Bd-swiss Review 1

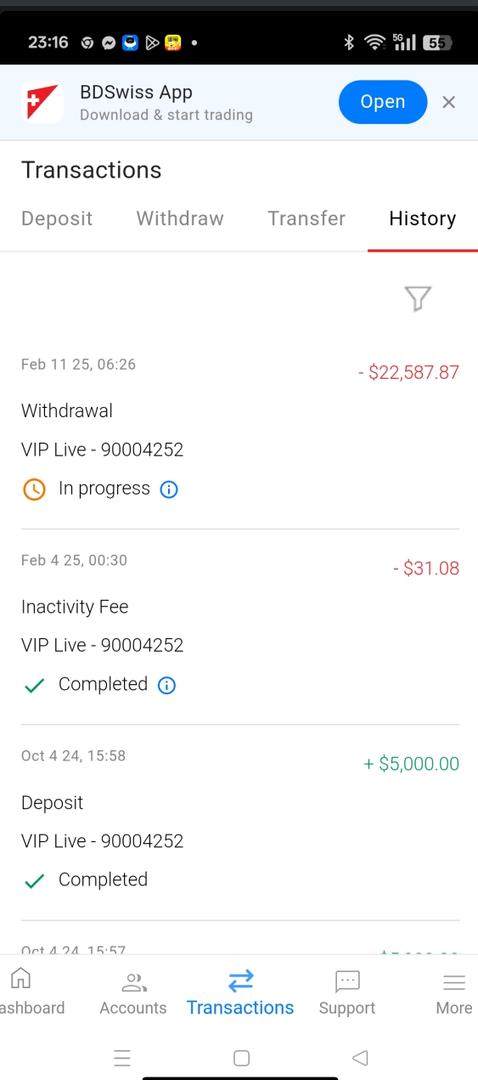

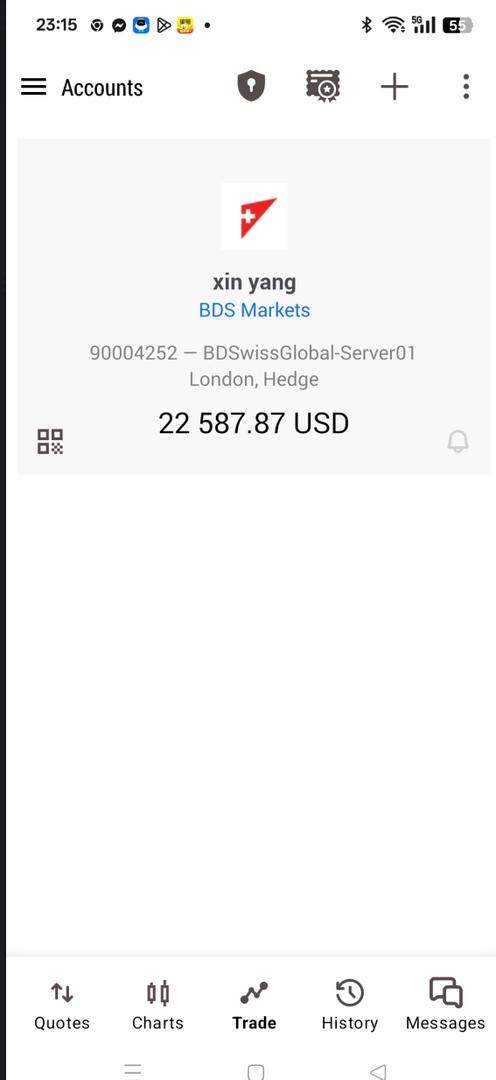

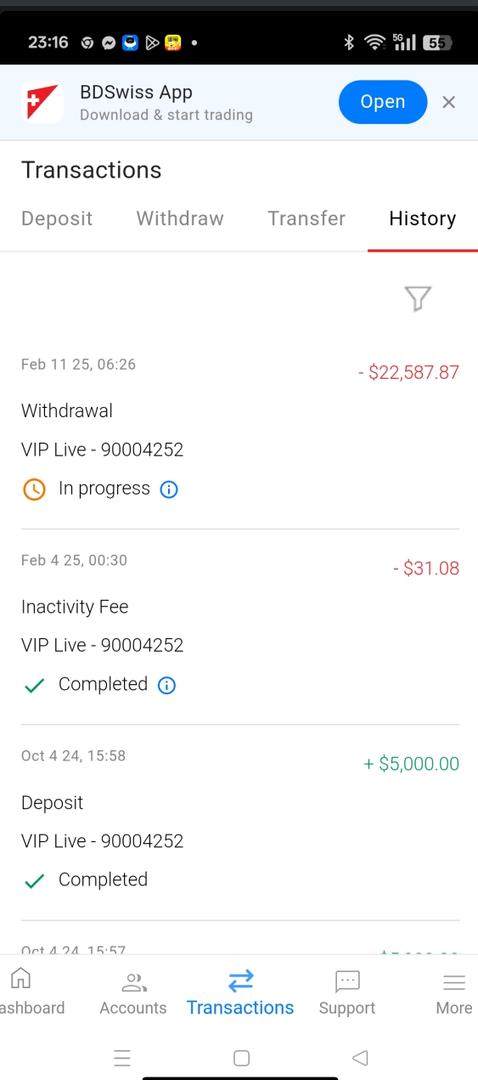

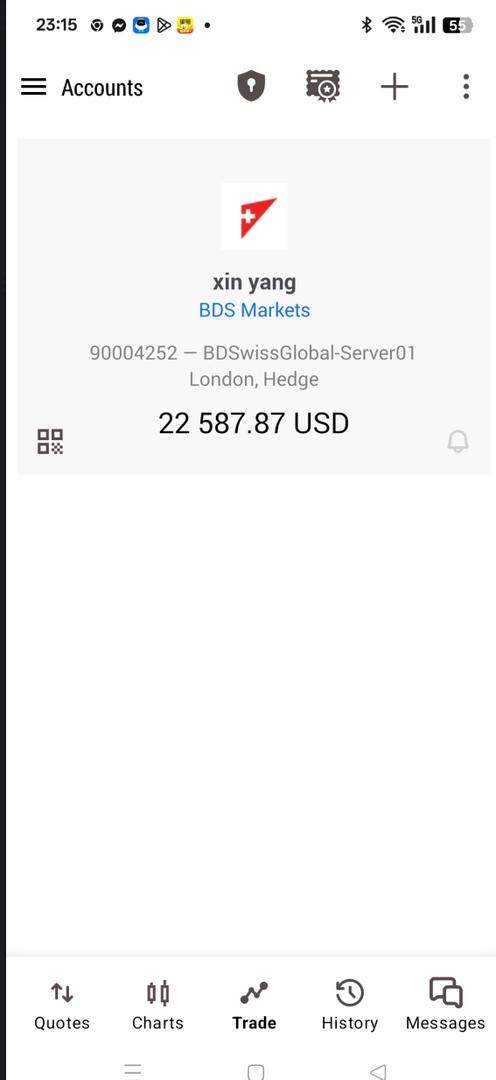

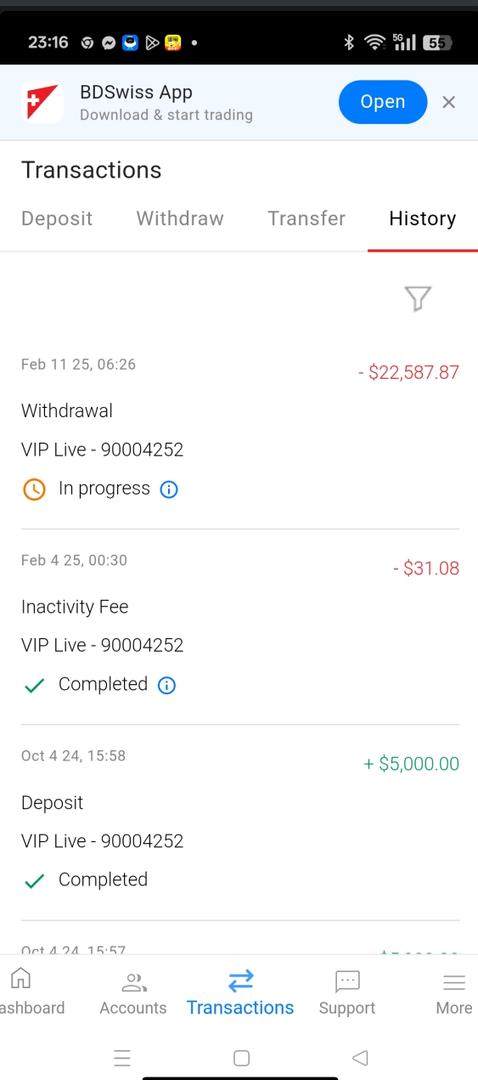

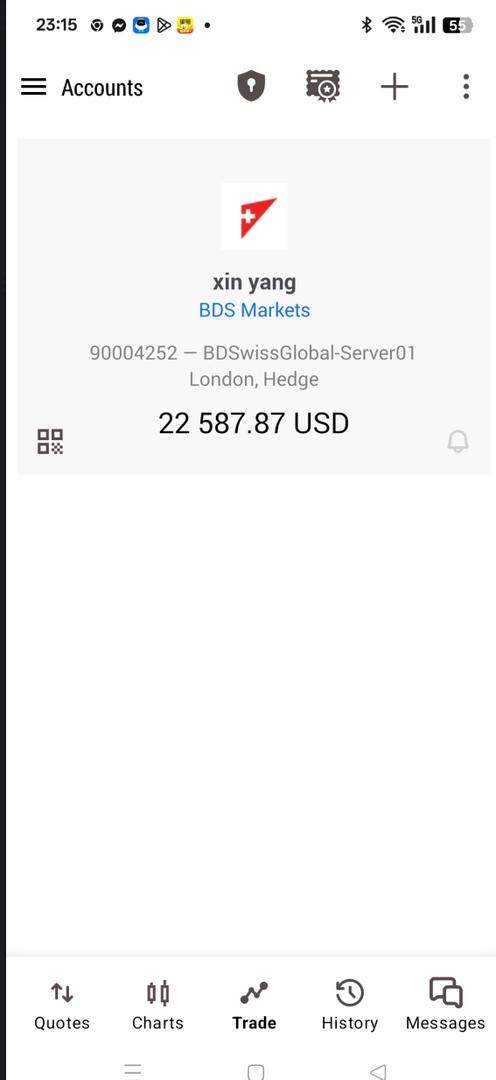

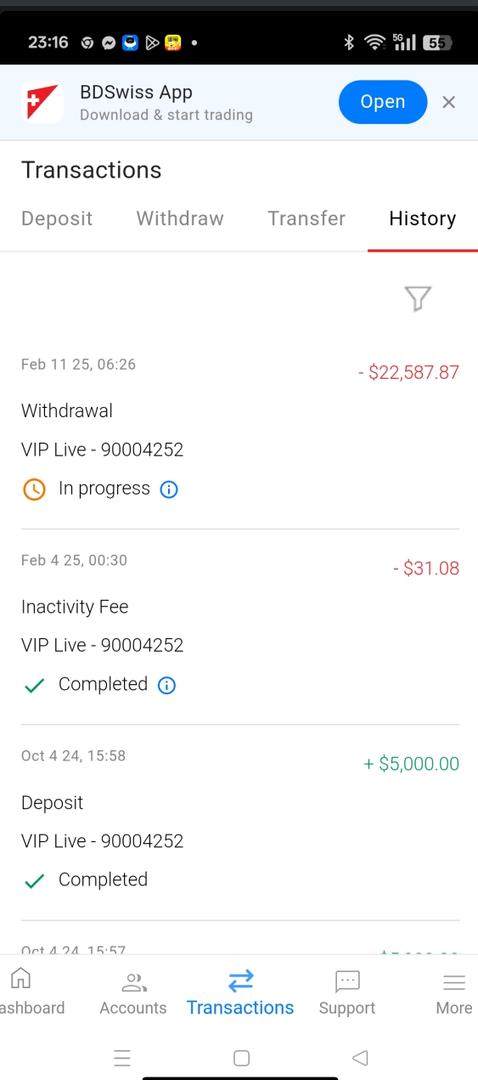

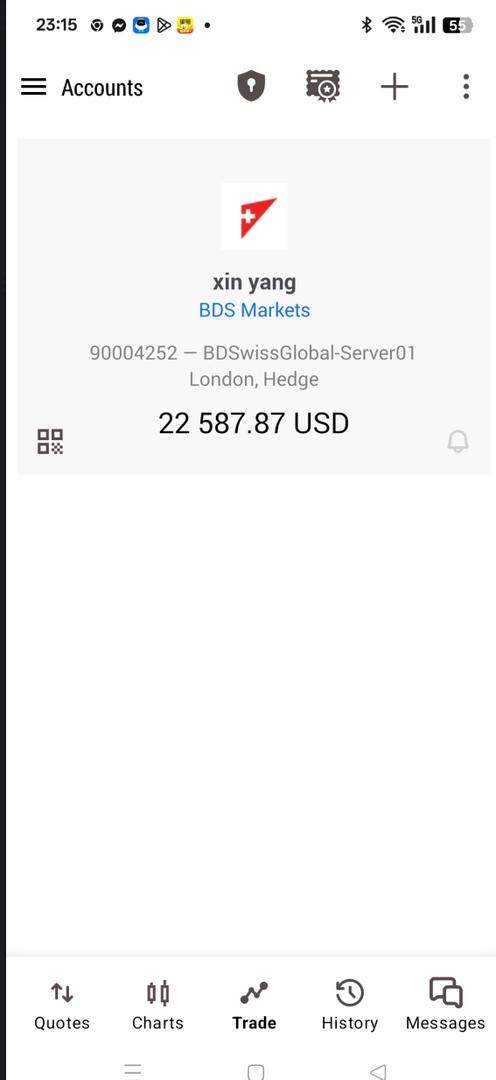

I request withdraw for 22000 USD,but until now, they are not process the request, numorious response is facing technical issue and will contact me when they ready. I have emailed regulation company but the respond is not satisfied.

Bd-swiss Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I request withdraw for 22000 USD,but until now, they are not process the request, numorious response is facing technical issue and will contact me when they ready. I have emailed regulation company but the respond is not satisfied.

Established in 2012, BDSwiss has carved a niche for itself in the competitive online trading landscape, offering a wide array of trading instruments, including forex pairs, commodities, stocks, indices, and cryptocurrencies. With user-friendly platforms like MetaTrader 4, MetaTrader 5, and their proprietary webtrader application, the broker caters to both novice and experienced traders. BDSwiss allows traders to begin with a minimal deposit of just $10, making it an appealing choice for those new to the forex market.

However, potential traders should tread carefully. BDSwiss operates under regulations from offshore bodies, which may not provide the same level of protection as more recognized authorities. Customers have raised significant concerns regarding withdrawal issues and high inactivity fees, underscoring the necessity for thorough evaluation before committing funds. This review will dissect the strengths and pitfalls of BDSwiss, offering insights into its operational structure, trustworthiness, trading costs, platforms, user experience, customer support, and account conditions, thereby guiding readers in making informed decisions.

Risk Statement: Trading involves substantial risk and potential loss of invested capital. While BDSwiss offers numerous trading opportunities, it is essential to be aware of these risks.

BDSwiss may not be the right broker for you if you prioritize stringent regulatory frameworks and fear withdrawal difficulties.

| Criteria | Rating (out of 5) | Justification |

|---|---|---|

| Trustworthiness | 2.5 | Regulatory oversight is insufficient, raising concerns about safety. |

| Trading Costs | 3.0 | Competitive spreads but substantial withdrawal fees pose challenges. |

| Platforms & Tools | 4.0 | Offers robust platforms, including MT4 and MT5; user-friendly interface. |

| User Experience | 3.5 | Generally positive, with a focus on educational content. |

| Customer Support | 3.0 | Responsive but not available on weekends; limited resources at times. |

| Account Conditions | 2.5 | High inactivity and minimum deposit fees; limited account types. |

BDSwiss was founded in 2012, initially emerging as a notable player in the online trading sphere primarily through its diverse range of trading instruments and trading platforms. Headquartered in Cyprus, the broker operates globally, claiming more than 1.6 million registered clients across 186 countries. However, it is crucial to note that clients from certain regions, including the U.S., are prohibited from trading.

BDSwiss operates predominantly as a retail forex and CFD broker providing access to a comprehensive selection of trading instruments. The broker markets itself predominantly on its trading platforms, which include MetaTrader 4 and 5, alongside its proprietary BDSwiss WebTrader. BDSwiss is regulated by several offshore bodies, including the Seychelles Financial Services Authority (FSA) and the Financial Services Commission (FSC) of Mauritius, but these regulatory bodies lack the stringent standards of top-tier authorities.

| Feature | Details |

|---|---|

| Regulation | FSC, FSA |

| Min. Deposit | $10 |

| Max. Leverage | Up to 1:2000 (varies by jurisdiction) |

| Major Fees | $30 inactivity fee after 90 days; $10 bank withdrawal fee under $100 |

BDSwiss operates under regulations from comparatively lower-tier entities such as the FSC in Mauritius and the FSA in Seychelles. This can leave clients more exposed to risks compared to brokers under strict regulations, such as the FCA in the UK. While BDSwiss seeks to assure clients of fund safety through segregated accounts and negative balance protection, the reliance on offshore regulators raises questions on client protection in critical scenarios.

"BDSwiss provides an excellent trading environment, but their withdrawal issues are need improvement." - Forex Peace Army

"Worse trading experience ever! I lost my funds, and they are not responsive to my withdrawal requests." - Trustpilot User

Despite growth and several awards, BDSwiss faces criticism, primarily regarding its regulatory status and withdrawal difficulties and this dual image poses both opportunities and risks for potential clients.

BDSwiss boasts a competitive trading fee structure, particularly for its threshold for minimum deposits. The Classic account showcases spreads beginning from 1.3 pips, competitive relative to other online brokers for beginners.

BDSwiss charges a significant $30 inactivity fee if there is no trading activity for 90 days, along with withdrawal fees for requests under specific minimum thresholds, which can disrupt the trading experience.

User Experience:

"Inactivity fees are outrageous compared to other brokers. Makes it hard to sit on funds." - Forex Forums User

The overall trading cost can accrue quickly for clients engaging infrequently in trading activities or requiring small withdrawals. Optimizing trading style and understanding fee structures is essential.

BDSwiss offers several platforms: MetaTrader 4 and 5, plus their BDSwiss WebTrader. Each platform caters to different trader needs, with MT4 being favored for its reliability and MT5 providing improved analytics.

BDSwiss provides robust educational materials, including access to the Autochartist tool for trend analysis and market notifications, aiding traders in making informed decisions.

Users generally appreciate the usability of BDSwiss platforms. However, there are reports of significant limitations in mobile applications compared to desktop trading capabilities. Users find BDSwiss' proprietary platforms convenient but somewhat basic compared to others in the market.

BDSwiss presents a user-friendly environment with commendable customer support. The brokers educational resources cater well to beginners, though they can be limited for experienced users seeking advanced analytical tools.

"Responsive support during weekdays. Would appreciate weekend options." - User from Trustpilot

While BDSwiss offers multiple channels for support, including live chat, email, and phone, their operational hours are limited to 24/5. This may not accommodate traders who require assistance outside of these hours.

Many users highlight the professionalism of the support staff but express dissatisfaction regarding the need for more robust and round-the-clock support.

BDSwiss offers four account types: Classic, Premium, VIP, and Raw. Each type has distinct conditions and features catering to different trader requirements.

Recommendation:

Traders should consider their trading habits, risk tolerance, and educational needs carefully before selecting an account type with BDSwiss.

With high commission structures on the Raw account and inactivity fees, traders must assess how their trading patterns may incur additional costs.

BDSwiss presents a compelling option for newcomers and intermediate traders, offering user-friendly platforms and valuable educational resources. However, potential investors must exercise caution given the broker's mixed regulatory standing and reported withdrawal challenges. Proper evaluation of personal trading needs and conducting thorough research will be crucial for assessing whether BDSwiss fits your trading profile.

FX Broker Capital Trading Markets Review