VCG Markets 2025 Review: Everything You Need to Know

Executive Summary

VCG Markets stands out as a clear and trustworthy forex broker. It has built itself as a solid choice for traders with some experience since starting in 2020. This vcg markets review shows a broker that puts honesty first in the forex world. The company offers complete trading solutions across many assets under the watch of the Financial Services Commission (FSC) of Mauritius.

The broker's main features include leverage up to 1:500 and strong safety tools like negative balance protection. This makes it very appealing to traders who want higher leverage while staying safe. VCG Markets mainly targets forex and commodity traders. These traders look for different investment chances across many asset types.

Based on available data, VCG Markets works under FSC Mauritius rules and offers good trading terms. It has changing spreads, fees starting from $0, and needs at least $500 to start. The broker gives access to over 500 trading tools across forex, commodities, indices, stocks, and cryptocurrencies. It uses both MetaTrader 5 and their own mobile app to serve traders worldwide.

Important Disclaimers

VCG Markets is regulated by the Financial Services Commission of Mauritius, so traders should know that legal protections may differ across countries. The rules in Mauritius may offer different investor protections than other major financial centers. Potential clients should think about these differences when looking at the broker.

This complete review uses public information, user feedback, and industry reports. The analysis here shows VCG Markets' services as they are in 2025, though specific terms may change. Traders should check all information directly with the broker before making trading decisions.

Rating Framework

Broker Overview

VCG Markets started in 2020 and has quickly become a major player in the global forex and CFD broker industry. The company is based in Mauritius and has built its name on truth, transparency, and trust as its main business ideas. The broker uses a No Dealing Desk (NDD) model, which means direct market access and fast order execution for clients.

The company's business plan focuses on providing trading opportunities across many assets while keeping trading conditions competitive. VCG Markets has designed their services for both new and professional traders through two different account types. However, specific details about these account differences need to be checked directly with the broker.

VCG Markets offers trading through the standard MetaTrader 5 platform and their own mobile app. This gives clients flexibility in how they access the markets. The broker covers major financial markets including forex pairs, commodities, stock indices, individual shares, and cryptocurrencies. Under the watch of the Financial Services Commission of Mauritius, VCG Markets follows international trading standards while offering leverage up to 1:500 for qualified traders.

Regulatory Jurisdiction: VCG Markets works under the Financial Services Commission (FSC) of Mauritius, which oversees financial services companies operating in and from Mauritius. This framework ensures following international standards for client fund protection and operational transparency.

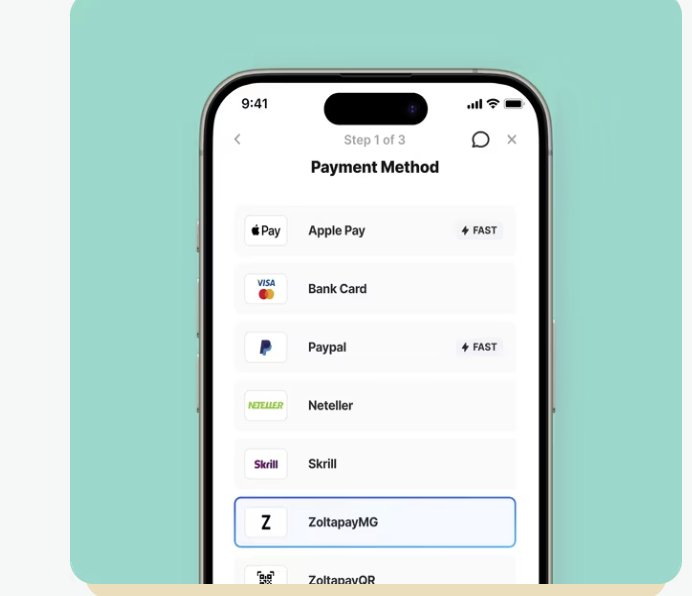

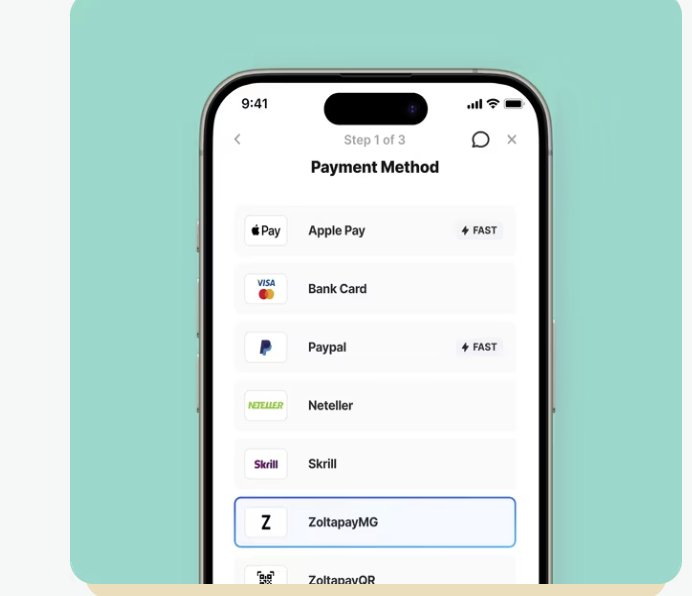

Deposit and Withdrawal Methods: Based on available information, VCG Markets supports multiple funding options including bank transfers, credit and debit cards, and various e-wallet solutions. However, specific processing times and fees need direct confirmation with the broker.

Minimum Deposit Requirements: The broker requires at least $500 to start, which puts it in the mid-range category for serious traders while staying accessible to intermediate investors.

Promotional Offers: VCG Markets attracts new clients through promotional campaigns, including a notable 100% deposit bonus offer designed to boost trading capital for qualifying accounts.

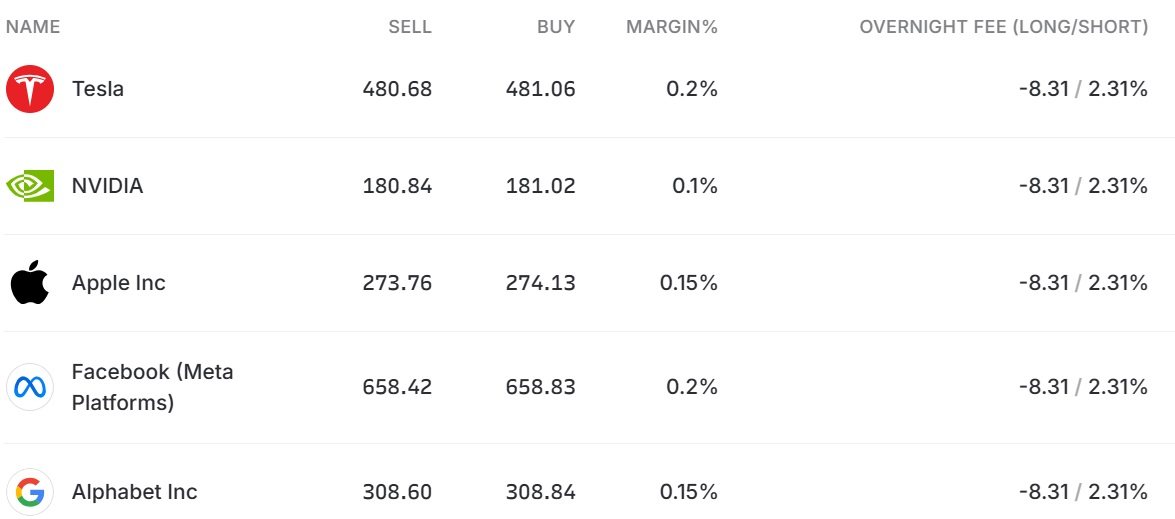

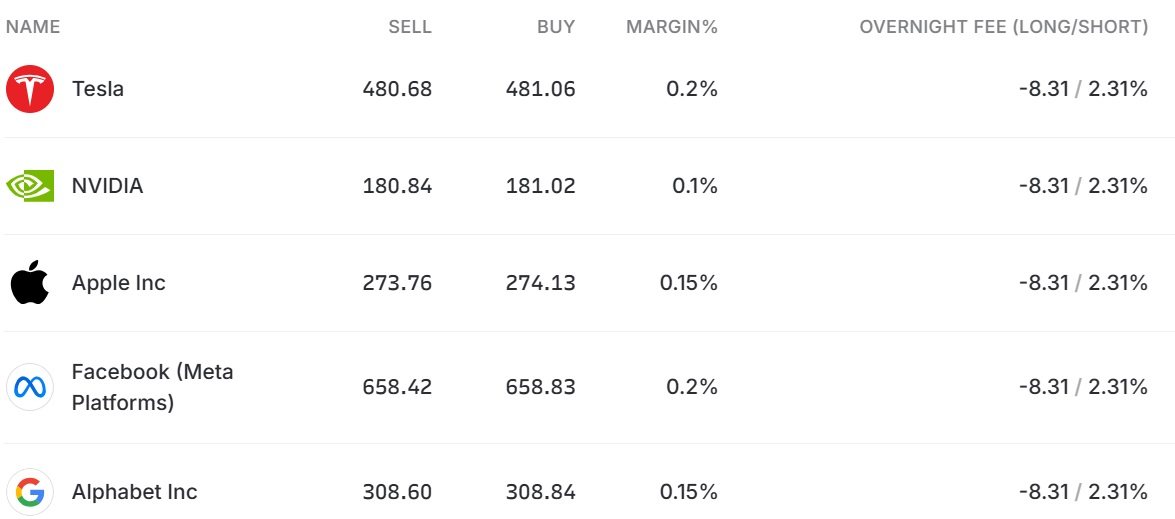

Available Trading Instruments: The broker provides access to over 500 trading instruments, covering major and minor forex pairs, precious metals, energy commodities, global stock indices, individual company shares, and popular cryptocurrencies.

Cost Structure: Trading costs use changing spreads with commission rates starting from $0, creating a competitive fee environment. The specific spread ranges and commission structures may vary based on account type and trading volume.

Leverage Options: Maximum leverage reaches 1:500, serving traders who prefer higher leverage ratios for their trading strategies. However, such leverage levels come with increased risk exposure.

Trading Platform Options: The main trading platform is MetaTrader 5, supported by the broker's own mobile application for trading on the go.

This vcg markets review shows that while complete service offerings are available, some specific operational details need direct verification with the broker for the most current information.

Detailed Rating Analysis

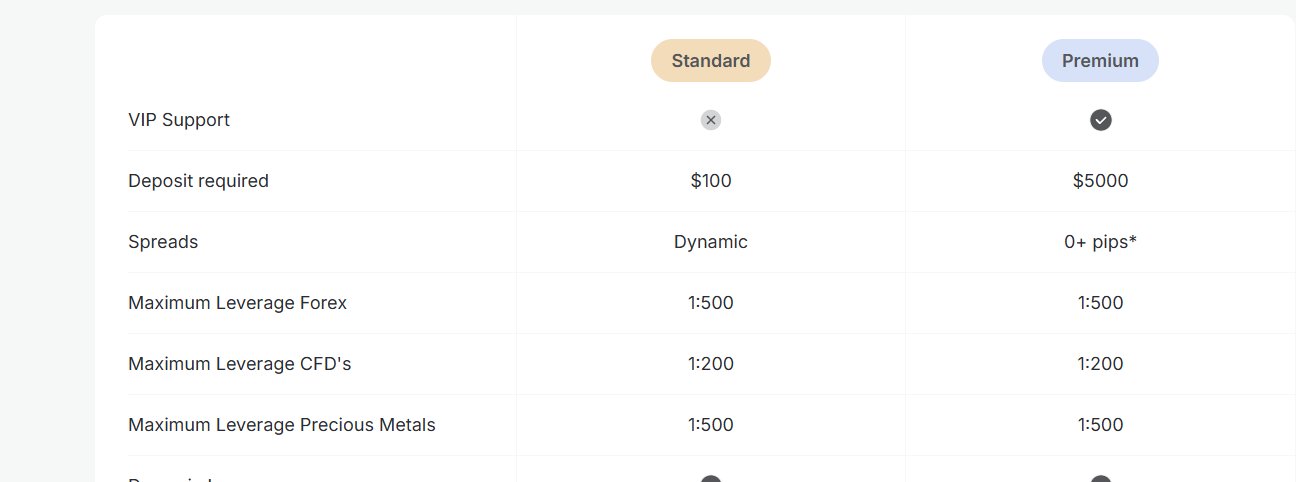

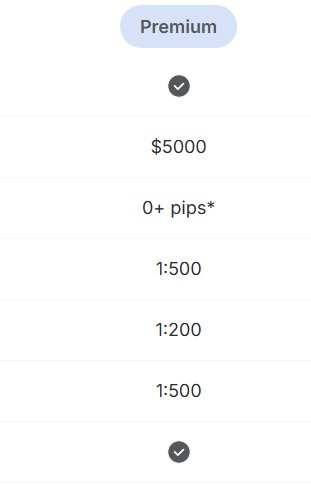

Account Conditions Analysis (Score: 8/10)

VCG Markets shows strong performance in account conditions through their structured approach to serving different trader groups. The $500 minimum deposit requirement strikes a good balance between accessibility and serious trading intent. This filters out casual traders while staying reasonable for intermediate to advanced market participants. This threshold matches well with industry standards for brokers targeting experienced traders who typically keep larger trading accounts.

The commission structure starting from $0 provides significant appeal, especially for high-frequency traders and those working on tighter profit margins. Variable spreads offer the potential for competitive pricing during good market conditions. However, traders should know that spreads may widen during volatile market periods or low liquidity sessions.

According to this vcg markets review, the broker offers two different account types designed for both beginners and professionals. However, specific details about account tier differences, such as minimum balance requirements, additional features, or better pricing, are not fully detailed in available public information. The account opening process and verification requirements follow standard industry practices. However, specific timeframes and documentation requirements should be confirmed directly with the broker.

The inclusion of risk management features such as negative balance protection adds significant value to the account conditions. This provides essential safeguards for traders using higher leverage ratios.

The breadth of VCG Markets' instrument offering represents one of their strongest competitive advantages. They offer over 500 tradable assets spanning multiple market sectors. This extensive selection enables traders to implement diversified strategies across forex majors and minors, commodities including precious metals and energy products, global equity indices, individual stocks, and cryptocurrency markets.

The forex selection covers all major currency pairs alongside numerous minor and exotic combinations. This provides opportunities for both conservative and aggressive currency trading strategies. Commodity offerings typically include gold, silver, crude oil, and agricultural products. This allows traders to capitalize on global economic trends and seasonal market patterns.

Stock indices from major global markets enable traders to participate in broader economic movements without selecting individual securities. The inclusion of individual company shares provides opportunities for equity-focused strategies. The cryptocurrency selection reflects the growing importance of digital assets in modern trading portfolios.

However, specific information regarding research and analysis resources, educational materials, market commentary, economic calendars, or automated trading support capabilities requires further clarification. These supplementary tools often distinguish premium brokers from basic service providers. Their availability significantly impacts the overall trading experience for serious market participants.

Customer Service and Support Analysis (Score: 6/10)

Customer service evaluation for VCG Markets faces limitations due to insufficient detailed information about their support infrastructure and service quality metrics. While the broker emphasizes transparency and trust as core values, specific data regarding customer support channels, availability hours, response times, and service quality remains limited in publicly available sources.

The absence of comprehensive user feedback regarding customer service experiences makes it challenging to assess the actual quality of support provided. Key factors that typically influence customer service ratings include the availability of multiple contact methods (phone, email, live chat), multilingual support capabilities, technical expertise of support staff, and resolution timeframes for various types of inquiries.

Professional brokers typically offer 24/5 support during market hours, with some extending to 24/7 availability for urgent technical issues. The quality of customer service often becomes most apparent during account opening processes, technical difficulties, or withdrawal requests. These are situations where prompt and knowledgeable assistance becomes crucial.

Without specific user testimonials or detailed service level commitments from VCG Markets, the customer service evaluation relies primarily on industry standards and the broker's general reputation for transparency. Potential clients should directly test the responsiveness and quality of customer support during their evaluation process.

Trading Experience Analysis (Score: 7/10)

VCG Markets' trading experience centers around the MetaTrader 5 platform, which provides a robust and widely recognized trading environment. MT5 offers comprehensive charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and multi-asset trading functionality. This aligns well with VCG Markets' diverse instrument offering.

The platform's stability and execution speed are critical factors for trading experience quality. However, specific performance metrics such as average execution times, slippage rates, or requote frequencies are not detailed in available information. The No Dealing Desk (NDD) execution model suggests direct market access. This typically results in faster execution and reduced conflicts of interest.

The proprietary mobile application extends trading accessibility beyond desktop environments. It enables traders to monitor positions, execute trades, and respond to market opportunities while away from their primary trading stations. However, detailed user feedback regarding the mobile app's functionality, reliability, and feature completeness is limited.

Trading environment factors such as spread stability during different market conditions, order execution quality during news events, and the availability of advanced order types significantly impact the overall trading experience. This vcg markets review indicates that while the fundamental infrastructure appears solid, comprehensive user experience data would provide better insight into day-to-day trading quality.

Trust and Reliability Analysis (Score: 9/10)

VCG Markets achieves strong performance in trust and reliability metrics, primarily anchored by their regulation under the Financial Services Commission of Mauritius and their emphasis on transparency as a core business principle. The FSC regulation provides essential oversight and ensures compliance with international standards for client fund protection and operational integrity.

The broker's implementation of negative balance protection demonstrates commitment to client safety, particularly important given their offering of leverage up to 1:500. This feature prevents traders from losing more than their account balance during extreme market movements. It provides crucial downside protection for leveraged positions.

User feedback indicates recognition of VCG Markets' transparency and trustworthiness, suggesting that the broker has successfully established credibility within the trading community. The company's stated commitment to "truth, transparency, and trust" appears to resonate with their client base. This contributes to their positive reputation.

However, comprehensive information regarding additional safety measures such as segregated client funds, insurance coverage, financial reporting transparency, or third-party audits is not extensively detailed in available sources. The broker's relatively recent establishment in 2020 means they have a shorter track record compared to more established competitors. However, their growth and user recognition suggest positive market reception.

The absence of significant negative incidents or regulatory actions in publicly available information supports their reliability profile. However, ongoing monitoring of regulatory compliance and user satisfaction remains important for long-term trust assessment.

User Experience Analysis (Score: 6/10)

User experience evaluation for VCG Markets faces constraints due to limited comprehensive user feedback data and detailed interface assessments. The overall user journey encompasses multiple touchpoints including account registration, verification processes, platform navigation, funding procedures, trading execution, and customer support interactions.

The broker's targeting of both beginners and professionals suggests an attempt to balance simplicity with advanced functionality. However, specific details about interface design, navigation intuitiveness, and learning curve considerations are not extensively documented. The availability of both MetaTrader 5 and a proprietary mobile application provides multiple access options. This potentially enhances user convenience.

Account registration and verification processes typically impact first impressions significantly. However, specific timeframes, documentation requirements, and process complexity are not detailed in available information. Funding and withdrawal experiences often influence user satisfaction substantially. However, comprehensive user feedback regarding transaction processing times, fee transparency, and procedural simplicity is limited.

The broker's minimum deposit of $500 suggests targeting of more serious traders who typically have higher expectations for platform sophistication and service quality. However, without detailed user testimonials regarding overall satisfaction, common complaints, or standout positive experiences, the user experience assessment relies primarily on general industry standards and the broker's reputation indicators.

Conclusion

This comprehensive vcg markets review reveals a broker that has successfully established itself as a transparent and trustworthy option in the competitive forex brokerage landscape. VCG Markets demonstrates particular strength in providing diverse trading opportunities with over 500 instruments and competitive leverage options up to 1:500. This makes it well-suited for intermediate to advanced traders seeking multi-asset exposure.

The broker's primary appeal lies in its combination of regulatory oversight from FSC Mauritius, competitive trading conditions with zero starting commissions, and robust risk management features including negative balance protection. These factors position VCG Markets as an appropriate choice for experienced traders who prioritize transparency and require access to diverse markets with flexible leverage options.

However, areas requiring attention include the limited availability of comprehensive user experience data and detailed customer service information. This prevents a complete assessment of day-to-day operational quality. While the fundamental infrastructure appears solid, potential clients should conduct thorough due diligence and direct testing of services before committing significant trading capital.