Regarding the legitimacy of MSFX forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is MSFX safe?

Pros

Cons

Is MSFX markets regulated?

The regulatory license is the strongest proof.

FCA Inst Market Making (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Inst Market Making (MM)

Licensed Entity:

Equiti Capital UK Limited

Effective Date:

2011-04-27Email Address of Licensed Institution:

compliance@equiti.comSharing Status:

No SharingWebsite of Licensed Institution:

www.equiticapital.co.ukExpiration Time:

--Address of Licensed Institution:

11 Ironmonger Lane London EC2V 8EY UNITED KINGDOMPhone Number of Licensed Institution:

+4402070970402Licensed Institution Certified Documents:

Is Msfx Safe or Scam?

Introduction

Msfx is a forex broker that has garnered attention in the trading community for its claims of providing a robust trading platform and a range of financial instruments. Positioned as a player in the competitive forex market, Msfx markets itself as a gateway for traders seeking to capitalize on currency fluctuations. However, the increasing number of reported issues surrounding the broker raises concerns about its legitimacy and reliability. As a trader, it is crucial to conduct thorough due diligence before engaging with any forex broker. This article aims to provide an objective analysis of Msfx's safety and reliability by examining its regulatory status, company background, trading conditions, customer experiences, and other pertinent factors. Our investigation is based on data collected from various online reviews, regulatory databases, and user feedback, ensuring a comprehensive evaluation of whether Msfx is safe or a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors to consider when assessing its safety. Regulation helps ensure that brokers adhere to strict standards designed to protect traders' interests. In the case of Msfx, claims have been made regarding its regulatory status, specifically that it is licensed by the Financial Conduct Authority (FCA) in the UK. However, investigations reveal that this claim is questionable, with indications that Msfx may be operating without proper authorization.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 528328 | United Kingdom | Suspicious Clone |

The FCA is known for its stringent regulatory framework, which requires brokers to maintain a high level of transparency and accountability. However, Msfx's alleged FCA license appears to be a clone, meaning it may not be legitimate. This lack of proper regulation raises significant red flags for potential investors. Furthermore, numerous complaints have surfaced regarding the broker's inability to facilitate withdrawals, which is often a telltale sign of a scam operation.

Company Background Investigation

Understanding the company behind a forex broker is essential for evaluating its credibility. Msfx claims to have a history of operations based in New York. However, the lack of verifiable information about its ownership structure and management team is concerning. A reputable broker typically provides detailed information about its founders and key personnel, including their qualifications and experience in the financial sector.

In the case of Msfx, there is a notable absence of such transparency. The company's website has reportedly been inactive, and attempts to gather information about its management have yielded little success. This opacity is a significant warning sign for potential traders, as it suggests a lack of accountability. A reliable broker should be forthcoming about its operations, and the absence of this information in Msfxs case raises questions about its legitimacy.

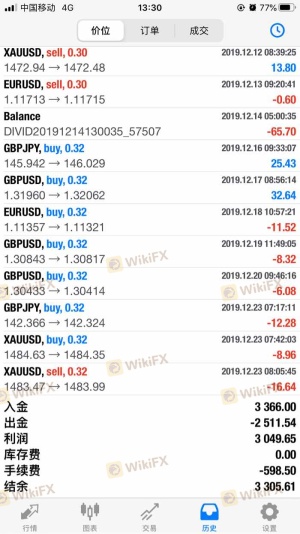

Trading Conditions Analysis

When evaluating a forex broker, it is vital to consider the trading conditions they offer, including spreads, commissions, and other fees. Msfx advertises competitive trading conditions; however, user experiences indicate otherwise. Many reports highlight excessive fees and unfavorable trading conditions that deviate from industry standards.

| Fee Type | Msfx | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Low to Medium |

| Commission Model | Unclear | Clear Structure |

| Overnight Interest Rates | Variable | Standardized |

The high spreads and unclear commission structure can significantly impact a trader's profitability. Traders have also reported unexpected fees that were not disclosed upfront, which is a common tactic used by fraudulent brokers to siphon off funds. Overall, the trading conditions at Msfx do not align with what traders would expect from a reputable broker, further suggesting that Msfx may not be safe.

Customer Funds Security

The security of customer funds is paramount when selecting a forex broker. Msfx's measures regarding fund protection have come under scrutiny, with reports indicating that clients' funds are not kept in segregated accounts, a standard practice among regulated brokers.

Additionally, there are concerns about whether Msfx offers any investor protection or negative balance protection policies. The absence of these protective measures leaves traders vulnerable to losing their entire investment, especially during volatile market conditions. Historical data also suggests that there have been instances where clients were unable to withdraw their funds, raising serious concerns about the broker's financial practices and overall safety.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reputation and reliability. In the case of Msfx, numerous complaints have surfaced, particularly regarding withdrawal issues and poor customer service. Many users have reported that after depositing funds, they faced significant hurdles when attempting to withdraw their money.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Unresponsive |

| Misleading Information | High | Ignored |

These complaints indicate a pattern of behavior commonly associated with scam brokers. For instance, one user reported that after an initial successful withdrawal, subsequent requests were met with excuses related to system maintenance and regulatory delays. Such tactics are often employed by fraudulent brokers to delay or deny withdrawals, making it essential for traders to remain vigilant.

Platform and Execution

The trading platform's performance is another critical aspect of a broker's credibility. Msfx claims to offer a robust trading platform; however, user reviews suggest otherwise. Many traders have experienced issues with platform stability, order execution speed, and slippage.

Additionally, there are concerns about potential platform manipulation, where brokers may alter prices or execution conditions to benefit themselves at the expense of traders. Such practices are unethical and indicative of a broker that cannot be trusted. If a broker's platform is unreliable, it can lead to significant financial losses for traders, further questioning whether Msfx is safe.

Risk Assessment

Using Msfx as a forex broker carries several risks that potential traders should carefully consider. The following risk assessment summarizes the key risk areas associated with Msfx:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated or falsely regulated |

| Financial Risk | High | Potential inability to withdraw funds |

| Operational Risk | Medium | Platform stability issues |

| Transparency Risk | High | Lack of information and disclosure |

To mitigate these risks, potential traders should approach Msfx with extreme caution. It is advisable to start with a minimal deposit or consider alternative brokers with established reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that Msfx exhibits several characteristics of a potentially fraudulent broker. The lack of proper regulation, coupled with numerous user complaints regarding withdrawal issues and a lack of transparency, raises significant concerns about the broker's legitimacy.

For traders considering entering the forex market, it is highly recommended to explore alternative brokers that are regulated by reputable authorities and have a proven track record of reliability. Brokers such as [insert reputable broker names] offer safer trading environments and better protections for traders' funds. Ultimately, while Msfx may present itself as a viable trading option, the risks associated with it far outweigh any potential benefits, making it crucial for traders to remain cautious and informed.

Is MSFX a scam, or is it legit?

The latest exposure and evaluation content of MSFX brokers.

MSFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MSFX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.