The absence of solid regulatory backing is a significant concern for UITT. User complaints point towards lackluster transparency regarding the broker's operational licenses, leading many to question its legitimacy. Individual brokers, by virtue of their registration and regulatory compliance, operate under strict oversight that helps protect traders from malpractices.

User Self-Verification Guide

- Visit Regulatory Websites: Check listings on the SEC, FCA, or other financial oversight bodies.

- Look for Licensing Information: Confirm the details of any licenses claimed by the broker through third-party verification.

- Consult Review Platforms: Seek out community insights on sites like Trustpilot or ForexPeaceArmy.

"Without a regulatory framework, trading through UITT may feel like venturing into uncharted waters." - Anonymous User Review.

Industry Reputation and Summary

While some users report satisfactory trading experiences, a worrying number of negative reviews center on issues surrounding fund safety and withdrawals. Many users express their dissatisfaction over perceived delays and challenges in accessing their funds, further eroding trust in the company's overall integrity.

Trading Costs Analysis

Advantages in Commissions

UITT's commission structure is competitive for experienced traders, especially those looking to engage in high-frequency trading across flexible asset classes. With low trading costs on the surface, it attracts clientele interested in leveraging trading strategies that could yield significant returns.

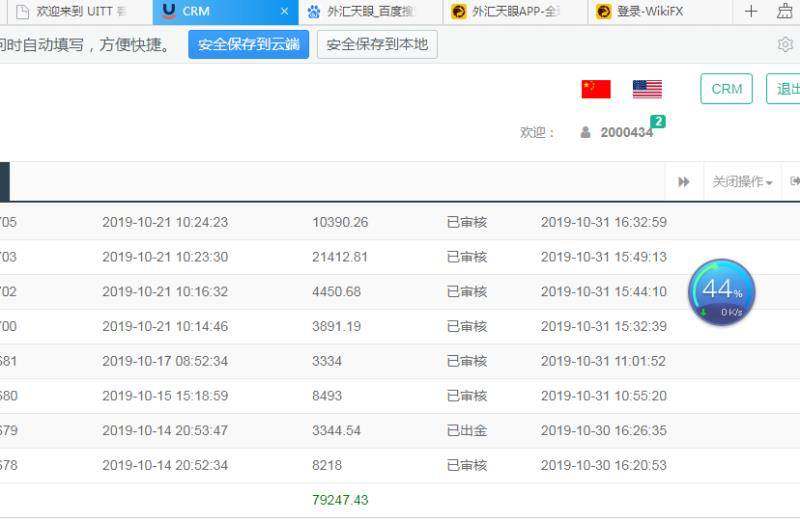

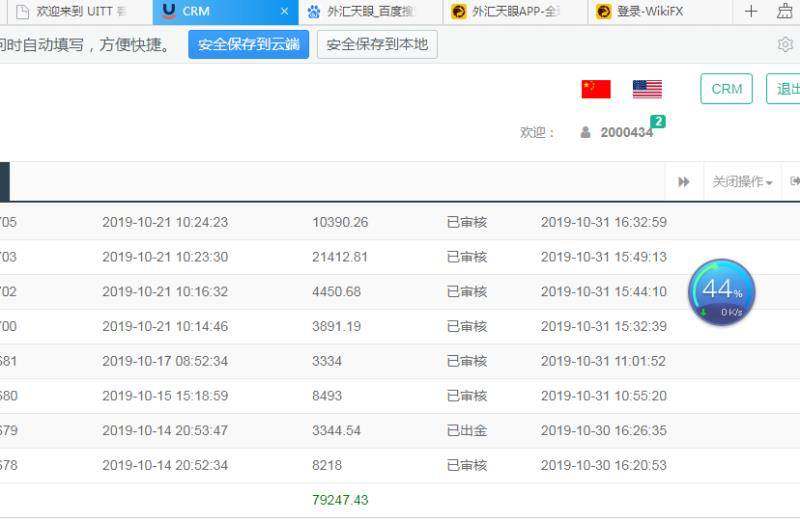

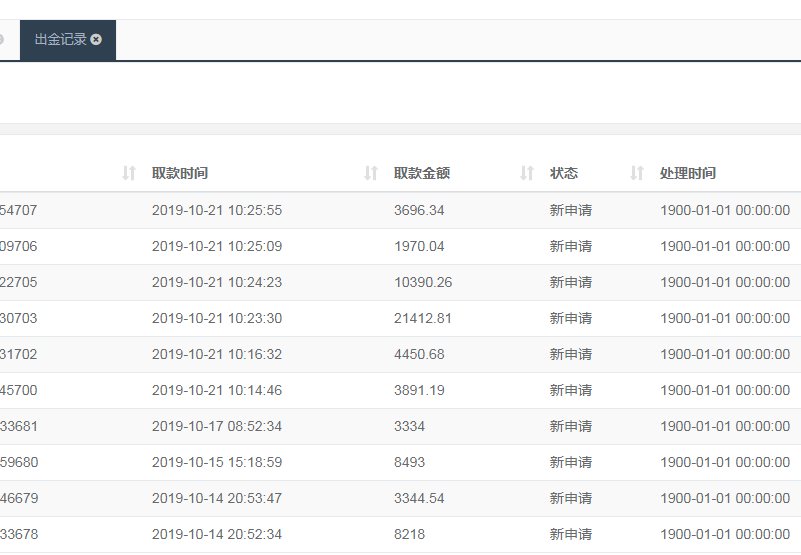

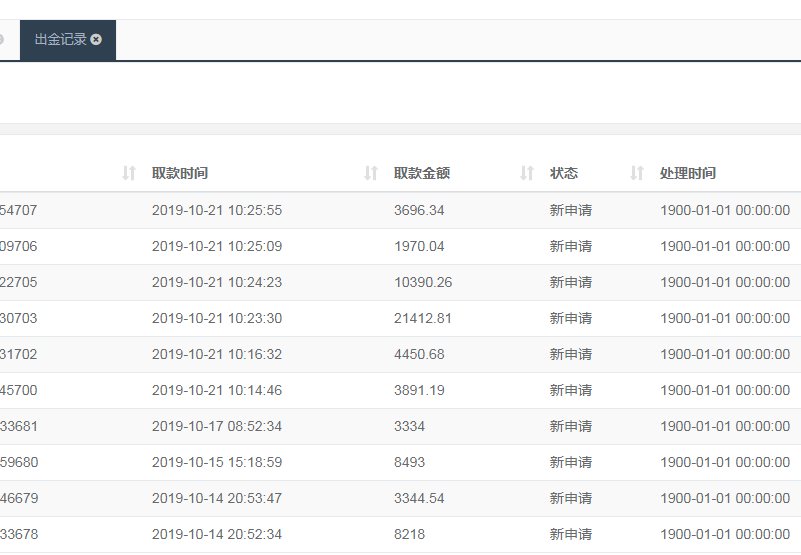

The "Traps" of Non-Trading Fees

Despite its low commission rate, UITT has been flagged for high withdrawal fees, which may impose unexpected costs on traders. Multiple user complaints highlighted experiences where traders struggled to withdraw funds, often met with unreasonable fees.

"They entice you with low trading costs, but the withdrawal fees are the real deal-breaker." - User Complaint on 4ex.review.

Cost Structure Summary

While UITT offers low trading costs, the entanglement of hidden fees makes it less appealing for novice traders; high withdrawal fees and potential account conditions may diminish profitability for even the most seasoned trader.

UITT provides a minimalistic platform that caters more to experienced users rather than beginners. The trading interface offers access to various financial instruments, yet it lacks sophisticated tools that traders often require for market analysis.

Users report that the analytical and research tools provided by UITT do not meet industry standards. Many express needing more robust trading solutions, particularly in charting and real-time data.

"The interface is clunky, and the tools just aren't sufficient for the trading I want to do." - Anonymous User Review.

Despite being functional, the platform and tools fall short of what many traders expect from a high-leverage broker, thereby impacting overall user satisfaction.

User Experience Analysis

Insights from User Feedback

User experiences are mixed, with reports indicating both satisfaction and frustration. Several users raised concerns about the broker's customer service, often pointing towards long wait times and inadequate support.

Areas of Improvement Noted

Many complaints on user experience encapsulate difficulties navigating the withdrawal process and challenges faced while dealing with customer service attributes. Some users highlight a labour-intensive process to resolve account-related issues.

Customer Support Analysis

Customer Support Report Card

Customer support remains a significant weak point for UITT, receiving frequent criticism for slow response times and poor-quality service. Users often find themselves frustrated with how their inquiries are handled, leading to a less than ideal trading experience.

Summary of Support Issues

Multiple review platforms report a common thread of unsatisfactory customer support. Many complaints derive from users struggling with withdrawal issues, often met with delayed responses or inadequate solutions.

Account Conditions Analysis

Examination of Account Conditions

UITT's account conditions are characterized by ambiguous terms surrounding withdrawals. Users frequently report navigating through convoluted terms, leading to misunderstandings and potentially costly consequences.

Transparency Challenges

Transparency in account conditions appears lacking, a common complaint voiced by users. This absence can create a foundation for mistrust, which is compounded by reports of high withdrawal fees.

As we wrap up this in-depth examination of UITT, it is crucial for potential clients to weigh the attractive high-leverage options against the glaring risks that accompany an unregulated broker. Ultimately, while UITT presents enticing trading opportunities, its lack of oversight and mixed user reviews emphasize the importance of thorough due diligence before proceeding.